Accounting

Svetlana Melnik

Expert – HR and accounting

Current as of May 25, 2019

The amounts of vacation payments must be reflected in the corresponding correspondence of the accounting accounts. Their competent preparation affects the process of collecting costs, which are then used to determine the taxable base for income tax.

The procedure for paying vacation pay

Pay for your vacation no later than three days before it starts.

At the same time, the Labor Code does not prohibit paying vacation pay earlier (Part 9 of Article 136 of the Labor Code of the Russian Federation). Situation: on which days should the three-day period for payment of vacation pay be counted - calendar or working days?

Calculate the deadline for payment of vacation pay based on calendar days.

After all, if the Labor Code does not directly indicate which days to count for a particular period, it is necessary to proceed from the calendar.

This procedure also applies to the deadline for the payment of vacation pay, since Article 136 of the Labor Code of the Russian Federation does not directly indicate which days to take into account. Therefore, count both working and non-working days - holidays, weekends. That is, all calendar days. Moreover, if the end of the term falls on a non-working day, then make the payment the day before - on the last working day.

This procedure is provided for in Article 14 of the Labor Code of the Russian Federation, similar conclusions are expressed in the letter of Rostrud dated July 30, 2014 No. 1693-6-1.

Situation: is it possible, at the request of an employee, to pay him vacation pay after he returns from vacation?

Answer: no, you can't.

Labor legislation does not allow this. The organization is obliged to pay vacation pay to the employee no later than three days before the start of the vacation (Part 9 of Article 136 of the Labor Code of the Russian Federation). And the Labor Code of the Russian Federation does not contain any exceptions to this provision related to the desire of the employee.

Second cost accounting option (controversial)

With the accrual method, the procedure for determining expenses is established by Article 272 of the Tax Code. According to it, expenses accepted for tax purposes are recognized as such in the reporting period to which they relate, regardless of the time of actual payment of funds and (or) other form of payment. In this case, labor costs (clause 4 of Article 272 of the Tax Code of the Russian Federation) are taken into account as an expense on a monthly basis based on the amount of labor costs accrued in accordance with Article 255 of the Tax Code. In other words, since vacation pay is accrued, as required by the Labor Code, it means that they can be recognized as expenses for profit tax purposes. That is, an organization that uses the accrual method when calculating income tax can recognize as an expense the amount of vacation payments in the accrual period in full.

There are many court decisions in defense of taxpayers: decisions of the FAS Moscow District dated June 24, 2009 in case No. A40-48457/08-129-168, FAS Ural District dated December 8, 2008 No. A07-6787/08, FAS West Siberian District dated December 1, 2008 in case No. A46-6675/2007, dated December 3, 2007 in case No. A75-4424/2007, etc.

It should be noted: the judges made decisions in favor of taxpayers even despite the submitted tax letters from the Ministry of Finance, noting that Article 272 of the Tax Code does not directly oblige the distribution of expenses in the form of vacation payments by period. Of course, we cannot remain silent about the fact that some courts agree with the Federal Tax Service; an example of this is the resolution of the Federal Antimonopoly Service of the North-Western District dated November 16, 2007 in case No. A56-39310/2006.

Responsibility for late payment of vacation pay

Attention: failure to comply with the payment deadline for vacation pay may be regarded as a violation of labor law requirements. For this violation, the labor inspectorate may fine the organization or its officials.

The responsibility is as follows:

- for officials of the organization (for example, a manager) - a warning or a fine from 1000 to 5000 rubles;

- for entrepreneurs – a fine from 1000 to 5000 rubles;

- for an organization – a fine from 30,000 to 50,000 rubles.

Repeated violation entails:

- for officials of the organization (for example, a manager) - a fine of 10,000 to 20,000 rubles. or disqualification for a period of one to three years);

- for entrepreneurs – a fine from 10,000 to 20,000 rubles;

- for an organization – a fine from 50,000 to 70,000 rubles.

Such liability measures are established in parts 1 and 4 of Article 5.27 of the Code of the Russian Federation on Administrative Offenses.

An employee who has not been paid vacation pay in a timely manner may request that annual leave be postponed to another time (Part 2 of Article 124 of the Labor Code of the Russian Federation, Clause 2 of the ruling of the Constitutional Court of the Russian Federation dated June 23, 2005 No. 230-O).

If vacation pay has been calculated and paid, but the employee cannot go on vacation due to an emergency situation at work, issue a recall from vacation (Part 2 of Article 125 of the Labor Code of the Russian Federation).

Reserve for vacation pay

Since 2011, organizations have been required to create a reserve for vacation pay in accounting, since upcoming expenses for vacation pay are recognized as an estimated liability (clause 8 of PBU 8/2010, letter of the Ministry of Finance of Russia dated June 14, 2011 No. 07-02-06/107). Accordingly, all vacation pay (including for transferable vacation) is written off in accounting at the expense of the created reserve. An exception is provided only for small businesses, provided that they are not issuers of publicly offered securities (clause 3 of PBU 8/2010). Such enterprises have the right not to create a reserve for vacation pay and assign vacation pay directly to current cost accounts.

Tax accounting

When should vacation expenses be recognized for income tax purposes if vacation pay is paid in one period and the vacation ends in another? Let's turn to the Tax Code.

The enterprise includes the costs of paying vacation pay as part of labor costs, which reduce the taxable profit of the organization (clause 7 of Article 255 of the Tax Code of the Russian Federation). Labor costs are included in the costs associated with production and (or) sales (clause 2 of Article 253 of the Tax Code of the Russian Federation).

Costs incurred are reflected depending on the cost recognition method chosen in the accounting policy for tax purposes in accordance with Articles 272 and 273 of the Tax Code.

When using the cash method, everything is simple. Expenses are recognized in the period when they are actually incurred, that is, on the day vacation pay is paid.

But with the accrual method everything is more complicated; there are two options for recognizing expenses.

Accounting: no reserve is created

If a reserve is not created in accounting, then reflect the accrual and payment of vacation pay as follows:

Debit 20 (23, 25, 26, 29, 44...) Credit 70

- vacation pay accrued.

Debit 70 Credit 50 (51)

- vacation pay was paid.

This procedure follows from the Instructions for the chart of accounts (account 70).

Make similar entries if the vacation is rolling (that is, it begins in one month and ends in another). In this case, the accountant will not have to distribute vacation pay by month.

This is explained as follows.

Since 2011, expenses incurred by the organization in the reporting period, but relating to subsequent reporting periods, may not be reflected in the balance sheet as deferred expenses (in a separate line). They are shown in the balance sheet in accordance with the conditions for asset recognition established by accounting regulations. And they are subject to write-off in the manner established for writing off the value of assets of this type.

Such rules are established by paragraph 65 of the Accounting Regulations, approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n.

In this regard, account 97 “Deferred expenses” is not used in all cases in which it was used previously. This account can be used provided that the corresponding amounts are expressly named as deferred expenses in the current accounting regulations. Or amounts are accounted for in account 97 if they meet the following criteria:

- the organization incurred expenses, while the counterparty did not have counter-obligations to it (otherwise a receivable is recognized, not an expense);

- these expenses do not form the value of tangible or intangible assets;

- expenses determine the receipt of income over several reporting periods.

Vacation pay accrued in the current month for the next month are not considered deferred expenses, since such expenses do not lead to the receipt of income in several reporting periods (clause 19 of PBU 10/99) and affect the financial result of the period in which they were incurred . Consequently, in accounting, vacation pay does not need to be distributed between the months in which the vacation fell, that is, they should be taken into account at a time upon accrual.

An example of how vacation pay is reflected in accounting. Vacation starts in one month and ends in another. The organization is a small business entity and does not create a reserve for vacation pay.

In June 2015, the manager of Torgovaya LLC A.S. Kondratiev was given basic paid leave. Duration of vacation - 28 calendar days: from June 16 to July 13, 2015. Vacation pay was paid to the employee on June 11, 2015.

For the billing period - from June 1, 2014 to May 31, 2015 - Kondratiev received a salary in the amount of 360,000 rubles. The billing period has been fully worked out.

Kondratiev’s average daily earnings were: 360,000 rubles. : 12 months : 29.3 days/month = 1024 rub./day.

The accountant accrued vacation pay in the amount of: 1024 rubles/day. × 28 days = 28,672 rub.

including:

- for June: 1024 rub./day. × 15 days = 15,360 rub.;

- for July: 1024 rub./day. × 13 days = 13,312 rub.

The accountant of the organization reflected the accrual of vacation pay in the accounting records with the following entries.

In June 2015:

Debit 44 Credit 70 – 28,672 rub. – vacation pay was accrued to Kondratiev for June and July.

Accounting: reserve is created

If an organization creates a reserve for vacation pay, then do not include the amounts of accrued vacation pay in the expenses of the current month. Reflect the accrual of vacation pay and contributions for compulsory insurance in accounting using the following entries:

Debit 96 subaccount “Reserve for vacation pay” Credit 70

– vacation pay is accrued from the reserve;

Debit 96 subaccount “Reserve for vacation pay” Credit 69 subaccount “Settlements with the Pension Fund for the insurance part of the labor pension”

– pension contributions were accrued from the reserve to finance the insurance part of the labor pension from vacation pay;

Debit 96 subaccount “Reserve for vacation pay” Credit 69 subaccount “Settlements with the Social Insurance Fund for social insurance contributions”

– social insurance contributions from vacation pay are accrued from the reserve;

Debit 96 subaccount “Reserve for vacation pay” Credit 69 subaccount “Settlements with the Federal Compulsory Medical Insurance Fund”

– contributions for health insurance to the Federal Compulsory Medical Insurance Fund of Russia from vacation pay were accrued from the reserve;

Debit 96 subaccount “Reserve for vacation pay” Credit 69 subaccount “Settlements with the Social Insurance Fund for contributions to insurance against accidents and occupational diseases”

– contributions for insurance against accidents and occupational diseases from vacation pay are accrued from the reserve.

Reflect the payment of vacation pay by posting:

Debit 70 Credit 50 (51)

- vacation pay was paid.

This procedure follows from the Instructions for the chart of accounts (accounts 70 and 96).

Vacation pay for rolling vacation

Situation: how to reflect in accounting the accrual of vacation pay from the reserve for rolling vacation (starts in one month and ends in another)?

The full amount of accrued vacation pay must be written off against the amounts of the previously created reserve. The fact that the leave is transferable from one month to another does not matter.

The reserve for vacation pay is an estimated liability (clause 5 of PBU 8/2010). It is reflected in accounting as of the reporting date. Its value represents the “virtual” debt of the organization if it had to simultaneously accrue and pay vacation pay to all employees. This debt includes both the vacation pay itself and the amount of taxes and contributions that must be paid to the budget from it.

This procedure for creating an estimated liability is provided for in paragraph 15 of PBU 8/2010.

At the time of payment of vacation pay to the employee, part of the estimated liability will be repaid. According to the rules of labor legislation, vacation pay is paid to the employee no later than three days before the start of the vacation (Article 136 of the Labor Code of the Russian Federation). Consequently, regardless of whether the vacation is transferable from month to month or not, the estimated liability is repaid in full when vacation pay is paid. This means that when accruing vacation pay to a specific employee, the previously created reserve must be reduced by their full amount. There is no need to break the vacation into parts in order to write off the obligation in parts corresponding to the number of vacation days in each month.

This follows from the provisions of paragraphs 5 and 21 of PBU 8/2010. An exception is the situation when the amount of the reserve turned out to be insufficient to write off accrued vacation pay at its expense.

An example of how accrual of vacation pay is reflected in accounting using the created reserve for vacation pay. Vacation starts in one month and ends in another

In June 2015, the manager of Torgovaya LLC A.S. Kondratiev was given basic paid leave. Duration of vacation - 28 calendar days - from June 16 to July 13, 2015. Vacation pay was paid to the employee on June 11, 2015.

For the billing period - from June 1, 2014 to May 31, 2015 - Kondratiev received a salary in the amount of 360,000 rubles. The billing period has been fully worked out.

Kondratiev’s average daily earnings were: 360,000 rubles. : 12 months : 29.3 days/month = 1024 rub./day.

The total amount of vacation pay is: 1024 rubles/day. × 28 days = 28,672 rub.

Including:

- for June: 1024 rub./day. × 15 days = 15,360 rub.;

- for July: 1024 rub./day. × 13 days = 13,312 rub.

The accountant of the organization reflected the accrual of vacation pay in the accounting records with the following entries.

In June:

Debit 96 subaccount “Reserve for vacation pay” Credit 70 – 28,672 rubles. – vacation pay was accrued to Kondratiev for June–July.

Payment of personal income tax to the budget

Payment of personal income tax to the budget is carried out no later than the last day of the month in which vacation pay was paid (paragraph 2, paragraph 6, article 226 of the Tax Code of the Russian Federation).

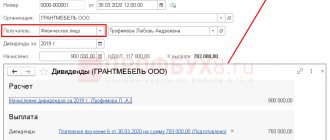

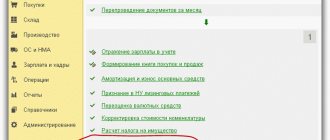

Payment of personal income tax to the budget is reflected in the document Write-off from the current account transaction type Tax payment in the Bank and cash desk section - Bank - Bank statements - Write-off button.

Please pay attention to filling out the fields:

- Transaction type - Tax payment .

- Tax - personal income tax when performing the duties of a tax agent .

- Type of liability - Tax .

- for - June 2018 , the month of income accrual (vacation).

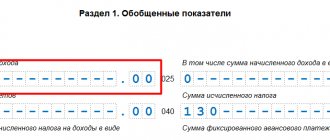

Postings according to the document

The document generates the posting:

- Dt 68.01 Kt - payment of personal income tax to the budget for June.