Organizations periodically conduct inventories. They are needed in order to obtain the current balances of a particular product. Inventory also allows you to compare actual data with accounting data in the program.

There are cases when such a reconciliation of balances makes it possible to identify thefts among financially responsible persons.

After conducting an inventory in 1C 8.3, the shortage can be written off and the surplus can be capitalized. For this entire sequence of actions and its reflection in accounting, there are special documents, the completion of which we will consider below.

Inventory of goods

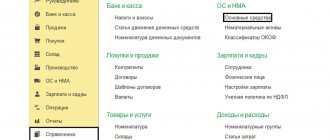

Let's start with the inventory itself. To do this, use the document of the same name in the “Warehouse” section of the program.

Our team provides consulting, configuration and implementation services for 1C. You can contact us by phone +7 499 350 29 00 . Services and prices can be seen at the link. We will be happy to help you!

The document is quite simple to fill out. First of all, we will indicate all the necessary header details.

Let's assume that an inventory was carried out at the retail warehouse of store No. 23 on March 31, 2016. You don’t have to indicate the responsible person, as we did, but fill it out if necessary.

For the convenience of filling out the list of goods, you can use the “Fill in by warehouse balances” item from the “Fill” menu, as shown in the image below. In any case, you can fill out the tabular part manually if, for example, during an inventory check in a warehouse, a product is found that is not on stock at all.

We did not complicate the example and used only automatic completion. The program “found” only 127 units of 95% Chocolate in the warehouse. Let's assume that this number does not coincide with reality, and we are missing seven tiles.

In the “Fact” column we will add that in fact there are only 120 units of 95% chocolate in the warehouse. Now some recalculation has been automatically carried out in the tabular part.

The “Deviation” column displays the quantity “-7”, which is highlighted in red. This color means there is a shortage of goods. Also, depending on the quantity taken into account in the program and the actual quantity, the corresponding amounts of goods were calculated taking into account the price.

When carried out, this document does not create any accounting movements. From it you can print out all the necessary reports, for example, on forms INV-3, 22, 19. Reflection in accounting of the fact of deviation can be done by writing off and capitalizing goods, depending on whether it is a shortage or a surplus. These documents are created both independently and based on the inventory.

Video on filling out an inventory card:

Capitalization of surpluses and shortages in 1C

Content:

1. Creation of documents for recounting goods in a regular warehouse

2. Creation of documents for recounting goods in an order warehouse in 1C

In the daily operational work of an enterprise, to reflect identified surpluses, shortages, mis-grading, damage to goods or the usual inventory in 1C, the document “Recalculation of goods” is used. To record the financial results of the recount, the following documents are used: “Write-off of shortages of goods”, “Capitalization of surplus goods” and “Re-grading of goods”.

Let's consider options for creating these documents in a regular warehouse and an order warehouse in 1C.

To work with the surplus and shortage block in 1C, no additional settings are required. You can immediately after the actual recount start creating the “Recount of Goods” document, because it is this document that will reflect the very fact of conducting an inventory in 1C.

Creating documents for recounting goods in a regular warehouse

Let's consider the option of creating a chain of documents in a regular (not order) warehouse in the 1C Enterprise 8.3 program.

Create a new document:

On the first tab, fill in the date of the document if it differs from the current one, as well as the fields “Responsible” and/or “Executor” - this is the employee or employees who will be reflected in the printed form and who can be asked clarifying questions if such a need arises.

If you need to print the “Recalculation Task Form”, you can check the “Print accounting quantity” checkbox and then the employee conducting the recount will see how much of a particular product is on the balance.

Next, we move on to filling out the goods subject to inventory. If this is not a recalculation of individual positions, which can be added to the document using the Add button, it is most convenient to use the “Selection” button:

In this example, the document will contain all the items available in the balance, but it is possible to set up any selection we need, for example, by product group or characteristic.

To fill in a quantity equal to the accounting quantity, click on the button.

You can then correct the actual quantity for individual items. We post the document and create an Inventory List for subsequent printing.

In the document we indicate the warehouse, inventory period, prices for the printed form. Cost prices can be printed out only if month-end closing calculations have been performed. This document does not have any tabular part; the printed form contains goods from the goods conversion documents for the specified period.

To consider all possible options, we will enter data on shortages, surpluses and mis-grading of goods:

The goods recalculation document does not create movement of goods - additional creation of documents is necessary to reflect surpluses and shortages in accounting.

The document is filled in automatically; if some fields are not filled in or you want to change them, you can always do this manually. The main thing to remember is that the price indicated in the “Type of price” line will be the price of the cost of capitalization.

The second tab contains goods for which surpluses have been identified:

After all the surplus has been delivered to the receipt, it is necessary to write off the resulting shortage in 1C:

Creating documents for recounting goods in an order warehouse in 1C

Let's look at the features of carrying out these same documents in the order warehouse in 1C.

In the list of documents for recounting goods, when you select an order warehouse, an additional information line appears, which informs you whether there are documents for registration for this warehouse.

In the goods recount document itself, the line “Status” is added. When created, it is automatically set to “In progress”. This means that you can fill in the accounting quantity and print the recounting task, but you cannot enter the actual quantity.

To enter the actual quantity, you need to change the status to “Entering results”.

When working with an order warehouse, it becomes possible to create documents not only based on the recalculation of goods, but also through the assistant for processing warehouse acts in 1C Enterprise. Let's consider the option of creating a product regrading document through this assistant.

In the assistant, we indicate the warehouse, the inventory period and the date of warehouse acts, and also indicate the prices that will be reflected in printed forms.

In the next assistant window, you can set up selection among rows for re-sorting if there are a lot of them. After viewing the positions, two options are possible: either transferring all positions for re-sorting, or only the selected lines.

After selecting the payment method, the positions are transferred to the table below, and you can proceed to creating documents.

When you click the “Next” button, two documents are automatically generated: “Inventory list”, which is necessary for printing the document, and “Re-grading of goods”. Let's look at the latter in a little more detail.

When creating the document “Re-grading of goods”, you need to pay attention to “Accounting for income and expenses”. In this document, you can indicate separately the items of income and expenses or check the box “Receive goods at write-off cost.” In such an article there will be no need to indicate.

To control the transactions performed, you can use the “Statement of goods in warehouses” report.

Specialist

Barinova Yulia

Write-off of goods

Let's continue with the previous example. During the inventory, it was found that in the sales area of store No. 23 there was a shortage of 7 chocolate bars (95%). This quantity must be written off from the warehouse, because it simply does not exist.

To do this, we will use the document “Write-off of goods”. We created it based on the previously entered inventory.

Please note that the document is completely filled out automatically. Despite the fact that the program gives us the opportunity to edit it, we will not do this.

After the document was completed, two movements were created: to write off seven chocolate bars 95% and to write off the trade margin. The second posting was created due to the fact that the warehouse with the detected shortage is a sales area and the prices are accordingly different.

Printed forms for inventory

We form the PF, INV-3 looks like this:

And INV-19 is like this:

The PF also experienced a shortage of the product Electric cable

, which was not in our documents. The fact is that I wrote off this product outside the lesson, also on the current date. And this product was included in our inventory list (it is on its basis that INV-3 and INV-19 are formed).

By default, in the reflections of surpluses and shortages, the data source for the cost (in PF) is taken from the warehouse settings:

Having generated a list of goods in warehouses, we see that all operations were performed correctly:

Other lessons on the topic “Warehouse operations”

Setting up accounting for warehouse operations in UT 11 Creating the structure of the enterprise and warehouses How to print price tags and labels in UT 11 How to move goods between warehouses How to register assembly and disassembly operations Internal consumption of inventory items, transfer to operation Using order warehouses Supply warehouse needs in UT 11 Separate supply of orders Maintaining warehouse stocks in UT 11 Setting up address storage in UT 11 Reference placement of goods in cells in UT 11 Storage of balances by product cells in UT 11 Responsible storage in UT 11 Accounting for alcoholic beverages in UT 11 (settings )

Posting of goods

Now let's look at the second example. During the inventory, it was found that instead of the 110 kilograms of “Assorted (commission)” candies reflected in the program, there are actually 150 of them in the warehouse. In this case, the deviation in the inventory will be 40 kilograms.

Since the deviation occurred in a positive direction, to take it into account it is necessary to capitalize the surplus. Capitalization, just like write-off, can be created from the goods inventory document itself.

The program filled out all the necessary fields automatically, and all we had to do was post the document. After it is carried out, the number of “Assorted (commission)” candies in the program will coincide with the actual quantity in the warehouse.

Video on capitalization and write-off of goods in 1C 8.3 based on inventory:

Learning to carry out an inventory of goods and materials (1C: Accounting 8.3, edition 3.0)

Lessons on 1C Accounting 8 >> Trade

2017-07-05T11:22:39+00:00

| Is the article outdated and in need of revision? |

Today we will look at how to reflect the completed inventory of inventory items (material assets) in the 1C: Accounting 8.3, edition 3.0 program. Let's figure out how to register identified shortages and surpluses.

Situation. In our organization, by order of the manager, an inventory of inventory items has been assigned.

, a shortage of 100 kg of flour , a surplus of 50 kg of sugar and 1 coffee maker were revealed in the warehouse .

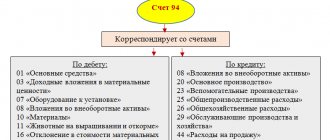

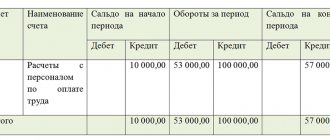

The shortage of 100 kg of flour, identified during the inventory, was taken into account in account 94 “Shortages and losses from damage to valuables”:

| Dt 94 Kt 10 100 kg [shortage identified] |

Then 20 kg of missing flour was written off as natural loss (shrinkage, shaking):

| Dt 44 Kt 94 20 kg [shortage written off within the limits of natural loss] |

Another 50 kg of missing flour was written off to the financially responsible person (account 73.02 “Calculations for compensation for material damage”):

| Dt 73.02 Kt 94 50 kg [shortage attributed to the guilty party] |

The remaining 30 kg were written off for other expenses:

| Dt 91.02 Kt 94 30 kg |

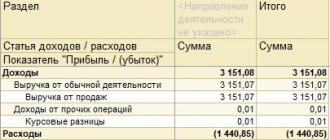

Excess sugar was credited to account 10:

| Dt 10 Kt 91.01 50 kg [unaccounted sugar reserves capitalized] |

The unaccounted for coffee maker was capitalized to account 41:

| Dt 41 Kt 91.01 1 piece [unaccounted coffee maker capitalized] |

Now we will reflect all these operations in 1C: Accounting 8.3, edition 3.0.

Let me remind you that this is a lesson and you can safely repeat my steps in your database (preferably a copy or a training one).

Manual filling

If capitalization was not preceded by an audit, then we fill out the tabular part by hand: we indicate the receiving warehouse, the income item from the directory “Other income and expenses” and, using the “Selection” button, indicate the goods that need to be capitalized.

Fig. 13 Selection of nomenclature

We capitalized the surpluses identified by the audit and reflected their “appearance” in accounting, thereby increasing its reliability, because any deviation of actual data from accounting data indicates shortcomings in organization and control, entailing errors and irregularities in the work.