Account 62 in the accounting department is “Settlements with buyers and customers,” an accounting account that reflects all mutual settlements for goods, works, and services that the company sold to third parties during the reporting period.

In accordance with the current chart of accounts, approved by Order of the Ministry of Finance No. 94n, special accounting account 62 should reflect settlements with buyers and customers for goods, works, and services that were sold in the reporting period. Account 62 in accounting accumulates information about mutual settlements for products sold without taking into account their organizational and legal form. That is, on the account. 62 take into account settlements with legal entities, entrepreneurs and individuals. To reflect currency transactions, accounting accounts 62.21 are used (along with 62.22), if acts are issued in foreign currency and payment is made in rubles - 62.31 and 62.33.

For novice accountants, the following explanation is suitable: there is a 62 accounting account for dummies: it is used to collect and summarize information on mutual settlements for goods sold, provided, shipped, performed, works, services of the company in favor of third parties - buyers and customers.

Account 62 is a mirror image of accounting account 60 “Settlements with suppliers and contractors”. The key difference between these accounting accounts is that 62 accounts each. reflect goods, works, services sold to other companies, and on the account. 60 - purchased from third parties.

Why do you need 60 count?

The account is used to record settlements with counterparties. The company's debt for purchased goods or services is recorded as a loan. For example, a company received raw materials from a supplier, which means the accountant will make the following entry:

Dt 10 Kt 60 - goods received from the counterparty

Thus, the company has increased its stock of raw materials, and its debt to the supplier has increased, since the raw materials have not yet been paid for. By debit, the debt is reduced, for example due to payment of a bill for raw materials. Then the accountant makes the following entry:

Dt 60 Kt 51 - supplier invoice paid

Count 60 - active-passive. At the end of the period there may be a debit or credit balance. The debit amount means that the inventory items were paid in advance and the supplier has not yet transferred them. A loan is a company’s debt to a counterparty.

Postings applicable for account 60

For account 60, postings are compiled in correspondence with accounts, a complete list of which is indicated in the order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n.

If the supplier works for OSNO, then VAT is included in the cost of goods (work, services). Often, the same counterparty can act as a supplier under one contract and as a buyer under another. In such cases, it is convenient to use offset when making calculations.

Let's give examples of some wiring.

Let's consider the standard scheme for using account 60.

Example 1

LLC "Inspector" (furniture store) 04/08/20XX transferred an advance payment for the supply of chairs to LLC "Shinel" in the amount of 150,000 rubles. Already on 04/09/20XX, goods were received in full in the amount of 200,000 rubles, including VAT of 33,333 rubles. 33 kopecks On the same day, the final payment for the delivery was made in the amount of 50,000 rubles.

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

Postings that were made by the accountant of Revizor LLC:

- 04.20ХХ: Dt 60.02 Kt 51 - 150,000 rub. — an advance has been received from the supplier.

- 04.20XX:

- Dt 41 Kt 60.01 — 166,666 rub. 67 kopecks — goods are capitalized according to the invoice.

- Dr Kt 60.01 - 33,333 rub. 33 kopecks — VAT on delivery is taken into account.

- Dt 60.01 Kt 60.02 — 150,000 rub. — the advance payment is credited towards payment for the delivery.

- Dt 60.01 Kt 51 - 50,000 rub. — payment for delivery (balance) has been made.

Let us focus on transactions related to uninvoiced deliveries. Uninvoiced delivery is a supply of material assets that is not supported by documents from which one can draw a conclusion about their value. For such deliveries, the “Uninvoiced Delivery” subaccount of account 60 is used. When documents are received, the following entries are made.

Option 1

Option 2

More extensive and up-to-date material on uninvoiced supplies was prepared by ConsultantPlus experts. If you don't already have access to the system, get a free trial online.

What sub-accounts are opened for account 60?

Within 60 accounts, several subaccounts are allocated. The main ones are 60.01 and 60.02.

Subaccount 60.01 is needed to account for mutual settlements with suppliers. It forms the company's accounts payable, that is, the amounts that the organization must pay to its counterparty.

Subaccount 60.02 is used to account for advance payments to suppliers. This is accounts receivable. That is, the company has paid the counterparty, but has not yet received the goods and materials. Let's look at wiring as an example.

| Debit | Credit | Sum | The essence of the operation |

| 60.02 | 51 | 10 000 | The supplier received an advance payment for the supply of raw materials |

| 10 | 60.01 | 10 000 | The supplier shipped the raw materials |

| 60.01 | 60.02 | 10 000 | The advance payment made earlier was taken into account as payment for the delivery made. |

In addition, by the 60th account the following sub-accounts are opened:

- 60.03 - for accounting of bills of exchange;

- 60.21 - debt to suppliers in foreign currency (analogous to 60.01);

- 60.22 - advances to suppliers in foreign currency (analogous to 60.02).

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

Characteristics and features of accounting

This special account belongs to the active-passive group, that is, the working balance can be formed by both debit and credit. The debit of account 62 shows the balance at the beginning and end of the month, the credit shows the payment of accounts receivable. When products are shipped to the company's customers, the operation is reflected as a credit turnover in the correspondence of accounting accounts 90 or 91. When funds are received from customers as an advance for a future supply of goods and materials or payment, a credit account entry is created. 62 in correspondence with special accounting accounts 50, 51, 52.

Current legislation provides for the creation of separate sub-accounts for additional detail of accounting data. So, in the accounting of companies the following are open:

- subaccount 62-01 - for mutual settlements with customers according to general rules with payment in the current mode;

- subaccount 62-02 - information is reflected on settlements with customers and buyers under agreements providing for the transfer of advance payments;

- subaccount 62-03 - data on mutual settlements with customers is generated if payment is made by bills of exchange.

If necessary, the organization has the right to create other sub-accounts that reflect the features and specifics of the activity. This decision should be reflected in the accounting policy.

Retail trade has the right to reflect transactions, bypassing account 62 of accounting - directly on the sales accounting account. We talked about what accounting entries to make in this case in a separate article “Revenue from the sale of goods: entries.”

Analytical accounting should be organized in such a way that when creating a card or balance sheet for account 62, it is possible to obtain information about mutual settlements and the amount of receivables and payables in the context of:

- documents for which the payment deadline has not arrived;

- documents with overdue payments;

- advances received from clients;

- bills of exchange for which the payment date has not yet arrived;

- bills of exchange accounted for in credit or banking organizations;

- bills overdue for payment.

For each operation, the company must prepare supporting documents: invoices, delivery notes, certificates of completion of work, checks, receipts and other documentation.

How is accounting carried out for contracts with trade discounts?

In accordance with the drawn up contract, it may not provide for a clearly established price for a product or product, but determine the procedure for determining the price depending on whether the buyer fulfills certain conditions. In particular, we are talking about the time of acquisition of goods or products, their quantity, as well as the terms of payment for already shipped products. All this is provided for by accounting account 62, the entries of which include such elements.

A price reduction after the buyer fulfills any conditions specified in the contract is usually called a trade discount. The form of its provision can be in kind or in value, that is, the product can be sold absolutely free or at a reduced price. In the event that we are talking specifically about the in-kind form of providing a discount, then in this case the revenue and the total amount of receivables are determined under the contract as a whole, taking into account the cost of the goods transferred in accordance with the established price, which is equal to zero or different from zero .

It is worth noting the fact that various trade discounts that are provided to consumers for purchasing goods out of season or in sufficiently large quantities can be taken into account in order to determine accounts receivable at the stage of shipment of goods to the consumer. It should be noted that accounting account 62 (active or passive) does not provide for the ability to take into account discounts provided to the consumer in case of payment for goods over a certain period, at the time of shipment of goods to the buyer. In this regard, the reflection of accounts receivable in the prepared accounting can be carried out in two ways.

Postings to account 62 Settlements with buyers and customers using an example

Let's study an example when a product is sold remotely through an online store. Payment for goods purchased through the online store can be made in one of the following ways:

- Bank card (transfer of funds is regulated by law dated June 27, 2011 No. 161-FZ);

- Cash to the courier upon delivery of goods (when selling goods through an online store, OKVED code 52.61.2);

- Through electronic payment systems (regulated by law dated June 27, 2011 No. 161-FZ).

Example

The VESNA organization sells goods through an online store. The organization entered into an Internet acquiring agreement with the bank, on the basis of which the remuneration is 1.5% of the receipt amount. Consequently, the amount of revenue minus remuneration is transferred to the current account.

Buyer Ivanov I.I. in January 2021, I paid for the goods with a bank card in the amount of RUB 50,000.00, incl. VAT 18% - RUB 7,627.12. After receiving the bank statement, the organization ships the paid goods to the buyer.

To carry out the operation, the accountant creates the following entries:

| Debit Account | Credit Account | Transaction amount, rub. | Wiring Description | A document base |

| 57.03 | 62.02 | 50 000,00 | The buyer made an advance payment by bank card | Payment register |

| 76.AB | 68.02 | 7 627,12 | We charge VAT on the advance received | Invoice issued |

| 51 | 57.03 | 49 250,00 | Receipt of proceeds to the current account | Bank statement |

| 91.02 | 57.03 | 750,00 | Bank remuneration under the agreement | Bank statement |

| 62.R | 90.01.1 | 50 000,00 | Accounting for sales revenue | Sale of goods and services (act, invoice), Invoice issued |

| 90.03 | 68.02 | 7 627,12 | VAT accrual on shipment | |

| 90.02.1 | 41.11 | 50 000,00 | Write-off of shipped goods | |

| 62.02 | 62.R | 50 000,00 | Settlement of advance received | |

| 68.02 | 76.AB | 7 627,12 | VAT deduction on advance received | Book of purchases |

Buyer Petrov P.P. I ordered goods worth RUB 12,000.00 through an online store, incl. VAT 18% - RUB 1,830.51. The buyer paid the goods in cash to the courier upon delivery of the goods. The delivery cost is 20% of the cost of the goods and is included in the price of the goods. According to the accounting policy, goods are accounted for at sales prices using 42 accounts, the trade margin in the organization is 15%.

To reflect the operation, the following transactions are generated:

| Debit Account | Credit Account | Transaction amount, rub. | Wiring Description | A document base |

| 50.01 | 90.01.1 | 12 000,00 | We take into account retail revenue | Help - report of the cashier-operator (KM-6) |

| 90.03 | 68.02 | 1 830,51 | We charge VAT on retail sales | |

| 90.02.1 | 41.11 | 12 000,00 | We write off sold goods at sales prices | |

| 50.01 | 90.01.1 | 12 000,00 | Delivery of proceeds to the cashier by courier | Receipt cash order (KO-1) |

| 90.02.1 | 42.01 | — 1 105,38 | Calculation of trade margins on goods sold | Help for calculating the write-off of trade margins on goods sold |

Buyer Sidorov A.P. through electronic payment systems paid for goods in the amount of 95,000.00 rubles, incl. VAT 18% - RUB 14,491.53. The money was first credited to the seller’s “electronic wallet” and then transferred to a bank account minus a commission. The commission is 3.5% of the transfer amount – RUB 3,325.00. The next day the goods were shipped to the buyer.

Postings for the operation:

| Debit Account | Credit Account | Transaction amount, rub. | Wiring Description | A document base |

| 55.04 | 62.02 | 95 000,00 | Advance received from buyer using electronic money | Register of payments. |

| 76.AB | 68.02 | 14 491,53 | We charge VAT on the advance payment | Invoice issued |

| 51 | 55.04 | 91 675,00 | Funds were transferred to the current account | Bank statement. |

| 76.09 | 55.04 | 3 325,00 | Bank commission withheld | Bank statement. |

| 44.01 | 76.09 | 2 817,80 | The commission amount is included in expenses | Packing list |

| 19.04 | 76.09 | 507,20 | Input VAT included | |

| 76.09 | 76.09 | 3 325,00 | Advance credited | |

| 68.02 | 19.04 | 507,20 | VAT is accepted for deduction | Invoice received |

| 62.R | 90.01.1 | 95 000,00 | Accounting for sales revenue | Sale of goods and services (act, invoice), Invoice issued |

| 90.03 | 68.02 | 14 491,53 | VAT accrual on shipment | |

| 90.02.1 | 41.11 | 95 000,00 | Write-off of shipped goods | |

| 62.02 | 62.R | 95 000,00 | Settlement of advance received | |

| 68.02 | 76.AB | 14 491,53 | VAT deduction on advance received | Book of purchases |

First option

The first option for how customer receivables are presented through accounting account 62 on the balance sheet involves the use of the terms of an agreement on the transfer of ownership of a certain product in the process of fulfilling obligations on the part of the contractor or supplier. In this case, the obligations of the customer or consumer arise along with the fulfillment of the supplier’s obligations, as well as the transfer of ownership of certain products. At the same time, the fulfillment of the contractor’s obligations in accordance with the contract constitutes the basis for the proceeds from the sale of services, goods, works or certain products to be reflected in the 62nd accounting account. In this case, subaccounts can also be compiled.

What to consider?

It is worth noting the fact that, in accordance with paragraph 6.2 of PBU 9/99, 62.01, the accounting account compiled in the process of performing work, as well as when selling any goods on the terms of a commercial loan in the form of installments or deferred payment, must include includes receivables in full amount under the concluded agreement.

If the company receives claims regarding the payment of the cost of products or services of inadequate quality, as well as a reduction in the contract price, in this case the company must agree with the requirements received from the customer or resolve this issue in court. If everything is resolved amicably, then, upon agreement with the consumer’s requirements, an entry should be made in all accounting accounts that reduces the total amount of the customer’s receivables.

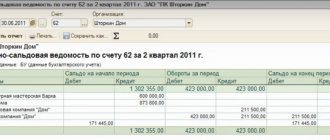

Balance sheet for account 60

The balance sheet for account 60 (SALT) is a convenient accounting record when working with identifying debts from suppliers and contractors. As the name of the report suggests, it displays turnover and balances by counterparties for the selected period. OSV discloses information on each counterparty with whom transactions were made during the specified period or at the beginning of which there was an outstanding debt.

An example of filling out the WWS is shown in the figure: