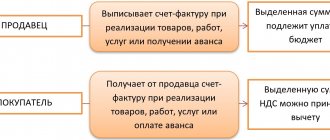

Errors when filling out invoices are not uncommon. Both experienced accountants and novice specialists can perform them. The question arises how to fix the error. The legislation provides for the possibility of using adjustment invoices and making corrections to existing invoices, while the procedure for canceling this document is not prescribed anywhere. According to the Federal Tax Service, there is nothing complicated or requiring additional clarification in canceling invoices. Accountants can only rely on accepted legislative norms and established practice, which will be discussed further. It should be noted that the tax service does not object to its application (letter of the Federal Tax Service No. BS-18-6/499 dated April 30, 2015).

What should a seller do if an invoice is issued by mistake ?

Why is cancellation necessary?

There are few situations when it is necessary to cancel an issued invoice. The main reasons are erroneous issuance of a shipping invoice and incorrect details that affect the deduction of VAT. In such cases, one of the parties will cancel and re-issue the invoice.

If you need to update the cost, price or volume of a product, service or work, cancellation is not required, since changes in tax liabilities can be reflected in the sales and purchases ledger. Cancellation is provided to replace an invoice that cannot be adjusted. We talked about the adjustment invoice here.

Who performs the operation?

The procedure for registering the cancellation of an invoice depends on the date of issue of the revised version, and is reflected in both the supplier's sales book and the customer's purchase book. The procedure and actions for filling out accounting books and additional sheets are specified in the rules for maintaining them, approved by Decree No. 1137 of the Government of the Russian Federation of December 12, 2011 “On the forms and rules for filling out documents for VAT calculations.”

For the quarter in which the invoice was canceled, an updated tax return is submitted, in accordance with paragraph 1 of Article 81 of the Tax Code of the Russian Federation and paragraphs 5-6 of the Rules for filling out additional tax returns. sheets of books of purchases and sales, in all cases when the amount of VAT changes.

Important! If the amount of tax paid after clarification is higher than in the initially prepared declaration, then, in order to avoid a fine for tax evasion, an additional penalty is paid when submitting the revised declaration.

You can find out about the rules for filling out an invoice here.

How to record the service provided

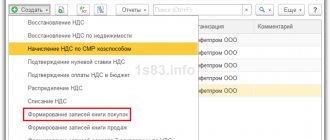

The provision of advertising services to the buyer of Clothes and Shoes LLC in the 1C: Accounting 8 program (rev. 3.0) is registered using the Implementation

(act, invoice) with the type of transaction

Services (act)

(section

Sales,

subsection ->

Sales

, hyperlink

Sales (acts, invoices).

After posting the document, the following entries are entered into the accounting register:

Debit 62.01 Credit 90.01.1

– the cost of the advertising service provided;

Debit 90.03 Credit 68.02

– the amount of accrued VAT.

Receipt is entered into the Sales VAT register

for the sales book, reflecting VAT at a rate of 18%.

The corresponding entry about the cost of the advertising service provided is also entered into the Sales of Services register.

You can create an invoice for the advertising service provided by clicking on the Issue an invoice

at the bottom of the document

Sales

(act, invoice).

Invoice issued

is automatically created and a hyperlink to the created invoice appears in the form of the basis document (Fig. 1).

Rice. 1

In the document Invoice issued

(section

Sales,

subsection

Sales

, hyperlink

Invoices issued

), which can be opened via a hyperlink, all fields are filled in automatically based on the data in the

Sales document (act, invoice).

From 01/01/2015, taxpayers who are not intermediaries acting on their own behalf (forwarders, developers) do not keep a log of received and issued invoices, therefore in the document Invoice issued

in the line

“Amount:”

it is indicated that the amounts to be recorded in the accounting journal (“of which in the journal:”) are equal to zero.

As a result of posting the document Invoice issued

An entry is made in the information register

Invoice Journal

.

Register entries The Invoice Register

are used to store the necessary information about the issued invoice.

Using the Print Document

accounting system

Invoice issued,

you can view the invoice form, as well as print it.

An invoice issued for the provision of advertising services is registered in the sales book for the third quarter of 2015 - see table. 1.

Table 1

The transaction subject to VAT for the provision of advertising services is reflected on line 010 of section 3 of the VAT tax return for the third quarter of 2015 (approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3 / [email protected] ) (Fig. 2) .

Rice. 2

Information from the sales book is reflected in section 9 of the VAT return.

Instructions for carrying out

The registration procedure is significantly different, both for the seller and the buyer, and based on the quarter in which the corrected invoice was drawn up (we discussed why an invoice is needed for the seller and the buyer here). For sellers, subclause 3 of clause 11 of the Sales Book Maintenance Rules provides the following template for making changes:

- If the preparation of an erroneous invoice occurred in the same billing period in which the cancellation sheet was registered, that is, the dates of lines 1 and 1a are within the same quarter, the original document is registered again.

- If cancellation occurs on an erroneous invoice already in the next quarter, based on the date in lines 1 and 1a of the corrected version, then an additional sheet is drawn up, in accordance with paragraph 3 of the Rules for filling out additional invoices. sheets.

Correction algorithm:

- The primary invoice is re-registered, with columns 13a-19 filled in with negative indicators, removed from the invoice with the “-” sign.

- The corrected version is registered in the prescribed manner, indicating in column 4 details 1a from the previous version.

The buyer, in accordance with subparagraph 4 of paragraph 9 of the Rules for maintaining the purchase book, cancels and re-registers a new invoice, in a manner that depends on the date of the corrections by the seller.

If the erroneous and corrected invoices are drawn up in the same quarter:

- An erroneous invoice is re-registered by entering negative indicators in columns 15-16.

- The corrected version is registered in the standard way, duplicating the date and number 1a in line 4.

If the seller did not have time to submit the corrections in the billing quarter, and the data has already been transferred to the tax service, the procedure is slightly different. An additional sheet is inserted into the new purchase book in accordance with paragraph 5 of the filling rules, in a similar way with the correction of the columns of the erroneous invoice.

Mandatory invoice details

Invoices must contain the mandatory details indicated:

- in paragraph 5 of Article 169 of the Tax Code of the Russian Federation - in relation to invoices that suppliers (performers) draw up when shipping goods (performing work, providing services), transferring property rights;

- in paragraph 5.1 of Article 169 of the Tax Code of the Russian Federation - in relation to invoices that suppliers (executors) draw up when receiving advances (partial payment) from the buyer for upcoming deliveries;

- in paragraph 5.2 of Article 169 of the Tax Code of the Russian Federation - in relation to adjustment invoices that suppliers (performers) draw up when the value (quantity, volume) of goods shipped (work performed, services rendered) and transferred property rights changes.

The invoice must be signed in the prescribed manner (clause 6 of Article 169 of the Tax Code of the Russian Federation).

Cancellation procedure

The detailed regulations for such a procedure are spelled out in paragraphs 3 and 11 of the Rules for maintaining a sales book, approved by Resolution No. 1137. For the buyer, the resolution in paragraph 4 of the Rules for maintaining the purchase book prescribes similar actions, but after receiving a corrected invoice from the seller.

For the past period

At the end of the tax period, the cancellation of the entry is carried out by registering a new invoice, with correction and indication of the details of the registered version. The buyer must record the receipt of the corrected invoice in its books and indicate the cancellation, and the seller must provide the corrected version of the original invoice and record it on its own.

The supplier did not register the document

If incorrect shipment data was entered into the sales book, but was discovered immediately afterwards, the procedure in this case is simpler. The circumstance of an error corrected in the same tax period does not affect the amount of tax deductions, so it is enough to fill out the corresponding columns 13a-19, canceling not the entire sheet, but only the incorrect data.

Cancellation by buyer

As long as no entries are made in the purchase ledger, the correction does not have any cancellation issues. However, when an erroneous invoice is received in the package of documents and the amounts are entered in the purchase ledger, it is more difficult to make a cancellation. After submitting distorted information, the tax deduction turns out to be underestimated or overestimated, and it must be recalculated. In this case, the buyer must make corrections. This is done in accordance with paragraph 5 of the rules for filling out additional information. leaf.

To cancel a submitted invoice, the accountant of the buyer’s organization must draw up a separate sheet for the submitted purchase book with negative values in columns 15-16, pay the difference in tax and penalty, in accordance with paragraph 1 of Article 81 of the Tax Code and paragraph 6 of the rules for filling out additional information. sheets of the shopping book.

Situations with registration work

The main point of registering corrected sheets is to enter negative values into them in the designated columns. Actions depend on the delivery party, the tax period and whether the error is recorded in the books.

The buyer did not enter data

According to paragraph 1 of Article 54 of the Tax Code, if distortions are detected in past periods, recalculation is carried out in the same period. However, this rule does not apply to previous periods, since Government Resolution No. 1137 does not contain a mechanism for its implementation, and the recalculation is carried out in the quarter when the correction is registered. Therefore, you can recalculate or pay additional tax after drawing up an adjustment invoice and submitting it to the tax service.

How to write a cover letter for documents

In general, a cover letter is understood as a kind of information certificate that is drawn up when sending documents, commercial proposals, material assets, a resume, etc. to another person.

It is sent using Russian Post or private mail - as a rule, it is better to do this by registered mail. The number of the shipment must be entered, which is recorded in the document flow log of the sending company. Under this address number he puts his own number - and thus the risk of confusion is significantly reduced.

Saving changes

When registering an adjustment invoice, the buyer must be guided by paragraph 3 of Article 170 of the Tax Code of the Russian Federation. If the cost of the goods increases, then the difference is taken to deduct VAT in the new period . If the VAT amount is reduced, it must be restored in the period when the supplier submitted the relevant document.

Attention! If a technical error is made, cancellation and registration of the adjustment invoice is not required. According to letter No. 13968 of the Federal Tax Service dated August 23, 2012, it is enough to make changes to the existing document.

Accounting book

According to paragraph 5 of the Accounting Regulations. accounting “Correcting errors in accounting and reporting” PBU 22/2010, approved by Order of the Ministry of Finance No. 63 dated June 28, 2010, the identified error is corrected in the month in which it was discovered.

Read more about accounting for invoices in this article.

Tax accounting

According to paragraph 1 of Article 81 of the Tax Code of the Russian Federation, if errors are detected in the submitted return that do not underestimate the amount of tax, the taxpayer has the right to submit an updated tax return on a voluntary basis.

How to write a sample cover letter for receiving invoices

The presence of a cover letter will allow the recipient to quickly process the received correspondence and, if necessary, provide a response as soon as possible. Details It is customary to conduct business correspondence between business entities, legal entities, and individual entrepreneurs on the letterhead of organizations containing corner stamps with the sender’s details.

Business etiquette dictates writing cover letters or, as they are also called, accompanying documents when sending documents to partners, government agencies and in other cases. This is especially convenient in situations where you need to confirm the transfer of a packet to the recipient, pay attention to fundamental points, convey a request or a guide to action, and also record the timing of response actions. All important information can be presented in the accompanying document.