Bank, cash desk

Natalya Vasilyeva

Certified Tax Advisor

Current as of January 30, 2020

Organizations paying income tax are required to make advance payments during the year. These payments, like the tax, are credited to two budgets: federal and regional. Let's consider how to draw up a payment order for the transfer of an advance payment for income tax in 2021.

Structure and purpose of props

When transferring payments for taxes, fees, contributions and other types of fiscal payments, take into account the special procedure for filling out a payment order. So, for example, to pay money to the Federal Tax Service, you will have to fill out special fields in the payment slip: tax line (fields 104 to 110 inclusive).

Field 107 is the tax period in the payment slip, 2021 - the format of this detail is presented as follows: “ХХ.ХХ.ХХХХ”, where the alphabetic and numeric values of the code are separated by dots.

The key purpose of the code is to determine for what period the settlement with the Federal Inspectorate is carried out. For example, when funds are received into a current account, tax authorities must know exactly in favor of which reporting period to credit the funds.

Income tax: payment details for 2021

You can find out the payment details of your Federal Tax Service, according to which the tax should be transferred, directly from the inspectorate by contacting them in person. An easier and faster way is to visit the online service “]]>Address and payment details of your inspection]]>” on the official website of the Federal Tax Service.

On the service page you will need to indicate the company’s address, or immediately select the Federal Tax Service number. As a result, the system will provide all the information about the required inspection, including bank payment details for transferring taxes.

Exceptional situations

In some cases, the tax period in the 2021 payment bill may have a different meaning. Let's determine the most popular:

- Contributions for injuries. When listing insurance coverage against accidents and occupational diseases, indicate “0” in clause 107.

- State duty. If the institution pays the state fee to the budget, then in paragraph 107 indicate the specific date of payment.

- Additional payments based on the inspection report. If the company pays arrears according to a tax audit report or according to writs of execution, then enter the value “0”. If payment is made upon request, which specifies a specific date for settlement, then in clause 107 indicate the exact date of payment.

- Customs duties in the payment invoice (tax period) - what to indicate? If the organization pays fees and duties to the customs authority, then in field 107 you will have to indicate the territorial number of the customs office.

If there is an error in the payment order in clause 107, then it is necessary to prepare a letter to clarify the payment. This document is compiled in any form indicating incorrect and correct values. Also, be sure to indicate in the letter the number of the payment document and its date, the name and credentials of the institution, and contact information.

Sample for payment of fine

In the event that the owner of the company simply did not have time to pay personal income tax on a voluntary basis, or if it was carried out, as a result of which personal income tax was additionally accrued, the inspectorate will most likely fine the company. In this case, the KBK number in the payment slip will be changed again.

Moreover, the fine must be paid only when the tax office has already issued a demand to you. Until then, you need to try to do everything so that the fine is either reduced or does not exist at all.

Requirement with UIN

Requirement without UIN

Changes in legislation occur every year. This applies not only to ordinary citizens - changes often affect commercial structures.

Documentation and accounting are being computerized, reports are moving into electronic format, but (PP) is still one of the most popular forms. The payment form is not much different from the fine payment form, and both documents can be in paper or electronic form.

Tax period codes in 2021

Tax returns must indicate the tax period code. Digital designations of periods depend on the type of declaration. We’ll figure out what codes to use when reporting taxes in this article.

The tax period code includes two digits. In addition to declarations, such a code is placed on tax bills. Thanks to these codes, Federal Tax Service inspectors determine the reporting period for the submitted declaration. Also, such a code will make it clear to the Federal Tax Service that the company is being liquidated (during liquidation, its own code is inserted).

Types of tax periods:

- month;

- quarter;

- half year;

- 9 months;

- year.

The tax period code is recorded on the title page of the declaration or other reporting form. Usually, payers can find all the codes for a particular declaration in the order they fill out the declaration (in the appendix). For example, for the income tax return, the period codes are described in the Order of the Federal Tax Service of the Russian Federation dated October 19, 2016 No. ММВ-7-3 / [email protected]

If the tax is considered cumulative, returns are submitted in the periods listed below with codes:

- quarter - 21;

- first half of the year - 31;

- 9 months - 33;

- calendar year - 34.

Fill out and send reports to the Federal Tax Service via the Internet and the first time. 3 months of Kontur.Externa for you for free!

Try it

If the declaration is submitted monthly, the codes will be as follows:

For consolidated groups of taxpayers, their own codes have been approved: from 13 to 16 (where code 14 corresponds to a half-year, and 16 to a year).

The coding of monthly reporting of consolidated groups begins with code 57 and ends with code 68.

When liquidating a company, you need to enter code 50.

For property tax, other codes are used:

51 - I quarter during reorganization;

47 - half a year during reorganization;

48 - 9 months during reorganization.

Payment order field 107: tax period

The value of field 107 of the tax payment can take the following form:

- “MS.XX.YYYY”, where XX is the month number (from 01 to 12), and YYYY is the year for which the payment is made. For example, when transferring an advance payment for income tax for March 2021, in field 107 of the payment slip, you need to enter “MS.03.2019”;

- “Q.XX.YYYY”, where XX is the quarter number (from 01 to 04), YYYY is the year for which the tax is paid. So, when transferring the next VAT payment, for example, for the second quarter of 2021, field 107 should indicate “KV.02.2019”;

- “PL.XX.YYYY”, where XX is the number of the half-year (01 or 02), YYYY is the year for which the tax is transferred. For example, when transferring a payment under the Unified Agricultural Tax for the 1st half of 2021, put “PL.01.2019” in the payment slip;

- “GD.00.YYYY”, where YYYY is the year for which the tax is paid. For example, when making the final calculation of income tax for 2021, in field 107 of the payment slip you will need to enter “GD.00.2019”.

Field 107 in a payment order in 2021: when is a specific date set?

If the Tax Code of the Russian Federation for the annual payment provides for more than one payment period and specific dates for payment of this tax are established, then these dates are indicated in field 107 of the payment slip (clause 8 of Appendix No. 2 to Order of the Ministry of Finance of Russia dated November 12, 2013 N 107n).

A striking example of such a tax is personal income tax paid by an individual entrepreneur to the OSN for himself (not as a tax agent). After all, he must transfer the tax at the end of the year no later than July 15 of the year following the reporting year, and during the year advances are transferred (clause 9 of Article 227 of the Tax Code of the Russian Federation): no later than July 15, October 15 of the reporting year and January 15 of the year following for reporting.

As we can see, the Code does not contain wording regarding this tax, as for other taxes (for example, “the tax is paid no later than the 28th day of the month following the reporting period”), but specific dates are indicated. Accordingly, in field 107 of the personal income tax payment for an individual entrepreneur, you need to put exactly the date for yourself, for example, “07/15/2019” when paying an advance for January - June 2021.

Field 107 in the personal income tax payment slip

If an organization/individual entrepreneur pays personal income tax to the budget as a tax agent, then in the personal income tax payment order, field 107 is filled out in the usual manner (i.e. in the “MS.XX.YYYY” format). After all, the Tax Code does not stipulate specific dates for payment of agency personal income tax.

Consequently, no new rules for filling out personal income tax payments have appeared. And the explanation of the Tax Service (Letter of the Federal Tax Service dated July 12, 2016 N ZN-4-1 / [email protected] ), given back in 2021 and regarded by some experts as an innovation in filling out field 107 of personal income tax payments, is only a general commentary on the procedure filling out payment orders for tax payments.

Taking into account this fact, when transferring personal income tax, for example, from a salary for March 2021, tax agents must put “MS.03.2019” in field 107 of the payment slip.

KBK

By the way, this year minor changes were made to the payment of contributions and taxes. The table below shows all the codes that will be needed in order to correctly fill out the payment slip this year. Changes that occurred this year are highlighted with an asterisk.

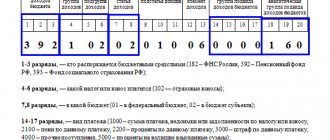

Field 104 called “KBK” must be filled out correctly. So, this code consists of 20 digits, which should be entered in this field. If we talk about current payments, then for them the BCC has not changed at all this year:

- If the funds go to the federal budget (the rate is 2%), then code 182 1 0100 110 is entered.

- When we are talking about the regional budget and the rate from 13.5 to 18%, then the code is 182 1 0100 110.

This year, only the KBK changed to , about which Order No. 90 was issued. For such payments it is now written as 182 1 01 01080 01 0000 110.

It is also worth entering field 105 “OKTMO” correctly. This code consists of 8 or 11 digits.

How to determine how many numbers to enter? In the event that the tax is credited to the federal budget - 8. The same number will be if the tax is sent to the municipal budget. But if personal income tax is distributed between several divisions at once, which are part of the municipality, then the code will be 11.

How to fill

To fill out a payment document through Sberbank Online, the client must undergo authorization. During initial registration, select the “New Document” tab and fill in the payment details. When making a repeated payment, select the necessary details from the filters that are suitable for your transaction. The “Tax period” field is filled in automatically when repeating a payment to Sberbank Online.

Important. Be sure to check that all data is entered correctly, especially in field 106.

Next, click “Create” and determine the order of payments. Confirmation is carried out via SMS notification to the number of the head of the organization or accountant.

The code looks like this: NN.NN.NNNN. It contains 8 characters of letters and numbers and two dots to separate items.

The letters (first and second) are the period code for timely payment of tax (MS - month, CV - quarter, PL - half-year, GD - payment for the year).

The third sign is a dot. The fourth and fifth indicate a specific payment period:

- monthly payment - enter the numbers 01 - 12 (01 - January, 02 - February, 03 - March, etc.);

- quarterly payment – numbers indicating the current quarter (01 – first, 02 – second, 03 – third, 04 – fourth);

- payment for half a year (01 – first half of the year, 02 – second half of the year);

- 00 is entered when making payments for the year.

The sixth character is a comma for separation. The seventh, eighth, ninth and tenth indicate the year (for example, 2021).

Note. The payment for June 2021 to the Social Insurance Fund will look like this: “MS.06.2018”.

The “00” icon is entered when paying an advance payment, fee or tax for the current period when an inaccuracy is detected in the declaration, when the taxpayer independently decided to pay the difference in tax.

Important. When transferring an advance payment, fill in the appropriate signs for the future period, not the current one.

If an individual entrepreneur is subject to simplified taxation and has received a patent, he can pay for it through Sberbank Online.

Insurance premiums

The data in column 107 depends on the recipient:

- to transfer insurance contributions to the Social Insurance Fund, indicate “0”;

- for any other contributions indicate data in the format “NN.NN.NNNN”.

Insurance premiums are transferred to the tax service from 01/01/2017. Contributions to the Social Insurance Fund for compensation for injuries caused while performing work duties are called “injury contributions.”

Payment order functions and fields 107

A payment order is a document with the help of which a legal entity or individual entrepreneur transfers funds for various purposes.

The order is accepted on paper with a blue seal or in electronic form. Funds are debited from the counterparty's current account.

Column 107, indicating the payment period, must be filled out in accordance with the rules.

Specifying the exact date

Options for indicating the exact date in field 107 “Tax period” are determined by the Legislation of the Russian Federation:

- if in cell 106 “Basic payment” the codes of the basis for paying tax to the budget are entered: TP, ZD, BF, TR, RS, OT, RT, PB, PR, AP, AR, TL, ZT, O, then in column 107 in In this case, write the exact date and current deadline.

Important. When filling out the exact date in column 107 based on the requirements of the Federal Tax Service or Enforcement Proceedings, enter the value “00”.

- if in cell 106 “Main payment” for payment of customs duties and fees the following values are entered: DE, PO, CT, TD, IP, TU, BD, KP, DK, PC, KK, TK, 0, then in this case indicate the customs code organ in field 107 of 8 digits.

Important! In column 107, it is permissible to manually enter the date in the value “Tax. period" or code in the meaning "Customs code. authority" in the case when the ID value is indicated in field 106.

Procedure for filling out field 107 when paying personal income tax

Personal income tax is not only levied on wages. Vacation and sick pay are also subject to personal income tax. The frequency of payment is specified in the Tax Code of the Russian Federation. It is different for each payment:

- for salaries, the transfer period is the day following the issuance in cash or transfer to a card;

- when transferring vacation pay, sick leave payments - on the last day of the month of settlement with the counterparty.

Paying personal income tax through Sberbank Online requires creating different payment orders; cell 107 is filled out the same way for each transfer.

Errors when filling out field 107

Article 4 of the Tax Code of the Russian Federation explains that if cell 107 is filled in incorrectly, the funds will be credited to the budget.

Important. An error in field 107 does not constitute evasion of tax contributions; accordingly, no fine or penalty will be charged.

Submit an application for correction to the tax authority and attach a copy of the payment order or payment receipt in which the error was made.

When field 106 is filled in

“Regulations on the rules for transferring funds” No. 383-P explains the procedure for filling out bank payment documents. Compliance with the rules helps to avoid disputes with regulatory authorities.

Cell 106 must be completed regardless of the type of document carrier. It indicates the basis for the current payment, for example, IN - repayment of an investment loan agreement, AR - repayment of debt under an executive document. The symbols and their interpretation can be found on the website of the Federal Tax Service or Sberbank.

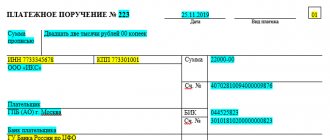

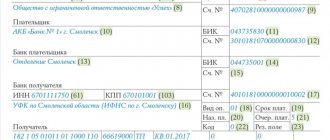

Filling example

The screenshot below shows an example of filling out a payment order.

Basis of payment - 2nd feature of the penalty payment

The 2nd difference in the payment for penalties is the basis of the payment (field 106). For current payments we put TP here. Regarding penalties, the following options are possible:

- We calculated the penalties ourselves and pay them voluntarily. In this case, the basis for the payment will most likely have a code ZD, that is, voluntary repayment of debt for expired tax, settlement (reporting) periods in the absence of a requirement from the Federal Tax Service, because we, as a rule, transfer penalties not for the current period, but for past ones.

- Payment of penalties at the request of the Federal Tax Service. In this case, the payment basis will have the form TP.

- Transfer of penalties based on the inspection report. This is the basis of payment to AP.

All three of the above cases are discussed in detail in the Ready-made solution from ConsultantPlus. Samples of filling out payment forms are provided for each of them.

Read more about payment details in this article.

Depending on what served as the basis for the payment, filling out this field will vary:

- In case of voluntary payment of penalties (the basis of the PP), there will be 0 here, because penalties do not have a frequency of payment, which is inherent in current payments. If you are listing penalties for one specific period (month, quarter), it is worth indicating it, for example, MS.08.2019 - penalties for August 2021.

- When paying at the request of tax authorities (basis of TR) - the period specified in the request.

- When repaying penalties according to the verification report (the basis of the AP), they also put 0.