Which BCCs are valid for individual entrepreneurs’ insurance premiums in 2021? Have new budget classification codes been introduced for entrepreneurs? What details should I include in payment slips for payment of fixed insurance premiums in 2021? To which BCCs should individual entrepreneurs pay their contributions for 2021? This material contains an overview of the CBC and useful tables. We also recommend that you read “Insurance premiums for individual entrepreneurs for themselves in 2021: new sizes.”

Changes from 04/23/2018 for individual entrepreneurs

Changes in the content of budget classification codes for expenses and income for insurance payments were regulated by Order of the Ministry of Finance of Russia No. 35n from 02/28/2018 to April 23, 2021. According to this Decree, the rules for attributing expenses to the corresponding types and subtypes of the code in relation to social policy have been changed. Thus, subclause 3.2 is supplemented with information that this paragraph reflects the costs of medical care, including insurance premiums for individual entrepreneurs in 2021. The BCC was changed in accordance with Order of the Ministry of Finance No. 255n, which established a new code for depositing funds in the amount of 1% for compulsory health insurance for IP for yourself. According to Decree No. 29n, these codes can be used from February 20 of last year.

But on April 23, 2018, the code was canceled and now businessmen who received an income of more than 300,000 rubles for 2021 pay 1% on compulsory pension insurance according to the previous coding for fixed contributions. Thus, the BCC for individual entrepreneurs in 2019 for themselves is 18210202140061110160.

How to calculate insurance premiums in 2018

From January 1, 2021, the minimum wage in Russia increased; it is now 9,489 rubles compared to 7,800 since July 1 of last year.

In theory, the minimum wage has increased, which means that insurance premiums paid will increase, since they depend on the amount of the minimum wage. But in 2021, the rules for calculating the payment of contributions will change. Does this mean that entrepreneurs will pay less ? Not at all! Can this happen in our country? No, we will pay more, but in a different way.

The whole point is that by 2021 they want to raise the minimum wage to the minimum subsistence level of a working person, which today is about 10,800 rubles .

I wonder if anyone from the government has tried to live on this amount per month? A rhetorical question, of course.

If this is done, then payments that are tied to the minimum wage will increase sharply, which will cause enormous dissatisfaction and non-payment of these payments. It’s okay when individual entrepreneurs pay only for themselves, without having employees. What if it has? What if not one or two, but ten, a hundred, a thousand? The economic situation is already bad, and employers will either close or go into the shadows.

Therefore, in 2021, it was decided to decouple the calculations of mandatory insurance contributions from the minimum wage indicator.

New amounts of contributions to the pension fund

Let's figure out how much you will pay as an individual entrepreneur.

- If your income does not exceed three hundred thousand rubles, then you are required to pay to the treasury - 26,545 rubles (versus 23,400 in 2017)

- If your income exceeds 300 thousand rubles, then add 1% of the income received over three hundred thousand to 26,545 rubles. Be careful, you pay 1% not on the entire income, but on the difference in income minus 300 thousand rubles .

Example:

In 2021 you will earn 800 thousand rubles. At the end of the calendar year, you must pay to the pension fund:

- fixed amount 26,545 rubles

- (800 000 — 300 000) × 0,01 = 5000 rubles

As a result, for the entire 2021 you will pay 31,545 rubles (26,545 + 5000)

That is, your final amount for 2021 will depend solely on your income. The higher it is, the more you will pay for yourself into the pension fund.

More on the topic: Step-by-step instructions on how to open an individual entrepreneur in 2021 on your own without intermediaries

Is the mandatory amount limited in OPS?

Yes, despite your income, the maximum base for calculating insurance premiums cannot exceed eight times the fixed amount, i.e. 26,545 * 8 = 212,360 rubles .

If you earn 30 million rubles, then according to the calculation formula you would have to pay (30,000,000 - 300,000) × 0.01 = 297,000 rubles . But since this amount is higher than the maximum, in this case you will pay 212,360 rubles . Well, thanks for that anyway.

In 2021, the maximum amount of this payment was 187,200 rubles. That is, in 2021 it increased by 25,160 rubles.

You must pay for yourself to the pension fund no later than December 31, 2021 , but you must pay 1% to the Pension Fund no later than July 1, 2021 .

New premiums for compulsory health insurance

The amount of contributions paid for compulsory health insurance will also change. In 2021, it was fixed in the amount of 5840 rubles . We remind you that a year earlier it was 4,590 rubles. And here we will pay more, as much as 1250 rubles .

You are required to pay contributions to compulsory medical insurance in any case, even if you did not conduct business activities. And payment must be made by December 31, 2021 .

When and where to pay

Individual entrepreneurs contribute funds for insurance to the Federal Tax Service at their actual location. For businessmen who pay contributions for themselves, payment deadlines are delimited depending on the annual profit received:

- up to 300,000 rubles - until December 31 of the current year;

- more than 300,000 rubles - before July 1 of the year that ended after the reporting year.

If a businessman interrupts work, then the money for insurance is transferred within 15 days from the date of deregistration with the Federal Tax Service. According to Art. 430 of the Tax Code of the Russian Federation, individual entrepreneurs have the right not to contribute money for insurance in five situations.

How were insurance premiums calculated in 2017?

The method of calculating contributions in 2021 will change greatly, so let's remember how it was. Previously, when calculating, we took into account:

- the minimum wage at the beginning of the calendar year (even after changing the minimum wage in the summer of 2021, the amount of contributions no longer changed);

- tariffs at which payments to the funds were made;

- period and terms of payment.

Contributions could also be paid once at the end of the calendar year. However, I always pay them every quarter; I don’t want to pay a large amount at once at the end of the year.

Taking these indicators into account, the entrepreneur paid:

- mandatory insurance payments “for yourself” (these payments were fixed and did not depend on the income received or without it at all);

- an additional contribution of 1% for an annual turnover of more than three hundred thousand rubles.

As a result, entrepreneurs in 2021 had to pay: 23,400 rubles (for pension insurance) + 4,590 (compulsory medical insurance) + 1% (if the amount of income is above 300 thousand rubles)

In 2021, the amount of all contributions could not exceed 187,200 rubles.

Fixed contributions

Contributions to compulsory health insurance and compulsory medical insurance for individual entrepreneurs for themselves, assigned to the Tax Code of the Russian Federation, are calculated in accordance with Art. 430 Tax Code of the Russian Federation. The calculation formula is uniform and depends on the current minimum wage, so the fixed insurance payment changes annually.

Table 1. Formulas for calculating insurance premiums for individual entrepreneurs for compulsory health insurance and compulsory medical insurance.

| Annual profit amount | On OPS | On compulsory medical insurance |

| up to 300,000 rubles | 1 minimum wage * 26% * 12 months | 1 minimum wage * 5.1% * 12 months |

| more than 300,000 rubles | 1 minimum wage * 26% * 12 months + 1% of the businessman’s total profit 300,000 rubles <, but not more than 8 minimum wage |

When paying the contribution amount for an annual income that exceeds the established norm, the businessman indicates in the payment slip the appropriate BCC for 1%. Over 300,000 rubles, the subtype code in the cipher changes. Thus, the amount of insurance premiums a businessman makes for himself with a profit of more than 300,000 in 2021 at a single percentage rate is calculated as much as possible using the formula:

8 minimum wage * 26% * 12 months.

To pay the assigned fee, you need to indicate the appropriate BCC. Individual entrepreneurs make a fixed payment for 2021 according to the codes from tables 2 and 2a.

Table 2. Payment codes for compulsory medical insurance and compulsory medical insurance for fixed payments for businessmen for themselves in the billing period before January 1, 2017.

| Name of payments | Annual profit | OPS | Compulsory medical insurance |

| Standard | up to 300,000 rubles more than 300,000 rubles | 18210202140061110160 18210202140061210160 | 18210202103081011160 |

| Penalty | 18210202140062100160 | 18210202103082011160 | |

| Fines | 18210202140063000160 | 1821020210308301116 |

Table 2a. Codings of payments for compulsory medical insurance and compulsory medical insurance for fixed payments for businessmen for themselves in the billing period after January 1, 2021.

| Name of payments | OPS | Compulsory medical insurance |

| Standard | 18210202140061110160 | 18210202103081013160 |

| Penalty | 18210202140062110160 | 18210202103082013160 |

| Fines | 18210202140063010160 | 1821020210308301316 |

General KBK table for paying contributions “for yourself”

Below is a summary table with all the necessary BCCs that may be required for individual entrepreneurs to pay fixed insurance premiums “for themselves” in 2021:

| Contributions | KBK 2018 |

| For pension insurance | |

| With an income of no more than 300,000 rubles. | 182 1 0210 160 |

| With income over 300,000 rubles. | 182 1 0210 160 |

| Penalty | 182 1 0210 160 |

| Fines | 182 1 0210 160 |

| For health insurance | |

| Contributions | 182 1 0213 160 |

| Penalty | 182 1 0213 160 |

| Fines | 182 1 0213 160 |

Amount of contributions for individual entrepreneurs for themselves in 2021

The calculation of the amount of contributions is legalized by the Tax Code of the Russian Federation and is also recorded in the formula. To deposit funds for a future pension, according to Art. 425 of the Tax Code of the Russian Federation, the amount of unsecured contributions is calculated based on annual income:

- up to 300,000 rubles - 20%;

- more than 300,000 rubles - 10%.

The applicable tariff for medical support for unsecured payments is 5.1%.

Fixed payments for future pensions and healthcare, which a businessman pays for himself in 2021, are calculated according to annual profit using the formula:

- OPS: up to 4 rubles;

- more than 300,000 - no more than 234,832 rubles;

Basis for calculating insurance premiums

Let us remind you that the mandatory contribution amount of 32,385 rubles (26,545 rubles for pension insurance and 5,840 rubles for medical insurance) is paid by all entrepreneurs. On any taxation system, with any income or loss, whether conducting or not conducting a real business. As soon as you have received the status of an individual entrepreneur, contributions begin to accrue to you, with the exception of some grace periods, which we will discuss below.

As for the additional contribution, the annual income that the entrepreneur receives is taken into account. Unfortunately, the procedure for calculating the base for paying this contribution established in the Tax Code can hardly be called fair.

The fact is that 430 of the Tax Code of the Russian Federation defines different procedures for accounting for income received by an entrepreneur, which depends on the chosen tax regime:

- for a simplified taxation system - sales and non-sales income excluding expenses;

- for the general taxation system - income received, reduced by business deductions;

- for the unified agricultural tax – sales and non-sales income excluding expenses;

- for a single tax on imputed income - imputed income calculated using the UTII formula;

- for the patent taxation system, the potential annual income specified in the law or local administration decree.

What is the result? Individual entrepreneurs on the simplified tax system Income minus expenses and unified agricultural tax have the largest base for calculating contributions - all income received excluding expenses. But these tax regimes are characterized by a high share of costs in revenue.

For example, a simplified wholesaler receives a sales income of 130 million rubles, but taking into account the costs of purchasing goods (let’s assume 110 million rubles), his real income is only 20 million rubles. Moreover, he must be charged a single tax on 20 million rubles, and an additional insurance premium on 130 million rubles. Agricultural tax payers find themselves in a similar situation.

This approach to calculating the base for an additional contribution has already been recognized by courts many times as unfair. And in private, payers of the simplified tax system Income minus expenses and the unified agricultural tax may well challenge in court the assessment of an additional contribution on all income without taking into account expenses. But if we talk about the general case, the Ministry of Finance and the Federal Tax Service categorically do not accept this option.

Once upon a time, payers of the general system also found themselves in the same situation - they also did not have their income reduced for business deductions. But after the Constitutional Court of the Russian Federation intervened in this story, the necessary changes were made to the Tax Code.

And a few words about UTII and PSN. In these regimes, the tax is calculated based not on the actual income received, but on the one calculated in advance by the state. It often turns out that the real income of entrepreneurs is greater than the established one, so the additional contribution is small.

Prepare a simplified taxation system declaration online

Generating a receipt for payment of contributions

Due to the fact that significant changes have taken place in the Tax Code, individual entrepreneurs will not be able to pay for the tax on receipts from previous years, since the recipient is now not the Pension Fund of Russia, but the Federal Tax Service. In order for an individual entrepreneur to receive an up-to-date payment document, he needs to:

- Go to the tax office website and use the “Pay taxes” service.

- Next, you need to click on the inscription “Fill out a payment order”. The individual entrepreneur will be faced with the task of choosing the type of taxpayer (IP) and the type of payment document (“Payment document”), which he can do without difficulty. It is worth noting separately that here you can not only pay for the CB, but also transfer the DS to pay off fines and penalties.

- After filling out the payment document type, you need to fill in the payment type. To do this, you will need to enter the correct BCC numbers and select the desired payment name from the drop-down list. After selecting the name of the payment, it becomes necessary to select the type of payment, which can also be done without much effort, knowing which SV is going to pay the individual entrepreneur.

- The next point is to indicate the tax office code and municipality. If an individual entrepreneur enters the registration address according to his passport, these columns will be filled in automatically, so theoretically the entrepreneur may not even know this information.

- Next, you should fill in the details of the payment document. The person’s status appears automatically (IP with code “09”). The entrepreneur only needs to select the basis for payment from the list that will open. In this case, we are talking about current year payments (TP), which we are going to pay in 2021.

- In order to correctly indicate the tax period for an individual entrepreneur, you need to select the “Annual payments” column, and then select the current year.

- After filling out these fields, all that remains is to indicate the required amount. In this case, the number can be any depending on the situation.

- After filling out the details of the payment document, you need to print the individual entrepreneur data. To complete this task, you need to indicate your last name and first name, as these are required fields. In this case, it is not necessary for the individual entrepreneur to indicate his patronymic and tax identification number, and the address of the place of residence will be filled in automatically if you check the box “Coincide with the address of the taxable object.”

- After checking all the data, click on the red “Pay” button. If the individual entrepreneur enters his TIN correctly, the system will allow you to pay the receipt electronically. And also the entrepreneur can print the document and pay for it in any other way.

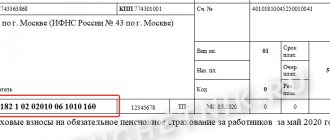

Payment document for payment of contributions to OPS IP

The process of generating a document for payment of SV will be the same for both payment of the compulsory health insurance contribution and the compulsory medical insurance contribution. The only difference will be in the choice of payment type and BCC.

Payment document for payment of compulsory health insurance premiums for individual entrepreneurs

Consequently, an individual entrepreneur can independently generate a receipt for payment of fiscal payments, without resorting to outside help, since the likelihood of an error when filling out this document is reduced to zero. It is worth noting that the Federal Tax Service website provides a system of tips when using this service, so it is very convenient to use.

Details for paying insurance premiums for injuries in 2021.

As for insurance premiums for injuries, their administrator remains the Social Insurance Fund. In this regard, the FSS details for paying insurance premiums in this category in 2021 have not changed.

When generating a payment order, you must indicate code 08 in the “Payer Status” column, and use previously established codes for the KBK. In the “Recipient” column (field 16) you need to enter the name of the Territorial Social Insurance Fund, and in fields 61 and 103 - its TIN and checkpoint. In fields 13-15 and 17, intended for bank details, the same values are entered as previously used (before 2017). When sending current payments for contributions “for injuries” or to pay off debts on them on personal initiative, you must enter zeros in fields 106-109.

See below for a sample of filling out a payment order for these insurance premiums.

Details for payment to the Pension Fund in Moscow

The PFR details for metropolitan payers will be as follows:

- Recipient – UFK in Moscow (for GU – branches of the Pension Fund of the Russian Federation in Moscow and the Moscow region)

- Recipient's bank – Branch 1 of the Moscow State Technical University of the Bank of Russia, Moscow 705

- INN – 7703363868

- Checkpoint – 770301001

- BIC – 044583001

- Current account – 40101810800000010041

Trade tax - concept and grounds for payment

Not all entrepreneurs are yet familiar with the concept of “trade tax”. A trade tax for individual entrepreneurs is a fixed mandatory payment that is levied on a specific object of trade and is introduced by the executive power of a specific federal subject of the Russian Federation (for example, Moscow today is the pioneer of this movement) . Trading entrepreneurs in St. Petersburg and other large cities should prepare for this gathering.

Legal entities and individual entrepreneurs who:

- trade through stationary retail outlets (with or without a sales area);

- sell goods through non-stationary objects (including through delivery and distribution trade);

- have the status of a management company (MC) of the retail market.

Trade tax may be imposed by regional authorities

There are also entrepreneurs and organizations exempt from this obligation, these include:

- Individual entrepreneurs who operate under a patent (technically, this contribution is included in the cost of the patent for businesses);

- Unified Agricultural Tax payers;

- a business operating on the Internet that does not have personal contact with the consumer;

- a business that trades through vending machines (selling small piece goods);

- Individual entrepreneurs working at fairs (one-time ones) and carrying out sales on the territory of retail markets (they are paid for by management companies, which, in turn, collect a fee from entrepreneurs indirectly through a place fee);

- entrepreneurs who are engaged in peddling trade in the premises of autonomous, budgetary and government institutions (including ticket sellers, newspaper peddlers, as well as those who sell religious objects in churches and church shops).

The cost of a vehicle largely depends on the type of trading activity, physical characteristics, as well as the location of the facility. The period for making payments for the trade fee is quarterly, until the 25th day after the end of the quarter.

The merchant must independently register with the tax authority as a payer of the trade tax.

Please note: as the regulator states, paying a trade tax will not increase the tax burden on entrepreneurs. The entire amount of the fee must be deducted from the amount of tax that the individual entrepreneur pays based on the regime he applies - a single simplified tax or personal income tax. But a business that operates on UTII cannot combine imputation and trade tax. When introducing a trade tax for individual entrepreneurs with UTII, you will have to switch to another regime.

KBK for payment of trade tax

| Purpose | KBK |

| Trade tax paid in the territories of federal cities | 182 1 0500 110 |

| Penalties for vehicles | 182 1 0500 110 |

| Interest | 182 1 0500 110 |

| Fines | 182 1 0500 110 |

Taxes, contributions, fees - all this falls on the shoulders of entrepreneurship with a heavy burden every year. If you don’t have time to pay one amount, the next payment is due. And if you miss something on payment, debts begin to grow like a snowball. In the current situation, businesses need not only to strictly control their payments, but also to have information about what can be done to ease tax and insurance burdens.

- Author: Ellina Rozhkova

49 years old, higher education (philologist, journalist, marketing). I have experience working both in individual entrepreneurship and in large corporate businesses. Rate this article:

- 5

- 4

- 3

- 2

- 1

(0 votes, average: 0 out of 5)

Share with your friends!

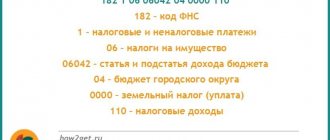

How to read KBK

The code is a combination of 20 digits, divided into groups. Moreover, each group of numbers has a specific meaning.

Let's try to figure it out with an example. In general, the KBK has the format: XXX - X XX XX XXX XX - XXXX - XXX.

The first group of numbers indicates the payee.

If the code starts at 182, this means that the recipient of your payment is the tax office, if at 393 it is the Social Insurance Fund (FSS).

The largest group of numbers - from 4 to 13 - indicate the type of income. The fourth digit in the code indicates the group. The next two characters indicate the type of payment.

For example, 01 - income tax, 03 - excise taxes, 08 - state duties, 13 - fees for government services.

Signs 7 to 11 indicate the item and subitem of income; they are marked strictly according to the classification of income of the budget of the Russian Federation, which can be found here. The last two characters in the second group indicate the budget into which the funds should go. The federal budget is designated by numbers 01, regional - 02.

The third group consists of four characters, which are used to divide budget revenues into taxes (1000), penalties (2100) and fines (3000).

And the last group, consisting of three characters, means the income category.

Money received as payment of taxes is indicated by the numbers 110, the income of a government department from the provision of paid services is 130, and the combination of numbers 140 means amounts that were forcibly seized.

Deciphering the KBK is not difficult if you know the basic principles of its formation