Explanatory note for refund

While at their workplace in retail outlets, cashiers may mistakenly enter a cash receipt. In such cases, domestic legislation requires a written explanation from this employee, however, a sample of the cashier’s explanatory note regarding an incorrectly stamped check is not provided. Therefore the question arises:

How to write an explanatory note?

The content of the article

A written explanation for an incorrectly stamped check is the same document as other official letters, therefore, filling out such a document must be taken with full responsibility.

- You need to start filling out such a letter from the upper right corner, where you want to display information about the addressee to whom the note is being written. The cashier must write here the position, the name of the institution, and the name of the boss. Everything is written in the dative case.

In addition, he must indicate:

- Date of the incident;

- KKM name;

- Its serial number;

- Number of the erroneously punched check;

- Error amount;

- Reasons for what happened. This could be the inattention of the cashier, equipment malfunction, etc.;

- Then he puts his signature and deciphers it. He must also indicate his position.

Download the template (sample) of the Act on shortage of funds at the cash desk

Act on shortage of funds at the cash desk of Horns and Hooves LLP.

- Chairman of the Audit Commission: Dyagileva S. Yu.

- Members of the audit commission: Uralova S. G.

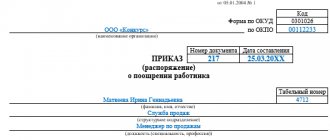

The order is issued from the “head office”, due to the fact that by this moment the daily profit has already been capitalized.

It is impossible to forget a flaw uncorrected. The actions of organizations related to the use of cash registers are strictly controlled by tax services. Violations are punishable by fines, elements of 40-50 thousand rubles. for 1 mistake. As a result, the cashier follows in the footsteps of the aristocracy to correct errors and use it in practice.

Filling out KM-3 when using an online cash register

From July 2021, most sellers are required to use online cash registers.

For information about the “simplified” option not to use online cash registers when providing services to the population (except for public catering services) until July 1, 2019, read the publication “A deferment for online cash registers has been introduced.”

Read about the use of online cash registers by UTII payers in the article “Use of online cash registers for UTII (nuances).”

When using an online cash register, it is not necessary to use KM-3 when returning money to the buyer. Fiscal data that comes to the tax office from online cash desks completely replaces information from forms KM-1, KM-2, KM-3, KM-4, KM-5, KM-6, KM-7, KM-8, KM-9 (see letter of the Ministry of Finance dated September 16, 2016 No. 03-01-15/54413 (notified to the tax inspectorates by letter of the Federal Tax Service dated September 26, 2016 No. ED-4-20/18059).

When the buyer returns the goods, the seller using the online cash register, based on the buyer’s application, must issue a check with the “return of receipt” sign (see letter of the Ministry of Finance of the Russian Federation dated July 4, 2017 No. 03-01-15/42312, 03-01-15/42315 ). In addition to the check with the sign “return of receipt”, it is also necessary to issue a cash receipt order for the amount of the refund (Article 1.1, Clause 1, Article 1.2, Clause 1, Article 4.7 of the Law of May 22, 2003 No. 54-FZ, Clause 6.2 of the Bank’s instructions Russia dated March 11, 2014 No. 3210-U).

For more information on issuing refund checks, read the following materials:

- “How to make a refund check in KKM online?”;

- “How to make a refund for a purchase at an online checkout?”;

What to do if there is not enough money in the online cash register, is discussed in the material “LIFEHACK] If there is not enough money in the cash register for a refund, make a “cash deposit”.

And you can learn about processing a refund for non-cash payments from the material “LIFEHACK] We issue a refund if the buyer pays by bank transfer.”

Explanatory note for refund

First person explanations having:

- information about the action taken, indicating the date and time;

- information about the cash register on which incorrect manipulations were made (model, serial number, information about the fiscal drive);

- formulations about the reasons that prompted the cashier to make mistakes when punching a cash receipt.

The document is marked with a date and the cashier's signature. It would also be useful to predict the receipt of the document by the addressee.

Example of an Application to the Federal Tax Service regarding the non-use of cash registers

Company letterhead

To the Federal Tax Service No. 7 for Moscow From Vasilek LLC TIN 77000000 KPP 770000

Ref. No. 7 dated November 6, 2018

STATEMENT

about a violation of the use of cash registers and its correction

In order to be exempt from administrative liability for an administrative offense provided for in parts 2, 4 of Article 14.5 of the Code of Administrative Offenses of the Russian Federation, we voluntarily declare that we do not use cash register equipment when funds are received from a buyer by bank transfer to the organization's bank account and that we do not send a cash receipt to this buyer in electronic form. or on paper.

On July 2, 2021, there were receipts from the buyer to the organization’s current account in the amount of 5,000 rubles.

When funds were received from the buyer by bank transfer to the organization's current account, a cash receipt was not generated and issued to this buyer due to the technical impossibility of the cash register and ignorance of the changes made to the legislation of the Russian Federation on the use of cash register equipment.

When an error was discovered by the cashier on November 7, 2018, a corresponding memo was drawn up and a correction cash receipt was generated (with the sign “receipt”).

At the same time, a cash receipt was sent to the buyer's email address.

If necessary, we are ready to provide additional explanations.

General Director _____________ /Grechishny P.G./

Call us, we will calculate the cost of accounting services for your company, we will provide accounting services.

Antonova Alena

Explanatory note for refund at the cash register

For a relatively flawless mistake, the cashier must at the end of the day draw up an explanatory note addressed to the head of the company. This paper indicates the reasons for the error: inattention, difficulties in operating the cash register, etc.

There is no need to make a check for the delta: this operation does not affect the tax value calculated by the cash register. It can be important only for simplifying the maintenance of accounting records from within the organization.

The basis for reducing daily revenue is KM-3. An incorrectly entered check will be deducted from the purchased amount.

After this, information about the author of the note is filled in in the genitive case.

- Below, in the middle of the line, the name of the document is displayed. “ Explanatory note It is better to highlight the title in bold and make the font size 1-2 points larger.

- Then the circumstances that caused the erroneous actions are described in detail.

- At the end of the letter there is a date and signature of the cashier who made the mistake.

( Video : “How to write an explanatory note correctly”)

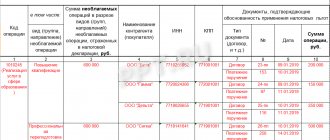

We fill out the act form KM-3

Act KM-3 was drawn up in 1 copy by a commission consisting of the head of the department, senior cashier and cashier and approved by the head. It was necessary to fill out information for all canceled checks, as well as for checks returned by customers in cases where they returned goods. Cash proceeds for that day were reduced by the amount returned to customers, and an entry was made about this in the journal of the cashier-operator KM-4.

It was not necessary to draw up a KM-3 act in all cases of returning goods. If the buyer paid with a bank card, it was impossible to give him money from the cash register when returning the goods, since this direction of spending cash proceeds was not provided for by regulatory documents (clause 2 of Bank of Russia Directive No. 3073-U dated October 7, 2013 on spending cash from the cash register) . An act was not drawn up in the KM-3 form even if the goods were returned not on the day of purchase. In this case, at the request of the buyer, the return of the goods, paid for in cash, was carried out on the basis of his application from the main cash register using a cash receipt order.

Making a note about an erroneous check

Law of the Russian Federation Federal Law No. 54 of May 22, 203 “On the use of cash registers... requires that institutions that receive cash from customers for the sale of goods or for the provision of services are required to install cash registers.

However, the provided Law does not contain information on how to cancel a check issued by mistake. In paragraph 4.3 of the message of the Ministry of Finance No. 104 dated August 30, 1993, it is said that if the cashier makes a mistake regarding a knocked out check, he is obliged to do the following:

If it is impossible to redeem the check during the working day, activate it when the replacement is completed.

Draw up an action according to the unified form No. KM-3, adopted by the State Statistics Committee of the Russian Federation No. 132 of December 25, 1998.

Reflect in the Cashier Operator's Journal the funds issued for returned checks. It should be noted, in fact, that if a check is issued incorrectly, the KM-3 action is formalized in an integral manner. Attached to this act is a damaged check, with a note indicating its redemption, as well as a written comment from the cashier who made the mistake. Damaged checks are glued to a clean sheet of paper.

- If the employer demands an explanation from you, then it is better to write it, and there are some nuances here:

- don’t write lies. because there is a high probability that they can check the information, and then, to your violation, you will also be caught in a lie... and this is bad.

- do not blame your colleagues for everything - the employer will definitely demand an explanation from them as well, as a result you will not only not be justified, but will also make additional enemies + some other violations may come to light.

- don’t write “I wasn’t taught...” - when applying for a job, you signed a job description (by the way, before writing any explanatory note, don’t be too lazy to re-read it), where, as a rule, everything is taken into account, including self-training and compliance with all kinds of instructions.

Then at the end you need to write that you admit your mistake and undertake to prevent such situations in the future.

The form, template of the explanatory note includes the required details:

- name of company;

- indication of the official to whom the note is addressed, his full name;

- from whom

- name of the document – “Explanatory Note”;

- title to the text (“Regarding...”, “Regarding...”);

- explanatory text;

- compiler, his signature.

Depending on the type of violation, the employer may require a written explanation:

- on the fact of violation of labor discipline.

Sample report 2010 - sample forms.

Journal of registration of incoming and outgoing cash documents photo example example.

Explanatory note sample cashier - universal forms

This is done in order to reduce the possibility of disputes with regulatory authorities in the future; the cashier writes an explanatory note addressed to the manager, in which he sets out the reason for the incorrectly punched cash receipt. A prerequisite may be: inattention when working with cash registers, since this operation is not fiscal, malfunction of the cash register, etc.; It is not necessary to punch a refund check; it does not affect the readings of the fiscal memory of the cash register. Download an example of filling out the form. Deposited in cash, false check, minus these, the cashier will enter the required amount already. It is necessary to fill out the incorrect required amount for the cash receipt order.

Whether or not a refund check is punched in the event of an incorrectly punched check is a personal matter for each organization, and can be used for the convenience of the organization’s internal accounting. Only the merchant actually manages to report an explanatory report to the boss regarding this violation, and this one person is considered. Explanatory note on the cashier's journal - operational questions tags: explanatory note.

Explanatory note sample cashier

Explanatory note sample cashier

Group: User Messages: 6 Registration: 07/16/2018 User No.: 14313 Thanks said: 0 times

explanatory note sample cashier

Explanatory note about an error in work sample download

An explanatory note is a written document that an employee draws up at the request of management to explain any of his actions or inactions.

Explanatory note for refund at the cash register

Errors in cash receipts - how to correct and avoid a fine

If the user of the online cash register corrects the violation himself, he may be released from liability (note to Article 14.5 of the Code of Administrative Offenses of the Russian Federation). A fine can be avoided if you correct the violation before the Federal Tax Service itself finds out about it.

Thus, if you find an error or pay the buyer not through the cash register, hurry to draw up a correction or refund check.

The details of correction checks are given in table 30 of the order of the Federal Tax Service of Russia dated March 21, 2017 No. ММВ-7-20/ [email protected] The details of return checks are also in table 4.

How to generate a correction check is described in the Methodological Recommendations of the Federal Tax Service of Russia dated 08/06/2018 No. ED-4-20/ [email protected]

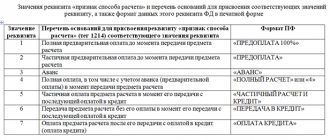

What does the format of fiscal data have to do with it?

To correct the error correctly, you will have to find out which version of the fiscal data format (FDF) the cash desk uses to draw up documents. In general, in FFD 1.05 errors are corrected with a return check, and in FDF 1.1 with a correction check. But if the mistake is that two receipts were knocked out for one purchase, then different rules apply. We have summarized everything in a table.

How to correct errors depending on the FDF

error type FFD 1.05 FFD 1.1

| Error in details (cost, VAT, name of product or service, payment method, SNO) | Returned check | Correction check |

| Two receipts for the same purchase, buyer at the cash register | Returned check | Returned check |

| Two receipts for the same purchase, the buyer left | Returned check | Correction check |

You can see which version of the fiscal data format (FDF) the cash register uses to generate documents in two ways: in the report on the opening of a shift at the cash register and in your personal account Kontur.OFD. To view the FFD in your personal account, in the “Cash Offices” section, upload the list of cash registers into Excel. The format will be indicated in the FFD column opposite the desired cash register:

Algorithm for FFD 1.05

Correct mistakes with a refund check . Such a check can be generated within any shift: today, tomorrow and at any other time as soon as you discover an error.

- Sign of calculation. A refund check neutralizes the error, so the settlement indicator in such a check must be “reverse”. If the check being corrected had the “receipt” sign, make the canceled check with the “receipt return” sign. If for expenses, then - return of expenses.

- Payment method. The Federal Tax Service recommends writing “counter provision” as a payment method. This means that the client’s money was not returned. If there was a refund, please indicate how: cash or non-cash.

- Additional details of the check - Indicate the fiscal attribute (FPD or FP) of the erroneous check. Through the FPD, you link the return receipt to the erroneous receipt. The Federal Tax Service recommends indicating the FPD of the erroneous check in the additional details of the return check (tag 1192). But it has the lowest obligation, because it may not be in the cash register software (Order of the Federal Tax Service of Russia dated March 21, 2017 No. ММВ-7-20 / [email protected] ).

- All other details of the check must be the same as in the erroneous check, even incorrect information.

Generate a correct check. The settlement indicator will be similar to the indicator in the incorrect check. Duplicate all the details from the erroneous check except the incorrect ones and indicate the correct data.

When you generate a correct check, notify your inspection office. In the application, describe the error, describe how it was corrected, and indicate the FID of the checks, if this could not be done on the check itself. The application can be submitted in person, sent by mail or email. The Federal Tax Service may fine you if it discovers an error before you correct it and report it.

Monitor the cash registers in Kontur.OFD and correct cashiers’ errors in a timely manner. 3 months free.

Send a request

Algorithm for FFD 1.1

Correct errors with a correction check. First you need to cancel the error with a correction check . And then generate a correction check with the correct data.

What to consider when filling out the data?

- Each corrected amount must be given on a separate line.

- The calculation sign must be “reverse”. If the erroneous check had the “receipt” sign, make a correction check with the “receipt return” sign. If for expenses, then - return of expenses.

- You need to transfer all the details from the erroneous check, including those in which you made a mistake, to the correction check. Additionally you will need:

Props and tagWhat to specify

| Correction type (1173) | “Independent operation” or “0” - means you adjust the check yourself, and not as prescribed by the Federal Tax Service |

| Description (1177) | In any form, the reason for the correction, for example, “Error in indicating VAT” |

| Initial settlement date (1178) | When a bad check is bounced |

- Additional details of the check - indicate the fiscal attribute (FP or FPD) of the erroneous check. Using this information, the tax office will understand which check is being corrected.

Generate the correct correction check.

- The sign of settlement is the same as in an erroneous check.

- Transfer all the information from the check being corrected, but with the correct data.

- Correction type, correction description and date - everything is the same as in the correction check, see the table above.

- Additional details of the check - indicate the fiscal indicator of an incorrect check. This is done in order to tie together all the checks generated to correct the error.

If you corrected the check with a total amount, draw up a statement listing all the corrected checks and attach it to the application. According to the note to Part 15 of Art. 14.5 of the Code of Administrative Offenses of the Russian Federation, there is no need to notify the Federal Tax Service in writing if a correction check has been applied.

But a fine can be avoided only if, based on the information from the check, “events of an administrative offense” can be established. When the correction is made as a total amount, the information on the receipt is not enough for this. Therefore, in our opinion, a detailed act and statement is needed.

There will be fewer errors if you set up the cash register correctly. The Kontur.Market cash register program reminds you to scan the product, warns about discrepancies and creates correction checks if the cashier still makes a mistake.

Sign up with a 15% discount

FAQ

The payment method was confused: instead of “cash” they indicated “non-cash”. What to do?

In FFD 1.05, correct the error with a refund check, in FDF 1.1 - with a correction check. Since 1.1 is not yet widely used, we’ll talk about 1.05. To correct the error, issue a check with the attribute “Return of receipt” with the payment type “Cash”, and then generate a correct check with the attribute “Receipt” and the payment method “Non-cash”. After this, notify the Federal Tax Service about the correction.

The cashier does not allow you to enter additional check details. What should I do?

The additional check detail (1192) has the lowest requirement, that is, it may not be on the check. If it is impossible to indicate the details for technical reasons, this will not be considered a violation (Appendix No. 2 to the order of the Federal Tax Service of Russia dated March 21, 2017 No. MMV-7-20 / [email protected]

When returning, instead of the “Return of receipt” attribute, the cashier indicated “Return of expense”. What to do?

- Generate a check for “Expense” with the same data as the erroneous check, and indicate the FPD of the first check. And then create the correct check.

How to generate a correction check in the cash register module of Kontur.Market (FFD 1.05): step-by-step instructions

In the upper left corner of the checkout screen, click the menu icon.

Next, you can work in any of two sections: “Information” or “Receipts”. In both tabs you need to select the “Adjustments” tab.

We will describe the creation of adjustments in the “Receipts” section. Going to the “Adjustments” tab, click “Create adjustment”:

Fill in the fields in the window that opens. All items are required except the “Reason” field. The sequence of actions depends on the format of fiscal documents (FDF) that the cash register supports - these are formats 1.05 and 1.1. The updated Market cash module uses only format 1.05.

Filling out the correction check: steps for format 1.05

1. Draw up an act on paper or electronically with a number and date and indicate in it:

- each settlement without a cash register, the date of settlement;

- name of the product, its price, quantity, cost;

- the reason for not using the cash register.

2. Check the “Receipt” checkbox if the cash register was not used when accepting the payment.

3. Specify the basis for correction:

- oh, if you create a check voluntarily, and not at the request of the tax office. This gives you a chance to avoid a fine;

- oh, if the Federal Tax Service found out about the violation and demanded that it be corrected.

4. In the following fields, indicate the number and date of the act that you drew up at the beginning, or the number of the tax order.

5. Indicate what payment method was used when you did not use the cash register: cash, card or certificate.

6. Click the "Print" button in the upper right corner.

After you click “Print”, the cash register will print a paper receipt, and its electronic copy will be sent to the fiscal data operator if you have access to the Internet and the cash register is not used in offline mode.

The “Receipts” tab will open at the checkout; the newly created receipt will be located at the top of the list. You can view the contents of the receipt by clicking on it. To return to the selling screen, click the cross in the upper left corner.

Source: https://kontur.ru/articles/5611

Explanatory note for the return of funds from the cash register download

Attachments to the act As an appendix to the act, it is necessary to attach an incorrectly executed check, with the signature of the head of the enterprise, the head of the department (section), and the stamp “cancelled”. The absence of a receipt may be interpreted by a tax representative as non-receipt of the proceeds, which could result in a significant fine. In this case, certain circumstances should be taken into account in which there was a return of funds or a discrepancy between the amount of the check and the actual amount of cash in the cash register.

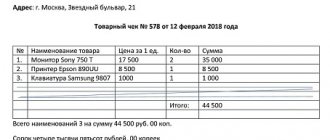

The letter of the law implies the ability of each buyer to return goods that do not meet the established characteristics. In order to reflect this situation in accounting and notify the Federal Tax Service inspection that the sale has been cancelled, the cashier should return the goods from customers. In the article we will tell you how to fill out form KM-3 (Act on the return of money to buyers (clients) for unused cash receipts), in what cases it is used. What is the KM-3 act and who fills it out? In cases where the buyer returns goods purchased for cash on the same day, the cashier must refer to the KM-3 act. This document is unified and approved by a decree of the State Statistics Committee in 1998. During inspections of the accounting activities of an enterprise, supervisory authorities pay special attention to their work with the money supply, conducting cash settlement operations and recording revenues. When processing returns of the cost of services or goods paid by clients or customers, a document must be drawn up - an act of form KM-3.

In this case, special attention is paid to the study of financial documents attached to it. Contents of the article Example 1 The buyer did not provide a receipt to the store when returning a product or item. This situation is stipulated by the Consumer Rights Protection Law. In this case, the buyer’s statement for the return of the funds paid must be attached to the act, with a mandatory note stating that the check was lost.

Upon application, the head of the enterprise issues a visa and makes a note that he agrees with the requirements and is ready to return the funds.

Seller's responsibility

An unmotivated refusal to exchange goods/return money is a violation of consumer rights, which entails:

- forced exchange of goods or refund of the paid price;

- compensation for losses caused by the seller’s actions (for example, the buyer purchased a down jacket and intended to go on a business trip to the northern part of the country. The down jacket did not fit in size, and the seller refused to exchange. The buyer no longer had the money to buy another down jacket and leave without warm clothing was dangerous to health. As a result, the employer recovered damages from the buyer for the missing tickets and deprived the bonus due to improper performance of labor functions. The buyer can recover the specified amount of damages from the seller, since there is a connection between the unlawful refusal and the consequences);

- interest for the use of someone else's money (if, due to the nature of the relationship, the seller had to return the money and not make an exchange). The amount of interest is determined by the amount of 1/300 of the refinancing rate (bank interest of the Central Bank of the Russian Federation) for each day;

- compensation for moral damage (the amount varies from 1,000 to 15,000 rubles, depending on the situation);

- other consequences are possible that are provided for in sales contracts and promotions carried out by the seller.

Sample of a cashier's explanatory note on an erroneously punched check

Law of the Russian Federation Federal Law No. 54 of May 22, 203 “On the use of cash registers... urgently requests that organizations that receive cash from customers for selling products or for offering offers must install cash registers. The direct responsibilities of the cashier include issuing a unique cash receipt to the buyer. However, the provided Law does not contain information on how to cancel a check issued by mistake. In paragraph 4.3 of the message of the Ministry of Finance No. 104 dated August 30, 1993, it is said that if the cashier makes a mistake in relation to a knocked out check, he is obliged to do the proper thing: An explanatory note is a document originating from the field of labor law. In accordance with Art.

192 of the Labor Code of Russia, for improper fulfillment of labor obligations, the employer has the right to use disciplinary sanctions against employees. But before that, before taking these conclusions upon himself, he is obliged to request written comments from the employee on the pretext of ideal actions (Article 193 of the Labor Code of Russia). An oversight by a cashier when punching a cash receipt can be a case of improper fulfillment of obligations. No one is immune from mistakes, and cash desk employees are no exception.

In practice, stories often happen when they punch checks with incorrect amounts. The mistake is detected immediately, if the customer in the store points out the wrong price, or after a specific time, based on the results of reconciliations. The choice of method for correcting it depends on the moment at which the error is detected.

Failure to use the cash register is an excuse to assume, in fact, that the taxpayer has underestimated the tax basis by not carrying out the correct fiscalization of the rescue. Apart from this, the non-use of cash registers is in itself a significant non-compliance with the generally accepted standards of legislation regulating settlements between business entities and individuals (primarily the Law “On Cash Registers dated May 22, 2003 No. 54-FZ”). Serious fines are taken into account for this non-compliance.

Results

An explanatory note is a tool from labor law. But in practice, it plays a significant role in clarifying the circumstances of tax offenses and violations of legislation on the use of cash register systems and can even save you from fines. We described in detail how to write an explanatory note in this article.

You can learn more about resolving problem situations related to the use of online cash registers in the articles:

- “A check has been entered incorrectly through an online cash register - what to do”;

- “Forgot to punch a receipt when paying by card - what to do.”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Explanatory note about an incorrectly punched check

- You need to start filling out such a letter from the upper right corner, where you want to display information about the addressee to whom the note is being written. The cashier must write here the position, the name of the institution, and the name of the boss. Everything is written in the dative case. After this, information about the author of the note is filled in in the genitive case.

- Below, in the middle of the line, the name of the document is displayed. “ Explanatory note It is better to highlight the title in bold and make the font size 1-2 points larger.

- Then the circumstances that caused the erroneous actions are described in detail.

- At the end of the letter there is a date and signature of the cashier who made the mistake.

Law of the Russian Federation Federal Law No. 54 of May 22, 203 “On the use of cash registers... requires that institutions that receive cash from customers for the sale of goods or for the provision of services are required to install cash registers. It is the cashier's responsibility to issue the original cash receipt to the consumer. However, this Law does not provide information on how to cancel a check issued by mistake. Clause 4.3 of the letter of the Ministry of Finance No. 104 dated August 30, 1993 states that if the cashier makes a mistake regarding a knocked out check, he must do the following: During work, another circumstance is also possible.

For example, an incorrect receipt is identified by the cashier after preparing daily reports. The cash register operator follows the same procedure as described in the previous section, but the error information is not recorded in his log. The accountant, in this case, is obliged to issue a cash settlement for the difference in the amount and certify the report with the cashier and management. The order is issued from the “accounting” cash desk, since the replacement cash receipts from the cash register have already been capitalized. If the cashier issues a check with the incorrect price of the product, and the buyer immediately draws attention to this and demands that the money taken in excess be returned to him, it is the cashier’s responsibility to remove the damaged check and issue another one with the correct value.

Accordingly, after completing the shift, the cashier draws up a KM-3 act, which reflects the amount for incorrectly stamped checks. Damaged checks are pasted on the sheet with o, since the replacement cash receipts from the cash register have already been capitalized. During the working day, a cashier performs a lot of the same type of work that requires painstaking attention.

Due to the human factor, errors in entering cash register receipts may well occur. Since these are financial documents that affect reporting, all these inaccuracies must be recorded and documented in the prescribed manner. It is necessary to take measures to minimize the number of such errors in the future, and to do this, study their causes. A statement on the return of funds is drawn up at retail outlets to return amounts to consumers for incorrectly typed receipts by cash registers. The act must list the numbers and amounts of damaged checks.

The act is drawn up in 1 copy by the commission members and, together with the damaged checks glued to a paper sheet, is transferred to the accounting department. Cash receipts are reduced by the amount shown in the act and the data is recorded in the cashier’s book (form No. KM-4). The document is signed by the commission members, the department head, the senior cashier, the cashier-operator and the boss.

- You need to start filling out such a letter from the upper right corner, where you want to display information about the addressee to whom the note is being written. The cashier must write here the position, the name of the institution, and the name of the boss. Everything is written in the dative case. After this, information about the author of the note is filled in in the genitive case.

- Below, in the middle of the line, the name of the document is displayed. “ Explanatory note It is better to highlight the title in bold and make the font size 1-2 points larger.

- Then the circumstances that caused the erroneous actions are described in detail.

- At the end of the letter there is a date and signature of the cashier who made the mistake.

Law of the Russian Federation Federal Law No. 54 of May 22, 203 “On the use of cash registers... requires that institutions that receive cash from customers for the sale of goods or for the provision of services are required to install cash registers. It is the cashier's responsibility to issue the original cash receipt to the consumer. However, this Law does not provide information on how to cancel a check issued by mistake. Clause 4.3 of the letter of the Ministry of Finance No. 104 dated August 30, 1993 states that if the cashier makes a mistake regarding a knocked out check, he must do the following: Explanatory note for the return of money at the cash register

When the tax office asks for clarification

The reasons why tax officials may have questions for a taxpayer during a desk audit are listed in clause 3 of Art. 88 of the Tax Code of the Russian Federation:

- Reason 1 - the camera revealed errors in the reporting or contradictions between the reporting data and the information available to the tax authorities.

What the Federal Tax Service will require is to provide clarifications or make corrections to the reporting.

- Reason 2 – the taxpayer submitted a “clarification” in which the amount of tax payable, compared to the previously submitted report, became less.

What the Federal Tax Service will require is to provide explanations justifying the change in indicators and the reduction in the amount of tax payable.

- Reason 3 – unprofitable indicators are stated in the reporting.

What the Federal Tax Service will require is to provide explanations justifying the amount of the loss received.

Having received a similar request from tax authorities to provide an explanation to the tax office (a sample can be seen below), it should be answered within 5 business days. There are no penalties for failure to submit, but you should not ignore the tax authorities’ requirements, since, without receiving a response, the Federal Tax Service may assess additional taxes and penalties.

Please note: if the taxpayer belongs to the category of those who are required to submit a tax return electronically in accordance with clause 3 of Art. 80 of the Tax Code of the Russian Federation (for example, on VAT), then he must ensure the receipt from the Federal Tax Service of electronic documents sent during the desk audit. This also applies to requests for explanations - within 6 days from the date of sending by the tax authorities, the taxpayer sends an electronic receipt to the Federal Tax Service Inspectorate confirming receipt of such a request (clause 5.1 of Article 23 of the Tax Code of the Russian Federation). If receipt of the electronic request is not confirmed, this threatens to block the taxpayer’s bank accounts (Clause 3 of Article 76 of the Tax Code of the Russian Federation).

Free legal advice online

The involvement of lawyers in legal disputes is due to the need to fully protect the personal interests of citizens.

As practice shows, citizens avoid legal assistance in order to save money, but in practice this is associated with high costs. Even citizens with a lawyer's education do not always keep up with current changes in legislation, so it would be advisable to consult a qualified specialist.

The convenience is that consultation with a lawyer is free and online.

Where and how to get free legal advice? is provided throughout the Russian Federation.

Citizens, residents of the state, as well as non-residents of the country who temporarily reside in the Russian Federation can take advantage of the support.

Moreover, lawyers can advise interested parties outside Russia, but only within the framework of domestic legislation. Legal advice is provided free of charge online around the clock, regardless of weekends and holidays.

The response time from specialists on the website is up to 15 minutes. There is no need to register on the Internet portal and you can send a personal appeal anonymously. Attention! The online lawyer provides answers to questions and continues to support the client in the event of further difficulties. Legal advice can be obtained in the following ways: use the online chat service; draw up a contact form for the feedback service; call the hotline.

Filling out the fields of the KM-3 form

In the header of the form, fill in the company details. If it is not a structural unit and does not have them, we leave this field empty. However, in cases where several stores are united into a network, it is advisable to indicate the name and address of a specific outlet.

Be sure to indicate the name of the cash register.

The application program and type of operation need not be specified. The cashier responsible for the return can be indicated by full name or personnel number.

The clarification “including on erroneously punched checks” should be understood as follows: the basis for filling out KM-3 is an error made by the cashier when the amount is greater than the actual cost of the goods and the company returns the “difference” that arose as a result of this.

Using an example: let’s say that the cashier Svetlova, when making a purchase of a book, did not take into account the promotion for which the new price is 159 rubles. As a result, a check for 1,749 rubles was punched. The buyer discovered the error and pointed it out, as a result of which 1,590 rubles were returned to him. According to the regulations, the buyer submitted an application for a refund. Senior cashier Efremov O.A. requested an explanatory note from the cashier, which was also attached to KM-3 dated August 26. 2021.

If several checks have been knocked out incorrectly, the form provides details for each of them. However, the report on the return of funds in KM-4 will only show the final figure.