One of the main documents that must be drawn up during construction and installation work is a certificate in the KS-3 form. It is drawn up on the basis of two documents: the contract and the KS-2 act. At the same time, KS-2 and KS-3 always accompany each other, since one document is invalid without the other.

The KS-3 certificate is drawn up in two copies, one of which remains with the customer, the second is transferred to the contractor. A third party, if there is one (investor or creditor), can receive a third copy if it expresses a desire and sends a corresponding request to either party.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

What it is

KS-3 is a certificate that is issued after acceptance of construction and installation work. The paper reflects the cost of work performed item by item. The document is created after the acceptance certificate for completed work (KS-2).

The paper is necessary for both the contractor and the customer, therefore it is drawn up in at least 2 copies. KS-3 refers to financial documents of primary reporting. A unified form, which is regulated by legislative acts, is used as a sample to fill out.

The paper reflects information on the price of individual services and the total cost of work performed. The entered data usually corresponds to the preliminary estimate. If new expenses appear during the period of contract work, they are also reflected in the paper. Among such expenses are an increase in the price of building materials, an increase in the cost of renting special equipment and machinery, and an increase in the salaries of employees of the contractor’s organization.

Why do you need the KS-3 form?

The result of the completion of contract work will be its acceptance by the customer organization and the signing of the KS-2 act. To approve the act and final acceptance of the work performed, the contractor draws up a KS-3 certificate.

A certificate of the cost of work performed and expenses in the KS-3 form is a document of a financial nature, on the basis of which the cost of contracting activities is approved. In accordance with this documentation, the results of the execution of the government contract are reflected in the accounting records.

The form reflects information about the total cost and expenses for the object of repair, construction or installation activities. The certificate also indicates costs not taken into account in the estimate (price increases, rental costs, etc.).

Legal basis

The registration form is approved by the Federal State Statistics Service. For future accounting, companies need to use a unified sample certificate. The paper will need to indicate the cost of the work without taking into account the premium cost. VAT is indicated as a separate item.

Among the basic rules for the design of KS-3, which are dictated by legislative acts, there are:

- use only a regulated sample to fill out;

- entering information without using abbreviations;

- mandatory writing of the name of the organization of the customer, contractor and investor (if any) indicating the organizational and legal form.

It is worth remembering that this certificate belongs to the category of documents of strict reporting. The accountant is responsible for incorrect preparation.

Form KS-2: act of acceptance of completed work

The act of acceptance of completed work, form KS-2 form, sample filling and key rules for document execution were approved by Resolution of the State Statistics Committee No. 100 of November 11, 1999 (OKUD 0322005). However, current legislation provides for the possibility of adjusting the structure of the form. For example, it is permissible to supplement a unified form with specific information that is characteristic of the exclusive activities of a business entity. Please note that such adjustments cannot be contrary to the current provisions of the law.

IMPORTANT!

Officials determined that the unified form KS-2 (filling sample 2020) is required to be drawn up when executing any types of agreements, contracts or agreements for construction and installation work. Without this document, payment for construction and installation work is not allowed (Rosstat Letter No. 01-02-9/381).

The responsibilities for drawing up the act are assigned to the executor. The customer, by signing this document, confirms his consent to the list, type and volume of construction and installation work performed. That is, the customer’s signature indicates that there are no disagreements between the parties to the contract.

Why and for what purposes is it used?

This certificate is almost always issued after construction work has been completed under a contract. If the contractor provides a service for budget money, then the preparation of the document is mandatory.

The paper is drawn up after the work has been completed and the acceptance certificate has been signed. At the moment, their use is not mandatory, but most companies, when collaborating with each other, prefer to issue KS-2 and KS-3.

The paper is drawn up by the organization performing the construction and installation work. It is necessary for all parties to the contract for accounting purposes in order to keep records. The certificate reflects information about the amount of expenses for each type of service provided. Based on the specified data, the final settlement between the customer and the contractor is made.

The certificate may be required in the future if claims arise against the counterparty. With its help, it will be possible to provide information in court about the total cost of the work performed, as well as the price for each type separately.

General procedure

Forms KS-2 and KS-3 are widely used in the construction industry. The first document is an act, which is an actual confirmation of the completed volume of construction and installation work. That is, the contractor draws up a special act, which reflects a complete list of the work performed. The document is then sent to the customer for approval. In turn, the customer carries out reconciliation, or acceptance. If there are no disagreements, then the act is signed.

Based on the signed act, a special KS-3 certificate is created. This certificate reflects information about the cost of construction and installation work performed under the current agreement or contract. Forms KS-2 and KS-3 approved, that is, signed by both parties (sample filling below) are the basis for the start of mutual settlements between the customer and the contractor. Based on these forms, the contractor issues invoices for payment and sends them to the customer’s accounting service.

Step-by-step instruction

To fill out the certificate correctly, you will need to prepare a contract and other sources of information. First of all, you need to create a title page. It is filled out as follows:

Enter information about the contractor, customer and other construction participants (name of organization, contact details) on the title side of the certificate. Next to the name of the organization, in the appropriate cell, indicate the OKPO code (issued to each company upon registration).- Indicate the location of the construction site and the type of construction ongoing.

- Enter the date and number of the agreement on the basis of which the certificate is created, and the date of creation of the document itself.

- Indicate the dates of the reporting period (start and end dates of the construction manipulation stage).

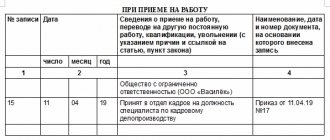

The main part of the document contains a table with 6 columns (see Table 1).

| Column number | Filler actions |

| 1 | indicate serial number |

| 2 | enter the name and type of service provided |

| 3 | indicate the code (if the performed action has a code) |

| 4 | indicate the price on an accrual basis |

| 5 | indicate the planned cost |

| 6 | indicate a specific price for the reporting period |

If the price of work for the reporting period has not changed, and the certificate is issued for the first time, then the same values are indicated in columns 4, 5 and 6.

After specifying all the numbers, the final calculation is carried out. The data is indicated at the very bottom of the table. In the required fields you will need to indicate the price of all work without VAT, the amount of VAT and the amount including VAT.

The last step is signing. On the customer’s side, the signature is carried out by the director or his representative. On the part of the contractor, the director or person responsible for performing the work.

How it is used in practice

After signing the acceptance certificate and a certificate of the cost of the work performed, the accounting department of the customer’s company can begin to pay the organization to the contractor for the services provided.

The Contractor creates documentation in the required quantity for all parties involved. Each party uses it to create reports. After the reporting period has passed, the certificate is sent to the archive for storage. If necessary, paper is removed from the archive and used again, for example, during legal proceedings.

Practical use

Why do you need a KS-3 certificate?

The KS-3 certificate is the basis for payment for completed construction and installation work. The amount in the KS-3 certificate must correspond to the amount in the KS-2 act (or several KS-2 acts) for the reporting period.

The contractor submits to the customer for signing, together with the work performed and as-built documentation, Certificate KS-3 , Certificate KS-2 and Invoice (if the contractor works under the simplified taxation system (USN), then the invoice is not provided).

The accounting department of the customer (general contractor) cannot make payment for work performed without a signed KS-3 certificate.

How to correctly fill in with a cumulative total

This type of calculation is considered more complex. The need to fill out a certificate in this way arises if the work is carried out in stages. For registration, you will need to know the amounts of work completed and accepted for different periods. For each acceptance certificate you will need to create your own certificate. In this case, each subsequent document must reflect information from the previous one.

As an example of filling, you can use the following sample:

- The contractor completed the first part of the work for the amount of 35,000 rubles. in the period 07/25/19-08/05/19, it was accepted and an acceptance certificate was drawn up. A KS-3 is drawn up for it, indicating in the 4th, 5th and 6th columns the amount of 35,000 rubles.

The contractor completed the second part of the work for the amount of 20,000 rubles. during the period 08.08.19-15.08.19. When compiled, column 4 indicates the amount 35,000 + 20,000 = 55,000 rubles. (price of work on an accrual basis). Column 5 indicates the amount for the entire year (if no work was previously performed, then this column also indicates the value of 55,000 rubles). Column 6 indicates the amount for the reporting period. In this case, it is 20,000 rubles.- The “total” column always indicates only the amount of work that was completed during the reporting period.

It is worth remembering that during paperwork, amounts from the estimate that have not undergone changes are used, without taking into account the added cost.

The KS-3 certificate allows the accounting department to record separately completed work, as well as indicate changes relative to the previous acceptance certificate and the beginning of the year.

KS-3: sample filling in 2021

The sample for filling out the KS-3 certificate for 2021 consists of two parts: the title and main parts (in the form of a table).

The title part provides information about the parties to the transaction (as in the KS-2 form) and information about the concluded contract. The time period accepted for the report and the date of preparation of the certificate are also indicated here.

In the tabular section, in the 4th column, the cost of construction and installation work and expenses should be indicated, which is entered on an accrual basis from the beginning of the work under the contract (including the reporting period). In the 5th column, the cost of construction and installation works is indicated incrementally from the beginning of the calendar year, and in the 6th column data is entered only for the period for which they are reporting.

The final line reflects the total amount of construction and installation work and expenses excluding value added tax. VAT itself is entered in a separate line, and in the “Total” column the added amount including VAT is indicated.

Main aspects of design

There are a number of nuances, knowledge of which will help when preparing the paper. Among them are:

- if the amount in the estimate for services is indicated including VAT, then to obtain data without a surcharge you will need to subtract 20% from it;

- if the initially planned price changes, the certificate reflects this moment by indicating the cost of unplanned expenses;

- The certificate form cannot be changed.

It doesn't take much time or effort to fill out the paper. If the person in charge knows about all the nuances, then it takes no more than 15 minutes to complete the registration correctly.

Completion requirements

All data that is entered is directly related to the cost and expenses of the repairs, installation, construction, etc. performed. The act of acceptance of completed work KS-3 includes costs that were not previously taken into account in the estimate documentation and the contract:

- an increase in wages for the contractor’s employees, which entailed an increase in contributions to extra-budgetary funds;

- increase in the cost of building materials;

- movement in the price level for rental of equipment and machinery involved in the performance of contract services;

- additional payments and allowances for hazardous working conditions and employment in the Far North;

- other unplanned expenses that adjusted the final cost.

IMPORTANT!

Since the form is standardized and unified, the contractor leaves the example of filling out KS-3 unchanged and does not make adjustments to it. Changing the number of lines in the form is prohibited!

A certificate of the cost of work performed and expenses applies not only to the entire construction project, but also to its constituent parts. The full cost of the entire construction project must be indicated.

Development of your own forms

Not all uniform forms are considered mandatory for use by organizations. The act and certificate of the Constitutional Court are not mandatory for use since 2013. In some situations, companies can carry out the acceptance certificate through the use of arbitrary forms of paper.

Own forms approved by the organization must comply with legal requirements. They should reflect information about the details of the parties to the transaction, the date of preparation, the name of the security, etc. The forms that will be used when accepting work are specified in advance in the contract.

Using the KS-3 form allows you to obtain a certificate that reflects the price of work performed for certain types. It also becomes possible to track the total cost for different reporting periods.

Top

Write your question in the form below

Where to download form KS-3

The certificate form in form KS-3, approved by Decree of the State Statistics Committee of the Russian Federation dated November 11, 1999 No. 100, can be downloaded on our website.

The forms, the form of which was approved by the State Statistics Committee, could be supplemented with rows and columns in the tables, as well as other necessary information. Since now the KS-3 form is used on the basis of other documents, it is better not to adjust its form.