Insurance premiums (fees) are payments for insurance (the policyholder to the insurer) or mandatory contributions from the employer to the social insurance fund. Employers paying social payments can be individual entrepreneurs, organizations, individuals without individual entrepreneur status, that is, those who pay sums of money and remuneration to individuals. They also include persons who conduct private activities and do not make any cash payments to individuals. They can be lawyers, doctors, private entrepreneurs. According to Russian legislation, organizations and entrepreneurs now make insurance contributions to extra-budgetary funds instead of the Unified Social Tax. In this article we will look at accounting for calculations of insurance premiums, analyze key entries, payment deadlines and fines.

What are insurance premiums and to which funds are they paid?

Contributions accrued for payment to social funds are called insurance. The basis for calculating contributions is the total amount of wage accruals in the organization and other related payments, for example, bonuses or additional payments for overtime.

Legislatively, Federal Law No. 212 dated July 24, 2009, as amended in 2017, establishes several rules and regulations, according to which every business or legal entity is obliged to make accruals and subsequent payments of funds to the following funds:

- PFR – pension fund;

- FSS – social insurance fund;

- MHIF – compulsory health insurance fund.

Coefficients and calculation base for calculating contributions to compulsory insurance funds

All calculations related to the payment of insurance premiums at the enterprise must be carried out by an authorized person: director or accountant. To calculate contributions to each fund, its own coefficients are applied and restrictions on the calculation base apply:

Limit amount of the base for accrual:

Let's consider this issue in more detail.

Insurance premium rates for employees in 2021

In 2021, insurance premium rates for all small businesses

were demoted. In 2021, contributions must be paid at the following rates:

- For pension insurance (PPI) with payments within the minimum wage - 22%

, above the minimum wage -

10%

(both within the limit of the base and above). - For health insurance (CHI) with payments within the minimum wage - 5.1%

, above the minimum wage

- 5%

. - For social insurance (OSI), excluding contributions from accidents

, payments within the minimum wage are

2.9%

; above the minimum wage are not paid.

Note! The portion of the payment above the minimum wage is determined based on the results of each calendar month.

Companies and individual entrepreneurs that were not included in the register of small and medium-sized businesses pay insurance premiums at the following rates:

- On OPS - 22%

. - On compulsory medical insurance - 5,1%

. - For OSS – 2.9%

(excluding contributions for injuries).

Some individual entrepreneurs and organizations have the right to apply reduced tariffs

(see table below).

In 2021, the limits for calculating contributions have changed:

- for OPS – 1,465,000

.

(in case of excess, contributions are paid at a reduced rate - 10%

); - for OSS – 966,000

rubles. (if exceeded, contributions are no longer paid); - for compulsory medical insurance – the maximum base value has not been established.

Read about how to apply the maximum base for calculating insurance premiums in this article.

note

that in 2021, benefits on insurance premiums do not apply to most individual entrepreneurs and organizations that were applied before 2018-2020. More details on insurance premium rates can be found in the table below.

General rates for insurance premiums in 2021

| Payer category | OPS | Compulsory medical insurance | OSS | Total |

| Large business, as well as SMEs with payments within the minimum wage, except for beneficiaries | 22% | 5,1% | 2,9% | 30% |

| If the limit of 966,000 rubles | 22% | 5,1% | — | 27,1% |

| If the limit of 1,465,000 rubles | 10% | 5,1% | — | 15,1% |

Reduced rates for insurance premiums in 2021

| Payer category | Pension Fund | FFOMS | FSS | Total |

| SMEs with payments above the minimum wage | 10% | 5% | — | 15% |

| NPOs on the simplified tax system, conducting activities in the field of social services. services, science, education, healthcare, sports, culture and art | 20% | — | — | 20% |

| Charitable organizations on the simplified tax system | ||||

| Companies and individual entrepreneurs operating in the free economic zone in Crimea and Sevastopol, in the territories of rapid socio-economic development, in the free port of Vladivostok and in the special economic zone in the Kaliningrad region | 6% | 0,1% | 1,5% | 7,6% |

| Organizations that have received the status of a participant in the Skolkovo project | 14% | — | — | 14% |

| Organizations and individual entrepreneurs making payments to crew members of ships registered in the Russian International Register of Ships | — | — | — | 0% |

| Companies and individual entrepreneurs engaged in the production and sale of animated audiovisual products produced by them and (or) provision of services for the creation of such products | 8% | 4% | 2% | 14% |

| Organizations in the field of IT, design and development of electronic component base products and electronic (radio-electronic) products (provided that the income from this activity at the end of 9 months is at least 90%, and the number of employees is at least 7 people | 6% | 0,1% | 1,5% | 7,6% |

Note

: If the limits are exceeded, beneficiaries do not need to transfer contributions to social and pension insurance.

Additional rates for insurance premiums in 2021

| Payer category | Pension Fund | FFOMS | FSS | Total |

| Payers specified in paragraphs. 1 clause 1 art. 419 of Law No. 400-FZ in relation to payments to individuals named in paragraph 1 of paragraph 1 of Art. 30 of this law | 9%* | — | — | 9% |

| Payers specified in paragraphs. 1 clause 1 art. 419 of Law No. 400-FZ in relation to payments to individuals named in paragraphs 2-18 of paragraph 1 of Art. 30 of this law | 6%* | — | — | 6% |

*After a special assessment of working conditions, depending on its results, the rate of additional insurance premiums will be from 0 to 8% (details in clause 3 of Article 428 of the Tax Code of the Russian Federation).

Note

: Additional contributions are paid regardless of limits.

The procedure for calculating contributions to the Pension Fund

An enterprise operating on a general basis calculates contributions using tariffs, which in 2021 remained the same - 22%, within the established calculation base.

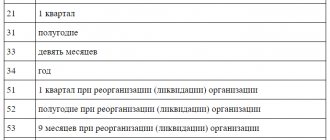

As for the period for calculating insurance premiums, they also remained the same:

- billing period – calendar year;

- reporting periods – 1st quarter, half year, 9 months.

The transfer of this amount is carried out indicating the budget classification code (BCC), and after that, the pension fund independently distributes the received funds between the insurance and savings parts, based on personalized accounting data, as well as taking into account the procedure for calculating the pension the citizen has chosen.

Example of a table for calculating insurance premiums:

As for restrictions on the size of the calculation base, in 2017 it should not exceed 876 thousand rubles. If the total salary exceeds this figure, then from the subsequent amount pension contributions are calculated at a rate of 10%. In accounting, this accrual is displayed in the form of a posting: Dt 20 (25,26,44) – Kt 69-2.

What does count 69 include?

Accounting, or more precisely, the transferred payments, together with the paid amounts for insurance fees, are displayed on account 69 “Calculations for social insurance and security” and subaccounts to it. Account 69 combines all information on insurance payments (applies to social, medical, and pensions). In order to take into account social contributions, it is appropriate to create subaccounts of the first and second order. Accordingly, subaccounts can be added to the account that take into account calculations regarding pension, medical or social insurance of employees, that is, a subaccount is created for each type of insurance.

| № | Subaccounts of the first order | № | Subaccounts of the second order |

| 69-1 | "Calculations for social insurance." | 69-1-1 | “Settlements with the Social Insurance Fund for insurance fees.” |

| 69-1-2 | “Settlements with the Social Insurance Fund for fees for social insurance against accidents and occupational diseases.” | ||

| 69-2 | "Calculations for pension provision." | 69-2-1 | “Calculations for the insurance part of the labor pension” (concludes, in turn, joint and several with the individual part); |

| 69-2-2 | “Calculations for the funded part of the labor pension.” | ||

| 69-3 | "Calculations for health insurance." |

As for vacation pay, they are recorded in account 96 “Reserves for future expenses.” To reflect deductions of funds from vacation pay, a subaccount is opened to the specified account. After the transfer of wages, postings display the money collected into extra-budgetary funds and for compulsory insurance against (occupational diseases) accidents at work. Account 69 corresponds to the production cost accounts. On the credit of this account, correspondence with account 99 (profit and loss) shows the accrual of penalties for late payments. By debit, account 69 corresponds with the expense accounts (transferred funds and amounts paid through payments for medical, pension and social insurance).

The procedure for calculating contributions to the Social Insurance Fund

Insurance contributions to the Social Insurance Fund are one of the most important transfers, since in the future these funds are used to pay for temporary disability, maternity leave and childbirth, and in the event of an injury at work.

The following rates apply when charging:

- 2.9% — contribution for temporary disability;

- 0.2-8.5% - insurance against industrial accidents.

The size of the second coefficient depends on which of the 32 industrial risk classes the company belongs to. For the first type of contributions, a limit on the calculation base for 2021 has been established in the amount of 755 thousand rubles. If this indicator is exceeded, contributions are not withheld. There are no restrictions when calculating contributions from accidents. In the accounting documentation, calculations are reflected in the form of postings: Dt 20 (25,26,44) – Kt 69-1.

All charges are reflected in the FSS-4 calculation, which is submitted quarterly, no later than the 20th day of the next month.

Contributions listed: what kind of postings are made?

Insurance premiums are transferred monthly no later than the 15th day of the month following the month of accrual (clause 3 of Article 431 of the Tax Code of the Russian Federation and clause 4 of Article 22 of the Law “On Mandatory Social Insurance” dated July 24, 1998 No. 125-FZ). When transferring funds to pay contributions, indicate the subaccount number of the corresponding fund in debit, and account 51 in credit, which reflects the current accounts of the company. The posting for payment of contributions (using the example of a pension fund) is as follows: Dt 69.2 Kt 51. Postings are made similarly for other subaccounts of each fund.

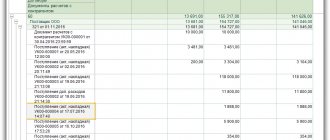

The accountant of Smiley LLC transferred the contributions untimely.

How to make a payment for insurance premiums, see here.

She reflected the following entries in accounting:

Dt 69.2 Kt 51 - 19,340.16 rubles;

Dt 69.3 Kt 51 – 6,708.58 rub.;

Dt 69.1 Kt 51 – RUB 1,483.88;

Dt 69.11 Kt 51 – 264 rub.

Transfer of insurance premiums for each fund must be carried out in separate payment orders. When paying contributions to funds, you need to pay special attention to the timing of their payment. For late payment of insurance premiums, organizations are charged penalties. Penalties are calculated for each day of late payment from the day following the payment due date until the day of payment inclusive. The amount of the penalty interest is taken at the rate of 1/300 of the Central Bank refinancing rate, and for companies - 1/300 for the first 30 days of delay and 1/150 of the refinancing rate starting from 31 days.

Also, the accountant of Smiley LLC calculated the penalties using our calculator and transferred them to the budget. She reflected the following entries in accounting:

Dt 99 Kt 69 (for subaccounts) - penalties accrued.

Dt 69 (for subaccounts) Kt 51 – penalties are transferred to the budget.

See also “Accounting entries when calculating penalties for taxes.”

If the policyholder does not also provide a calculation of contributions to the relevant fund, an additional fine will be issued. It will be 5% for each month of delay. It is calculated from the amount of accrued contributions for the last 3 months. The maximum fine is 30% of this amount, the minimum is 1,000 rubles.

The entry when calculating a fine or penalty will be Dt 91 Kt 69.1. Account 91 “Other income and expenses” is used here. True, there is another opinion that in this case you need to use account 99. The choice of account depends on the accounting procedure for such expenses adopted in accounting, which is enshrined in the accounting policy of the organization.

The material “Basic entries when paying penalties on insurance premiums” will help you figure out which account should be used to calculate penalties on insurance premiums.

Accrued penalties and fines do not reduce taxable profit (clause 2 of Article 270 of the Tax Code of the Russian Federation).

For information on what sanctions and fines are provided for non-payment of premiums, see the material “What is the responsibility for non-payment of insurance premiums?”

Find out about liability for late payment of taxes and contributions in the Ready-made solution from ConsultantPlus. If you don't have access to the system, get a free trial online.

When an accountant needs to accrue temporary disability benefits, they use the following entry: Dt 69.1 Kt 70 (for regular sick leave) or Dt 69.1.2 (69.11) Kt 70 (for benefits due to an industrial injury).

ATTENTION! Since 2021, all regions of the Russian Federation have joined the FSS pilot project “Direct Payments”. Our experts have prepared a guide for accountants. To avoid making mistakes in your calculations, study this material.

As for temporary disability benefits, the first 3 days are paid for by the organization, the rest - by the Social Insurance Fund. For the calculation, data on earnings for 2 years before the occurrence of the insured event is used. The benefit amount for a calendar month should not be less than calculated from the minimum wage (RUB 12,792 in 2021).

Example of calculating insurance premiums

Let us give an example of calculating contributions to each fund at a specific enterprise. At Orion LLC, the wage fund for the 1st quarter of 2017 amounted to:

- January – 125,000 rubles;

- February – 129,000 rubles;

- March – 118,000 rub.

We will calculate contributions to the Pension Fund, Social Insurance Fund and Compulsory Medical Insurance Fund.

- (125,000 * 22%) + (129,000 * 22%) + (118,000 * 22%) = 81,840 rub. – the total amount of contributions to the Pension Fund for the first quarter of 2021.

- (125,000 * 2.9%) + (129,000 * 2.9%) + (118,000 * 2.9%) = 10,788 rub. – the total amount of contributions to the Social Insurance Fund for the first quarter of 2021 for temporary disability.

- (125,000 * 0.2%) + (129,000 * 0.2%) + (118,000 * 0.2%) = 74.4 rubles. – the total amount of contributions to the Social Insurance Fund at a rate of 0.2% for the first quarter of 2021 for industrial accidents.

- (125,000 * 5.1%) + (129,000 * 5.1%) + (118,000 * 5.1%) = 18,972 rubles. – payments to the Federal Compulsory Medical Insurance Fund.

Total: 81,840 + 10,788 + 74.4 + 18,972 = 116,647.4 rubles. – the total amount of social contributions at the enterprise.

Organization of accounting of calculations for social contributions

Organization of accounting of calculations regarding insurance deductions is the responsibility of all employers, regardless of the taxation system applied. The billing period is the calendar year, and the reporting period is the first quarter, six months, 9 months, and a year. According to the approved procedure, the employer must record:

- accrued, transferred social contributions, pennies, fines;

- excess insurance deductions, penalties, penalties subject to refund, including interest;

- settlements with Social Insurance for social insurance funds due to maternity and illness at the place of registration of the policyholder (including amounts from the Social Insurance Fund);

- insurance costs.

Cost accounting for deductions for insurance coverage carried out by the policyholder is represented by social cash benefits (for disability, when registering in early pregnancy, at the birth of a child, for child care (every month), etc.). This also includes cash payments in excess of the established amounts and in amounts taken into account when counting into the insurance period periods that are not subject to compulsory insurance (applies to cash assistance for temporary disability due to illness and due to maternity).

Accounting for the amounts of calculated payments is carried out based on the results of each month by the policyholders during the billing (reporting) period for all employees. The basis is the amount of cash payments and material incentives credited from the beginning of this period to the end of the month, as well as the rates of the insurance contributions themselves. In this case, mandatory payments in relation to the individual in whose favor the cash payments were made are excluded. Regressive rates are no longer in effect.

When the maximum amount is reached, accruals (Government Decree No. 974 of November 24, 2011) are terminated, with the exception of pension insurance. The calculation for the Pension Fund does not stop, but only the tariff is reduced. The policyholder can obtain background information on the status of settlements regarding contributions, penalties or fines through a request to the territorial fund authority within 5 days.

The payer prepares and submits a declaration on social contributions for pension insurance, as well as calculations of advance payments under the Unified Social Tax (for those who make cash payments to individuals). Reporting is prepared and submitted in accordance with forms 4-FSS and RSV-1 Pension Fund of the Russian Federation. Form 4-FSS has been filled out since 2021, taking into account the new rules established by FSS Order No. 59. It is mandatory for all those entrepreneurs who use hired labor. The proposed form contains information about accrued and paid insurance premiums and is submitted quarterly. It has nothing to do with entrepreneurs who cover Social Insurance contributions for themselves.

How to take it

Not everyone can submit paper reports. The rule depends on the average number of employees in whose favor payments were made for the previous period. Reporting on paper can only be submitted if the average number of employees does not exceed 25 people. Reports can be submitted in person, through a representative, by Russian Post or courier service.

In electronic form, reporting is submitted only with an electronic digital signature through an EDF operator.

Rules for completing the form

The legislation regulates the filling out of the form, which is described in detail in Order No. ММВ 7–11 / [email protected] For accountants, the following basic requirements are sufficient:

If you do not follow the rules, the Federal Tax Service will not accept the report on insurance premiums and the funds will not be credited to the account. And this leads to the application of penalties in relation to the payer. Reporting is submitted in the same way as a payment order - in person, via e-mail, or by registered mail.

Contribution accounting settings

In the accounting policy settings, you need to display the tax system in force in the company. Their indication is no different from the settings related to “salary”. To do this, in 1C: Accounting 8, open the section “Salaries and Personnel” – “Directories and Settings” – “Salary Accounting Settings”, and in 1C: Salaries and Personnel Management in the section “Settings” – “Organization Details” – “Accounting Policies” "

Calculation submission deadline

The deadlines for submitting calculations of insurance premiums for 9 months according to the specified application are established, similar to the provision of other reporting documentation. The deadline for submitting the report form is no later than the 30th day of the month that follows the reporting period.

If there is a delay in submitting documentation under Appendix No. 9, violators may be subject to administrative penalties provided for by current legislation.

Proper careful attitude to the responsibilities assigned to insurance premium payers by current legislation ensures the correct completion and submission of reporting forms. The rules for preparing documents are not very difficult. In any case, the payer will be able to find help on the questions that arise on the Internet or seek advice from representatives of the tax authorities.