In business activities, the purpose of which is to make a profit, it is necessary to keep records. The income that is taken into account is

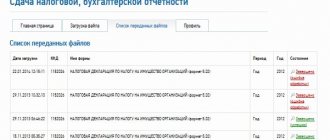

Organizations and individual entrepreneurs may not go to the post office and government agencies, but send reports

When counting property during an inspection, an inventory list of inventory items is filled out. Sample - below

Taxes and contributions Marina Dmitrieva Leading expert - professional accountant Current as of March 7

Personal income tax (NDFL) has its roots in the history of ancient Rus'. Only then

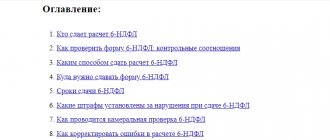

Business lawyer > Accounting > Accounting and reporting > Zero 6-NDFL: sample filling

Kontur.Accounting is a web service for small businesses! Quick establishment of primary accounts, automatic calculation of taxes, sending reports

Difficulties often arise with deductions upon dismissal. Here is just one example: an employee was accrued

The need to make payments under a writ of execution gives rise to disputes and misunderstandings between the debtor and employees

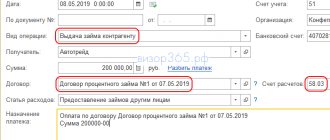

The concepts of “credit” and “loan” Accounting for credits and borrowings in accounting is regulated by PBU 15/2008.