Composition of annual financial statements 2021

The annual financial statements of commercial companies must include:

- Balance sheet;

- Statement of changes in equity;

- Cash flow statement;

- explanatory notes to the balance sheet and reports;

- auditor's report - if the organization is subject to mandatory audit.

Statement of financial results (profit and loss statement);

The forms of the balance sheet and the above-mentioned reports were approved by Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n.

Attention! Insurance and credit organizations have their own reporting forms. For more information about them, see the relevant paragraphs of this reference material.

Deadlines for submitting annual reports

Article 23 of the Tax Code of the Russian Federation states that organizations are required to submit annual financial statements to the Federal Tax Service no later than March 31 of the year following the reporting year.

If March 31st falls on a Saturday or Sunday, then you can submit reports on the following Monday. In 2021, this day falls on a Friday, so there will be no postponement.

Since you can submit a report in different ways, the question arises of how exactly the date of submission of the report will be calculated:

- If the reporting is sent by mail in a valuable letter with a description of the attachment, this date is considered the day of its mailing. It is indicated on the postmark placed by the postal worker on the inventory of the attachment.

- If the reporting is submitted in person, this date is considered to be the date of its submission. The tax officer must indicate this date on a copy of the reporting or a copy thereof, which remains with the taxpayer. The date is put together with a signature from an employee of the Federal Tax Service, confirming that the tax authority has received a report from the organization.

- If the reporting is submitted electronically, the date of dispatch is considered to be the date indicated in the confirmation of dispatch, i.e. in an electronic document generated by a telecom operator or tax authority.

IMPORTANT! There is no need to submit interim accounting reports (for a quarter or a month) to the tax office.

PBU and IFRS

PBU and IFRS are accounting standards. What is the difference?

PBU is an abbreviation for “Accounting Regulations”. These are Russian accounting standards that regulate the accounting of assets, liabilities or events of economic activity. PBUs are internal documents of Russia, they are adopted by the Ministry of Finance of the Russian Federation and are valid for commercial non-banking organizations (for banks and credit organizations, the provisions adopted by the Central Bank of the Russian Federation are used).

Today there are 24 PBUs in force, all of them are mandatory for use when preparing financial statements and maintaining accounting registers.

IFRS is an abbreviation for International Financial Reporting Standards. These standards are adopted by the International Accounting Standards Board (IASB), located in the UK.

IFRS is mandatory for use in some European countries, as well as for almost all European companies whose securities are traded on the stock exchange.

In Russia there is a program for reforming accounting in accordance with IFRS. By Order of the Ministry of Finance of Russia dated November 25, 2011 No. 160n, 63 documents were put into effect in our country: the IFRS standards themselves and explanations to them.

What does publicity mean?

According to the Law “On Accounting” (clause 16), some enterprises are required to make information from their financial statements publicly available so that anyone can familiarize themselves with them.

Back to contents

Who is required to publish reports?

According to the law, individual enterprises whose activities are directly related to finance, investment, and the like are required to annually provide their accounting data for review to any interested party.

Such enterprises include:

- banks;

- credit organizations;

- exchanges;

- Insurance companies;

- open joint stock companies;

- investment funds;

- funds created from private, public and government funds;

- limited liability companies that have placed their bonds or other securities publicly.

Back to contents

When should reports be published?

Since the organization must initially prepare all the information, carefully double-check it, and also submit it to regulatory authorities - otherwise it will be forced to pay a large fine - publication of documents in the public domain is carried out only after all these operations have been completed. But it must be carried out no later than the first of July of the year following the reporting year. That is, information for 2021 must be published no later than July 1, 2021.

Each enterprise establishes the procedure for disclosing information independently. By law, two basic requirements must be met: accessibility to any interested party (in the case of, for example, an insurance company or a bank) and compliance with publication deadlines. The method of bringing data to the attention of users can be any:

- publication in certain printed publications - newspapers or magazines;

- placement on the official website of the enterprise;

- publishing special brochures or booklets and distributing them among users.

Back to contents

Forms of financial statements of commercial organizations

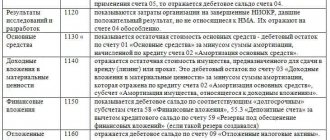

- Balance sheet (form 071001) - consists of 5 sections: Non-current assets, Current assets, Capital and reserves, Short-term and Long-term liabilities. The balance sheet form is filled out line by line, each line contains the indicators as of the reporting date of the reporting period, as of December 31 of the previous year and as of December 31 of the previous year.

- Statement of financial results (report and profit and loss) - form 0710002. It reflects information on the organization’s income and expenses, as well as its profits and losses for the reporting period and the same period of the previous year (this is established in PBU 4/99).

- Statement of changes in capital (form 0710003) - shows the movement of the organization’s capital for the reporting year and the two previous years.

- Cash flow statement (form 0710004) - shows the flow of cash and cash equivalents in the organization for the reporting year and the previous year.

- Explanatory note to the Balance Sheet and the Financial Results Report - these documents can be formatted either as a table or as text. In the case of a table, the organization itself determines the content of these explanations.

All these forms of financial statements, as well as the procedure for filling them out, were approved by Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n.

Small businesses also use the Balance Sheet and Financial Results Report forms approved by the same order of the Ministry of Finance.

Accounting report and accounting in a simplified manner

Law 402-FZ on accounting allows some organizations (including small businesses) to maintain accounting records and submit reports in a simplified manner. At the same time, these organizations have the right to prepare financial statements in accordance with the generally established procedure. The corresponding decision is made by organizations independently.

According to a simplified scheme, they can keep records:

- Participants of the Skolkovo project.

- Small businesses.

- Non-profit organizations.

The law specifically stipulates who does not have the right to conduct simplified accounting and submit simplified reporting. This:

- organizations whose financial statements are subject to mandatory audit;

- Housing complexes, housing cooperatives and microfinance organizations;

- credit consumer cooperatives;

- state organizations;

- political parties;

- bar associations, law offices, chambers and consultations;

- notary chambers;

- non-profit organizations performing the functions of a foreign agent.

Accounting and reporting of small businesses

The criteria for classifying companies as small enterprises are specified in Article 4 of Federal Law No. 209-FZ dated July 24, 2007. The main ones: number of employees - no more than 250 people, annual income - no more than 2,000,000,000 rubles, participation share of other legal entities in the authorized capital (there are several options).

Small businesses only submit a Balance Sheet and a Statement of Financial Results. They are also given the right to add financial indicators to the report only for groups of items without detail.

As for the simplified methods of accounting, they are all listed in Information of the Ministry of Finance of Russia No. PZ-3/2015. This:

- Keeping records without double entry.

- Abbreviated chart of accounts.

- Simplified system of accounting registers.

- Possibility not to apply some PBUs.

- Cash method of accounting for income and expenses.

- Valuation of financial investments at their original cost (that is, without subsequent revaluation).

- And some other details.

Accounting and reporting of Skolkovo participants

Accounting and reporting for this category of companies are subject to the same rules that apply to small businesses.

Accounting report of non-profit organizations

Simplified methods of accounting for non-profit organizations are listed in Information of the Ministry of Finance of Russia No. PZ-1/2015 (this letter applies only to non-profit organizations!). They generally repeat the same rules that are established by Information of the Ministry of Finance No. PZ-3/2015 for small enterprises (see above in the text), with some minor changes.

The annual accounting report of a non-profit organization consists of a balance sheet, a report on the intended use of funds and appendices thereto.

The Report on the targeted use of funds discloses information about the receipt of funds by the NPO intended to support its statutory activities, and about the targeted use of these funds in accordance with the approved budget or financial plan. The report also contains data on the balance of these funds at the beginning and end of the reporting period (year).

The form in which NPOs prepare this report can be of two types:

- generally established form 0710006

- simplified form 0710006.

The second, simplified, can be used by those non-profit organizations that keep records according to a simplified scheme (they have the right to do this according to Law 402-FZ).

The first, general one, is used by all others. Or, if desired, “simplified” people can also use it.

Both forms were approved by Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n.

Users of accounting documentation and reporting

From the title it may seem that the main users of the above documents are accountants, and that’s all. But this is not true at all. Since the main purpose of financial or accounting documentation is an accurate reflection of the state of the enterprise in measurable indicators and figures, virtually anyone can be a user of the reporting.

There are internal and external users.

Internal ones include:

- heads of enterprises, structural divisions, departments - those people who are on the staff of the enterprise and use documentation to analyze the current situation and make the necessary management decisions;

- chief accountants of the enterprise and financiers - again, people on staff who study and maintain these documents to perform their immediate job responsibilities;

- internal auditors are people on staff and appointed by management directly to conduct reporting audits.

External users include:

- auditors - representatives of third-party organizations who are not directly interested in the activities of the enterprise, but study the papers in order to give an accurate assessment of the activities;

- shareholders and investors who are persons interested in the activities of the enterprise, but do not directly participate in its work. Such people study the documentation in order to determine whether the investment is worthwhile;

- representatives of tax and other government services who study reporting in order to check the activities of the enterprise and maintain documentation for compliance with legal requirements;

- clients and potential clients who, based on documentation, draw conclusions about the profitability and stability of the enterprise and make decisions, for example, about the start of service.

Most external users gain access to an enterprise's financial statements due to their public nature.

Back to contents

Accounting statements of budgetary organizations

The reporting of budgetary, autonomous and government institutions is regulated by separate regulations. It differs from the reporting of commercial companies. Moreover, this reporting is also different for different types of budgetary institutions, although it has similar principles and features.

Budgetary and autonomous institutions draw up and submit financial statements in accordance with the Instructions on the procedure for compiling and submitting annual and quarterly financial statements of state (municipal) budgetary and autonomous institutions, approved by Order of the Ministry of Finance of Russia dated March 25, 2011 No. 33n.

government institutions are guided by another document - the Instruction on the procedure for compiling and submitting annual, quarterly and monthly reports on the execution of budgets of the budget system of the Russian Federation, approved by Order of the Ministry of Finance of Russia dated December 28, 2010 No. 191n.

General reporting requirements for budgetary, autonomous and government institutions are as follows:

- Reporting is prepared based on the results of the calendar year.

- The data reflected in the statements must be confirmed by the results of the inventory of assets and liabilities.

- The report must be signed by the manager and chief accountant and can be submitted both on paper and electronically.

Reporting must be submitted in the following forms:

- Institutional balance sheet (form 0503730 - for budgetary and autonomous, form 0503130 - for government institutions)

- Certificate on consolidated settlements (form 0503710 - for budgetary and autonomous, form 0503125 - for government institutions)

- Certificate for the conclusion of budget accounting accounts (form 0503725 - for budgetary and autonomous, forms 0503110 and 0503111 - for government institutions)

- Report on the execution of the plan/budget (form 0503737 - for budgetary and autonomous, forms 0503127, 0503317 and 0503117 - for government institutions)

- Report on the obligations assumed by the institution (form 0503738 - for budgetary and autonomous, form 0503128 - for government institutions)

- Report on financial results of activities (form 0503721 - for budgetary and autonomous, form 0503121 - for government institutions)

- Explanatory note (form 0503760 - for budgetary and autonomous, form 0503160 - for government institutions)

- Certificate of amounts of consolidated revenues to be credited to the budget account (form 0503184 - only for government institutions)

- Balance of budget execution (form 0503120 - only for government agencies)

- Cash flow statement (form 0503123 - only for government institutions)

- Report on cash receipts and outflows of funds (form 0503124 - only for government institutions)

- Separation balance sheet (form 0503230 - only for government institutions)

- Consolidated statement of financial results (form 0503321 - only for government institutions)

- Consolidated cash flow statement (form 0503323 - only for government institutions)

Accounting statements of banks and credit organizations

The accounting statements of banks and credit institutions are special. It is regulated by the regulatory documents of the Bank of Russia. The fundamental documents are the “Regulations on the rules of accounting in credit institutions located on the territory of the Russian Federation” (approved by the Bank of Russia on July 16, 2012 No. 385-P) and the Bank of Russia Directive dated September 4, 2013 No. 3054-U “On the procedure for drawing up credit organizations annual accounting (financial) statements.” Attention!

New reporting forms for banks were established by Bank of Russia Directive No. 4212-U dated November 24, 2016, which canceled the previously effective Bank of Russia Directive No. 2332-U dated November 12, 2009.

New reporting forms include:

- 0409120 “Data on the risk of information for calculating the amount of participation of foreign capital in the total authorized capital of credit institutions licensed to carry out banking operations”;

- 0409702 “Information on unexecuted transactions”, developed for the purpose of maintaining statistics and operational monitoring of systemic risks of the financial system associated with the non-execution of certain types of transactions in financial markets.

The requirements for the formation of indicators of reporting forms and the procedure for their submission to the Bank of Russia are also clarified.

Annual reporting of banks is compiled based on the results of the calendar year. It is subject to mandatory audit. The auditor's report is submitted along with the annual report to the Bank of Russia.

Audit and publicity

According to legal requirements, all enterprises whose financial statements are subject to publication in the public domain must undergo an annual audit.

Previously, the inspectors’ conclusions had to be submitted along with the company’s documents to the regulatory authorities; since 2013, this rule is no longer in effect, but for public reports all the previous requirements have been preserved.

The inspection must be carried out by third-party organizations with appropriate permission and trained specialists.

During the audit we study:

- content and composition of financial reporting forms;

- correspondence of various indicators from various documents to each other;

- interconnection of indicators;

- correctness of evaluation of reporting items;

- correct formation of consolidated reporting.

Without a signed audit report, the company's documents are considered invalid. The audit is carried out completely: for the entire enterprise as a whole, for the entire reporting period.

In addition to independent verification, some companies are also required to hold a shareholders meeting before publication, at which information is approved for release to the public.

Back to contents

Audit of financial statements

In a number of cases, the law establishes that an organization is required to conduct an audit of its financial statements. The list of cases when this is mandatory is established by Federal Law No. 307-FZ of December 30, 2008 “On Auditing Activities”. In particular, an audit is required:

- for all JSC (joint stock company);

- for companies whose securities are admitted to organized trading;

- for credit institutions, funds, securities market participants, insurance and clearing companies;

- for gambling organizers and lottery operators;

- for SROs (self-regulatory organizations);

- for state companies and corporations;

- for a number of specific companies (Rostec, Rosatom, Deposit Insurance Agency, Roscosmos, etc.);

- and also if the volume of revenue from the sale of products (goods, works, services) of the organization for the previous reporting year exceeds 400 million rubles or the amount of balance sheet assets as of the end of the previous reporting year exceeds 60 million rubles;

The auditor's report is not included in the annual financial statements, but is attached to it. The organization is obliged to submit the audit report to the state statistics body and publish it along with its annual reports.

Reflection of expenses for publishing reports in tax accounting

In accounting, the costs of publishing financial statements are classified as expenses for ordinary activities. The basis is paragraphs 5 and 7 of PBU 10/99. In tax accounting, the procedure for reflecting expenses associated with the publication of financial statements depends primarily on whether the organization is obliged to publish its financial statements.

If an organization is required to publish its reports

Taxpayers who are required by Russian legislation to publish their financial statements and disclose other information may take into account the costs of publishing financial statements and disclosing other information when calculating their income tax. This is indicated in subparagraph 20 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation.

In other words, if the organization belongs to any of the categories of legal entities listed in Article 16 of Law No. 129-FZ (that is, it is an open joint-stock company, a credit or insurance organization, an exchange or an investment or other fund created at the expense of private, public and government funds), it has the right to reduce taxable profit by the amount of expenses associated with the publication of financial statements. When calculating profit tax, these organizations include such expenses in other expenses associated with production or sales (subclause 20, clause 1, article 264 of the Tax Code of the Russian Federation).

Please note: in accordance with the provisions of Article 16 of Law No. 129-FZ, these categories of legal entities, with the exception of credit institutions, are required to publish only annual financial statements. This means that for tax purposes they can recognize expenses incurred by them in connection with the publication of annual reports only. the costs of publishing quarterly financial statements in the tax base for income tax on the basis of subparagraph 20 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation.

Since credit institutions are required to publish both annual and quarterly financial statements, when calculating income tax, they can take into account the costs of publishing both statements (paragraphs 1 and 2 of Article 16 of Law No. 129-FZ).

If an organization is not required to publish its reports

Organizations that publish their annual or quarterly financial statements on their own initiative do not have the right to recognize expenses for their publication on the basis of subparagraph 20 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation. But if the published information meets the advertising criteria, then the costs associated with its publication in the press can be taken into account for tax purposes as part of advertising expenses in accordance with subparagraph 28 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation.

Let us remember that advertising means information disseminated in any way, in any form and using any means, addressed to an indefinite number of people and aimed at attracting attention to the object of advertising, generating and maintaining interest in it and promoting it on the market. This definition is given in paragraph 1 of Article 3 of the Federal Law of March 13, 2006 No. 38-FZ “On Advertising”.

The Federal Antimonopoly Service, in a letter dated 04/05/2007 No. ATs/4624, explained that in this norm, an indefinite circle of persons are understood as those persons who cannot be determined in advance as the recipient of advertising information. Such a sign of advertising information as its intended for an indefinite number of people means that the advertisement does not contain any indication of a certain person or persons for whom the advertisement is created and to whose perception it is directed. Published financial statements, as a rule, do not contain indications of these persons. Moreover, the financial statements published in periodicals can be viewed not only by interested users (for example, creditors, shareholders, counterparties, investors of the company), but also by other persons, that is, they are intended for general information. In other words, the organization’s reporting published in newspapers or magazines is addressed to an indefinite number of people, and since it contains information about the financial position of the company, the publication of the reports is aimed at attracting attention to the organization’s activities. Consequently, the publication of financial statements in periodicals can be recognized as advertising for tax purposes, and therefore expenses associated with publication are taken into account when calculating income tax as part of advertising expenses (subclause 28, paragraph 1, article 264 of the Tax Code of the Russian Federation).

Expert opinion

A.A. Matitashvili, head of consulting department:

“Some organizations and institutions are required to publish their quarterly financial statements. Thus, according to Article 16 of Law No. 129-FZ, extra-budgetary funds (PFR, FFOMS, FSS of Russia) and their representative offices and branches in the territories of the constituent entities of the Russian Federation are required to do this. In addition, by virtue of Article 8 of Federal Law No. 395-1 dated December 2, 1990, credit institutions must publish quarterly a balance sheet, profit and loss statement and other essential information.

Expenses for the publication of financial statements and disclosure of other information are taken into account for profit tax purposes as part of other expenses associated with production and sales, if the legislation of the Russian Federation imposes an obligation on the taxpayer to publish or otherwise disclose them. This norm is enshrined in subparagraph 20 of paragraph 1 of Article 264 of the Tax Code.

Thus, a taxpayer who is not obliged, according to the legislation of the Russian Federation, to publish its quarterly financial statements, cannot recognize the costs of its publication, referring to subparagraph 20 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation. However, he still has the right to take into account these expenses if he can prove that these expenses meet the criteria established in paragraph 1 of Article 252 of the Tax Code of the Russian Federation, that is, they are economically justified, documented and incurred to carry out activities aimed at generating income.”

In tax accounting, expenses for advertising events through telecommunication networks and the media (including advertisements in the press) are not subject to rationing and are included in expenses that reduce taxable profit in the amount in which they were actually incurred (clause 4 of Article 264 Tax Code of the Russian Federation).

Expert opinion

A.A. Matitashvili, head of consulting department:

“I believe that based on the definition of advertising given in paragraph 1 of Article 3 of Federal Law No. 38-FZ of March 13, 2006, the annual financial statements of an organization published in accordance with Article 16 of Law No. 129-FZ cannot be considered advertising. Consequently, the costs of publishing financial statements should not be reflected in tax accounting as part of advertising expenses. After all, such a publication usually does not contain information about goods (work, services) sold (performed, provided) by the organization, the procedure for their sale, discounts provided and other information aimed at attracting attention to the object of advertising, creating or maintaining interest in it and its promotion on the market. In other words, a publication containing exclusively financial statements does not meet the criteria of advertising and therefore the costs for it cannot be considered advertising.

Arbitration courts apply a similar approach. When considering cases concerning, however, the calculation of advertising tax, the courts usually indicated that the publication of annual financial statements in the open press does not relate to the advertising activities of the taxpayer (resolution of the Federal Antimonopoly Service of the Volga District dated September 23, 2003 in case No. A55-19279/02-5 ).

At the same time, if the published material, in addition to the financial statements themselves, also contains information about the taxpayer, designed to create or maintain interest in him, his goods (works, services), then this publication can be recognized as advertising (resolution of the Federal Antimonopoly Service of the North-Western District dated May 20, 2004 in case No. A56-22319/02). This means that the costs of this publication can be taken into account for tax purposes as part of advertising expenses on the basis of subparagraph 28 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation. This option for recognizing the costs of publishing statements will be useful for those organizations that, by virtue of current legislation, are not required to publish their financial statements, but do so on their own initiative.”

Article 16 of Federal Law No. 38-FZ of March 13, 2006 states that the placement of advertising text in periodicals that do not specialize in advertising messages and materials must be accompanied by the mark “Advertising” or “Advertising.” This means that if the financial statements of an organization that is not obliged to publish its statements published in a newspaper or magazine contain one of the above notes, it will be easier for the organization to prove the advertising nature of the publication and justify the expenses incurred.

Let's say an organization (for example, an insurance company) is obliged, in accordance with the provisions of Article 16 of Law No. 129-FZ, to publish its annual financial statements. It takes into account the costs associated with such publication when calculating income tax (subclause 20, clause 1, article 264 of the Tax Code of the Russian Federation). However, by decision of the general meeting of shareholders (participants), the company also publishes its quarterly financial statements. Since the current legislation of the Russian Federation does not provide for the obligation of insurance companies to publish quarterly financial statements, the costs of publishing quarterly financial statements cannot be taken into account on the basis of subparagraph 20 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation. At the same time, these expenses can be recognized for tax purposes as part of advertising expenses, provided that the information posted meets the advertising criteria (subclause 28, paragraph 1, article 264 of the Tax Code of the Russian Federation).

If the reports are published in the form of brochures or booklets

Often, instead of publication in newspapers or magazines or in addition to such publication, organizations draw up their financial statements in the form of separate brochures, booklets, prospectuses, etc. As a rule, statements published in this way are sent directly to shareholders, participants, creditors, partners of the organization and others interested users or distributed among an unlimited number of people through investments in periodicals (mainly magazines).

The costs of preparing, publishing and distributing special brochures and booklets containing financial statements, which an organization is obliged to publish in accordance with the legislation of the Russian Federation, it has the right to take into account when calculating income tax (subclause 20, clause 1, article 264 of the Tax Code of the Russian Federation). In this case, the method of distribution (distribution) of these publications does not matter. Even if a company's annual accounts are subject to mandatory publication, the cost of producing and distributing brochures containing its quarterly accounts should not be included as a tax-deductible expense. Such expenses can be taken into account when calculating income tax as part of advertising expenses if brochures with quarterly financial statements are distributed to an indefinite number of people. The basis is subparagraph 28 of paragraph 1 and paragraph 4 of Article 264 of the Tax Code of the Russian Federation. Moreover, the costs of producing advertising brochures and catalogs containing information about the organization itself are not standardized in tax accounting and are recognized in the amount actually incurred (clause 4 of Article 264 of the Tax Code of the Russian Federation).

Expert opinion

A.A. Matitashvili, head of consulting department:

“In my opinion, organizations that, according to the legislation of the Russian Federation, are not required to publish their annual (quarterly) financial statements, but still publish them in printed publications, have the right to take into account the costs associated with such publication when calculating income tax. To do this, they must comply with the conditions provided for in paragraph 1 of Article 252 of the Tax Code of the Russian Federation for recognizing expenses in tax accounting. That is, the organization should confirm that the costs of publishing reports are justified (economically justified), necessary to carry out activities aimed at generating income, and there are properly executed supporting documents for them.

What norm of the Tax Code of the Russian Federation can one refer to in this case? Since the list of expenses accepted to reduce taxable profit is open, the most appropriate would be subparagraph 49 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation (other expenses associated with production or sales).

At the same time, tax authorities, as a rule, believe that expenses for carrying out activities that are not obligatory for the taxpayer cannot be considered justified and cannot be taken into account when calculating income tax. This means that if an organization that is not obliged by Russian law to publish annual financial statements recognizes the costs of such publication in tax accounting, then it will most likely have to defend its interests in court. I believe that the organization’s chances of winning this dispute in court are quite high. After all, the publication of an organization’s annual reports is directly related to its current activities, and the goal of any company is to generate income. Thus, even if there is no direct connection between the publication of financial statements and the receipt of income in a particular tax period, the costs of publishing financial statements can be considered aimed at generating profits in the future. Arbitration courts confirm that, within the meaning of Article 252 of the Tax Code of the Russian Federation, the economic justification of expenses incurred is determined not by the actual receipt of income in a specific tax (reporting) period, but by the focus of such expenses on generating income, that is, their conditionality by the economic activity of the taxpayer (resolutions of the Federal Antimonopoly Service of the West Siberian District dated August 18, 2008 No. F04-4832/2008(9466-A03-42) and FAS of the East Siberian District dated October 28, 2008 No. A19‑13680/07-24-F02-5268/08)"

Inventory

Before preparing annual financial statements, the organization is required to conduct an inventory. This obligation applies to all companies, regardless of their tax regime or legal form. The purpose of inventory is to ensure the reliability of accounting data and financial statements. To do this, during the inventory, the presence, condition and assessment of the organization's assets and liabilities are checked and documented.

This inventory is planned. To carry it out, the manager must approve the inventory regulations. The timing of such an inventory is from January 1 to December 31 of the reporting year.

An annual inventory is carried out on all assets and liabilities of the company, the verification is complete.

There are other reasons for conducting an inventory, unscheduled. They are established by the Regulations on accounting and financial reporting, Federal Law 402-FZ and PBU 4/99). This:

- change of financially responsible persons;

- identification of facts of theft, abuse or damage to property;

- natural disasters, fire or other emergencies;

- liquidation or reorganization of an organization.

Inventory procedure

- Step 1. Creation of an inventory commission

- Step 2. Receiving the latest incoming and outgoing documents

- Step 3. Receiving a receipt from the financially responsible person

- Step 4. Preparation of inventory records (acts)

- Step 5. Verification and documentary evidence of the presence, condition and valuation of assets and liabilities

- Step 6. Summarizing the results identified by the inventory

- Step 7. Approval of inventory results

- Step 8. Reflection of inventory results in accounting

You can read more about these stages in the “Practical guide to annual financial statements 2016” of the Consultant Plus system.

Mandatory Public Reporting Requirements

The documents that the organization will provide to interested users must comply with all the requirements imposed on them by law.

Back to contents

General requirements

The main documentation requirements are:

- completeness – all data must be reflected in full;

- timeliness - every fact, every operation should be reflected as immediately as possible, as soon as it was completed;

- prudence - it is unacceptable to create hidden reserves, record premature income, and so on;

- consistency - analytical accounting data must be identical to the accounting data for turnover and balances on the last day of each reporting period;

- priority of content over form - economic activity should be taken into account according to its economic content, not its legal content;

- rationality - documentation must be maintained on production volumes and conditions of economic activity of the enterprise;

- reliability - documents should reflect the true state of affairs at the enterprise as fully as possible;

- neutrality - only facts should be reflected, without propaganda information, advertising or the like;

- integrity - data should be reflected as much as possible, taking into account the activities of all branches, if any;

- sequence - information must be submitted in chronological order;

- materiality - reporting should contain only those information that are important for a correct assessment of the enterprise;

- Comparability – all data provided must be comparable with the same data for other periods.

In addition, reporting must be prepared in Russian and indicators must be entered in national currency, even if some transactions were carried out in foreign currency.

Back to contents

Content requirements

Since the publicity of financial statements means that anyone can read them at any time, some measures have been taken to protect enterprises and facilitate the preparation of documents: it is allowed to publish abbreviated forms of reports containing only the totals for the necessary sections.

For example, you may not include intermediate results; It is permitted not to include in documents information that constitutes a commercial or other secret of the enterprise.

Reports that are posted publicly must contain:

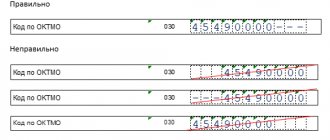

- full name of the organization and its legal form;

- reporting date and reporting period;

- clear indication of the currency and format of the presented numerical indicators;

- last name, first name, patronymic and full position of the persons who signed the reports;

- date of approval of documents at the general meeting;

- the address where you can review the report data and receive a copy of the documents;

- information about the branch of the State Statistics Committee to which the enterprise submitted its annual financial statements.

In addition, it is necessary to annually comply with the once accepted publication form and provide data for the previous period along with new data.

Back to contents

We prepare an annual report with Consultant Plus

The developers of the legal reference system Consultant Plus traditionally publish an annual analytical material, “A Practical Guide to Annual Accounting Reports.” This material usually includes very detailed explanations about the formation of an accounting report for the year, with examples, comments, samples of filling out document forms, etc.

The unique tool contained in this material, the “Interconnection of indicators” section, will help you once again check your finished report for the correctness of the details.

Read more about the Practical Guide to the Annual Report from Consultant Plus.

Legislation on accounting documentation

More recently, until January 2013, issues of maintaining financial documents affected only some entrepreneurs. Only organizations that were on the general taxation system were required to keep books. Those on the simplified system may not have documented their activities as thoroughly.

Since January 2013, the requirements of Order No. 402 of the Ministry of Finance of December 6, 2011 came into force, according to which all enterprises are required not only to maintain accounting documentation, but also to annually report on it to regulatory authorities.

True, with the tightening of measures, there was also a relaxation: entrepreneurs were relieved of the need to submit interim reports. Now only a very small number of organizations, whose activities are regulated by special federal laws, submit reports not only once a year, but also once every three, six and nine months.

On the one hand, this made life easier not only for entrepreneurs, but also for tax officials. On the other hand, the burden on the tax office at the beginning of the reporting period increases enormously.

However, it is worth noting that the Russian accounting system is systematically moving towards international standards and a more simplified scheme, therefore, at the moment, far from the latest innovations and changes have been introduced. The process of searching for optimal forms of documents and their execution will continue and we should expect other innovations in the new year.

Back to contents