Filling out section 1 The first section should contain general indicators for production, shipment and sales.

Last modified: January 2021 When faced with financial difficulties, an enterprise is forced to make unpopular decisions and

Just like other employees, the director of an LLC is classified as hired personnel. But unlike

Why do you need account 01 Accounting account 01 “Fixed assets” was created to record information about

A payment order is a document with which the owner of a current account gives an order to the bank

Any control involves carrying out a number of activities to determine the degree of compliance with current legislation, rules, regulations,

Intangible assets (IMA) of an enterprise are property objects operated by the copyright holder for a long time (more

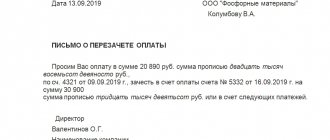

An application for offset of overpaid tax is a document with which a taxpayer applies

If you received income that is subject to declaration (for example, you sold an apartment or a car), then up to

Individual entrepreneurs and organizations using the simplified tax system do not pay VAT. But there are exceptions to this rule,