Certificate of tax residence

A certificate of tax residency of both a legal entity and an individual is documentary evidence of the fact that this person has the status of a tax resident of the Russian Federation. The official name of such a certificate is “Confirmation of permanent residence in the Russian Federation.”

Important! A resident, in turn, is understood as a legal or natural person registered in a specific location in a specific country, for example, a resident of the Russian Federation.

This status is necessary for certainty in the payment of taxes to the budget of a particular state. At the same time, when determining the status of an individual, his stay in the Russian Federation for 183 days over a consecutive 12 month period .

This period will not be interrupted if the person stays outside the Russian Federation for less than 6 months for the purpose of treatment, training, work or provision of certain services (

What documents can confirm the fact of a person’s presence on the territory of the Russian Federation?

- Data from the time sheet;

- Copies of passport pages with marks from border control authorities about the time of border crossing;

- Documents on registration at the place of residence or place of stay, drawn up in accordance with the procedure established by the legislation of the Russian Federation;

- Information from migration cards.

As a result of this procedure, at the end of the year, a situation is likely where the tax status of the taxpayer will change, for example, he will acquire the status of a tax resident of the Russian Federation, and the amount of personal income tax will need to be recalculated.

To recalculate, at the end of the tax period, you must submit to the tax authority a tax return and documents confirming the tax status of the taxpayer in a given year. In this case, the tax authority makes a recalculation (Article 78, clause 1.1 of Article 231 of the Tax Code of the Russian Federation) and returns the overpaid amount of personal income tax in connection with the acquisition by a person of the status of a tax resident of the Russian Federation.

Normative base

The procedure for confirming tax residence status was approved by order of the Federal Tax Service of Russia No. ММВ-7-17 / [email protected] dated 07.11.2017. The same order approved the application form for obtaining status, as well as methods for submitting it to the tax authority. A resident document is issued by the Federal Tax Service of the Russian Federation or an authorized territorial tax authority . Let us remind you that until the end of 2021 it was possible to obtain a certificate only in one place - MI Federal Tax Service for Data Center (Interregional Inspectorate of the Federal Tax Service for Centralized Data Processing).

Association of International Road Carriers

It will be possible to obtain a document confirming your Russian tax resident status faster.

Information from the Federal Tax Service dated October 18, 2021 “The Federal Tax Service of Russia has reduced the period for issuing documents confirming the status of a tax resident of the Russian Federation.” From October 22, 2021, the time period for issuing a document confirming the status of a tax resident of Russia is being reduced. The processing time for electronic applications is 10 days, and for paper applications - 20 days. The procedure for issuing a document has been accelerated and made possible thanks to the “Confirmation of tax resident status of the Russian Federation” service.

From July 1, 2021, tax authorities are required, at the request of the taxpayer, to provide the taxpayer (his representative) with a document in electronic form or on paper confirming the status of a tax resident of the Russian Federation, in the manner, form and format approved by the Federal Tax Service of Russia (clause 16 clause. 1 Article 32 of the Tax Code of the Russian Federation).

Order of the Federal Tax Service of Russia dated November 7, 2017 N ММВ-7-17/ [email protected] defines the form and procedure for issuing a document confirming the status, as well as the form of an application for its issuance.

According to the Information of the Federal Tax Service of Russia dated January 16, 2018, you can submit an application and receive a document in PDF format confirming your tax resident status on the official website of the Federal Tax Service of Russia through the electronic service “Confirmation of the status of a tax resident of the Russian Federation.”

Order of the Federal Tax Service of November 7, 2021 N ММВ-7-17/ [email protected] “On approval of the application form for the submission of a document confirming the status of a tax resident of the Russian Federation, the form of a document confirming the status of a tax resident of the Russian Federation, procedure and format its presentation in electronic form or on paper"

In accordance with paragraph 4 of Article 31 and subparagraph 16 of paragraph 1 of Article 32 of the Tax Code of the Russian Federation (Collection of Legislation of the Russian Federation, 1998, No. 31, Article 3824; 2006, No. 31, Part 1, Article 3436; 2014, No. 45 , Article 6157; 2015, No. 18, Article 2616; 2016, No. 49, Article 6844; 2021, No. 30, Article 4453) and subclause 5.9.37 of clause 5 of the Regulations on the Federal Tax Service, approved by decree of the Government of the Russian Federation dated September 30, 2004 N 506 “On approval of the Regulations on the Federal Tax Service” (Collected Legislation of the Russian Federation, 2004, N 40, Art. 3961; 2015, N 15, Art. 2286; 2021, N 29, Art. 4375) , I order:

1. Approve:

an application form for the submission of a document confirming the status of a tax resident of the Russian Federation, in accordance with Appendix No. 1 to this order;

the form of a document confirming the status of a tax resident of the Russian Federation, in accordance with Appendix No. 2 to this order;

the procedure for submitting a document confirming the status of a tax resident of the Russian Federation, in accordance with Appendix No. 3 to this order.

2. Establish that in electronic form a document confirming the status of a tax resident of the Russian Federation is sent in PDF format.

3. The heads (acting heads) of the departments of the Federal Tax Service for the constituent entities of the Russian Federation should bring this order to the attention of lower tax authorities and ensure its application.

4. Control over the implementation of this order is entrusted to the deputy head of the Federal Tax Service, who coordinates the work on methodological and organizational support for the work of the Federal Tax Service of Russia and territorial tax authorities on the application of international treaties of the Russian Federation on the avoidance of double taxation.

| Head of the Federal Tax Service | M.V. Mishustin |

Registered with the Ministry of Justice of the Russian Federation on November 27, 2021 Registration No. 49015

Appendix No. 3 to the order of the Federal Tax Service of Russia dated 07.11.17 N ММВ-7-17/ [email protected]

The procedure for submitting a document confirming the status of a tax resident of the Russian Federation

1. This Procedure establishes the procedure for submitting a document confirming the status of a tax resident of the Russian Federation, in accordance with subparagraph 16 of paragraph 1 of Article 32 of the Tax Code of the Russian Federation (hereinafter referred to as the Code) (Collected Legislation of the Russian Federation, 1998, No. 31, Art. 3824; 2006 , N 31 (part 1), Article 3436; 2021, N 49, Article 6844; 2021, N 30, Article 4453) and subclause 5.9.37 of clause 5 of the Regulations on the Federal Tax Service, approved by the Decree of the Government of the Russian Federation dated September 30, 2004 N 506 “On approval of the Regulations on the Federal Tax Service” (Collection of Legislation of the Russian Federation, 2004, N 40, Art. 3961; 2015, N 15, Art. 2286; 2021, N 29, Art. 4375) for organizations, individuals who are individual entrepreneurs, individuals who are not individual entrepreneurs (hereinafter referred to as taxpayers).

2. The status of a tax resident of the Russian Federation is determined in accordance with Articles 207 and 246.2 of the Code (Collected Legislation of the Russian Federation, 1998, No. 31, Article 3824; 2001, No. 1 (Part 2), Article 18; 2006, No. 31 ( Part 1), Article 3436; 2013, No. 40 (Part 3), Article 5038; 2014, No. 48, Article 6660; 2015, No. 24, Article 3377; 2021, No. 7, Article 920; 2021, N 15 (part 1), article 2133; N 30, article 4453).

3. Confirmation of the status of a tax resident of the Russian Federation is carried out by issuing the Federal Tax Service of Russia or the territorial tax authority authorized by it (hereinafter referred to as the authorized tax authority) of a document confirming the status of a tax resident of the Russian Federation, in the form according to Appendix No. 2 to this order.

4. A document confirming the status of a tax resident of the Russian Federation is issued to the taxpayer (his representative (1)) on the basis of an application for the submission of a document confirming the status of a tax resident of the Russian Federation (hereinafter referred to as the Application). Documents on facts and circumstances requiring confirmation of the taxpayer’s status as a tax resident of the Russian Federation may be attached to the Application.

5. Application (2) is submitted to the Federal Tax Service of Russia or the authorized tax authority by the taxpayer or his representative on paper in the form in accordance with Appendix No. 1 to this order in one of the following ways chosen by him:

personally;

by mail;

in electronic form through the official website of the Federal Tax Service of Russia on the Internet information and telecommunications network https://www.nalog.ru.

6. The period for consideration of the Application is 40 calendar days from the date of its receipt by the Federal Tax Service of Russia or the authorized tax authority.

7. A document confirming the status of a tax resident of the Russian Federation is issued for one calendar year (preceding the day of submission of the Application to the tax authority or the current calendar year).

For the purposes of applying international treaties of the Russian Federation on the avoidance of double taxation, a document confirming the status of a tax resident of the Russian Federation is issued for each source of income and property.

8. The issuance of a document confirming the status of a tax resident of the Russian Federation is made based on the results of consideration of the Application if there are documents on facts and circumstances requiring confirmation of the status of a tax resident of the Russian Federation and is issued on paper in the form according to Appendix No. 2 to this order or in electronic form in PDF format.

A document confirming the status of a tax resident of the Russian Federation is sent to the taxpayer or his representative depending on the method of receiving the document chosen by him:

on paper by mail;

in electronic form through the official website of the Federal Tax Service of Russia on the Internet information and telecommunications network https://www.nalog.ru.

9. The fact of issuing a document confirming the status of a tax resident of the Russian Federation can be confirmed by entering the verification code contained in the document specified in paragraph 7 of this Procedure in the service on the official website of the Federal Tax Service of Russia on the Internet information and telecommunications network https:/ /www.nalog.ru.

10. If, based on the results of consideration of the Application, the status of a tax resident of the Russian Federation is not confirmed, the taxpayer (his representative) is informed about this in the method chosen by the taxpayer (his representative) to receive a document confirming the status of a tax resident of the Russian Federation.

_____________________________

(1) Hereinafter, the powers of the taxpayer’s representative are documented in accordance with Articles 27 and 29 of the Code (Collected Legislation of the Russian Federation, 1998, No. 31, Art. 3824; 1999, No. 28, Art. 3487; 2003, No. 27 (Part. 1), Article 2700; 2009, No. 30, Article 3739; 2011, No. 47, Article 6611; 2021, No. 30, Article 4453), as well as Articles 182 and 185 of the Civil Code of the Russian Federation (Collection of Legislation of the Russian Federation , 1994, No. 32, Article 3301; 2013, No. 19, Article 2327; 2021, No. 31 (part 1), Article 4808).

(2) The taxpayer has the right to attach to the Application documents confirming his status as a tax resident of the Russian Federation.

Information from the Federal Tax Service dated January 16, 2021 “ You can now confirm your status as a tax resident of the Russian Federation in an electronic service”

On January 16, 2021, the electronic service of the Federal Tax Service of Russia “Confirm the status of a tax resident of the Russian Federation” was launched.

You can register in the service using email or TIN with a password from the personal account of an individual.

The service allows individuals, individual entrepreneurs and legal entities to quickly create an application and receive a document in PDF format confirming the status of a tax resident of the Russian Federation. In this case, the user only needs to send an application; additional documents are optional. To obtain a document confirming the status of a tax resident of the Russian Federation on paper when creating an application, you must o.

Using the service, you can also track in real time the status of consideration of an application from the moment of its registration with the Federal Tax Service of Russia.

A document confirming the status of a tax resident of the Russian Federation now has a unique verification code, which is generated automatically for each document. With its help, in a special section of the service “To all interested parties” you can check whether a document confirming your tax resident status was actually issued.

In 2021, the Federal Tax Service of Russia issued more than 32 thousand documents confirming the status of a tax resident of the Russian Federation, which is 6% more than in 2021 and 14% than in 2015. The electronic service will significantly simplify the procedure for taxpayers to confirm their tax status. In addition, tax agents and competent authorities of foreign countries will now be able to check confirmation of the status of a tax resident of the Russian Federation on the Internet using a verification code.

The service was developed in accordance with subparagraph 16 of paragraph 1 of Article 32 of the Tax Code of the Russian Federation and order of the Federal Tax Service of Russia dated November 7, 2017 N ММВ-7-17/ [email protected] “On approval of the application form for the submission of a document confirming the status of a tax resident of the Russian Federation, the form of the document confirming the status of a tax resident of the Russian Federation, the procedure and format for its submission in electronic form or on paper.”

Order of the Federal Tax Service of December 26, 2021 N ММВ-7-17/1093 “On the transfer of powers to the Interregional Inspectorate of the Federal Tax Service of Russia for centralized processing of data to issue documents confirming the status of a tax resident of the Russian Federation, in electronic form or on paper”

In accordance with subparagraph 16 of paragraph 1 of Article 32 of the Tax Code of the Russian Federation (Collection of Legislation of the Russian Federation, 1998, N 31, Art. 3824; 2021, N 49, Art. 7315), as well as the order of the Federal Tax Service of Russia dated November 7, 2017 N MMV- 7-17/ [email protected] “On approval of the application form for the submission of a document confirming the status of a tax resident of the Russian Federation, the form of a document confirming the status of a tax resident of the Russian Federation, the procedure and format for its submission in electronic form or on paper” (registered by the Ministry Justice of the Russian Federation 12/09/2017, registration number 49015) I order:

1. Establish that the authorized territorial tax authority of the Federal Tax Service for issuing documents confirming the status of a tax resident of the Russian Federation, in electronic form or on paper, is the Interregional Inspectorate of the Federal Tax Service of Russia for centralized data processing.

2. Entrust control over the implementation of this order to the deputy head of the Federal Tax Service, who coordinates the work on methodological and organizational support for the work of the Federal Tax Service of Russia and territorial tax authorities on the application of international treaties of the Russian Federation on the avoidance of double taxation.

| Head of the Federal Tax Service | M.V. Mishustin |

Electronic service address: https://service.nalog.ru/nrez/

Contacts

Physical adress:

125373, Moscow, Pokhodny proezd, building 3

Legal address:

125373, Moscow, Pokhodny proezd, building 3

Telephone:

reception of the head of the inspection +7 Help desk +7 Contact center of the Federal Tax Service of Russia 8-800-222-2222

Fax machine:

+7

Boss:

Shcheverov Andrey Yurievich

Why do you need a tax residence certificate?

Important! Typically, a tax residence certificate is required in cases where a person (legal or individual) begins any cooperation with foreign companies.

For an individual, this certificate will serve as a basis for avoiding double taxation. And for legal entities, a certificate is needed when working with organizations from other countries. Thus, confirmation of status and receipt of a certificate will be required in the following cases:

- When a Russian company provides services to a foreign company (sale of goods). In this case, in order to avoid double taxation, the foreign company requests confirmation of its status from the Russian organization.

- In case of provision of services to a foreign company by an individual entrepreneur or an individual. In order to avoid double taxation, a foreign company requests this certificate from an individual.

- When a Russian organization or individual receives income from participation in the activities of a foreign company (the participant receives income in the form of dividends).

- For submission to a foreign authority upon appropriate request.

Determination of residence by indirect evidence

If the above conditions are not enough to identify the company as a resident/non-resident, or information to verify the specified conditions is not available, residence can be verified by indirect signs, including:

- by personal account number assigned by the Central Bank;

- by tax identification number or checkpoint;

- using electronic services from the Federal Tax Service.

By current account number

Perhaps the surest way to check a counterparty for residency is to analyze his bank account. Thus, any organization to conduct commercial activities in the Russian Federation is required to have its own current account. The currency of such an account does not matter; its structure is much more important.

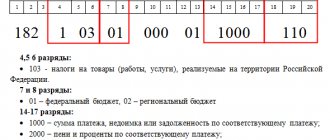

Thus, each current account has a twenty-digit code and its own structure, presented in the format “АААА-BBB-C-DDDD-EEEEEEE” - the sign of a resident or non-resident company is “hardwired” into it. As you can see, the structure of such an account is divided into groups, where the first 5 digits (AAAA) refer the specified account to a certain group of bank balance sheet accounts provided for by Central Bank Regulation No. 579-P dated February 27, 2017.

It, in turn, can be divided into first-order (AAA) and second-order (AA) accounts. Analysis of this provision allows us to clearly determine which specific bank balance sheet accounts will belong to non-resident individuals and legal entities.

All current accounts, including first-order account “408” and second-order accounts 04-09, 12, 14, 15, 18, are assigned exclusively to non-residents.

By TIN

Each company wishing to conduct commercial activities in the Russian Federation must be identified for tax purposes - for this purpose, each of them is assigned a TIN, regardless of their place of registration. In accordance with the order of the Federal Tax Service No. MMV-7-6/ dated June 29, 2012, the structure of an organization’s taxpayer number consists of a ten-digit code presented in the format “AAAA-BBBBB-S”, where:

- AAAA – index determined by the Federal Tax Service during registration;

- BBBBB – code of a foreign organization;

- C – verification number.

As a rule, any foreign organization, upon initial registration with the Federal Tax Service, starting in 2005, receives an index (AAAA) in the form of code “9909,” denoting the Interregional Inspectorate of the Federal Tax Service, where it is registered. Thus, any company whose TIN begins with the specified numbers will be foreign.

But, as we know, foreign status does not determine residency - with a high degree of probability, an individual entrepreneur may turn out to be a resident; the TIN of non-resident legal entities does not have any key differences. For accurate determination, other sources must be used.

By checkpoint

Another identifier of a legal entity, assigned within the same time frame as the TIN, is the reason for registration code (RPC). It consists of a nine-digit code in the format “AAAA-BB-SSS”, where “BB” is precisely the reason for registration. In accordance with clause 5 of the Procedure, approved. By order of the Federal Tax Service No. ММВ-7-6/, the numerical value of “BB” for a foreign organization is expressed as a number from 51 to 99.

Thus, like the TIN, the organization’s checkpoint number allows us to determine the foreign origin of the enterprise, but not its residence.

Check using the electronic service of the Federal Tax Service

Another sure way to check a counterparty is the electronic service from the Federal Tax Service. By clicking on the link, readers will have access to a search system for open and publicly available information from the Unified State Register of Real Estate on foreign enterprises registered in the Russian Federation.

To use this service, it is enough to use the name of the company, its INN/KPP or the actual location address.

Based on the result, the user is provided with:

- full name of the foreign enterprise;

- the name of its representative office, if it operates in the Russian Federation;

- TIN and checkpoint;

- status, whether registered or not at the moment;

- Federal Tax Service body where the foreign enterprise is/was registered.

As we can see, information about residency is also not provided. However, information about the tax authority allows you to contact him and make some inquiries, which in some cases may be convenient.

Apostille on the certificate

It is important to remember that a residence certificate is always intended for other countries, which means that in order to understand the contents of such a document, it must be drawn up in an understandable language. For this purpose, an apostille is affixed to the certificate. It is affixed to a copy of the certificate, which is certified by a notary, but only if the country for which this certificate is intended is a party to the Hague Convention . Otherwise, the apostille will not be affixed, but a legalization procedure will be required.

Procedure for obtaining a tax residence certificate

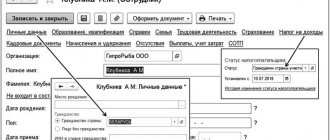

Until recently, there was no special application form that companies, individual entrepreneurs and other individuals had to submit to the tax authority. It had to be compiled in free form. But from December 9, 2021, the application must be submitted in a form approved by the Federal Tax Service (KND 1111048). The application contains the following information:

- name of the organization (if the application is submitted by an individual or individual entrepreneur, then his full name);

- periods of time for which the applicant needs a certificate (for example, for the past year or several years);

- the reason for issuing the certificate (required in the case of application of bilateral international treaties or for other purposes);

- duration of stay of an individual entrepreneur or other individual in the Russian Federation;

- the grounds on which a person (legal or individual) can be considered a tax resident of the Russian Federation;

- information about the identity document (indicated if there is no TIN).

Differences in the statuses of residents and non-residents of the Russian Federation

The key differences between these statuses are:

- The rates of taxes on income and profit (for individuals and legal entities, respectively);

- List of objects of taxation;

- The procedure for determining the tax base;

- Possibility of providing tax deductions;

- The procedure for calculating income or profit tax.

Bet sizes

For residents (individuals and legal entities), the rate is limited to 13 and 20%, respectively. For non-residents of both categories, the rate is 30%. However, in some cases, the rate may be reduced for non-residents.

You may also like

1

Finding suitable work with temporary residence permits in the Russian Federation

2 648

The conditions for this are:

- Belonging to a certain category of taxpayers, including: crew members of sea vessels, migrants, refugees, workers with a labor patent, holders of the status of a high-qualified specialist, citizens of the EAEU. The personal income tax rate for these persons is 13%;

- Carrying out investment activities. The tax rate on income received as a result of investing in Russian organizations can be reduced to 15%.

Objects of taxation

Residents are required to declare and pay taxes on all income, incl. received from abroad. The object of taxation for non-residents is only income received in the Russian Federation.

The tax base

For residents, the tax base is calculated on an accrual basis with consistent monthly accrual for all income received. For non-residents – it is determined only by the amount of income received over the past month.

Providing deductions

Residents, subject to legally established grounds, may be provided with a certain tax deduction. This option is not available for non-residents.

Calculation order

For residents, the tax amount is calculated sequentially - from the beginning of the calendar year, with an increase in the total based on the results of each past month. For non-residents, this amount is calculated for each individual amount of income received.

The procedure for filling out an application by individuals

Individual entrepreneurs and other individuals must fill out the following sections in the application:

- A title page on which the full name, TIN, years (for which a certificate is required), as well as methods for obtaining the document are indicated. If an individual does not have a TIN, he will additionally need to fill out 1 section on page 002. In this section, you will need to indicate the details of an identity document (passport, birth certificate, military ID, etc.).

- Data on the length of stay of an individual in the Russian Federation (fill out section 2 of page 002).

What confirms the tax status of an individual

- Certificate of the established form;

- A form established by the legislation of a foreign state, certified by the signature of an authorized person and the seal of the tax authority. Such a form can be issued to confirm tax status only if the Federal Tax Service of Russia has been notified of the availability of such forms by the competent authorities of a foreign state. Also, information about these forms can be posted on the official website of the competent state authority; this will also be sufficient to prepare the appropriate form for submission to the tax authority of a foreign state.

As a general rule, an individual receives confirmation of his tax status in one copy. But if a foreign state, in accordance with its legislation, requires the submission of confirmation in two or more copies, and the competent authorities of this state notified the Federal Tax Service of Russia in the prescribed manner about the presence of such a feature of the legislation, the confirmation will be issued to the person in the required number of copies.

What documents are attached to the application?

When submitting a tax application for a certificate, you will need to attach the following documents to it:

- an agreement/contract that will confirm the receipt (the right to receive) income from a foreign company;

- documents confirming ownership of property;

- a document establishing the payment of dividends in a foreign company (for example, a decision of company participants to pay dividends);

- copies of payment slips (cash receipts) confirming the payment of dividends;

- accounting certificates;

- other primary documents.

Important! In some cases, copies of documents confirming the person’s presence in the Russian Federation during the period of time for which the certificate is required are attached to the application of an individual entrepreneur or other individual.

If the documents attached to the application are drawn up in a foreign language, then they should be translated into Russian and the translation certified by a notary.

Calculation rules 183 days

Until the beginning of 2007, instead of a continuous time period of 12 months, a period of 1 calendar year was used. It was extremely inconvenient to count the required number of days from January 1 to December 31. According to these rules, on the 1st day of each new year, all subjects automatically became tax non-residents, since they could acquire this status only after 183 days in the coming year, i.e. July 2.

The new interpretation makes it possible to sum up days starting from any date, for example, from February 25 to February 24 of the next year, the main thing is that the required number of days have accumulated in this period.

The following factors are not taken into account when calculating:

- stay abroad for less than 6 months for medical or educational purposes;

- work as a seafarer or offshore hydrocarbon production specialist;

- military service outside the country and business trips of employees representing government authorities.

The last 2 paragraphs are not limited by time frames. There are no prohibitions on the choice of educational or medical institutions, as well as restrictions on the list of countries into which you can enter.

To prove the fact of undergoing medical procedures or a training course in another country, you need to prepare the following documents:

- a signed agreement with the organization providing the services;

- a certificate confirming the fact of being in the institution, indicating the timing of the event.

In addition, you will need copies of border crossing marks.

When calculating 183 days, you need to take into account the day of arrival and departure. It is not necessary that this period be continuous: during the 12 months chosen as the reference period, you can leave the country.

Calendar days can be calculated in the following way:

- from February 25.02 to April 30.04 - 65 days;

- from May 10.05 to July 9.07 - 61 days;

- from 24.07 to 19.09 - 57 days.

The result is 183 days. Wherein:

- from 1.05 to 09.05 - vacation spent in another country;

- from 10.07 to 23.07 - business trip abroad.

Accordingly, during the 12 months, from February 25 to February 24, the subject stayed in Russia for at least 183 days.

How to submit an application to the tax office

An application for a residence certificate and the accompanying package of documents can be sent to the tax office in one of the following ways:

- by personally contacting the tax authority;

- send documents by registered mail with a list of attachments;

- via the Internet through the tax website.

Important! As a method of receiving a completed certificate, an organization or individual can also choose one of the following methods: in person, by mail or via the Internet.

How to get an answer

Choose the most convenient way to obtain a certificate of residence of a legal entity:

- on the inspection website;

- by mail to the address specified in the application.

The information provided in the document is valid for 12 months. Issued exactly for the year that you indicate in the application. You can receive several copies at once. But this must be noted in the application.

It happens that the fiscal department does not issue a certificate. In such a situation, the applicant is sent a justified refusal. You can try to eliminate the shortcomings - collect evidence and ask for an answer again. The period for studying papers is 40 days.

If you need to confirm your tax status, take care of this in advance. Collect documents and send them to MIFTS in a convenient way.

Confirmation of tax resident status online

In 2021, tax resident status can be confirmed online by going to the Tax Service website. The website offers a special service “Confirmation of tax resident status of the Russian Federation”, which can be used by individuals and legal entities. This service allows both organizations and individuals to quickly fill out an application and send it to the tax office, as well as receive the necessary document in PDF format, or a refusal to issue it. One of the advantages of this service is that you do not need to send additional supporting documents to the tax office. It will be sufficient to simply formulate an application. Moreover, if a residence certificate is needed on paper, then the corresponding note should be made when filling out the application, that is, “Submit the document on paper.” Using the service, the applicant can also monitor the processing status of his application at the tax authority. It should be remembered that the period for reviewing the document in this case does not change and is also 40 calendar days. In addition, tax agents and foreign authorities can also check a person's tax resident status online. They can also use the service presented on the tax website. Moreover, any interested person can do this and there is no need for special registration or entering any codes.

Who are residents of the Russian Federation

Tax residents of the Russian Federation are (Article 246.2 of the Tax Code of the Russian Federation):

- Russian organizations;

- foreign organizations recognized as tax residents of the Russian Federation in accordance with the international treaty of the Russian Federation on taxation issues - for the purposes of applying this international treaty;

- foreign organizations whose place of management is the Russian Federation, unless otherwise provided by an international treaty of the Russian Federation on taxation issues.