Liabilities are the totality of a company's monetary obligations. Some of them are related to securities issued by a business entity, and these obligations are repaid upon presentation of the security (issued bills of exchange, accepted checks, issued bonds, etc.), others arise due to accounts payable to suppliers for goods and services received, to employees, budget, etc.

Liabilities include all sources of funds of the entity, both borrowed (borrowed capital) and own (equity).

The following types of liabilities are distinguished.

How assets and liabilities are formed

In the course of the company's business activities, personal property and liabilities are formed. These concepts have a polar accounting structure and are reflected in the balance sheet in different sections.

In essence, they are the same financial resources, divided according to the principle of use. Current liabilities on the balance sheet are sources of assets, so they should always be equal. A violation of the balance sheet indicates that the acquired property is not backed by cash. The main working capital management strategy is aimed at maintaining the solvency of the company and maintaining a certain level of assets.

What is considered a fixed asset?

Fixed assets include property assets that can be used as production assets necessary for the manufacture of products (providing services, carrying out work), as well as property used to manage the company. The fixed assets include:

- buildings and constructions;

- land;

- equipment;

- auto, motorcycle and other equipment;

- computing devices;

- measuring instruments;

- household equipment;

- farm livestock;

- perennial plantings;

- on-farm, logistics roads and railways, as well as other similar assets.

Fixed assets also include capital investments in the land fund (carrying out work that significantly improves the quality of agricultural land), environmental management facilities, as well as completed capital investments in leased property.

The cost of registered fixed assets consists of all costs associated with their acquisition and is repaid through depreciation. Depreciation charges are made using one of the methods chosen by the enterprise (clause 48 of the PBU for accounting and accounting, approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n):

- linear;

- reduction of balance;

- by the sum of the numbers of years of useful life;

- in proportion to the volume of production.

NPO property is not depreciated. The cost of land and mining facilities, water and other subsoil is not repaid.

To learn about the similarities and differences between depreciation charged in accounting and tax accounting, read the article “Depreciation bonus in accounting and tax accounting.”

What are current assets

Funds that can be converted into money during one production cycle are called current (current) assets. These include all material assets, inventories, components, accounts receivable, finished products and, of course, cash. Current assets are in constant motion, ensuring continuity of the production process.

Depending on how quickly property assets are converted into money, they are assigned a degree of liquidity. Current balance sheet items are placed as this indicator decreases from higher to lower values.

How are the sources of property of enterprises reported?

Reporting of a company's property assets involves identifying the sources of organization of such property.

Accounting for the sources of formation of an organization's own property provides for the division of material assets into two key categories: own assets, borrowed funds. Often, an LLC acquires property through the use of its own funds. The company creates equipment, and with money from the sale of the product, it updates the production line: it adds to the list of fixed assets, thanks to which it subsequently receives income. As a rule, to develop large-scale activities, one’s own finances are not always sufficient, especially at the initial stage of development of the company’s activities. Therefore, organizations often attract third-party resources, that is, they enter into contractual agreements with business partners and credit institutions.

The nature of liabilities

The totality of all the obligations of the company, which occupies the opposite side of the balance sheet, is usually called liabilities. Such funds include short-term loans, accounts payable, authorized capital, accumulated profit.

Depending on the nature of their occurrence, such funds can be divided into own and borrowed funds. In turn, own funds paired with long-term loans form permanent liabilities, and short-term liabilities and accounts payable form current short-term liabilities.

Practical examples of capitalization of fixed assets

Example 1

LLC "Medved" purchased a machine worth 250 thousand rubles. (including VAT – 38135.59). The price included additional costs for transporting the machine and installing it at the workplace.

All transactions are reflected in the accounting records of the LLC with the following entries:

Dt08 Kt60

RUB 211,864.41 – accounting for the costs of purchasing an asset (transportation and installation are carried out by the seller and are included in the price).

Dt19 Kt60

RUB 38,135.59 – input VAT is displayed.

Dt01 Kt08

211864.41 rub. — the initial cost of the equipment was formed, the machine was put into operation.

Dt68 Kt19

RUB 38,135.59 – input VAT is claimed for deduction.

Note from the author! In the case when the acquired fixed assets will be used in activities that are not subject to VAT, the initial cost of the object is formed together with input VAT.

Example 2

A manufacturing company decided to create a new warehouse for storing materials and goods. The construction of the building was carried out by the company’s workers, the final cost of the work according to the estimate was 10 million rubles.

The accounting transactions show:

Dt08.03 Kt60,10,70, 69, etc.

10 million rubles – the actual costs of building a warehouse are taken into account (salaries of employees involved in construction, insurance contributions from wages, cost of materials expended (according to the act of writing off inventories), costs for additional services of contractors (for example, drawing up estimate documentation), etc.) .

Dt01 Kt08.03

10 million rub. – a new warehouse building was registered and put into operation

Placement of passive liabilities by balance sheet items

Financial management of working capital is a thorough analysis of the movement of current liabilities and assets. This policy is aimed at solving such problems as accelerating turnover in order to increase liquidity, optimizing the formation of assets, and identifying shortages or surpluses of funds.

Due to the fact that current liabilities have different sources of origin, their distribution in the balance sheet is strictly structured. The third section of the balance sheet is entirely devoted to all types of capital (authorized, reserve, additional). Also in this section you can find retained earnings, which remain at the disposal of the company after taxation.

The balance sheet items of the fourth section consist of long-term credit and deferred liabilities. The fifth section of the balance sheet is devoted to accounts payable, which includes tax obligations, accrued wages to employees, debt to suppliers and founders, as well as short-term loans.

The procedure for generating indicators according to the lines of section V of the balance sheet liabilities

The organization’s liabilities (essentially its borrowed capital) are presented in two liability sections of the balance sheet, depending on their maturity date:

- in Sect. IV “Long-term liabilities” – liabilities whose maturity is more than 12 months after the reporting date;

- in Sect. V “Short-term liabilities” – obligations that must be repaid within the next year.

Section V “Short-term liabilities” of the liabilities side of the balance sheet reflects information about short-term borrowed sources attracted by the organization.

In line 1510 “Borrowed funds” the credit balance of account 66 “Settlements on short-term loans and borrowings” is entered, as well as part of the amounts from the credit of account 67 “Settlements on long-term loans and borrowings” (in the part subject to repayment within the next 12 months after the reporting period). dates).

On line 1520 “Accounts payable,” the organization needs to show the total amount of all types of short-term debt to other organizations and individuals, as well as to the state and extra-budgetary funds. To do this, add up the credit balances of the following accounts (in terms of short-term accounts payable):

- 60 “Settlements with suppliers and contractors”;

- 62 “Settlements with buyers and customers” (in terms of short-term accounts payable for advances and prepayments received);

- 68 “Calculations for taxes and fees”;

- 69 “Calculations for social insurance and security”;

- 70 “Settlements with personnel for wages”;

- 71 “Settlements with accountable persons”;

- 73 “Settlements with personnel for other operations”;

- 75 “Settlements with founders”, subaccount 2 “Settlements for payment of income”;

- 76 “Settlements with various debtors and creditors.”

Organizations have the right to independently determine the detail of indicators for reporting items.

Therefore, in principle, an organization can add decoding lines to detail the indicator on page 1520 “Accounts payable”.

For example, for separate presentation of information on short-term accounts payable to suppliers and contractors, to the organization’s personnel, to the budget for the payment of taxes and fees, as well as to extra-budgetary funds, if the organization recognizes such information as significant.

The organization must fill out page 1530 “Deferred income” of the balance sheet liability in cases where the accounting provisions provide for the recognition of this accounting object.

For example, commercial organizations here reflect the sum of the credit balances of accounts 98 “Deferred income” and 86 “Targeted financing”.

The fact is that in commercial organizations receiving budget funds, amounts of targeted financing aimed at acquiring non-current assets or inventories are taken into account as part of deferred income. The balances of targeted financing are also reflected within this category of accounting objects.

Line 1540 “Estimated liabilities” is intended to reflect the credit balance of account 96 (except for amounts included in long-term liabilities).

Line 1550 “Other liabilities” reflects other types of short-term liabilities that are not included in the above lines.

For example, the amount of targeted financing received by developer organizations from investors and generating an obligation to transfer the constructed object to them within 12 months after the reporting date (in accounting they are taken into account in account 86 “Targeted financing”), or the amount of VAT accepted for deduction when transferring an advance (prepayments) and subject to restoration and payment to the budget upon actual receipt of goods, works, services or upon return of the transferred advance payment (prepayment), usually accounted for in account 76 “Settlements with various debtors and creditors.”

The total amount of lines 1510 - 1550 is reflected on line 1500 “Total for Section V”, which characterizes the total amount of short-term borrowed capital (liabilities) of the organization.

Conservative working capital management

The capital management policy is based on maintaining a sufficient level of current assets by attracting financial sources. Depending on what goals are pursued when running a particular business, three main models for managing current assets and liabilities can be identified.

The conservative management method assumes the presence of a fairly low number of current assets. At the same time, the turnover period of funds is also reduced to a minimum. This policy is convenient for companies that clearly know the time frame of the production cycle. Products are manufactured for a specific consumer, so the volume of reserves is strictly limited. The manufacturer has no doubts about the timing of receipt of payments, and therefore there is no need to purchase materials for future use.

In conditions of extreme savings, a sufficiently high indicator of asset liquidity is achieved, and, as a result, an increase in production profitability. But with such business tactics, there is a high risk of unforeseen situations when payments are not received on time and the material base is at zero.

The main distinguishing feature of conservative management is that current liabilities in the form of short-term loans have a very low share in the mass of all liabilities. All activities of the enterprise are carried out at the expense of its own working capital.

Movable and immovable property

Back in 2013, the Ministry of Finance, in letter No. 03-05-05-01/5322 dated February 25, 2013, proposed to be guided by the Civil Code of the Russian Federation when classifying property as movable (immovable).

Is a fence a piece of real estate, or is it considered movable property ?

Art. 130 defines the following property as immovable:

- land plots and subsoil;

- buildings (structures), including unfinished construction;

- residential and non-residential premises;

- garages, parking lots, parking spaces, the boundaries of which are determined in cadastral registration.

Question: Can legal entities enter into an agreement between themselves for the free use of movable or immovable property? View answer

Property is recognized as immovable because its movement without damage to subsequent use is impossible. The objects mentioned above most often become the subject of accounting for organizations and firms.

By the way! Immovable objects include vessels: sea and air vessels and space objects.

Federal Law No. 218 of 07/13/15 prescribes state registration of such objects in the Unified State Register (USRN).

Question: How does an object (equipment) qualify as movable or immovable property for the purposes of corporate property tax? View answer

The Federal Tax Service defines property as immovable if it is registered in the Unified State Register of Real Estate, or according to documents for the object, from which it is clear that it is firmly connected to the land and cannot be moved without destruction. The rest of the property of the Civil Code is defined as movable. Such property does not need to be registered in the register.

Obviously, in accounting, many objects of movable and immovable property, due to the difference in the criteria of civil and accounting legislation, will end up on the same accounts. The management of the company will have to think about how to separate property that is subject to taxation from others in accounting, and how to build an accounting policy in this area.

Aggressive model for increasing assets and liabilities

With a significant amount of cash, the company continuously increases the volume of inventories and finished products. In addition, due to the increase in current assets, a direct relationship appears in the form of an increase in liabilities. In turn, the production process itself is quite lengthy, and the turnover of material assets is slow.

By choosing such a management policy, we can say with confidence that the risk of technical failure of the production process will be minimal in this case, as well as economic profitability.

An aggressive management model increases current liabilities through short-term borrowings that ensure sufficient levels of inventory and cash flow. In turn, a large amount of accrued interest acts as a financial lever, which increases costs and reduces profitability. The risk of loss of asset liquidity is also high.

Codes and decryptions

The balance sheet document includes 5 main sections. Let's look at their names and contents.

Section 1 – Non-current assets

Section 1 is a direction that includes information about what assets that have a low degree of liquidity the organization owns.

Traditionally, these include equipment, buildings, premises, intangible active parts and other elements. The basis of the section is 7 lines, starting with intangible assets (1110) and ending with other elements (1170). In addition, this part contains lines with the results of research work (1120), fixed assets (1130), profitable investments (1140), tax assets (1160).

The last line (1100) summarizes all previous directions and elements.

Section 2 – Assets in circulation

Section 2 is a group of resources that are the most highly liquid. These include commodity items, debt from debtors, cash in the cash register, in the organization’s accounts, etc.

Considering a more detailed description of the document, it is worth paying attention to the inventories reflected in line 1210, VAT (1220), debt for the amounts that debtors must pay (1230), financial investments (1240), cash resources (1250) and so on.

Section 3 – Capital

Section 3 displays information related to the enterprise’s capital and the reserve portion on which it can rely. This part contains 6 main directions and one summary line.

The lines should include stock capital resources (1310), own securities, mainly shares, the redemption of which occurred from shareholders (1320), revaluation of assets outside of circulation (1340), additional funds not subject to revaluation (1350), reserve stock capital ( 1360), uncovered loss part (1370).

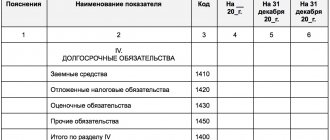

Section 4 – Long-term financial obligations

Section 4 includes various debts of the organization that it owns for the future. If we consider and study this part of the balance sheet in detail, we can highlight the following areas: borrowed resources (1410), deferred obligations for fees and contributions to the state treasury (1420), reserves created as part of contingent liabilities (1430), other debts (1450) . And finally, the final line, represented by the sum of all filled columns (1460).

Section 5 – Short-term liabilities

The assignment of code values and numbering in section 5 follows the same principle. There are 5 main directions and one final direction.

In line 1510, borrowed funds are reflected; in 1520, you can obtain information about data on accounts payable. Within the framework of page 1530, it is possible to obtain data on income receipts of future periods.

Reserves for upcoming expenditure areas appear in column 1540, and other liabilities are indicated in 1550.

Traditionally, code values are required so that bodies and structures of official statistics are able to combine information presented in different types of balance sheet data into a single whole.

But if the paper is compiled for a quarter or another, shorter reporting period, filling out the lines is not necessary, since they do not include any functional features.

Coding is only needed in those practical situations where documents are subsequently submitted to authorities.

Moderate working capital management policy

If you analyze moderate business tactics, you will notice that this model occupies an intermediate place among the above. Half of all assets under this policy are occupied by current working capital, which has a moderate period of liquidity. Current liabilities, current liabilities and borrowings are also average.

This model is the safest and most calculated. The likelihood of a risk of decreasing asset liquidity is minimal. The formation of current assets occurs in most cases at the expense of own funds.

Types of balances

Balances are divided according to various criteria, for example:

- by time (introductory, initial, intermediate, final and liquidation);

- by completeness of information (general, specific).

The opening balance sheet is drawn up upon the establishment of an organization, approval of a company, joint-stock company, etc.

The initial balance sheet is drawn up every year in order to clarify the property status of the organization after the annual work and determine the qualitative composition of the property. The opening balance drawn up at the end of the reporting year is the final balance for the past year and the initial balance for the coming year.

The interim (test) balance is drawn up quarterly and can be adjusted at the end of the financial year.

The final (liquidation) balance sheet is drawn up upon termination of the organization's activities. It is constituted by a special commission tasked with liquidating the organization.

General balance sheets contain information about the property, rights and obligations of the entire organization as a whole, and private balance sheets contain information about the property, rights and obligations of any individual part of the organization.

The impact of current assets on financial stability

The solvency and economic stability of a company are determined by the ratio of the efficiency of asset use and the level of financial risk. Based on such concepts, a business model and working capital management policy are built.

If current liabilities in the form of short-term liabilities remain unchanged against the backdrop of growing assets, this means that the company has acquired financial stability and is able to break-even increase working capital at the expense of its own income.

At the same time, if current liabilities (balance sheet line 610 “Short-term liabilities”) grow against the background of equity and long-term liabilities, then in such a situation one can observe an increase in the liquidity of working capital, but at the same time financial stability and solvency will be reduced.

Long-term liabilities of the enterprise in the balance sheet

Long-term liabilities of the enterprise in the balance sheet are represented by such elements as:

- loans and credits of the organization;

- deferred tax liabilities;

- other long-term liabilities.

All long-term loans and credits that were provided to the organization are recorded in accounting account 67 “Long-term loans and borrowings” with an analytical breakdown by type. Long-term are loans or credits whose repayment period exceeds 12 calendar months. The credit balances of this account are an indicator as part of the company's long-term liabilities for loans and credits.

Deferred tax liabilities also represent long-term liabilities of the organization. Such obligations arise in an organization in the presence of tax permanent differences. Data on such differences are recorded in account 77 “Deferred tax liabilities”.

Can not understand anything?

Try asking your teachers for help

Note 1

If the organization has other long-term liabilities, then they are taken into account in the line “Other long-term liabilities”. For example, this may be debt to suppliers for goods, the repayment period of which is more than one calendar year.

Adequacy of cash in relation to current liabilities

In order to find out how much cash is required to pay current obligations, it is necessary to calculate the adequacy ratio. When determining it, an economic concept such as the degree of coverage is used. In other words, you need to determine the ratio of the amounts of current liabilities and assets.

If, as a result of calculations, it turns out that current assets have a fairly significant weight in balance sheet items, then there is confidence that current liabilities will be paid from own funds. This dominance allows the company to create a reserve stock in case of unexpected losses. The amount of reserve stock is an important indicator for lenders. If the resulting coverage ratio is greater than 2, then this value is a guarantee of the safety of current assets in the event of a decline in market prices.

The company's commercial cycle also plays an important role in the formation of current assets and liabilities. The enterprise's need for working capital directly depends on the timing of accounts payable and receivable. The longer the term of the supplier's credit obligations, the more confident the company feels in the event of delays in payments from customers.

The relationship between current liabilities and assets in the commercial activities of an enterprise is obvious. These concepts are the fundamental constants of the balance sheet. The size of working capital and liabilities characterizes the economic condition of the company and its financial stability.

Short-term liabilities of the enterprise in the balance sheet

All short-term loans and credits that were provided to the organization are recorded in accounting account 66 “Short-term loans and borrowings” with an analytical breakdown by type. Short-term are loans or credits whose repayment period is less than 12 calendar months. The credit balances of this account are an indicator as part of the company's short-term liabilities for loans and credits.

An organization's accounts payable, as a rule, consists of several types and is recorded in the appropriate accounts:

- 60 – debt to suppliers for goods or products received, if such products on the date of drawing up the balance sheet were received by the enterprise but not paid for;

- 62 – debt to customers for returns of goods, if as of the date of compilation of the balance sheet such claims for return were made;

- 70 – debt to employees of the enterprise for payment of wages and other payments. As a rule, at the end of the reporting period, part of the wages for the second half of the last reporting month remains unpaid in organizations;

- 68 – debt to the budget for various taxes (value added tax, income tax, personal income tax, etc.). As a rule, organizations do not pay most of the taxes “up front”, so at the end of the reporting period such debt appears;

- 69 – debt to extra-budgetary funds (Pension Fund, Social Insurance Fund, etc.). As a rule, the amount of such debt is proportional to the amount of debt for unpaid wages.

The organization may also have other accounts payable, which are reflected in the “Other creditors” line.

Information about the debt to participants for the payment of income is reflected in the credit of account 75 “Settlements with founders” in an analytical context for each founder.

Note 2

If a company has deferred income on its balance sheet, then it is also reflected in the balance sheet line of the same name.

Current liabilities on balance sheet

Home » Accountant » Current liabilities on the balance sheet

Return to Balance Liabilities Current Balance Liabilities. This item includes debt obligations that mature within the next year. Current balance sheet liabilities are liabilities that are usually covered by existing current assets or by creating other current liabilities. In practice, the most widespread are the following types of current liabilities: - settlements with suppliers and creditors (Accounts Payable); — short-term bank and other loans (Notes Payable); — debt for expenses payable (Accrued Expenses Payable); — taxes and other charges (Federal Income Tax Payable). Since it is assumed that the reader is familiar with accounting, we will not consider in detail all the balance sheet items, but will only talk about those that require special knowledge or, more often, a special approach on the part of the analyst. In industrial, trading and service companies, assets and liabilities are divided into current and long-term. Such a division, as a rule, does not exist in electric power companies, banks, insurance and other financial companies. The word current means assets and liabilities (liabilities) that are subject to conversion into money or payment in money within no more than 12 months or during the production cycle (if it lasts more than 12 months). For example, cigarette tobacco is typically aged for three years before being sold. Therefore, tobacco stocks are classified as current assets. Likewise, wines, liqueurs and cognacs to be aged, long-term construction projects, etc. create current assets that will not be converted into cash within 12 months because they require more time. But the current practice is such that even when a liability is an element of the production cycle, it is classified as current only by the criterion of feasibility within 12 months. For example, an advance payment obligation or an inventory of materials under a long-term construction contract would typically be classified as a non-current asset. Current assets and duration. The division of assets into current and long-term outlines the period during which one can expect that, in the normal course of business, this asset will be converted into money. Duration is an indicator of risk, to a certain extent related to the indicator of maturity. The duration of accounts receivable can be several days or months. The duration of inventory can be measured in months or even years. For fixed assets and long-term debt, duration is measured in years and decades.

Duration and risk. The riskiness of long-duration assets is clearly seen in the case of bonds, because the longer the maturity, the larger price changes these interest rate changes create. Although in the case of buildings, structures and equipment the presence of such a risk is not so obvious, it is present here too. As with bonds, prices of buildings, structures and equipment reflect the average discounted present value of future earnings. Current assets increase liquidity. The ratio of current assets to balance sheet can be used as an indicator of risk. The longer you wait for the day when an asset turns back into cash, the more likely it is that something will go wrong. Therefore, the analyst will approach the analysis of current assets, the ratio of the amount of current assets to the amount of the balance sheet and the liquidity ratio (the ratio of current assets to current liabilities) from the standpoint of assessing risk and liquidity. Working capital Fixed assets Intangible assets Balance sheet Maternity leave Travel expenses

| | Up