Since 2021, the tax service has been administering insurance premiums and accepting reports on them. The only exceptions are contributions for insurance of employees against injuries and occupational diseases - they still remain under the responsibility of the Social Fund. To report on contributions paid, all employers submit Form 4-FSS, you will learn about it from our article.

Changes in 4-FSS from 01/01/2021

The FSS of Russia has published a draft order on the implementation of the updated form 4-FSS and the procedure for filling it out from the 1st quarter of 2021.

The need to change reporting is due to the fact that from 01/01/2021, policyholders begin to transfer insurance contributions to the Social Insurance Fund in full, without reducing the amount of benefits paid. The new mechanism applies to the entire Russian Federation. The assignment and payment of insurance coverage will be handled by the territorial bodies of the Social Insurance Fund. Form 4-FSS was simplified by excluding from it the tables in which policyholders provided information about expenses incurred through insurance premiums. In addition, the following will change:

- table 1 “Calculation of amounts of insurance premiums” - the line “Calculated insurance premiums” was added instead of the line “Date of establishment of the premium”;

- tables with calculations for OSS from accidents at work and occupational diseases and with the corresponding expenses will be excluded;

- new table 1.1 with a breakdown of information about the taxable base and calculated contributions for organizations with designated independent classification units;

- table of information for calculating contributions (Table 2 instead of Table 1.1) for policyholders who outsource personnel.

IMPORTANT!

We will use the new form for reporting for the 1st quarter of 2021. We report for the 4th quarter of 2021 using the old form.

What is reporting form 4-FSS

The current form and electronic calculation format were approved by FSS Order No. 381 dated September 26, 2016, as amended by FSS Order No. 275 dated June 7, 2017. The main difference from the previous form is the exclusion of sections on contributions for disability and maternity, which have been transferred to a single calculation of insurance premiums, which the Federal Tax Service now accepts from employers.

The quarterly calculation of accrued and paid insurance premiums in Form 4-FSS has significantly decreased in volume. In fact, only section 2 of the old form, dedicated to contributions for injuries, which remained under the jurisdiction of the Social Insurance Fund, was preserved.

Who may need sick leave verification

We can talk about checking:

- a regular paper sick leave certificate. The check here will be carried out, first of all, for the authenticity of the document. The main stakeholders in this are the employer and the employee for whom the sick leave is issued;

- innovative electronic sick leave.

Since July 2021, electronic sick leave began to operate at the federal level (before that in several regions). Unlike paper ones, which are handed out to patients, they are stored on the FSS servers. If necessary, they can be accessed by:

- FSS;

- medical organization that issued the document;

- employer;

- employee-patient.

Each of them can request access to sick leave for different purposes.

Let's take a closer look at how to check sick leave in the two indicated varieties when using the FSS website and other available resources. Let us agree that such a check is required to be carried out by the employer, a representative of the medical institution and the patient himself.

Reporting deadlines in 2021

Form 4-FSS for the 4th quarter of 2021 is submitted to the regional FSS department in paper or electronic form. On paper, it will only be accepted by those employers whose average number of employees does not exceed 25 people.

A paper report is submitted by the 20th of the month following the reporting period, and an electronic report by the 25th. These requirements have not changed.

| Billing period | Deadline for submission to the Social Insurance Fund in paper form | Deadline for submission to the Social Insurance Fund in electronic form |

| For the 4th quarter of 2020 | Until 01/20/2021 | Until 01/25/2021 |

| For 1st quarter 2021 | Until 20.04.2021 | Until 04/26/2021 (04/25 – Sunday) |

| For Q2 2021 | Until July 20, 2021 | Until 07/26/2021 (07/25 - Sunday) |

| For the 3rd quarter 2021 | Until October 20, 2021 | Until October 25, 2021 |

| For the 4th quarter 2021 | Until 01/20/2022 | Until 01/25/2022 |

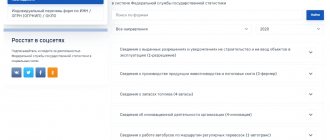

Signing and sending an XML report through the program

For these purposes you need:

- Go to the website https://fss.ru, select “Download programs”.

- Click on “Qualified certificate of public key signature of an authorized person to sign the receipt of payment” and download the latest files. Install both certificates in any order by double-clicking them - like a regular program (during installation, select the “Automatically select storage” option).

- Go to the website https://fss.ru, click on the “Download programs” link, select the one that is responsible for signing and encrypting documents, download it as an archive.

- Insert a flash drive or eToken with an electronic key issued by the certifying agent into the computer (if the electronic signature is not registered in the OS registry). Run the arm.exe file from the downloaded archive.

- On the “Sign and Decrypt” tab, specify the required value in the “Crypto Provider” line (which one, please check with the certification center support service).

- On the same tab, in the “Personal certificate” line, add a certificate issued to an employee authorized to send reports to the Social Insurance Fund.

- Click “Install FSS authorized person certificate.”

- In the “File for signature” line, select the saved XML file of the 4-FSS form. After waiting for the same file name to appear in the line below, but with the ef4 extension, click “Sign and encrypt.”

- Click “Send to FSS”. Write down or remember the exact time of sending. Go to the “Sent reports” tab and wait until the “Successfully processed” status appears there in the line that indicates the time that matches the recorded one. If necessary, click “Update” after a while.

Basic rules for filling out and structure of form 4-FSS

Generating a report is not difficult. The form consists of a title page and five tables. All employers are required to fill out basic information about themselves on the title page and tables 1, 2 and 5. These sheets must be submitted even if the policyholder did not have any accrual of contributions during the reporting period. The remaining tables are filled out if the relevant information is available in the reporting period. If they are not present, then these pages are not provided.

Our detailed instructions for dummies on how to make a FSS report will help you avoid any inaccuracies:

- When filling out the form by hand, use only black or blue ink.

- Only one indicator is entered in each cell. If the required indicator is not available, a dash is added.

- Electronic reporting is certified by an electronic signature.

- Each report page is numbered in the appropriate cell at the top of each sheet.

Especially for participants of the FSS pilot project

Fill out and submit 4-FSS according to special rules. To figure it out and not break anything, use free special instructions from ConsultantPlus.

Errors and their consequences

There are two types of errors when working with the FSS reporting gateway:

- Problems with the physical key carrier, electronic certificate, as well as problems associated with errors in the operation of the certification center that issued the certificate, as well as user errors in the organization when working with keys and electronic signatures. They can be eliminated by re-sending the report, in compliance with all established rules, and contacting the certification center to reissue the certificate. This type of error is the most unpleasant and dangerous due to violation of reporting deadlines. The date of submission of the report is considered to be the day the document was submitted without errors. If the report was submitted with errors, it will not be accepted by the system. If the errors are subsequently corrected, the filing date is considered to be the day the corrected report was sent, not the original one.

- Calculation errors of the accounting service. The FSS report contains control ratios and figures, violations of which are automatically detected by the system. The nature of the errors is visible to the user and is given in the form of “hints”: what exactly should be changed and why. The user is obliged to correct false information. After this, the report is sent to the FSS again.

Important! On the last day set aside by law for reporting, the reception gateway experiences significant load and may work in slow mode. It is advisable to submit calculations in advance.

Violation of deadlines for submitting reports, ignoring the requirements for correcting errors in the information provided, threatens the organization with penalties.

Summing up

The electronic gateway for receiving reports to the Social Insurance Fund is one of the most convenient and economical ways to submit payments to the Fund. In order to use it, the organization must have an electronic signature, an analogue of the physical signature of the responsible person, with the help of which electronic reporting is certified. Electronic signature can be obtained from authorized federal centers along with a certificate confirming its legitimacy.

When interacting with the FSS, it is necessary to study the terms enshrined in the Fund’s order No. 19 in order to work correctly together with it.

Before you start using the gateway, you must register on the website, obtain a number of extended user rights and install certificates from the organization’s CA and the FSS. The file can be prepared directly on the website or in the policyholder’s accounting program.

In order to avoid violation of reporting deadlines and subsequent penalties, it is recommended to submit the report 2-3 days before the expiration of these deadlines.

Instructions for filling: title page

Here are detailed instructions for filling out 4-FSS (the title page indicates basic information about the policyholder).

As an example, we took the abstract Alpha LLC, registered and operating in Moscow. The organization employs three people (including the director). Employment contracts have been concluded with all employees. One of the employees is disabled group III. During 2021, the number of employees did not change. Alpha LLC applies a rate for accident insurance premiums of 0.40%. Discounts and surcharges to the insurance rate are not established.

At the top of each page, indicate the registration number and subordination code, which you will find in the notice issued by the Social Insurance Fund when registering as an insurance premium payer.

The title page indicates the adjustment number, reporting period code and calendar year. If reporting for a specific period is submitted for the first time, then the code 000 is indicated in the “Adjustment number” field. The quarter code is indicated in the “Reporting period” field:

- 03 - in the 1st quarter;

- 06 - in the 2nd quarter;

- 09 - in the 3rd quarter;

- 12 - in the 4th quarter.

In 4-FSS for the 4th quarter of 2021 we indicate code 12.

The calendar year must also be specified. If the organization ceases activity, it is necessary to check a special field.

The full name of the enterprise or full name is entered in the appropriate columns. individual entrepreneur, TIN, KPP, OGRN, address, contact details and average number of employees. Be sure to indicate the type of activity code according to OKVED 2 - there is a special window for this on the right side of the form.

If the organization employs disabled people, they are included in the payroll. In the example, this is 1 person.

At the bottom of the page there are cells where the number of pages and sheets of the report that is sent to the Fund is indicated. Insert the date the document was completed and the signature of the authorized person of the policyholder. Next to them are fields that the social insurance worker fills out. You cannot make any marks on them.

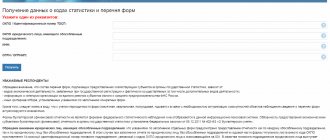

Login for registered users

If you have previously completed the registration process, then no problems will arise. On the main page of the FSS website, you need to select “Insured Person’s Account” and then click on the link “Login to the FSS Account.” You will see a field for entering your login and password.

You can log into your personal account in different ways:

- By email address.

- By SNILS number.

- By phone number.

- Using an electronic signature.

The first 3 options are available for registered users of the State Services website. For login, you can use your phone number, SNILS number or email address, and your password from the State Services website will be suitable as a password. Additionally, you do not need to register on the FSS website.

To receive electronic services, you often need to sign documents online. This requires an electronic signature, which is a special code. A signature is required for both legal entities and individuals. When registering on the State Services portal, you can create your own signature. You will need it to log into your FSS personal account.

After filling out all the fields, click “Login” and your personal account page will open.

Filling out table 1

The first section of form 4-FSS is devoted to the calculation of insurance premiums if there was an accident or occupational disease. Here's how to correctly fill out Form 4-FSS - Section 1:

- Indicators for contributions are indicated in rubles on an accrual basis from the beginning of the year and broken down by month of the last quarter of the reporting period.

- Start filling out Table 1 of Form 4-FSS with columns 4–6, then enter the data in column 3 on an accrual basis.

- Table 1.1 is filled out only by those employers who sent their employees for temporary work with other employers under a contract, as provided for in clause 2.1 of Art. 22 of Federal Law No. 125 of July 24, 1998. All other policyholders do not need to fill out and submit this sheet.

Filling out table 2 of form 4-FSS

Table 2 is filled out by policyholders based on accounting data on the status of settlements with the Fund for contributions and expenses for the reporting period. The numbers are indicated in rubles.

In the left column, the amount of insurance premiums payable is entered in the context of the balance for the reporting period, accrued amounts and funds received from the Social Insurance Fund. In the right column, the policyholder indicates the expenses incurred by him for labor protection measures and payments for compulsory insurance. At the end, the debt to the Social Insurance Fund at the end of the reporting period is displayed.

Here is an example of filling out form 4-FSS - table 2:

How to view personal data in your FSS personal account

To view the data, you need to open the button with three dots in the upper right corner.

You will see a menu with personal data:

- Last name, first name and patronymic;

- Floor;

- Passport details;

- SNILS;

- Contacts;

- Information on benefits and disability.

You cannot edit data in your personal account, you can only view it. Based on the FSS data, all information is entered into your personal account. To change the data, you must independently contact the Fund with documents.

Filling out tables 3 and 4 of form 4-FSS

These tables are not included in the list of required ones. They are filled out by those employers who spent social security funds in the reporting period, namely:

- paid benefits for accidents and injuries;

- paid for treatment of workers in hazardous industries in sanatoriums;

- financed preventive measures for labor protection;

- purchased personal protective equipment.

If the organization did not have such expenses during the reporting period, then there is no need to fill out and submit this sheet. On the same sheet with Table 3 there is Table 4, which provides information on cases of occupational diseases and industrial accidents for the reporting period. If such incidents were recorded by acts, this table indicates the number of injured workers.

Responsibility for late submission and errors in the calculation of 4-FSS

For each calendar month (including incomplete ones) for which the organization is late in submitting the report, it will have to pay from 5 to 30% of the amount of accrued contributions, excluding benefits paid, but not less than 1000 rubles.

For a zero report, officials will impose a fine at the minimum rate, but if it contains indicators, then even a few days of delay will cost 30% of the amount of contributions.

Responsibility for incorrect report form has been introduced. If, by law, the employer is required to submit it electronically, but filled it out and submitted it on paper, social insurance specialists will impose a fine of 200 rubles (Clause 2 of Article 26.30 of Law No. 125-FZ). In this case, the employee of the organization who is responsible for submitting reports will be fined in the amount of 300 to 500 rubles under Part 2 of Art. 15.33 Code of Administrative Offenses of the Russian Federation.