Stationery accounting

In order to capitalize stationery purchased for cash or non-cash funds, a receipt order is drawn up (form M-4). The movement of valuables from the warehouse is recorded in special cards (form M-17), which are entered according to the number of each stock. The designated financially responsible person is responsible for maintaining such cards. The basis for an entry in the card is receipt and expenditure documents that date back to a certain date of completion of the business transaction. Stationery supplies are accepted for accounting at their actual cost, that is, at the purchase price, minus VAT (

Written-off stationery - documentation in the Republic of Belarus (budget discrepancies)

To carry out this operation correctly, you need to enter the following information:

- name of the insurance company;

- the date on which the products were shipped;

- the number of the telephone message indicating that the sender was called, and the date on which it was composed;

- volume of seats;

- what does the packaging look like?

- units in which the measurement is carried out;

- passport ID.

It is worth noting that the contract can specify other papers that will be drawn up if deviations are detected.

The procedure for posting stationery

Different accountants carry out accounting for office supplies in different ways. Some people find it convenient to arrive separately for each position. In this case, there is no need to be afraid of tax audits, but such accounting will require a lot of time. Another accounting option involves not counting each item separately, but simply indicating the general name “Stationery”, and then their quantity. This method will not take much time, but it will also be impossible to control the stationery. Most likely, tax inspectors will not like this method either and the company may face claims.

Important! If you count all purchased office supplies as one unit, this may lead to claims from inspection authorities. It is better to write off office supplies by product groups.

This is due to the fact that, for example, the cost of different types of stationery varies significantly. A pen can cost 20 rubles, but a cartridge can cost 2,500 rubles. In addition, office supplies are not handed over to employees immediately, and sometimes after some time. The remaining office supplies are stored either in the warehouse or with the secretary. And you can write off office supplies as expenses only when they have already been issued to employees. When accounting for stationery as one unit, it will not be possible to separate the goods according to whether they are accepted for accounting or not (Read also the article ⇒ Procedure for accounting for inventory and household supplies in 2021).

The best option is to write off office supplies by groups of office supplies. That is, separately pens, pencils, paper, calculators, etc. In this case, accounting will not be distorted, since the indicated cost of goods in one group of goods is approximately the same. It is important to consolidate the chosen method in the accounting policy; it is indicated in the “Raw materials and supplies” section.

Are office supplies returnable?

The possibility of returning purchased stationery is determined mainly by the terms of purchase. In particular, it is of great importance who purchased the “stationery” that did not meet some parameters.

If the purchase took place privately, i.e. by an individual for household, for example, school, needs, then the law “On the Protection of Consumer Rights” comes into force, allowing, subject to certain conditions, to exchange or hand over high-quality, but unsuitable goods . There is a condition:

- goods must retain their original presentation;

- have a whole package;

- The return period must not exceed 14 calendar days.

Please note that there is a List of quality goods that cannot be exchanged, but office supplies do not belong to this category, which means that they can be returned or exchanged if all conditions are met. If at the time of application the required goods are not available for sale and the exchange cannot be carried out, then the seller is obliged to return the money within three days.

When making a purchase by an enterprise, returning office supplies becomes very problematic, since the Civil Code of the Russian Federation does not provide for the possibility of returning or exchanging quality products, and the law mentioned above does not apply in such cases. Here we can only hope for the good will of the seller.

Synthetic accounts for office supplies

Stationery supplies are received in the debit of account 10 “Materials”, and the organization provides a sub-account for accounting for a separate type of inventories on its own. For example, you can open a subaccount 10.01 “Stationery”. It should be taken into account that the accounting policy must provide for the accounting of office supplies in this subaccount.

An organization can pay for office supplies either in cash or by non-cash means. Depending on this, accounts 60 “Settlements with suppliers and contractors” or 71 “Settlements with accountable persons” will be used.

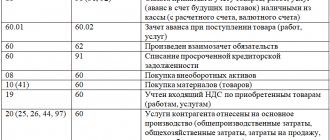

The main wiring will be as follows:

| Business transaction | Debit | Credit |

| Payment to the supplier for stationery | 60.1 | 51 |

| Stationery accepted for accounting | 10.1 | 60.1 |

| An accountable amount was issued to the employee | 71 | 50 |

| Stationery received from the accountable | 10.01 | 71 |

| Return of the unspent advance by the accountable person to the cash desk | 50 | 71 |

Documents confirming the acquisition of inventory items by the accountant

An accountable person is an employee who has received funds for business, administrative and other expenses.

To account for the money received for the purchase of goods and materials, the accountable person fills out an advance report, which indicates exactly what valuables, in what quantities and in what amounts were purchased.

ATTENTION! With effect from November 30, 2020, by the Bank of Russia’s instruction No. 5587-U dated October 5, 2020, the Central Bank introduced a number of changes to the procedure for conducting cash transactions. For example, an organization has the right to independently set the period for which funds are issued for reporting purposes.

ConsultantPlus experts spoke in more detail about the innovations. Get trial access to the K+ system and go to the review material for free.

You can see an example of filling out an advance report (AO), as well as a completed AO, in the material “Sample of filling out an advance report in 2021 - 2021”.

Supporting documents are attached to the advance report, i.e. documents confirming these expenses. Let's look at what documents these might be. An employee of an organization, having received money on account, can purchase goods and materials anywhere: in a retail chain, in a small organization, having received a sales receipt and, if available, a cash receipt as documents confirming the purchase. In this case, a sales receipt confirms the fact of purchase of goods and materials, and a cash receipt confirms their payment.

What should an accountant do if the accountant did not bring a cash receipt, see the material “Features of an advance report without a cash receipt.”

An important point is the acceptance of correctly completed documents.

For what exactly should be indicated in the documents submitted by the accountable person, see the material “Check the details in the accountable person’s documents so as not to be subject to personal income tax.”

If inventory items were purchased from an organization that is not a VAT payer, these documents are quite sufficient to accept an advance report and capitalize inventory items for it.

In order for the accountable person, when purchasing goods and materials, to act before the selling organization not as an individual, but as a representative of his enterprise, it is necessary to issue a power of attorney for this employee. The power of attorney must contain the date of issue and expiration date. The written power of attorney is registered in a special journal and handed over to the employee. By presenting a power of attorney to the seller, the employee acts on behalf of his organization. All documents provided to him by other enterprises will be issued in the name of his employer. By purchasing goods and materials in this way, he will receive both a delivery note and an invoice indicating the details of his organization, which will allow him to accept “input” VAT for deduction.

ConsultantPlus experts explained how to issue a power of attorney to receive goods and materials. Get trial access to the K+ system and upgrade to the Ready Solution for free.

Write-off of stationery

The transfer of stationery from the warehouse to the organization’s divisions is documented with the following documents:

- Limit-fence card, form M-8;

- Request-invoice, form M-11;

- Invoice in form M-15.

Important! The cost of refilling a cartridge cannot be included in the cost of office supplies. They should be classified as material expenses of the organization.

When the service life of stationery supplies ends, they are written off by drawing up a special act. In this case, indicate the following information:

- Name of stationery, its quantity;

- Unit price, the total amount of all items of stationery;

- Consumption standards and where the stationery was used;

- Other information provided at the discretion of the organization.

The posting for writing off office supplies will be as follows:

D 26 K 10.01 – stationery written off for accounting needs.

The write-off report is filled out according to the form approved by the local documents of the organization. In addition, such documents confirm the composition of the commission. An organization can develop the form on its own, or use Form M-11, supplementing it with the necessary details. The demand invoice is filled out in a form that the organization must approve in its accounting policies.

Important! Companies develop a form for writing off office supplies independently, or use a unified form, supplementing it with the details they need.

Sometimes accountants make the mistake of writing off office supplies as expenses. They do it this way: the write-off is carried out bypassing the 10th account, that is, from D26 directly to K60. It is not right. In this case, not only are accounting rules violated, but the organization may not receive a VAT deduction. Since the main condition is lost - the stationery was not accepted for registration.

Results

Accounting entries reflecting the receipt of material assets from the accountable person are formed on the basis of supporting documents received with the advance report from the employee.

They will depend on whether the employee presented the seller with a power of attorney from his organization, as well as on which company (VAT payer or not) the accountable person purchased the inventory items from. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Accounting for stationery in an organization using the simplified tax system

If an organization or individual entrepreneur uses the “simplified” system, then they take into account office supplies as follows: the costs of purchasing office supplies immediately after payment are included in the costs according to the simplified tax system. When exactly these stationery items are written off for production does not matter.

If office supplies arrive as one unit and, accordingly, they are also written off, then this threatens claims from the tax authorities. It would also be correct to divide stationery into homogeneous groups.

Stationery supplies are accounted for in account 10.9 “Inventory and household supplies.” In this case, receipts are processed in the usual way, and releases from the warehouse are processed as follows:

D 23 (25, 26) K 10.9

If simplified people pay tax on income, then there is no need to take office supplies into account when calculating the tax base. But for those organizations using the simplified tax system that pay tax on the difference between income and expenses, the tax base can be reduced by the cost of stationery.

Important! Expenses for office supplies of organizations using the simplified tax system are taken into account immediately after payment.

In order to avoid possible claims from inspection authorities, the cost of office supplies for tax purposes should be taken into account at the time of transferring them to the department.

It is important to take into account that expenses included in expenses for which the tax base is reduced must be economically justified, documented, and also aimed at generating income.

If a company recognizes office supplies as expenses when calculating taxes before writing them off to divisions, tax authorities have the right to challenge this. They can do this on the basis that the costs taken into account are not related to activities aimed at generating income. That is, the cost of stationery can be included as expenses only after the vacation is issued, by issuing a demand invoice (Form M-11) or an act.

What applies to stationery

The accounting legislation and the Tax Code do not define the concept of office supplies. From the point of view of commodity science, these include the following groups and types of goods:

- writing supplies: pencils, pens, quills, sets of writing supplies, ink;

- accessories for drawing: drawing tools and sets, preparation tables, drawing boards, drawing bars, drawing accessories (rulers, squares), erasers, buttons;

- drawing supplies: paints, brushes, cardboard;

- small office equipment: paper clips, hole punches, staplers, proofreaders, clamps, erasers, glue;

- school goods: sharpeners, notebooks;

- office equipment: calculators.