The essence and purpose of income tax Income tax is the main type of direct taxes. Calculated in

What taxes must a Russian company pay when paying dividends to a foreign investor - an individual?

Tax accounting of bills of exchange, unlike accounting for other securities, has its own characteristics. This

What characteristics of furniture are considered for write-off? When it comes to furniture, we mainly have

Why were new control ratios for calculating insurance premiums introduced? All primary and updated

Legal basis of the issue The main legislative acts that should be used are: Tax Code of the Russian Federation. Except

Acceptance of an item of fixed assets in an organization occurs according to an inventory card to record all operations,

Accounting consequences of writing off work in progress We prepare documents For various reasons, the company’s plans may change,

Method 1. Intermediary services This method of re-invoicing transport costs is the most common, although quite

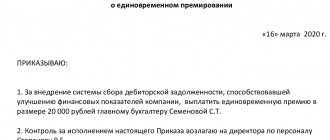

Home / Labor Law / Payment and Benefits / Bonuses Back Published: 04/08/2016 Time