Expenses taken into account when calculating the unified agricultural tax

The Tax Code (Article 346.5) provides for a limited list of expenses that an agricultural entrepreneur can take into account when calculating tax. And not all costs will be included in this list. Let's consider the main ones:

- purchase of fixed assets and intangible assets, as well as their maintenance in working condition;

- rental and leasing of property;

- purchase of young livestock, poultry, fish fry;

- material expenses, including the purchase of seeds, fertilizers, seedlings, biological products, etc.;

- insurance;

- VAT on those amounts that are included in the expenses of the inventories;

- interest on loans and credits;

- for the acquisition of agricultural land;

- from the death of animals and chickens;

- fire safety expenses;

- to conduct an independent assessment of employee qualifications.

A complete list of costs is presented in Art. 346.5 Tax Code of the Russian Federation. It has recently become possible to include the costs of assessing qualifications, as well as training and retraining of personnel as costs. This item is included in the list of expenses only in 2021.

By the end of March, Unified Agricultural Tax payers must calculate the tax and submit tax returns. Before submitting your Unified Agricultural Tax return, you need to check whether you have correctly accounted for your expenses throughout the past year. In this regard, I would like to draw your attention to the mistakes that taxpayers often make when calculating the single tax in terms of expenses. Practice shows that this is typical for many agricultural organizations, so in this article we will look at “problematic” expenses, taking into account the changes made to the legislation this year.

First, let's talk about the costs of purchasing fixed assets, which account for significant amounts in the overall expenses of the organization.

1. First of all, please note that the amounts spent on the purchase of materials for the construction or modernization of a fixed asset must be written off not after payment, but after putting this asset into operation. Very often in practice, a situation occurs when an agricultural organization purchases materials, pays for these materials, and their cost is taken into account in expenses when calculating the Unified Agricultural Tax. But in the future, the materials are written off for the construction of fixed assets, and it is in the cost of the commissioned object that the cost of purchased materials should be taken into account, that is, only once when calculating expenses.

2. Secondly, many accountants still, when calculating operating expenses, intentionally or not, incorrectly take into account and divide the costs of repairs and reconstruction.

In accordance with clause 14 of PBU 6/01, changes in the initial cost of fixed assets, in which they are accepted for accounting, are allowed in cases of completion, additional equipment, reconstruction, modernization, partial liquidation and revaluation of fixed assets.

Obviously, in the case of repairs (major or current), the initial cost is not changed.

Therefore, during inspections, tax authorities show increased interest in the organization’s expenses associated with repair work. Particular attention to such expenses is explained by the following: according to sub. 3 p. 2 art. 346.5 of the Tax Code of the Russian Federation, costs for current or major repairs at a time in the full amount are taken into account in expenses when calculating the Unified Agricultural Tax. And reconstruction costs increase the cost of the fixed asset and are written off as expenses at a time when all the conditions provided for in Art. 346.5 Tax Code of the Russian Federation.

During audits, we also often encounter a situation where an organization changes the characteristics of an OS object being repaired, and in accounting this is carried out as a repair and is reflected in the entry:

Dt 23, 25 – Kt 60, 70, 69.

But this is very controversial, since many of the costs incurred should increase the cost of the object, because this is, in fact, not a repair, but a reconstruction. In this regard, it is necessary to answer the question: how to properly separate repair work and reconstruction?

First of all, when qualifying work for tax purposes, organizations must be guided by the definition given in the Tax Code of the Russian Federation. According to paragraph 2 of Art. 257 of the Tax Code of the Russian Federation, reconstruction includes the reconstruction of existing fixed assets, associated with the improvement of production and increasing its technical and economic indicators and carried out under the project for the reconstruction of fixed assets in order to increase production capacity, improve quality and change the range of products.

Therefore, when estimating expenses, the main thing for an accountant to understand is that reconstruction is the reorganization of existing fixed assets, associated with the improvement of production and an increase in its technical and economic indicators and carried out under a project for the reconstruction of fixed assets in order to increase production capacity, improve quality and change the range of products.

But what can we classify as repair?

The concept of “repair” is absent in the current tax and accounting legislation. At the same time, the Town Planning Code of the Russian Federation contains definitions of capital repairs. In particular, capital repairs of facilities include:

— replacement and (or) restoration of building structures of capital construction projects or elements of such structures (with the exception of load-bearing building structures);

— replacement and (or) restoration of systems (networks) of engineering and technical support for real estate objects or their elements;

— replacement of individual elements of load-bearing building structures with similar or other elements that improve the performance of such structures and (or) restoration of these elements.

In order to avoid claims from the tax inspectorate when assigning expenses to expense accounts when carrying out repairs, it is necessary to have documents justifying the repair and confirming the costs of its implementation.

Such documents include: a defective statement, an order from the head of the organization to carry out repairs, a contract for repair work (if the repair is carried out by the company independently, repair plans (schedules), repair cost estimates, invoices for the internal movement of fixed assets and for the release of materials are required for repairs, payroll statements for the payment of wages to employees carrying out repairs), an acceptance certificate for repaired objects, technical characteristics of objects after repair, expert opinions. Only in this case and with the availability of such documents can expenses incurred be attributed to expense accounts. Otherwise, the expenses are recognized as reconstruction and increase the cost of the fixed asset.

And of course the main problem here is the registration of the reconstructed object. It is obvious that most reconstructions are carried out without project approval and other necessary documents for registration, because it is very expensive. Consequently, in most cases it is impossible to register such a reconstruction, and this led to the fact that the costs associated with the reconstruction did not reduce the tax base when calculating the Unified Agricultural Tax.

But once again I would like to remind you that not all constructed (modernized) objects are subject to registration in order to accept their value as expenses for calculating the Unified Agricultural Tax.

Let me remind you once again of the norm of the Tax Code of the Russian Federation: Fixed assets, the rights to which are subject to state registration in accordance with the legislation of the Russian Federation, are taken into account in expenses in accordance with this article from the moment of the documented fact of filing documents for registration of these rights. The specified provision regarding the mandatory fulfillment of the condition of documentary confirmation of the fact of filing documents for registration does not apply to fixed assets put into operation before January 31, 1998.

Based on this, previously only the cost of registered real estate objects put into operation after January 31, 1998 was taken into account. The cost of those real estate objects that were put into operation after January 31, 1998, but have not yet been registered, was not included in the expenses under the Unified Agricultural Tax; similarly, the costs of completion, additional equipment, reconstruction, modernization and technical re-equipment of fixed assets that increase the cost were not included fixed assets. Therefore, in order to accept the cost of real estate as expenses, it was necessary to register it.

But Federal Law No. 325-FZ dated September 29, 2019 excludes the requirement for mandatory documentary confirmation of the fact of filing documents for registration of rights of OS objects.

That is, if previously the costs of acquiring fixed assets subject to state registration could be taken into account subject to documentary confirmation of the fact of filing documents for registration of such rights, now this condition is absent. The law came into force on September 29, 2019, therefore the cost of real estate objects already put into operation is accepted as expenses in 2019 without registering the object.

In previous periods, it was also important for agricultural organizations to determine which property was classified as movable and which was classified as immovable from the point of view of current legislation. Very often, Unified Agricultural Tax payers have a question: are fixed assets such as, for example, hangars, silo trenches, etc., real estate subject to registration?

In Art. 130 of the Civil Code of the Russian Federation says:

- immovable things (real estate, real estate) include land plots, subsoil plots and everything that is firmly connected to the land, that is, objects whose movement without disproportionate damage to their purpose is impossible, including buildings, structures, unfinished construction objects. Real estate also includes aircraft and sea vessels, inland navigation vessels, and space objects subject to state registration;

— things not related to real estate, including money and securities, are recognized as movable property.

In practice, this formulation caused controversy in relation to a wide range of objects - shopping pavilions, hangars, extensions to buildings, warehouses, car washes and parking lots, gas stations, asphalt sites, etc. Abstractly, the following conclusion can be drawn: everything that cannot be moved to another location without damage - real estate, what is possible - movable property. But the courts indicate that the connection of an object with the land is not the only sign by which it can be classified as real estate . This issue must be resolved taking into account all documents related to the disputed property. That is, if a hangar made of metal structures is attached to the foundation, this is not yet a reason to recognize the object as real estate; other criteria must be taken into account.

In this regard, the tax authorities insisted that such objects as, for example, a hangar and a silo trench, etc., must be registered in order to accept their value as expenses for the Unified Agricultural Tax, but the courts often did not agree with this opinion, recognizing that These objects are not subject to registration.

Expenses for the acquisition of property rights to land plots

According to sub. 31 clause 2 art. 346.5 of the Tax Code of the Russian Federation reduces the tax base for the Unified Agricultural Tax:

expenses for the acquisition of property rights to land plots, including expenses for the acquisition of the right to conclude a lease agreement for land plots, subject to the conclusion of the specified lease agreement, including:

for land plots from agricultural lands;

on land plots that are in state or municipal ownership and on which buildings, structures, and structures used for agricultural production are located.

At the same time, clause 4.1 of Art. 346.5 of the Tax Code of the Russian Federation establishes that expenses for the acquisition of property rights to land plots are taken into account as expenses evenly over a period determined by the taxpayer, but not less than seven years. Amounts of expenses are taken into account in equal shares for the reporting and tax periods.

The amount of expenses for the acquisition of property rights to land plots is subject to inclusion in expenses after the taxpayer has actually paid for property rights to land plots in the amount of the amounts paid and in the presence of a documented fact of filing documents for state registration of the specified right in cases established by the legislation of the Russian Federation .

Documentary confirmation of the fact of filing documents for state registration of property rights is understood as a receipt by the body carrying out cadastral registration, maintaining the state real estate cadastre and state registration of rights to real estate and transactions with it, documents for state registration of these rights.

Thus, in this case, the fact of registration for the recognition of expenses continues to apply.

Another big point in determining expenses for the Unified Agricultural Tax is standardized, or even better, reasonable expenses

Recently, tax inspectors have been demanding that even those expenses that the Tax Code allows to be written off without restrictions be rationed.

Agricultural producers are subject to rationing costs for maintaining official vehicles. And also for losses from death or slaughter of poultry and animals. In fact, it is not only these costs that need to be taken into account within the norms.

Tax services call violations typical of agricultural producers in the form of inflated costs for seeds, fertilizers and plant protection products. Such costs can only be taken into account when truly necessary. To do this, approve cost standards. The basis can be approved standards or data from the sellers from whom you plan to purchase goods.

Therefore, when an organization spends too much on seeds (beyond the reasonable norm), fuels and lubricants, etc., problems may arise.

An accountant can document the validity of costs with a certificate in which he provides a calculation of costs. The certificate reflects the difference between the standard amount of expenses and the actual amount. When writing off expenses, keep in mind that expenses in excess of the limit you set will be unreasonable.

Questions also arise when taking into account losses from mortality. To ensure that the tax authorities do not exclude these losses from expenses, you need to fill out the documents correctly. The death must be reflected in the act of disposal of animals and poultry (form No. SP-54, approved by Resolution of the State Statistics Committee dated September 29, 1997 No. 68). The report is drawn up by a commission that determines the causes of death and diagnosis. Without documents confirming the total cost of damage and losses during cultivation, it will not be possible to prove the validity of the costs (resolution of the Administration of the West Siberian District dated January 29, 2019 in case No. A03-11765/2017).

The death of birds or animals does not mean that they must subsequently be completely destroyed. For example, an agricultural company used all the dead poultry as raw material for dietary supplements, which were used to fatten the remaining poultry. The tax inspectorate did not agree with this approach, but the court supported it. According to the judges, the use of bioadditives obtained in this way reduces the cost of purchasing feed (resolution of the Arbitration Court of the Ural District dated February 15, 2017 No. F09-69/17 in case No. A50-11010/2016).

But keep in mind one small thing, writing off mortality is not an expense for the Unified Agricultural Tax, it is a standard according to which the costs of growing (wages, feed, etc.) are justified, that is, once again it is clearly necessary to understand that writing off mortality itself is an expense cannot be attributed.

Cost standards that agricultural producers can use in their work

| Expenses | Normative act |

| Cost of seeds of cereals, potatoes, vegetables and melons | Resolution of Rosstat dated December 25, 2006 No. 82 |

| Cost of vegetable seeds and seedlings in greenhouses, fertilizers | Methodological recommendations RD-APK 1.10.09.01-14, approved by the Ministry of Agriculture on August 13, 2014 |

| Fuel for sowing, caring for plants, harvesting | Standard standards for production and consumption of fuel for agricultural mechanized work, approved by the Ministry of Agriculture and Food |

| Losses from forced slaughter of poultry and animals | Government Decree No. 431 dated June 10, 2010 |

| Losses from deaths of birds and animals | Government Decree No. 560 dated July 15, 2009 |

| Maintenance of official transport, compensation for the use of personal cars for official trips | Government Decree No. 92 dated 02/08/2002 |

In conclusion, I would like to draw your attention once again to the fact that almost all expenses incurred by an agricultural organization are included in the reduction of the tax base under the Unified Agricultural Tax. The taxation system in the form of the Unified Agricultural Tax is structured in such a way that amounts received are included in income, and amounts spent are included in expenses with minor conditions and adjustments. Therefore, many expenses that are not even listed in the list provided for in paragraph 2 of Art. 346.5 of the Tax Code of the Russian Federation are included in the reduction of the tax base, as evidenced by the Letters of the Ministry of Finance of the Russian Federation. Here are some of them:

| What did you spend the money on? | Which letter contains the explanation? |

| Payment for services for transmitting reports electronically and setting up the work of the workplace | Letter of the Ministry of Finance dated December 20, 2019 No. 03-11-11/99968 |

| Payment for services to update the website on the Internet | Letter of the Ministry of Finance dated December 18, 2019 No. 03-11-11/98947 |

| Travel expenses for renting accommodation, including payment for additional services | Letter of the Ministry of Finance dated December 18, 2019 No. 03-11-11/99333 |

| Payment for notary services for certifying the authenticity of signatures on a bank card and copying documents | Letter of the Ministry of Finance dated December 18, 2019 No. 03-11-11/99020 |

| Development and creation of a website, its content (domain and hosting services) | Letter of the Ministry of Finance dated December 17, 2019 No. 03-11-11/98698 |

| Payment for video conferencing services | Letter of the Ministry of Finance dated December 9, 2019 No. 03-11-11/95724 |

| Placement on the website of advertising of manufactured and sold goods, trademark and service mark | Letter of the Federal Tax Service for Moscow dated May 22, 2019 No. 20-14/083438 |

| Remuneration, and the list is not closed. Expenses must be provided for in a collective or employment agreement | Letter of the Ministry of Finance dated August 30, 2019 No. 03-11-11/66828 |

Expenses on fixed assets

Since the beginning of 2007, agricultural organizations have taken into account expenses for fixed assets and intangible assets from the moment these facilities are put into operation. This applies to those objects that were purchased during the period of application of this special regime. This means that the cost of these objects is included in expenses in parts until the end of the year in which they were purchased.

In addition to the purchased operating systems, the costs of their construction and production can also be taken into account when calculating the unified agricultural tax.

The residual value of previously acquired assets is included in expenses depending on how long their useful life is. It is determined in accordance with the Classifier of fixed assets included in depreciation groups.

Unified agricultural tax and VAT in 2021: advantages and disadvantages

What are the positive and negative aspects of the new duty of agricultural producers? Paying VAT is an additional tax burden for businesses, which is a negative factor. The volume of reports compiled automatically increases, and therefore labor costs. Also, the emergence of an obligation to pay a new tax means additional control on the part of the tax service.

On the other hand, payers of the single agricultural tax are now more attractive to counterparties. It is often unprofitable for buyers to purchase goods from those persons who do not have to pay VAT. In these cases, they lose their right to receive a deduction. It is expected that the introduction of VAT for agricultural producers will increase demand for their products.

Expenses for leasing payments

Let's consider the expense item in the form of leasing payments. Who exactly has the property on their balance sheet does not matter. When transferring property to the lessee, that is, the payer of the Unified Agricultural Tax, its redemption value is included in expenses in the period in which the payment was made.

The peculiarity of accounting for these material costs as expenses is that they are taken into account as expenses at the time of payment. In other words, either at the time of debiting funds from the organization’s account, or paying from the cash register, or another method of repaying the debt. When paying interest on credit and borrowed funds, the same accounting procedure is used.

Fiscal reporting form

The tax form, mandatory for all payers of the Unified Agricultural Tax, is fixed by Order of the Federal Tax Service of Russia dated July 28, 2014 No. ММВ-7-3/ [email protected] The report has a standardized code - KND 1151059. The latest changes to the form were introduced back in 2021.

IMPORTANT!

It is unacceptable to use other forms or outdated forms to submit reports. Before sending the declaration, be sure to check the relevance of the document. Otherwise, the Federal Tax Service will not accept the reports and will impose penalties.

Agricultural Insurance Costs

Agricultural producers depend on weather conditions like no other. In a dry year, entrepreneurs may lose most of the harvest, and sometimes the entire harvest. In order to reduce the risk of unexpected losses as a result of weather conditions, entrepreneurs can insure their future harvest, for example, against drought.

The farmer has the right to include insurance costs in expenses to reduce taxes. Then insurance payments will need to be taken into account as non-operating income. In addition to drought insurance, an agricultural producer can reduce the tax base for other types of voluntary insurance costs. For example, insurance of fixed assets, transport, cargo, supplies, etc.

Rules for filling out a tax return

By virtue of Art. 346.10. Code, the declaration must be submitted:

- no later than March 31 of the year following the reporting year;

- no later than the 25th day of the month that follows the month. deregistration as a payer of the Unified Agricultural Tax.

KND declaration form – 1151059. You can download the template for filling out the declaration using this link.

The declaration consists of 4 pages and is filled out according to standard rules:

- either by hand or on a computer;

- if by hand, then with a ballpoint pen with blue or black ink;

- letters – only capital printed;

- each cell contains one symbol;

- Fields cannot be left empty - dashes must be entered.

Expenses for young animals and animals

In addition to the costs of purchasing the youngest stock, for example, a young animal for forming a herd, or fish fry, the following costs are also included in the tax calculation:

- salaries for specialists directly involved in raising young animals;

- feed costs;

- other costs directly related to raising young animals.

But, you need to keep in mind that the shortage resulting from losses of young animals cannot reduce the tax base.

Accounting

In accounting, reflect the accrual of the Unified Agricultural Tax (advance payment) on the last day of the tax (reporting) period on account 68 “Calculations for taxes and fees.” To do this, open a sub-account “Settlements under Unified Agricultural Tax” for account 68. When calculating tax, make the following entry:

Debit 99 Credit 68 subaccount “Settlements under Unified Agricultural Tax” – accrued Unified Agricultural Tax (advance payment) based on the results of the tax (reporting) period;

Debit 99 Credit 68 subaccount “Settlements for Unified Agricultural Tax” – the over-accrued amount of Unified Agricultural Tax at the end of the year is reversed.

Reflect the transfer of tax to the budget by posting: Debit 68 subaccount “Settlements under Unified Agricultural Tax” Credit 51

An example of calculating and reflecting in accounting an advance payment under the Unified Agricultural Tax and the total tax amount for the year

Alpha LLC, a payer of the Unified Agricultural Tax, received revenue from the sale of agricultural products in the amount of 3,000,000 rubles for the first half of the year. The amount of expenses for the same period amounted to 2,000,000 rubles.

At the end of the year, Alpha’s income amounted to 7,000,000 rubles, and expenses – 6,500,000 rubles.

The amount of the advance payment under the Unified Agricultural Tax for the six months is equal to: (3,000,000 rubles – 2,000,000 rubles) × 6% = 60,000 rubles.

On June 30, Alpha’s accountant reflected the amount of the accrued advance payment in accounting:

Debit 99 Credit 68 subaccount “Settlements under Unified Agricultural Tax” – 60,000 rubles. – advance payment under the Unified Agricultural Tax for the first half of the year has been accrued.

On July 27, the advance payment for the Unified Agricultural Tax was transferred to the budget. On this day, the following entry was made in Alpha's accounting records:

Debit 68 subaccount “Settlements under Unified Agricultural Tax” Credit 51 – 60,000 rub. – the advance payment under the Unified Agricultural Tax for the first half of the year is listed.

The amount of Unified Agricultural Tax for the year is equal to: (7,000,000 rubles – 6,500,000 rubles) × 6% = 30,000 rubles.

Since the amount of the accrued advance payment is counted towards the payment of the Unified Agricultural Tax for the year, at the end of the year Alpha incurred an overpayment. In this regard, the accounting must reflect the amount of tax to be reduced: 30,000 rubles. – 60,000 rub. = –30,000 rub.

On December 31, Alpha’s accountant reflected this amount by posting:

Debit 99 Credit 68 subaccount “Settlements under Unified Agricultural Tax” – 30,000 rubles. – the excessively accrued amount of unified agricultural tax is reversed.

Material costs and expenses

One of the items on the list of expenses is material costs. They include costs such as the purchase of seedlings, seeds, feed, medicines, plant protection products, etc. These costs are taken into account in their full cost after the fact of their payment, regardless of the period in which they are transferred to production.

In addition to the above, material costs also include payment for services from third-party organizations, for example, raw materials processing services or OS maintenance services.

Report submission methods

Report to the Federal Tax Service in one of three ways:

- Personal inspection visit. The report is submitted on paper. The declaration is submitted by the manager or an authorized representative. Be sure to take 2 copies of the report with you (one will remain with the Federal Tax Service, and the second, with the controller’s mark, will be kept in the organization). Also take a passport, power of attorney and other documents certifying the applicant’s authority.

- Sending information by mail. The declaration form is sent to the Federal Tax Service by post. When sending by mail, the sending option is important: use a registered letter with a list of attachments. Of course, it is not prohibited to send reports by simple letter. But the taxpayer will not have any confirmation of the fact of sending. And the inventory of investments is documentary evidence; it can be used when resolving disputes with the inspectorate.

- Electronic reporting. It is possible to submit a declaration report via the Internet: through the taxpayer’s personal account or via secure communication channels. The declaration is generated electronically. The report is certified with an enhanced digital signature. Be sure to receive confirmation from the Federal Tax Service that the report has been accepted.

They fill out the reporting document using specialized accounting programs or use Internet resources. But some services and programs charge fees for providing services.

Expenses for the acquisition of agricultural land

For expenses associated with the acquisition of property rights to a plot of agricultural land, a special accounting procedure has been established. If for other costs expenses are recognized immediately, then the costs of purchasing a plot are distributed into expenses in equal parts over a minimum of 7 years. These expenses can be deducted only after payment, as well as in the presence of supporting documents on state registration of the site, or that documents for registration have already been submitted. The supporting document is a receipt from the authorities involved in the registration of these rights.

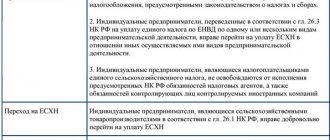

What replaces

In the following table we have listed which taxes are being replaced by the Unified Agricultural Tax for organizations and entrepreneurs.

Table 1. What taxes does the Unified Agricultural Tax replace?

| Tax | A comment |

| For organizations | |

| Corporate income tax | In addition to income tax on dividends and some other transactions |

| Organizational property tax | In terms of property that is used for the production and processing of agricultural products, as well as the provision of services to agricultural producers |

| For entrepreneurs | |

| Personal income tax (for yourself) | In relation to activities subject to Unified Agricultural Tax |

| Property tax for individuals | In terms of property that is used for the production and processing of agricultural products, as well as the provision of services to agricultural producers |

From 2019, entities on the Unified Agricultural Tax are VAT payers and will be able to deduct input tax.

Being exempt from the taxes indicated in the table, entities on the Unified Agricultural Tax continue to play the role of tax agents. In particular, they pay personal income tax for their employees.

Legislative basis for calculations

It is recommended to study the following documents:

| Legislative act | Content |

| Art. 346.5 Tax Code of the Russian Federation | “The procedure for determining and recognizing income and expenses” |

| Clause 1 of Article 252 of the Tax Code of the Russian Federation | That expenses must be justified and confirmed |

| Decree of the Government of the Russian Federation No. 431 of June 10, 2010 | “On the norms of expenses in the form of losses from the forced slaughter of poultry and animals” |

Who is obliged to pay

Who is obliged to pay the agricultural tax is stated in Art. 346.2. Code.

So, according to Part 1 of this article, the following are required to pay tax:

- organizations and individual entrepreneurs that are agricultural producers;

- and switched to agricultural tax in the prescribed manner.

Part 2 regulates who are agricultural producers:

- legal entities and businessmen who produce agricultural products, process them, sell them, but on the condition that income from the sale of agricultural products is at least 70% of their total amount;

- legal entities and businessmen who provide services to producers of agricultural products, for example, those who prepare fields for further sowing of agricultural crops or spray crops, trim trees, drive or graze livestock, etc.;

- horticultural, market gardening, livestock-raising consumer cooperatives and partnerships, if the share from the sale of agricultural products is more than 70% of the total profit;

- fishery and fishing organizations (city- or village-forming).

Answers to common questions

Question No. 1. Can we take into account the milk that goes into fattening young animals? Are these costs related to feed?

If you use milk produced at your enterprise to fatten young animals, it cannot be taken into account in these costs. And if you purchase milk from a third party, then it can be classified as a material cost.

Question No. 2. In addition to our own transport, we also use rented transport on our farm. Can we reduce the tax on the amount of rental vehicle insurance?

You can. In this case, it does not matter whether the vehicle belongs to the manufacturer or is rented from a third party. The main thing is that the basic conditions for cost accounting are met. In this particular case, all conditions are met.