If you have received income that is subject to declaration (for example, you sold an apartment or a car), then by April 30 of the next year you are required to submit a declaration to the tax authority, and by July 15 to pay the income tax calculated in the declaration (more details Deadline for filing the 3-NDFL declaration and payment of tax). A logical question is what will happen if you do not file a return on time or do not pay tax. In this article, we will take a closer look at the legal consequences of failure to file a return and failure to pay income taxes.

We will divide situations into three main groups and consider them separately:

- if you did not submit a return on time, according to which you do not have to pay tax (“zero” return);

- if you did not submit a return on time, as a result of which you had to pay tax;

- if you submitted your return on time, but did not pay the tax on time.

General provisions

Filing tax reports is the main responsibility of every taxpayer.

In addition to the fact that officials have developed and approved individual forms for each fiscal obligation, each type of reporting has its own deadline. If a company or entrepreneur delays a report, for example, forgets to send it to the Federal Tax Service, then he will be fined for failure to submit a declaration. Note that the deadlines for most fiscal obligations are approved in the Tax Code of the Russian Federation. However, exceptional rules apply for regional and local taxes. Thus, the authorities of a subject or municipal entity have the right to regulate individual deadlines for the provision of fiscal reporting, which will be valid only in the territory of a given region or municipal entity. For example, corporate property tax, transport or land tax.

Let us remind you that each tax, fee or other payment has its own forms and reporting forms, as well as deadlines by which information must be provided to the Federal Tax Service. If this is not done, the taxpayer will be punished - a fine will be issued for failure to submit a declaration or calculation. The reason for failure does not matter; punishment can be avoided only in exceptional cases.

Zero report

If, after applying deductions, the amount of the fee payable is zero, then this does not relieve the citizen from the obligation to provide 3‑NDFL. Late submission of a declaration with zero indicators is punishable by a penalty of 1,000 rubles.

Example

In 2021 Popov M.P. sold the garage for 100 thousand rubles. The fee after applying the deduction was 0 rubles. Popov did not submit a declaration, and the Federal Tax Service fined him 1,000 rubles.

Payment of the established penalty does not relieve the taxpayer from the obligation to send 3‑NDFL to the inspectorate. If the declaration is not submitted after repayment of the accrued sanctions, the Federal Tax Service will again bring the violator to justice.

Amount of fine for failure to submit a declaration

All organizations and entrepreneurs have uniform provisions for determining the amount of punishment. In other words, the amount of the fine for late submission of a tax return for any tax is determined using a single algorithm.

So, liability for late submission of a tax return is defined as 5% of the amount of the unpaid fiscal obligation to the budget. Moreover, this 5% will be charged for each month of delay, full or incomplete. However, the total amount of the fine for failure to submit a tax return cannot be more than 30% of the amount of tax not paid on time, but not less than 1000 rubles. Such instructions are enshrined in paragraph 1 of Art. 119 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance dated August 14, 2015 No. 03-02-08/47033.

Administrative responsibility

Bringing an organization to justice for committing a tax offense does not relieve its officials, if there are appropriate grounds, from administrative, criminal or other liability provided for by the laws of the Russian Federation. Administrative liability is established by the Code of Administrative Offenses of the Russian Federation. According to Art. 15.5 of the Code of Administrative Offenses of the Russian Federation, violation of the established deadlines for submitting a declaration to the tax authority at the place of registration entails the imposition of an administrative fine on officials in the amount of 300 to 500 rubles. An official may be punished for an administrative violation in connection with failure to perform or improper performance of his official duties. Managers and other employees of organizations who have committed administrative offenses in connection with the performance of organizational, administrative or administrative functions bear administrative liability as officials, unless otherwise provided by law. Based on the stated norms, the Federal Tax Service of Russia for Moscow, in Letter No. 09-14/081895 dated August 29, 2008, concluded that it is legal to hold the head of an organization administratively liable for failure to submit a declaration.

Example: calculating the fine for late filing of a declaration

VESNA LLC submitted a VAT return report for the 3rd quarter of 2021 to the Federal Tax Service late - 10/29/2019. Let us remind you that the deadline for submitting VAT tax returns for the 3rd quarter. 2021 - until October 25, 2019.

The amount of value added tax according to the report for the 3rd quarter amounted to 1,200,000 rubles. Only a third of the total amount was transferred to the budget late - 400,000 rubles (1,200,000 / 3). The date of payment to the Federal Tax Service is October 29, 2019.

The submission of the VAT tax return and payment was overdue by 4 days, therefore, the penalty for late submission of a tax return will be calculated as follows:

400,000 × 5% × 1 month. (one incomplete month of delay) = 20,000 rubles.

If VESNA LLC had paid VAT on time, the tax authorities would have issued a fine for late submission of the declaration in the amount of 1,000 rubles.

IMPORTANT!

If a company has not submitted an advance calculation for property tax or ND for income tax for the reporting period (quarter, month), then the penalty for late filing of a tax return - a fine - will be only 200 rubles. The grounds are enshrined in clause 1 of Art. 126 of the Tax Code of the Russian Federation, Letter of the Federal Tax Service dated August 22, 2014 No. SA-4-7/16692.

For example, VESNA LLC reported its income tax for the 3rd quarter of 2021 on time by 12/15/2019. The date regulated at the legislative level is October 29, 2019.

Tax authorities will impose penalties in the amount of 200 rubles. Moreover, the amount of the penalty does not depend on the time of delay and the amount of the advance payment.

The size of the punishment can be significantly reduced. To do this, prepare an appeal to the Federal Tax Service. We talked about how to do this in a special material “How to draw up a petition to reduce a fine to the tax office.”

What is the statute of limitations for prosecution?

Tax authorities have the right to hold an enterprise accountable only within 3 years after violating the reporting rules.

The date from which to count the statute of limitations for fines for late submission of reports is determined in two ways:

- from the time following the end of the period in which the violation was committed;

- from the date of the event.

In Art. 46 of the Tax Code of the Russian Federation states within what period a fine will be issued after submitting a declaration if the company has not made the payment voluntarily.

Tax officers can:

- no later than 2 months after the end of the period for fulfilling the requirement for payment, make a decision on collection and issue a collection;

- If you miss the moment for an indisputable recovery, go to court with a claim, the filing of which is given 6 months.

In 2021, the deadline for sending tax payment requests has been increased by 6 months (Government Decree No. 409 of 04/02/2020).

Penalties for other reporting

If a company does not report on time for other types of fiscal reporting, then it faces the following penalties:

- For violating the deadline for submitting certificates in Form 2-NDFL, you will be fined 200 rubles for each certificate not submitted on time.

- For failure to submit 6-NDFL payments, sanctions are imposed in the amount of 1000 rubles for each full and partial month of delay.

- If you are late in submitting your annual financial statements to the Federal Tax Service, you will have to pay 200 rubles for each form not submitted.

But for failure to complete payment of insurance premiums, the punishment is similar to the general fines for late submission of a declaration: 5% for full and partial months of delay. The total amount of the penalty cannot be less than 1000 rubles and more than 30% of the amount of tax payable. They will also calculate the penalty for late submission of the 4-FSS report to Social Security.

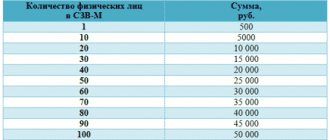

For failure to submit pension reports in the SZV-M form, they will be punished with 500 rubles for each insured person from the overdue report.

Is it possible to reduce the size of sanctions and how to do it?

A reduction in the amount of the fine for failure to submit reports on personal income tax and other taxes is allowed under mitigating circumstances, as stated in paragraph 1 of Art. 112, paragraph 3 of Art. 114 Tax Code of the Russian Federation. You will need to prepare an appeal to the Federal Tax Service indicating the reasons for the violation.

Arguments used as mitigation:

- payment of tax on time;

- the violation was committed once;

- no debt in payment of other taxes.

Often tax authorities reduce the amount of punishment for failure to submit reports if the violation occurred for the first time and the company has paid the debt according to the audit report.

An enterprise has the right to file a lawsuit if the tax authorities refuse to reduce the amount of sanctions. To consider the case, you will need to attach documents confirming the plaintiff’s claim.

Exceptional cases

Some believe that in some cases there is no need to report your income to the state. More precisely, part of the population believes that if there is no need to pay tax on a particular profit, there is no need to declare it.

Actually this is not true. Even if a citizen has received tax-free profit, it must be reported. Otherwise, the person will face certain punishment. Which one exactly?

How to pay?

If you submitted your reports and noticed that you underestimated the tax, you need to calculate and pay penalties yourself to avoid a fine. In other cases, the tax office or the fund itself must impose penalties. Controlling authorities have the right to collect something in the form of fines and penalties, but are not obligated. Often there are no fines for minor violations (especially for the first time).

If, when transferring a tax or contribution, you made a mistake in the KBK or other details that did not prevent the money from “falling” into the account of the Federal Tax Service, then arrears do not arise. There is no right to charge penalties. You just need to clarify the payment.

To pay a fine or penalty, it is enough to pay a regular payment, like a tax, but at the same time replace 1 or 2 digits in the BCC. For example, the simplified tax system is 182 1 0500 110 (initial).

KBK for transferring penalties (we change the 6th and 7th digits on the right in KBK) for tax 182 1 0500 110 - for payment of penalties, 182 1 05 01011 01 2200 110 - for interest.

KBK for transferring a fine (change the 7th digit on the right in KBK) for tax - 182 1 0500 110

Late submission of reports to the tax authorities

Violation of deadlines for submitting reports to the inspection (or failure to submit reports at all) is a fairly common phenomenon, explained by constant changes in the deadlines and procedure for their submission.

IMPORTANT! Do not forget that if the last day for filing reports falls on a Sunday or a non-working national holiday, then it is shifted to the next working day following this weekend or holiday (Clause 7, Article 6.1 of the Tax Code of the Russian Federation). Whether regional holidays are postponed, see here.

Read more about the rules for determining the deadlines for paying various taxes in the material “What you need to know about the deadlines for paying taxes .

Results

Fines for violations of tax laws are quite numerous, and not every taxpayer can avoid them. But in some cases, the legislation allows you to get rid of fines (for example, by paying arrears and penalties before filing an updated declaration or proving that there was no understatement of the tax base for a transaction between related parties, and prices corresponded to market prices) or reduce their size.

In what cases can you expect a reduction in the fine, read the material “Circumstances Mitigating Liability for a Tax Offense”.

Sources:

- Tax Code of the Russian Federation

- Criminal Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Payment deadlines

Deadlines for paying taxes and insurance fees, filing tax returns and reports.

The day indicated in the Tax Code is the last day for tax payment. The wording “before” or the adverb “no later” is not important (letter of the Ministry of Finance dated April 30, 2019 No. 03-02-08/32422) and (Supreme Court ruling dated October 16, 2018 No. 304-KG18-7786).

TaxTax payments under the simplified tax system (once a quarter): Q1. - until April 25Q2 - until July 25th quarter - until October 25th quarter — until April 30 (for individual entrepreneurs) until March 31 (for organizations) UTII tax payments (once a quarter): I quarter. - until April 25Q2 - until July 25th quarter - until October 25th quarter - until January 25 Personal income tax payments (13%) (once a year): until April 30 Payments Income tax (once a quarter): Q1. - until April 28Q2 — until July 28th quarter - until October 28th quarter - until January 28 VAT payments (once a quarter): I quarter. - until April 202nd quarter - until July 20th quarter — until October 20 IV quarter - until January 20 Since 2015, VAT returns must be submitted by the 25th. But the payment deadline is still until the 20th. Personal income tax 13% for employees (until the 15th of the next month) | Pension FundFixed payment to the Pension Fund of Individual Entrepreneurs (paid once a year, until December 31) in 2021 and 2021 - 40,874 rubles. (for income up to 300 rubles per year and + 1% of income from amounts over 300 rubles),

in 2021 - 36,238 rubles.

(for income up to 300 tr. per year and + 1% of income from amounts over 300 tr.) See IP Payment Calculator Contributions to the Pension Fund for compulsory pension insurance (paid monthly no later than the 15th day of the next calendar month) For employees: 26% (or

18%

for preferential activities (production, construction, education, IT)) for OSNO, simplified tax system, UTII (20% (or 12% for preferential) for insurance 6% for the funded part; if 1966 and older, if older - everything for insurance),

FFOMS 3.1%

for OSNO, simplified tax system, UTII,

TFOMS 2.0%

for OSNO, simplified tax system, UTII. The pension penalty also needs to be broken down into a penalty for the insurance and savings part, FFOMS, TFOMS See: Salary and Pension Fund contribution calculator (free) In this case, you can try to reduce the fine and sue. For example, the company reduced the fine by 2 times, citing the fact that the report was overdue by a small number of days (see resolution of the Moscow District Arbitration Court dated April 1, 2016 No. A41-30902/2015). The Pension Fund itself cannot reduce fines, only through the courts. | FSSPayment to the Social Insurance Fund: Q1. — until April 15, 2nd quarter. — until July 15, 3rd quarter. — until October 15, quarter IV. - until January 15 Completed sample 4-FSS 2015. See: Salary and Social Insurance Contributions Calculator (free) |

The annual report was not submitted

Almost all Russian organizations are required to submit a balance sheet with appendices. The penalty for failure to submit financial statements to the tax service is less severe. Thus, an economic entity that has not submitted a balance sheet to the Federal Tax Service must pay only 200 rubles to the budget. However, 200 rubles is a punishment for each form not turned in.

Let us remind you that annual accounting consists of several forms:

- Balance sheet.

- Income statement.

- Statement of changes in equity.

- Cash flow statement.

- Report on the intended use of funds.

Moreover, the specific list of financial statements is determined depending on the category of taxpayer. For example, small businesses can report using simplified forms (balance sheet and financial results report). For them, untimely submission of financial statements to the tax office will cost 400 rubles. (200 × 2).

Whereas commercial organizations and banking institutions are required to report in full. For these subjects the penalty will be 1000 rubles. (200 × 5 shapes).

Moreover, controllers have the right to punish responsible officials. Thus, the fine for failure to submit a balance to the tax office in 2021 for a company employee will be 300–500 rubles.

Calculator

The calculator for calculating fines and penalties is completely free. There is no need to register or send SMS. The result is immediate.

Calculation result

The penalty for unpaid tax (contribution) will be: 62.32 rubles Calculation procedure: (tax amount: 23153.33 * days of non-payment: 19 * refinancing rate (on average): 4.25 / 300 / 100 = 62.32)

Amount restrictions

From November 27, 2021, the amount of the penalty 62.32 cannot be higher than the amount of the arrears 23153.33 The total amount of the penalty is: 62.32

Tax calendar

| ← 2021 2021 |

January

Mon | Tue | Wed | Thu | Fri | Sat | Sun |

| 1 | 2 | 3 | 4 | 5 |

| 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M and SZV-TD reports to the Pension Fund of the Russian Federation. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

- Pay personal income tax 13% for individual entrepreneurs *for the fourth quarter* Payments and receipts

| 16 | 17 | 18 | 19 |

- 20

For all tax regimes *annual* Form (50 kb.) Information on the AVERAGE number of employees - Submit a UTII declaration *for the fourth quarter* UTII declaration calculator + form

- Quarterly: Report 4-FSS NS and PZ (paper) for employees. Sample 4 FSS

| 21 | 22 | 23 | 24 | - 25

Pay UTII *for the fourth quarter* Payments and receipts - Submit a VAT return *for the fourth quarter* Sample declaration

- Pay VAT *for the fourth quarter* Payments and receipts

- Quarterly: Report 4-FSS NS and PZ (electronic) for employees. Sample 4 FSS

| 26 |

| 27 | 28 | 29 | - 30

Quarterly: Submit the calculation of the Unified Social Insurance Tax (USSS) to the Federal Tax Service. Sample report, fines

| 31 |

FebruaryMon

| Tue | Wed | Thu | Fri | Sat | Sun |

| 1 | 2 |

| 3 | 4 | 5 | 6 | 7 | 8 | 9 |

| 10 | 11 | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M and SZV-TD reports to the Pension Fund of the Russian Federation. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

| 16 |

| 17 | 18 | 19 | 20 | 21 | 22 | 23 |

| 24 | 25 | 26 | 27 | 28 | 29 |

MarchMon

| Tue | Wed | Thu | Fri | Sat | Sun |

- 1

Submit new annual reports to the Pension Fund - SZV-Stazh and ODV-1 Sample SZV-Stazh - Submit 2-NDFL declaration for employees to the tax office *annual* Sample 2-NDFL

- Submit 6-NDFL declaration for employees to the tax office *for the year* Sample 6-NDFL

- Submit a report to the Pension Fund *for the year* Report RSV-2 of peasant households (no individual entrepreneur required)

|

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 9 | 10 | 11 | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M and SZV-TD reports to the Pension Fund of the Russian Federation. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

|

| 16 | 17 | 18 | 19 | 20 | 21 | 22 |

| 23 | 24 | 25 | 26 | 27 | - 28

Pay tax Income tax *for the year* Payments and receipts - Submit an income tax return *for the year* Income tax for LLC.xls

| 29 |

- 30

Submit financial statements: Form No. 1 Balance sheet *for the year*. Form: Balance Sheet.XLS - Submit financial statements: Form No. 2 of the Profit and Loss Statement *for the year*. Form: Profit and Loss Statement.XLS

| - 31

For Organizations (not individual entrepreneurs): Pay the simplified tax system *for the year* Payments and receipts - For Organizations (not individual entrepreneurs): Submit a declaration of the simplified tax system *for the year* Declaration of the simplified tax system calculator + form

|

|

April

Mon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | 2 | 3 | 4 | 5 | | 6 | 7 | 8 | 9 | 10 | 11 | 12 | | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M and SZV-TD reports to the Pension Fund of the Russian Federation. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

- Confirmation of the type in the FSS

| 16 | 17 | 18 | 19 | - 20

Submit a UTII declaration *for the first quarter* UTII declaration calculator + form - Quarterly: Report 4-FSS NS and PZ (paper) for employees. Sample 4 FSS

| 21 | 22 | 23 | 24 | - 25

Pay the simplified tax system *for the first quarter* Payments and receipts - Pay UTII *for the first quarter* Payments and receipts

- Submit a VAT return *for the first quarter* Sample declaration

- Pay VAT *for the first quarter* Payments and receipts

- Quarterly: Report 4-FSS NS and PZ (electronic) for employees. Sample 4 FSS

| 26 | | 27 | - 28

Pay tax Income tax *for the first quarter* Payments and receipts - Submit an income tax return *for the first quarter* Income tax for LLC.xls

| 29 | - 30

For individual entrepreneurs: Pay the simplified tax system *per year* Payments and receipts - For individual entrepreneurs: Submit a declaration of the simplified tax system *for the year* Declaration of the simplified tax system calculator + form

- Submit 3-NDFL declaration for individual entrepreneurs *annual* Payments and receipts

- Quarterly: Submit the calculation of the Unified Social Insurance Tax (USSS) to the Federal Tax Service. Sample report, fines

- Submit the 6-NDFL declaration for employees to the tax office within 3 months. Sample 6-NDFL

|

| MayMon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | 2 | 3 | | 4 | 5 | 6 | 7 | 8 | 9 | 10 | | 11 | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M and SZV-TD reports to the Pension Fund of the Russian Federation. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

| 16 | 17 | | 18 | 19 | 20 | 21 | 22 | 23 | 24 | | 25 | 26 | 27 | 28 | 29 | 30 | 31 |

| JuneMon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | | 8 | 9 | 10 | 11 | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M and SZV-TD reports to the Pension Fund of the Russian Federation. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

| 16 | 17 | 18 | 19 | 20 | 21 | | 22 | 23 | 24 | 25 | 26 | 27 | 28 | | 29 | 30 |

| | July

Mon| Tue | Wed | Thu | Fri | Sat | Sun | - 1

Pay the Pension Fund OPS for the individual entrepreneur himself (additional 1%) *for the last year* Payments, receipts and calculator

| 2 | 3 | 4 | 5 | | 6 | 7 | 8 | 9 | 10 | 11 | 12 | | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M and SZV-TD reports to the Pension Fund of the Russian Federation. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

- Pay personal income tax 13% for individual entrepreneurs *for last year* Payments and receipts

- Pay personal income tax 13% for individual entrepreneurs *for six months* Payments and receipts

| 16 | 17 | 18 | 19 | - 20

Submit a UTII declaration *for the second quarter* UTII declaration calculator + form - Quarterly: Report 4-FSS NS and PZ (paper) for employees. Sample 4 FSS

| 21 | 22 | 23 | 24 | - 25

Pay the simplified tax system *for six months* Payments and receipts - Pay UTII *for the second quarter* Payments and receipts

- Submit a VAT return *for the second quarter* Sample declaration

- Pay VAT *for the second quarter* Payments and receipts

- Quarterly: Report 4-FSS NS and PZ (electronic) for employees. Sample 4 FSS

| 26 | | 27 | - 28

Pay tax Income tax *for the second quarter* Payments and receipts - Submit an income tax return *for the second quarter* Income tax for LLC.xls

| 29 | - 30

Quarterly: Submit the calculation of the Unified Social Insurance Tax (USSS) to the Federal Tax Service. Sample report, fines

| - 31

Submit 6-NDFL declaration for employees to the tax office *for six months* Sample 6-NDFL

|

| AugustMon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | 2 | | 3 | 4 | 5 | 6 | 7 | 8 | 9 | | 10 | 11 | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M and SZV-TD reports to the Pension Fund of the Russian Federation. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

| 16 | | 17 | 18 | 19 | 20 | 21 | 22 | 23 | | 24 | 25 | 26 | 27 | 28 | 29 | 30 | | 31 |

| SeptemberMon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | 2 | 3 | 4 | 5 | 6 | | 7 | 8 | 9 | 10 | 11 | 12 | 13 | | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M and SZV-TD reports to the Pension Fund of the Russian Federation. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

| 16 | 17 | 18 | 19 | 20 | | 21 | 22 | 23 | 24 | 25 | 26 | 27 | | 28 | 29 | 30 |

| | October

Mon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | 2 | 3 | 4 | | 5 | 6 | 7 | 8 | 9 | 10 | 11 | | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M and SZV-TD reports to the Pension Fund of the Russian Federation. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

- Pay personal income tax 13% for individual entrepreneurs *for the third quarter* Payments and receipts

| 16 | 17 | 18 | | 19 | - 20

Submit a UTII declaration *for the third quarter* UTII declaration calculator+form - Quarterly: Report 4-FSS NS and PZ (paper) for employees. Sample 4 FSS

| 21 | 22 | 23 | 24 | - 25

Pay the simplified tax system *for 9 months* Payments and receipts - Pay UTII *for the third quarter* Payments and receipts

- Submit a VAT return *for the third quarter* Sample declaration

- Pay VAT *for the third quarter* Payments and receipts

- Quarterly: Report 4-FSS NS and PZ (electronic) for employees. Sample 4 FSS

| | 26 | 27 | - 28

Pay tax Income tax *for the third quarter* Payments and receipts - Submit an income tax return *for the third quarter* Income tax for LLC.xls

| 29 | - 30

Quarterly: Submit the calculation of the Unified Social Insurance Tax (USSS) to the Federal Tax Service. Sample report, fines

| - 31

Submit the 6-NDFL declaration for employees to the tax office *within 9 months* Sample 6-NDFL

|

| novemberMon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | | 2 | 3 | 4 | 5 | 6 | 7 | 8 | | 9 | 10 | 11 | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M and SZV-TD reports to the Pension Fund of the Russian Federation. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

| | 16 | 17 | 18 | 19 | 20 | 21 | 22 | | 23 | 24 | 25 | 26 | 27 | 28 | 29 | | 30 |

| DecemberMon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | 2 | 3 | 4 | 5 | 6 | | 7 | 8 | 9 | 10 | 11 | 12 | 13 | | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M and SZV-TD reports to the Pension Fund of the Russian Federation. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

| 16 | 17 | 18 | 19 | 20 | | 21 | 22 | 23 | 24 | 25 | 26 | 27 | | 28 | 29 | 30 | - 31

Pay the Pension Fund OPS for the individual entrepreneur himself (fixed part) *per year* Payments, receipts and calculator

|

| | | 2021 | January

Mon | Tue | Wed | Thu | Fri | Sat | Sun | | 1 | 2 | 3 | | 4 | 5 | 6 | 7 | 8 | 9 | 10 | | 11 | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M and SZV-TD reports to the Pension Fund of the Russian Federation. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

- Pay personal income tax 13% for individual entrepreneurs *for the fourth quarter* Payments and receipts

| 16 | 17 | | 18 | 19 | - 20

For all tax regimes *annual* Form (50 kb.) Information on the AVERAGE number of employees - Submit a UTII declaration *for the fourth quarter* UTII declaration calculator + form

- Quarterly: Report 4-FSS (paper) for employees. Sample 4 FSS

| 21 | 22 | 23 | 24 | - 25

Pay UTII *for the fourth quarter* Payments and receipts - Submit a VAT return *for the fourth quarter* Sample declaration

- Pay VAT *for the fourth quarter* Payments and receipts

- Quarterly: Report 4-FSS (electronic) for employees. Sample 4 FSS

| 26 | 27 | 28 | 29 | - 30

Quarterly: Submit the calculation of the Unified Social Insurance Tax (USSS) to the Federal Tax Service. Sample report, fines

| 31 |

| FebruaryMon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | | 8 | 9 | 10 | 11 | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M reports to the Pension Fund. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

| 16 | 17 | 18 | 19 | 20 | 21 | | 22 | 23 | 24 | 25 | 26 | 27 | 28 |

| MarchMon| Tue | Wed | Thu | Fri | Sat | Sun | - 1

Submit a report to the Pension Fund *for the year* Report RSV-2 of peasant households (no individual entrepreneur required) - Submit new annual reports to the Pension Fund - SZV-Stazh and ODV-1 Sample SZV-Stazh

- Submit 2-NDFL declaration for employees to the tax office *annual* Sample 2-NDFL

- Submit 6-NDFL declaration for employees to the tax office *for the year* Sample 6-NDFL

| 2 | 3 | 4 | 5 | 6 | 7 | | 8 | 9 | 10 | 11 | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M reports to the Pension Fund. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

| 16 | 17 | 18 | 19 | 20 | 21 | | 22 | 23 | 24 | 25 | 26 | 27 | - 28

Pay tax Income tax *for the year* Payments and receipts - Submit an income tax return *for the year* Income tax for LLC.xls

| | 29 | - 30

Submit financial statements: Form No. 1 Balance sheet *for the year*. Form: Balance Sheet.XLS - Submit financial statements: Form No. 2 of the Profit and Loss Statement *for the year*. Form: Profit and Loss Statement.XLS

| - 31

For Organizations (not individual entrepreneurs): Pay the simplified tax system *for the year* Payments and receipts - For Organizations (not individual entrepreneurs): Submit a declaration of the simplified tax system *for the year* Declaration of the simplified tax system calculator + form

|

| April

Mon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | 2 | 3 | 4 | | 5 | 6 | 7 | 8 | 9 | 10 | 11 | | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M reports to the Pension Fund. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

- Confirmation of the type in the FSS

| 16 | 17 | 18 | | 19 | - 20

Submit a UTII declaration *for the first quarter* UTII declaration calculator + form - Quarterly: Report 4-FSS NS and PZ (paper) for employees. Sample 4 FSS

| 21 | 22 | 23 | 24 | - 25

Pay the simplified tax system *for the first quarter* Payments and receipts - Pay UTII *for the first quarter* Payments and receipts

- Submit a VAT return *for the first quarter* Sample declaration

- Pay VAT *for the first quarter* Payments and receipts

- Quarterly: Report 4-FSS NS and PZ (electronic) for employees. Sample 4 FSS

| | 26 | 27 | - 28

Pay tax Income tax *for the first quarter* Payments and receipts - Submit an income tax return *for the first quarter* Income tax for LLC.xls

| 29 | - 30

For individual entrepreneurs: Pay the simplified tax system *per year* Payments and receipts - For individual entrepreneurs: Submit a declaration of the simplified tax system *for the year* Declaration of the simplified tax system calculator + form

- Submit 3-NDFL declaration for individual entrepreneurs *annual* Payments and receipts

- Quarterly: Submit the calculation of the Unified Social Insurance Tax (USSS) to the Federal Tax Service. Sample report, fines

- Submit the 6-NDFL declaration for employees to the tax office within 3 months. Sample 6-NDFL

|

| MayMon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | 2 | | 3 | 4 | 5 | 6 | 7 | 8 | 9 | | 10 | 11 | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M reports to the Pension Fund. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

| 16 | | 17 | 18 | 19 | 20 | 21 | 22 | 23 | | 24 | 25 | 26 | 27 | 28 | 29 | 30 | | 31 |

| JuneMon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | 2 | 3 | 4 | 5 | 6 | | 7 | 8 | 9 | 10 | 11 | 12 | 13 | | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M reports to the Pension Fund. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

| 16 | 17 | 18 | 19 | 20 | | 21 | 22 | 23 | 24 | 25 | 26 | 27 | | 28 | 29 | 30 |

| July

Mon| Tue | Wed | Thu | Fri | Sat | Sun | - 1

Pay the Pension Fund OPS for the individual entrepreneur himself (additional 1%) *for the last year* Payments, receipts and calculator

| 2 | 3 | 4 | | 5 | 6 | 7 | 8 | 9 | 10 | 11 | | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M reports to the Pension Fund. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

- Pay personal income tax 13% for individual entrepreneurs *for last year* Payments and receipts

- Pay personal income tax 13% for individual entrepreneurs *for six months* Payments and receipts

| 16 | 17 | 18 | | 19 | - 20

Submit a UTII declaration *for the second quarter* UTII declaration calculator + form - Quarterly: Report 4-FSS NS and PZ (paper) for employees. Sample 4 FSS

| 21 | 22 | 23 | 24 | - 25

Pay the simplified tax system *for six months* Payments and receipts - Pay UTII *for the second quarter* Payments and receipts

- Submit a VAT return *for the second quarter* Sample declaration

- Pay VAT *for the second quarter* Payments and receipts

- Quarterly: Report 4-FSS NS and PZ (electronic) for employees. Sample 4 FSS

| | 26 | 27 | - 28

Pay tax Income tax *for the second quarter* Payments and receipts - Submit an income tax return *for the second quarter* Income tax for LLC.xls

| 29 | - 30

Quarterly: Submit the calculation of the Unified Social Insurance Tax (USSS) to the Federal Tax Service. Sample report, fines

| - 31

Submit 6-NDFL declaration for employees to the tax office *for six months* Sample 6-NDFL

|

| AugustMon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | | 2 | 3 | 4 | 5 | 6 | 7 | 8 | | 9 | 10 | 11 | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M reports to the Pension Fund. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

| | 16 | 17 | 18 | 19 | 20 | 21 | 22 | | 23 | 24 | 25 | 26 | 27 | 28 | 29 | | 30 | 31 |

| SeptemberMon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | 2 | 3 | 4 | 5 | | 6 | 7 | 8 | 9 | 10 | 11 | 12 | | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M reports to the Pension Fund. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

| 16 | 17 | 18 | 19 | | 20 | 21 | 22 | 23 | 24 | 25 | 26 | | 27 | 28 | 29 | 30 |

| October

Mon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | 2 | 3 | | 4 | 5 | 6 | 7 | 8 | 9 | 10 | | 11 | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M reports to the Pension Fund. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

- Pay personal income tax 13% for individual entrepreneurs *for the third quarter* Payments and receipts

| 16 | 17 | | 18 | 19 | - 20

Submit a UTII declaration *for the third quarter* UTII declaration calculator+form - Quarterly: Report 4-FSS NS and PZ (paper) for employees. Sample 4 FSS

| 21 | 22 | 23 | 24 | - 25

Pay the simplified tax system *for 9 months* Payments and receipts - Pay UTII *for the third quarter* Payments and receipts

- Submit a VAT return *for the third quarter* Sample declaration

- Pay VAT *for the third quarter* Payments and receipts

- Quarterly: Report 4-FSS NS and PZ (electronic) for employees. Sample 4 FSS

| 26 | 27 | - 28

Pay tax Income tax *for the third quarter* Payments and receipts - Submit an income tax return *for the third quarter* Income tax for LLC.xls

| 29 | - 30

Quarterly: Submit the calculation of the Unified Social Insurance Tax (USSS) to the Federal Tax Service. Sample report, fines

| - 31

Submit the 6-NDFL declaration for employees to the tax office *within 9 months* Sample 6-NDFL

|

| novemberMon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | | 8 | 9 | 10 | 11 | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M reports to the Pension Fund. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

| 16 | 17 | 18 | 19 | 20 | 21 | | 22 | 23 | 24 | 25 | 26 | 27 | 28 | | 29 | 30 |

| DecemberMon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | 2 | 3 | 4 | 5 | | 6 | 7 | 8 | 9 | 10 | 11 | 12 | | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M reports to the Pension Fund. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

| 16 | 17 | 18 | 19 | | 20 | 21 | 22 | 23 | 24 | 25 | 26 | | 27 | 28 | 29 | 30 | - 31

Pay the Pension Fund OPS for the individual entrepreneur himself (fixed part) *per year* Payments, receipts and calculator

|

- purple - festive

- red - weekend

- green - shortened days

- black - days of reports and payments

- blue - special non-working days (coronavirus quarantine)

|

|

|