Payment

Home — Articles I purchased a car and signed an agreement on February 11, 2010

Workwear is part of the employee's personal protective equipment (PPE). This is actually special clothing, special shoes

Cases of failure to submit reports to the Federal Tax Service are not that rare. They may be due

The need for accounting and accounting policies The basic provisions on the rules of accounting are contained

Let’s define the problem. Literally every company or businessman knows that, along with tax and accounting

Organizations and individual entrepreneurs are required to perform the functions of a tax agent, i.e. withhold personal income tax on each payment

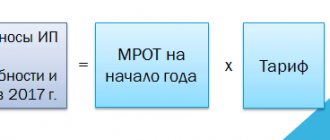

Insurance premiums refer to those payments made for their employees by individual entrepreneurs and legal entities.

Carrying out an inventory of settlements refers to one of the stages of the mandatory inventory of property and liabilities carried out by

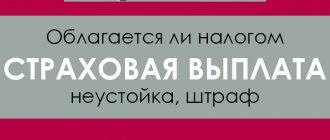

Financial liability is the duty of a citizen, in the event of damage to another person, to compensate for it. Order

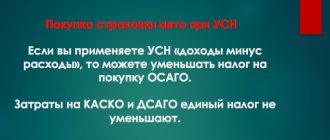

Costs for compulsory motor liability insurance relate to other expenses for ordinary activities. Enterprises on the simplified tax system “Income