Bank, cash desk

Natalya Vasilyeva

Certified Tax Advisor

Current as of January 22, 2020

Organizations and individual entrepreneurs with employees are required to pay insurance premiums for compulsory pension insurance (MPI). It does not matter what kind of contract is concluded with the employee: labor or civil law. Let's consider how to draw up a payment order to pay pension contributions for employees in 2021.

It is necessary to check payment orders in 2021

It is necessary to indicate new details of the Federal Treasury. Although I didn't notice any changes in the details.

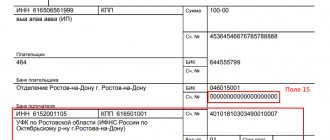

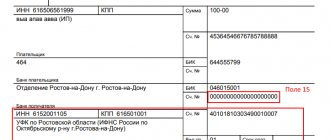

You need to fill out detail “15” of the payment order - the account number of the recipient’s bank, which is part of the single treasury account (STA).

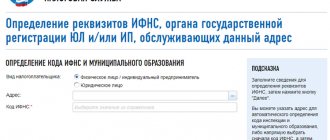

The details can be checked using the service of the Federal Tax Service website.

Attention! Starting from 2021, the new KBK and the new recipient of contributions are not the Pension Fund of Russia but the Federal Tax Service. Here you can find out the details of the Federal Tax Service.

Starting from 2021, someone else can pay taxes for an individual entrepreneur, organization or individual. Then the details will be as follows: “TIN” of the payer - TIN of the one for whom the tax is being paid; “Checkpoint” of the payer – checkpoint of the one for whom the tax is transferred; “Payer” – information about the payer who makes the payment; “Purpose of payment” – INN and KPP of the payer for whom the payment is made and the one who pays; “Payer status” is the status of the person whose duty is performed. This is 01 for organizations and 09 for individual entrepreneurs.

A payment order or payment document is a document to the bank on behalf of the owner (client) of the current account: transfer money to another account (pay for a product or service, pay taxes or insurance premiums, transfer money to the account of an individual entrepreneur or pay a dividend to the founder, transfer wages to employees, etc. .everything is below)

A payment order can be generated (and sent via the Internet) in Internet banking (for example, Sberbank-online, Alpha-click, client bank). Internet banking is not needed for small organizations and individual entrepreneurs because... it is complicated, expensive and less safe. It is worth considering for those who make more than 10 transfers per month or if the bank is very remote. Payments can also be generated using online accounting.

Where can I get a payment order for free? How to fill out a payment order? What types of payment orders are there? I will post here samples of filling out payment slips in Excel for 2020-2021, made using the free Business Pack program. This is a fast and simple program. In addition to payment slips, it also contains a bunch of useful documents. I recommend to all! Especially useful for small organizations and individual entrepreneurs who want to save money. Some additional functions in it are paid, but for payment orders it is free.

How to fill it out yourself and a sample

You should fill out the receipt yourself according to the norms and all the rules.

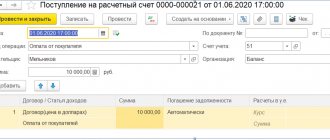

Sample:

All codes, including KBK, must be entered correctly, since they are the ones that regulate the payment of contributions. In case of errors, you will have to write a statement in which you will need to indicate that a check for relevance is necessary.

If at least one mistake was made, the payment may not be credited to the account, and therefore you will have to pay again. In most cases, the tax office sends a notification, but if you do not pay, then penalties are possible, which will be an additional amount to the mandatory insurance contribution.

In accordance with the law, all fields in the receipt are filled out.

Sample payment slip

From 2021, tax contributions can be clarified if the bank name and the recipient's account are correct. The remaining contributions must be returned and paid again (subclause 4, clause 4, article 45 of the Tax Code of the Russian Federation).

Any insurance premiums, unlike taxes, are never rounded.

Let us remind you that since 2015, to pay an additional 1%, a different BCC has been used that is different from the fixed insurance premium. And for 2017-2018 they are completely different - see them below.

Fixed Pension Fund

You can calculate this fixed payment for any period (even an incomplete year or month) using our calculator here.

Purpose of payment: Insurance contributions for compulsory pension insurance in a fixed amount from income up to 300 rubles. for the 1st quarter of 2021 Reg. No. 071-058-011111

Payer status: Payer status: 24 - for individual entrepreneurs for themselves (since 2017, you need to indicate 09, because we pay contributions to the Federal Tax Service Order of the Ministry of Finance dated April 5, 2021 No. 58n).

TIN, KPP and OKTMO should not start from scratch. OKTMO must be 8-digit.

Rice. .

Attention! Starting from 2021, the new KBK and the new recipient of contributions are not the Pension Fund of Russia but the Federal Tax Service. Here you can find out the details of your Federal Tax Service.

Fig. Sample of filling out a payment order (insurance fixed contribution of an individual entrepreneur) in the Business Pack.

Pension Fund over 300 tr.

You can see how to calculate additional interest on the simplified tax system, UTII, PSN, OSNO, and Unified Agricultural Tax systems using our calculator here.

Purpose of payment: Insurance contributions for compulsory pension insurance in a fixed amount for income over 300 tr. for the 1st quarter of 2021 Reg. No. 071-058-011111

Payer status: Payer status: 24 - for individual entrepreneurs for themselves (from 2017 you need to indicate 09, because we pay contributions to the Federal Tax Service).

TIN, KPP and OKTMO should not start from scratch.

Rice. .

Attention! Starting from 2021, the new KBK and the new recipient of contributions are not the Pension Fund of Russia but the Federal Tax Service. Here you can find out the details of your Federal Tax Service.

Fig. Sample of filling out a payment order (PFR over 300 tr. Individual entrepreneur) in Business Pack.

How long should payments be kept?

Within 6 years after the end of the year in which the document was last used for calculating contributions and reporting (Clause 6 of Part 2 of Article 28 of the Federal Law dated July 24, 2009 No. 212-FZ) or 5 years (clause 459 Order of the Ministry of Culture of Russia dated August 25 .2010 N 558)

Medical insurance FFOMS

You can calculate this fixed payment to medicine for any period (even less than a year or a month) using our calculator here.

Purpose of payment: Insurance premiums for compulsory medical insurance in a fixed amount for the 1st quarter of 2021 Reg. No. 071-058-011111

Payer status: Payer status: 24 - for individual entrepreneurs for themselves (from 2017 you need to indicate 09, because we pay contributions to the Federal Tax Service).

TIN, KPP and OKTMO should not start from scratch.

In field 109 (date, below the “reserve field”, on the right) enter the date of the declaration on which the tax is paid. But under the simplified tax system and all funds (PFR, FSS, MHIF) they set 0.

It will sound strange, but field 108 (below the “code” on the right and the “reserve field” on the left) indicates “14; SNILS IP number”. This is the requirement of the Pension Fund.

Rice. .

Fig. Sample of filling out a payment order (Medical insurance FFOMS IP) in Business Pack.

Attention! Starting from 2021, the new KBK and the new recipient of contributions are not the Pension Fund of Russia but the Federal Tax Service. Here you can find out the details of your Federal Tax Service.

When to pay

The deadlines for paying insurance premiums and taxes are established in the Tax Code of the Russian Federation.

In 2021, all payments and taxes are transferred directly to the Federal Tax Service, and not to various funds, as was before.

The deadline for transferring the amount is December 31, 2018. This date is the final date for one-time and quarterly payments.

Often payments are made quarterly, that is, the entire amount is divided into 4 parts.

Deadlines for quarterly transfers:

| 01 | 31.03 |

| 04 | 30.06 |

| 07 | 30.09 |

| 10 | 31.12 |

Fractional payments are made by those entrepreneurs who have various tax deductions. The quarterly option is more convenient with a small contribution amount.

If the amount of income exceeds 300,000 rubles, then you need to pay 1%. The deadline for payment of this fee is 07/01/2019. Moreover, if the excess began in the current year, then you can start paying such tax immediately, and then pay off the balance.

For initial registration during 2021, contributions are only for months worked. When opening and closing a case within a year, the payment deadline also has an end date of December 31, 2018.

KBK insurance premium for individual entrepreneurs

| Payment type | For 2021 in 2021 | For 2021,2015 and earlier | For 2021, 2021 |

| Insurance contributions for pension insurance of individual entrepreneurs for themselves in the Pension Fund of the Russian Federation in a fixed amount (based on the minimum wage) | 392 1 0200 160 | 182 1 0200 160 | 182 1 0210 160 |

| Insurance contributions for pension insurance of individual entrepreneurs for themselves in the Pension Fund of the Russian Federation with income exceeding 300,000 rubles. | 392 1 0200 160 | 182 1 0200 160 | 182 1 0210 160 |

| Insurance premiums for medical insurance for individual entrepreneurs for themselves in the Federal Compulsory Compulsory Medical Insurance Fund in a fixed amount (based on the minimum wage) | 392 1 0211 160 | 182 1 0211 160 | 182 1 0213 160 |

Payment order

After choosing an activity and familiarizing yourself with the regulations, you need to set the required payment terms. This can be done either at the end of the year or every quarter.

Payment order:

- choice of terms for making contributions;

- creating reports and generating receipts;

- filling out the receipt and entering all data;

- payment of contributions and verification that the contribution has actually been received.

If the contribution has not been received, then a statement is written indicating all the details of the receipt and the date of generation.

With the right procedure, you can pay all insurance premiums in full. It is also worth considering that for any delay a penalty will be charged. For this reason, payment is required at least one week before the end date. This period is enough to correct the data if there is an error and re-make the payment.

Insurance premiums must be paid without fail. For payment, a receipt is generated, which is filled out and paid before the end date of the selected transfer period.

Starting from 2021, the formation is carried out on the Federal Tax Service website. Any errors and omissions in the receipt can be corrected by first writing an application to the tax authorities and indicating all the data with the date of generation.

All payments

See the full list of payment orders:

- For a description of the fields and rules for payment orders, see here.

- Sample of filling out a payment order for payment of the simplified tax system in Excel and in Business Pack

- Sample of filling out a payment order (personal income tax for employees) in Excel and in Business Pack

- Sample of filling out a payment order for VAT payment in Excel and Business Pack

- Sample of filling out a payment order for payment of Property Tax in Excel and in Business Pack

- A sample of filling out a payment order for the payment of Income Tax in Excel and in Business Pack

- A sample of filling out a payment order for payment of the Fixed Contribution of Individual Entrepreneurs (PFR and FFOMS) in Excel and in Business Pack

- Sample of filling out a payment order (PFR, Social Insurance Fund contributions for employees) in Excel and in Business Pack

See also: Free IP Payment calculator (+ for an incomplete period).

Payment order details for insurance premiums in 2021

All details required to be filled out in the contribution payment form are presented in the following table:

| Field | Filling |

| Payer status, field 101 | Payer of insurance premiums – “01” |

| Payer's TIN, field 60 | TIN of the organization |

| Payer checkpoint, field 102 | Checkpoint of an organization, a separate division or real estate, depending on the place of payment of contributions |

| Payer, field 8 | name of the organization or separate division |

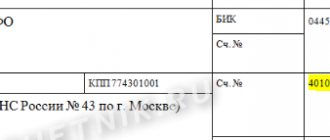

| Recipient's TIN and KPP, fields 61 and 103 | TIN and checkpoint of the Federal Tax Service to which you submit your reports. |

| Details of the Federal Tax Service | Details of the Federal Tax Service to which the payment is sent |

| Recipient, field 16 | UFK for ______ (indicate the name of the subject of the Russian Federation where insurance premiums are paid), and then in brackets - the name of the Federal Tax Service. For example, “UFK for Moscow (IFTS No. 22 for Moscow)” |

| Code, field 22 | current payment – “0” |

| KBK | field 104 – KBK tax or insurance premiums |

| OKTMO | field 105 – OKTMO at the address of the organization, separate division or real estate, depending on the place of payment of contributions. |

| Reason for payment, field 106 | current payment – “TP”; arrears – “ZD”; arrears at the request of the Federal Tax Service - “TR”; arrears under the inspection report before the Federal Tax Service makes a demand - “AP” |

| Period, field 107 | For TP or ZD - the period for which you pay contributions, in the format XX.YY.YYYY. XX – frequency of payment: month – MS; quarter - KV; half a year - PL; year – GD; YY – payment period: month number from 01 to 12, quarter from 01 to 04, half year 01 or 02, annual payment – 00; YYYY – year. For example, when paying contributions for April 2021 - “MS.04.2018”; for TR – the date of payment of the tax or contribution on demand; for AP – “0” |

| Document number, field 108 | for TP or AP – “0”; for TR – requirement number; for AP – verification decision number |

| Document date, field 109 | for TP – the date of signing the calculation of contributions, and if it is not submitted – “0”; for ZD – “0”; for TR – date of requirement; for AP – date of inspection decision |

| Payment purpose, field 24 | Text explanation + registration number of the policyholder in the fund. For example, “Insurance contributions for compulsory pension insurance for April 2021 reg. No. 567-111-000000” |

NEWFORMES.RF

From this article you will learn in an accessible form about the amount of contributions to funds for individual entrepreneurs for yourself in 2021 and earlier, you will be able to independently calculate the amount of the contribution, incl. and for less than a year. Familiarize yourself with the cases when individual entrepreneurs may not pay insurance premiums, the deadlines for paying premiums, how to find out the details, generate a receipt and pay the insurance premiums yourself.

The fixed amount of contributions to funds for individual entrepreneurs for themselves in 2021 is 40,874 rubles. (FFOMS: 8,426 rubles + Pension Fund: 32,448 rubles) + 1% in the Pension Fund of the Russian Federation on the amount of income for the year exceeding 300,000 rubles. Read more about this below...

- Payment of insurance premiums to the Pension Fund and the Federal Compulsory Medical Insurance Fund

- Formula for calculating insurance premiums

- Minimum wage by year

- Insurance premium rates

- Individual entrepreneur insurance premiums 2019

- Individual entrepreneur insurance premiums 2018

- Insurance premiums for individual entrepreneurs 2017

- Insurance premiums for individual entrepreneurs 2016

- Insurance premiums for individual entrepreneurs 2015

- Insurance premiums for individual entrepreneurs 2014

- Insurance premiums for individual entrepreneurs 2013

- Insurance premiums for individual entrepreneurs 2012

- Calculation of contributions to individual entrepreneur funds for an incomplete year

- Responsibility for non-payment of old contributions to funds

- Cases when individual entrepreneurs may not pay insurance premiums

- Payment of contributions to the Pension Fund and FFOMS for individual entrepreneurs

- How to find out the details for contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund

- How to print a receipt for payment of insurance premiums to the Pension Fund of the Russian Federation and the Federal Compulsory Medical Insurance Fund step-by-step instructions 2019

- Calculator for calculating insurance premiums for individual entrepreneurs

Payment of insurance premiums to the Pension Fund and the Federal Compulsory Medical Insurance Fund

Every individual entrepreneur, regardless of whether he has employees or not, must pay fixed insurance contributions for himself to two extra-budgetary funds - the Pension Fund of the Russian Federation (PFR) and the Federal Compulsory Medical Insurance Fund (FFOMS). The total amount of fixed contributions to the funds is paid once a year no later than December 31 (Part 2 of Article 16 of Federal Law No. 212-FZ). Moreover, you can pay it either at a time or in parts, the main thing is that the entire amount of contributions is paid by December 31 of the current calendar year. In case of non-payment or incomplete payment of insurance premiums on time, penalties will be charged.

Formula for calculating insurance premiums

Until 2021:

The formula for calculating contributions is determined by Article 14 of Federal Law No. 212-FZ and is as follows:

Contribution amount = minimum wage * TARIFF * number of months

Where the minimum wage is the minimum wage established by federal law at the beginning of the financial year for which insurance premiums are paid, TARIFF is the rate of insurance contribution to the Pension Fund of the Russian Federation or the Federal Compulsory Medical Insurance Fund, established by Article 12 of the Federal Law No. 212-FZ.

An example of calculating the contribution to the Pension Fund for 2021

7,500 rub. * 26% * 12 = 23,400 rub.

Attention!

Starting in 2021, the authorities have abolished the link between fixed individual entrepreneur contributions and the minimum wage (minimum wage). The amount of payments is established by clause 1 of Article 430 of the Tax Code of the Russian Federation. Formula for calculating contributions: fixed part + 1% of income over 300 thousand rubles.

The President signed a law that transfers insurance premiums to the control of tax authorities. From January 1, 2021, you need to pay contributions for individual entrepreneurs not to the Pension Fund and Social Insurance Fund, as before, but to the tax office at the place of registration.

Minimum wage by year

Starting in 2021, the authorities have abolished the link between fixed individual entrepreneur contributions and the minimum wage (minimum wage). The amount of payments is established by clause 1 of Article 430 of the Tax Code of the Russian Federation.

For 2021, the minimum wage was 7,500 rubles.

For 2021, the minimum wage was 6,204 rubles.

For 2015, the minimum wage was 5,965 rubles.

For 2014, the minimum wage was 5,554 rubles.

For 2013, the minimum wage was 5,205 rubles.

For 2012, the minimum wage was 4,611 rubles.

Amounts of insurance premiums for individual entrepreneurs 2021

The amount of contributions to the funds in 2021 is 40,874 rubles, of which:

— the amount of insurance contributions to the Federal Compulsory Medical Insurance Fund in 2021 = 8,426 rubles.

— the amount of insurance contributions to the Pension Fund in 2021 = 32,448 rubles.

If the income of an individual entrepreneur exceeds 300,000 rubles. for 2021, the contribution to the Pension Fund increases by an additional 1% of the excess amount.

An example of calculating an additional contribution to the Pension Fund with an income of 1,000,000 for 2021:

(1,000,000 - 300,000) * 1% = 7,000 rub.

This payment to the Pension Fund must be made no later than April 1, 2021.

Individual entrepreneur insurance premiums 2019

The amount of contributions to the funds in 2021 is 36,238 rubles, of which:

— the amount of insurance contributions to the Federal Compulsory Medical Insurance Fund in 2021 = 6,884 rubles.

— the amount of insurance contributions to the Pension Fund in 2021 = 29,354 rubles.

If the income of an individual entrepreneur exceeds 300,000 rubles. for 2021, the contribution to the Pension Fund increases by an additional 1% of the excess amount.

An example of calculating an additional contribution to the Pension Fund with an income of 500,000 for 2021:

(500,000 - 300,000) * 1% = 2,000 rub.

This payment to the Pension Fund must be made no later than April 1, 2020.

Individual entrepreneur insurance premiums 2018

The amount of contributions to the funds in 2021 is 32,385 rubles, of which:

— the amount of insurance contributions to the Federal Compulsory Medical Insurance Fund in 2021 = 5,840 rubles.

— the amount of insurance contributions to the Pension Fund in 2021 = 26,545 rubles.

If the income of an individual entrepreneur exceeds 300,000 rubles. for 2021, the contribution to the Pension Fund increases by an additional 1% of the excess amount.

Insurance premiums for individual entrepreneurs 2017

The President signed a law that transfers insurance premiums to the control of tax authorities. From January 1, 2021, you will have to pay contributions for individual entrepreneurs not to the Pension Fund and Social Insurance Fund, as before, but to the tax office at the place of registration.

The amount of contributions to the funds in 2021 is RUB 27,990, of which:

— the amount of insurance contributions to the Federal Compulsory Medical Insurance Fund in 2021 = 4,590 rubles.

— the amount of insurance contributions to the Pension Fund in 2021 = 23,400 rubles.

If the income of an individual entrepreneur exceeds 300,000 rubles. for 2021, the contribution to the Pension Fund increases by an additional 1% of the excess amount.

An example of calculating an additional contribution to the Pension Fund with an income of 1,000,000 for 2021:

(1,000,000 - 300,000) * 1% = 7,000 rub.

This payment to the Pension Fund must be made no later than April 1, 2018.

Insurance premiums for individual entrepreneurs 2016

The amount of contributions to the funds in 2021 is 23,153.33 rubles, of which:

— the amount of insurance contributions to the Federal Compulsory Medical Insurance Fund in 2021 = RUB 3,796.85.

— the amount of insurance contributions to the Pension Fund in 2021 = 19,356.48 rubles.

If the income of an individual entrepreneur exceeds 300,000 rubles. for 2021, the contribution to the Pension Fund increases by an additional 1% of the excess amount.

An example of calculating an additional contribution to the Pension Fund with an income of 500,000 for 2021:

(500,000 - 300,000) * 1% = 2,000 rub.

This payment to the Pension Fund must be made no later than April 1, 2017. The total payment to the Pension Fund for 2021 is limited to the amount of 158,648.69 rubles, which is calculated based on 8 times the minimum wage based on Article 14 of Federal Law No. 212-FZ.

Insurance premiums for individual entrepreneurs 2015

The amount of contributions to the funds in 2015 is 22,261.38 rubles, of which:

— the amount of insurance contributions to the Federal Compulsory Medical Insurance Fund in 2015 = 3,650.58 rubles.

— the amount of insurance contributions to the Pension Fund in 2015 = 18,610.80 rubles.

If the income of an individual entrepreneur exceeds 300,000 rubles. for 2015, the contribution to the Pension Fund increases by an additional 1% of the excess amount.

An example of calculating an additional contribution to the Pension Fund with an income of 500,000 for 2015:

(500,000 - 300,000) * 1% = 2,000 rub.

This payment to the Pension Fund must be made no later than April 1, 2016. The total payment to the Pension Fund for 2015 is limited to the amount of 148,886.40 rubles, which is calculated based on 8 times the minimum wage based on Article 14 of Federal Law No. 212-FZ.

Insurance premiums for individual entrepreneurs 2014

The amount of insurance premiums for individual entrepreneurs in 2014 is 20,727.53 rubles, of which:

— the amount of insurance contributions to the Federal Compulsory Medical Insurance Fund in 2014 = 3,399.05 rubles.

— the amount of insurance contributions to the Pension Fund in 2014 = 17,328.48 rubles.

If the income of an individual entrepreneur exceeds 300,000 rubles. for 2014, the contribution to the Pension Fund increases by an additional 1% of the excess amount. The total payment to the Pension Fund for 2014 is limited to the amount of 138,627.84 rubles, which is calculated based on 8 times the minimum wage based on Article 14 of Federal Law No. 212-FZ.

Insurance premiums for individual entrepreneurs 2013

The amount of insurance premiums for individual entrepreneurs in 2013 is 35,664.66 rubles, of which:

— the amount of insurance contributions to the Federal Compulsory Medical Insurance Fund in 2013 = 3,185.46 rubles.

— the amount of insurance contributions to the Pension Fund in 2013 = 32,479.20 rubles.

Insurance premiums for individual entrepreneurs 2012

The amount of insurance premiums for individual entrepreneurs in 2012 is 17,208.25 rubles, of which:

— the amount of insurance contributions to the Federal Compulsory Medical Insurance Fund in 2013 = 2,821.93 rubles.

— the amount of insurance contributions to the Pension Fund in 2013 = 14,386.32 rubles.

Calculation of contributions to individual entrepreneur funds for an incomplete year

If you registered as an individual entrepreneur, for example, in mid-2015, then the amount of contributions is calculated for less than a full year. It is important to calculate this amount accurately, down to the penny, so that there is no arrears. To determine how much of the fixed payment must be paid before the end of the current year, calculate the contributions for the days of the month in which registration occurred, and then the contributions for the full months remaining until the end of the year and sum them up.

Formula for calculating the contribution for an incomplete month:

Contribution amount = minimum wage * TARIFF / number of days in a month * number of working days

An example of calculating the contribution to the Pension Fund for 6 months and 12 days:

Partial month: 5,965 rub. * 26% / 31 * 12 = 600.35 rub.

Full months: RUB 5,965. * 26% * 6 months. = 9,305.4 rub.

Total: 600.35 rub. + 9,305.4 rub. = 9,905.75 rub.

Attention!

Individual entrepreneurs must calculate contributions for their insurance starting from the day following the day of state registration. The day of state registration itself is not required to be included in the calculation (Part 2 of Article 4 of Federal Law No. 212-FZ).

If an individual entrepreneur is deregistered before the end of the year, then the number of calendar days of work must be taken taking into account the day on which the termination of business activity was registered (Part 4.1, Article 14 of Federal Law No. 212-FZ).

To avoid errors in calculations, use a free online calculator for calculating individual entrepreneur insurance premiums.

Responsibility for non-payment of old contributions to funds

Since 2010, the territorial bodies of the Pension Fund have received the right to forcibly collect arrears of insurance premiums, as well as fines and penalties. In particular, the right to send instructions to debtor banks to write off the amount of debt (arrears on contributions, penalties and fines) from the accounts of defaulters without acceptance.

Penalties for late payment of contributions are calculated for each day of delay based on 1/300 of the refinancing rate of the Central Bank of the Russian Federation. Penalties are accrued for each day of delay up to and including the day of payment (collection).

Cases when individual entrepreneurs may not pay insurance premiums

Cases when entrepreneurs do not pay insurance premiums for personal insurance are given in Part 6 of Article 14 of Federal Law No. 212-FZ.

Payment of contributions to the Pension Fund and FFOMS for individual entrepreneurs

Attention!

From January 1, 2021, you need to pay contributions for individual entrepreneurs not to the Pension Fund and Social Insurance Fund, as before, but to the tax office at the place of registration.

When paying fees for 2018-2021, new BCCs must be indicated on your payment slips:

182 1 0210 160 - insurance premiums in a fixed amount.

182 1 0210 160 — insurance premiums 1% of income over 300 thousand rubles.

182 1 0213 160 - contributions to the Federal Compulsory Medical Insurance Fund.

The amount of payments is established by Article 430 of the Tax Code of the Russian Federation.

How to find out the details for contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund

Attention!

If you are an individual entrepreneur using the simplified tax system or UTII, we advise you to use the Elba online service, which will remind you about reporting deadlines, help you correctly calculate taxes, prepare all the necessary reports and send them to the tax office via the Internet.

It will help you calculate and pay insurance premiums (including online) and report for you and your employees to the tax, pension fund and Social Insurance Fund. Our website offers favorable connection conditions; if less than three months have passed since the registration of your individual entrepreneur, you will receive the first year of service as a gift. Read more at the link... The information below is no longer relevant, see above.

Now there is no need to look for a receipt form, a sample form and details for paying insurance premiums to the Pension Fund and the Federal Compulsory Medical Insurance Fund. The Pension Fund service for generating payment documents will help you in generating a receipt for payment of insurance premiums to the Pension Fund and the Federal Compulsory Medical Insurance Fund. This service also allows you to generate a receipt for payment of insurance premiums, penalties and fines for previous periods. We print and pay the receipt without commission at any bank, we save the paid receipt. There is no fee for paying insurance premiums (Part 3, Article 24 of Federal Law No. 212-FZ).

In order to find out the details for paying insurance premiums to the Pension Fund and the Federal Compulsory Medical Insurance Fund, use the Pension Fund service for generating payment documents. Below are step-by-step instructions for generating a receipt for payment of insurance premiums to the Pension Fund of Russia and the Federal Compulsory Medical Insurance Fund through the Pension Fund of Russia service for generating payment documents, where you can obtain details for paying insurance premiums to the Pension Fund of the Russian Federation and the Federal Compulsory Compulsory Medical Insurance Fund in your region.

How to print a receipt for payment of insurance premiums to the Pension Fund of the Russian Federation and the Federal Compulsory Medical Insurance Fund step-by-step instructions 2019

1. Go to the PFR service page for generating payment documents;

2. We note that we are the insurer and choose our subject of the Russian Federation;

3. We choose payment of insurance premiums as payment;

4. Because We are not an employer, so we choose individual entrepreneurs as payers who do not make payments and other remuneration to individuals;

5. Type of payment – payments in 2021, where we select the fund to which we will make the payment (PFR or FFOMS);

6. Next, select the type of payment - contributions and immediately receive payment details, which you can print out if necessary if you suddenly want to make a payment from your individual entrepreneur bank account;

7. Below we are asked to fill in the necessary fields to generate a receipt, where we need to indicate OKTMO (find out your OKTMO at the address), full name, address, registration number in the Pension Fund and the amount of payment;

8. After this, we can immediately print the receipt and also save it on our computer as a PDF file by clicking on the appropriate button;

9. We print and pay the receipt without commission at any bank; an example of the generated receipt is presented below.

Sample payment order for payment of the minimum tax in 2020 for individual entrepreneurs

Since the minimum tax is paid only at the end of the year, field 107 should always contain the value KV.04.2019; For advance payments, use the value of the quarter for which the payment is made.

The sample payment system for the simplified tax system “income” 2021 contains the same values of fields from 104 to 110 for both organizations and individual entrepreneurs.

Reducing taxes for individual entrepreneurs

In 2021, individual entrepreneurs can still calculate taxes and reduce them by mandatory payments; the simplified 6% rate for an entrepreneur without employees is especially beneficial in this regard. Let's look at an example of how to take into account fixed payments paid under the simplified tax system Income.

An individual entrepreneur without employees received the following income in 2021:

- 1st quarter – 217,000;

- 2nd quarter – 338,000;

- 3rd quarter – 180,000;

- 4th quarter – 360,000.

Total, the total amount of income was 1,095,000 rubles, the amount of tax at the rate of 6% was 65,700 rubles. The entrepreneur paid contributions quarterly in order to immediately reduce advance payments for the single tax.

The amount of individual entrepreneur contributions for himself at the 2021 tariffs was: 40,874 rubles. fixed contributions plus 1% of excess income ((1,095,000 – 300,000 = 795,000) * 1%) = 7,950, total 48,824 rubles. Taking the opportunity to reduce the calculated tax payable through contributions, the individual entrepreneur paid only (65,700 – 48,824) = 16,876 rubles to the budget.

Read about how to reduce advance payments on the simplified tax system at the expense of insurance premiums in this article.

Individual entrepreneurs can also reduce the calculated tax by the entire amount of paid insurance premiums on UTII if they do not have employees. Individual entrepreneurs working on the simplified tax system Income and UTII have the right to reduce the tax by no more than 50%. Payers of the simplified tax system Income minus expenses, OSNO and Unified Agricultural Tax take into account the paid contributions in their expenses. And only individual entrepreneurs who have purchased a patent cannot reduce its value through contributions. Thus, the transfer of the administration of insurance premiums to the control of the Federal Tax Service did not affect the right of entrepreneurs to reduce the tax payable.