In this article we will look at how to fill out a payment order for fines. Let's look at common mistakes.

If an LLC or individual entrepreneur made mistakes as a result of which a tax, fee or contribution was not paid, or the accountant missed the deadline for sending funds to pay taxes, the company will soon receive a request from the Federal Tax Service to transfer the underpaid amounts. In addition, a fine and penalties will be assessed.

And here you will need the ability to competently fill out payment orders for the payment of fines, otherwise the tax inspectorate will be forced to take more stringent measures against the willful defaulter.

Fines and penalties for taxes, fees and contributions

To transfer the amounts of a fine or penalty, the same details of the Federal Tax Service are entered in the payment order as when paying taxes and fees. The recipient of the payments will be the department of the tax service to which your company is assigned, and where you regularly send reports on payments transferred to the budget.

The line <Payment order> must contain the same value as when sending funds for taxes: <5>.

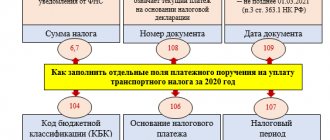

If the company has already received a notification from the Federal Tax Service that it has been fined or that a penalty has been charged, the document may indicate a unique accrual identifier (hereinafter referred to as UIN), this value will be useful for filling out the <Code> field. If the document from the Federal Tax Service does not contain a UIN, the value of this field remains zero.

OKTMO depends solely on the place of registration of the LLC or the registration of the individual entrepreneur, so its value coincides with that usually indicated when transferring tax amounts.

The line <Basis of payment> will contain one of two values:

- <TR> , if the company has already received an official request from the tax authorities to pay a fine;

- <ЗД> , if the accountant independently transfers funds to pay the fine, without waiting for notification from the Federal Tax Service, because knows that the deadlines for paying a tax or fee have been violated and a fine will be imposed.

Fields 108/109 will contain the value <0> if the company, on its own initiative, decided to pay the fine. And if it is paid at the insistence of the Federal Tax Service, the No and date from the request received from the Federal Tax Service are entered in these columns, respectively.

Line 107 <Tax period indicator> will also contain a zero if there is no official notification. If it was received, the payment deadline specified in the document will be recorded here.

The most important thing is to correctly indicate the budget classification code (BCC). The main thing to remember here is that the code used is not the one that relates to the period in which there were violations that resulted in a fine. The BCC is the one that relates to the year during which the payment actually occurs.

The Federal Tax Service has the right to impose a fine based on the laws of not only the Tax Code of the Russian Federation, but also the Code of Administrative Offenses.

It is also important to know that the BCC for underpaid tax and the fine/penalty for it differ; for all three you will have to fill out your own payment documents.

Consequences of repeated violations

Repeated offenses in the field of taxation are aggravated by administrative punishment (Article 112, paragraph 2 of the Tax Code of the Russian Federation). Paragraph 3 of this article states that if a person has been subject to penalties, they are valid for one year after the court decision enters into force. If during this period the violator commits a tax crime again, the amount of the fine will be increased by 100% (Article 114 of the Tax Code of the Russian Federation).

Conditions for repeated offenses:

- New violation after the entry into force of the decision in the previous case.

- The interval between violations is less than a year.

- The statute of limitations for imposing administrative punishment has not expired.

Article 129.1 of the Tax Code of the Russian Federation provides for punishment for failure to provide the Federal Tax Service with information that must be submitted in the manner established by law. Such a violation, if repeated, entails a 4-fold increase in the fine. However, one should keep in mind mitigating circumstances that reduce the amount of sanctions in the manner prescribed by Article 114 of the Tax Code of the Russian Federation, 3 paragraphs.

How penalties and fines on insurance premiums will change in 2021

From January 1, 2021, payments for insurance premiums will be placed under the control of the Federal Tax Service, which means penalties for late payments and arrears will now be imposed in a manner similar to taxes and fees.

Now organizations will not have to pay penalties for the day when they made payments on contributions; previously, penalties were assigned for this date as well. It follows that if payment is made one day later than the deadline, there will be no consequences in the form of penalties. The amount of the penalty for that day can be refunded as an excess payment. If the amount is insignificant, then it is not worth it.

The Federal Tax Service will fine an enterprise only when the company's accountant deliberately underestimated the base subject to insurance contributions.

Changes in details for paying fines and penalties in Moscow and the Moscow region

6.02.2017 Changes to the Federal Tax Service details in payment orders for the city of Moscow and the region have come into force:

- Account number for accounting for cash receipts divided by the Federal Treasury between the budgets of Russia within the borders of Moscow: 40101810045250010041

- bank name : Main Directorate of the Bank of Russia for the Central Federal District of Moscow

- BIC: 044525000

Changes in payment documents issued in the Moscow region are due to the fact that the accounts of the Fed. Treasuries for the Moscow Region in Branch 1 Moscow are sent for processing to the Main Directorate of the Bank of Russia for the Central Federal District:

- Account number: 40101810845250010102

- The bank and its BIC are the same as in payment cards in Moscow.

When a zero indicator of the basis of payment is allowed 106

Due to the fact that the basis for payment is, first of all, the amount of obligations to the budget, taxpayers ask themselves: what will happen if this field is filled out incorrectly? As mentioned above, it is not allowed to leave an empty gr. 106, but putting “0” or indicating an incorrect value is not considered sufficient grounds for refusing to credit the payment.

If for any reason the payer has entered “0” or an incorrect letter code, tax officials independently assign the required value, focusing on general legal requirements (clause 7 of Appendix No. 2 of Order No. 107n). Received funds are not subject to classification as unidentified income and are credited to the taxpayer’s account. To clarify the payment, you may need to provide written explanations in the form of a statement in any form.

Legislative acts on the topic

This table describes the legislative acts of the Russian Federation.

| Appendix 6 to the order of the Ministry of Finance dated 07/01/2013 No. 65n | Current KBK |

| para. 7 p. 4 sec. II Order of the Ministry of Finance dated July 1, 2013 No. 65n | On the use of income subtype code 3000 (14-17 digits of the code) for fines |

| Appendix 2 to Order of the Ministry of Finance of the Russian Federation No. 107n | Rules for filling out payment order details for paying fines |

| clause 6 art. 32 Tax Code of the Russian Federation | On the obligation of the tax service to provide information to taxpayers about filling out payment orders for the purpose of paying taxes, fees, fines and penalties |

| Part 5 Art. 15 of the Law of July 24, 2009 No. 212-FZ | About the deadline for paying insurance premiums |

| Part 3 Art. 25 Federal Law of July 24, 2007 No. 212-FZ | On the accrual of penalties for late or partial payment of insurance premiums |

| Art. 47 of Law No. 212-FZ | About fines for incomplete payment of insurance premiums |

| Ruling of the Supreme Court of the Russian Federation dated March 13, 2015. No. 310-KG15-1761, Resolutions of the Federal Antimonopoly Service of the Central District dated December 19, 2014 No. A64-8264/2013 and dated November 27, 2014 No. A64-8265/2013 | About the absence of grounds for imposing a fine on an enterprise if the calculation of insurance premiums contained errors, but payment for the year was made in full |

| Letter of the Federal Tax Service dated November 7, 2016 No. ZN-4-1/21026 | About the transition period of payment orders with old details to new ones (in Moscow and Moscow Region) |

Types of administrative violations in the field of taxation

Violations of tax legislation are regulated by the Code of Administrative Offenses of the Russian Federation and are subject to administrative penalties in the form of fines. The imposed penalty obligations do not relieve the taxpayer from fulfilling them - only the court can decide to remove the penalty from the person. Therefore, payment of fines is a necessary measure.

Code of Administrative Offenses

Note! The Code of Administrative Offenses establishes a list of offenses for which they can be fined under the relevant article.

In Art. 15.3-10 of the code lists the main reasons for applying fines:

- Late registration of a business entity or conducting illegal activities without registration. Fine 500-3000 rubles*.

- Delay in providing information on opening/closing a bank account, etc. Fine from 1000 to 2000 rubles*.

- The declaration was not submitted to the territorial tax authorities on time. Fine from 300 to 500 rubles*.

- Failure to provide data that must be submitted to control the economic activities of the organization. Fine 100-1000 rubles*.

- Violations related to opening a bank account. Fine 1000-3000 rubles*.

- Late calculation and deduction of taxes. Fine from 4000 to 5000 rubles*.

- Violations of the deadline for making customs payments. Fine from 500 to 300,000 rubles*.

Detected violations are recorded in the protocol, then a decision (resolution) is made to apply sanctions or release them. The resolution acquires legal force 10 days after its adoption.

Common mistakes

Error No. 1: In the payment order, a zero value was entered in the “Code” field, when the debt on penalties was repaid by the enterprise independently, without waiting for a request from the Federal Tax Service. The next time the tax office received a notice of payment of a fine, the accountant automatically entered “0” in the “Code” column.

Comment: When a company receives a document requesting the Federal Tax Service to pay penalties or fines, a unique accrual identifier specified in the request is entered in the “Code” field of the payment. And only if it is not specified there, you can leave a zero value.

Error No. 2: Indication by the organization that received a request from the tax service to pay penalties, the code “ZD” in the “Base of payment” field.

Comment: When an official request from the Federal Tax Service has already been received, the payment is considered to have been made not on a voluntary basis, but at the insistence of the tax inspectorate, therefore the code “TP” must be indicated in the “Base of payment” field.

Error No. 3: Indication in the KBK payment order of the tax period in which the tax arrears arose and when penalties were accrued.

Comment: The BCC is indicated as current as of the date of actual repayment of the debt.

How to draw up a payment order

For each line of the request, it is necessary to generate a separate payment order. This can be done manually - transfer the data from the received request to fields 24 and 104-109 of the payment order.

When filling out a payment slip, you can use this table, which will tell you what value you need to indicate in each field. Be careful when entering data - an error in even one figure will lead to the fact that the organization’s money will not go to its intended destination, and the debt will not be repaid.

You can read complete instructions on how to generate a payment order on the Accounting Online website.

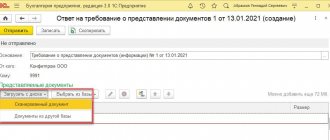

The second option to prepare a payment order is to generate it automatically. This function has recently been available to Kontur.Extern users.

Having received an electronic request for payment in Externa, notify the Federal Tax Service about this by clicking on the button “Send an acceptance receipt to the Federal Tax Service.” Then proceed to create a payment order: follow the “Create payment order” link and enter the name of your bank and current account. The system itself will insert all other data from the request into the appropriate fields of the payment order. You can also choose what type of debt to make a payment for and, if necessary, change the payment amount.

You can create a ready-made payment slip either in Word format and then print it, or download a special text file to then upload to the Internet bank.

KBK 18211603010016000140 - why the fine of 200 rubles?

But the document that instructs the company to pay according to BCC 18211603010016000140 raises the most questions - what was the fine for in this case and what does this BCC mean?

If the basis is a requirement, then the UIN specified in the requirement is entered in the “Code” field. Otherwise, 0 is entered. When paying fines, a similar rule applies to the details “Tax period”, “Document date” and “Document number”.

First of all, let’s figure out what the meaning of KBK is 18211603010016000140. To administer budget revenues, each type of payment has a special code - KBK (budget classification code). It must be indicated in each payment order for the payment of funds to the budget, as well as in tax reporting sent to the Federal Tax Service, Social Insurance Fund and other government agencies.

The full list of codes is contained in the KBK classifier (order of the Ministry of Finance of Russia dated July 1, 2013 No. 65n).

We recommend reading: Who pays transportation costs for warranty repairs in an online store

It is in it that you need to look for the decoding of 2021 KBK 18211603010016000140. According to the classifier (in the current version) indicating KBK 18211603010016000140 - decoding for which the fine is in 2021 - the taxpayer must transfer the fine for violation of tax legislation under the following articles of the Tax Code of the Russian Federation: 116, 119.1, 119.2 , 120 (items 1 and 2)

Preparation for payment through Sberbank Online

To pay tax fines via the Internet, the payer must first be a client of Sberbank, having an open and valid account through which payments will be made. It is also worth activating the Mobile Bank service if it is not activated for a client who wants to carry out transactions with funds.

Activating the Mobile Banking service will not take much time; you should do one of the following:

- visit the nearest Sberbank branch and fill out the appropriate application according to the specified form;

- activate the service using Sberbank self-service devices (ATMs and terminals).

After activating the Mobile Bank service, you can go to the official website of Sberbank (www.sberbank.ru). Next, you need to go to the Sberbank Online page.

Now we go through the registration procedure. To do this you need:

Register on the site

- enter the number of a bank card opened with Sberbank;

- enter the password that will be sent by the system to your mobile phone;

- come up with a login and password that will be used in the future to log into Sberbank Online.

To simplify the login procedure, it is recommended to obtain a user ID and permanent password from an ATM or terminal of a given bank.

Making a payment for a fine

Starting from 2021, payers are given the right to make payments to the tax office for third parties.

This is also true for penalty payments.

In addition, there are no restrictions on such payment of accruals made before 2021. This means that a situation is possible when either the payer himself pays the fines, or another person does it for him. Depending on the situation, the payment order for a fine to the tax office, a sample of which is given below, will indicate the corresponding status of the payer.

Also, depending on the situation, the name of the payer, his TIN and KPP, and, if necessary, also the name, TIN and KPP of the person for whom the payment is being made, will be indicated.

BCCs for penalties are established for each type of tax and contribution. When making a payment for a fine, it is important to take into account that in the KBK for penalties the 14th and 15th digits will always be 30. The inspectorate in which the “penalty” person is registered will be indicated as the recipient of the “penalty” payment for taxes and contributions .