The VAT return reflects all information related to the calculation of value added tax. There are sections in the VAT return where you need to fill out the VAT amount for crediting and deducting. There are also sections for tax agents to reflect VAT on exports and imports, as well as transactions that are not subject to taxation.

In order to ensure that tax inspectors do not raid the company for an inspection, it is necessary to fill out the VAT return correctly.

VAT return structure

The VAT return consists of twelve sections. When filling out a VAT return, there is no need to complete all sections. The required sections to be filled out are the title page and the first section, the remaining sections are filled out as necessary, it all depends on what VAT transactions were carried out at the enterprise in the reporting period in which the VAT return is submitted. Let's look at each section separately in table form:

| Section title | Information that is reflected in the section |

| Title page | Information about the enterprise is indicated, namely: INN, KPP, Full name, OKVED code, contact telephone number, and the tax period must also be indicated. |

| Section No. 1 | Reflects the amount of tax that is payable to the budget for the taxpayer |

| Section No. 2 | The amount of tax that is payable to the budget according to the tax agent is reflected. |

| Section No. 3 | Calculation of the amount of tax that must be paid to the budget for those transactions that are subject to taxation |

| Section No. 4 | Calculate the amount of tax that falls under the 0% rate with supporting documents |

| Section No. 5 | Calculation of the amount of tax deduction for sold goods, works, services, at a rate of 0% based on supporting documents |

| Section No. 6 | Calculation of the amount of tax on the sale of goods, works, services at a rate of 0%, but not documented |

| Section No. 7 | Transactions that are not subject to taxation or are exempt from VAT are reflected. |

| Section No. 8 | Displays information from the purchase book that is reflected for the current reporting period |

| Section No. 9 | Reflects data from the sales book that is reflected for the reporting period |

| Section No. 10 | Reflects data from the book of issued invoices for transactions that are associated with persons who provide forwarding services, developers and commission agents and agents working for the benefit of third parties |

| Section No. 11 | Reflects data from the book of received invoices for transactions that are associated with persons who provide forwarding services, developers and commission agents and agents working for the benefit of third parties |

| Section No. 12 | availability of invoices with allocated VAT presented to counterparties. |

Reflection of VAT in the purchase book: rules and examples

During the quarter—the VAT tax period—the organization accumulates many documents giving the right to deduction. To summarize the data from all documents and obtain the amount of tax that can be deducted, it is necessary to reflect VAT in the purchase book - a special tax register.

A purchase ledger is a summary tax document. It includes information about invoices on the basis of which VAT deductions are applied for the corresponding tax period (quarter). Those. Each quarter has its own purchase book.

The purchase book is maintained in accordance with the form of Appendix No. 4 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137. From October 1, 2014, the updated form of the book is used.

The content of the article

1. Do I need to keep a purchase book?

2. What goes into the purchase book

3. What is not included in the purchase book

4. Purchase book structure

5. If not the entire amount of VAT is accepted for deduction

6. VAT codes in the purchase book

7. Formation of a purchase book in 1C: Accounting 8

8. Reflection of VAT in the purchase book when purchasing goods and services

9. Advances issued in the purchase book

10. Advances from the buyer in the purchase book

11. Return from the buyer in the purchase book

12. Registration for separate VAT accounting

13. Design of a purchase book

So, let's go in order. If you don't have time to read a long article, watch the short video below, from which you will learn all the most important things about the topic of the article.

(if the video is not clear, there is a gear at the bottom of the video, click it and select 720p Quality)

We will discuss the topic further in the article in more detail than in the video.

Do I need to keep a purchase book?

Maintaining a purchase book is the responsibility of VAT payers (clause 3 of Article 169 of the Tax Code of the Russian Federation). If an organization is not a VAT payer and does not accept tax as deduction, then it has no obligation to fill out a purchase ledger.

Based on information from the purchase book, the amount of VAT deduction is reflected in the tax return. But since 2015, not only data on the amount of deductions is transferred from the purchase book to the declaration. Now indicators from the book are included line by line directly into the declaration. Section 8 is intended for these purposes.

There will be as many sections 8 in the declaration as there are entries registered in the purchase book for the corresponding quarter. This is partly why the VAT return is submitted electronically, because With a large number of entries in books, printing it manually became simply unrealistic.

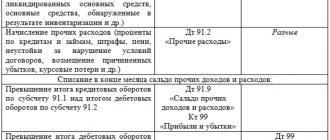

Based on the entries in the purchase book, accounting records reflect the transactions for accepting VAT for deduction - using the entry:

Debit 68 - Credit 19 - this accounting entry means that VAT was included in the purchase book.

What goes into the shopping book

VAT is reflected in the purchase book on the basis of documents confirming the organization’s right to deduct. And it's not just invoices. The purchase book records:

- Invoices, including:

- received from sellers (for advances transferred to them, as well as for goods shipped, work performed, services rendered);

- advance invoices from the seller for subsequent shipment of goods and materials (which were previously registered in the sales book);

- adjustment invoices to reduce the cost of shipment from the seller and increase it from the buyer;

- for construction and installation works for own consumption, when deducting VAT on them

- Other documents that, along with invoices, serve as the basis for deducting VAT, for example:

- strict reporting forms or copies thereof - when deducting travel expenses:

- customs declaration and payment documents confirming payment of import VAT - when importing:

- statements on the import of goods and payment of indirect taxes - when importing goods from the EAEU.

VAT is reflected in the purchase book as the right to tax deductions arises. In this case, invoices are registered in a unified manner (clause 2 of the Rules for maintaining a purchase ledger):

- regular, corrective and corrected;

- received on paper and electronically;

- filled out partly using a computer, partly by hand.

What doesn't make it into the shopping book?

Invoices that do not comply (clause 3 of the Rules for maintaining a purchase ledger) should not be included in the purchase ledger:

- requirements of Art. 169 NK

- established forms

In addition, the book does not record invoices received (clause 19 of the Rules for maintaining the purchase ledger):

- by buyers upon gratuitous transfer of goods and materials

- intermediaries from customers for goods transferred for sale (work, services, property rights), including the amount of advance received (partial payment);

- by intermediaries from sellers, issued in the name of the intermediary for goods (work, services, property rights, as well as for the advance amount received (partial payment);

- for the amount of prepayment for non-cash forms of payment;

- for the amount of prepayment for goods and materials purchased for VAT-free transactions;

- advance invoices issued or received after the seller has received (issued) shipping invoices.

- marked “without VAT” from sellers who are not VAT payers.

If the purchase is intended for taxable and non-taxable transactions, an invoice is registered for the amount accepted for deduction based on the proportion of separate accounting (clause 6 of the Rules for maintaining the purchase ledger). More about this a little later.

Purchase ledger structure

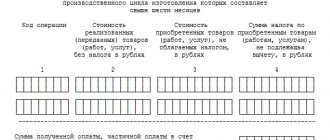

When filling out the purchase book, it reflects the following information:

in the header - information about the taxpayer-buyer (its full or abbreviated name in accordance with the constituent documents (or full name of the individual entrepreneur), INN and KPP), as well as information about the tax period (its start and end dates);

in the tabular part - information about the documents serving as the basis for deducting VAT and its amount.

According to Resolution No. 1137, the purchase book is filled out in the following order (clause 6 of the Rules for maintaining the purchase book):

Column 1 indicates the serial number of the record of information about the invoice (including adjustment);

Column 2 contains the code for the type of operation

Column 3 generally reflects the serial number and date of the seller’s invoice; if the deduction is confirmed by other documents, then their details are provided (for example, the number of the customs declaration for import, cash receipt when returning goods by an individual, if payment was in cash);

What data is entered into the purchase book when importing goods and what conditions for deducting VAT are necessary in this case, read in another article on the site.

in columns 4–6 - serial numbers and dates of corrected, corrective or amended adjustment invoices;

in column 7 - the number and date of the document confirming payment of tax

It is necessary to reflect the details of the payment document in column 7 of the purchase book only if VAT is deductible only after it has been paid:

- when importing goods into the Russian Federation (see letter of the Ministry of Finance of Russia dated November 26, 2014 No. 03-07-11/60221)

- return of the advance payment to the buyer in case of termination/change of the contract (letters of the Ministry of Finance of Russia dated March 24, 2015 No. 03-07-11/16044 and March 23, 2015 No. 03-07-11/15889))

- for travel and entertainment expenses, etc. (Letter of the Ministry of Finance of Russia dated March 23, 2015 N 03-07-11/15889).

- paid by tax agents specified in paragraphs 2, 3, 6 of Article 161 of the Tax Code of the Russian Federation;

- accepted for deduction by the buyer from the amount of the advance payment transferred (transferred) by him;

in column 8 - the date of registration of goods (performance of work, provision of services), property rights;

in columns 9 and 10 - the name and INN/KPP of the seller, respectively;

Columns 11 and 12 are filled in by the committing buyer (principal) - they indicate the name, tax identification number and checkpoint of the intermediary commission agent (agent) purchasing GWS on his own behalf (it is important to remember that columns 11 and 12 appeared in the purchase book from 01.10. 2014);

Column 13 of the purchase book is filled out if the company buys imported goods from a Russian supplier. The company transfers the declaration number from the counterparty's invoice.

in column 14 - the name and code of the currency (only in the case of purchasing goods and services, property rights for foreign currency). When purchasing goods for rubles from Russian suppliers, data on the currency in column 14 is not required.

in column 15 - the cost of goods and services, property rights or the amount of the advance payment including VAT; In column 15 of the purchase book, the cost of purchases including VAT must be reflected in the currency in which the company paid.

Column 15 indicates the cost of goods (work, services), property rights from column 9 in the “Total payable” line of the registered invoice, including VAT. In the case of an advance transfer, the transferred amount of the advance, including VAT (clause “t” of clause 6 of the Rules for maintaining a purchase book used in calculations of value added tax, approved by Decree of the Government of the Russian Federation of December 26, 2011 N 1137).

When purchasing from Russian suppliers, information is provided in rubles. But if a company imports goods, then it is necessary to fill out the customs value in foreign currency, increased by the amount of tax. The value of the goods in foreign currency can be taken from column 12 of the customs declaration.

in column 16 - the amount of VAT accepted for deduction.

The reflection of VAT in the purchase book depends on the transaction for which information is entered into this tax register.

If not the entire VAT amount is deductible

An interesting situation arises when not all VAT indicated in the invoice in column 9 is deducted. For example:

- when VAT is offset in parts;

- advance VAT from the seller in cases where only part of the previously received advance is offset against the shipment. Then the advance VAT attributable to this part is subject to deduction, but there is no right to the rest of the deduction yet - it will arise during the next shipment;

- input VAT on entertainment expenses (only VAT related to expenses that fall within the limit of 4% of labor costs is deducted).

In this case, in column 15 of the purchase book, record the entire cost , which is indicated in the invoice in column 9 on the line “Total payable”. And in column 16 only the amount of VAT that is accepted for deduction is indicated .

VAT codes in the purchase book

The list of codes for column 2 of the purchase book was approved by the Order of the Federal Tax Service dated March 14, 2016. No. ММВ-7-3/ [email protected] and applies from July 1, 2016.

If the invoice simultaneously reflects several transactions, then in column 2 several corresponding codes are indicated, separated by a semicolon (clause “d”, clause 6 of the Rules for maintaining a purchase book used in calculations of value added tax, approved by the Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137).

There are a lot of codes and it’s easy to get confused in them. What is the danger of an error in the form of an incorrectly specified code? There are no penalties for such an error. However, it may become a reason for requesting additional documents and explanations when checking the declaration by the tax office.

In essence, an incorrectly specified transaction type code is a technical error that does not affect the amount of tax payable and does not underestimate the tax base.

However, transaction codes from the purchase book are transferred to section 8 of the VAT return (line 010). And the indicators of this section (including some transaction codes) undergo a format and logical check and must comply with the control ratios established by the letter of the Federal Tax Service of Russia dated March 23, 2015 No. GD-4-3/4550, No. ED-4- 3/4550.

Therefore, an incorrect transaction code transferred from the purchase ledger to the declaration may result in the organization receiving a request for additional documents and explanations. If suddenly this happens to you, then when preparing explanations, take note of the letter of the Federal Tax Service dated 04/07/2015 No. ED-4-15/5752.

Formation of a purchase book in 1C: Accounting 8

For those who keep records in the 1C: Accounting program - see how the purchase book is formed in 1C: Accounting 8th ed. 3.0 in video format.

Reflection of VAT in the purchase book when purchasing goods and services

Most recently, the Federal Tax Service of the Russian Federation prepared a large information letter “Examples of reflecting invoice entries in the purchase book and sales book indicating transaction type codes.” This impressive document of more than 80 sheets contains a list and detailed description of transaction type codes used in VAT calculations and examples of filling out purchase and sales books for each code.

Amounts of VAT on purchased goods, works and services are reflected in the purchase book using code 01. In this case, the number and date of the invoice, the name and tax identification number of the seller, the date of registration of the goods and services, the cost of goods (work, services) according to the invoice with VAT, VAT amount.

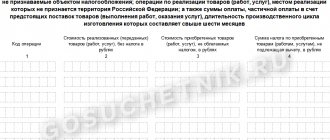

An example of filling out a purchase book for deducting VAT on the cost of purchased goods, works, and services is given below.

Advances issued in the purchase book

Now let's see how advances are reflected in the buyer's purchase book. Let's assume that you paid an advance to the supplier, and he sent you an invoice for it. And we decided to deduct this “advance” VAT.

Code 02 is set for this operation. The purchase book indicates: the number and date of the invoice, the name and TIN of the seller, the number and date of the document confirming payment of the tax, the cost of goods (work, services) according to the invoice with VAT, the amount of VAT.

For an example of how advances issued in the purchase book are recorded, see the figure below.

Advances from the buyer in the purchase book

Now let's see how advances received from the buyer are reflected in the purchase book, after the seller has shipped goods, performed work, and provided services. Code 22 is set for this operation. By the way, about how VAT is calculated on an advance received from a buyer, read this article.

When filling out an entry in the purchase book for an invoice with code 22, the following must be indicated: the number and date of the invoice, the name and INN/KPP of the seller (indicate your own details), the cost of goods according to the invoice with VAT, the amount of VAT.

How to reflect an advance payment after shipment in the purchase book is shown in the figure below.

Return from buyer in purchase book

Code 16 will be useful if you previously shipped goods to a buyer who is not a VAT payer or is exempt from payer duties; the buyer accepted them for registration and is now returning them.

How to register a return from the buyer in the purchase book in this case? Here, in the purchase book, you need to register your invoice (another document), which was drawn up during shipment and was registered in the sales book with code 01 or 26.

When recording an invoice entry with code 16 in the purchase book, the following must be indicated: the number and date of the invoice, the name and INN/KPP of the seller (indicate your own details), the date of acceptance of the returned goods for registration, the cost of goods according to the invoice with VAT, VAT amount.

Registration for separate VAT accounting

If an organization combines the general taxation system and UTII and maintains separate VAT accounting, then invoices for goods, works, and services intended for use in taxable and non-VAT-taxable transactions are registered in the purchase book only for the amount of VAT that is subject to deduction. We talked in more detail about separate accounting when combining OSNO and UTII in this article.

In this case, column 15 of the purchase book will indicate the full cost of goods (work, services) from column 9 of the presented invoice. And in column 16 you need to write down only the amount of VAT that the organization has the right to deduct in the current quarter (letter of the Ministry of Finance dated 03/02/2015 No. 03-07-09/10695)..

This is due to the fact that VAT is deductible only on those goods (works, services) that are used in activities subject to VAT (clause 4 of Article 170 of the Tax Code of the Russian Federation). To determine the amount that can be deducted, separate accounting is maintained.

If an organization has transferred an advance to the supplier for the upcoming supply of goods, works, services that will be used for taxable and non-taxable transactions, then the received “advance” invoice is recorded in the purchase book for the entire amount.

But if it is known in advance that the advance is transferred towards the supply of goods (work, services) for non-taxable transactions, then the received invoice does not need to be registered in the purchase book, because there will be no right to deduction for it.

Making a purchase book

The purchase book can be kept both in paper form and electronically. The electronic format of the purchase book was approved by order of the Federal Tax Service of Russia dated March 4, 2015 No. ММВ-7-6/93.

Currently, making entries directly into a pre-designed and stitched paper purchase book is an atavism, because The VAT declaration is submitted electronically, and one of the sections of the declaration is information from the purchase book.

If you initially register your purchase book electronically in the program, then for each quarter the book must be printed, numbered, laced and sealed with the signature of the manager (or an authorized person) and a seal. This must be done no later than the 20th day of the month following the expired quarter.

What problematic issues did you encounter when reflecting VAT in the purchase book? Ask them in the comments and together we will find the answer!

Reflection of VAT in the purchase book: rules and examples

How to submit a VAT return

The VAT return is submitted electronically; for this, the taxpayer must register in the system for providing tax and accounting information. After which the taxpayer will be provided with an electronic signature, with which he will be able to sign documents and send them to the tax office.

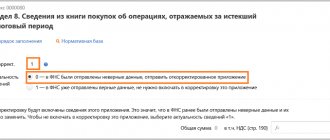

The date of reporting is considered to be the date of dispatch, where the taxpayer receives a response about the fact of its acceptance. After a desk audit, the taxpayer receives an acceptance response in the form of a receipt for acceptance of the reporting or a refusal to accept the reporting in the form of a notice of refusal. If there was a refusal, then it is necessary to adjust the previously sent declaration and send it to the tax office again.

Important!!! If, when sending reports, there are technical failures in the system or operator service, then there is no reason for the accountant to send reports untimely, but this will need to be proven.

Filing reports on paper is permitted only to tax agents who are not VAT payers or are exempt from paying it.

A few nuances that you should pay attention to when checking your declaration:

- During the tax period, were advances refunded to customers? Then you will see these amounts in line 120 of section 3 of the declaration. At the same time, during the reconciliation of the declaration and analysis of account 68.02, you will see discrepancies of the same amount in turnover with accounts 19 and 76.AB.

- If you plan to compare the total turnover on the debit-credit of account 68.02 with the total amounts of calculated VAT and VAT deductible on the declaration, then please note that in the account analysis in the “Debit” column additionally displayed the amounts of paid VAT that are not displayed in the declaration (turnover with a score of 51).

- The final balance in account 68.02 will fully agree with the amount of tax payable according to the declaration only when there is no debt or overpayment for previous tax periods.

Based on materials from “Accounting in 1C without worries”

Line 070 in the VAT return

The VAT return consists of 12 sections, and almost every section has line 070.

But in each section this line has its own specifics and is filled out according to the appropriate rules. When filling out a VAT return, it is not necessary to fill out all sections; there are sections that do not require completion. But section No. 3 is always filled out and under any circumstances.

Line 070 of Section 3 reflects the amount of VAT calculated on advances paid by customers. Then, at the time of sale of goods (works, services), the advance payment is offset and this VAT is claimed for deduction.

Before entering data on advance VAT in line 070, the buyer must:

| The seller must attribute the advance to future sales, subject to VAT at a rate of 10 or 18% | To do this, you need to do the following: Deduct VAT from the advance received on the day it is received; Determine the amount of VAT using the calculation method; Issue an invoice to the buyer within five days from the date of receipt; The advance payment and the corresponding tax amount are reflected in the sales book and in line 070 of section 3 of the VAT return |

| Sales of goods, works or services are taxed at a rate of 0% or are generally exempt from tax. | In this case, VAT is not charged on the advance payment, and no VAT invoice is issued. And the data on the advance received and VAT invoiced is not reflected in line 070. |

New reporting form

The VAT reporting form has changed, and for the 2nd quarter of 2021 it is necessary to report exclusively on the new form. Please note that the changes are associated with a rate increase.

So, lines 010 and 020 of section 3

declarations are now intended for transactions at rates of 20/120 and 20 percent.

However, while it is still possible to reflect the tax at a rate of 18 percent, lines 041 and 042 were retained in the section.

To exporters who have refused the zero rate, in section 3

Now it will be necessary to record the tax base

in a separate line 043.

And

in section 9

of the declaration, fill in new

lines 036 and 116

with the product type code.

The Federal Tax Service has updated the codes for non-taxable transactions ( section 7

). A code for the sale of scrap metal, waste paper and raw animal skins appeared - 1011715, and code 1010230 was excluded.

An example of filling out line 070 in the VAT return in section No. 3

Limited Liability Company "OknaPlast" is engaged in wholesale supplies of plastic windows according to customer orders. Contracts are concluded with the buyer only upon provision of an advance payment in the amount of 10% to 30% of the contractual delivery amount.

In the second quarter of 2021, OknaPlast LLC:

- We sold goods in the amount of 29,688,800 rubles. (including VAT = RUB 4,528,800);

- An advance payment was received in the amount of RUB 14,903,400. (VAT = 14,903,400 rubles × 18 / 118 = 2,273,400 rubles);

- Purchases from a supplier of plastic and other components in the amount of RUB 10,055,960, including VAT = RUB 1,533,960.

Therefore, in the second quarter:

- accrued VAT amounted to RUB 6,802,200. (RUB 4,528,800 + RUB 2,273,400);

- VAT deductible: RUB 1,533,960;

- VAT payable: RUB 6,802,200. – 1,533,960 rub. = 5,268,240 rub.

Invoices

The key to success when preparing VAT reporting is the correct preparation of invoices, both issued and received from suppliers, as well as their timely and correct reflection in the 1C system.

Let’s assume that in July of this year we purchased 500 pieces of Rainbow paint from Vodnik LLC at a price of 200 rubles. VAT on this transaction amounted to 20,000.0 rubles. The supplier issued the invoice on time.

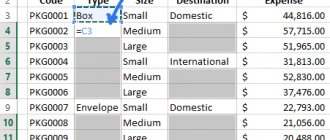

Fig.1 Receipt of goods

At the bottom of the document we reflect receipt of the invoice on the same date.

It is important (!) to remember that in order to submit VAT for reimbursement, it is necessary to fulfill the conditions established by Article 172 of the Tax Code of the Russian Federation (Part Two), which provides for the mandatory acceptance for accounting of purchased goods (works, services). Otherwise, the tax authorities have the right to refuse refund of “input” VAT.

Next, we register the sale of previously purchased paint by LLC “in the amount of 300 pieces at a price of 450 rubles, VAT on this transaction is equal to 20,500.22 rubles.

Fig. 2 VAT from the transaction

What are the penalties for submitting a VAT return on time?

If an enterprise or individual entrepreneur for some reason does not submit a VAT return on time, then he faces penalties, which amount to:

- 1000 rubles – if the tax has been paid or the amount according to the declaration is zero;

- If the tax has not been paid, then 5% of the amount indicated in the declaration for each month of delay, but not more than 30% and not less than 1000 rubles.

Important!!! An error in the VAT return format is not punishable by a fine. In the Resolution of the Arbitration Court of the North Caucasus District dated December 2, 2016 No. F08-9002/2016, the judges noted that clause 1 of Art. 119 of the Tax Code of the Russian Federation provides for a fine for failure to submit a declaration as such. Violation of the declaration format does not fall under this rule.

Express check

In addition, it is necessary to conduct an express check of accounting, which allows you to quickly track the presence of incorrect transactions in the system that prevent the correct completion of the VAT return.

This operation is available in the menu “Reports” – “Accounting Analysis” – “Express Check”.

Fig.6 Express check

Set the period and click “Run check”.

Fig.7 Perform check

Since the program did not detect any errors, we can safely proceed to generating a declaration.

Section 11

According to the Rules for filling out section 11 “Information from the logbook of received invoices in relation to operations carried out in the interests of another person on the basis of commission agreements, agency agreements or on the basis of transport expedition agreements reflected for the expired tax period” of the declaration, approved. Order No. 558, section 11 of the declaration is completed in the event of receipt of invoices when carrying out business activities in the interests of another person on the basis of commission agreements, agency agreements or on the basis of transport expedition agreements by the following persons:

- VAT taxpayers, including developers, as well as VAT taxpayers exempt from fulfilling taxpayer obligations related to the calculation and payment of tax;

- tax agents who are not VAT payers.

All information from part 2 of the log of received and issued invoices, approved, is transferred to section 11 of the declaration. in Appendix No. 3 to Resolution No. 1137, with the exception of the name of the seller (column and the name of the sub-commissioner (column 10).

in Appendix No. 3 to Resolution No. 1137, with the exception of the name of the seller (column and the name of the sub-commissioner (column 10).

The construction of section 11 of the declaration is similar to the construction of sections 8, 9 and 10. So, if in part 2 of the invoice journal all information about the received invoice is reflected in one line in the corresponding columns (columns 2 - 19), then in section 11 of the declaration they are indicated in the form of lines located one below the other (lines 010 – 200). As many registration entries as Part 2 of the invoice journal contains, so many repeating blocks of lines located on two sheets will be reflected in section 11 of the tax return. Therefore, if in part 2 of the invoice journal, for example, 10 invoices are registered, then the paper version of section 11 of the declaration will consist of 20 sheets. Let us remind you once again that in the presence of intermediary activities (in the broad sense of the word), the declaration is always submitted by all categories of declarants only in electronic form.

In addition, in section 11 of the declaration there is a traditional line 001, which is filled out only on the first page and which indicates the relevance of the information for the updated declaration.

Document clarification

In a situation where a declaration has already been created and submitted regarding a completed transaction, and later certain adjustments were made to the cost or quantity (volume) of goods (services), then creating an adjustment account in such a situation will be completely sufficient.

This applies to both the supplier and the buyer (when issuing and receiving this document, respectively). Moreover, an updated declaration is not issued not only in the case of a decrease in value , but also in a situation where it has increased, and therefore the amount of the tax itself has increased.

Therefore, in order to retain all rights to deductions and avoid fines from the inspectorate, it is enough to fill out the adjustment invoice on time (within 5 days from the date of change) and note it in the purchase/sales books (read more about the time frame for filling out the adjustment invoice account, read here). There is no need to create or submit any additional documents other than this.

Section 9

Section 9 “Information from the sales book on transactions reflected for the expired tax period” of the declaration, like the sales book itself, is filled out by taxpayers (tax agents) in all cases when the obligation to calculate VAT arises in accordance with the Tax Code of the Russian Federation.

As determined by Order No. 558, all information on each registered invoice reflected in the corresponding columns of the sales book, approved, is transferred to section 9 of the declaration. in Appendix No. 5 to Resolution No. 1137, with the exception of the name of the buyer (column 7) and the name of the intermediary (column 9).

If in the sales book all the information from the invoice is reflected in one line in the corresponding columns (columns 2 - 19), then in section 9 of the declaration they are indicated in the form of lines located one below the other (lines 010 - 220). Because of this, in the paper form of the declaration, three sheets are intended to reflect information for each registered invoice. The number of registration entries the sales book contains, the number of repeating blocks of lines located on three sheets will be reflected in section 9 of the tax return. So, for example, if 50 invoices are registered in the sales book, then the paper version of section 9 of the declaration will consist of 150 sheets.

In addition, if several buyers are indicated in one invoice in accordance with subparagraphs “i” - “l” of paragraph 1 of the Rules for filling out an invoice, approved. Resolution No. 1137 (for example, in a “consolidated” invoice reissued by the principal to the commission agent), then as many sheets are filled in as there are buyers indicated in the invoice. For example, if two buyers are indicated in the invoice in lines 6, 6a and 6b and in columns 7 and 8 of the sales book, then information about such a registered invoice in section 9 of the declaration will contain:

- 3 sheets reflecting a complete set of information on all lines, including information about the first buyer on line 100;

- one more sheet - to reflect in line 100 information about the second buyer with dashes on all other lines.

If payment for a registered invoice (indicator of column 11 of the sales book and, accordingly, indicators of lines 120 and 130 of section 9 of the declaration) was made with several payment documents, then you need to fill out as many sheets of the section as there were such payment documents. For example, if payment was made in three documents, then to reflect information on this invoice the following will be filled in:

- three sheets with a complete set of information on all lines and indicating in lines 120 and 130 the number and date of the first payment document;

- two more additional sheets with dashes placed on each sheet on all lines with the exception of the indicators on lines 120 and 130, which will indicate information about the second and third payment documents.

In addition to the repeating block of lines 005 - 220, intended to reflect registration information for each invoice, section 9 contains a number of general lines in which information is indicated only once:

- line 001 – filled in only on the first page. This line traditionally (as in all sections from 8 to 12) indicates the relevance of the information for the updated declaration.

- lines 230 – 280 are filled in only on the last page; on the remaining pages of the section, dashes are placed on these lines. These lines reflect the total amounts for the sales book, i.e. according to the “Total” line of the sales book.

Section 10

As explained in the Rules for filling out section 10 “Information from the journal of issued invoices in relation to operations carried out in the interests of another person on the basis of commission agreements, agency agreements or on the basis of transport expedition agreements reflected for the expired tax period” of the declaration, approved. Order No. 558, section 10 of the declaration is completed in the case of issuing invoices when carrying out business activities in the interests of another person on the basis of commission agreements, agency agreements or on the basis of transport expedition agreements by the following persons:

- VAT taxpayers, including developers, as well as VAT taxpayers exempt from fulfilling taxpayer obligations related to the calculation and payment of tax;

- tax agents who are not VAT payers.

All information from part 1 of the log of received and issued invoices, approved, is transferred to section 10 of the declaration. in Appendix No. 3 to Resolution No. 1137, with the exception of the name of the buyer (column and the name of the seller (column 10).

in Appendix No. 3 to Resolution No. 1137, with the exception of the name of the buyer (column and the name of the seller (column 10).

The construction of section 10 of the declaration is similar to the construction of sections 8 and 9. Thus, if in part 1 of the invoice journal all information about the issued invoice is reflected in one line in the corresponding columns (columns 2 - 19), then in section 10 of the declaration they are indicated in the form of lines located one below the other (lines 010 – 210). The number of registration entries contained in Part 1 of the invoice journal, the number of repeating blocks of lines located on two sheets will be reflected in section 10 of the tax return. Therefore, if in part 1 of the invoice journal, for example, 20 invoices are registered, then the paper version of section 10 of the declaration will consist of 40 sheets. However, it should be remembered that in the presence of intermediary activity (in the broad sense of the word), the declaration is always submitted by all categories of declarants only in electronic form.

When forming the section, you should pay attention to filling out lines 120 - 140, where information about intermediary activities is transferred, indicated by the commission agent (agent), forwarder, developer, and which is reflected in columns 10 - 12 of part 1 of the invoice log. If one invoice issued by an intermediary in accordance with subparagraphs “c” – “d” of paragraph 1 of the Rules for filling out an invoice reflects information about several sellers (for example, if the intermediary re-issued a “consolidated” invoice to the principal (principal), then as many sheets of the section are filled in as the number of sellers reflected in the reissued invoice and the number of incoming invoices reflected in column 4 of part 2 of the invoice journal that the intermediary received. For example, if in the “consolidated” invoice in lines 2, 2a and 2b and, accordingly, in columns 10, 11 and 12 of part 1 of the invoice journal, three sellers and details of three invoices received from sellers are indicated in three lines , then the reflection of information about such an invoice in section 10 of the declaration will contain:

- two sheets reflecting a complete set of information on all lines, including information about the first seller and invoice on lines 120 - 140;

- two more sheets - to reflect in lines 120 - 140 information about the second and third sellers and received invoices with dashes for all other lines.

In addition, in section 10 of the declaration there is line 001, which is filled out only on the first page. This line indicates the relevance of the information for the updated declaration.

Line by line completion of section 2

Let's look at each line that needs to be filled in:

- line 010 - checkpoint of the organization;

- 020 - full name;

- 030 - Taxpayer Identification Number;

- 040 - KBK;

- 050 - OKTMO;

- 060 - the amount of VAT calculated for payment to the budget;

- 070 - operation code.

In some cases (clauses 4-5 of Article 161 of the Tax Code of the Russian Federation), the amount of tax may depend on additional indicators:

- 080 - the amount of tax calculated upon shipment of goods;

- 090 - the amount of tax calculated from advances received on account of future shipments;

- 100 - the amount of tax calculated by the tax agent from advances upon shipment.

IMPORTANT! The final tax amount on line 060 is determined taking into account the data reflected in the mentioned lines: line 060 = line 080 + line 090 – line 100.