Accounting account 60 “Settlements with suppliers and contractors” is intended to generate data on payments made

G.N. Khimich, expert of the Russian Tax Courier magazine Russian Tax Courier magazine The publication was prepared with

Today, rent is one of the most profitable areas of business. Huge staff of qualified

What has changed The mandatory storage periods for personnel documents in an organization in 2021 are regulated by clause.

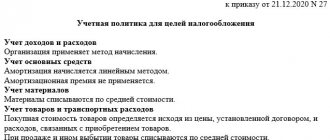

Tax accounting policy is a document that approves the set selected by the organization

Property deduction in 2021 can be applied for when purchasing real estate acquired before 2021,

A tax audit is a form of tax control over compliance with laws on taxes and fees

On the territory of the Russian Federation, all kinds of accessible economic activities, which are freely and legally entitled

Any enterprise is profitable only if its activities make a profit. Profit accounting is one of the

Results More and more organizations are involved in research and development to achieve