Law No. 54-FZ, regulating the use of cash registers, has undergone changes and its updated version was released on July 3

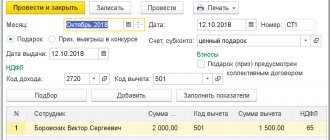

Gifts to employees are part of the corporate culture and an element of employee motivation. New Year holidays, February 23,

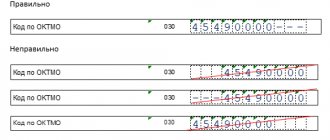

The Federal Tax Service has published new tax return forms for personal income tax

Until July 1, 2021, we received an exemption from the obligation to switch to new cash registers

Previous forms of tax return and tax calculation for advance payment of property tax

From the beginning of 2021, statistical authorities will oblige the small business sector to report using updated forms

In 2021, accountants are offered at least three ways to submit reports to

Accountants submit a new report to the Federal Tax Service. Photo klerk.ru The introduction of numerous restrictions, a decline in labor activity,

The cancellation of insurance premiums for the 2nd quarter of 2021 means a reduction in the amount of insurance premiums,

Controllers reason as follows. Accountable amounts for which the employee did not report are his