The need to make payments under a writ of execution gives rise to disputes and misunderstandings between the debtor and accounting employees who are required to make deductions from wages. The former believe that the amount is large, the latter strive to fulfill the requirements of the law, exceeding the amount of payments established by the regulations. At the legislative level, the order of execution of writs of execution is regulated and cannot be interpreted arbitrarily. We must follow the letter of the law and there will be no disputes.

What is the order of payment in a payment order for writs of execution?

The fact is that it is impossible to receive any government service without first confirming that the fee has already been paid to the budget on an initiative basis. Also see “Payment order for payment of state duty to the arbitration court: sample”. Dividends If we are talking about the distribution of profits between business owners, then for dividends the order of payment in the payment order is set to the latest - the fifth. From the state's point of view, they do not have priority over any other payments. Also see “Dividend Payment Period”. What to do if the priority is indicated incorrectly If there are enough amounts in the client’s current account to make all declared and necessary payments, then the priority indicated in the order does not play a fundamental role. All payment orders will be executed by the bank in the order they are received.

Order of payment in a payment order: what to put in field 21 in 2021

Sequence of payment - definition Sequence of payment is the sequence established in the Civil Code of the Russian Federation for the bank to write off funds from customer accounts based on received orders (settlement documents), the payment period for which has already arrived or is due on the day they are received by the bank. The payment queue does not depend on the types of orders received by the bank (payment orders, payment requests, collection orders, ...) to the client’s account, but depends on the availability of funds in this account and their sufficiency to pay for all received settlement (payment) documents. Where and with what symbols is the order of payment indicated? The order of payment is indicated in all types of customer orders.

Insurance premiums

Since 2021, responsibility for insurance premiums has been assigned to the tax authorities. Previously, it was carried by foundations. But the changes in question did not change the queuing code. If a scheduled payment is made, code 5 is indicated. If the payment is made on the basis of a collection request, a fine is imposed, code 3 is indicated. If the contribution for the company is made by a third party, code 5 is indicated.

Penalties and fines

Payments upon account blocking

The account may be blocked by decision of the tax office. In this case, almost all calculations are suspended. However, some payments will continue. In particular, these are the following payments:

- Taxes paid on the basis of a collection order.

- Current payments of taxes, penalties.

Tax payment code is 3. Even when the account is blocked, requirements with codes 1-3 are fulfilled.

The account has run out of money

An organization can send orders to the bank for an amount that exceeds the amount in the account. It works like this: a banking institution receives an order from a company and then checks the amount of money in the account. Is it enough to carry out the assignment? If the money runs out, these are the possible ways the situation could develop:

- Orders with order 5 are immediately rejected (cancelled).

- Orders with a different order are placed in the queue.

Payments are executed as money arrives in the account. It must be borne in mind that the organization can at any time withdraw a payment in the queue.

Payment sequence: sequence of debiting funds from a bank account

In fact, this is one of the ways to protect family values. Mandatory payments of the 1st, 2nd, 4th and partially 3rd priority can be made by the bank without the client’s consent, since the basis for the transfer of money is an executive document. Therefore, in the generated payment order, the organization can only indicate the 3rd or 5th priority. The general principle of the queue is this: all payments that belong to one queue are executed in the calendar order of their receipt by the bank. How to correctly enter As for taxes, the order of payment in the 2018 payment order for their transfer in the corresponding line of the payment is “5” when there is a voluntary payment without any receipts from the Federal Tax Service. In turn, payment of taxes based on the requirements of the inspection must be carried out by the bank in third place.

The bank does not accept a payment with incorrectly filled in details - should I correct it or not?

According to the regulation of the Bank of Russia dated June 19, 2012 No. 383-P, an incorrectly completed “Payment order” detail is not grounds for refusing to transfer money. According to the Ministry of Finance of Russia (letter dated October 4, 2017 No. 05-07-06/64623), an accountant’s error in the order of payment cannot be grounds for bankers to return a payment.

Therefore, formally, the bank must accept such payments. But there is a practice when banks ask you to redo documents and fill out the specified details correctly. Whether to correct the documents or not is up to you. But you need to take into account that it is not difficult to redo the payment, but disputes with the bank can take time and delay payments.

For information on where to know that your tax payments have reached the intended recipient, read the article “Make sure your payments have reached their intended destination .

Alimony order of payment

The company's accounting department monitors the sending of a payment order for each reporting period on this issue to the banking institution, where clear deadlines for the deduction of funds are indicated. The banking institution makes money transfers based on the established priority. The order of payment is a point of decisive importance in conditions of limited financial resources of a legal entity.

There may be situations when a company has the ability to make only part of the mandatory payments: wages, transfer of fees and taxes, transactions to the Pension Fund, etc. Regulation of this issue is regulated by Article 855 of the Civil Code of Russia, which establishes the rules for priority payments for alimony, as well as for compensation for all kinds of damage.

The order of payment in the payment order

Fine The exact order of the fine in the payment order depends not on its type (tax/administrative, etc.), but on the order in which it is entered into the budget. If a person pays it of his own free will and the controllers have not received a corresponding order or receipt, then this will be the 5th stage. In the opposite situation - 4th line. State duty As for the state duty, the order of payment in the payment order is almost always “5”.

Collections from wages are made from an officially employed debtor in the amount that was specified in the alimony agreement or appointed by the judicial authority. The company's accounting department carries out the appropriate calculations and draws up a special payment order for the purpose of transferring funds to the alimony collector. The bank observes the order of payment and its timely transfer.

Payment order is a document that has been subject to changes regarding the order of payments. Alimony (according to the law) is a priority deduction. When filling out this document, the accountant puts the number 1 in column number 21, which confirms the priority of this payment.

If the debtor has obligations under several writs of execution, then the debt is repaid in accordance with the scheme described above.

Review results

Based on the results of consideration of the application, the judicial authority issues a decision by which:

- satisfies the petition - the debtor managed to obtain an installment plan for the specified period;

- refuses to satisfy the requirements due to insufficient justification. In such circumstances, enforcement measures will be applied to the borrower.

If the issue is resolved positively, the debtor’s main task is to regularly make payments according to the established installment schedule. Then neither the creditor nor the executors have the right to demand that the borrower repay the debt ahead of schedule or in amounts other than those determined by the court.

What is the order of payment in a payment order for writs of execution?

In payment documents, the order of payment (in field 21) is always indicated, although from all of the above we can conclude that the calendar order of payments is applied in the following cases:

- when there are enough funds in the account for all payments;

- within each (one) priority of payment when there are insufficient funds;

- when making all payments of the fifth priority.

So, from December 14, 2013, the number of payment queues decreased from 6 to 5 in accordance with the amendments introduced by Federal Law of December 2, 2013 N 345-FZ “On Amendments to Article 855 of Part Two of the Civil Code of the Russian Federation.”

That is, when taxes or contributions are forced to be paid. Then repay the amount of debt with a payment slip, in which in field 21 indicate the number 3. If you have identified the arrears yourself and have not yet received any demand for repayment, indicate the value “5” in the payment slips.

In other words, if there are not enough funds in the account, the demands of the Federal Tax Service for repayment of arrears (payment of fines, penalties) will be a priority. And then there will be requests from the payer company itself to transfer current obligatory amounts or repay its own debt. For personal income tax paid by a company (individual entrepreneur) in the status of a tax agent, no special procedure is provided. There will be a queue of 5 if the “income” is transferred voluntarily, albeit late. Queue 3 – in the case when payment is already a requirement of the auditors. As a general rule, code 3 is used for the current salary.

- various rewards to authors engaged in intellectual activity.

- Third priority – payments made on the basis of relevant documents and related to:

- payments for wages to persons who carry out activities under a contract (employment agreement),

- instructions from tax authorities (budget collections, payment of taxes, etc.);

- writing off or transferring debts incurred for fees, taxes, insurance premiums, etc.

- In fourth place are payments under enforcement documents related to the satisfaction of various monetary requirements.

- The fifth stage includes transfers for all kinds of payment documents in accordance with the established calendar priority.

Procedures for withholding alimony payments in 2017-2018.

Compulsory enforcement authorities

In accordance with Article 5 of Federal Law No. 229-FZ “On Enforcement Proceedings”, the main body carrying out collections is the bailiff service. There are regional branches in each subject, and local branches in municipalities and even individual districts.

Collections are made at the place of residence of the debtor; accordingly, the document will be transferred to the appropriate department. This is done so that the specialist can quickly and effectively carry out the actions provided for by law aimed at executing a decision or other act.

The writ of execution can also be sent to the debtor’s place of work (Article 9 No. 229-FZ) or to another organization that pays periodic payments to the person. In this case, the accounting department of this organization must independently perform all the necessary actions to deduct funds according to the details provided by the claimant.

What is the order of payments?

At the legislative level in Art. 855 of the Civil Code of the Russian Federation, the priority (including the sequence of tax payments) in 2021 is defined as the procedure for writing off funds from the account. If there is a sufficient amount of money, the requirements are satisfied according to the rules for the calendar receipt of documents for transfer. If there are not enough funds in the account, and the number of transactions is significant, payments are carried out in a strictly defined order.

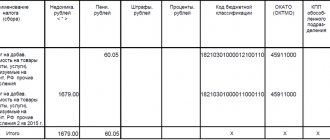

To indicate the priority in the payment order, field “21” is reserved. According to the Civil Code of the Russian Federation, there are 5 types of priority. This means that when filling out, the accountant will indicate a digital code - from “1” to “5”. For example, using code “3” the employer transfers wages to staff; and with code “5” – taxes to the budget. More detailed queue types are presented in the table below:

Digital queue designation

What payments are included?

Denotes payments under enforcement documents - primarily for alimony and compensation amounts to compensate for harm caused to the health or life of a citizen

Valid for payments under executive documents for the issuance of severance pay, salaries for dismissed employees, as well as for the transfer of amounts of royalties within the framework of intellectual activity

Indicates the issuance of wages to personnel employed under employment contracts, the transfer by collection of taxes and insurance contributions to the budget and extra-budgetary funds of the Russian Federation

Valid for other types of payments under writs of execution

The most common type of queue. Applicable when transferring various fees, taxes, arrears, penalties, penalties and other types of payments

Debt repayment procedure

The main method of repaying debt will look like this:

- the collector receives a writ of execution, which indicates the existence of a debt of a certain person in his favor;

- territoriality is determined, since collection is carried out at the location of the debtor. If the sheet is sent to the wrong department, the bailiff service will redirect it to the correct one;

- the bailiff initiates proceedings. After the end of the period for voluntary compliance, all necessary measures begin to be taken;

- a search is made for the debtor's accounts, income and property. First of all, collections are made from deposits and other funds, then other sources are used. If necessary, real estate and movable property are seized and subsequently sold.

Other actions may also be performed as part of enforcement proceedings. For example, if the debtor has no other property, then the bailiff (or creditor) has the right to request an allocation from the property jointly acquired with the spouse. Another option is to allocate a share from the LLC. But all these are extreme measures that are used in exceptional situations.

If the sheet is submitted at the place of work, the procedure is slightly different:

- the writ of execution and the application are submitted at the place of work or other income generation;

- The accounting department begins collection and transfers funds according to the details.

If the employer refuses to execute the document, you can file a complaint against him or go to court, however, most often it is enough to just describe his obligation in a statement with references to legal acts.

What to indicate in the “Payment order” field – taxes in 2018

When preparing a payment slip for paying taxes, what priority number do you need to indicate? Should I enter “3” or “5”? The answer depends on who initiates the payment of the amount. If the payment is collected on the basis of a collection document, at the request of the control authority (IFTS, Social Insurance Fund, Pension Fund), correctly indicate “3”. If the company pays the tax independently in the current regime, “5” is entered.

The requirement is valid for any type of tax payments - from profit, VAT, personal income tax, insurance premiums, etc. A similar procedure should be followed when paying sanctions or penalties. If the company pays off debts voluntarily, the queue number “5” is entered in field “21”.

Features of using codes 3 and 5

If all payments are made by the company within the specified time frame, code 5 is written on the payment slip. It is relevant for taxes of any type: simplified tax system, income tax, property tax.

Code 3 becomes relevant when there is a demand for debt payment. For example, this could be a collection order in which there is a sequence.

IMPORTANT! If the debt was identified by the organization itself, the number 5 is indicated on the payment slip.

Sequence under different circumstances

In some circumstances, the accountant may have difficulty indicating the priority code. Let's consider typical situations.

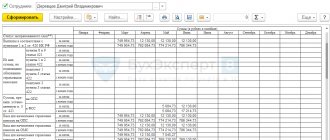

The order of payment of wages in 2021

When an employer issues wages to staff, non-cash payment methods are often used. The priority of wage payments for 2021 is set at number “3”. And when paying income tax on earnings to the budget, the accountant must enter “5”.

Article 855 of the Civil Code of the Russian Federation provides for priority “2”. This queue number is entered in cases where the employer has delays in payments to staff. If in the future such an obligation is extinguished on the basis of a writ of execution, the priority “2” is indicated in field “21”. When making payments to individuals operating under GPC agreements, “5” is entered.

Note! For alimony, the order of payment in 2021 is approved as number “1”.

conclusions

The order of payments executed by payment orders to the bank for debiting or transferring funds is of great importance.

This is especially true for those situations where there is clearly not enough available money in the client account to repay all generated payments at once.

In this case, you have to follow the priorities regulated by the current legislation. The required order is entered in field 21 of the payment order.

The article describes typical situations. To solve your problem , write to our consultant or call for free:

+7 (499) 938-43-28 - Moscow - CALL

+7 - St. Petersburg - CALL

+7 — Other regions — CALL