Whether we like it or not, the state obliges everyone who works to officially register with the relevant government agencies, thereby agreeing to the deduction of monthly deductions from earnings.

An employee may be an employee, then his rights and obligations are specified in an employment agreement drawn up between the employee and the employer. An employment agreement is a guarantee that the worker not only pays contributions to social funds, but can also hope for a refund of the money, provided that he gets sick and has issued a sick leave in accordance with all the rules established by Russian legislation.

During the vacation, which is granted to the employee annually, the income is retained in full, which is also beneficial to the worker. Moreover, sufficient work experience will guarantee that in the future, upon reaching retirement age, you will be awarded a larger pension, compared to the pension of citizens who did not work or deliberately did not register with state funds, thereby hiding from paying taxes.

Mostly unregistered employees remain undetected; it is too difficult to catch a citizen by the hand and bring him to justice. However, if you are still working unofficially, think not only about today, but also about tomorrow, because someday you will also become a pensioner.

According to statistics, in 2021, among the active working population of Russia, 6% are unemployed, but in reality this figure is most likely higher. Of this number of Russian citizens, almost half still work, but do not pay contributions for social needs, which means they deliberately deprive the older generation of increased pensions. The state is constantly trying to plug the hole in the state budget by increasing tax rates, which are still levied on the same workers, the rest, out of habit, sit back and consider themselves free from obligations.

What are social needs?

In addition to wages, compensation, incentive bonuses and other payments guaranteed to employees, the employer bears costs by making contributions to social needs. This makes it possible, if necessary, in situations provided for by law, to receive cash benefits and pensions.

The meaning of the very concept of “need” includes a lack of something, sometimes a vital need.

Consequently, the employer’s expenses for social needs are expenses associated with the payment of insurance contributions to funds that, if necessary, can pay a person a monetary benefit or provide assistance.

In addition, material support for employees may be provided for by local legal acts of internal use, for example:

- additional payments for employee health;

- financial assistance for organizing funerals of close relatives;

- benefits upon retirement;

- other.

Social contributions include:

Health insurance

Labor legislation guarantees working citizens the preservation of their jobs during absence:

- if there is confirmation of being on treatment;

- when a person undergoes rehabilitation after injuries.

Days of incapacity for work are paid according to a duly issued sick leave certificate.

In addition, insured persons in the event of a deterioration in their health, for preventive measures, receive free medical care guaranteed by the basic program.

Why do we need social insurance for workers?

Mandatory insurance by the employer of newly hired employees during employment provides protection against deterioration in social or financial situation under circumstances beyond the control of the employees.

Insured citizens have the right to receive social assistance if they lose the opportunity to earn a living due to:

- the onset of old age;

- disability in case of illness;

- recognition of disability as a result of an occupational disease or after injuries;

- motherhood;

- and so on.

Pension insurance

Allows a person, having reached retirement age or having lost the ability to work (partially, completely) due to an established disability, to receive monthly pension payments.

In addition, persons who were dependent on the deceased breadwinner have this right.

What expenses should be taken into account as social security contributions?

According to Russian laws, expenses for social obligations include contributions to social, pension and health insurance.

Until 2001, such expenses also included contributions to the fourth extra-budgetary fund - the Employment Fund. But after the transition to a single social tax, employers’ obligations were reduced to transferring payments only to three extra-budgetary funds. Despite the fact that the employment fund has long been gone, some departmental guidelines for accountants still retain the wording stating that a certain percentage of labor costs must be transferred to this organization. But this recommendation no longer needs to be followed.

Who pays insurance premiums?

Insureds making social contributions. needs for working citizens are:

- organizations, enterprises represented by the owner or manager representing the interests of a legal entity;

- individual entrepreneurs using hired labor.

The formation of social insurance funds occurs through contributions made by enterprises, organizations, and entrepreneurs.

The missing funds to cover expenses are transferred from the country's federal budget.

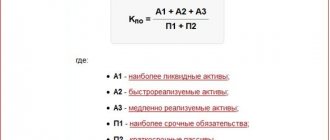

Deduction formula

To calculate contributions to the pension fund, a formula is used that takes into account the costs incurred by the enterprise for the production and sale of goods, it has the following form:

Contributions to the Pension Fund = salary of the employee * percentage of deductions / 100;

To calculate the amount of contributions to the Social Insurance Fund of the Russian Federation, the following formula is used:

Contributions to the Social Insurance Fund = employee's salary * percentage of contributions / 100;

The health insurance premium is calculated using the formula:

Contributions to compulsory medical insurance = employee’s salary * percentage of deductions / 100.

The resulting values are calculated in rubles, so to find the full deduction amount, you should add up the results.

To summarize, it should be concluded that social contributions to funds are a deferred part of each employee’s salary, the return of which occurs at the time of an emergency or ensures the citizen’s old age.

In an idealized view, social contributions are an agreement between the workforce and the enterprise. As the practice of Western countries shows, the way to reduce government intermediation in this system is the most effective.

What is voluntary social insurance, read the article: voluntary social insurance. You can read what is included in the concept of social insurance in this article.

Find out about social insurance calculations here.

What payments do you need to make deductions from?

Before calculating contributions for social needs, you need to decide which payments are subject to mandatory contributions.

Contributions must be withheld from the calculation of amounts paid:

- wages for officially employed full-time employees;

- monetary compensation for unused annual leave upon dismissal;

- for services provided under civil contracts;

- royalties;

- benefits if their amounts, at the discretion of the manager, exceed the established limits.

Insurance premiums are not charged for:

- amounts for payment of sick leave, child benefits;

- compensation payments for compensation for damage to the health of workers due to the fault of the employer;

- providing employees with housing, payment of utilities,

- payment for the cost of special food;

- the amount of guaranteed benefits upon dismissal (for reduction of staff or number of employees, for health reasons, other cases);

- employer expenses associated with training (in this area) of specialists and employees undergoing advanced training courses;

- compensation by the employer of expenses to employees associated with relocation when transferred to a structural unit located at a remote distance;

- the amount of one-time financial assistance provided to compensate for material damage or harm to their health as a result of natural disasters, accidents, and other emergency situations;

- one-time cash payments at the birth (adoption) of children, if their amount does not exceed 50 thousand rubles;

- travel expenses (travel and daily expenses) for employees sent by order of the manager to other localities in order to fulfill assigned production tasks;

- financial assistance provided to subordinates by decision of the owner in the amount of up to 4,000 rubles;

- and other payments and compensations (Article 422 of the Tax Code of the Russian Federation).

Social contributions are the employer's responsibility

Employers' contributions to social insurance

Based on current laws governing the activities of social funds, all enterprises are required to make payments.

The amount of deductions is determined by the Federal Law, as well as regional regulations. The current rates are influenced by the industry in which the organization operates.

It should be noted that cases of non-payment of social contributions by an employer are not grounds for depriving a citizen of social benefits for old age, temporary disability or disability.

Violation of payment deadlines implies the employer's liability to regulatory authorities and payment of fines. To identify such violations, tax authorities carry out on-site inspections; starting from 2015, their duration will be up to six months.

Starting this year, a deferment of payments to social insurance funds will be introduced. This change has been introduced into the legislation of the Russian Federation. Previously, organizations had to pay social obligations by December 31. Now they have the opportunity to take advantage of installments exceeding a period of one year.

To do this, the company must conduct its activities with a seasonal nature or be recognized as having suffered from natural disasters. With some exceptions, budgetary organizations can receive a deferment.

How to calculate the amount of deductions

The policyholder pays premiums in accordance with current tariffs.

Deductions for social needs from the wage fund (phot) are percentages:

- 22% – for pension provision of insured workers;

- 2.9% – for payments related to temporary disability of full-time employees, including guaranteed payments to pregnant women when taking maternity leave, benefits for the birth (adoption) of children;

- 5.1% – for the provision of medical care and preventive health measures.

Calculation of social Deductions can be made in two ways.

Option 1

The total amount of all mandatory contributions is

22% + 2,9% + 5, 1% = 30 %.

By multiplying the amount included in the estimate for salary expenses by 30%, the amount of required deductions is obtained.

Option 2

They calculate the expenses necessary for monthly payments in the billing period for each employee.

Add up the results for all employees.

The percentage of mandatory insurance premiums is calculated from the amount received.

Are contribution rates changing?

Insurers keep their finger on the pulse every year and fix the interest at the beginning of each year. Preferential tariffs are also adjusted taking into account currency indexation and changes in its exchange rate. In 2021, compared to the previous 2021, the percentages have not changed, and taxpayers' money continues to be allocated to such important items:

- provision of pension payments;

- free receipt of qualified medical care;

- payment of benefits such as sick leave and maternity leave.

This article is accompanied by this video:

Legislative regulation

Regulatory support for the Unified Social Tax is formalized at several levels, here they are:

- The mandatory presence of taxes in social spheres is prescribed in the Constitution of the Russian Federation. This act is key, because it is at the first level in the hierarchy of legal acts.

At the first level there are all types of codes.- Laws adopted at the federal level can also be classified as first-level regulations. The unified social tax was introduced on January 1, 2011 in accordance with Federal Law No. 118 of May 5, 2000. In this form, social tax deductions existed for nine years. And starting from 01/01/2010, the tax took its usual form.

Categories of individual entrepreneurs for which benefits have been canceled

For 2021, only a few groups of individual entrepreneurs do not lose benefits:

Individual entrepreneur on the simplified market, practicing preferential activities, whose profitability is less than 70%. But with one limitation that the annual individual entrepreneur is no more than 78 million rubles.- Pharmacy companies and individual entrepreneurs who have the appropriate license to open and conduct a pharmaceutical business, on UTII.

- Individual entrepreneurs who apply a patent taxation system in relation to salary payments and other remunerations for their employees.

Contributions from employees

At the expense of employees, namely from their wages, the employer pays one tax to the state - personal income tax. Tax is paid on all types of remuneration for work: wages, under work contracts, civil contracts, etc. The tax inspectorate closely monitors these deductions, and for non-payment, as well as for errors in calculations, a fine of 20% of the amount is imposed. which had to be paid (Article No. 123 of the Tax Code of the Russian Federation).

The personal income tax calculation process in 2021 remains unchanged. In order to calculate the amount of tax, an accountant or other responsible employee must determine the amount of income for the reporting period and subtract from it the amount of the tax deduction, if any. Tax deductions can be:

- standard - these are deductions that are provided to parents of minor children, disabled children, Chernobyl victims, widows of military personnel, etc. (Article No. 218 of the Tax Code of the Russian Federation);

- social - deductions for expenses for treatment, voluntary medical insurance, training, charity, etc. (Article No. 219 of the Tax Code of the Russian Federation);

- investment - deductions for transactions with securities and investment accounts (Article No. 219.1 of the Tax Code of the Russian Federation);

- property - these are deductions for the sale, purchase, construction of real estate;

- professional - deductions from income received for the work of individual entrepreneurs, notaries, scientists and cultural figures (Article No. 221 of the Tax Code of the Russian Federation);

- deductions that are made when carrying forward losses from transactions with securities and financial instruments in forward transactions (Article No. 220.1 of the Tax Code of the Russian Federation).

After this, the resulting amount is multiplied by the personal income tax rate. The tax rate depends on whether the employee is a resident of the Russian Federation (has Russian citizenship or a residence permit), so for a resident the personal income tax is 13%, and for a non-resident it is already 30% (with the exception of highly qualified specialists working in the Russian Federation on a patent, and residents of the Eurasian economic union).

For example, an employee’s salary is 63,000 rubles per month, he has the right to a deduction for three children, which is 3,000 rubles: (63,000 - 3,000) * 13% = 7,800 rubles, respectively, the employee will receive 55,200 rubles (63,000 - 7,800) .

Methods and methods of calculation

Now you know how to calculate wage insurance contributions. In fact, all methods and techniques come down to correctly determining the tax base, as well as applying the current rate, which, as you know, can be reduced if the established limit is exceeded.

There are several important features that allow you to carry out calculations correctly:

- Insurance premiums are calculated monthly. Moreover, their payment must be made at the time the employee’s wages are calculated, and not on the day of actual payment.

- Funds are transferred in several payments depending on the type of insurance premiums.

- First, the specialist must calculate the amount of insurance contributions for each individual employee. Then all the data must be added up to find out the amount of total payments for the organization.

- Another feature is that each employee is required to enter information about insurance premiums on a separate card, the form of which is established by law. However, it may be subject to change. This is why a specialist must keep track of current information.

In some cases, insurance premiums are calculated at reduced rates. This applies to companies that create innovations, operate in the field of small business or engage in charity. In this case, it is necessary to provide the tax authorities with relevant documents that confirm the right to apply reduced tariffs.

Peculiarities

The Russian Federation has a regressive taxation system, which, in turn, leaves some imprint on the specifics of paying insurance premiums. When calculating them, you need to take into account the established limits applied to the taxable base. If you neglect this information, then you will not be able to find out how to calculate the amount of insurance premiums accurately. Otherwise, you will have to face administrative measures from the tax inspectorate.

Postings for fixed payments of individual entrepreneurs

Individual entrepreneurs have the right not to keep accounting records. Accordingly, such an operation as the calculation of fixed payments does not require the individual entrepreneur to prepare transactions. If an entrepreneur nevertheless makes entries for his own accounting of income and expenses, the easiest way is to use the general rules. That is, when calculating fixed payments, the individual posting generates the following:

- Dt 20, 26, 44 - Kt 69.02.7 - fixed contributions to the Pension Fund;

- Dt 20, 26, 44 - Kt 69.03.1 - fixed contributions to the FFOMS.

Entrepreneurs are not required to transfer payments to other extra-budgetary funds.

Changes in 2021

The current economic model cannot adapt to the current state of the market and the situation in general, so some changes are required to promote growth factors. It is precisely to achieve this growth that the system of collecting the single social tax will be reviewed and partially changed starting this year.

This innovation in a group with other measures will help prevent such a phenomenon as stagnation in the economy. Representatives of the Ministry of Economic Development claim that if measures are not taken now and the system of collecting unified social tax is not reviewed, then a new crisis cannot be avoided.

Of course, tax rates will be changed in the current 2021 and the Unified Social Tax is no exception. It is impossible to say unequivocally what consequences such a decision will lead to; we can only wait to see in which direction the functioning of the economic system will change in a year. The updated rates are already presented on the Federal Tax Service website and are freely available.

The Russian authorities remind that changes in the tax rate will only come into force after the elections, so there is no point in prematurely hoping for a significant reduction in the current levels of insurance payments.

It is worth noting that such losses will be compensated by increasing VAT, and this in turn affects the prices of goods and services.

Object of taxation

The Tax Code of the Russian Federation specifies several objects of taxation under the Unified Social Tax, which every taxpayer needs to know in order to pay them. More precisely, these payments are provided for in a legally certified employment agreement concluded between the applicant and the employer and an agreement on additional remuneration that is attributed to individuals. persons.

In paragraph number 3 of Article 236 of the Tax Code of the Russian Federation, it is clearly stated that the objects of payment will not be recognized or related to actual payments that in no way reduce the size of the tax base. Precisely, in this regard, there is no refund on them, and there is no need to pay them.

FSS

Let's start our discussions with this fund. This is where funds intended to pay for sick leave, maternity and other benefits come. A legal entity whose employee receives social benefits will be able to receive reimbursement of the funds spent by contacting the Social Insurance Fund. However, this requires correctly calculating the amount of insurance premiums for individual entrepreneurs or legal entities. Currently, the amount of deductions is set at 2.9% of the employee’s salary.

In addition, every company must insure employees against accidents that may occur at the enterprise. The contribution amount does not have a fixed rate and ranges from 0.2 to 8.5%. It depends on the production risk class. There is no limit above which the accrual of contributions is suspended.