Accounting for fixed assets at an enterprise in 2021 - 2021

First of all, accounting specialists at an enterprise should clearly understand the differences and similarities in approaches to reflecting fixed assets and transactions with them in the accounting and tax accounting of fixed assets.

In both accounting and tax accounting, in order for a company to consider certain equipment as its fixed asset, the object must meet the following criteria:

- the estimated period of use of the object exceeds 12 months;

- the object was acquired for use in the business of the enterprise, and not for resale;

- the asset is capable of bringing economic benefits to the enterprise;

- the initial cost exceeds 40,000 rubles. for accounting and 100,000 rubles. for tax accounting purposes.

ConsultantPlus experts explained in detail how to take into account fixed assets for income tax purposes. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

Until 01/01/2016, the criterion for the initial cost of fixed assets in accounting coincided with that in tax accounting: fixed assets were considered equipment worth more than 40,000 rubles. But from 01/01/2017 in paragraph 1 of Art. 256 and paragraph 1 of Art. 257 of the Tax Code of the Russian Federation, amendments were made, according to which OS began to be recognized for tax purposes only for property exceeding the value of 100,000 rubles. Moreover, this increase in the limit applies only to OS accepted from 01/01/2016. In accounting, the value of the limit has not yet changed: depreciable property is an asset worth more than 40,000 rubles. In this connection, taxable temporary differences are formed between tax and accounting.

See here for details.

Each fixed asset belongs to a specific depreciation group, and its cost is written off as expenses over a certain time period.

Physical deterioration

Physical wear and tear is a decrease in the original value of property for the consumer. It is calculated in two ways, see table 2.

| Name | Description | Formula | Decoding |

| Based on scope of work | It is suitable for items with established performance | I = (Tf x Pf) / (Tn x Pn) | Tf – time that the object actually served Pf – average quantity of products produced per year Tn - SPI according to the norm Mon – normal productivity |

| By period of use | It is established by comparing the actual and normative SPI. Valid for determining the wear and tear of any OS. |

Calculation formulas on video:

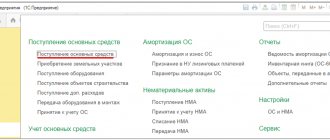

The procedure for accounting for the receipt of fixed assets in a company

When a company acquires (or receives) fixed assets, the task of accounting specialists is to ensure a correct reflection of the fact that the fixed assets have been received by the company, as well as the subsequent accounting of the fixed assets in the financial statements.

The first thing to do in this context is to determine the initial cost of the fixed asset. Therefore, it is important to know what this cost consists of.

As follows from paragraph 8 of PBU 6/01, the initial cost is determined by adding up all the costs that the company actually made in order to acquire the object and bring it to a state where it can be used in production, namely:

- Purchase price or construction price. If the operating system for the company was built by a counterparty, the costs can be confirmed using a transfer and acceptance certificate, invoice, work completion certificate, etc.

IMPORTANT! The price should be included in the original price excluding VAT. VAT is taken into account in the cost of fixed assets only if the company will use such fixed assets for VAT-free activities.

- Amounts spent on delivery of an object from the manufacturer (previous owner) to the company. For accounting, confirmation of this part of the initial cost of the fixed assets will be a waybill or waybill (when the company independently brought the fixed assets).

- The costs a company had to incur to make a facility suitable for use in production. This group of costs includes costs for installation, debugging, etc.

- If a company imported an asset from abroad, then customs duties and fees specified in the declaration can also be taken into account as part of the initial cost. This, in particular, was indicated by the Federal Tax Service of the Russian Federation in a letter dated April 22, 2014 No. GD-4-3/ [email protected]

- State duty, if its payment is necessary so that the object can be used by the company in production. Confirmation of such costs can be a simple payment order for payment of the duty.

- Any other costs that the company was forced to incur in connection with the acquisition of the operating system.

NOTE! The fundamental difference between accounting and tax accounting is that it allows you to take into account in the initial cost of an investment asset interest on loans that the company had to take out in order to acquire such an asset (clause 7 of PBU 15/2008, approved by order of the Ministry of Finance of Russia dated October 6, 2008 No. 107n). In tax accounting, interest is always a non-operating expense.

You can find out what are the nuances of accepting real estate for accounting and tax accounting from the Ready-made solution from ConsultantPlus. Trial access to the legal system is free.

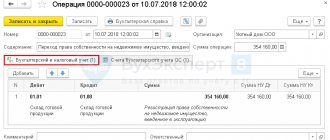

An example of the formation of the cost of fixed assets in accounting based on 1C ERP version 8.3 is presented below:

All expenses associated with the acquisition and/or construction of fixed assets are reflected in the debit of account 08.04 and are controlled by the “Account Card” report.

After a company specialist calculates the total initial cost of the fixed assets, such an object can be taken into account. To do this, the company should issue an OS acceptance and transfer certificate, and then open a special inventory card for the object.

IMPORTANT! The company should be aware that even if the OS needs to be registered with government authorities, this procedure will not affect the moment of acceptance for accounting. In any case, such a moment occurs on the date when the initial cost of the fixed asset is determined.

Assigning an inventory number

An inventory identification number is assigned to a property at the time it is registered. It is registered in the inventory card f. OS-6. This is necessary to be able to control and record the assets of the enterprise.

The inventory number must meet the following requirements:

- it must be unique in accounting

- assignment is in order

Setting the structure, duration and other characteristics for numbers is determined by the internal regulations of the organization.

Depreciation and revaluation of fixed assets in accounting

The company depreciates the OS over the course of its operation, i.e., gradually transfers its value to account 02.

NOTE! Depreciation in accounting for the operating system used should not be interrupted. An exception exists only for OS preserved for more than 3 months, as well as for OS, the restoration of which should last longer than 12 months (clauses 17, 23 of PBU 6/01).

However, accounting specialists should remember that some categories of fixed assets do not need to be depreciated. These include, for example, land plots.

For information on how to calculate depreciation and display it in accounting, read the material “Methods of calculating depreciation in accounting.”

The company also has the right to revaluate its fixed assets, that is, recalculate both the cost of fixed assets and the amounts of previously accrued depreciation. This follows from clause 15 of PBU 6/01. Such revaluation must be carried out at the end of each year. In this case, the results of revaluation (the value of revaluation or discount) can both influence the financial results of the company and increase/decrease the company’s additional capital.

How to formalize the revaluation of OS in practice, read in the Typical situation from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

For more information about the revaluation of fixed assets, see the article “Why is the revaluation of fixed assets necessary?” .

Important point

Please note that the main means is recognized as an object with all its accessories and devices, or a structurally isolated product intended to perform specific independent functions, or a complex of several mechanisms, components, etc., used to perform certain work. Such a complex is one or more objects of the same or different purposes, having common controls, accessories, devices mounted on the same plane, as a result of which each element can perform functions exclusively in interaction with other components, and not independently.

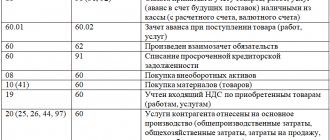

Organization of accounting for the sale of OS

If a company decides to sell an operating system, then the accounting specialist has the task of correctly showing the fact of sale in the financial statements. What are the accounting consequences of selling an asset?

1. On the date of sale (transfer of ownership rights to the new owner), the selling company should record income. Such income is taken into account as part of other income and accumulated in account 91 (on the loan).

IMPORTANT! Income is only the net sales price, excluding VAT. However, all income is first credited to account 91, after which the amount of VAT on fixed assets is reflected by posting to the debit of account 91 in correspondence with account 68.

How to calculate VAT on the sale of fixed assets can be found in the publication “Calculation and procedure for paying VAT on the sale (realization) of fixed assets.”

2. The sale of fixed assets entails the need to attribute the residual value of such fixed assets to other expenses of the company.

Find out about the features of accounting for the sale of fixed assets here.

In terms of documenting the sale of OS to a company, it should be remembered that the fact of transfer of OS to the buyer is recorded in an acceptance certificate.

Transfer of ownership

D01.v - K01 - write off the initial cost of the object D02 - K01.v - write off the accumulated depreciation D91 - K01.v - write off the residual value D62 - K91 - receive proceeds from the sale of fixed assets D91 - K68 - VAT is charged on the sale of fixed assets (for companies on BASIC)

Keep records in Kontur.Accounting - a convenient online service for calculating salaries and sending reports to the Federal Tax Service, Pension Fund and Social Insurance Fund. The service is suitable for comfortable collaboration between an accountant and a director.

Try free for 5 days

What is important to remember when selling unfinished properties

In practice, cases often arise when a company decides to sell an unfinished future OS, for example, a warehouse or building. Here you should also remember some accounting features.

In particular, income from the sale of such unfinished objects is also considered other income and is credited to account 91 in the amount that the buyer paid for the object.

However, since the unfinished object has not yet been recognized by the company as fixed assets, it does not have a formed initial value. The question arises as to what should be included in expenses.

IMPORTANT! As indicated by paragraphs. 11, 14.1, 16, 19 PBU 10/99, approved by order of the Ministry of Finance of the Russian Federation dated May 6, 1999 No. 33n, in this situation, in other expenses (debit of account 91), the company should include those costs that it has already incurred in connection with the construction of the operating system ( the actual value of the object as of the date of sale), as well as, if relevant, costs associated with the sale (for example, intermediary fees, etc.).

As in the case of the sale of fixed assets, when selling an unfinished object, income arises (and is shown in the reporting) on the date when ownership rights transferred to the acquirer.

Nuances of accounting for the transfer of fixed assets to the authorized capital of an LLC

If a company decides to transfer its former OS to the authorized capital of another organization, it should be remembered that such a transfer must also be formalized by an appropriate act. It can be compiled either in free form or using a template in the OS-1 form. At the same time, it is important that such an act reflects the residual value of the fixed assets, as well as the amount of VAT that the company will have to recover in connection with the transfer of the fixed assets as a contribution to the capital of another company.

Further. The transferred OS is assessed by the participants of the receiving organization to determine the size of the contribution made by such OS. Therefore, it is important for the company to understand that if participants evaluate the fixed assets at a cost exceeding its book value, then the company will attribute the difference to its income (credit to account 91 in correspondence with the debit of account 76, intended to account for the company’s debt on a contribution to the capital of a third-party company). In the opposite case, if the shareholders valued the operating system at a smaller amount than what was indicated in the company’s accounting documents, it turns out that in fact the debt on the contribution to the capital company was not fully repaid. Therefore, the difference should be included in other expenses and written off as a debit to account 91.

Whether to charge depreciation on fixed assets received as a contribution to the management company, read here.

Types of wear

The following types of wear exist:

physical, when the decrease in value is associated with the loss of physical, biological, chemical and other similar qualities- moral, when analogues with lower cost or analogues with greater productivity appeared

- social wear and tear, when the OS has lost value because more comfortable or secure analogues have appeared

- environmental, when sanitary standards are tightened

At the same time, social and environmental wear and tear are taken into account very rarely and exclusively in certain areas. Basically, physical and moral wear and tear are calculated.

Liquidation of fixed assets in accounting

Liquidation of fixed assets has some peculiarities in terms of accounting.

Firstly, since the company did not receive income for the disposed fixed assets, the company will only have to show expenses in its accounting. In this case, expenses (recorded in the debit of account 91) will include the following:

- residual value of the liquidated asset;

- the amount of costs for work (both own and performed by third parties) that directly accompanied the liquidation of the OS;

- the amount of VAT that the company had to restore in connection with the liquidation of the operating system.

What transactions are made when disposing an asset , see . in the material “Disposal of fixed assets in accounting (nuances).”

Secondly, specialists responsible for fixed assets accounting should not forget that as a result of liquidation, the company receives some new inventory. They must be taken into account on account 10 (debit) in correspondence with the increase in the company’s other income (credit 91).

Read about how to take into account costs when liquidating an OS here.

Purpose of order

It should be noted that issuing an order to register a value is necessary not only for the correct preparation of reports. The order is the basis for drawing up an act on putting the property into operation. Such an act shall indicate:

- Characteristics of the object.

- Description of appearance, technical condition.

- Full name of employees responsible for operation.

- The level of readiness of the object for use.

This document must be signed by a special commission, which also includes the manager and chief accountant.

Results

Accounting for fixed assets in 2021 should, for the most part, be carried out in the same order as before.

Namely, to take into account the operating system on the date of bringing it to a state of readiness for operation. Subsequently, when selling the OS, the remuneration received is included in income, and the residual value of the OS is included in expenses. Similar rules apply to the sale of unfinished properties. At the same time, it is important for specialists to remember: despite the fact that in tax accounting the cost criterion for recognizing an asset has increased to 100,000 rubles, in accounting it has not changed and is still 40,000 rubles. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Formation of initial cost

The initial cost is formed based on the estimated cost of the operating system. It is according to this that the object is accepted for accounting. The norms for the formation of the initial cost depend on the order in which the object is entered onto the balance sheet of the enterprise.

Thus, the object is registered by the organization at a cost that is formed from the actual expenses for purchase, construction, and release minus VAT. When receiving fixed assets free of charge, its initial price is set at the current market price on the date of acceptance for accounting.