The editors receive many letters from the heads of transport and construction companies that are updating their fleet of machinery and equipment. They are unanimous in their aspirations - to receive equipment for use in the shortest possible time, and make payments gradually. These are not speculative fantasies. Such acquisitions are possible both with the help of a bank loan and through a leasing transaction (financial lease). In this article, we will try to consider the possibility of purchasing machines through a leasing agreement from the position of the equipment purchaser (lessee organization).

Part 1 Part 2

The practice of leasing transactions shows that when purchasing vehicles and special equipment, most often the lessor (leasing company) has general requirements that are stipulated in the contract. The legal relations of the parties under a financial lease (leasing) agreement are regulated by paragraph 6 “Financial lease (leasing)” Ch. 34 “Rent” of the Civil Code of the Russian Federation, as well as Federal Law dated October 29, 1998 No. 164-FZ “On financial rent (leasing)”. According to Art. 665 of the Civil Code of the Russian Federation, under a financial lease agreement (leasing agreement), the lessor undertakes to acquire ownership of the property specified by the lessee from a seller identified by him and to provide the lessee with this property for a fee for temporary possession and use for business purposes.

In a leasing agreement, the section on the use of property always regulates the obligations of the lessee. All these requirements are quite objective: use the property strictly for its intended purpose, keep it in good repair, comply with the relevant standards, technical conditions, rules of technical operation and instructions of the manufacturer, carry out technical and repair maintenance of the property at your own expense and not make any design changes ( modifications) of property that worsen its quality and performance characteristics. The lessee may carry out structural changes (modifications) of the property at his own expense only with the written consent of the lessor. It is also impossible to sublease property without the written consent of the lessor. If the lessor agrees to carry out subleasing operations, responsibility for the safety of the property, as well as for the timely payment of lease payments, remains with the lessee.

The lessee also has obligations to fulfill the terms of the concluded agreement. In accordance with paragraph 5 of Art. 15 of the Federal Law of October 29, 1998 No. 164-FZ “On financial lease (leasing)”, he is obliged to accept the leased asset in the manner prescribed by the leasing agreement; pay lease payments to the lessor in the manner and within the terms provided for in the leasing agreement; upon expiration of the lease agreement, return the leased asset, unless otherwise provided by the specified leasing agreement, or acquire ownership of the leased asset on the basis of a purchase and sale agreement and fulfill other obligations arising from the contents of the leasing agreement.

According to paragraph 3 of Art. 17 of Law No. 164-FZ, maintenance of the leased asset, its major and current repairs must be carried out by the lessee, unless otherwise provided by the leasing agreement. In accordance with paragraph 1 of Art. 22 of Law No. 164-FZ responsibility for the safety of the leased asset from all types of property damage, as well as for the risks associated with its destruction, loss, damage, theft, premature breakdown, error made during its installation or operation, and other property risks with the moment of actual acceptance of the leased asset is also borne by the lessee, unless otherwise provided by the leasing agreement.

An integral part of the leasing agreement is the schedule of leasing payments, which stipulates the amount and procedure for their payment. The parties independently establish the method and frequency of payment of lease payments. This is stipulated in paragraph 2 of Art. 28 of Law No. 164-FZ. An important point of the leasing agreement is the identification of the “purchase price”. If the redemption price is not fixed in the agreement, then upon expiration of the agreement the parties enter into a purchase and sale agreement. The recipient of the property will take into account all lease payments in full for income tax as they accrue, and the redemption value of the property will be formed later.

When purchasing equipment through leasing, there are often cases when the leasing company is in a tight relationship with the company that sells this equipment and the insurance company.

Russian legislation establishes two options for accounting for leased property: depending on the terms of the agreement, the leased object can be recorded on the balance sheet of either the lessor or the lessee. In particular, such a norm is prescribed in paragraph 1 of Art. 31 of Law No. 164-FZ. The accounting and tax accounting of leasing operations by the lessee depends on the conditions for accounting for leased property. Moreover, the terms of the leasing agreement cannot establish that the leased property is taken into account in accounting on the balance sheet of one party, and in tax accounting by the other.

Documenting

The transfer of property for leasing can be formalized by an acceptance certificate in any form or using the unified forms No. OS-1, No. OS-1a, No. OS-1b, approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 No. 7. Deciding which forms will be applied in the organization, fix it in the accounting policy.

This procedure follows from the provisions of parts 1 and 4 of Article 9 of the Law of December 6, 2011 No. 402-FZ, paragraph 4 of PBU 1/2008 and paragraph 1 of Article 655 of the Civil Code of the Russian Federation.

Legal nuances

Both the lessor and the lessee have the right to terminate the leasing agreement early.

Article navigation

- Refund upon termination of the leasing agreement

- Unilaterally

- Notice of termination of contract

- At the initiative of the lessee

- At the initiative of the lessor

- Conclusion

According to the current legislation of the Russian Federation, leasing is one of the types of rental agreements. Accordingly, the relationship between the parties in such a transaction is regulated by the Civil Code. This makes it possible to apply general rules for concluding and terminating contracts.

For early termination of a leasing agreement, the consent of both parties is required. When one of the participants has legal grounds to terminate the fulfillment of obligations, he is obliged to inform the other party about this, describing the essence of the problem and the consequences of termination. The fact of cancellation of the transaction is recorded in writing. The document may also be needed when going to court. The package of documents for filing a claim is determined depending on the circumstances.

The Agreement terminates:

- on the initiative of one of the participants;

- by mutual agreement;

- upon expiration of the period.

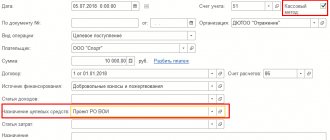

Accounting

Before the leased asset is placed on the balance sheet, the lessor must, in accordance with the general procedure, create expenses for its acquisition on account 08.

The initial cost is formed from the purchase price paid to the supplier of the fixed asset, the costs of delivering the object and bringing it into a condition suitable for use. This is reflected in accounting by the following entries:

Debit 08 Credit 60 (76) – the cost of property acquired for a fee for leasing is taken into account;

Debit 08 Credit 23 (26, 70, 76...) - reflects the costs associated with bringing the property to a state in which it can be transferred to the lessee for use.

Include the cost of paying state duty in the initial cost of the leased item. Do this if the responsibility for registering real estate is assigned to the lessor.

Determine the initial cost of the leased property based on:

- primary accounting documents (invoices, acceptance certificates, etc.);

- any other documents confirming the costs incurred (customs declarations, business travel orders, etc.).

For more information about this, see How to reflect the acquisition of fixed assets for a fee in accounting.

After the value has been formed, the leased asset must be reflected in accounting as a profitable investment in tangible assets in account 03. For the convenience of control over the movement of transaction objects, the lessor has the right to open corresponding sub-accounts to account 03:

- “Property intended for lease”;

- "Property transferred on lease."

Take into account the property intended for leasing in the amount of the cost of its acquisition:

Debit 03 subaccount “Property intended for leasing” Credit 08 – leased property is accepted for accounting as profitable investments in material assets.

The further procedure for accounting for leased property depends on where it is recorded:

- on the lessor's balance sheet;

- or on the balance sheet of the lessee.

Current legislation gives the parties the right to agree on whose balance sheet the leased asset will be accounted for (clause 50 of the Methodological Instructions approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n).

Income tax

When calculating the income tax base, the lessee has the right to increase its expenses by the amount of lease payments, which are included in other expenses associated with production and sales (subclause 10, clause 1, article 264 of the Tax Code of the Russian Federation).

However, when writing off expenses, there is a peculiarity associated with the transfer of ownership of the leased asset (redemption value). If the leasing agreement does not provide for the transfer of ownership of the leased asset to the lessee, but a purchase and sale agreement is drawn up, then there are no problems with the formation of the tax base for income tax. The lessee has the right to include in monthly expenses the entire amount of the lease payment in accordance with the terms of the leasing agreement on the basis of subclause 10 of clause 1 of Art. 264 Tax Code of the Russian Federation.

If the leased asset is owned by the lessor, the redemption value of the fixed asset will have to be excluded from the deductions written off as expenses. Expenses for the purchase of depreciable property do not increase the income tax base (clause 5 of Article 270 of the Tax Code of the Russian Federation). These are the costs that include the purchase price of the equipment. This means that it can be written off only gradually through depreciation, after the object has passed into the ownership of the lessee (Letter of the Ministry of Finance of Russia dated November 9, 2005 No. 03-03-04/4/348, dated May 24, 2005 No. 03-03-01- 04/1/288, dated April 8, 2005 No. 03-03-01-04/1/174 and dated October 26, 2004 No. 03-03-01-04/4/15 and Letter of the Federal Tax Service of Russia dated April 26. 2005 No. 02-1-07/40).

In the case where the redemption price is not determined by the leasing agreement, when the transfer of ownership of the leased asset to the lessee was provided for under the condition that during the leasing agreement lease payments were made on time and in full, as stipulated by the position of the Ministry of Finance of Russia (Letter of the Ministry of Finance of Russia dated 09.11.2005 No. 03-03-04/1/348). In particular, this Letter states that “if the leasing agreement stipulates that the leased asset becomes the property of the lessee after payment of all leasing payments without indicating the purchase price in the leasing agreement, the entire amount of leasing payments should be considered as an expense aimed at acquiring ownership rights to the leased asset, which is depreciable property, included in the initial cost of depreciable property after the transfer of ownership of it to the lessee.”

Let us recall that the accounting rules for transactions under a leasing agreement do not provide for any special procedure for reflecting the redemption price of leased property provided for as part of leasing payments.

In the next publication on this topic, we will consider cases when the leased asset is taken into account on the balance sheet of the lessee.

Property on the lessor's balance sheet

Document the operation of transferring property for leasing with the following entries:

Debit 03 subaccount “Property transferred to leasing” Credit 03 subaccount “Property intended to be transferred to leasing” - property was transferred to leasing.

This accounting procedure follows from paragraph 3 of the instructions approved by Order of the Ministry of Finance of Russia dated February 17, 1997 No. 15 (this document can be used to the extent that does not contradict later regulatory legal acts on accounting (letter of the Ministry of Finance of Russia dated July 3, 2007 No. 07-05-06/180)), and from the Instructions for the Chart of Accounts (account 03).

An example of reflecting the transfer of property for leasing in accounting. The property is recorded on the lessor's balance sheet

One of the activities of Alpha LLC is leasing. In January, Alpha purchased equipment and leased it (without repurchase). The cost of purchasing leased property amounted to RUB 967,000. (including VAT – RUB 147,508).

In January, the following entries were made in the organization’s accounting:

Debit 08 Credit 60 – 819,492 rub. (967,000 rubles – 147,508 rubles) – the costs of purchasing equipment are reflected;

Debit 19 Credit 60 – 147,508 rub. – VAT on purchased equipment is taken into account;

Debit 60 Credit 51 – 967,000 rub. – the cost of the equipment has been paid to the supplier;

Debit 03 subaccount “Property intended for leasing” Credit 08 – RUB 819,492. – equipment intended for leasing has been accepted for accounting;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 147,508 rub. – VAT is accepted for deduction on the cost of equipment;

Debit 03 subaccount “Property transferred for leasing” Credit 03 subaccount “Property intended for lease” – 819,492 rubles. – equipment is leased.

If leased property (usually worth more than 40,000 rubles) remains on the lessor’s balance sheet, charge depreciation on it.

This procedure follows from paragraph 21 of PBU 06/01, paragraph 50 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n.

Depreciation must be calculated starting from the month following the month in which the property was accepted for accounting as a fixed asset (that is, its value was reflected by the lessor on account 03) (clause 21 of PBU 6/01, clause 61 of the Methodological Instructions , approved by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n).

For more information on the procedure for calculating depreciation by the lessor, see:

- How can a lessor reflect leasing payments in accounting under a contract without repurchase;

- How can a lessor reflect leasing payments under a buyout agreement in accounting.

Value added tax

Value added tax on leasing payments is deductible from the lessee in full, regardless of whether the agreement provides for the transfer of ownership of the leased asset to the lessee. Even if the structure of the leasing payment provides for a redemption price, which is paid by the lessee during the leasing agreement, VAT on leasing payments is deductible in full.

This position is set out in Letters of the Ministry of Finance of Russia dated November 22, 2004 No. 03-03-01-04/1/128, dated November 9, 2005 No. 03-03-04/1/348. This is also confirmed by arbitration practice, for example, Resolution of the Federal Antimonopoly Service of the North-Western District dated 05.08.2005 No. A05-1981/2005-13. After January 1, 2006, the fact of payment of leasing payments is not important for the deduction of “input” VAT. The lessee has the right to deduct VAT on lease payments on a monthly basis based on invoices received from the lessor, regardless of the status of settlements with the lessor. But we must not forget that a prerequisite for deducting “input” VAT both before January 1, 2006 and after this date is the fact that goods (works, services) were accepted for accounting. Therefore, if advance payments are made under the terms of the leasing agreement, deduction is possible only as the tax periods to which the lease payments are made occur.

Tax differences

The difference in accounting and tax accounting for leasing lies in the different approach to the concept of expenses. In accounting, these are understood as regular payments under a finance lease, and NU is the amount of accrued depreciation. With a nonlinear (progressive or regressive) system of calculations between LD and LP, these values may not coincide - in practice this most often happens. Ultimately, at the end of the contract, they are equalized, but temporary differences between tax and accounting arise. They entail uneven fiscal obligations. The amounts of taxes according to accounting and NU do not match.

In particular, this situation arises already in the initial period of operation of leasing equipment, when the rental payment has already been made, and the accountant begins to calculate depreciation only from the next month after the facility is put into operation.

Experts recommend reducing the amount of temporary difference by subtracting depreciation from the lease payment when calculating income tax if the property is on the balance sheet of the company. In this case, the accountant may refer to subparagraph 10 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation.

Tax accounting of penalties under a leasing agreement

If one of the parties violates the terms of the leasing agreement, the counterparty has the right to impose financial sanctions. They can be spelled out in a special way in the text of the agreement, but in practice and by default they are accepted as one three hundredth of the discount rate of the Central Bank of the Russian Federation, accrued on the amount of debt for each overdue day. If the penalty, fine or penalty required by the creditor is beyond reasonable limits, the sanctions can be challenged in court.

In the tax accounting of the recipient of the penalty, it is taken into account in “other income.” Accordingly, like any other additional profit, it is taxed, regardless of what system the enterprise has adopted (STS, OSN).

Postings for penalties are reflected in the correspondence of accounts:

- Dt76 – Kt91.1 – accrual of a fine (forfeit, penalty);

- Dt51 – Kt76 – crediting funds to a bank account.

The payer of the penalty classifies it as other expenses:

- Dt91.2 – Kt76 – charging a fine;

- Dt76 – Kt51 – transfer of the amount of penalties from a bank account.

In this case, the profit tax base is reduced by the amount of the sanction, since in fact it represents losses.

Unilaterally

The full list of provisions under which either party has the right to unilaterally initiate termination of the agreement is regulated by Article 450 of the Civil Code of the Russian Federation. Unauthorized termination of fulfillment of obligations is fraught with penalties against the violator.

The party that decides to terminate the agreement is obliged to comply with the procedure for terminating the leasing agreement, according to which it is necessary to notify the counterparty in writing of its intention. This can be done either in person or by registered mail. The agreement is terminated upon receipt of the notification by the second party.

Notice of termination of contract

There is no established form for this type of request, but it must contain the following information:

- Information about the parties to the agreement.

- Number and date of conclusion of the contract.

- Violations committed by the other party and the time frame allocated for their elimination.

- Warning about possible legal action.

- Signature stamp.

- Warning about termination through the courts.

- Signature and seal of the sender.

It is recommended to submit the claim in two copies, keeping one copy for yourself.

Refund upon termination of the leasing agreement

In situations where termination of cooperation is planned, one of the most pressing topics is the full return of lease payments. Currently, there are two types of calculations:

- Monthly payments (rental cost and part of the property cost).

- The recipient pays only the rent, and the cost of the property is paid at the end of the term.

It is these nuances that affect the refund. But it is worth remembering that rental payments are made on a non-refundable basis. Only actual amounts paid for the value of the property are refundable.

The refund procedure is as follows:

- The initiator of termination informs the partner of his intention to terminate the agreement.

- The leased asset is returned to the lessor.

- Representatives of the parties conduct an inspection with the assistance of an expert, if necessary.

- The refund amounts are calculated.

- An agreement to terminate the leasing agreement is drawn up.

The parties can go to court only after attempts to resolve the issue out of court have not yielded a positive result. Having a statement of claim and a negative response from the second party in hand, you can demand payment of refunds in court.

The agreement to terminate the leasing agreement must contain:

- Number and date of conclusion of the contract.

- The amount to be refunded.

- Deadline for payments.

- Terms of settlement between counterparties.

- Recipient's payment details.

Let's look at an example:

A legal entity or individual entrepreneur needed a fleet of cars or an expensive cardboard production machine to develop their business.

The leasing company financed the necessary purchase of the leased asset. Everyone was happy. But after some time, due to the economic crisis in the country, the lessee began to have financial problems, and he stopped paying lease payments to the lessor for the ownership and use of the property.

Having missed several monthly payments in a row, the lessee was left without leased items. The leasing company seized them from the client. In turn, the indignant lessee wanted to return all the money that he had paid to the leasing company. This is a normal desire, but let’s finally figure out whether it’s that simple?

There are three myths that lessees believe in and which do not allow them to take a realistic look at the current situation.