In April 2014, a law was passed that made changes to the Tax Code. The amendments affected a number of issues relating to companies using the simplified tax system, UTII, etc. Many innovations came into force this year, while others are expected later. Thus, changes to the simplified tax system regarding payment of property tax will take effect from January 1, 2015. The amendments have already caused a lot of noise in the business community. Let's take a closer look at what these changes are and who they will affect first.

So, Federal Law No. 52 dated April 2, 2014. introduced amendments to the first and second parts of the Tax Code. Thus, Article 346.11 of the Tax Code, which concerns the payment of taxes by companies using the simplified tax system, has changed. In particular, from January 1, 2015, such organizations will have to pay a tax on real estate, the tax base for which is determined as their cadastral value (for the rest of the property they are exempt from taxes, as before).

That is, as you can see, in paragraph 2 of Art. 346.11 introduced small but significant changes that must be taken into account starting in the new year. However, in order not to create panic among entrepreneurs and especially small businesses, it should immediately be clarified that changes to the simplified tax system since 2015:

- will not affect all regions, but only those in which a tax on the cadastral value of real estate has already been paid. Among these regions: Moscow and the Moscow region, as well as the Kemerovo and Amur regions;

- will depend on whether the taxable object is on the list of real estate, the basis for which is the cadastral value;

- will affect large real estate used for shopping centers, administrative and business buildings, public catering, etc. (for Moscow, for example, a tax is imposed on real estate - over 5 thousand sq. m.).

Thus, it is clear that not all regions will be required to pay taxes under the simplified tax system from 2015 with changes, and not every property owned by a company can be considered a taxable object. That is, as you can see, small businesses are unlikely to be affected by changes to the simplified tax system in 2015.

What is a simplified system and who is it for?

The simplified taxation system is a special taxation regime for small businesses, the main features of which are simpler accounting and reporting, as well as the ability to pay one tax instead of several mandatory ones.

What taxes is an entrepreneur exempt from under the simplified tax system? These are personal income tax (PIT) for yourself, value added tax (VAT) and property tax. However, there are exceptions for each of these taxes, for example, an entrepreneur is required to pay personal income tax for hired employees; VAT – when importing goods from abroad; certain types of real estate on which tax is calculated are specified in Article 378.2 of the Tax Code of the Russian Federation.

The obligation of an entrepreneur on the simplified tax system, in addition to paying a single tax, is to transfer insurance contributions to the budget for himself and his employees (if any). The individual entrepreneur must pay pension contributions and health insurance for himself.

The primary legislative source for the simplified tax system is Chapter 26.2 of the Tax Code of the Russian Federation, which you can always refer to if additional questions arise.

Let us immediately note that not all entrepreneurs can use the simplified tax system. It is prohibited to be “simplistic” if your activity is related to:

- production of goods subject to payment of indirect tax - excise tax (alcoholic beverages, tobacco products, fuel, etc.); — mining of minerals, except non-metallic ones, used as building materials (sand, clay, limestone, etc.); — legal practice or notary practice; - gambling; — insurance, investment, banking services, securities, pawnshops. In addition, you cannot use the simplified tax system if you have more than 100 employees, an annual income of more than 60 million rubles and a residual value of fixed assets of more than 100 million rubles.

Limit on simplified tax system for 2020-2021 for existing companies

If the income of a “simplified” person in any period of 2021 exceeds the established simplified tax system income limit of 150 million rubles, he loses the opportunity to work on the simplified tax system.

You must report the loss of your right to the simplified tax system to the tax office. How such a message is filled out is discussed in detail in the Ready-made solution from ConsultantPlus. Get free access to the system and proceed to the explanations and completed sample.

In 2021, the income limit will work a little differently. To apply the simplified tax system under general conditions, you will need to meet a limit of 150 million rubles, indexed by the deflator coefficient. If your income exceeds this amount, but is within 200 million rubles, you can remain on the simplified tax regime and pay tax at higher rates.

Read about how this will work in practice in our article.

If you decide to voluntarily switch from the simplified tax system to a different tax regime, read the message “Notification of leaving the simplified tax system is required.”

Methods for determining the object of taxation under the simplified tax system.

There are two such methods, and the entrepreneur has the right to choose any of them at his own discretion:

1. The first method assumes that the object of the single tax will be the income of the entrepreneur. Such income recognizes both revenue received from sales during the conduct of the main activity, and income received in other ways (donated property, interest income on deposits, securities, etc.). 2. The second method assumes that the object of the single tax will be the difference between income and expenses. You can find out the full list of income and expenses by referring to the primary sources - Articles 346.15 and 346.16 of the Tax Code of the Russian Federation, respectively.

Individual entrepreneur simplified taxes 2015: rates.

The size of the single tax rate is influenced by the method of choosing the object of taxation:

6% - a single tax on the simplified tax system is levied on the income of entrepreneurs; 15% - a single tax is levied on the simplified tax system on the difference between income and expenses.

It should be noted here that the rate of 15% is not fixed, since the subjects of the federation set it independently. The law defines the possibility of reducing this rate to 5% in the case of attracting investments or developing priority activities in a given region. To do this, you need to contact the tax service with which you are registered.

Important aspects

The declaration must be filled out electronically or manually using a dark pen. Corrections to the document are not permitted. You need to start recording from the leftmost cell and put dashes in all empty cells. Write names in capital letters. Calculations are indicated in rubles, kopecks are rounded according to accounting rules.

Each page must be signed and dated, and the pages must be numbered. You only need to send completed sheets; empty declaration sheets are not needed. It is not allowed to staple sheets.

Amounts of insurance premiums for individual entrepreneurs on the simplified tax system in 2015.

As we have already mentioned, an individual entrepreneur using the simplified tax system, in addition to the single tax, must pay insurance premiums for:

— pension provision; - health insurance.

Regarding insurance contributions to the Pension Fund for yourself, their value depends, on the one hand, on the size of the individual entrepreneur’s annual income, and on the other, on special parameters (the size of the minimum wage and insurance rates).

If an entrepreneur earns less than 300 thousand rubles a year, then he must transfer a fixed amount monthly to pension insurance: 1550.90 rubles = 5965 rubles (minimum wage in 2015) * 0.26 (insurance rate in the Pension Fund). Accordingly, the annual amount of insurance premiums will be: 1550.90 * 12 = 18610.80 rubles.

How will the amount of insurance payments for pensions change if income exceeds the threshold of 300 thousand rubles? Then you will need to pay an additional 1%, taken from the amount of this excess.

Regarding deductions for health insurance, there is no differentiation by income level; their size for all individual entrepreneurs has a fixed value: 304.23 rubles per month and, accordingly, 3650.58 rubles per year.

LIFO canceled

Simplified companies can no longer write off goods using the LIFO method when calculating taxes. Legislators abolished it in order to bring tax accounting closer to accounting. After all, this method has not been used in accounting for a long time. Therefore, companies that assessed goods in this way in 2014 must choose one of the three remaining (subclause 2, clause 2, article 346.17 of the Tax Code of the Russian Federation, as amended by Federal Law No. 81-FZ of April 20, 2014):

— at the cost of the first acquisition (FIFO);

- at average cost;

- at the cost of a unit of goods.

There is no need to recalculate the balances of goods that are listed in the company’s records as of January 1. In 2015, they need to be written off according to new rules, which the company needs to approve in its accounting policies.

What should an entrepreneur be guided by when choosing an object of taxation?

Many entrepreneurs starting their activities, as well as those who have been working for some time and want to reduce their tax burden, face this choice. Which object is more correct to choose – income or the difference between income and expenses?

The “income” method is extremely simple and convenient for entrepreneurs; the tax base for it is income received in the reporting period. There are no pitfalls or points that require explanation.

Regarding the “income minus expenses” method, in this case the individual entrepreneur must take into account a number of significant factors. Let's look at the points that individual entrepreneurs, first of all, need to pay attention to:

- Choosing the “income minus expenses” method requires clear documentation of all expense transactions. We are talking here about both documents confirming the transfer of goods or provision of services (acts, invoices), and certifying their payment (payment orders, checks, receipts). If the documents on expenses are drawn up incorrectly or are not available, then the right to use them when determining the object of taxation disappears - you simply will not be credited for such expenses. It also happens that not all counterparties provide documents signed by them on time. You will need to take care of this, since only you are interested in reducing the tax base. But even if you have all the documents confirming expenses, the tax service has the right not to recognize them if they do not comply with Article 346.16 of the Tax Code of the Russian Federation.

- The next important point of this method is the availability of prepayments. If the specifics of your activity are such that you use customers’ funds to purchase from suppliers, then in this case you need to very carefully monitor the deadlines. If in the reporting quarter it is not possible to transfer money to the supplier from the received advance payment, then you risk a large amount of the advance payment! After all, you did not have time to make expenses, which means that 15% (or less, depending on what rate is assigned to you) will be accrued on the amount of income received, that is, the prepayment. Of course, these expenses will be taken into account in the future, but not all individual entrepreneurs are able to pay a significant amount of tax at once.

- It would be more appropriate to choose this method only if expenses in total income amount to more than 60%.

- If in your region there are benefits for the chosen type of activity in the form of a rate reduction of up to 5%, this is a significant advantage in choosing the “income minus expenses” method. We note here that in this case the costs according to the previous paragraph may be less than 60%.

Thus, after weighing the indicated criteria, an entrepreneur can accurately make a choice in favor of one or another method of determining the tax base.

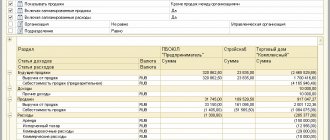

Declaration of the simplified tax system: fill out section 3

The third section of the declaration under the simplified tax system is intended to be filled out only by those organizations that received funds in accordance with paragraphs 1 and 2 of Art. 251 Tax Code of the Russian Federation. We are talking about targeted funding, targeted revenues and income received as part of charitable activities. Previously, companies using the simplified tax system, if they had such amounts, had to fill out sheet 7 of the income tax return. Therefore, the procedure for filling out the new section is similar to the previous requirements. This is a specific section, so it is not common among simplifiers.

The codes for column 1 “Receipt type code” are given in Appendix No. 5 to the Procedure for filling out the declaration.

Next, filling out section 3 must begin with the transfer of funds that were not used on time (or without a period of use), but received in the previous year. For those amounts where the period of use is established, you need to indicate the date of their receipt in column 2, and in column 3 - their amount. If the period of funds received in the previous reporting period has not expired, then their amount is entered in column 6.

Only after this do they fill in the data on funds received in the reporting period:

- In columns 2 and 5 for funds with a set deadline, enter the dates of receipt and use.

- Column 3 - the amount of funds received with a specified period.

- Column 6 shows the amount of unused funds that have not yet expired.

- Column 4 - funds fully used for their intended purpose within the prescribed period.

- In column 7 - funds used for other purposes (they must be included in non-operating income at the time of actual use).

The line “Report Total” indicates the total amounts for the corresponding columns 3, 4, 6, 7 of Section 3. And lastly, only completed sections must be sent to the tax office.

For individual entrepreneurs first registered in 2015, who are engaged in the types of activities listed in Article 1 of Federal Law No. 477-FZ of December 29, 2014, the tax rate will be 0. However, you still need to fill out a declaration, but in the form specified in the attachment to the letter from the Federal Tax Service No. ГД-4-3/ [email protected] dated 05/22/15. Also, the zero tax rate applies to individual entrepreneurs registered in the Republic of Crimea and Sevastopol.

How to become a single tax payer using the simplified tax system?

An individual entrepreneur from the moment of his registration and over the next 30 days has the right to submit a special application to the tax service. This is the only thing that needs to be done when switching to a simplified taxation system. This right exists even before the start of business - directly when submitting registration documents.

If an individual entrepreneur is already working and wants to switch to the simplified tax system, then this right is granted only from the beginning of next year. In this case, he will need to submit an application this year. The deadline for submission is December 31 of the current year. The procedure is similar for those who want to change the object of taxation “income” to “income minus expenses” and vice versa. The transition will take place only from next year, provided that an application is submitted within the specified period this year.

If an entrepreneur paid a single tax on imputed income (for one or all types of activities), then, upon application, he can switch to the simplified tax system in the month in which he ceased to be a UTII payer.

What kind of entrepreneur can think about benefits?

To receive property tax benefits, a businessman must meet several conditions. For example, the property that he owns is necessary for him to carry out business activities. Further, this entrepreneur works according to one of three systems: patent, simplified tax system or UTII . Thus, if an entrepreneur uses property in business and operates under a simplified taxation system, then he may be exempt from paying property tax . But there is not even a developed procedure in the law and with its help it is possible to prove the use of property in business. And in order to receive benefits, you must somehow prove your right. To do this, the entrepreneur needs to collect documents that would confirm this right and the application for benefits. All this is then submitted to the inspectorate. It is useful to find out all the explanations on this issue in the correspondence of the Federal Tax Service of Russia dated August 19, 2009 No. 3-5-04/1290.

The recommendations in this letter are quite accessible and can be applied in 2015. The application, which must be submitted to the inspectorate for tax breaks, is not written according to established forms, but freely. The application must name all the real estate owned and indicate those objects that are worth paying attention to. That is, they are necessary for conducting business. If the property is really used for this purpose, then this can be confirmed by documents, for example, payments, agreements with buyers, partners, and so on.

Property tax in 2015 is paid until the first of October. Accordingly, the application must be submitted much earlier than this deadline, since the tax notice will also be sent in advance.

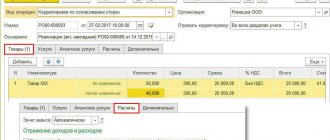

Concepts of tax and reporting period according to the simplified tax system. An example of calculating an advance payment.

The tax period for individual entrepreneurs using the simplified tax system is a calendar year, and the reporting period is a quarter. The declaration is submitted once a year until April 30 of the following reporting year. And although the reporting period for individual entrepreneurs is three months (quarter), there is no need to file a declaration for this period, however, entrepreneurs are required to independently calculate and pay advance payments for the single tax on the simplified tax system on a quarterly basis. In this case, the advance amount is determined as follows: the tax base in each subsequent quarter is taken on an accrual basis, multiplied by the appropriate tax rate, and the previously paid tax is subtracted from the resulting amount. For the 1st-3rd quarters of the current year, advances are paid until the 25th of April, July and October, respectively. But the final tax amount at the end of the tax period is due until March 30 of the next year.

An important point when calculating advances: • Individual entrepreneurs on a single tax of 6% (the “income” method) reduce the amount of the tax base by the amount of insurance premiums; • Individual entrepreneurs with a single tax of 15% or less (the “income minus expenses” method) include insurance premiums as expenses.

Let's consider an example: an entrepreneur is a single tax payer under the simplified tax system at a rate of 6%. In the first quarter his income was 50 thousand rubles, in the second - 80 thousand rubles, in the third - 100 thousand rubles and in the fourth - 60 thousand rubles. The entrepreneur's annual income was: 50 + 80 + 100 + 60 = 290 thousand rubles. The total amount of monthly insurance premiums for yourself is: 304.23 (FFOMS) + 1550.90 (PFR) = 1855.13 rubles. Since payment of advances under the simplified tax system is carried out quarterly, it is advisable to determine the amount of insurance premiums for this period: 1855.13 rubles * 3 = 5565.39 rubles. By April 25, the individual entrepreneur must pay to the budget: (50,000 rubles - 5565.39) * 6% = 2666.08 rubles. By July 25, the individual entrepreneur must pay to the budget: (50,000 rubles + 80,000 rubles - 5565.39 * 2) * 6% - 2666.08 rubles = 4466.07 rubles. Until October 25, the individual entrepreneur must pay to the budget: (50,000 rubles + 80,000 rubles + 100,000 rubles - 5565.39 * 3) * 6% - (2666.08 rubles + 4466.07 rubles) = 5666.08 rubles. The final tax amount for the year must be paid before March 30 of the next year and will be: (290,000 rubles - 5565.39 * 4) * 6% - (2666.08 rubles + 4466.07 rubles + 5666.08 rubles) = 3266, 08 rubles. Thus, the total amount of the single tax on the simplified tax system for the year, which will be included in the declaration, will be: 2666.08 rubles + 4466.07 rubles + 5666.08 rubles + 3266.08 rubles = 16064.31 rubles. Please note that the established payment deadlines are required to be met in order to avoid fines and penalties. For each day of non-payment of tax, a penalty is charged, amounting to 1/3 of the Central Bank refinancing rate. In addition, in case of late payment of tax based on the results of the year, a 20% fine of the amount of underpayment will be charged.

Are there advantages and disadvantages to the simplified tax system?

The simplified tax system for entrepreneurs certainly has a number of advantages . The most important advantage is the simplification of the tax calculation and accounting system and the absence of requirements for mandatory submission of reports to the Federal Tax Service . This way, an entrepreneur can independently determine which tax object to choose. Let us remind you that there are two objects: income minus expenses or only income . Under the simplified tax system, the tax period is the entire year, that is, 12 months, and the declaration to the tax office needs to be submitted only once for the entire year. There are still many advantages, and entrepreneurs have and will continue to be convinced of this from their own experience. But the negative aspects of this phenomenon can also be called. For example, the simplified tax system may not be used in all areas of business. In the banking sector, for example, there is no system. Also, neither lawyers, nor investment funds, nor notaries, and so on, can switch to the simplified tax system. The simplified tax system can also be an obstacle when expanding a business.

What are the advantages of “simplified”?

The attractiveness of the simplified system for individual entrepreneurs is obvious, since it has a number of advantages: 1. Simplified reporting - the declaration is submitted once a year. 2. Simple accounting, no need for accounting. 3. Reduced tax rates compared to the general taxation system. 4. The ability to reduce the tax base through insurance premiums (using the “income” method). 5. Due to simplified accounting, there is little interest from the tax service in “simplified” people, an almost complete absence of on-site inspections and pressure.

Summing up the topic “individual entrepreneur taxes simplified 2015”, one significant drawback can be identified, despite all the listed advantages - this is the inability of counterparties - VAT employees working with individual entrepreneurs - to receive a VAT tax deduction. Under such circumstances, enterprises that pay VAT often refuse to work with “simplified” companies, especially if the transactions are large in nature. Therefore, if your business involves a sufficient number of such operations, then it is advisable to think about either switching to a general taxation system or registering a new enterprise.