What taxes do self-employed people pay and which ones are they exempt from?

By law, all self-employed citizens pay tax on professional activities. This is their main and, in most cases, their only tax burden.

The self-employment tax eliminates the need to pay personal income tax on the amounts received by the self-employed as a result of his activities. For example, if you do not provide services as a self-employed person, you must pay a profit tax of 13%. If you are self-employed, then either 4% or 6%. There will be no double taxation, as many fear (that is, you do not have to pay both NAP and personal income tax - only one of them).

It's profitable. For example, self-employed citizens who rent out a residential building pay tax on rental income at the NAP rate (4-6%), rather than personal income tax (13%).

Individual entrepreneurs who switched from tax regimes to self-employment also do not pay personal income tax on that part of their income that is subject to tax on professional activities, and do not pay VAT in general cases.

The concept of "self-employed"

Who belongs to the category of “self-employed”? There is no clear definition yet and it is not enshrined in law. But the Federal Tax Service and the Ministry of Justice understand a self-employed citizen of the Russian Federation as an individual who independently, without the involvement of hired workers, provides services to the population or is engaged in retail trade. The Pension Fund also classifies individual entrepreneurs as the self-employed population. However, the differences between self-employed citizens and individual entrepreneurs are obvious - individual entrepreneurs can hire employees on the basis of employment contracts, they are registered taxpayers and submit the necessary reports to the inspection authorities. On behalf of the Government of the Russian Federation, the Ministry of Justice, the Ministry of Finance, the Ministry of Labor and the Ministry of Economic Development must finally determine the status of the self-employed by June 26, 2021.

Tax if a self-employed person cooperates with an individual

A self-employed citizen pays a professional activity tax of 4% of his income if he receives funds from individual clients. For example, a landlord - from rent payments, a tutor - from students, a hairdresser - from visitors to a beauty salon, a taxi driver - from passengers, etc.

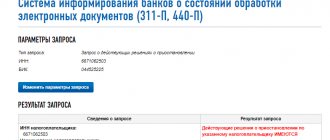

If there is any doubt about who exactly (individual or legal entity) made the payment to your address, then you can check its data in the mobile application or online account of your bank. You can find out that the receipt of funds came from an individual by looking at an extract from your current account, which necessarily displays the sender’s information.

You need to declare the receipt of funds from an individual in the “My Tax” application. In the “Recipient” column, simply indicate “Individual”; no other data (last name or passport number) is required. However, you will need to indicate the service for which you received payment. For example, “Consultation”, “Conducting a lesson” or “Selling a product”.

Types of activities of the self-employed

There are quite a lot of types of activities of self-employed citizens, but the Tax Code of the Russian Federation stipulates only 3 main ones that are not subject to personal income tax (clause 70 of Article 217 of the Tax Code of the Russian Federation):

- supervision and care of children, the sick, the elderly over 80 years of age and other persons in need of constant care;

- tutoring;

- residential cleaning and housekeeping.

Subjects of the Russian Federation at the regional level can supplement this list. So in 2021 it additionally includes:

— livestock grazing services;

— sewing services;

— premises repair services;

— construction and finishing services;

— hairdressing services;

— photo and video shooting;

— repair of electronic household appliances, household appliances, home and garden equipment.

Tax if a self-employed person cooperates with a legal entity

If self-employed people provide services or sell goods to organizations, the self-employed tax will be 6% of income.

Such income must be confirmed by an agreement - that is, the legal entity is obliged to transfer funds to the self-employed solely on the basis of documents. For example, a self-employed person may enter into an agreement with a company to provide consulting or information services.

You can also find out that the payment came from the company through a mobile bank linked to your card. Payments received from legal entities are always displayed with the name of the organization that makes them. Make sure that the “Order” period indicates the agreement on the basis of which the funds were transferred.

Payments received from a legal entity must be declared in the “My Tax” application in the same way as an individual. But you need to correctly indicate the sender of the money: full or abbreviated name and TIN.

The program will automatically calculate the tax.

How are tax contributions calculated?

The amount of tax paid by the self-employed is calculated automatically by the My Tax application.

The application counts all registered checks on the fly and calculates a tax of 4% on income received from individuals and 6% on income from legal entities. At the end of the month, all the resulting indicators are summed up, and the Federal Tax Service issues a tax notice marked “Payable” for the past month.

This amount of tax must be paid by the self-employed.

Another useful article: Which bank is better for a self-employed person to open an account?

For example, in October, a self-employed person sold 5 self-made cakes to individuals, receiving 1,500 rubles for each, and another 10 cakes to an organization under one contract for a total amount of 20,000 rubles. Let's calculate the tax amount:

- 4% * 5 * 1500 = 300 rubles - this is the total tax on cakes for individuals;

- 6% * 20,000 = 1,200 rubles - this is the order tax for a legal entity.

In total, a self-employed person must pay 1,500 rubles in tax for October.

Oh, this is not an easy job... Counting checks from my income...

The law on self-employed citizens – latest news + when it will come into force

A new tax regime for self-employed persons was introduced on January 1, 2021 , although it is officially called an “experiment” that will last until December 31, 2028 inclusive.

According to this act, citizens will be required to pay 4% tax if they work with individuals. People working in this special mode with legal entities, as well as individual entrepreneurs in the simplified system, will pay 6% of the income received .

To make it convenient for citizens, the Federal Tax Service created and launched a special application “My Tax”. With it, you won’t need to visit the tax office every month. Transactions will be processed and displayed online.

The State Duma assures that the rules of the experiment will not change for 10 years. That is, all registered will be calm regarding changes in the tax percentage.

The deputies stipulated that the term “professional income” includes not only the services described in the previous section, but also profit from one’s own real estate, for example, from renting out living space.

At first it was assumed that registered persons who actually carried out business without issuing checks would be fined.

Then they decided that in the first year of the law’s operation, no fines would be levied on citizens .

How to pay tax: deadlines, procedure, algorithm

When receiving money from a client, self-employed people generate checks through the My Tax application. The receipts must indicate to whom the service was provided: an individual or a legal entity, as well as all the necessary details of the transaction.

A self-employed person must generate checks by the 9th day of the next month (for example, for November - before December 9, for December - before January 9, etc.).

Until the 15th of the next month, the tax office checks payments and sets the amount of tax due for the previous month (for example, taxes for June will be calculated until July 15). In this case, the application will indicate an approximate tax calculation that you can use as a guide - the program itself is calculated immediately after registering the next check.

The taxpayer must pay the specified amount by the 25th day of the following month. For example, taxes assessed in June must be paid by July 25th.

Paying tax couldn't be easier. The My Tax application generates a payment receipt. It can be printed and paid using the details via online banking or at a bank branch.

Or you can do it even simpler - by online transfer directly through the My Tax application for self-employed people. You just need to attach a card and give a payment order: the money will be debited in the required amount. You can even set up automatic payment: as soon as the tax office issues an invoice, the program will automatically debit the money from the card.

After paying your tax, be sure to check if there are any outstanding debts in the My Tax app. After all, situations can be very different: part of the amount can be “eaten up” by a commission, or as a result of a failure, the money can be returned to the account without ever reaching the tax office. If you fail to pay your debt, you may face a fine. For the first time - 1000 rubles, then there may be more serious penalties, including administrative liability.

Removal from the register

De-registration as a tax payer is allowed in two cases:

- When a citizen no longer wants to use this special mode;

- If a person is included in the list of those who are not eligible to use the tax for self-employed people. Those. any of the mandatory criteria is violated. In this situation, the tax authority removes the citizen from the register unilaterally without submitting any application, and notifies him through the “My Tax” application.

Attention! If a citizen decides to no longer use the self-employed regime, he must send an application to the tax authority. The day of deregistration will be considered the day on which this application was sent. In addition, the fact of deregistration will be notified using a mobile application - this will happen no later than the day following the day the application is sent to the authority.

Tax deduction and tax bonus in 2021

Upon registration, a self-employed person is accrued a tax deduction in the amount of 10,000 rubles. This amount cannot be received in person in whole or in part. However, it reduces the amount of self-employment tax:

- from 4% to 3% when working with individuals;

- from 6% to 4% when working with legal entities.

Each time you pay tax, the tax deduction will be reduced by the amount of the “discount”. Thus, until you spend the entire tax deduction amount, tax rates will be 3-4% instead of 4-6%.

Let's take the example given above and calculate the tax at the preferential rate. Let us remind you that a self-employed person sold 5 cakes for 1,500 rubles to individuals and 10 cakes to a legal entity for 20,000 rubles. Let's calculate the tax amount with a discount:

- 3% * 5 * 1500 = 225 rubles - service tax for individuals (instead of 300 rubles);

- 4% * 20000 = 800 rubles - service tax for a legal entity (instead of 1200 rubles).

The difference between the tax for a self-employed person with and without deduction is 475 rubles. The tax deduction will be reduced by this amount: instead of 10,000 rubles, a self-employed person will have a deduction of 9,525 rubles next month. And so on - until the deduction is completely exhausted.

Please note that in 2021, due to the pandemic, the government additionally “sponsored” the self-employed for 12,130 rubles - the average cost of living in the country. This tax bonus was provided in addition to the tax deduction and was fully used to cover the amount of professional activity tax required for payment for the past month.

Thus, self-employed citizens did not need to pay anything until this bonus and deduction were exhausted. However, in December 2021, the tax calculation algorithm returned to the previous mechanism, and now both of these amounts only reduce the tax to 3% and 4%, respectively.

Another useful article: Can a self-employed person be an individual entrepreneur at the same time?

It is unknown whether an additional tax bonus will be provided in 2021. However, it is unlikely that the state, curtailing other support measures, will leave preferences for the self-employed. Most likely, now when registering in 2021, self-employed people will be given a tax deduction of 10,000 rubles and that’s it.

Where is the tax bonus?

What is professional income tax

The professional income tax is a new type of taxation that began as an experiment, but in 2021 it expanded throughout Russia. The regime is called preferential or special because it exempts individuals from paying personal income tax at a rate of 13%.

The concept of professional income is established in Article 2 of Law No. 422-FZ of November 27, 2018: “Income of individuals from activities in which they do not have an employer and do not attract employees under employment contracts, as well as income from the use of property.” NAP payers can be not only ordinary individuals, but also those who have registered individual entrepreneurs.

Separately, it is worth mentioning the reservation regarding employers. Payers of professional income tax can simultaneously work under an employment contract, but not in the type of activity for which they are recognized as self-employed. Moreover, the law states that the tax payer cannot provide services or perform work for a customer who was his employer less than two years ago. This was done specifically to prevent mass layoffs of hired workers and their transfer to NAP payers.

At its core, the tax on professional income is closest to the simplified tax system Income regime. Here, too, to calculate the tax base, only income received without expenses incurred is taken into account. However, compared to the simplified tax system, income restrictions in the regime for the self-employed are greater.

| USN Income | Professional income tax |

| Annual income – no more than 150 million rubles (*) | Annual income – no more than 2.4 million rubles |

| You can hire up to 100 workers under GPC and labor contracts (*) | Workers under employment contracts cannot be hired |

| You can engage in trade, production, services, works | You cannot engage in trade; the types of activities are services, work and the sale of goods of your own production. |

(*) From 2021, not only regular but also increased limits apply to the simplified tax system. However, in this case, the tax rates are higher: 8% for the “Income” object and 20% for the “Revenue minus expenses” object.

You can become self-employed with Sberbank right now. Leave a request in the service and receive all the advantages of the application from the Federal Tax Service, plus additional benefits from Sberbank.

Become self-employed with Sberbank

Is it possible to get a tax refund?

The tax office independently calculates the amount of tax due. But no one is immune from confusion. If suddenly you paid more than necessary, then it will be impossible to return the money back to the card. However, they will not be lost. The amount that you will be charged as a tax contribution for the next month will be reduced by their value.

Many self-employed people believe that they can return taxes in the same way as individuals return personal income tax: by submitting an application for a deduction for treatment, education, investments, etc. But this is a mistaken opinion. The tax on professional activities is a preferential regime, therefore legislators do not provide for the possibility of returning funds paid through any deductions. The tax paid by the self-employed is transferred to the Federal Tax Service without the possibility of reimbursement.

How to register

To start using this mode, you must register with the tax authority. To do this, you need to send an application to the tax authority in the prescribed form, a copy of your passport and your photo. If a self-employed person has a personal account on the Federal Tax Service website, then all you need to do is submit an application.

In addition, you can carry out the procedure through a mobile application. To do this, an electronic application is generated through it, the passport is scanned, and a selfie is used as a photo.

To submit documents, it is not required that the applicant has an enhanced qualified digital signature.

If registration is successful, a registration notification will be sent via the application no later than the next day.

The tax authority has the right to refuse registration if, when checking the documents, contradictions are revealed between them and the information that the tax authority itself has. However, information about such an error is deciphered, and the self-employed is asked to eliminate it and resubmit the documents.

Attention! The day of registration is the date on which the application was sent.

Are there other taxes?

No, self-employed people do not pay any other taxes, except for professional activity tax - neither PFDL, nor VAT, nor anything else. Also, self-employed people are exempt from paying pension and insurance contributions (and individual entrepreneurs, for example, are required to pay them).

However, a self-employed person can make contributions to the Pension Fund himself by purchasing pension points to increase his pension. The size of pension contributions is not limited in any way - you can pay either 1,000 rubles a month or 10,000 - it all depends on the financial capabilities (and desires) of the self-employed.

Tax holidays

Let's figure out what a “tax holiday” is».

Remember! In this case, we are talking about a program for self-employed citizens (residents and non-residents), under the terms of which these citizens:

- are exempt from taxes on their existing income until 01/01/2019;

- may not make insurance contributions “for themselves” until 01/01/2019.

The listed rights appear to citizens the moment they come to the tax office and register as self-employed persons.

Types of activities that these citizens can register:

- tutor services;

- cleaning of apartments and houses;

- caring for the sick and elderly, caring for small children.

Conditions that a program participant must comply with:

- no individual entrepreneur status;

- no hired workers;

- income comes only from individuals;

- services are provided for personal or household needs.

Let's sum it up

So, the tax that self-employed people pay is officially called occupational activity tax (OPT). It amounts to 4-6% of the income received by the self-employed for the sale of their goods or provision of services. The NPT is calculated automatically by the tax service based on the results of the past calendar month, based on the amount of checks generated by the self-employed in the “My Tax” application. Upon registration, a newly minted self-employed person is given a tax deduction in the amount of 10,000 rubles, which compensates for part of the tax and actually reduces the tax amount to 3-4%. After the deduction is exhausted, you will need to pay the entire amount accrued by the Federal Tax Service.

(Visited 383 times, 5 visits today)

Self-employed in the Russian Federation

Self-employedv.rf is an information portal for self-employed people. Relevant and interesting information, answers to important questions and solutions to non-standard problems of the self-employed.