Payment

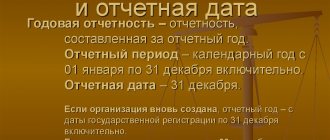

Forms of annual financial statements Balance sheet (form No. 1); Report on the financial results of the enterprise (reporting form

While working in the organization, employees are rewarded for a number of indicators. They can receive bonuses monthly,

Employer reporting Natalya Vasilyeva Certified tax consultant Current as of November 27, 2019 Based on the results

Why do we need tax accounting? Each type of accounting is focused on its purpose. The result of the work of accountants

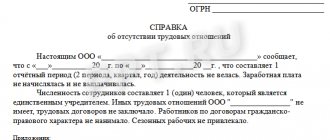

Business lawyer > Accounting > Primary documents > Letter to the tax office about absence

Good afternoon, dear colleagues. At the beginning of 2021, the Internet was blown up by numerous videos where

There are a lot of non-cash payments going on in Russia these days. They have become common practice. This

What taxes have to be calculated in Russia? In any country there are many types of tax

The only reporting period established by Federal Law dated December 6, 2011 No. 402-FZ “On Accounting” is

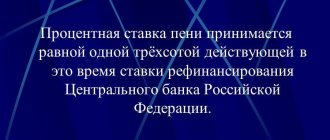

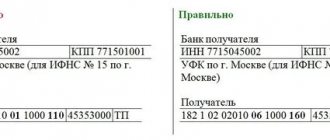

Deadline for transferring the single tax to KBK in 2017 Payers of the simplified tax system must calculate quarterly