Accounting for the release of metal from the warehouse to the procurement shop

Accounting for metal cutting using application cards

Calculation of metal consumption efficiency

The cost of materials in the structure of the cost of mechanical engineering products constitutes a significant share, therefore control over metal consumption has a positive effect on the profitability of production. The rational and standardized use of metal and the reduction of material costs are largely determined by the establishment of primary accounting and the organization of analytical work.

Let's consider the specifics of the work of the procurement shop of a machine-building plant, in which about 70% of the metal is processed.

FEATURES OF ORGANIZATION OF ACCOUNTING IN FERROUS METALLURGY.

At ferrous metallurgy enterprises, all production costs (except for general plant expenses), including the costs of the workshop for servicing production and management, are reflected in the “Main production” account. Analytical accounting for this account is carried out in special statements opened annually for each workshop and called the “Statement of analytical accounting of production costs.”

The “Auxiliary production” account and the “Shop expenses” sub-account are not used at ferrous metallurgy enterprises. General plant expenses are recorded in the “General business expenses” account. To these accounts should be added an account for commercial expenses, which, together with the indicated production accounts, forms the full cost of marketable products. The table shows what applies to these expenses.

Capitalization of scrap metal from write-off of fixed assets, accounting (postings)

After issuing a write-off act, the accounting department must note that the fixed assets object is no longer in use. This is done using inventory cards of forms OS-6, OS-6a and OS-6b.

If we talk about accounting, then the cost of the liquidated fixed asset should be written off from the 01st account, thereby reflecting the fact that happened. Depreciation accrual stops from the next month.

When scrap metal is generated as a result of liquidation work, the corresponding volume should be capitalized. The market price of scrap metal is used for reflection in accounting registers. In the future, the company's management makes decisions on the sale of such materials or their use in production.

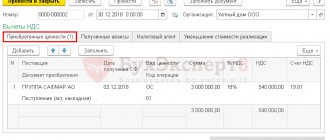

In accounting, write-off of fixed assets should be reflected as follows:

Dt 10 Kt 91 - we receive materials generated during the liquidation of the OS facility (in this case, scrap metal).

The result from the sale of scrap metal should be recorded in other income. The cost of scrap metal, in turn, is included in other expenses. As a result, the wiring will look like this:

Dt 62 Kt 91-1 - reflect revenue from the sale of scrap metal;

Dt 91-2 Kt 10 - we write off the cost of scrap metal.

Entry Dt 91 Kt 08 should be used when the liquidation affected an unfinished construction project. The fact is that the unfinished object is classified as capital investment, and not as fixed assets.

Dt 10 Kt 91 - we reflect the scrap metal that remained after the liquidation of the unfinished object at the market price in other income.

All accounting entries are made on the basis of primary documents. Samples of paperwork for writing off fixed assets are available in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

FEATURES OF ORGANIZATION OF ACCOUNTING IN NON-FERROUS METALLURGY.

At non-ferrous metallurgy enterprises, it is recommended to keep records of production costs by production complexes, workshops, sections and other structurally separate divisions. With a shopless management structure, costs are fixed by area, type of product and expense item.

Cost accounting is carried out by products and types of work, dividing direct costs by elements, and indirect costs by items with a preliminary grouping of them by elements, which makes it possible to identify the elemental composition of costs for the enterprise as a whole. In complex combined production of non-ferrous metallurgy, production costs are recorded by type or process of work (processes).

Planning and accounting of production costs are carried out using the conversion method, in which the cost of production of each subsequent workshop is composed of the costs incurred by it and the cost of semi-finished products. The semi-finished products themselves, when transferred from workshop to workshop, are posted to the account “Semi-finished products of own production” and are shown in the calculation of the receiving workshop under the item of the same name.

For your information:

With the semi-finished version of accounting for production costs, the cost of ore, concentrates and other semi-finished products of own production in planned and reporting calculations, as well as in the report on the implementation of the plan for the cost of marketable products, is not distributed among individual expense items, but is shown comprehensively.

Semi-finished products of own production, consumed at one’s own enterprise, are accounted for and transferred for further processing at shop cost, which is determined taking into account work in progress and by-products related to the calculated semi-finished products, with the addition of general business expenses. The correspondence of accounts with the cross-cutting method of accounting is as follows (for the purpose of simplicity and clarity, semi-finished products are valued at actual cost):

| Contents of operation | Debit | Credit |

| For the first stage (workshop) | ||

| The actual costs of the first stage are reflected | 20-1 | 10, 70, 69 |

| Shows the costs of the auxiliary unit related to this process (shop) | 23-1 | 10, 70, 69 |

| Costs are included in the price of semi-finished products | 21-1 | 20-1, 23-1 |

| The cost of semi-finished products has been increased by part of the total costs* | 21-1 | 26 |

| Semi-finished products are transferred to the next processing stage | 20-2 | 21-1 |

| For the second stage (workshop) | ||

| The actual costs of the second stage are reflected | 20-2 | 10, 70, 69 |

| Shows the costs of the auxiliary unit related to this process (shop) | 23-2 | 10, 70, 69 |

| The cost of finished products includes an assessment of semi-finished products and own and auxiliary costs of this processing stage | 43 | 20-2, 23-2 |

| The cost of finished products has been increased by part of the total costs** | 43 | 26 |

* At non-ferrous metallurgy enterprises, the costs of auxiliary production are significant. They can also produce semi-finished products used in the main production. Therefore, these costs are highlighted in accounting. However, the cost of products, work and services of small auxiliary production, consumed entirely within the enterprise, is not separately calculated, and the costs are directly included in the corresponding items of consumer expenses.

** Like semi-finished products, for the sake of simplicity and clarity, finished products of the second (final) stage are assessed at actual costs.

When processing complex polymetallic ore, processing plants produce concentrates with different contents of base metal. Depending on the percentage of its content, prices are set for homogeneous concentrates, which are finished products, at which settlements with customers are made. In addition to the base metal, concentrates contain separately paid non-ferrous, rare and precious metals, for example:

- in lead concentrates, in addition to lead, precious metals (gold, silver) and bismuth are paid for;

- in zinc concentrates, in addition to zinc, gold and cadmium are paid;

- in copper concentrates, in addition to copper, gold and silver are paid;

- in antimony concentrates, in addition to antimony, mercury is paid for.

The described diversity in the composition of concentrates makes it necessary to keep their accounting records in the following natural meters:

- in the dry mass of the concentrate;

- in a conventional mass, determined by recalculating the dry mass according to the established standard for the content of the base metal in a given concentrate;

- by the amount of individual metals contained in the concentrate.

For your information:

Data on the conditional mass of the concentrate and the individual metals contained in it by quantity are used in operational statistical accounting and reporting for the purpose of comparison with the plan, and in technical reporting - when compiling a balance of metals (to control the production process).

In analytical accounting, the released con is taken into account on cards of a specialized form in dry and nominal mass according to the actual production cost per 1 ton of conventional concentrate and according to the amount of base metal contained in the concentrate.

Consumption efficiency

A separately taken card, a card-application for receiving blanks, does not give an idea of how fully, for example, a sheet of metal was used, what the total losses were for one nomenclature item of metal (article, one receipt, one sheet), since the card provides consumption analytics only for one part blank or a batch of identical blanks. In this regard, it is advisable to draw up a summary document - “Control analytics of metal consumption by article”, which reflects the entire list of blanks cut from a given sheet, the resulting business waste and scrap metal. If necessary, the economist can raise each individual application card to which there is a link.

In this document, the following efficiency coefficients are derived for one article:

1. The coefficient of useful use of metal is determined by dividing the amount of metal used for workpieces (taking into account allowances for cutting, cutting) by the total initial weight of this metal:

16,095 / 16,95 = 0,9496.

For your information

Each enterprise should strive to maximize this coefficient, because the higher it is, the more efficient the cutting, the more economical the metal consumption, and, as a result, savings on the purchase of materials.

2. Business waste (residue) coefficient - determined by dividing the weight of the pieces of received business waste by the total initial weight:

0,721 / 16,95 = 0,0425.

3. Waste ratio (scrap metal) - the weight of scrap metal received is divided by the total weight:

0,134 / 16,95 = 0,0079.

Depending on the accounting policy and management’s attitude towards the standards, the following manipulations may occur on the part of the procurement shop staff:

- or more metal is written off for the weight of the workpiece, and then there is an overexpenditure of norms for individual parts;

- or more is written off as business waste and metal - hence the high and ineffective values of the coefficients of useful use of metal, business waste and scrap metal.

We recommend

An economist should not refuse to work with such coefficients. It is important to organize the receipt of such analytics, accumulate statistics on these coefficients, analyze it taking into account the range of manufactured products, the equipment used for cutting/cutting blanks, craftsmen, storekeepers, and procurement shop workers.

Statistics and analysis must be performed separately for each standard size, for example separately for sheets S8 and S20. Based on the results of the analysis, standard values for each coefficient should be approved by management. Then, if in the current reporting period the metal utilization rate is below the approved level, the economist will have the right to demand an explanation from the shop management.

Another direction of analysis of cutting efficiency is determining the coefficient of metal utilization per part. Calculated using the formula:

Km = Md / Mn,

where Km is the coefficient of metal utilization per part (a measure of the density of workpieces);

Md is the mass of the part, kg;

Mn - rate of material consumption per part, kg.

The coefficient shows the level of efficiency in the use of metal, compliance with consumption standards, as well as the degree of accuracy of the manufactured workpieces:

- rough - Km < 0.5;

- reduced accuracy: 0.5 ≤Km <0.75;

- precise: 0.75 ≤Km ≤0.95;

- increased accuracy, for which Km >0.95.

Let's calculate the metal utilization factor for the part “Flange ABC 1544.01.008” (the result is presented in Table 1).

Table 1

Calculation of the metal utilization factor for the part “Flange ABC 1544.01.008”

| Index | Calculation | Coefficient values |

| Actual metal utilization rate | 3,43 / 5,30 | 0,647 |

| Planned metal utilization rate | 3,43 / 5,25 | 0,653 |

The difference in coefficients is insignificant:

0,647 – 0,653 = –0,006.

Both coefficients fall into the group of reduced accuracy blanks. It can be argued that 0.353 of the workpiece went into scrap metal, shavings, and waste. Of course, the efficiency of using metal is determined by the shape of the part. And if, according to the previous three coefficients, the economist needs to work with the employees of the procurement shop, then in this case - with the technologists, because they are the ones who describe the manufacturing technology, lay down the raw materials and consumption rates.

To increase the metal utilization rate per part, you should:

- for the most material-intensive, most frequently manufactured parts - perform the calculation indicated above;

- for workpieces of rough and reduced accuracy - compile a separate list and submit it to the chief technologist;

- request the chief technologist to reconsider the manufacturing technology of the parts on the list; it may be possible to manufacture the part using a different technology or with the involvement of third-party cooperation;

- simultaneously transfer the list to the chief designer so that he can review the design of the manufactured products and, if possible, replace the parts listed in the list with ones close to Km >0.95;

- if a particular product contains too many rough parts, suggest that management abandon its production, and designers instead develop a design that is more efficient in terms of metal consumption.

Let's look at an example. Thus, the initial cost of materials for Flange ABC 1544.01.008 is 5.3 × 120 = 636 rubles, of which only 0.647 × 636 = 411.49 rubles. the part costs 224.51 rubles. "gone" into waste.

If it is possible to increase Km to 0.95, then the cost of materials in the workpiece will be 411.49 / 0.95 = 433.15 rubles.

The savings on one part will be 636 – 433.15 = 202.85 rubles.

If 1000 such parts are produced per year, the savings will be 202,850 rubles. per year on only one part. And there may be more than one of these on the list.

In general, this is a rather interesting area of working with technologists. But you need to remember that if savings of 202.85 thousand rubles are planned on materials, then the enterprise should not receive a significant increase in labor costs (with all the charges and labor-related overhead costs) - such savings are meaningless, and you can’t call it savings .

* * *

The article examines some of the features of cost accounting for ferrous and non-ferrous metallurgy enterprises. In practice, methodologists have, of course, more controversial issues. When resolving them, remember that the recommendations presented relate to production processes that may have changed over time. The accountant must take into account the advice of the developers of guidelines, taking into account modern production technology. This may lead to a change in the recommended cost accounting procedure.

Industry: accounting and taxation, No. 10, 2017

Tax accounting during liquidation of fixed assets, use and sale of scrap metal

According to the norms of paragraph 13 of Art. 250 of the Tax Code of the Russian Federation, when calculating income tax, non-operating income should include the cost of materials generated during liquidation. Only those indicated in paragraph 18 of Art. should be excluded from this list. 251 Tax Code of the Russian Federation.

The moment of income recognition is strictly tied to the method used to calculate income and expenses.

Thus, under the accrual method, the moment of recognition of income will occur on the day when the act of liquidation of the depreciable object is drawn up. And with the cash method - on the day when this object is capitalized.

If the company decides to use the scrap metal generated during liquidation in its production or sell it, the cost of this material is included in material or sales expenses.

NOTE! According to Art. 252 of the Tax Code of the Russian Federation, the appropriateness of expenses must be justified and documented. If such efforts are not made, tax inspectors will have grounds to exclude these costs from the income tax base and, accordingly, charge an additional amount of this tax.

Read about what changes have appeared in the tax accounting of fixed assets in 2021 in the material “Procedure for tax accounting of fixed assets.”

Work of the liquidation commission

It is created to deregister an operating system. It includes employees of the enterprise; it necessarily includes the chief accountant, who is responsible for the balance sheet and accounting of scrap metal at the enterprise. The commission calculates the cost of the liquidated asset, decides on the advisability of further operation, and assesses the prospects for using the parts remaining after dismantling.

After inspecting the object, the final documents include the reasons why its operation is not rational, a description and options for using parts, if such a possibility exists. When loss of performance occurs before the estimated time, the culprits are identified.

To write off an asset, it is necessary to document the impossibility of using scrap in your own production and justify the rationality of its sale.

There is no official form of conclusion issued by the commission. It is mandatory that the document be signed by all members. On its basis, an order is issued from the director of the enterprise, and an act of write-off for scrap is issued.

Previously, only official forms were used: OS-4 and OS-4a for cars. Now this is not necessary. A typical sample is available on thematic sites. The act contains:

- seal, signatures of the manager and the person certifying the act (chief accountant);

- date of capitalization and entry into registers;

- estimated service life;

- initial cost;

- date of manufacture, start of use at the enterprise;

- depreciation at the time of liquidation;

- the number of repairs and the general condition of parts of the object at the time of inspection and issuance of a conclusion.

A write-off act is necessary when making a transaction: the owner of the goods is required to confirm that it is on the organization’s balance sheet.