The formation of a balance sheet for 41 accounts is an important part of the accounting of all trade organizations, since it makes it possible to quickly obtain information:

- on the availability of products and packaging purchased from suppliers intended for further sale to the company’s counterparties;

- on the movement of goods for further sale between warehouses and departments;

- on receipt of goods from suppliers;

- on the sale of goods to assess the demand of buyers and customers;

- on the cost of purchasing goods (when accounting for goods in purchase prices).

The balance sheet of account 41 allows you to quickly check data on the availability and movement of goods of the enterprise purchased for further resale. A report can be generated daily for the total accounting price of all products in warehouses, as well as broken down by warehouses and product groups. In addition, more detailed monitoring of warehouses is provided for each individual item.

In the company's accounting, the purchase of products for their further sale to buyers and customers, as well as all movements of goods between the organization's warehouses, is reflected in the account. This account is active: debit – information about goods received from suppliers and their receipt at the company’s warehouse; The loan shows the sale of products to counterparties or the write-off of assets (due to defects, shortages, etc.).

Something to keep in mind! All additional costs for transporting purchased assets are recorded in account 44.

Purchased goods are credited to the warehouse on the basis of closing documentation from suppliers in correspondence with the invoice. When selling products, the accounting price is written off to subaccount 90.02, which collects data on the cost of sales according to the methodology defined by the company’s accounting policy: at the average cost or at the price of the first purchases.

Accounting for goods and materials

Goods and materials are often combined into one accounting group and given a general name - inventory assets, abbreviated as goods and materials.

Inventory materials in finished form intended for further sale are goods. And materials are goods and materials that are purchased for use in the manufacture of the company’s products, or for their own needs that affect the overall production process, provision of services or performance of work.

Inventory and materials are taken into account at the actual cost, which consists of the amounts of funds transferred or paid (in cash) to the supplier and other expenses associated with transportation, commission costs, etc.

Documents on cost for customs

It’s the 4th quarter of 2014, and the issue of preparing the so-called customs clearance is becoming especially relevant for customs clearance. "price package" for customs. Almost all products are lower risk. The dollar is becoming more expensive, goods purchased in euros are becoming cheaper, and customs is angry. The customs representative routinely collects, with the help of the client, documents that serve customs to justify such a low price.

So, let’s refresh the information: when and what to prepare and provide.

Cost documents (“price package”) are collected in the following cases:

- imported goods are lower risk (ask your customs broker for risk);

- the cost of goods is much lower than the average level in the base, especially if a foreign economic transaction is carried out between interrelated companies.

How goods are accepted for accounting

Goods are accepted for accounting in the same way as materials, at actual cost. For accounting purposes, account 41 and subaccounts opened to it are used. When carrying out retail trade, you also need account 42 “Trade margin”. If you keep records at accounting prices to reflect the difference between them and actual prices, then accounts 15 and 16 will be needed.

Products are sold wholesale and retail. In this case, accounting is influenced by the organization’s taxation system, and the methods enshrined in the accounting policy, and automation, or its absence at the point of sale, and the presence of intermediaries. When concluding a supply agreement, it is necessary to clearly state all the conditions that relate to prepayment, full payment and shipment, since the write-off of costs and the moment of sale of goods depend on this.

Wholesale trade can be carried out on the following terms:

- Prepayment and subsequent shipment.

- Shipment and then payment for the goods.

- Payment in foreign currency and then shipment. And vice versa.

- Sale of goods with their transportation to the buyer.

There are also many nuances in retail trade:

- Sale of goods at an automated point of sale (ATP) at sales prices in cash and non-cash.

- Sale of goods at a manual point of sale (NTP) at sales prices in cash and non-cash.

- Sale of goods at purchase prices.

general characteristics

“Goods” is an inventory account for the material assets of an enterprise. Novice auditors ask themselves: “Account 41 in accounting is an asset or a liability of the organization?” The answer is not as complicated as it might seem. It is important to understand that the account itself is not an asset or a liability. But the goods accounted for in account 41 can easily be identified as funds or sources of the organization. An asset is a company's property right, in other words, everything that belongs to it. Goods are tangible property and, therefore, are accounted for as assets.

Based on the answer received, how can you characterize account 41 in accounting? Active or passive? Or maybe active-passive? There should be no doubt, account 41 in accounting is active. Receipt of goods is shown in debit, and their write-off and sale in credit. At the end of the reporting period, only a debit closing balance is formed.

Example of postings for 41 accounts

The Alpha organization carries out wholesale and retail trade. The goods were shipped to Omega after receiving full payment in the amount of RUB 274,520. (VAT RUB 41,876). Three days later the goods were shipped to the buyer.

Cost of goods sold RUB 129,347. In retail, daily revenue amounted to 17,542 rubles. (VAT 2676 rub.). The sale was carried out using ATT. To account for the trade margin, account 42 was used. The amount of the margin was 6,549 rubles.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 51 | 62.02 | Money has been deposited into the bank account from Omega | 274 520 | Bank statement |

| 76.AB | 68.02 | An advance invoice has been issued | 41 876 | Outgoing invoice |

| 62.01 | 90.01.1 | Revenue from sales of goods is taken into account | 274 520 | Packing list |

| 90.02 | 68.02 | VAT charged on sales | 41 876 | Packing list |

| 90.02.1 | 41.01 | Sold goods written off | 129 347 | Packing list |

| 62.02 | 62.01 | Advance credited | 274 520 | Packing list |

| An invoice for sales has been issued | 274 520 | Invoice | ||

| 68.02 | 76.AB | VAT deduction on advance payment | 41 876 | Book of purchases |

| 50.01 | 90.01.1 | Retail revenue taken into account | 17 542 | Certificate-report of the cashier of the operator based on the retail sales report |

| 90.03 | 68.02 | VAT charged | 2676 | Certificate-report of the cashier of the operator based on the retail sales report |

| 90.02.1 | 41.11 | Write-off of goods at sales price | 17 452 | Certificate-report of the cashier of the operator based on the retail sales report |

| 90.02.1 | 42 | Accounting for mark-ups on goods | -6549 | Help for calculating the write-off of trade margins on goods sold |

Correspondence

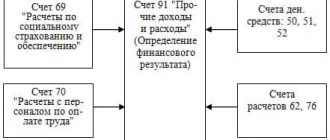

Account 41 in accounting is a method of controlling and describing the process of purchasing and selling goods, which leads to correspondence with most main accounts. Account 41 is debited in the posting with the accounts:

- settlement transactions (60, 63, 68, and 71-78);

- capital funds (80, 88);

- stocks (14);

- production accounting (20, 23, 26, 29, 37);

- goods (42);

- accounting of monetary transactions (50).

The “Goods” account corresponds for the loan with the following accounts:

- assets (06);

- stocks (10, 13, 14);

- production and commodity accounting (20, from 43 to 46);

- accounting of monetary transactions (58);

- accounting for settlements (62, 63, from 76 to 79 except 77);

- capital funds (80, 84, 87, 89)

In the process of compiling quotes, do not forget that account 41 in accounting is active.

Translation of goods into materials

In production and trading organizations, goods are often transferred to the category of materials. Such a movement is documented with the TORG-13 consignment note.

Example

Alpha purchased 920 meters of cable for sale in the amount of RUB 179,412. (VAT RUB 27,383). To carry out electrical installation work, 120 meters of cable were needed, so this amount of goods was converted into materials.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 41.01 | 60.01 | Goods have arrived | 152 029 | Packing list |

| 19.03 | 60.01 | VAT included | 27 383 | Packing list |

| 68.02 | 19.03 | VAT is accepted for deduction | 27 383 | Invoice |

| 10.01 | 41.01 | Products translated into materials | 19 830 | Internal movement invoice |

Documents confirming the cost of supplies are:

- Export declaration.

- Translation of export declaration.

- Manufacturer's price list, if the companies have a relationship with each other, the price list should not indicate the final addressee.

- Agreements for the supply of goods between the company receiving the goods under DT and other Russian companies, and/or invoices for the shipment of these goods.

- Account card 41, if the goods are subsequently sold.

- Data on the value of imported goods on the domestic market, from any open sources (for goods without duty, their value should not exceed two times the customs value according to the customs declaration, for goods with duty, three times the customs value).

- If the goods are raw materials, or their cost directly depends on commodity quotations, data on their value on commodity exchanges, for example London.

- Application for international transportation, with the cost of transportation corresponding to the transport invoice.

- Feasibility study agreement.

- Insurance.

- Letter of non-insurance of cargo, depending on delivery conditions.

- Letter about the availability of loading and unloading operations and their cost, under delivery conditions of groups E and F.

These documents must relate to the current quarter or be no more than 3 months old. It is necessary to update the “price package” at least once a quarter.

The article was prepared by D.A. Zimin. and Vedunov K.S.

If you have anything to add on the topic or need help with customs clearance of cargo, call 8-800 700 5542... or write

Write-off of goods from 41 accounts for the needs of the organization

An organization may need the goods it sells for general business needs. Write-offs can be made by converting goods into materials or bypassing this operation, based on an order.

Example situation:

The organization purchased 87 packs of paper for retail sale for a total amount of 7,905 rubles. (VAT 1206 rub.) For office needs, 5 packs were needed.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 41.01 | 60.01 | Goods have arrived | 6699 | Packing list |

| 19.03 | 60.01 | VAT included | 1206 | Packing list |

| 68.02 | 19.03 | VAT is accepted for deduction | 1206 | Invoice |

| 41.11 | 41.01 | The goods were moved from the wholesale warehouse to the retail warehouse | 6699 | Invoice for internal movement (TORG-13) |

| 41.11 | 42 | Take into account the trade margin | 2609 | Invoice for internal movement (TORG-13) |

| 26 | 41.11 | Products written off for office needs | 604 | Request-invoice |

| 26 | 42 | Adjusting the cost of goods for office needs | 219 | Accounting information |

Consolidation of knowledge

Having carefully studied all the information presented and summed up, we can outline the key points about the characteristics and accounting of accounts. 41:

- goods are among the assets of the enterprise;

- account 41 - active, inventory;

- upon receipt of goods, the account is debited excluding VAT;

- the sale of goods results in the debiting of amounts from account 41;

- The trade margin is reflected by posting Dt 41 Kt 42.

Regardless of how accounting is kept at the enterprise (in 1C or in writing), knowledge of the properties of account 41 will simplify the work of a novice accountant.

Typical operations for accounting for goods

- Reflection of additional costs for goods - for example, delivery or storage of goods.

- Return of goods from the buyer - return receipt of goods from the buyer.

- Write-off of goods is a reflection in accounting of damage or loss of goods.

Accounting for receipt of valuables

Goods can be supplied to the company from manufacturers or wholesale companies. Accompanying documentation must be supplied with the product. If the goods are transported using a vehicle, a consignment note must be filled out. This paper is divided into two sections. The product section includes this information:

- Information about the supplier and recipient: name of the subject, address, payment details.

- Information about the product: its cost, weight, distinctive characteristics.

- VAT amount.

The transport section contains this information:

- Vehicle number.

- Waybill designation.

- Delivery date.

- Loading and unloading area.

- Cargo information.

The supplier must also provide documents for the goods themselves. In particular, these are papers confirming the safety of products (for example, a certificate). The accompanying document is an invoice, an invoice for payment for products.

FOR YOUR INFORMATION! If the goods arrived without documentation, this operation cannot be reflected in accounting. Any action must be documented. The information required for accounting is taken from the papers.

Categories for articles on product accounting:

- Accounting for goods in accounting: postings, examples, laws

- Revaluation of goods in accounting

- Movement of goods through warehouses: postings, rules, examples

- Resale of goods between the commission agent and the principal in accounting

- Reflection of goods in storage in accounting entries

- Expenses for selling goods - postings and examples

- Examples of warehouse postings

- Accounting entries for the transfer of goods free of charge

- Accounting entries for payment for goods and services

- Accounting for goods in transit

- Consignment goods: the relationship between the consignor and the commission agent

- Carrying out an inventory: receipt of surpluses and write-off of shortages

- How does the shipment of goods occur from an accounting point of view?

- Postings for the purchase of goods and services

- Postings for the sale of goods and services

- Returning goods to the supplier: reasons, postings, examples

- Postings for receipt of goods to the warehouse

- How to reflect the return of goods from a buyer in accounting

- Write-off of goods in case of shortage or damage in accounting entries

- Postings according to additional costs for delivery of goods

A short video on how to reflect the sale of a product in 1C 8.3:

Basic postings

You can ensure full accounting of inventory items using postings. The most commonly used postings are presented in the table:

| Debit accounts | Credit accounts | the name of the operation |

| 41 | 60 | Purchase and receipt of goods from suppliers |

| 62 | 90 | Selling goods to consumers |

| 90 | 62 | Return of goods |

| 90.02 | 41 | Cost of goods sold |

| 60 | 41 | Return of purchased goods to the supplier |

| 76.01 | 41 | Return of purchased goods through a claim |

| 41 | 91.01 | Receipt of surpluses discovered during inventory |

| 94 | 41 | Write-off of shortages discovered during accounting |

Account 41 must be maintained in quantitative and monetary terms. The account records the balances and total volume of goods movement for a certain period of time.

When should goods be taken into account off balance sheet?

There are situations when there are valuables of other persons on the company’s territory. For example, when accepting a product, a defect is detected - until the supplier picks up the product, the buyer is obliged to ensure its safety (Clause 1, Article 514 of the Civil Code of the Russian Federation). Or the company provides goods storage services. In such cases, material value not related to the company's own property is subject to off-balance sheet accounting.

The postings for posting goods to the balance sheet will be as follows:

Whether it is possible to deduct VAT on goods included in the balance sheet, find out in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

What needs to be taken into account in off-balance sheet accounts and how the company will be punished if off-balance sheet accounting is not organized, learn from this material.

Accounting for the receipt of products at the warehouse

The receipt of goods is taken into account in account 41. Its debit reflects the receipt, and its credit reflects the disposal. There are several accounting methods:

- At cost of sale.

- At book value.

- At cost.

Cost accounting is relevant for wholesale and manufacturing entities. In retail companies, accounting is carried out either at cost or at cost of sales.

Accounting at actual cost

If accounting is kept at cost, you need to record the cost that is written down in the papers from the supplier. If the supplier has calculated VAT and presented an invoice, the amount of tax deductions is placed in a separate sub-account. Capitalization occurs at cost, which does not include VAT. However, the price may include transportation costs. Sometimes these expenses are separately accounted for on the debit of account 44. Let's consider the entries used:

- DT41 KT60 (76). Receipt of products to the warehouse.

- DT19 KT60 (76). Allocation of VAT.

- DT60 KT51. Transfer of funds to the supplier.

Products can be purchased using a loan. In this case, interest on the loan may be included in the cost. In this case, they are recorded on the debit of account 41.

Example of accounting at actual cost

The company took out a loan to purchase goods. Interest is charged on borrowed funds, which is included in the structure of operating expenses. The received goods were later sold. Let's look at the wiring used:

- DT51 KT66. Obtaining borrowed funds.

- DT41 KT60. Posting of goods.

- DT19 KT60. Allocation of tax.

- DT68 KT19. VAT tax deduction.

- DT91/2 KT66. Calculation of interest on the loan.

- DT90/2 KT41. Write-off of the cost of products for sale.

- DT62 KT90/1. Revenues from sales.

- DT90/3 KT68. VAT accrual on products sold.

- DT51 KT62. Receiving payment for goods sold.

The transaction for obtaining a loan must be confirmed by an agreement with the banking institution.

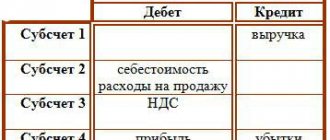

Accounting at cost of sales

If goods are accounted for at the cost of their sale, you will need invoice 42. The trade margin is recorded on it. It includes VAT. To fix the markup, this wiring is used: DT41 KT42. When the goods are sold, the markup is reversed, which is why this posting is needed: DT90/2 KT42.

The seller can discount his products. In this case, the amount of the markdown is written off against the markup. If the size of the markdown is greater than the markup, the difference is included in the structure of other expenses. In this case, this wiring is used: DT91/2 KT41.

If products are written off for the needs of the company, the markup must also be written off for needs. These wirings are required: DT44 KT41, DT44 KT42. If products are disposed of due to spoilage, this entry is used for write-off: DT94 KT41. The extra charge will be written off in DT account 94 . The corresponding account is KT42.

Example of accounting at cost of sales

The company purchased products in the amount of 12,000, the price included VAT in the amount of 2,000 rubles. The VAT rate on sales is 18%. The markup is 30%. Accounting is preceded by these calculations:

- (12,000 – 2,000) * 30% = 3,000 rubles (markup amount).

- (10,000 + 3,000) * 18% = 2,340 rubles (VAT on sales).

- 3,000 + 2,340 = 5,340 rubles (total markup).

The following entries are used in accounting:

- DT41 KT60. Capitalization in the amount of 10,000 rubles excluding VAT.

- DT19 KT60. Allocation of tax on purchased valuables in the amount of 2,000 rubles.

- DT68 KT19. Tax deduction for VAT in the amount of 2,000 rubles.

- DT60 KT51. Transfer of funds to the supplier in the amount of 12,000 rubles.

- DT41 KT42. Trade margin in the amount of 5340 rubles.

- DT90/2 KT41. Write-off of the value of valuables in the amount of 15,340 rubles.

- DT90/2 KT42. Reversal of the markup in the amount of minus 5,340 rubles.

- DT62 KT90/1. Proceeds from the sale in the amount of 15,340 rubles.

- DT90/3 KT68. VAT accrual on goods sold in the amount of 2,340 rubles.

- DT51 KT62. Transfer of payment for goods from the buyer.

Cost and sales value accounting are the most common accounting methods.