If you discover an error in your financial statements and correct it, how you present the corrected balance sheet depends on who you send the corrected copy to.

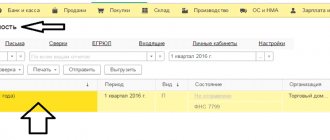

If the updated balance needs to be submitted to the Federal Tax Service, you need to correctly fill out the same forms and enter the adjustment number in the financial statements.

To submit accounting statements, the founders need to prepare an explanatory note in addition to the balance sheet. The explanatory note must indicate the nature of the identified error, the amount of deviations, and the method of correction.

What determines the adjustment of financial statements?

Regulates the procedure for correcting errors made in the reporting forms of PBU 22/2010, and it varies depending on the type of error and the time of its discovery.

An important criterion influencing the need to adjust the annual financial statements is the degree of materiality of the error, which is established by the company. In this case, the magnitude and nature of the error, as well as the size of the distortion of balance sheet items that followed it, are taken into account.

The procedure for determining the significance of errors is fixed in the accounting policy. Such errors must be corrected. The non-essential ones, i.e. those that do not fall within the established standards are corrected in the current period; their identification does not entail an adjustment to the accounting statements.

Based on the time factor, the gradation of errors as detected is determined:

- In the reporting period until the end of the year (eliminates by correctional entries in the month of detection in the reporting year);

- During the reporting period until it is signed by the chief accountant and general director (eliminates by corrective entries for December of the reporting year);

- After signing and submitting the reports to the Federal Tax Service, but before submitting them to the owners of the company. In such a situation, adjustments to the financial statements for the previous period are necessary. They do it like this:

– correctional entries were made in December last year;

– calculate the financial result;

– generate an updated version of reporting;

- they hand it over to the Federal Tax Service.

- After presentation to the owners, but before their approval of the statements. For example, at a general meeting some inaccuracies are discovered. And in this case, the reporting should be updated according to the above algorithm, adding in the explanation the reasons for the revision;

- After approval by the owners. Adjustment of financial statements after approval is impossible, and the identified error is corrected in the current period in which it was identified.

So, you can correct the information presented in the annual reports after submitting it to the Federal Tax Service and Rosstat in the period before approval by the business owners. Submission of reports not approved by the owners to tax authorities is an ordinary event, since the deadline for submitting reports to the Federal Tax Service expires on March 31, and the period for approving reports in an LLC lasts from March to April, and in a JSC from March to June inclusive. Thus, adjustments to financial statements after submission to the tax office can be carried out for as long as the business owners have not approved them.

Is it possible to submit an updated balance sheet for 2015?

Is it possible to submit an updated balance sheet? Do I need to take simplified exam? · Please tell me, is it possible to submit the updated balance sheet to the tax office for the year now? Balance sheet adjustment By March 31 of the year following the reporting year, all without exception. Is it possible to submit now? Is it possible to submit the adjusting balance sheet for the year? Is it necessary to submit a balance sheet for the year if the company is registered in December?

Is it possible to submit an update on the Balance to the State Registrar, Stat. Management and Tax. I discovered that I had mixed up the column and showed fixed assets in the “Long-term Biological Assets” column.

Balance adjustment

What should I do? Maybe leave it like that? Tell me, please, who knows!!! An updated balance sheet with a letter of explanation can be submitted to statistics, but it is accepted only at the central statistics office on Turgenievskaya - this is in Kyiv. They grumble, but they accept. I had this experience.

Regarding the tax office, I think it’s possible to send a letter through the office and get in touch, a letter with a mark in the statistics. Tell me, what if I made a mistake in 2. If the mistake entails changes in all periods, bring a letter about the reason and a new balance sheet to the office of the Main Statistical Department, that’s all. Then submit it correctly.

Search form

But you need to submit the balance of small 1st to the tax office for the first quarter of the year. I printed it, but for the life of me I forgot to submit it or just like last year for the year. Allusik writes: And you need to submit the balance of small 1st to the tax office for the first quarter of the year. I think I read somewhere that starting from this year quarterly, but I can’t find where.?!

Girls, let’s not lump everything that hurts into one topic! In the next topic, filing financial statements has been discussed for several days now. And this one is for those who made a mistake in what has already been submitted. I wish everyone to work without errors!

How to set up data transfer from mobile windowsphone to PC

Last year, an updated balance was submitted to statistics in the form of a correct balance sheet and a letter with a request to “accept the updated report for the 2nd quarter. I was given an acceptance mark on the letter itself, but there are no marks on my balance. What happens if I change the data in that balance sheet and found another error and put it under my letter? Will the data be verified during inspections? But who will check them? I did that too. I just added the corrected balance under the delivery receipts.

How to submit an accounting adjustment. reporting

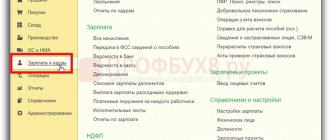

Since the legislation regulating accounting operations does not provide for the submission of adjustment reports, clarifying options are submitted by redoing the previous reporting forms and submitting them on paper. In machine-readable forms submitted to the Federal Tax Service, the adjustment number in the financial statements is changed. In the “Adjustment No.” field provided, enter its number – 1—, 2—, etc.

The grounds that led to the revision of the statements must be set out in an explanatory note, and the entire package of newly submitted statements is accompanied by a letter explaining the reasons for submitting the clarification and emphasizing the significance of the corrections made. Reporting adjustments must be submitted to all regulatory authorities where the primary information was submitted.

If an error is identified, it would be useful to notify the Federal Tax Service in writing about the upcoming changes, indicating specific corrections. This is important, since tax authorities compare tax and accounting data, and discrepancies in them, which are considered gross, can lead to penalties for officials. Art. 15.11 of the Code of Administrative Offenses of the Russian Federation provides for fines from 5 to 10 thousand rubles, and if the situation repeats - from 10 to 20 thousand rubles. Distortions of any accounting indicator or understatement of taxes in the amount of 10% of the amount of the corresponding indicator can be considered gross.

Balance sheet: how and when

An accounting report is a reflection of the enterprise’s activities as of the reporting date. Properly compiled, it can be useful not only to the tax authority, but also to the manager or owners of the enterprise. Therefore, you should pay special attention to how the balance sheet is formed and how it is surrendered.

The composition of the reporting and the rules for its completion are regulated by the federal law “On Accounting”. But when the balance is handed over is stated in Article 23 of the Tax Code of the Russian Federation.

Who hands over the balance

Which organizations hand over the balance sheet is stated in Law 402-FZ of December 6, 2011. Now all economic entities are required to provide financial statements, with the exception of some individual entrepreneurs who keep records of income and expenses. Also in this law there is a clause about which organizations may not hand over the balance. This applies to branches of enterprises established on the territory of foreign countries.

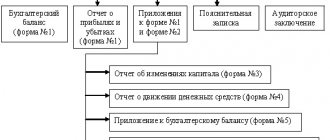

Composition of financial statements

Which reporting forms will need to be submitted depends on whether the enterprise is commercial, budget-funded, or whether it is a small business entity (SMB).

A commercial organization submits the following package of reporting forms:

- Balance sheet;

- Income statement;

- Attachments (statement of changes in equity, statement of cash flows and an appendix with a breakdown of the main lines of the balance sheet and income statement).

SMEs that are not subject to mandatory audit criteria have the right to provide simplified financial statements. It is distinguished by aggregated indicators grouped by articles and the absence of detailed transcripts. It is necessary to understand that this opportunity exists regardless of the taxation system.

That is, both organizations using the simplified tax system may be required to submit basic detailed forms, and enterprises using the simplified tax system may provide simplified reporting. In addition, those who submit a balance sheet should remember that providing it in a simplified form is a right, not an obligation.

And if necessary, you can always submit the main report.

For non-profit enterprises, the reporting includes a report on the intended use of funds instead of a report on financial results.

Advice: Every year before submitting the balance sheet, you should check whether the reporting forms have changed.

The form of the accounting report and appendices was approved by Order of the Ministry of Finance 66n dated 07/02/2010 and when writing the accounting policy, it can be supplemented, if necessary, with any number of lines, but it is not allowed to exclude any information from the established forms. When finalizing the form of the document, we must not forget that the financial statements must be:

- Reliable;

- Informative for users of the report in order to make economic decisions based on the data obtained;

- Compiled on the basis of data from accounting registers.

Remembering that the balance sheet is not only a report for regulatory authorities, but also an opportunity to check the state of accounting and assess the economic stability of the enterprise, drawing up such a document no longer seems like a burden.

Example: adjustment of financial statements for 2021

On April 10, 2021, after submitting the financial statements of Luch LLC to the Federal Tax Service, an inaccuracy was identified in the calculation of due dividends. The misstatement amounted to 11% of the true amount of accrued payments. Since the company’s financial statements have not yet been approved by the owners, but have already been submitted to the Federal Tax Service and statistical authorities, adjustments are necessary to normalize the accounting statements.

The accountant will have to inform the Federal Tax Service as a matter of urgency:

- Make corrective entries, dating them to December 31, 2017;

- Recalculate the results of work for the year;

- Prepare a new version of financial statements;

- Submit to all regulatory authorities with the necessary written support about the changes made.

Amendments to reporting or calculation formulas

You can prepare adjusted reports, but you can also make adjustments directly to the calculation formulas, for example:

Total liquidity ratio = (Current assets – DZ12 – RBPneob – NelOA) / Current liabilities,

where DZ12 is accounts receivable with a maturity period of more than 12 months. from the reporting date, den. units .;

RBPvneob - the amount of expenses of future periods that it is advisable to transfer to non-current assets, including the cost of software, the exclusive rights to which remained with the seller, etc., den. units;

NELOA - cost of illiquid current assets, den. units

For your information

The amendments make sense if the components under discussion (accounts receivable with a maturity of 12 months, illiquid assets) are significant in size. Each company sets its own criteria for materiality. For example, it can be equal to 10% (or higher) of the value of assets.

An example of the above adjustments is presented in Table 6.

Amendments related to off-balance sheet accounting of property received under financial lease agreements (financial leasing) also make sense if their value is significant in relation to the total assets of the company. Information on the value of leased property can be found in the contracts, as well as in appendix to the balance sheet 2.4 “Other use of fixed assets.” In the example (Table 2), the cost of leased and off-balance sheet assets is significant - comparable to the value of total assets on the balance sheet. Thus, the amount of assets involved in the company's operation is noticeably higher than shown in the balance sheet. The indicators calculated without adjusting the reporting would be significantly distorted.

table 2

Excerpt from the reporting of AK Transaero OJSC (reporting in the public domain)

| Reporting line | Line code | As of December 31, 2014, thousand rubles. |

| Total for Section I “Non-current assets” | 1100 | 107 866 379 |

| Balance sheet (total assets = total liabilities) | 1600 | 128 862 566 |

| Appendix to the balance sheet 2.4 “Other use of fixed assets”, line “Leased fixed assets listed on the balance sheet” | 5283 | 131 421 435 |

Adjustment of simplified financial statements

Other rules apply to the reporting of small enterprises, incl. companies on the simplified tax system. Regardless of whether the detected error in the reporting forms is significant or not, adjustments to the financial statements are not provided, since simplifiers are given the right to recognize all errors found in the reporting as insignificant and correct them in the period in which they are discovered. Thus, the simplifiers do not adjust the reporting, but, of course, the obligation to correct errors in accounting remains.

Adjustment to the Federal Tax Service

The correcting balance sheet for the tax office is drawn up on the same unified form, which is approved by Order of the Ministry of Finance of Russia No. 66n (KND 0710099 - all forms, KND 0710001 - balance sheet). The rules and procedure for filling out the correction form do not change.

On the title page of the form, in the “Adjustment number” field, put “1” if the corrections are submitted to the Federal Tax Service for the first time, “2” for the second adjustment, and so on chronologically.

Please note that there is no need to report minor errors to the Federal Tax Service. Also, companies that conduct simplified accounting and generate reporting using simplified forms are not required to submit adjustment forms.

Penalty for incorrect accounting: tax liability

Art. 120 of the Tax Code of the Russian Federation determines the company’s liability for gross violation of the rules for accounting for income/expenses. This formulation means:

- lack of primary documents and accounting registers;

- repeated twice or more times incorrect or untimely recording in accounting and reporting of transactions or accounting objects - intangible assets, finance and inventory, investments and reserves.

Such violations detected for the first time will entail a fine of 10 thousand rubles. If this situation repeats in more than one period, the company will be required to pay 30 thousand rubles. If, due to accounting violations, the tax base was understated, the company will be assessed a fine of 20% of the amount of unpaid tax, but not less than 40 thousand rubles.

Art. 126 of the Tax Code of the Russian Federation provides for a fine of 100,000 rubles if a company acting as a controlling person of a foreign company refuses to submit reports or submitted them with deliberately false information.

To fix or not

The procedure and rules for compiling accounting reports are established not by fiscal, but by accounting legislation. Moreover, current standards do not allow the making of corrective entries into already approved statements. Therefore, if the owner has already approved the finished balance sheet, then corrections cannot be made to the form. This means that you won’t have to send the adjustment balance to the tax office.

Also, the need to provide correction records is determined by the nature of the error found. The submitted forms will have to be corrected if significant errors are found in the accounting.

Let us recall that significant errors are those that, individually or in combination with other economic indicators, can affect the economic decisions made by the owner based on the analysis of reporting data. In simple terms, these are the errors that significantly distort the real results and performance indicators of the institution. However, the level of materiality for each organization should be fixed in the accounting policy.

Conclusion: adjustments can be submitted to the Federal Tax Service only using unapproved reporting forms and if significant errors are identified in accounting. Otherwise, this is a direct violation of accounting legislation.

Clarifying the balance: right or obligation

The rules for drawing up a balance sheet are established not by tax legislation, but by accounting legislation. At the same time, current legislation in the field of accounting does not allow corrections of financial statements already approved by the owner.

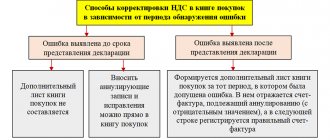

Therefore, we further proceed from the fact that the reporting has not yet been approved by the owners, because only in this case can corrective reporting be drawn up. Although here, not everything is so simple: whether or not to draw up an adjustment balance depends on the nature of the detected error.

Thus, if a significant error is identified in the balance sheet submitted to the tax office, it is corrected in the relevant accounting accounts in December of the reporting year (clause 8 of PBU 22/2010). Once the error is corrected, new financial statements are prepared, called restated financial statements. In the machine-readable form submitted to the tax office, it is necessary to fill in the “Adjustment number” field with the value “1- -”. If the statements are not prepared on machine-readable forms, then it is necessary to indicate in them that they are revised.

How to fix the error

If a significant error was identified before the owner approved the accounting statements, follow the general rules:

- Make corrective accounting entries in accordance with current recommendations and instructions.

- Based on the corrected data, create a “new” balance sheet and appendices to it. Do o.

- Check reference ratios.

- Submit the new, corrected version of the reports to the owner for approval. Then prepare an adjusting balance sheet for the tax office.

- Submit corrected reports to all regulatory authorities where erroneous information has already been sent. For example, in Rosstat, the Ministry of Justice.

- If an organization is required to publish reports in the Unified Information System or in other electronic portals, then the corrections will have to be published on the Internet.

When submitting your balance to the Federal Tax Service, a different, special procedure applies.