I went on vacation to visit my parents in the village. The time has come to submit income reports to the tax office, but it is not possible to go to the city for this, and things are not as good with the Internet as we would like. The only option is to send documents by mail. In this article I will describe in detail the process of sending and generating reports. At the same time I will answer questions like:

- Basic options for filing income reports;

- Requirements for an official declaration;

- Sending tax by mail;

- Rules for compiling an inventory;

- Violation of delivery deadlines.

What is the difference between submitting reports: in person, by mail, via the Internet?

Most reports can be submitted to regulatory authorities in person, online or by mail.

Submitting reports in person on magnetic media to the Federal Tax Service

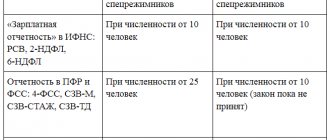

Direct submission of a report to the inspector at the Federal Tax Service is possible only for entities with a small staff of up to 25 people. The report is submitted in two copies on paper. You may need to attach an electronic file on a flash drive. The main advantage of this method is that the taxpayer immediately knows whether the report has been compiled correctly or not.

The Federal Tax Service will tell him, if necessary, what needs to be corrected. But on the days of quarterly and annual reporting, large queues form at the tax office, in which a representative of an enterprise or individual entrepreneur will have to spend more than one hour. In addition, the inspector will refuse to accept the report if he finds any errors.

Attention! Therefore, it is better to submit the statement directly not on the last reporting day, since there is a risk of simply not submitting it. If the head of the organization or entrepreneur cannot submit the report in person, it is necessary to issue a power of attorney for the representative.

Submitting reports by mail

Submitting reports by mail is a good alternative:

- Reports can be sent from any post office.

- Even if you are in the tax queue for submitting reports and you do not have time to defend it, you can submit it even on the last day.

- There is no subscription fee for an electronic digital signature or other special programs required for electronic reporting.

Only enterprises with a small number of employees can also send a declaration by mail. The report in the amount of one copy must be placed in an envelope, and there is no need to attach additional media with its electronic form. You will definitely need to fill out an inventory of the investment.

This report will be accepted by the regulatory authority, even if there is an error in it. In this regard, it will require further adjustment and clarification. But the company or individual entrepreneur will find out about this later. If the tax return is not submitted by mail by a director or entrepreneur, a power of attorney will only be required for registered items.

Attention! For large companies with more than 25 employees, the statement cannot be sent by mail to the tax office, since the law stipulates that reporting must be submitted via the Internet.

Submitting reports via the Internet

Today, submitting a tax report via the Internet is the most popular method of sending. Moreover, this will be a more profitable alternative to mail if you have to submit a lot of reports. In this case, the declaration is transmitted only in electronic form. This method is available to every enterprise or individual entrepreneur, but provided that they have an electronic digital signature.

Reporting options

Modern legislation establishes several options for transferring a declaration:

- In electronic form through special portals and Internet communication channels.

- In person or via mail in the form of regular paper.

The choice of one option or another is not free. For example, an enterprise or company with more than 100 employees and a large taxpayer is required to submit reports exclusively electronically.

Small organizations and individuals are allowed to submit reports in paper form - in person or via mail; they are allowed to use the electronic version.

These rules are spelled out in clause 3 and paragraph 1 of clause 4 of Art. 80 of the modern Tax Code of the Russian Federation!

What are the deadlines for accepting reports when sending them by mail?

The legislation establishes that the date of sending the report by mail is the date indicated in the receipt for the postal item or the day marked on the inventory of the attachment.

No later than the next day from the date the report is received by the tax authority by mail, it must be registered by an official using a specialized program. If there is no automatic registration of reports, then it is recorded in a special journal in which it is assigned an incoming number.

Requirements for filing a paper declaration

All currently accepted tax reporting forms are fully adapted for convenient and quick reading of information. This process is carried out using scanners. It is for this reason that special requirements are imposed on the forms on which income data is filled out:

- The form must be printed on A4 sheet;

- The width of the margins on the paper should not exceed the permitted boundaries - the left margin is from 5 to 30 mm, the right and bottom edges are from 5 mm;

- Information is written strictly on one side of the paper;

- The main text is printed in black font, the font category is Times New Roman, as well as Arial;

- Letter size should be 10-11 for titles and 9 for body text. It also sets single spacing between lines;

- There must be a special barcode on the sheet of paper.

These requirements are established by the standard for the form of documents. It was approved by order of the Federal Tax Service of Russia No. ММВ-7-17/535!

If a company or individual entrepreneur submits an income report on paper, copied on special equipment, these rules and requirements must be observed.

What letter should I use to send reports to the tax office?

The subject himself can choose how to send reports to the tax office by mail. The only obligatory condition is that the letter with the reporting must have an inventory of the attachments.

Thus, the following options are available to the taxpayer:

- Regular mail is the cheapest postal service. You will only need to pay for the envelope and its weight. An inventory of the attachment is drawn up independently on company letterhead, but usually the postal worker refuses to put a stamp on it. Due to the fact that the letter is not registered, if it is lost, it will be impossible to prove the fact of sending.

- Registered shipping is a low-cost option for registered shipping. When submitting it, the employee is given a receipt confirming acceptance of the envelope for forwarding, which will be proof of submission of the report if the letter is lost. But the accountant must draw up the inventory himself, and the postal worker does not stamp it. Thus, the fact of sending and the date can be proven using a receipt. If it is lost, then it will be difficult to confirm the date and fact of departure. You can attach a receipt receipt to the letter.

- A valuable letter with a description of the attachment is also a registered item. However, the sender can assign a “price” to it, which will be paid in case of loss. In this regard, the post office draws up an inventory of the attachment on its own letterhead and puts a stamp on it. With this type of shipment, the inventory can serve as confirmation of the date and fact of sending the declaration to the tax office. If necessary, return receipt can also be used here.

Important! When sending reports to the tax office via mail, it is best to do this in a valuable letter with a list of attachments! Otherwise, the letter may simply be lost. In this case, an inventory with a postal stamp describes the contents of the envelope.

Violation of reporting method

If the reporting person files the return incorrectly or fails to provide required documents, he or she will face tax liability. Here are the main penalties:

- 200 rubles for violating reporting deadlines.

- 200 rubles for a missing additional document.

- From 300 to 500 rubles for late submission of a report on an official tax application.

To avoid such penalties, it is necessary to track the sending of reports using the stamp issued by the post office.

The declaration will be considered sent on time if it was sent by mail 24 hours before the due deadline!

If problems arise related to violation of deadlines and a fine issued, you can go to court. If the taxpayer is sure that he did not violate the deadlines, he will need to present a postal receipt. If it indicates the date of dispatch, at least one day before the due date, the fine will be automatically removed.

It turns out a similar receipt without problems. If a valuable or registered letter is sent, it must be registered and a special receipt is issued. In addition, when issuing a valuable letter, the postal employee takes a receipt from the addressee that the letter has been received.

What if the tax office receives the letter after the deadline for submitting reports?

If the report is sent by mail, then according to the provisions of the Tax Code, the date of its submission is the date of dispatch. In this case, this period is valid until 24:00 of the day on which the deadline for filing the declaration is set.

If a report is received after the established date, the tax inspectorate may impose fines, but such an action is unlawful. The same position is shared by the arbitration court, which considered that if the letter was sent on time, but was delayed due to the fault of the postal service, the taxpayer is not responsible for this.

Attention! However, if the fine was still imposed incorrectly, you will have to defend your case only through litigation.

Inventory of attachment

If the declaration is sent by mail, there must be a special inventory of the attachment. This is stated in paragraphs 1 and 3 of paragraph 4 of Art. 80 NK!

There are several rules for how to correctly compose an inventory:

- Information must be entered on letterhead.

- At the top is written the full name of the company or the name of the entrepreneur, as well as checkpoint codes, INN, OGRN, official bank details and legal address.

- In the middle part the name of the paper is written, that is, Inventory of the Attachment.

- Next, the list contains all declarations and documents enclosed in the registered letter.

- After the list, responsible and management persons put their signatures.

This type of inventory is suitable for enterprises. If the declaration is submitted by an individual, you can use standard forms drawn up in Form 107. You can obtain a sample of such a form at the post office itself.

The paper with the inventory must be prepared in two copies. One is placed in the envelope with the declaration. The second sender keeps it for himself. It must be accompanied by a receipt that the letter has been sent and a special notification with a postmark has been issued.

Preparation of a tax return attachment when sent by mail with an inventory

To submit reports by mail, you must follow a certain procedure. If it is not observed, the organization may pay a fine for late submission of the declaration.

- At the post office you need to purchase an envelope (A4 format) for documents. Then you don’t have to collapse the declaration. In addition, stamps will be required. The department employee will issue two forms for inventorying the investment. One document remains with the parcel, and the second is taken by the sender. The declaration is sent by a valuable letter with an inventory attached.

- When filling out the inventory, you must indicate the address and details of the shipment addressee. Next, the quantity, name of valuable items and the cost of each in rubles are reflected. After filling out, the sender puts a signature and a postmark. A copy of the inventory is included in the valuable letter.

- The finished item is handed over to the postal employee. The sender pays for shipping services, on the basis of which he is issued a check and an inventory. These documents may be required if there is a dispute regarding the shipping date.

When compiling an inventory, an enterprise employee should be guided by the example provided in the department. To fill out, use form 107.

The inventory notes:

- addressee's name;

- full postal address;

- name of items;

- number of investments;

- estimated amount.

Each form is signed by the sender.

After this, the postal employee must:

- check the entries in the inventories;

- check the coincidence of the addresses on the envelope and in the inventory;

- evaluate investments with those indicated in the inventory;

- check the value of investments;

- put a stamp on each version of the documents;

- put one copy of the inventory in an envelope, and give the second to the sender.

Responsibility for failure to comply with the established method of submitting tax reporting

Tax liability is provided for the incorrect choice of the established method for submitting tax reports in electronic form. The fine is 200 rubles. for each violation in accordance with Article 119.1 of the Tax Code of the Russian Federation.

Late submission of information on the average number of employees is an offense (Article 106 of the Tax Code of the Russian Federation, Article 2.1 of the Code of Administrative Offenses of the Russian Federation), for which tax and administrative liability is provided.

The fine under Article 126 of the Tax Code of the Russian Federation is 200 rubles. for each document not submitted.

In addition, for late submission of information at the request of the tax inspectorate, the court may impose administrative liability on officials of the organization (for example, its head) in the form of a fine in the amount of 300 to 500 rubles. (Article 15.6 of the Code of Administrative Offenses of the Russian Federation).

additional information

It is important to familiarize yourself with the content of the changes regarding sending declarations by mail. In this case, it is necessary to comply with the deadlines for the transfer so that the person is not held accountable. Also, tax officials may make unfounded claims against the person.

Changes to the procedure for submitting declarations were made on December 28, 2001 by Federal Law No. 180. According to the current edition, it is allowed to send reports by mail with an inventory.

The rules for sending correspondence do not exclude the possibility of sending registered letters with an inventory. But in most cases, a valuable letter is used. Therefore, on the basis of the law, the transfer must be carried out by letter with a declared value and an inventory of the investment.

The inventory must necessarily contain a department stamp. If it is not there, the document drawn up independently will not have legal force.

The use of the term postal item instead of a valuable letter is due to the fact that more than one declaration can be transmitted. In this case, if a bundle is being sent, a parcel post will be required. Therefore, the law specifies only a generalized version of shipments.

Duration of the procedure

According to the law, taxpayers must submit returns no later than April 30. During this period, data for the past tax period is provided.

The norm reflects the provision of not only declarations, but also other documentation. If the deadlines are missed, the person is held accountable.

Some taxpayers are subject to unjustified sanctions. One of them is a fine for the lack of an inventory of the investment (Article 199 of the Tax Code of the Russian Federation). It is worth remembering that you can only be fined for absence. The filing procedure is not violated if supporting documents are missing.

In practice, cases arise when court decisions are made in favor of taxpayers. After all, the absence of an inventory is not considered a reason for refusing to accept the declaration. And many tax specialists note that the declaration has arrived, but without an inventory. In this case, the deadline is not considered missed.

How to create a postal inventory?

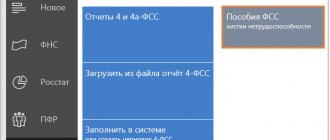

In our service NDFLka.ru you can not only fill out the 3-NDFL declaration, but also create a postal inventory. This is very convenient, because all you have to do is put the finished inventory in an envelope and take the documents to the post office. In order for the postal inventory to be generated, at the end of filling out the declaration in the NDFlka program, namely, in the “Results” section, you need to select the method of sending documents: “Through the post office.” Please look at the picture:

How to submit tax reports for an organization with separate divisions.

If for the past year the average number of employees in each separate division is less than 100 people, and in the head office more than 100 people, then, regardless of the number of employees in separate divisions, any organization whose average number of employees for the previous year exceeded 100 people must submit tax reports in electronic form via telecommunication channels.

Moreover, both by the location of the organization’s head office and by the location of each separate division (except for the largest taxpayers). Special rules can be established only for those organizations whose information is a state secret. This follows from the provisions of paragraph 3 of Article 80 of the Tax Code of the Russian Federation.

Briefly about the main thing

- Reporting can be sent using different methods - in person, through online portals and by mail.

- The appearance of the declaration depends on whether it is a paper version or electronic.

- When sending a report via mail, you can use one of three options - regular mail, certified letter or registered mail.

- In any case, when sending the declaration by mail, an inventory must be attached. This investment is also compiled according to established rules.

- When sending reports by mail, you must comply with the sending deadlines. This will avoid fines.

How can you simplify the diagram?

Fines cannot be imposed on an enterprise that sent a declaration without an inventory. This conclusion was made by the judicial authorities of the Federal Antimonopoly Service of the North-West Region.

In accordance with this, the inspectors of one of the tax authorities, after receiving the declaration, noted its submission on the day the document was received in fact. This conclusion was made based on the missing inventory. The company was fined and had to pay a penalty.

After going to court, the taxpayer made a decision that the fine was unjustified. The judges noted that the norm does not contain information about the impossibility of sending a declaration by registered mail. Therefore, the period must also be calculated from the moment of transmission of the correspondence.

Tax reporting

Procedure for submitting tax reports