Accounting: inventory

In accounting, reflect the shortage identified during the inventory on account 94 “Shortages and losses from damage to valuables” in correspondence with property accounting accounts.

Reflect missing inventory items (inventories) at actual cost, which is determined based on accounting data. Fixed assets – at residual value. In this case, make a posting: Debit 94 Credit 01 (10, 41, 43, 50...)

– reflects the cost of the shortage identified during the inventory.

This procedure is established in the Instructions for the chart of accounts.

In the accounting accounts, reflect the shortage at the time of completion of the inventory (drawing up the act) or on the date of preparation of the annual financial statements (i.e. no later than December 31 of the reporting year) (clause 5.5 of the Methodological Instructions approved by Order of the Ministry of Finance of Russia dated June 13, 1995 No. 49).

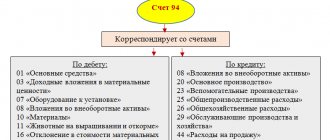

Count 94: basic information

Account 94 allows you to summarize the amounts of shortages and losses of goods, including monetary resources. It can also be used to determine the amount that in the future needs to be identified as a shortage or loss. Initially calculated amounts are not subject to qualification.

Shortage is a discrepancy between the actual goods available and the amount of valuables that are reflected in the reporting documents.

In practice, shortages are identified as a result of the following actions:

- inventory;

- acceptance of goods;

- document checks.

Account 94 belongs to the category of active accounting accounts. It summarizes information about the state and changes in values owned by the organization. In addition, the score 94 is synthetic. Information on it is recorded in monetary terms.

Accounting: write-off as expenses

Accounting for the shortage depends on the reason for which it arose:

- due to natural loss (for inventories (MP));

- through the fault of the financially responsible person;

- as a result of force majeure (flood, fire, etc.).

This follows from subparagraph “b” of paragraph 28 of the Regulations on Accounting and Reporting.

The shortage and damage to valuables within the limits of natural loss norms are attributed to the costs of production and circulation on the basis of the order (order) of the head of the organization. Determine such shortages after regrading. Carry out mutual offset of shortages and surpluses:

- for the same audit period;

- from the same person being checked;

- in relation to stocks of the same name;

- in identical quantities.

Determine the value of the missing property using accounting data. Do the following wiring:

Debit 20 (23, 44…) Credit 94

– the cost of missing inventory items is written off within the limits of natural loss norms.

This procedure follows from paragraph 5.1 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated June 13, 1995 No. 49, and the Instructions for the chart of accounts.

Norms of natural loss. Calculation formula

Shortages and spoilage within the limits of natural loss norms depend on many factors (type of goods and materials, method of transportation, storage methods and periods, etc.). This indicator is calculated in each specific situation:

- To establish standards for natural loss during the transportation (delivery) of inventory items, it is necessary to take into account either the cost of each product or the total weight of inventory items. Shortages or damage are identified upon acceptance, then they are documented (notes in accompanying documents, acts).

- To establish norms of natural loss during the storage or sale of inventory items, it is necessary to apply the calculation formula:

| EU = T x Well x 100% where: T – mass or cost of goods and materials; Well, there is a regulated rate of loss for a specific inventory item (the legislation provides reference books and classifiers of various inventory items with their rates of natural loss). |

- To establish norms of natural loss for the storage of goods, norms are calculated for the balances of goods, for their receipts and disposals during inter-inventory periods

Accounting: compensation for damage by the guilty party

Attribute the shortage of goods in excess of the norms of natural loss, as well as the shortage of other property, to the perpetrators. In this case, the employee must compensate the organization for the entire amount of damage caused (Article 243 of the Labor Code of the Russian Federation). Determine the amount of damage based on the market price of the missing property, but not lower than its value according to accounting data (Article 246 of the Labor Code of the Russian Federation).

If the employee reimburses only the book value of the property, make the following entries:

Debit 73 Credit 94

– the shortage of property is attributed to the employee at book value;

Debit 50 (51, 70) Credit 73

– the employee’s shortfall debt has been repaid.

If an employee compensates for damage based on the market price of the missing property, make the following entries:

Debit 73 Credit 94

– the shortage of property is attributed to the employee at book value;

Debit 73 Credit 98

– reflects the difference between the market and book value of the missing property;

Debit 50 (51, 70) Credit 73

– the employee’s shortfall debt has been repaid.

As the employee repays the amount of debt due from him, write off the difference in proportion to the share of the repaid debt:

Debit 98 Credit 91-1

– the difference between the market and book value of the missing property is included in income.

This procedure follows from paragraph 5.1 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated June 13, 1995 No. 49, and the Instructions for the chart of accounts.

If a shortage is identified in the reporting year, but it relates to previous reporting periods, and the culprit is identified, take it into account as part of future income. At the same time, assign the amount of the shortfall to the guilty person. In this case, make the following entries:

Debit 94 Credit 98

– reflects the shortage identified in the reporting year, but relating to previous reporting periods;

Debit 73 Credit 94

– the shortage of property is attributed to the employee.

As the employee repays the debt, make the following entries:

Debit 98 Credit 91-1

– the shortfall repaid by the employee is included in income.

Such rules follow from the Instructions for the chart of accounts.

Situation: is it possible to recover the shortfall from a dismissed employee? Was an agreement on collective financial responsibility concluded with the employee? The inventory was carried out after dismissal.

Answer: no, you can't.

Article 232 of the Labor Code of the Russian Federation states that termination of an employment contract does not exempt an employee from compensation for damage. But in order to prove that the shortage of property arose through the fault of the employee, it was necessary to conduct an inventory upon his dismissal. After the passage of time, it is impossible to prove the guilt of the dismissed employee. This means that it is also impossible to recover the shortage.

When deficiencies are discovered

The main way is, naturally, inventory. Everyone deals with inventory in one way or another (remember the movie “Office Romance”?). The inventory is carried out once a year before summing up the results for the preparation of financial statements for the past year. You can do it more often, but not less often. For fixed assets, an inventory can be carried out every three years. But, as a rule, in practice, fixed assets are also inventoried once a year.

Inventory is also carried out during the reorganization of the enterprise, when facts of theft are revealed, after emergency incidents, when there is a change in persons bearing financial responsibility.

Also, shortages can be identified immediately at the time of acceptance of goods or materials from the supplier. The features of reflecting transactions in this case will be discussed below.

Accounting: write-off in the absence of culprits

If the perpetrators have not been identified or the court has refused to recover the amount of damage caused from them, write off the shortage of property to the financial results of the organization. Refer the amount of the shortfall to other expenses. A document that can confirm the absence of guilty persons can be, for example, a court acquittal, a decision to suspend a criminal case, etc. (clause 5.2 of the Methodological Instructions approved by Order of the Ministry of Finance of Russia dated June 13, 1995 No. 49). Determine the amount of loss based on the value of the missing property according to accounting data. In this case, do the wiring:

Debit 91-2 Credit 94

– the loss from the shortage of property is written off due to the absence of the guilty person (refusal to recover damages).

This procedure follows from paragraph 11 of PBU 10/99 and the Instructions for the chart of accounts.

If the cause of the shortage was force majeure, take into account the shortage of property as part of the losses of the reporting year at book value. Do the following wiring:

Debit 91-2 Credit 94

– loss from a shortage of property resulting from force majeure is written off.

This procedure follows from paragraph 13 of PBU 10/99 and the Instructions for the chart of accounts.

How to write off the shortage at the expense of net profit

Net profit is the final financial result of the company's activities for the reporting period. Its indicator is formed on account 99 “Profit and losses” and with the final turnover at the end of the year is written off to the credit of account 84 “Retained earnings (uncovered loss)”. Retained earnings can be used to cover losses (for example, when a shortage is discovered). However, only the owners of the company can decide on this form of using profits.

This publication talks about where the company’s net profit can be directed.

If the owners make such a decision, the entries when writing off the shortfall at the expense of net profit will not affect accounts 99 and 84. The operation to write off the shortfall in accounting will be reflected in the correspondence of accounts Dt 91.2 Kt 94. Such writing off of the shortfall leads to discrepancies between accounting and tax accounting , since this amount will not participate in calculating the taxable base for income tax. As a result, a permanent tax liability must be reflected in the accounting accounts.

Attention! Hint from ConsultantPlus: There is a position of the Russian Ministry of Finance, according to which if the perpetrators have not been identified, then a document confirming the right to include losses from theft in expenses is... (read more).

Learn about the types of discrepancies between accounting and tax accounting from this material.

Shortage of property written off the balance sheet

Situation: how to reflect in accounting a shortage of property that is not listed on balance sheet accounts (for example, materials written off as expenses)? The property for which the shortage was discovered belonged to the organization.

If a shortage of property is identified that is not listed on the balance sheet, the reduction of available property does not occur. However, for the organization such a shortage is recognized as damage. The procedure for reflecting such a shortage in accounting depends on the reasons for its occurrence.

A shortage of property can occur:

- due to natural loss;

- as a result of force majeure (flood, fire, etc.);

- through the fault of the financially responsible person (other guilty persons);

- for unknown reasons (the culprits were not found).

If the shortage of property not listed on balance sheet accounts occurred due to natural loss or as a result of force majeure, there is no need to reflect this with additional entries. The missing property must be written off from off-balance sheet accounting (if it was listed on off-balance sheet accounts). Apply the same procedure in cases where those responsible for the shortage have not been identified. This is explained as follows. If the shortage arose for these reasons, the organization’s accounting has no reason to take into account either expenses (the property was already previously included in expenses) or income (receipts for compensation of damage are not expected). This conclusion follows from the Instructions for the chart of accounts (account 91).

If the shortage occurred due to the fault of an employee or another guilty person, the organization has the right to recover material damages from him (Clause 1 of Article 1064 of the Civil Code of the Russian Federation, Articles 243, 248 of the Labor Code of the Russian Federation). Since the value of the property has already been written off from the balance sheet accounts, the correspondence of account 94 “Shortages and losses from damage to valuables” with the organization’s property accounts is impossible. This conclusion follows from the Instructions for the chart of accounts (account 94). In accounting, compensation for material damage resulting from a shortage can be reflected in two ways: using account 94 and without it. The organization has the right to choose any of the above options.

When using the first method (using account 94), the wiring diagram will be as follows:

Debit 94 Credit 98

– the amount of the identified shortage is reflected;

Debit 73 (76) Credit 94

– reflects the amount of damage to be compensated by the financially responsible person (other guilty person);

Debit 70 (76) Credit 73 (76)

– the cost of the damage caused is withheld from the salary (remuneration) of the guilty person;

Debit 50 (51) Credit 73 (76)

– the amount of damage is repaid to the cash desk (to the current account) of the organization;

Debit 98 Credit 91-1

– the amount of repaid damage is reflected in income.

When choosing the second method (without using account 94), make the following entries:

Debit 73 (76) Credit 98

– reflects the amount of damage to be compensated by the financially responsible person (other guilty person);

Debit 70 (76) Credit 73 (76)

– the cost of the damage caused is withheld from the salary (remuneration) of the guilty person;

Debit 50 (51) Credit 73 (76)

– the amount of damage is repaid to the cash desk (to the current account) of the organization;

Debit 98 Credit 91-1

– the amount of repaid damage is reflected in income.

If the property for which a shortage was discovered was listed in off-balance sheet accounting, write it off from the off-balance sheet account (Instructions for the chart of accounts).

An example of reflecting in accounting a shortage of protective clothing written off from balance sheet accounts as expenses. The amount of the shortfall was withheld from the salary of the guilty employee

In March, OJSC “Proizvodstvennaya”, in accordance with industry standards, purchased workwear (wearing period 12 months) worth 1,180 rubles for an employee of the main production. (including VAT - 180 rubles). In the same month, the organization issued special clothing to the employee.

The accounting policy of “Master” states that workwear costing less than 20,000 rubles. taken into account in the composition of materials. At the same time, workwear, the cost of which is less than 20,000 rubles. and the period of use of which is no more than 12 months is written off as expenses at a time (accounting for such workwear is kept in special statements).

In May, one of the employees quit and did not return his work clothes upon dismissal. The manager decided to recover the shortage of protective clothing from the employee’s salary. To pay off the material damage, the cost of special clothing in the amount of 1,000 rubles was collected from the employee’s last salary.

The accountant reflected the amount of the shortfall in accounting using account 94.

In March, the accountant made the following entries:

Debit 10-11 Credit 10-10 – 1000 rub. – special clothing was issued to the employee for use;

Debit 20 Credit 10-11 – 1000 rub. – the cost of workwear is written off as expenses.

In May, the accountant made the following entries:

Debit 94 Credit 98 – 1000 rub. – the amount of the identified shortage is reflected.

Debit 73 Credit 94 – 1000 rub. – reflects the amount of the employee’s debt for compensation for damage caused.

Debit 70 Credit 73 – 1000 rub. – the cost of lost work clothes is deducted from the employee’s salary;

Debit 98 Credit 91-1 – 1000 rub. – the amount of repaid damage is reflected in non-operating income.

Types of natural loss

Above there were constant references to natural decline. How does it arise and how can its rate be calculated? In general, there is no strict definition of the concept of attrition in the legislation.

But we can come to the conclusion that natural loss is the loss of a mass of goods that occurs due to natural causes. More specifically, the following types of natural loss can be distinguished:

- shrinkage (when humidity changes, moisture evaporates and, as a result, the mass of raw materials decreases);

- utruska (spraying of bulk goods and materials);

- crumble (well, no need to explain here, everyone cuts bread at home);

- leakage (melting, absorption into the container, seepage from the container);

- spill (for example, when pumping from container to container);

- fight (when transporting something fragile, for example, glass containers, mirrors, ceramics, etc.).

Natural loss applies to the following types of goods:

- for food products and agricultural products;

- for medicines;

- for some types of non-food products.

The norms by which natural decline occurs are approved by the relevant industry departments. Some approved standards have existed since the times of the Soviet Union.

BASIC

The procedure for accounting for shortfalls when calculating income tax depends on the reason for which this shortfall arose:

- due to natural loss (for MPZ);

- through the fault of the financially responsible person;

- as a result of force majeure (flood, fire, etc.).

BASIC: shortage within the limits of attrition norms

Take into account the shortage within the limits of natural loss norms when calculating income tax as part of material expenses (subclause 2, clause 7, article 254 of the Tax Code of the Russian Federation). Include it in expenses at the time the inventory is completed or on the date of preparation of the annual financial statements (i.e. no later than December 31 of the reporting year). Do this even if the organization recognizes expenses on the accrual basis and if it uses the cash method. This follows from paragraph 2 of Article 272 and subparagraph 1 of paragraph 3 of Article 273 of the Tax Code of the Russian Federation. At the same time, if the organization uses the cash method, take into account the shortage if the property for which it was identified has been paid for (clause 3 of Article 273 of the Tax Code of the Russian Federation).

BASIC: shortage in excess of loss norms

Accounting for shortages in excess of natural loss norms depends on whether the guilty person is identified or not. If the guilty person is identified and the shortage is recovered from him, then the organization receives non-operating income (clause 3 of Article 250 of the Tax Code of the Russian Federation). If an organization recognizes income on an accrual basis, take into account the shortfall that the employee has compensated when calculating income tax at the time the employee admits his guilt or at the time the court decision enters into force (subclause 4, clause 4, article 271 of the Tax Code of the Russian Federation). If the decision is not appealed, it comes into force 10 days after it is made (Article 209 of the Code of Civil Procedure of the Russian Federation).

If the organization uses the cash method, take into account the amount of compensation as part of income at the time the employee compensates for damage (clause 2 of Article 273 of the Tax Code of the Russian Federation). For example, on the day an employee deposits funds into the organization’s cash desk.

Situation: is it possible to include shortages identified during inventory as expenses when calculating income tax? Material damage due to shortages shall be compensated by the person at fault.

Answer: yes, you can.

At the same time, material damage leads to a decrease in the economic benefits of the organization, that is, it is an expense. In order to take into account the shortfall in expenses, its size must be justified and documented (clause 1 of Article 252 of the Tax Code of the Russian Federation). The justification is that when an employee compensates for the shortage, the organization also receives income (clause 3 of Article 250 of the Tax Code of the Russian Federation). Documentary evidence of expenses is a matching statement, an explanatory note from the employee and other documents. If these requirements are met, then the amount of the shortage (at actual cost) can be included in other non-operating expenses in full (subclause 20, clause 1, article 265 of the Tax Code of the Russian Federation).

This position is confirmed by letters of the Ministry of Finance of Russia dated August 27, 2014 No. 03-03-06/1/42717, dated April 17, 2007 No. 03-03-06/1/245.

An example of how shortages of inventories are reflected in accounting and taxation. The culprit has been identified. The organization applies a general taxation system

In the first quarter, Alpha LLC carried out an inventory of the raw materials warehouse. The basis for the inventory was the dismissal of the materially responsible person - storekeeper P.A. Bespalova. The inventory ended on March 15th. As a result, a shortage of raw materials was identified. Its cost according to accounting data was 20,000 rubles. The market value of raw materials was 30,000 rubles.

For tax purposes, the organization uses the accrual method. The reporting period for income tax is a month.

On March 15, Alpha’s accountant made the following entry:

Debit 94 Credit 10 – 20,000 rub. – reflects the cost of the shortage of raw materials identified during the inventory.

Since the guilty person has been identified and Bespalov has admitted his guilt, he compensates for the damage. By decision of the head of the organization, the market value of the missing raw materials is collected from Bespalov. Therefore, on March 15, the accountant made the following entries in accounting:

Debit 73 Credit 94 – 20,000 rub. – the shortage of raw materials is attributed to the storekeeper at book value;

Debit 73 Credit 98 – 10,000 rub. (30,000 rubles – 20,000 rubles) – reflects the difference between the market and book value of the missing raw materials.

Bespalov contributed 15,000 rubles to pay off the debt. March 30 and April 16. Therefore, on March 30 and April 16, Alpha’s accountant made the following entries:

Debit 50 Credit 73 – 15,000 rub. – the debt for the shortage was repaid by Bespalov;

Debit 98 Credit 91-1 – 5000 rub. (10,000 rubles × (15,000 rubles : 30,000 rubles)) – the difference between the market and book value of the missing raw materials is included in income.

When calculating income tax for March, the accountant took into account:

- the amount that the employee must reimburse (RUB 30,000) as part of non-operating income;

- the amount of loss from shortage (RUB 20,000) as part of other non-operating expenses.

If the perpetrators have not been identified or the court has refused to collect the amount of damage caused from them, take into account the shortage of property when calculating income tax as part of non-operating expenses. In this case, the fact that there are no perpetrators must be documented by an act of the authorized agency. This is stated in subparagraph 5 of paragraph 2 of Article 265 of the Tax Code of the Russian Federation.

At what point, when calculating income tax, can the amount of the shortfall be included in expenses if the persons responsible for the theft have not been identified? For more details, see How to reflect the disposal of depreciable property in tax accounting.

If the cause of the shortage was force majeure, take into account the shortage of property as part of non-operating expenses (subclause 6, clause 2, article 265 of the Tax Code of the Russian Federation). Include it as an expense at the time the inventory is completed or at the date of preparation of the annual financial statements. Do this even if the organization recognizes expenses on the accrual basis and if it uses the cash method. This follows from paragraph 1 of Article 272 and subparagraph 1 of paragraph 3 of Article 273 of the Tax Code of the Russian Federation. At the same time, if the organization uses the cash method, take into account the shortage if the property for which it was identified has been paid for (clause 3 of Article 273 of the Tax Code of the Russian Federation).

In all cases of shortage of excisable goods (except for shortages within the limits of natural loss), the moment of its discovery is considered the date of sale for the purpose of calculating excise taxes (clause 4 of Article 195 of the Tax Code of the Russian Federation).

The question of the need to restore input VAT on lost property is controversial.

Identifying shortages at a point of sale

If a shortage is detected at a retail outlet, the following actions are possible with respect to the seller:

- Demand from him an explanation regarding the identified shortage.

- If the seller is found to be at fault, or there is liability under a collective agreement on financial responsibility, then the shortage, which cannot be written off, can also be deducted from wages. In the first case in the full amount, in the second - in a certain percentage. Interest deductions exceeding 20% are established only in court.

Amounts collected from employees should not exceed their official salary. However, if necessary, by court decision, it is possible to exceed it.

simplified tax system

If a simplified organization has chosen as an object of taxation income reduced by the amount of expenses, when calculating the single tax, include only the amount of the shortfall within the limits of natural loss norms (subclause 5, clause 1 and clause 2, Article 346.16 of the Tax Code of the Russian Federation). Please take into account the shortfall if the property for which it was identified has been paid for (subclause 1, clause 2, article 346.17 of the Tax Code of the Russian Federation).

If an organization pays a single tax on the difference between income and expenses, expenses in the form of amounts of damage caused in excess of the norms of natural loss do not reduce the tax base. These costs are not in the list of expenses that can be taken into account when calculating the single tax (Clause 1, Article 346.16 of the Tax Code of the Russian Federation).

If a simplified organization has chosen income as an object of taxation, then do not take into account the amount of the shortfall when calculating the single tax. This is not provided for by clause 3 of Article 346.21 of the Tax Code of the Russian Federation.

If the shortage of property is compensated by the guilty person, take it into account as part of the income when calculating the single tax, regardless of what object of taxation the organization has chosen (paragraph 3, paragraph 1, article 346.15, paragraph 3, article 250 of the Tax Code of the Russian Federation). Include the shortfall in income at the time of compensation for damage to employees (clause 1 of Article 346.17 of the Tax Code of the Russian Federation). For example, on the day an employee deposits funds into the organization’s cash desk.

Actions of the employer upon detection of a shortage

If a shortage is detected, the seller’s actions will be as follows:

- Require employees to write an explanatory note regarding the lack of valuables. If an employee refuses to give explanations, then it is necessary to draw up an appropriate act of refusal, in accordance with the requirements of the Labor Code of the Russian Federation.

- Collect shortfalls from workers. This can only be done within a month from the date of the inventory results. After this period, recovery can only be applied in court. The employer can give an order for recovery in an amount not exceeding the average monthly salary. If it is necessary to recover a large amount, then this can only be done through the court.

What is a shortage?

A shortage is a discrepancy between accounting and actual values. For example, according to the accounting register, an enterprise has 100 units of equipment, but during the inventory, only 95 units were found. Shortages occur for the following reasons:

- Theft.

- Natural loss (for example, expiration of the shelf life).

- Accounting errors.

- Emergency situations (for example, accidents, natural disasters).

- Abuse by financially responsible persons.

- Errors when accepting and issuing inventory items.

FOR YOUR INFORMATION! Account 94 also summarizes information about damage to inventory items.