Base What is subject to tax. This can be either the number of extracted minerals or their value. The tax base varies depending on the type of mineral, determined by the taxpayer independently. Benefits Not provided As such, tax benefits for this payment are not provided by the Tax Code. But the legislation defines a list of minerals, the extraction of which is taxed at a zero rate. Transfer procedure Tax reports must be provided by the taxpayer on a monthly basis. Period The period of time for which the tax is calculated. The tax period is determined to be one month. What is taxed, what subsoil? Extracted minerals are taxed.

Mining tax in 2021 - deadlines for submitting the report and paying the tax

Attention: We are talking only about objects obtained:

- from the bowels of the Russian Federation;

- from mining waste;

- from the subsoil of areas leased by the Russian Federation abroad.

Those minerals that are not on the balance sheet of the state, collection, paleontological and other resources according to the Tax Code of the Russian Federation are not subject to taxation. Mineral resources mean the products of quarries and mining enterprises, which are contained in raw materials obtained from the subsoil.

The object of this payment is only those minerals that have been extracted. These are hard and brown coal, anthracite, shale, peat, oil, gas, etc.

Object of taxation of mineral extraction tax

The following minerals are recognized as the object of taxation:

- extracted from the subsoil on the territory of the Russian Federation on a subsoil plot provided by law (including from hydrocarbon deposits);

- extracted from waste (losses) of mining production, subject to separate licensing;

- extracted from the subsoil outside the Russian Federation in territories leased or used under international treaties, as well as under the jurisdiction of the Russian Federation.

The following are not subject to taxation:

- common minerals, incl. groundwater extracted by an individual entrepreneur and used directly by him for personal consumption;

- mined (collected) mineralogical, paleontological and other geological collection materials;

- extracted from the subsoil during the formation, use, reconstruction and repair of specially protected geological objects that have scientific, cultural, aesthetic, sanitary or other public significance;

- minerals extracted from the mine's own dumps or waste (losses) and related processing industries;

- drainage groundwater;

- Coal bed methane.

Mineral extraction tax in 2018

Tax Code of the Russian Federation);

- characterizing the characteristics of oil production and calculated using a formula that includes several coefficients, both calculated and taking a certain digital value depending on the year of application (Article 342.5 of the Tax Code of the Russian Federation).

The deduction provided for by the Tax Code of the Russian Federation, applied to the calculated tax amount, is also special for such a fossil as oil. It is used in production carried out in the Republic of Tatarstan and Bashkortostan, and is provided for oil that is desalted, dehydrated and stabilized.

The amount of the deduction depends on the volume of the initial reserves of the field and is determined by a formula that takes a specific form depending on the year in which it is applied (Article 343.2 of the Tax Code of the Russian Federation). An example of oil tax calculation can be found here.

Filling out the declaration: procedure, sample

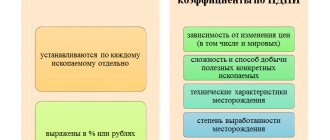

All rates are reflected within the framework of Art. 342 of the Tax Code of the Russian Federation. They are divided into two main types:

- those expressed as percentages;

- rates presented in ruble equivalent.

Many of these indicators require the use of coefficients that take into account the following factors:

- fluctuations in consumer prices;

- variability of PI extraction routes;

- features of the territory of the field being developed;

- instability of world prices;

- the level of complexity that the mining process has;

- the extent to which a deposit is considered popular.

Some coefficients apply only to certain minerals, while others are valid in combination. Parameters can have a fixed value or be subject to calculation. However, a specific indicator may vary depending on the year in which the indicator is applied. In a number of situations, taxpayers have the right to expect a reduction in rates:

- by 30% if all activities are carried out at their own expense;

- by 40% when it comes to mining near Magadan and throughout the region.

Payment of the fee is subject to the filing of a declaration. It is provided at the place where the organization is registered or located, as specified in paragraph 1 of Art. 345 Tax Code of the Russian Federation. There is a unified template for this document that allows you to avoid errors and blots during the filling process. The time frames differ from the limits on transfers of mineral extraction tax to the budget.

The payer of the fee undertakes to send reports to the Federal Tax Service before the end of the month following the reporting month. If it is a weekend, then you must act no later than the next working day.

If you ignore this legal requirement, you may receive a fine of 5% of the amount for each monthly period of delay. In this case, the amount of the penalty cannot be less than 30% of the corresponding monetary value. Along with this, a fine may be imposed on the manager. Its size is 300-500 rubles.

The Russian Ministry of Finance explained the procedure for calculating the dm indicator in the mineral extraction tax formula for oil

Important

Kts is determined monthly by the taxpayer independently. There is a formula for this: where C is the average price per month on the world market for Yurlas oil, which is expressed in US dollars per barrel, P is the average ratio of $ to the ruble.

The remaining coefficients are also determined by the taxpayer independently at the end of each tax period, in accordance with Art. 342.2 Tax Code of the Russian Federation. Gas Gas and its derivatives are subject to the mineral extraction tax on gas at a fixed rate, which is determined in rubles per 1 cubic meter.

m of produced gas. Each of these coefficients is calculated in accordance with Art. 342.4 Tax Code of the Russian Federation.

Payment deadline and tax period

The time period during which this fee must be paid is established at the federal level. It falls on the 25th of the month following the reporting month. If the date of payment of mineral extraction tax falls on a weekend, payment can be made no later than the next working day.

If the payer is late, he will be obligated to pay a penalty. The tax is transferred to the account of the Federal Tax Service, which is responsible for collection at the place where the subsoil is located, which is stated in clause 2 of Art. 343 Tax Code of the Russian Federation. However, the procedure by which the addressee of the declaration is determined is somewhat different, as are the deadlines for submitting reports.

Mndpi in 2021 online calculator

If a situation arises that expenses have been incurred but the tax amount has not been accrued, they can be offset in the month when the tax is accrued. If in the reporting month expenses exceeded the deduction limit, then the difference can be offset over the next three years.

For example, Quarry LLC produced 20 tons of brown coal and 30 tons of anthracite in January. The tax rate for brown coal is 11 rubles per ton, for anthracite - 45 rubles per ton.

Info

In January, the company spent 4,500 rubles on labor protection measures. The value of the coefficient for mineral extraction tax is fixed in the accounting policy of the enterprise at the level of 0.25.

The remaining deduction can be applied within three years after the reporting month.

Tax deduction for mineral extraction tax

Article 343.1 of the Tax Code of the Russian Federation regulates the right of a taxpayer to receive a tax deduction - you can, at your choice, reduce the amount of tax calculated for the tax period when mining coal at a subsoil site by the amount of economically justified and documented expenses of the taxpayer in the tax period and related to ensuring safe conditions and labor protection during coal mining in this subsoil area.

The following expenses are included in the tax deduction:

- material expenses of the taxpayer, determined in the manner prescribed by Chapter 25 “Income Tax” of the Tax Code of the Russian Federation;

- taxpayer's expenses for the acquisition and (creation) of depreciable property;

- expenses for completion, additional equipment, reconstruction, modernization, technical re-equipment of fixed assets.

The right to apply this tax deduction is directly related to the obligation of the mineral extraction tax payer - the employer to ensure safe working conditions and their protection.

The procedure for recognizing expenses for the purpose of applying this deduction must be reflected in the accounting policy for tax purposes.

Mineral extraction tax - 2018

MET: data for calculating tax for January 2021 has been published. Attention, the Tax Code of the Russian Federation, dedicated to MET, changes have been made, but only one group of them is directly related to the year in question. It concerns a tax deduction that is available to taxpayers of Crimea and Sevastopol producing gas in the Black Sea. Otherwise, the procedure for calculating tax corresponds to that used in 2021, but some coefficients should be used in other values. The rules for determining the deadlines for payment and reporting are also preserved, corresponding, respectively, to the 25th and last day of the month following the reporting month.

Procedure and deadlines for tax payment, reporting

At the end of the month, the amount of tax is calculated separately for each type of extracted minerals. The tax is payable to the budget at the location of each subsoil plot provided to the taxpayer for use.

The tax is paid no later than the 25th day of the month following the expired tax period.

Subsoil users pay regular payments quarterly no later than the last day of the month following the expired quarter, in equal shares in the amount of one-fourth of the payment amount calculated for the year (RF Law of February 21, 1992 N 2395-1).

The procedure and conditions for collecting regular payments for the use of subsoil from subsoil users are established by the Government of the Russian Federation, and the amounts of these payments are sent to the federal budget.

The mineral extraction tax declaration is submitted to the tax authority at the location of the Russian organization, the place of residence of the individual entrepreneur, the place of activity of the foreign organization through branches and representative offices established on the territory of the Russian Federation.

The obligation to submit a tax return arises starting from the tax period in which the actual extraction of mineral resources began. Submitted no later than the last day of the month following the expired tax period. The tax return for mineral extraction tax can be submitted both in paper and electronic form.

Please pay attention!

Taxpayers whose average number of employees for the previous calendar year exceeds 100 people, as well as newly created organizations whose number of employees exceeds the specified limit, submit tax returns and calculations only in electronic form. The same rule applies to the largest taxpayers.

More information about submitting electronic reporting

A complete list of federal electronic document management operators operating in a certain region can be found on the official website of the Office of the Federal Tax Service of Russia for the constituent entity of the Russian Federation.

Mineral extraction tax (MET) 2017-2018

- From the resulting value, subtract the amount of expenses:

83400 – 2600 = 80800 rubles – the net cost of the mineral. Mineral extraction tax: 80800*10% = 8080 rubles. Question No. 2. Is it necessary to pay mineral extraction tax when the minerals extracted by an enterprise are used for subsequent processing and are not sold externally? Yes, in this case the subsoil user has an obligation to accrue and pay the mineral extraction tax.

Since the resulting product is not sold, but is used for further processing, the tax base will be calculated based on its estimated value. Question No. 3. Is there an obligation to pay mineral extraction tax on products obtained from waste from our own processing production? When an enterprise has obtained a mineral as a result of processing some natural resource, the mineral extraction tax need not be transferred.

Types of minerals

- Coal and oil shale

- Peat

- Hydrocarbon raw materials (oil, gas condensate, combustible natural gas, coal bed methane)

- Commercial ores of ferrous and non-ferrous metals, rare metals forming their own deposits

- Useful components of complex ore

- Mining chemical non-metallic raw materials (apatite, phosphorite ores, salts, sulfur, spar, earth paints, etc.)

- Mining non-metallic raw materials

- Bituminous rocks

- Raw materials of rare metals (indium, cadmium, tellurium, thallium, gallium, etc.)

- Non-metallic raw materials used mainly in the construction industry (gypsum, anhydride, chalk, limestone, pebbles, gravel, sand, clay, facing stones)

- Standard product of piezo-optical raw materials (topaz, jade, jadeite, rhodonite, lapis lazuli, amethyst, turquoise, agates, jasper, etc.)

- Natural diamonds, other precious stones (diamonds, emerald, ruby, sapphire, alexandrite, amber)

- Concentrates and other intermediate products containing precious metals (gold, silver, platinum, palladium, iridium, rhodium, ruthenium, osmium) as well as alloyed gold that meets the national standard (technical conditions) and (or) the standard (technical conditions) of the taxpayer organization

- Natural salt and pure sodium chloride

- Groundwater containing minerals and medicinal resources, as well as thermal waters

- Raw materials of radioactive metals (in particular, uranium and thorium).

What is mineral extraction tax (MET)

It is defined in monetary terms per 1 ton of product. An adjustment factor is applied to it, reflecting the dynamics of oil prices in the world. This indicator is calculated by the taxpayer independently, taking into account the average cost of a barrel of Yurlas oil and the average dollar-to-ruble ratio. When determining the value of the mineral extraction tax in relation to oil production, the following coefficients are also applied:

- designations;

- degree of development of the site;

- the amount of reserves of the site;

- degree of difficulty of production;

- degree of depletion of carbon raw materials.

These indicators are calculated by the subsoil user independently in accordance with the requirements of legislation in the field of taxation of natural resource extraction. Gas tax rate The gas tax rate is also determined in value terms per 1 cubic meter of fossil fuel.

Subsequently, it can only be changed if significant adjustments occur in the technical design or production process technology. The cost of extracted resources can be calculated in one of three options: Cost determination method Contents At sales prices in the reporting period, not including subsidies The method is applicable when there are government subsidies to the sales price At sales prices in the reporting period Applicable in the absence of government subsidies At estimated prices of the extracted product Used when there is no sale Subsoil tax deduction The mineral extraction tax deduction is the possibility of reducing the payment for expenses incurred during the reporting period when calculating the tax base.

Such costs are divided into direct and indirect.

Calculus models and examples

Based on the methods of determining the tax base and the types of rates applied, there are four models by which the amount of tax is determined.

- Model No. 1. This model is used for most minerals. The base for calculating the tax here is defined as the cost of extracted PI, and the rates are taken from the Tax Code of the Russian Federation.

- Model No. 2. Here we consider the case in which the mineral extraction tax is imposed on gas. In this case, the physical volume of extracted raw materials and the special rates specified in the previous part of the article are taken into account.

- Model No. 3. Used to calculate the amount of taxes for the extraction of precious metals. The tax base is determined as the cost of sales of either chemically pure raw materials or nuggets mined at the deposit.

- Model No. 4. This model concerns the mineral extraction tax on oil and its production. The basis for determining the tax is determined in tons. In this case, the bet is adjusted by certain coefficients.

The basic formula for calculating the size of the mineral extraction tax is:

MET = NB*NS, where

NB is the tax base, and NS is the tax rate.

For an example of calculating the mineral extraction tax, let’s take a conditional company engaged in the extraction of such a mineral as silver.

During the reporting period, 10 thousand tons of silver ore were mined. The price for one ton on the market was 650 rubles. Including VAT - 118 rubles (in what cases can VAT be refunded?).

It turns out that the size of the tax base will be equal to: 10,000*(650 – 118) = 5,320,000 rubles. The tax rate for the extraction of silver ore is 6.5%. The tax amount will be: 5,320,000 * 6.5% = 345,800 rubles.

How to calculate the mineral extraction tax? This is discussed in the video.

Our website talks not only about the taxation of mining activities, but also about water, agricultural, land taxes, as well as taxes on the gambling business, on the payroll, and on the property of organizations. In addition, from our articles you will learn about such taxation systems as general and simplified.

Mndpi in 2021 online calculator

Such activity is recognized as an object of taxation if it is subject to compulsory licensing.

- Extracted outside of Russia from areas recognized as subsoil in accordance with international treaties. These plots must be leased or owned by the taxpayer on other grounds.

- To mineral resources for taxation under this tax, according to Art.

337The Tax Code of the Russian Federation applies only to those minerals that can be mined. It can be:

- oil shale;

- hydrocarbon raw materials;

- peat;

- other listed in this article.

The following are not subject to tax:

- common minerals that are not listed on the state balance sheet;

- paleontological and other collectible minerals;

- other minerals that are listed in paragraph

2 of Art.

Mineral extraction tax is a federal-level tax. The Tax Code of the Russian Federation has established that the tax base for the subsoil use tax is the quantitative ratio of minerals. These include oil, natural and associated gas, coal and gas condensate, and other minerals are determined only by the cost of the resource.

Taxpayers

- Organizations and individual entrepreneurs registered and recognized as subsoil users.

- Organizations whose information is entered into the Unified State Register of Legal Entities on the basis of Article 19 of the Federal Law of November 30, 1994 N 52-FZ, recognized as users of subsoil in accordance with the legislation of the Russian Federation, as well as on the basis of licenses and other permits valid in the manner established by article 12 of the Federal Constitutional Law of March 21, 2014 N 6-FKZ “On the admission of the Republic of Crimea to the Russian Federation and the formation of new entities within the Russian Federation - the Republic of Crimea and the federal city of Sevastopol.”

As a general rule, taxpayers must register as a mineral extraction tax payer at the location of the subsoil plot they are using within 30 calendar days from the date of state registration of the license to use the subsoil plot.

A special registration procedure has been established for subsoil users in Crimea and Sevastopol.

Registration is carried out at the location of the organization or at the place of residence of the individual (if the taxpayer is an individual entrepreneur).

The Ministry of Finance of the Russian Federation also additionally determines the specifics of registering as taxpayers of mineral extraction tax - see Order Order of the Ministry of Taxes of the Russian Federation dated December 31, 2003 N BG-3-09/731.

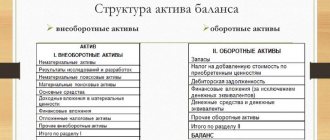

Determination of the tax base

The procedure for calculating the amount of duty on extracted minerals begins with the calculation of the tax base (TB). The latter, in turn, is determined by the quantity and cost of extracted resources.

The tax base, or the number of minerals, is measured only in physical terms, and is calculated by two methods - direct and indirect. After choosing a method for determining the amount of extracted raw materials, it is fixed in the accounting policy. Taking into account these data, a declaration is filled out. Each option is used under individual circumstances.

Direct calculation formula

Losses count like this

The second component of NB is cost. To calculate the cost of extracted raw materials, the payer uses three methods:

- Based on the resulting estimated cost of the resource, excluding subsidiary investments.

- Taking into account the value relevant during the current tax period.

- Using the established estimated price of the extracted resource.

Method 1:

or

Method 2:

Method 3:

What is subject to mineral extraction tax?

There is a special list of objects that are subject to mineral extraction tax. These include:

- PI obtained from subsoil resources located in the Russian Federation, and it is important that this location is transferred by the state to the company in accordance with the license and production permit it has received;

- obtained from waste from various industrial production facilities engaged in mining activities, however, even such extraction must be permitted by a license;

- taken from the subsoil located beyond the border of Russia, but it is important that these territories are under the jurisdiction of the country or are leased from other states.

Important! There are certain objects that cannot be recognized as an object for accrual of mineral extraction tax.

The following objects cannot be classified as objects of mineral extraction tax accrual:

- common PIs or groundwater not on the balance sheet of the state;

- obtained by individual entrepreneurs, as well as used for personal use, and not in the process of entrepreneurial work;

- extracted collection materials, and they can be geological, mineralogical or paleontological;

- discovered during the creation, use, repair or reconstruction of various geological objects;

- PI obtained from waste or dumps of various industries associated with mining or processing activities, but the important point is that in the process of extracting these minerals they must be taxed in the general manner;

- groundwater that is not taken into account on the state balance sheet, but is discovered during the development of various deposits or during the construction of underground facilities;

- methane of coal seams.

Thus, every entrepreneur who plans to engage in work related in any way to mineral extraction should carefully understand which PIs are taxable and which are not.

Determination of the tax base, tax rate and size

Every company that is required to pay the mineral extraction tax must know how to determine the main indicators related to this tax.

The tax base must be determined independently by each taxpayer. For this, the main criteria are taken into account:

- the base is determined depending on the cost of the mined PI;

- For each individual type of mineral, its own tax base is determined, so these indicators differ significantly in different companies.

Important! When calculating the cost of the tax, not only direct costs used for mining, but also indirect ones are taken into account.

Each taxpayer is required to independently determine all expenses, which makes it possible to determine the amount of mineral extraction tax. He must also calculate the number of PIs mined and their volume. For this purpose, special measurements are carried out, and a direct or indirect method can be used for this.

The unit of measurement is mass or volume. If oil is produced, then the net is used to determine the amount of this material.

Important! In the process of calculating the mineral extraction tax, only minerals for which the entire technological process was carried out are taken into account, and the cost set by the deposit developer is also taken into account.

The mineral extraction tax rate depends entirely on the type of investment, since they can be ad valorem or specific. The rate is often set at 0%, and it is applied in the following cases:

- PI production is classified as standard losses;

- obtaining associated gas;

- extraction of groundwater that occurred during the extraction of other resources or the construction of underground facilities;

- obtaining substandard minerals;

- extraction of PIs that are found in overburden rocks;

- the use of mineral waters for the treatment of people;

- use of water for agriculture;

- obtaining super-viscous oil;

- injection of flammable gas designed to maintain optimal pressure in the formations during the process of condensate extraction.

The tax rate in other cases will be different, and it depends on what exactly the company produces:

- 3.8% – production of potassium salts;

- 4% – extraction of peat, oil shale and some types of ore;

- 4.8% – production of ferrous metal ore;

- 5.5% – production of radioactive metals, salt, non-metallic materials, etc.;

- 6% – mining of gold-bearing or bituminous rocks;

- 6.5% – production of precious metals;

- 7.5% – mining of mineral water or medicinal mud;

- 8% – production of ore of rare or non-ferrous metals;

- if oil is produced, then the rate in rubles per ton is taken into account, equal to 919 rubles in 2021.

Thus, in the process of PI extraction, it is necessary to pay quite significant taxes, since such an activity is in any case considered profitable.

What is the tax rate and tax period for OSNO - find out in this article.

Mineral extraction tax calculation with examples

At the moment, it is impossible to calculate the mineral extraction tax and fill out a mineral extraction tax declaration in the 1C program for all types of natural resources. But with the release of a new version, the program will support the corresponding codes. The direct amount of subsoil use tax is calculated using an accounting calculator using the formula:

The above formula applies to all natural resources that taxpayers extract, but some minerals have a number of features when calculated.

Oil

The Federal Tax Service has established that the tax on mineral resources for March 2021 must be calculated taking into account the following information:

- the average monthly price of Urals oil on the oil market, which is $63.58 per barrel;

- The average exchange rate of the dollar currency against the ruble equivalent, which was established by the Central Bank of the Russian Federation, is 57.0344 rubles / 1 dollar. CC = 10.6158. The formula used here is:

- CC is an element that shows price jumps in the world for a product, determined by the formula: Average oil prices are published every 15th of the month in Rossiyskaya Gazeta.

- DM is a standard that reflects the characteristics of product extraction, defined as follows:

- EF is a component that reflects the level of production of subsoil used in production;

- KZ - an element showing reserves in this area;

- CD - the indicator reflects the complexity of resource extraction in this well;

- KDV - indicates the level of oil product production in this well;

- KKAN - indicates the immediate area of oil product production.

The mineral extraction tax coefficient is currently 559, while in 2015 it was 530.

An example of calculating the tax on black gold with real data for February 2021:

- the tax base is calculated in tons;

- tax tariff - 919 rubles/1 ton;

- CC = 8.5698;

- KNDPI = 559;

- CV = 0.3;

- KZ = 1;

- CCAN = 1;

- CD = 1;

- KDV = 1;

- CC = 306.

Conventionally, the organization received 10,000 tons of oil in February 2021. Using the formulas, we get:

10,000 * (919 * 8.5698 - 559 * 8.5698 * (1 - 0.3 * 1 * 1 * 1 * 1) - 306) = 42,162,835 rubles.

This amount is the mineral extraction tax on oil production in a conditional example.

Coal

When calculating the mineral extraction tax, the organization takes into account the use of tax deductions, that is, whether the enterprise spends funds on employee safety and labor protection. The company makes these contributions in two ways: including it in the amount of other expenses or deducting it from the mineral extraction tax. When choosing one option or another, the organization consolidates it in the accounting policy of the enterprise and regularly uses the chosen method.

Without a tax deduction, the organization calculates the mineral extraction tax on coal according to the general rules:

- Determine the total amount of waste on safety and labor protection.

- The tax is calculated using the formula:

- Calculate the maximum amount of tax withheld:

- Compare the amount of actual costs for occupational safety and health. Sometimes expenses exceed the tax limit. In this case, it is included in the total amount of monthly deductions (up to 36 months).

Gas

Calculation formula:

When multiplying EUT, KS and TG, the result is a figure less than zero, then the rate will be zero. When calculating the EUT indicator, the monthly price tag and the coefficient reflecting the share of the extracted resource are taken into account.

Gas condensate

The mineral extraction tax for this condensate is calculated in the following way:

EUT and other data are calculated in the same way as gas indicators. The correction factor is calculated:

where KGP is an indicator that reflects income from gas exports.

MET. Why are these 4 letters so important for Russian oil workers?

The oil production industry for the Russian Federation is one of the most significant and largest in the country. The lion's share of tax revenues comes from oil and gas production. For the purposes of taxation of the oil industry, a number of special mechanisms have been created, one of which is the mineral extraction tax. In this material we will try to understand what this instrument is, how it affects the performance of oil and gas companies and what its prospects are.

What is mineral extraction tax

The mineral extraction tax (MET) is the main tax instrument for the extractive industries of the Russian Federation. For the oil and gas business, it is one of the largest expense items. In the case of oil, the mineral extraction tax is levied on each ton of hydrocarbons produced and represents a certain payment for the use of subsoil. Funds received from oil producing companies are sent to the federal budget. Thus, there is a kind of redistribution of funds for the use of subsoil in favor of citizens of the country and the state as a whole.

How is the mineral extraction tax calculated?

In general, the formula for calculating it looks like this:

Mineral extraction tax per ton of oil produced = Price coefficient (Kts) * Standard mineral extraction tax rate - Production specificity coefficient (Dm)

The price coefficient (Pc) is calculated monthly by the Federal Tax Service based on the price of Urals oil and the US dollar exchange rate. Its formula looks like this:

Price coefficient (Kts) = (Price of a barrel of Urals in dollars - 15) * US dollar rate / 261

As of March 2021, the price coefficient was 12.72, that is, for each ton of oil produced, 11,690 rubles had to be paid. excluding adjustments.

The standard mineral extraction tax rate from January 1, 2021 is set at 919 rubles. per ton of oil produced. In 2021 it was at the level of 857 rubles.

The mining specificity coefficient (Dm) is the most complex element, consisting of a large number of components. Its essence is to take into account various coefficients characterizing the degree of depletion of specific areas and deposits, as well as the amount of reserves of specific subsoil areas, the degree of complexity of production, the geography of the region and the properties of oil. It looks like this:

Dm = Kndpi x Kts x (1 - Kv x Kz x Kd x Kdv x Kkan) - Kk - Kabdt - Kman x Svn

Kndpi - from 2021 set at 559 rubles; Kc - previously noted price coefficient; Kv - coefficient characterizing the degree of depletion of reserves; Кз - coefficient characterizing the amount of reserves of a particular subsoil area; Kkan is a coefficient characterizing the production region and the properties of oil; Kd is a coefficient characterizing the complexity of production; Kdv is a coefficient characterizing the degree of depletion of a specific hydrocarbon deposit; Kk - from January 1, 2021, set at 428 rubles; Kabdt is a coefficient characterizing premiums for motor gasoline and diesel fuel; Kman is a coefficient that takes into account the influence of the export duty; Svn is a coefficient characterizing the production of super-viscous oil.

Understanding this part of the formula is quite difficult and time-consuming, and you also need to know the specifics of production at a particular field. But if anyone wants to delve deeper, here is the link, everything is described in detail here.

For a quicker assessment, you can take into account in the structure of the production characteristics coefficient (Dm) only the Kk indicator, fixed at the level of 428 rubles. for 2021. This coefficient has a noticeable impact on the final result and is included in the final formula with a plus sign, thereby increasing the tax. The remaining coefficients for making a shallow conservative assessment can be neglected since they mainly reduce the final indicator.

The modified formula looks like this:

Mineral extraction tax per ton of oil produced = Price coefficient (Kc) * Standard mineral extraction tax rate (919 rubles) + Fixed indicator (Kk)

At the end of 2021, the average mineral extraction tax for oil production was RUB 12,468. per ton of produced hydrocarbons without taking into account the coefficient of production features.

Taken together, the most important factor in calculating the indicator is the price coefficient. Taking into account the fact that the base mineral extraction tax rate is set by regulation and it is extremely difficult to predict its change, the main factors for changes in the mineral extraction tax can be considered the price of Urals oil and the US dollar exchange rate.

Thus, an increase in the market price of Urals by $1 per barrel of oil at a price above $15 per barrel (without taking into account the specifics of production) leads to an increase in the mineral extraction tax rate by $3.52 per ton.

Why is the mineral extraction tax important for oil and gas companies?

The mineral extraction tax can be called the most significant tax for oil companies. If the standard income tax is 20% of profit before tax, then mineral extraction tax payments accounted for about 27.4% of Rosneft’s revenue or 347.9% of net profit for the entire 2018. For Tatneft, the share of mineral extraction tax in revenue at the end of 2021 amounted to 31% of revenue or 134.3% of net profit. On such a scale, even a slight increase in the coefficients when calculating the mineral extraction tax can significantly affect the results of oil companies.

The important point is the way the tax is collected. The tax base is considered to be a ton of extracted oil without taking into account the costs of its production. This means that as easily accessible and high-margin fields are developed, the impact of the mineral extraction tax on the results of oil producing companies will increase, which may ultimately lead to a slowdown in production volumes.

The mineral extraction tax is also one of the means of redistributing funds from mining companies. For example, in 2021, against the background of Gazprom’s exemption from paying dividends in the amount of 50% of net profit, the coefficient for calculating the mineral extraction tax for the company was raised from 1.4022 to 2.055. Thus, the budget leveled the funds lost from insufficient dividends.

What will happen to the mineral extraction tax?

On January 1, 2021, the so-called “tax maneuver” came into force. The tax maneuver consists of a gradual increase in the mineral extraction tax while simultaneously reducing the export duty (another significant fee from oil workers). As stated, the meaning of this law is to reduce the dependence of the Russian budget on oil prices.

This will happen through the consistent introduction of correction factors: from 0.167 in 2021 to 1 in 2024 for the mineral extraction tax and from 0.833 in 2021 to 0 in 2024 for the export duty.

Rate

Mineral extraction tax rates are set differentially depending on the type of resource, that is, each element has its own percentage. The mineral extraction tax rate for 2021 is divided into two types: percentage expression and in rubles.

Every year the tax rate undergoes changes, and each year the rate increases rather than decreases. But the reduced tariff, benefits and 0% rate make it easier to get busy.

- If the mineral extraction tax tariff on oil in 2021 was 857 rubles per ton, then in 2021 it increased to 919 rubles. At this time, the tariff has not increased further.

- The mineral extraction tax on gold in 2021 is 6%, and the tariff on other precious metals is 6.5%. According to Federal Law No. 41, the amount of tax on precious metals is calculated on the territory of the deposit.

- Gas and natural condensate is measured not only as a percentage, but also in rubles, which makes it more expensive: condensate - 42 rubles. for 1 thousand m3, 35 rubles. - natural fuel.

- The coal coefficient varies greatly between types of resource: the tariff for the extraction of brown coal is 11 rubles. per ton and 47 rubles. costs 1 ton of anthracite. The latter rate has been maintained since 2021.

Privileges

For some organizations, a reduction factor of 0.7 is provided. An enterprise uses it if it meets the requirements:

- before 07/01/2001, a company or individual entrepreneur paid OVMSB, but did not pay this duty for work on developed fields;

- the enterprise searched for and developed new deposits at its own expense, and government subsidies were compensated.

Zero rate

The 0% tariff rate is regulated by Art. 342 of the Tax Code of the Russian Federation, which contains information about natural resources that are not subject to duty. Mineral extraction tax is not paid in the following cases:

- in case of standard losses of obtained fossil raw materials during the work process;

- during the production of sand, associated, natural gas, its condensate, very thick oil;

- during the production of qualified associated tin ores;

- when receiving groundwater that contains minerals;

- when processing residues after the extraction of a natural resource;

- during the extraction of medicinal waters;

- when extracting water for agriculture. needs.

Also in paragraph 21 of Art. 342 of the Tax Code of the Russian Federation indicates specific geographical zones where extraction of natural resources is carried out free of mineral extraction tax.

Ad valorem

Ad valorem tariff indicators are used as a percentage of the cost of the extracted resource. According to Art. 342 of the Tax Code of the Russian Federation they vary between 0–8%.

In 2021, the Tax Code of the Russian Federation introduced a number of changes and innovations to the section dedicated to mineral extraction tax. Not only the indicators have changed and the coefficients have increased, but also the calculation formulas. They are relevant in this article.

The Russian oil industry is a key sector of the oil complex, which provides almost all economic sectors and citizens with a rich range of fuels, fuels and lubricants and other petroleum products. About 13% of the world's oil reserves are located in Russia. As for production volumes, Russia extracts approximately 10% of all oil from the depths of the earth.

Mineral extraction tax in tax legislation

According to the Tax Code of the Russian Federation, a mineral is a product of mining and quarrying contained in mineral raw materials. Products must comply with the standard.

Mining operations are licensed by the state. Organizations and individual entrepreneurs that have received such permission to use subsoil are placed on special registration with the Federal Tax Service no later than 30 days after receipt. As a general rule, registration of a miner of fossil raw materials is carried out at the location of the subsoil plot. If it is located outside the country, the tax payer is registered at his location.

Mineral resources (PI) are taxed, according to the text of the Labor Code of the Russian Federation, Art. 336:

- mined in Russia;

- extracted from mining waste (if such extraction requires a license);

- mined abroad (if the site is under the jurisdiction of the Russian Federation, leased from states, used under an international treaty).

Not taxed:

- common PIs (sand, chalk, some clays);

- groundwater, if it was extracted by an individual entrepreneur for personal needs;

- minerals in the collection;

- extracted mineral resources, if work was carried out with protected geological objects;

- PI from waste, owned dumps, if the tax has already been calculated during mining, etc.

Extracted mineral resources are taxed at two rates:

- as a percentage (ad valorem);

- in rubles per ton (specific, solid).

Accordingly, percentages play a role if the base is expressed in value terms, and solid ones are related to the natural quantitative base production indicator. The “quantitative” base applies to gas, oil, coal, gas condensate, and multicomponent ore PIs of the Krasnoyarsk Territory. This provision does not apply to new offshore deposits. “Value” covers the remaining PIs, oil, gas (and condensate), and coal from new offshore production sites.

There are no benefits for this tax. However, in fact, a zero rate of mineral extraction tax can be considered a benefit, which relates (according to the text of Article 342, paragraph 1) to:

- regulatory losses of PI (they are determined by government decree No. 921 of 12/29/01);

- associated gas;

- development of substandard, low-quality PIs, decommissioned;

- waters containing minerals, extracted as a by-product with other mineral extraction or during underground work;

- mineral waters directly used in treatment, without sale;

- underground water for irrigation of agricultural crops;

- overburden layers covering the PI layer, host rocks;

- regulatory waste from mining and processing.

In addition, under certain conditions and to certain individual entrepreneurs, reduction factors may be applied when calculating tax. Tax deductions provided for in Art. 343.2 for Khanty-Mansi Autonomous Okrug, Bashkortostan, etc., can also be classified as actual benefits.

A separate calculation is made for each PI. The rates are given in Art. 342 of the Tax Code of the Russian Federation. The tax period is a month.

Once actual production begins, the obligation to declare tax arises. The calculation is submitted to the location, place of residence (Article 345 of the Tax Code of the Russian Federation), no later than the last day of the next month. The declaration is generated monthly, without a cumulative total. The tax is paid by the 25th day of the following month, at the location of the production sites, and if they are located outside the country - at the location of the legal entity, residence of the individual entrepreneur.

By the way! The Ministry of Finance proposes to increase the mineral extraction tax in 2021. This measure, according to officials, will help keep gasoline prices at an acceptable level for consumers.

Structure of Russian oil revenues

The results of the activities of oil complex companies today represent a reliable basis for the country's balance of payments, stabilization of the ruble exchange rate and recovery after the crisis.

A key role in obtaining oil revenues in Russia is played by vertically integrated oil companies - oil companies that produce about 90% of the total volume of oil in the country. The oil industry accounts for approximately 12% of domestic industrial production, and the enterprises employ about 3% of the population. In fact, the oil industry is the basis of the Russian economy.

Oil and gas budget revenues include:

- Tax on income of oil companies from the sale of oil and gas products;

- Tax on the extraction of oil, natural gas and gas condensate from all existing fields;

- Excise taxes on gasoline, motor oil, diesel fuel;

- Customs duties on the export of crude oil and refined oil products, as well as natural gas;

- Dividends on state shares in oil producing companies.

Dynamics of Russian oil revenues

A positive trend in the growth of oil revenues began to be seen in 2011, when the country’s economy gradually began to recover from the crisis. In 2013, the share of oil revenues in the total amount of Russian budget revenues was 50.2%.

Despite the fact that in 2014, oil prices dropped by almost 2 times (previously a barrel cost $100-110, and then the price dropped to $65), the situation in the Russian economy has not changed - taxes and fees from the oil and gas sector remained the main source income for the domestic budget. In the first half of 2014, the budget received 3.7 trillion rubles in oil revenues, which amounted to 52% of all tax payments.

In the first 6 months of 2015, the Russian budget received 6.6 trillion rubles, of which 3.6 trillion came from taxes, and 2.3 trillion from customs duties. At the same time, the share of oil revenues amounted to 45% - 3 trillion rubles, respectively. As you can see, the collapse in prices reduced revenues, but only slightly.

However, in January-February 2021, the Ministry of Finance estimated that the share of oil revenues in the budget decreased by another 7.6%, amounting to 37.4% of all revenues. This is the lowest figure since the crisis in August 2009.

How the feds fight for taxes through the resignations of governors and external control of regions

We wrote about what happens to regions where tax collection is difficult last year. Let us remind you that at the end of 2021, the tax trickle from the Trans-Baikal Territory decreased by 96%: from 3.7 billion to 137.5 million rubles. The region was already considered problematic. At the end of 2015, the region was warned about a strong increase in the debt burden - “in terms of its level (82.7% of its own income), Transbaikalia ranked 15th in the country, the level itself is critical.” In 2021, the regional budget reached the maximum level of public debt. The situation in the region at the end of 2021 did not improve; it ranked third in terms of negative dynamics.

Natalya Zhdanova did not work even three years as governor, like the previous head of the region. Photo by governor.zabaikalskiykrai.rf

At the beginning of 2021, it became known that the debt of the Trans-Baikal Territory budget to the federal budget would be restructured with payment in installments until 2024: as of January 1, 2018, the amount of the region’s debt was already 14.6 billion rubles. The result was the resignation of Governor Natalya Zhdanova in October last year, who had not served in office for even three years, like the previous head of the region, who resigned in 2021. The new head of the region, who will have to clean up the financial stables, is Alexander Osipov, who previously worked as the first deputy head of the Ministry of Eastern Development of the Russian Federation.

Even earlier, the federal authorities came up with another technique, starting to introduce external management of the Ministry of Finance of the Russian Federation in the regions. Currently, three Russian regions are under this regime. Treasury support is provided in relation to Khakassia (tax collections in 2018 fell 2.6 times, to 902 million rubles, resulting in 3 billion rubles in subsidies), Mordovia, which we have already written about (2.7 billion rubles in subsidies were allocated to last year to equalize budgetary security), and the Kostroma region.

In the latter, despite the state debt, tax revenues last year increased by 35%, to 9.8 billion rubles (the volume of subsidies amounted to 3.7 billion rubles). Mordovia and Kostroma, as of February 2021, have public debt that exceeds their own income for the year. At the beginning of last year, seven regions had critical debts. At the same time, Mordovia is still at risk: if the Kostroma region in 2018 reduced its public debt by 7% and the market debt by 10%, then Mordovia increased its debts by 12% and 45%, respectively. Last year, the state debt of the regions nevertheless decreased by 4.7%, or 109 billion rubles, and debts to banks - by 2.3%, or 28 billion rubles.

Last year, the most problematic region in terms of tax collections was the Kirov region (their drop was then 5%), this year they collected 1% more, but, of course, they failed to recoup the fall: 13 billion rubles were collected for the federal budget. As in the case of the Trans-Baikal Territory, at the beginning of 2021, a decision was made to restructure the region’s debt: the Kirov region will repay about 15.6 billion rubles of debt within seven years through the restructuring program.

Last year, the most problematic region in terms of tax collections was the Kirov region. Photo nesiditsa.ru

If we talk about the Volga Federal District, the most impressive growth in tax revenues, of course, is in the oil regions. The best indicators, we recall, are from Tatarstan, as well as from the Orenburg region (collected 1.5 times more - 300.8 billion rubles), Samara region (one third more, 291.7 billion rubles), Perm Territory (40% more , 261.3 billion rubles) and Bashkortostan (one third more, 221.8 billion rubles). The Saratov region also entered the top 20 best regions of the Russian Federation, where tax collections to the federal budget increased by only 10%, to 108 billion rubles.

Forecast of oil revenues in 2017

The deal by OPEC members and other oil-producing countries outside the cartel to reduce production came after the Federal Reserve decided to raise rates by 25 basis points. In practice, a significant decrease in oil production has not yet occurred, but the price of “black gold” has increased by 20%, averaging $55 per barrel.

An increase in oil prices does not guarantee an improvement in the economic situation in Russia. When this figure remained at $100, growth in the Russian Federation slightly exceeded 1%. In 2021, the price of a barrel of oil was $44, and GDP fell by 0.5%, which is a minor change given the calculation error.

The 2021 budget includes a price of $40 per barrel. Even if the figure remains at $55, it will not have such a significant impact on the economy as other growth factors.

The only beneficiary of rising oil prices is the Russian budget, which in recent years, not so successful for the oil industry, has become “used” to doing without abundant oil revenues.

Nuances of calculating mineral extraction tax in relation to crushed stone

The policy of saving and freezing expenses has borne fruit: the dependence of the Russian budget on oil revenues has decreased. In 2016, they accounted for only 36% of total income, which in nominal terms equated to 4.9 trillion rubles. In 2021, oil and gas revenues will decline by another trillion.

Provided that the price of oil in 2021 remains at the level of 50-55 dollars, the volume of income from the industry will be equal to that of 2015. At the same time, taking into account forecasts for a decrease in inflation rates, the nominal tax base will grow exactly the same as in 2021.

In conclusion, it is worth mentioning the common myth that Russia is largely dependent on oil. The above statistics for 2013-2016 show that the share of oil revenues in the domestic budget is falling, but this does not significantly affect the growth rates of the economy as a whole. In addition, if you look at GDP, the share of hydrocarbons in it is only 16% - the rest comes from non-oil and gas sectors, the largest of which are manufacturing and services.

... suffered, including the Ulyanovsk region and Bashkortostan

Despite such iron-fisted measures, the number of regions to which the volume of subsidies was reduced was only 22 (of which, which is significant, 14 were reduced by exactly 5%). A year earlier, subsidies to 26 regions fell under the scissors. And yet, who is among the first victims as a result of the new methodology of the Ministry of Finance of the Russian Federation?

Interestingly, Bashkortostan, for example, was among the “victims”. And he obviously got in not because his share of subsidies exceeds 40% (16.4 billion rubles of subsidies in 2021 accounted for 392.6 billion rubles in tax collections, of which 170.7 billion rubles remained in the republic). Nevertheless, the volume of subsidies for budget equalization was reduced by 5%, to 15.6 billion rubles.

Subsidies to another region of the Volga Federal District, the Ulyanovsk region, were reduced by exactly 5%: from 3.3 to 3.18 billion rubles. Last year, the ratio of subsidies to tax collections was only 5.6% (in Bashkortostan it was 4.2%) - in total, the region collected 60 billion rubles, of which 40 billion rubles were left at home.

In addition to them, subsidies to the Jewish Autonomous Region, Oryol, Kostroma, Kurgan regions, Karelia, Khabarovsk and Kamchatka territories were reduced by almost exactly 5% with small shares. As well as Irkutsk, Bryansk, Tambov, Kemerovo and Magadan regions. Subsidies were cut the most in the Murmansk region (by 93.6% - from 473 million rubles to 31.6 million, but since 2011 the region has received more than 1 billion rubles almost every year.

Subsidies to the Krasnoyarsk Territory were reduced by almost half: from 3.2 billion to 1.7 billion rubles. But this was obviously due to the fact that previously, in order to prepare the region for the 2019 Universiade, it was allocated a considerable part of the funds for this (in 2021, the region received a record 5.5 billion rubles).

Subsidies for the Tula region were reduced by 40%, and for the Vologda region by 13.5%. We also note that due to the problems of the Trans-Baikal Territory and the change of governor there, the region also received a little cut, but within the statistical error: last year it received 12.1 billion rubles, this year it will receive 11.9 billion.

Subsidies to the Krasnoyarsk Territory were reduced by almost half, but this was obviously due to preparations for the 2019 Universiade. Photo trk7.ru