As always, we will try to answer the question “How to Fill out RSV If an Employee is on Vacation Without Pay in 2021.” You can also consult with lawyers for free online directly on the website without leaving your home.

The insurance period is calculated differently. It includes only those working periods during which accruals and payments of insurance premiums for compulsory health insurance are made for a specific employee. Rest at your own expense is called unpaid, which means that no remuneration for work, no vacation pay, or insurance contributions are accrued. Vacation periods that an employee takes at his own expense are not included in the insurance period.

To reflect an unpaid period of time, you need to use a certain code - leave at your own expense in SZV-STAZH 2020 is marked with the value “NEOPL”. The unpaid leave code is entered in column 11 of section 3 “Information about the periods of work of insured persons.” At the same time, the code “NEOPL” is used not only for periods of unpaid leave, but also for a number of other periods of time that are not paid by the employer-insurer:

When and where to take it

Let's look at how the SZV-STAZH report documents leave at your own expense and whether the length of service is interrupted. In this case, the length of the unpaid vacation period must be taken into account. If an employee takes a vacation at his own expense for more than two weeks (from 14 days) per year, then this period of time will not be taken into account when calculating the vacation period (paragraph 6, part 1, article 121 of the Labor Code of the Russian Federation). A short vacation at your own expense is included in the length of service (vacation pay).

Column 11 is intended for information about unworked periods and periods of work in harmful or special climatic conditions. For leave without pay, SZV-STAZH has a special code: “NEOPL”.

Columns 2–4 are intended for the employee’s full name. They are indicated in the nominative case. Moreover, the columns “Last name” and “Name” must be filled out. The “Patronymic” column may not be filled in if such details are not included in the identity document (for example, for foreigners).

The procedure for recording unpaid leave in SZV-STAZH

You can fill out the information online and submit it via the Internet in the BukhSoft program. It transmits any reporting online automatically. You can send declarations and calculations to the tax service, social services. fear, Pension Fund, Rosstat and other government agencies. Before sending, any report is tested by all verification programs of the Federal Tax Service and the Pension Fund of Russia. Try it for free:

Several contracts have been concluded for some of them. How many times will such an employee be included in the register: by the number of contracts? No, you need to create one form per employee, but when filling out information about the length of service, it indicates the periods of validity of contracts with their validity dates. Please note that validity dates are reflected only within the reporting period; in reporting for the 2nd quarter, dates must be no earlier than April 1 and no later than June 30. If, after successfully submitting reports for the 1st quarter of the year, there is a need to make clarifications in the report in connection with the additional accrual of bonuses for March for individual employees, do they need to be shown in the report line for the 2nd quarter?

NEOPL code in the Pension Fund: decoding

The NEOPL code in individual information means that for the specified period of time the employee did not receive money in wages. The reasons for this may be different, so the policyholder must enter the same NEOPL code in the RSV-1 in different situations.

Thus, the code NEOPL is used to denote ():

- leaves without pay (Article 128 of the Labor Code of the Russian Federation);

- period of downtime due to the fault of the employee (Article 157 of the Labor Code of the Russian Federation);

- unpaid period of suspension from work / non-admission to work (Article 76 of the Labor Code of the Russian Federation);

- unpaid leave provided to teaching staff (Article 335 of the Labor Code of the Russian Federation);

- an additional day off per month without pay, provided to women working in rural areas (Article 262 of the Labor Code of the Russian Federation);

- unpaid time for participating in a strike (Article 414 of the Labor Code of the Russian Federation);

- other unpaid periods, except for periods with codes DLDETI and Chernobyl NPP.

As you can see, in reporting submitted to the Pension Fund, NEOPL is a frequently encountered code.

Deadlines for granting leave without pay

What is vacation at your own expense? This is an extraordinary and usually short-term leave granted to an employee for family and other personal reasons. The possibility of providing it, as well as the duration, is discussed with the employer on an individual basis. The employer's obligation to provide such leave applies only to certain employees.

The maximum period of unpaid leave depends on the reason for which it is granted, as well as on the category of the employee requesting it.

Specific vacation periods are prescribed in various articles of the Labor Code of the Russian Federation. To make the information easier to perceive, we have compiled a special table.

Neopldog in personalized accounting

Despite the obvious similarity of the NEOPLDOG codes, it is indicated in individual information in a completely different case: in relation to the period of work performed by the contractor under a civil law contract, in which remuneration was not accrued and will be paid later (Table “Calculation of the insurance period: additional information” of Appendix No. 2 to the Procedure for filling out RSV-1). Let's explain with an example.

Let’s say the GPA for the execution of work was concluded on August 22, 2016. The contract states that the contractor must begin work on September 1, 2021. The certificate of completion of work was signed on October 13, 2021, and at the same time the contractor was awarded remuneration. Then the period from September 1 to September 30 should be marked with the code NEOPLDOG in subsection 6.8 of the RSV-1 for this performer. And the period from October 1 to October 13 - the code is AGREEMENT.

The organization has one employee on staff - the director. Salary is not accrued. The SZV-M report is submitted monthly to the pension fund. Filling out a zero calculation for strass contributions and submitting it to the Federal Tax Service.

Question:

In the LLC, the employment contract is concluded only with the director and he is on unpaid leave (SZV-M is submitted to him monthly). No salary is paid. How can this be reflected in the calculation of insurance premiums? (If you indicate in section 3 only the personal data of the director, and the rest are “0”, then the program generates errors)

Answer:

When calculating the director's insurance premiums, include in lines 010 of subsections 1.1 and 1.2, 010 of Appendix 2. Fill out subsection 3.1. Do not fill out subsection 3.2. In practice, special operator programs show an error if subsection 3.2 is missing. But the inspectorate accepts the calculation with such an “error”.

Rationale

How to prepare and submit a calculation of insurance premiums to the Federal Tax Service

Situation:

Is it necessary to reflect in section 3 of the calculation of insurance premiums to the Federal Tax Service information on the director, the only founder, who does not receive a salary?

Yes need.

The sole founder director is the insured person. Therefore, regardless of whether his salary was calculated, fill out section 3 for the director and include him in the number of insured employees. These conclusions follow from paragraph 1 of Article 7 of the Law of December 15, 2001 No. 167-FZ, paragraph 1 of Part 1 of Article 2 of the Law of December 29, 2006 No. 255-FZ, paragraph 1 of Article 10 of the Law of November 29, 2010 No. 326-FZ, paragraphs 22.1 -22.36 The procedure approved by order of the Federal Tax Service of Russia dated October 10, 2021 No. ММВ-7-11/551.

The Pension Fund verifies the SZV-M and the calculation of contributions

Information about the founding director

The Pension Fund of Russia will verify the information about the founding director that you indicated in the SZV-M reports and the calculation of contributions. The fact is that the company is obliged to submit a zero calculation for contributions, even if it did not conduct business (letter of the Ministry of Finance of Russia dated March 24, 2017 No. 03-15-07/17273).

In the zero calculation for the first quarter of 2021, you filled out section 3 for the founding director. If there were no accruals in his favor, you filled out only subsection 3.1. Inspectors will pay attention to line 160.* In it you indicated the characteristics of the insured person, depending on whether or not an employment or civil law contract was concluded with the director.

An agreement has been concluded with the founding director.

In this case, the director is classified as an insured person in the compulsory pension insurance system. In line 160 you must indicate attribute 1 (see sample 3 below).

Sample 3. Attribute of the insured person in the calculation of contributions

If, during reconciliation, the Pension Fund discovers that you have not submitted SZV-M reports for January, February and March to the director, the company will be fined 1,500 rubles. (500 rub. ? 3). In addition, the fund will fine the director up to 500 rubles. (Article 15.33.2 of the Code of Administrative Offenses of the Russian Federation).

There is no contract concluded with the founding director.

A director without an employment or civil law contract is not an insured person in the compulsory pension insurance system. In line 160 you must enter the insured person's attribute 2.

Let’s assume that you filled out Section 3 of the contribution calculation with feature 2 for the director, but did not submit SZV-M reports on it. When reconciling reports, the Pension Fund discovered this. No one will ask you for explanations. You have the right not to submit SZV-M reports, because the company does not have insured persons (

What is the procedure for filling out section 3 of the calculation of insurance premiums in 2021, submitted to the Federal Tax Service? How many sections 3 should I fill out? Do I need to fill out 3 for each employee? You will find answers to these and other questions, as well as an example of filling out Section 3, in this consultation.

Leave without pay

specifically for this version? It seems they have already promised to fix it.

Can you tell me when the update is planned?

Deirdre Are you sure you have completed the packs of section 6?By default, they seem to be formed, but not carried out.

geek Faced a problem in ZUP 79.4 I decided to delete the RSV-1 report from the Regulated reports. Reforming the entire RSV-1 through the master. During the generation, the master pointed out an error with one employee - he corrected it and when generating the RSV-1 report itself - Section 6 appeared.It was suggested on another forum, I don’t pretend to be a “sallution”, since I don’t know how it’s implemented in spacecraft, but it helped me.

Good luck!

ffidelite (10) Helped.| Category of employees who are granted leave without pay | Maximum duration of vacation |

| Ordinary workers in the case when they have a child, a wedding is planned, or a close relative has died. There are other possible grounds for going on leave for personal reasons (Article 128 of the Labor Code of the Russian Federation) | Leave is granted at the request of the employer. Its duration cannot exceed 5 calendar days |

| Disabled workers (Article 128 of the Labor Code) | 60 calendar days a year |

| Pensioners by length of service or age (Article 128 of the Labor Code) | 14 calendar days a year |

| Participants of the Second World War (Article 128 of the Labor Code) | 35 calendar days a year |

| Parents or spouses of military personnel and employees of various internal affairs bodies, fire service, customs and penal system bodies who died in the line of duty or as a result of an injury (illness) received in the service (Article 128 of the Labor Code) | 14 calendar days a year |

| Employees entering universities for the period of passing entrance examinations (Article 173 of the Labor Code of the Russian Federation) | 15 calendar days |

| Employees who are students of preparatory courses at universities and are awaiting final certification (Article 173 of the Labor Code) | 15 calendar days |

| Employees studying at universities in specialty, bachelor's and master's programs to pass intermediate certifications (Article 173 of the Labor Code) | 15 calendar days in each academic year |

| Employees who prepare and defend final qualifying works, as well as pass the final state exam (Article 173 of the Labor Code) | 4 months |

| Employees who take only the final state exam at the university (Article 173 of the Labor Code) | 1 month |

| Employees who need to pass entrance examinations for admission to institutions of secondary vocational education (Article 174 of the Labor Code of the Russian Federation) | 10 calendar days in the academic year |

| Employees receiving secondary vocational education (full-time) to undergo intermediate certification (Article 174 of the Labor Code) | 10 calendar days in the academic year |

| Employees receiving secondary vocational education (full-time) to pass the final state certification | 2 months |

| Employees working part-time in an organization (Article 286 of the Labor Code of the Russian Federation) | For a period that is not enough to cover the duration of leave at the main place of work |

| Employees who have two or more children under 14 years of age or a disabled child under 18 years of age. Single mothers and single fathers who have a child under the age of 14 years (Article 263 of the Labor Code of the Russian Federation) | 14 calendar days (according to the conditions stipulated in the collective agreement) |

| Employees who work in the Far North or other areas equivalent to it | For the time required to travel to the vacation spot and back |

| Employees who are members of the people's squad | 10 calendar days |

| Members of volunteer fire brigades | 10 calendar days |

| Members of election commissions, as well as proxies of political parties and individual candidates | For the duration of the powers |

| Candidates for deputies | For the period from the day of their official registration until the day on which the election results will be announced |

In addition to these categories of employees to whom the employer is obliged to provide extraordinary unpaid leave, there are others. They are covered in various federal regulations. This applies, for example, to Heroes of Socialist Labor, full holders of the Order of Glory, military spouses (for part of the leave that exceeds the duration of annual paid leave), and so on.

A separate question is how many days can a pregnant employee be sent on leave without pay. We are talking about a period of pregnancy when she is not yet entitled to paid maternity leave. In this case, the possibility of such leave, as well as its duration, is determined by agreement of the parties. Usually employers will accommodate you halfway. Moreover, if the employee provides medical documents confirming her fears for her own health.

In other cases, the employer can give its employees leave at their own expense only at will. However, the need for employees to receive such leaves may be stipulated in a personal or collective employment contract.

What is section 3 for and who fills it out?

In 2021, a new form of calculation for insurance premiums will be used. The form was approved by order of the Federal Tax Service of Russia dated October 10, 2021 No. ММВ-7-11/551. Cm. " ".

This reporting form includes section 3 “Personalized information about insured persons.” In 2021, section 3 as part of the calculation of contributions must be filled out by all organizations and individual entrepreneurs that have paid income (payments and rewards) to individuals since January 1, 2017. That is, section 3 is a mandatory section.

How to reflect compensation from the Social Insurance Fund

If the Social Insurance Fund reimburses funds to the policyholder, the amount of compensation must be reflected in the new calculation of insurance premiums. According to the Order of the Federal Tax Service of Russia dated October 10, 2016 N ММВ-7-11/, the amounts of the payer’s expenses reimbursed by the territorial bodies of the Social Insurance Fund for the payment of insurance coverage for compulsory social insurance in case of temporary disability and in connection with maternity are reflected in line 080 of Appendix 2 of Section 1 of the calculation.

Since the new calculation of insurance premiums is due from 2021, it is logical to assume that benefits paid in the current year for periods before 2021 are not included in the calculation. The procedure for filling out the calculation (clause 11.14) states that on line 080 it is necessary to indicate the amount of funds reimbursed by the Social Insurance Fund:

- from the beginning of the billing period - from 01/01/2017;

- for the last three months of the reporting (calculation) period;

- for each of the last three months of the reporting (calculation) period.

If in the first quarter of 2021, the company’s current account received compensation for benefits for 2021, it is better to clarify the procedure for reflecting such payments with the Federal Tax Service.

Who to include in section 3

Section 3 provides for the inclusion of personalized information for each individual in relation to whom in the last three months of the reporting (calculation) period the organization or individual entrepreneur was the insured. It does not matter whether during this period there were payments and rewards in favor of such individuals. That is, if, for example, in January, February and March 2021, an employee under an employment contract was on leave without pay, then this should also be included in section 3 of the calculation for the 1st quarter of 2021. Since during the designated period of time he was in an employment relationship with the organization and was recognized as an insured person.

Of course, it is necessary to formulate section 3 for persons in whose favor in the last three months of the reporting period there were payments and remunerations under employment or civil law contracts (clause 22.1 of the Procedure for filling out calculations for insurance premiums, approved by order of the Federal Tax Service of Russia dated October 10, 2021 No. MMV -7-11/551).

Let us assume that during the reporting period a civil contract (for example, a contract) was concluded with an individual, but the person did not receive any payments under this contract, since the services (work) have not yet been provided (performed). In this case, is it necessary to include it in section 3 of the calculation of insurance premiums? In our opinion, yes, it is necessary. The fact is that those employed under civil contracts are also recognized as insured persons by virtue of paragraph 2 of clause 1 of Article 7 of the Federal Law of December 15, 2001 No. 167-FZ “On Compulsory Pension Insurance”.

We also believe that section 3 should be formed for the general director, the only founder with whom the employment contract has been concluded. After all, such persons are also named in paragraph 2 of paragraph 1 of Article 7 of the Federal Law of December 15, 2001 No. 167-FZ “On Compulsory Pension Insurance”. Therefore, they should fall under section 3. Even if they did not receive any payments from their own organization in the last three months of the reporting period.

Procedure for going on unpaid leave

When can you take vacation at your own expense? Leave without pay, whether it is leave guaranteed by the Labor Code or other federal acts or leave that is given by agreement of the parties, can be taken at any time. This can be done even at a new job, when the work experience has not yet reached a month; the law does not set any restrictions in this regard.

The sequence of actions when taking leave at your own expense does not differ from the procedure for taking annual paid leave or any other leave:

- First of all, the employee writes a vacation application by hand. A special form can be used for this if it is developed by the organization. The application is written according to standard rules; it must indicate the reason for going on leave and its duration. For example, “I ask you to grant me leave without pay due to difficult family circumstances for the period from September 1, 2021 to September 4, 2021 inclusive.” It would also be useful to provide a link to the article of the Labor Code of the Russian Federation or other legislative act on the basis of which the request to go on vacation is based;

- Submitting the application for review and approval to the manager. To increase the chances of receiving leave in cases where it is not guaranteed by law, it is worth attaching to the application any documents confirming the grounds described in the application. For example, a copy of an application for marriage registration at the registry office, the death of a close relative or the birth of a child (from the maternity ward);

- If the manager approves the application, he will issue an order (unified form T-6), on the basis of which the employee will receive the right to go on extraordinary leave without pay. He must be familiar with the order against signature.

If an employee wants to take leave without pay earlier than the period specified in the application, he must notify his superiors in advance. In this case, the days on which wages should not have been paid will be recalculated.

How to fill out section 3: detailed analysis

Initial part

If you are filling out personalized information for a person for the first time, then enter “0–” on line 010. If you are submitting an updated calculation for the corresponding billing (reporting) period, then show the adjustment number (for example, “1–,” “2–,” etc.). In field 020, reflect the code of the billing (reporting) period, for example:

- code 21 – for the first quarter;

- code 31 – for half a year;

- code 33 – for nine months;

- code 34 – per year.

In field 030, indicate the year for the billing (reporting) period of which personalized information is provided.

Check

The value of field 020 of section 3 must correspond to the indicator of the field “Calculation (reporting period (code)”) of the title page of the calculation, and field 030 of section 3 - the value of the field “Calendar year” of the title page.

In field 040, reflect the serial number of the information. And in field 050 – the date of submission of information. As a result, the initial part of section 3 should look like this:

Subsection 3.1

In subsection 3.1 of the calculation, indicate the personal data of the individual for whom section 3 is being filled out. We will explain what personal data to indicate and provide a sample:

| Line | Filling |

| 060 | TIN (if available) |

| 070 | SNILS |

| 080, 090 and 100 | FULL NAME. |

| 110 | Date of Birth |

| 120 | Code of the country of which the individual is a citizen from the Classifier approved on December 14, 2001 No. 529-st, OK (MK (ISO 3166) 004-97) 025-2001 |

| 130 | digital gender code: “1” – male, “2” – female |

| 140 | Identity document type code |

| 150 | Details of the identity document (series and document number) |

| 160, 170 and 180 | Sign of an insured person in the system of compulsory pension, medical and social insurance: “1” – is an insured person, “2” – is not an insured person |

Subsection 3.2

Subsection 3.2 contains information about the amounts:

- payments to employees;

- accrued insurance contributions for compulsory pension insurance.

However, if you are filling out section 3 for a person who has not received any payments in the last 3 months of the reporting (settlement) period, then this subsection does not need to be filled out. This is stated in paragraph 22.2 of the Procedure for filling out calculations for insurance premiums, approved by order of the Federal Tax Service of Russia dated October 10, 2021 No. ММВ-7-11/551. If the fact of payments took place, then fill out the following fields:

| Count | Filling |

| 190 | |

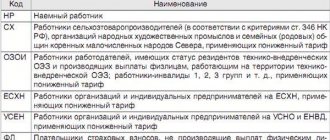

| 200 | Category code of the insured person (according to Appendix 8 to the Procedure for filling out the calculation). Enter the code in capital letters of the Russian alphabet. For example - HP. |

| 210 | The total amount of payments in favor of an individual for the first, second and third months of the last three months of the billing (reporting) period, respectively. |

| 220 | The basis for calculating pension contributions, not exceeding the maximum value. In 2021, this value is 876,000 rubles. |

| 230 | The amount of payments under civil contracts (allocated from the database). |

| 240 | Amount of pension insurance contributions. |

| 250 | The total amount of payments in favor of the employee, not exceeding the maximum base amount for all three months of the reporting (billing) period. |

Let's give an example.

Example

Lobzik and Company LLC is preparing calculations for insurance premiums for the 1st quarter of 2021. In section 3, the accountant needs to include data on mechanic O.V. Romashkin. In January, February and March 2021, he received 30,000 rubles monthly. The accountant included the entire amount in the base for calculating insurance premiums. The accountant filled out subsection 3.2 as follows:

If you apply different insurance premium rates, fill out the required number of lines.

Subsection 3.2.2

In subsection 3.2.2, reflect the payments from which pension contributions were calculated at additional tariffs. The transcript of this section is as follows:

| Count | Filling |

| 260 | The serial number of the month in the calendar year (“01”, “02”, “03”, “04”, “05”, etc.) for the first, second and third month of the last three months of the billing (reporting) period, respectively. |

| 270 | Tariff code. |

| 280 | Amounts of payments from which contributions at additional tariffs were calculated. |

| 290 | Amount of insurance premiums at additional rates. |

| 300 | The total amount of payments and insurance premiums. |

What general principles should be used to formulate section 3 of the unified calculation of insurance premiums in 2021? Who exactly should provide this part of the report put into effect by Order No. ММВ-7-11/ dated 10.10.16? And is it possible to submit a blank section 3 of the calculation of insurance premiums? Current answers to these and other questions follow.

Procedure for submitting calculations

Calculation of insurance premiums is submitted to the Federal Tax Service once every three months: based on the results of the first quarter, half a year, 9 months and a year.

The last date for sending the calculation is the 30th day of the month following the reporting period. Due to holidays and weekends, reporting deadlines are delayed.

You can submit the calculation in two ways (clause 10 of Article 431 of the Tax Code of the Russian Federation):

- in electronic form, if the number of employees is 26 or more people;

- on paper for no more than 25 people.

If during the reporting period the organization had payments in favor of individuals, it is necessary to submit to the Federal Tax Service the title page, section 1, subsections 1.1 and 1.2, appendix 1 and appendix 2 to section 1, section 3. The remaining sheets are filled out in the presence of certain circumstances (payment of benefits from the Social Insurance Fund, contributions at an additional tariff, etc.).

What is section 3 of the unified calculation of insurance premiums intended for?

Detailed section 3 of the new calculation of insurance premiums is compiled in order to provide personalized information for all insured individuals. The frequency of submission of this report is quarterly, therefore all business entities that have entered into employment contracts with staff must include section 3 in the current calculation of insurance premiums - a sample is given below. At the same time, the fact of issuing money in this case is not of key importance.

When exactly is it necessary to fill out section 3 of the calculation of insurance premiums:

- If settlements are made with employees within the framework of labor or civil relations (clause 22.1).

- When specialists are on vacation without saving their earnings.

- When employees go on maternity leave, in the calculation of insurance premiums, section 3 for the maternity leave is drawn up without the formation of a subordinate. 3.2 about payments.

- If the company has only one employee, he is also the director, who is the founder.

- If settlements were made with dismissed persons in the current quarter.

Important! If the policyholder submits to the regulatory government agencies a calculation of insurance premiums without section 3, such a report will be considered incomplete, which will entail a refusal to accept the document.

Filling out section 3 of the calculation of insurance premiums in 2017

Full instructions for entering information into section 3 of the calculation of insurance premiums are in the Procedure for filling out the report regulated by order MMV-7-11 / Separate recommendations are given by the Federal Tax Service in letter No. BS-4-11/4859 dated March 17, 2017. Coding algorithm for line 040 Section 3 of the calculation of insurance premiums is explained in detail in letter No. BS-4-11/ dated January 10, 2017.

Rules for filling out section 3 of calculation of insurance premiums:

- Information is entered separately for each insured individual.

- At the top, initial data is formed - by corrective number (in case of clarifications), reporting period, reporting number and date.

- It is mandatory to reflect personal personalized information in other information. 3.1 – TIN, SNILS of a person, his full name, citizenship, exact date of birth, identity document number, attribute code in the insurance system.

- Other 3.2.1 is formed only if there are various payments to citizens in the reporting period - for example, section 3 of the calculation of insurance premiums for the employee’s maternity leave is provided without this part (subclause 22.2).

- Other 3.2.2 is formed when calculating contributions for compulsory pension insurance in terms of additional tariffs.

Important! If the zero section 3 of the calculation of insurance premiums is presented, “0” is entered in the corresponding lines with monetary indicators, and dashes in the rest. If payments were made on sick leave, the benefits in section 3 in the calculation of insurance premiums must be entered in page 210 sub. 3.2.

How to fill out section 3 of calculating insurance premiums - example

Using the initial data, we will analyze exactly how to form section 3 for 1 sq.m. 2021 Let’s assume that an LLC under the general tax regime is engaged in the wholesale trade of electrical equipment. There is 1 employee on staff, whose salary is 45,000 rubles. per month. There are no contract workers. In Sect. 3, data is entered for one specialist; accordingly, if there is more staff, information for each individual should be filled out separately.

Sample of filling out section 3 of the calculation of insurance premiums

Attention! Often when filling in for employees who were on unpaid leave in the current quarter ,

Section 3 of calculation of insurance premiums in 1C is not formed correctly, because the program automatically indicates empty values for all lines. To rectify the situation, experts recommend accountants to enter monthly indicators in subdivisions. 3.2.1 with zero amounts. After this, the program skips the report and it can be promptly sent to the Federal Tax Service.

“Neopl” in personalized accounting is one of the codes whose inclusion in reporting documents based on length of service is mandatory. Let's look at how these codes are used in 2019.

Personalized accounting

Personalized accounting is intended to summarize the data on the personal account of each employee (from the moment of his employment) for the insurance and funded parts of the pension. Data on his work experience is recorded on the same account.

The main regulatory documents for such accounting are:

- Law “On individual (personalized) accounting in the compulsory pension insurance system” dated April 1, 1996 No. 27-FZ;

- Resolution of the Pension Fund of the Russian Federation “On the forms of individual (personalized) accounting documents in the compulsory pension insurance system and Instructions for filling them out” dated July 31, 2006 No. 192p.

The source of data for personalized accounting is information submitted by employers.

New reporting

Starting in 2021, all employers must submit a new SZV-STAZH report to the Pension Fund. This form discloses information about the pension experience of employees of the organization (individual entrepreneur). SZV-STAZH is an annual report and must be submitted for the first time for 2021. Everything new raises questions, and this form is no exception. One of the stages of filling out the form, which causes difficulties for specialists, is using the correct code for vacation taken in 2021 at your own expense in SZV-STAZH 2021.

The popularity of the question is due to the fact that this form must be submitted by all employers (organizations and entrepreneurs) who pay remuneration to individuals (clause 1.5 of the Procedure, approved by Resolution of the Board of the Pension Fund of the Russian Federation dated January 11, 2017 No. 3p):

- within the framework of employment contracts;

- under civil law contracts;

- under copyright contracts and licensing agreements.

In turn, leave without pay is by no means uncommon. So how do you celebrate vacation at your own expense in SZV STAZH?

In general, legal entities submit the SZV-STAZH form to the territorial divisions of the Pension Fund of the Russian Federation at the place of their state registration. As for businessmen, individual entrepreneurs submit a report at their place of residence (Clause 1, Article 11 of the Federal Law of 04/01/1996 No. 27-FZ).

Features of personalized reporting in 2021

Starting from 2021, reporting regarding the calculation of insurance premiums (including those intended for the Pension Fund of Russia) is submitted to the tax authorities. The calculation of contributions, which combines information on all types of contributions transferred under the control of the Federal Tax Service, contains a section devoted to personalized data. However, these data only include information on accrued income for the period and related contributions. There is no information about experience in them.

Reporting on length of service is submitted at the end of the year directly to the Pension Fund of the Russian Federation before March 1 (clause 2 of Article 11 of Law No. 27-FZ of April 1, 1996). For it, by resolution of the Board of the Pension Fund of December 6, 2018 No. 507p, a new form SZV-STAZH was approved, in which for information about length of service a table is provided, similar to that included in the expired form RSV-1.

IMPORTANT!

From 01/01/2019 it is necessary to use the new forms SZV-STAZH and EDV-1, approved.

Resolution of the Board of the Pension Fund of December 6, 2018 No. 507p. Resolution of the Pension Fund Board of January 11, 2018 No. 3p, according to which personal reporting has been submitted until now, has lost force. You can download the updated forms. By the way, before the end of the year, the liquidating organization and the individual entrepreneur deregistering must submit the SZV-STAZH.

Resolution No. 507p approved the rules for filling out the new form and the formats for submitting it to the Pension Fund. The text of the rules contains a reference to the same codes that were used when filling out personalized information in the RSV-1.

The most difficult moments in the new SZV-STAZH uniform

The code in column 8 is indicated if the employee has the right to early retirement due to territorial conditions, for example: Code Full name RKS/RKSM Region of the Far North MKS/MKSR Area equated to the regions of the Far North VILLAGE Work in agriculture According to column 9 of the form SZV-STAZH indicates the code of working conditions that give the right to early assignment of a pension.

Codes for SZV-STAZH

According to them, reporting (starting from the period 2021) should be filled out as follows: Only those employees who work in special working conditions (OUT) will need to highlight the period in the form and enter a special annual leave code in SZV-STAZH (DLOTPUSK). For all other employees, there is no need to mark the time of the next vacation of the insured person, starting from 01/01/2020. It is no longer necessary to allocate a period of paid annual leave in a separate block, except for the cases specified in the previous paragraph.

Where are the types of codes indicated?

Grouped by sections, the codes of the parameters required to fill out information about the length of service are contained in clause 2.3.26 to the Pension Fund Resolution No. 507 p dated December 6, 2018:

- insured persons by category;

- taking into account working conditions in the territories of the Far North and those exposed to radiation contamination;

- for special working conditions;

- on the basis for calculating the insurance period;

- according to additional information for calculating the insurance period;

- for periods that are not included in the insurance period when calculating the length of service;

- on the grounds for assigning a labor pension early;

- for a special assessment of working conditions.

The parameter classifier is intended to identify employees and the conditions of their work when considering personalized data in the Pension Fund. It allows you to ensure the assignment of a pension taking into account all factors (earnings, length of service, working conditions, etc.).

The classifier also includes codes for such categories of insured persons as foreign citizens temporarily residing in the territory of the Russian Federation.

Filling out the zero DAM for the 1st quarter of 2021

The delivery of a zero RSV also follows the usual rules. It must be sent to the tax authority on time (for the 1st quarter of 2021 it expires on 04/30/2020). Late submission results in a fine, which in its minimum possible amount (RUB 1,000) will be charged even in the absence of digital indicators in the main sections of the report (clause 1 of Article 119 of the Tax Code of the Russian Federation).

Where to download a sample of filling out the zero RSV for the 1st quarter of 2020

The report (during the year compiled on an accrual basis) will be completely zero (that is, with zeros in all fields corresponding to the digital indicators of accruals) only when there is no activity at the beginning of the year. Because of this, the most often created with zero data is the DAM generated for the 1st quarter. The appearance of data in later periods of the year automatically transfers the report to the non-zero category.

In line 220 (the basis for calculating contributions), do not include income that is not subject to insurance contributions. The general list of non-taxable income is given in Art. 422 of the Tax Code of the Russian Federation. Also take into account the explanations of officials and courts. We have collected some of them in a table:

- Russian companies (LLC, JSC), as well as their branches;

- foreign enterprises operating in the Russian Federation;

- entrepreneurs and heads of peasant farms-employers;

- individuals who are not registered as individual entrepreneurs, but pay income to hired employees.

Fill out Appendix 2 to Section 1

In the finished calculation, put the number of each page in the “Page” field. Calculation pages have continuous numbering, starting with the title page. And it doesn’t matter how many sections you filled out, which ones you included, and which ones you skipped. The number for the first page is “001”. This is stated in clauses 2.1-2.21 of the Procedure approved by Order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11/551.

If the policyholder submits the report later than the due date, he will be fined. The fine is equal to 5% of the contributions reflected in the report. It is charged for each full and partial month of delay. At the same time, you will not be able to pay a fine of less than 1,000 rubles, but you will not be punished for more than 30% of the contributions.

This is interesting: Otsdi over 2020

“Neopl” and “Agreement” in personalized accounting

The “Neople” code is used if there were periods during which no work was carried out. Such periods are:

- leave without pay;

- downtime due to the employee’s fault;

- suspension from work in case of violations of labor regulations (for example, state of intoxication);

- unpaid leave of up to one year provided to teachers;

- other unpaid periods.

The “Contract” code is entered if work under the contract began in the previous reporting period and continues in the current one. It is used for contracts, transportation and others.