From July 1, 2021 and January 1, 2021, the Russian Federation will introduce

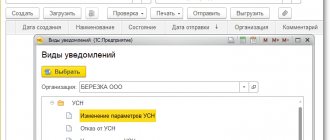

The uniqueness of the simplified taxation system lies, in particular, in the fact that the taxpayer applying this special regime

In modern business, situations arise when entrepreneurs provide each other with financial support in the form of

Inventory is a responsible and serious process for entrepreneurs involved in retail trade. Almost everyone

From January 1, 2021, 48 international standards will come into force in the Russian Federation

Liabilities are the totality of a company's monetary obligations. Some of them are related to securities,

The VAT deduction operation reduces the amount of tax payable. There are situations when a deduction was made, but

Payment of one-time assistance to an employee in difficult or joyful life situations that require additional expenses –

UTII, USN, PSN, OSNO. For some, these abbreviations mean nothing, but for the owners

Foreign exchange transactions can sometimes be a nightmare. Obviously, when one company trades with