For whom is the transition to Unified Agricultural Tax available?

Tax law provides for the application of a special regime for commercial structures that meet the following parameters:

- legal entities or individual entrepreneurs engaged in the reproduction and sale of products classified as agricultural;

- the share of sales of agricultural products in gross revenue is at least 70% (for all types of products).

Based on their functionality and the organizational and legal form of a business entity, payers of the Unified Agricultural Tax include:

- LLCs and individual entrepreneurs with OKVED codes of agricultural producers;

- agricultural consumer cooperatives (processing, marketing, livestock, horticultural);

- artels engaged in fishing and processing of fish and other aquatic biological resources.

Important: to be classified as an agricultural producer, the complex presence of three factors is necessary - the products must be produced, processed and sold by an applicant for the use of unified agricultural tax. The absence of one component provides grounds for refusing the taxpayer to switch to the agricultural tax.

Fishing farms in Russian single-industry towns and settlements, where this type of activity is a city-forming activity, must meet additional criteria to use the preferential regime:

- the number of employees of fishing enterprises (including family members living with them) must be at least half of the total number of residents of the city/village;

- the number of employees involved in fishing activities is limited - no more than 300 people per year;

- fishing must be carried out using own or leased (chartered) fishing vessels.

Please note: for fishing enterprises (IEs), the requirement to use the Unified Agricultural Tax remains with the volume of sales of agricultural products (fish catch) amounting to 70% of gross income.

An example of calculating agricultural tax for 2020

Let's look at an example of how to accurately calculate taxes for 2020.

Berezka LLC has been operating as an agricultural producer since 2021. For the first three years, the entire cost of agricultural machinery was attributed to expenses according to the rules of clause 4 of Art. 346.5 Tax Code of the Russian Federation.

During 2021, buyers transferred RUB 1,620,000.00 to the company for agricultural products. (let’s agree that the LLC applies VAT exemption).

The organization also incurred and paid the following expenses:

- salary, including contributions to compulsory social insurance - 650,000 rubles;

- Fuel and lubricants and other material expenses - 260,000 rubles;

- contributions for voluntary crop insurance against drought - 30,000 rubles;

- rental payments - 360,000 rubles;

- stationery - 25,000 rubles;

- quality certificate - 40,000 rubles.

For the first half of the year, the advance payment was not paid to the budget, since the amount of expenses was significantly higher than the amount of income.

For the year, income amounted to 1,620,000.00 rubles, expenses: 650,000 + 260,000.00 + 30,000.00 + 360,000.00 + 25,000.00 + 40,000.00 = 1,365,000.00 rubles. All these expenses correspond to those given in Art. 346.5 Tax Code of the Russian Federation.

The tax is calculated based on a rate of 6% using the formula:

Tax = (Income - Expenses) × 6%.

Tax = (1,620,000.00 - 1,365,000.00) × 6% = 15,300.00

Thus, 15,300 rubles. must be transferred to the budget by March 31, 2021.

Prohibition on the use of the single agricultural tax

In some cases, tax legislation does not allow the application of preferential treatment even if the above conditions are met. Agricultural producers who, in addition to their main activities, perform the following work are not allowed to use the Unified Agricultural Tax:

- produce goods subject to excise duties (tobacco products, alcohol);

- are engaged in gambling business.

In addition, it is prohibited to switch to paying unified agricultural taxes to agricultural organizations that are part of the budget structure.

Reporting of peasant farms under the Unified Agricultural Tax: reporting forms for extra-budgetary funds

If a peasant farm does not have employees, then its interaction with extra-budgetary funds is carried out in the manner that determines interaction with the corresponding funds of individual entrepreneurs. That is, there is no need to report to the Pension Fund. At the same time, individual entrepreneurs on the Unified Agricultural Tax must pay insurance premiums in a fixed amount.

If a peasant farm has employees, then the farm will have to report:

1. Before the Pension Fund, providing:

- form SZV-M - monthly (until the 15th day of the month following the reporting month);

- form SZV-TD - monthly until the 15th of the previous reporting period.

2. Before the Social Insurance Fund, submitting form 4-FSS to the fund - based on the results of each quarter by the 20th day of the month following the reporting period on paper. If a peasant farm employs more than 25 people, then its reporting to the Social Insurance Fund must be submitted via electronic communication channels. However, it can be submitted 5 days later than the paper version of the report is submitted.

The activities of peasant farms at the unified agricultural system are regulated by a large number of regulations. You can confirm the correctness of what you have written using the materials of the ConsultantPlus system. Get free trial access to the system and watch the explanations of the expert of the NP “Chamber of Tax Consultants” A.V. Anishchenko.

Procedure for transition to Unified Agricultural Tax

If an organization or individual entrepreneur meets all the criteria corresponding to the status of an agricultural producer, then the taxpayer has the right to declare to the fiscal authorities his intention to use a preferential special regime.

Please note: the transition to the Unified Agricultural Tax is not mandatory and is carried out by taxpayers on a voluntary basis.

When to declare the use of Unified Agricultural Tax

The unified agricultural tax is calculated based on the results of the tax period – the calendar year. For this reason, you can declare the transition to the Unified Agricultural Tax when using other taxation methods before the start of the new reporting period .

The deadlines for filing an application with the tax authority are:

- for existing LLCs/IPs – December 31;

- for new business entities – within 30 days from the date of registration.

Remember: violation of the deadlines for notification of the transition to the Unified Agricultural Tax is grounds for non-recognition of the taxpayer as a subject of the special regime and the accrual of all taxes according to the previous taxation scheme.

Tax rates and payment deadlines

The single agricultural tax is calculated using the following formula:

Unified agricultural tax = tax base * 6%,

where the “tax base” should be understood as the amount of income from activities, taking into account the deduction of all expenses incurred, expressed in monetary terms;

6% – fixed tax rate.

It is also important to note that entrepreneurs can also reduce the tax base if their expenses are higher than their income. The tax base can be reduced by an amount equal to the amount of losses, but not more than 30%.

How to draw up a notice of application of the Unified Agricultural Tax

FILES

An application-notification on the use of the unified agricultural tax is drawn up by the taxpayer using Form No. 26.1-1 independently.

A separate block is provided for the tax authority’s marks, in which the inspector indicates the date of receipt of the document and the registration number.

At the head of the notification, the applicant indicates the required information:

- name of the subject;

- INN and KPP of the taxpayer notifying about the transition to the Unified Agricultural Tax;

- number (code) of the tax office at the location/registration of the applicant;

- taxpayer sign.

Drawing up a notification does not cause problems for the applicant, but attention should be paid to the following nuances:

- the applicant's attribute is selected depending on the time of submission of the notification;

- if the notification is submitted to the regulatory authority along with the main package of documents for registration, then the number “1” should be indicated;

- when submitting an application within a month (30 days) after registration - number “2”;

- when switching from another tax regime – number “3”.

Newly created individual entrepreneurs and organizations indicating “1” or “2” as the applicant’s attribute sign the notification, certify it with a seal and submit it to the tax office.

For payers who previously applied a different taxation scheme and plan to switch to the Unified Agricultural Tax from January 1 of the next calendar year, it is necessary to provide information on the share of gross revenue related to the sale of agricultural products. The same field indicates the period for which the calculated share is at least 70%.

Notification of the application of the unified agricultural tax can be submitted directly to the fiscal authority (by the head of the organization, entrepreneur or authorized representative), sent by mail or via telecommunication channels.

Keep in mind: if application No. 26.1-1 is submitted by an authorized person, then a power of attorney certified by a notary office is required.

Who has the right to apply the Unified Agricultural Tax?

In accordance with clause 2.1 of Art. 346.2 of the Tax Code of the Russian Federation, the unified agricultural tax in 2021 can be applied by producers of agricultural products, which include:

- legal entities and individual entrepreneurs who are comprehensively engaged in the production of agricultural products, primary and subsequent processing and sales (if the entity is engaged only in the processing of agricultural products, it will not be able to switch to the Unified Agricultural Tax), the share of income from the sale of agricultural products in the total income of which is at least 70% (during the year, preceding the transition);

- economic entities providing auxiliary agricultural services, the share of income from which is at least 70% (such services include preparing fields, sowing seeds, cultivating land, as well as grazing animals, examining and caring for them, etc.);

- agricultural cooperatives subject to the same 70 percent limit;

- fishery entities (provided that the number of hired workers does not exceed 300).

The full list of products related to agricultural products is approved by Decree of the Government of the Russian Federation dated July 25, 2006 No. 458.

Organizations and entrepreneurs who:

- produce excisable products;

- organize gambling;

- belong to budgetary, state or autonomous institutions.

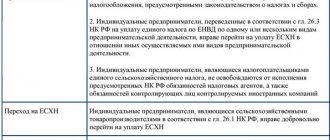

Start of work on Unified Agricultural Tax

Individual entrepreneurs and firms operating under a general or simplified taxation system switch to the Unified Agricultural Tax starting on January 1 of the year following the year in which the notification was submitted. Those who received the status of an individual entrepreneur or a legal entity and immediately declared their intention to apply the Unified Agricultural Tax, use this regime from the beginning of production activities.

When the right to use the unified agricultural tax is lost

Loss of the status of an agricultural producer and, accordingly, the right to apply a preferential agricultural special regime is possible in the following cases:

- reducing the mandatory 70% barrier to the share of sold agricultural products in gross income;

- violation of requirements for agricultural producers entitled to apply a special regime;

- termination of activities that give the right to apply the Unified Agricultural Tax;

- transition to another form of taxation.

Since the tax period for agricultural tax is a calendar year, all decisions regarding the loss of the right to use the Unified Agricultural Tax are made after December 31. If you refuse to further apply the special regime (regardless of the circumstances), the business entity is obliged to notify the fiscal service about this as follows:

- in case of violation of the criteria of the Unified Agricultural Tax payer - by submitting an application for loss of the right to a special tax in form No. 26.1-2;

- if you wish to use a general or simplified taxation system - according to form No. 26.1-3;

- when interrupting activities related to agriculture - according to form No. 26.1-7.

Information on the given forms must be submitted to the tax authority for a limited period - from January 1 to January 15 of the new calendar year.

VAT or Unified Agricultural Tax: let's calculate

Permanent expert of the CHAIRMAN, director of Auditskaya LLC Alexey LUZYANIN continues the conversation about the choice of taxation in 2019: which system should an agricultural producer prefer and what are the first steps in the new system?

– So, everyone already knows that from January 1, 2021, most agricultural organizations will pay VAT. This was determined on the basis of the norms of Federal Law No. 335-FZ “On amendments to parts one and two of the Tax Code of the Russian Federation and certain legislative acts of the Russian Federation.”

But this Law gave many agricultural organizations the right to choose a taxation system, and even more questions arose: what is best for my enterprise, what is more profitable? But this choice is very important: sometimes we are talking about hundreds, thousands and millions of overpaid taxes due to the wrong choice. Therefore, today the majority of managers of agricultural organizations are deciding: to remain payers of the Unified Agricultural Tax (USAT) and at the same time pay VAT - or to switch to a general taxation regime (leave the Unified Agricultural Tax). Or perhaps your parameters allow you not to pay VAT yet, and you calmly continue to pay the Unified Agricultural Tax.

What to choose? Let's figure it out.

So, according to the changes made, if in 2021 the income from the sale of goods (works, services) of your organization exceeds 100 million rubles, you will be required, along with the calculation of the Unified Agricultural Tax, to accrue and pay VAT. And in the future, the revenue threshold for switching to VAT payment will be lower and lower.

Based on these standards, today most managers of agricultural enterprises can understand whether their organization will pay VAT or not. Let's consider taxation options that both large and small agricultural organizations can choose.

For small ones

So, if in 2021 the income from the sale of goods (works, services) of your organization does not exceed 100 million rubles, you have 2 main options:

1. Continue to apply the Unified Agricultural Tax (that is, continue to keep records and calculate the Unified Agricultural Tax in the same manner as before), postponing thoughts about VAT to a “bright” future.

2. On a voluntary basis, regardless of the fact that the revenue is less than 100 million rubles, switch to paying VAT , in this case you can charge VAT with the simultaneous use of the unified agricultural tax, or you can switch to the general taxation regime (we will consider the choice between these two options below).

Obviously, most small farms will choose the first option. But you need to understand that such an annual choice will not last forever, because sooner or later all agricultural producers will switch to paying VAT - this is written both in the Law itself and between its lines.

After all, if you continue to pay the unified agricultural tax, the amount of the unified agricultural tax itself will increase significantly. This was written in detail in one of the previous issues of the magazine (see CHAIRMAN magazine No. 6(79), p. 50. It is also in the archive on the magazine’s website www.predsedatel-apk.ru – editor’s note) . After all, expenses will no longer include the amount of VAT from suppliers. That is, even if you are not a VAT payer, but a supplier, you have been issued an invoice with VAT, this VAT is not accepted as an expense when calculating the Unified Agricultural Tax. Thus, the amount of calculated tax will grow every year, and sooner or later you will begin to think: maybe you should switch to paying VAT and at the same time maintain payment of the Unified Agricultural Tax? After all, as practice shows, VAT (due to the fact that we buy materials at a rate of 20%, and sell most of the products at a rate of 10%) will be deductible and will cover the payment of the Unified Agricultural Tax.

Of course, not all agricultural organizations that may not yet switch to paying VAT will voluntarily agree to charge VAT, but this is everyone’s right, and everyone must make a calculation, weighing all the pros and cons. In my opinion, for now it is possible to use the Unified Agricultural Tax. However, with automated accounting and clear control of suppliers, you can switch to paying VAT, because it is more economically profitable.

For big ones

Well, now let’s talk about those who exceeded the threshold of 100 million rubles in 2021 and will pay VAT. All the problems and difficulties that we talked about above will immediately arise for VAT payers. Therefore, it is worth preparing now, because later there will be no time. The most important point is to try to fully automate accounting.

Today, VAT cannot exist without automation and proper control over suppliers. If you don’t have this, you will face a huge number of problems in taxation, or rather, simply huge additional tax charges.

First you need to decide on the tax system. There are only two options here:

Option 1: remain a payer of the Unified Agricultural Tax and at the same time switch to paying VAT. The most acceptable option for an agricultural producer, but only if the agricultural organization has an accumulated loss under the Unified Agricultural Tax or sees that the amount of the accrued single tax is very insignificant (this is the most common option).

The main thing when choosing this option is whether agricultural producers in the region pay property taxes or not. If they pay, then regardless of the amount of the unified agricultural tax, this is your option, because, as a rule, the amount of property tax will be very significant.

In one of the previous issues of the magazine (see No. 6(79), p. 50, - editor's note) we suggested that our deputies consider the issue of property tax relief in the Novosibirsk region, and thanks to the fact that not only we, but and many have raised this question - this problem has caused great controversy in our Legislative Assembly, and we really hope that it will be resolved in favor of the agricultural producer.

Option 2: switch to a general taxation regime. With this option, the organization stops paying the Unified Agricultural Tax, but in this case, along with VAT, a property tax will have to be paid, so if, finally, a property tax benefit is adopted for agricultural producers in our region, this is your option. In addition, under the general tax regime, income tax is calculated on the sale of non-agricultural products (work, services). This also needs to be taken into account and the expected amount of payment of this tax must be calculated.

Let's look at the choice of option using an example. Let’s take an agricultural organization with revenue of 150 million rubles. and with a residual value of property of 30 million rubles, which will choose between the last two options, since it will pay VAT. It is located in the Novosibirsk region, where property tax benefits for agricultural producers have not yet been established.

It is obvious that the amounts of personal income tax, insurance premiums, land and transport taxes remain the same under any taxation system. The VAT amount will also be the same for these options, but we will focus on it, since its final value affects the choice of taxation system. Let's try to calculate the amount of taxes for each option.

Property tax:

With Unified Agricultural Tax + VAT, property tax is not charged.

In the ORN mode, a tax amount of about 450,000 rubles will be charged for the year. (with an average tax rate of 1.5%).

VAT:

When using Unified Agricultural Tax + VAT and when using ORN, the VAT amount will be the same. In this case, as a rule, a budget debt to the enterprise arises. Let’s say that at our enterprise for the year the amount to be reimbursed from the budget was 120,000 rubles. (calculated as the difference between the amount accepted for deduction and the accrued amount of sales tax). Why does this happen? All accountants understand this very well: the sale of agricultural products is subject to VAT at a rate of 10% for the most part, and when purchasing goods and materials, fixed assets, and services, VAT at a rate of 20% is accepted for deduction - most agricultural organizations, with clear accounting, will receive VAT reimbursement from the budget.

*Here is another important nuance - while on the Unified Agricultural Tax, many were not interested in whether your counterparties pay VAT or not, and Unified Agricultural Tax payers now have many suppliers who do not pay VAT, and this needs to be changed urgently, because now you will not be able to deduct VAT.

Unified agricultural tax:

If the enterprise continues to use the unified agricultural tax, the obligation to pay a single tax will arise. And here again I draw your attention: be sure to look at whether you have accumulated losses from previous years (section 2.1 of your declaration for the previous year). If it has been accumulated in a sufficient amount, you can safely use the Unified Agricultural Tax and VAT, because there will be no single tax to pay. Moreover, it will be very disappointing when the amount of this accumulated loss is lost, because in the future, if you again want to switch to the unified agricultural tax, it will no longer be taken into account. In addition, many agricultural organizations are planning a large acquisition of fixed assets in 2021 (no matter, at the expense of their own money or loans) - in this case there will be serious savings on taxes: after all, a large amount of VAT will be deductible and the amount of expenses for the Unified Agricultural Tax will be significant (in in most cases, will cover the income received, resulting in a loss according to the Unified Agricultural Tax).

ORN:

Under this system, you must pay income tax. At the end of the billing period, the amount of income tax will be 300,000 rubles. This amount is determined by the profit received from the sale of products (work, services) that are not related to agricultural products (for example, rental of premises, motor transport services, sawmill services, sales of purchased agricultural products, etc.). As is known, profits received from the sale of agricultural products are not subject to income tax.

What do you get from these calculations?

According to the accounting data of our enterprise, the following amounts of taxes were accrued for the billing period when applying the general taxation regime (see table):

Thus, under the general taxation regime, the organization will accrue taxes in the amount of 630,000 rubles. If the Unified Agricultural Tax and VAT are applied, the amount of taxes will be reimbursed from the budget, that is, the budget will give us 120,000 rubles. The savings are obvious, so it is more profitable for our organization to switch from January 1, 2021 to the use of Unified Agricultural Tax and VAT, but not to the general taxation regime.

Of course, each organization must make its own calculation; for your data it may be completely opposite.

VAT: almost not scary

Many accountants, having been paying the Unified Agricultural Tax for more than 10 years, have forgotten VAT, and some of them are very afraid of this tax. Of course, any major changes are scary, and it’s not for nothing that there is a Chinese curse: “May you live in an era of change.” But calculating VAT is not such a complicated process, and any of you will be able to work under the new conditions of the general taxation regime or Unified Agricultural Tax and VAT. But first, today I highly recommend doing the following:

1. Automate accounting, if it is not already automated, because a modern accounting computer program (for example, “1C: Enterprise”, and the latest version is better - 8.3) clearly forms a book of purchases and sales.

2. Establish document flow.

3. Establish a system of working with suppliers who pay VAT to accept VAT.

Let's dwell a little on VAT itself. As you understand, VAT is calculated as the difference between the amount that your organization charges on the sale of goods (work, services) and the amount of VAT that you accept for deduction from suppliers. As for calculating VAT on sales, everything is not so complicated: the main thing is to correctly determine the rates and issue invoices to your customers. Particular attention and complexity are paid to the amounts of VAT deductible (from suppliers), because they, as a rule, involve the largest number of disputes with the tax authorities. A deduction is the amount of tax that is presented for payment by the supplier of the goods. The tax that will go to the budget from you will be reduced by this figure.

But there are nuances that you need to know and understand. This concerns the conditions for the tax service to accept these deductions. In most organizations, the final amount of VAT will be deductible (and this is logical if VAT to be deducted will generally be at a rate of 20% from 2021, and to be paid at 10%, because you mainly sell agricultural products). This becomes a reason for tax authorities to monitor you much more seriously. Well, our tax authorities really don’t like it when you don’t pay VAT, but it comes back to you!

It often happens that a tax audit makes a decision according to which VAT is “crossed out” from the amounts subject to deduction, and, accordingly, the unpaid amount of VAT is charged. This can happen if there are errors on the invoice. And it is not so difficult to allow them, because the invoice is issued by the counterparty, not the taxpayer. Or if the supplier did not pay VAT on the invoice issued to you to the budget (evaded paying tax, which is simply impossible for you to check).

In this regard, the document flow system must be established in such a way that all suppliers are checked, for each of them there is a dossier with data on constituent documents, certificates, decisions, etc., which would confirm that it is a reliable and law-abiding counterparty.

A system for accepting invoices from suppliers should also be built. It often happens that your counterparty does not submit an invoice on time (even though the goods have already been received from him). Here it is necessary to clearly provide the accountable persons with powers of attorney to receive invoices, require them to receive them from suppliers, otherwise, introduce strict regulations so that even if the invoices are not transferred immediately, the accountable person, together with the accountant, will track the fact of the receipt of the invoice from the supplier.

If you have switched to paying VAT, then all contracts must be drawn up indicating that you are a VAT payer or your supplier is a VAT payer. Therefore, you need to analyze all existing contracts and review them so that the price includes VAT.

Practice has shown that agricultural organizations were not at all interested in whether they were purchasing goods from a VAT payer or a non-payer; this was not important for the Unified Agricultural Tax. And many today have a situation where the majority of counterparties are VAT non-payers (this happens especially often when the counterparties are regional suppliers who mainly served agricultural organizations in their region). If you have a large proportion of supplier organizations that are not VAT payers, the amount of VAT payable will be large. In this regard, the manager needs to raise the question regarding the organization’s further work only with suppliers who pay VAT. It is necessary to analyze all suppliers and raise a question with the procurement department about replacing certain suppliers who are not VAT payers. After all, it will be more profitable to buy from VAT payers in order to deduct the tax. And since contracts with many suppliers have already been concluded, it is necessary to make adjustments to them and, if necessary, terminate them. Be sure to ask your suppliers for information on whether they will be VAT payers in the coming year or not.

In conclusion, I would like to note that for those who prepare in a timely manner, the transition to the new system will go smoothly. And to be prepared means to arrange all the work in advance so that this “terrible” VAT does not become an unbearable burden for the enterprise.

Good luck with your work!

Recalculation of taxes upon loss of the right to a special regime

After the end of the reporting year, a taxpayer who has violated the requirements for agricultural producers is obliged to recalculate tax payments.

Instead of the unified agricultural tax paid during the year, an organization or individual entrepreneur will have to calculate and pay the main types of taxes to the budget:

- property tax (if there are fixed assets);

- VAT;

- income tax (NDFL);

- income tax.

All additional tax returns must be filed by January 31, and all budget obligations must be paid during this period.

Simultaneously with the formation and submission of declarations to the Federal Tax Service under the general taxation system, the former agricultural producer is obliged to draw up an updated calculation for the Unified Agricultural Tax (advance payments) for the 1st half of the year. The amounts paid will be considered an overpayment of agricultural tax.

You can return to the use of the Unified Agricultural Tax after one year has passed after the loss of the right to use it (or voluntary refusal).

Changes in 2021

The new law of November 27, 2017 No. 335-FZ, adopted by the State Duma, introduced a number of changes to the procedure for paying this tax. The main innovation was that from 2021, Unified Agricultural Tax payers were obliged to pay property tax, and from 2021 they must become VAT payers.

The rules for working with VAT in 2021 remain the same - payers of the Unified Agricultural Tax are exempt from paying it, as well as:

- if VAT is accepted for deduction before the transition to the payment of unified agricultural taxes, it cannot be restored;

- VAT presented after leaving the special regime is not subject to deduction (clause 8 of Article 346.3 of the Tax Code of the Russian Federation).

From 2021, taxpayers of the Unified Agricultural Tax will be able to exercise the right to exemption from VAT (if there are grounds) in accordance with the provisions of Art. 145 of the Tax Code of the Russian Federation.

The obligation to pay property taxes has also increased the burden on agricultural businesses. From 2021, entrepreneurs and legal entities producing agricultural products will be able to avoid paying this tax only on property used directly in the production, processing and sale of agricultural products.