All legal entities and individual entrepreneurs that employ hired employees must send a report to the social insurance department once every 3 months. 4-FSS. This report records information about accrued and paid contributions. These contributions are paid in order to create a reserve for payments for illnesses and injuries caused by production factors. If errors are found in the report, it will not be accepted. The electronic document is sent back with the mark “Error 508”.

How to fill out and submit reports on Form 4 - FSS for accident insurance premiums ?

Deciphering the error code

The 4-FSS report is required for preparation by all employers registered in the Russian Federation (justification - Law of July 24, 1998 No. 125-FZ). The reporting form template was approved by Order No. 381 dated September 26, 2016. The form is drawn up and submitted to the regulatory authority taking into account the following deadlines:

- when sending a paper version of the report, it must be completed by the 20th day of the month following the expired reporting quarter;

- when generating and sending 4-FSS electronically via TKS, the deadline is shifted to the 25th day of the month following the quarterly reporting period.

If at the time of submitting the document error code 508 appears in the FSS report, then the form will not be accepted by the regulatory authority. The deadlines remain the same. The corrected report file must be submitted within standard time limits.

To avoid delays and refusals to accept the report, it is recommended to conduct an independent preliminary check of the completed form. Code 508 – errors in the logical control of the FSS report.

The program on the FSS website allows you to upload a completed electronic document with reporting data or enter the numbers manually on the portal and check for compliance according to key criteria:

- compliance with control ratios;

- use of the current form;

- whether the logical control will be passed (error 508);

- using the correct formats.

After automatic checking, the program provides results about detected inaccuracies and problems (if any). If positive results are achieved, the report can be sent to the regulatory authority. If a message is displayed that a logical error 508 has occurred, the FSS will not be able to see and accept this version of the report. This code means that the document could not pass the automatic system of format-logical type of control.

If the reporting form is rejected, the policyholder receives a notification with problems and codes for deficiencies listed in it. In situations where a 508 error is displayed, it is imperative to correct it and comply with the standard deadlines for submitting the document. Reasons why this type of code may appear:

- the information was not downloaded in full from the accounting program used by the employer;

- the software containing the reporting forms to fill out is outdated and produces outdated document forms.

If it is impossible to independently eliminate the shortcomings and pass the logical control (error 508), the FSS recommends using the official website of the government agency and filling out a report on it. A function has been introduced for employers to check a document and send it from the Social Insurance Fund website. To use the service for transferring forms through the social insurance portal, you must go through the registration procedure.

Responsibility measures

The report is considered accepted if, when checking it, the program does not produce any error information. If there is information about existing problems and shortcomings, they must be promptly eliminated. This rule applies to all situations where error 508 is recorded; when sending sick leave or a report, this code means there are technical problems. The principle is established by law according to which the deadline for submitting documents is not extended if errors are detected.

If the employer managed to meet the deadlines and submitted the correct version of the reporting form on time, no liability measures will be applied to him. If the time frame is violated and reporting is delayed (and due to errors), a fine is imposed for each month of delay - a full monthly interval or not, it does not matter. Amount of penalties:

- calculated at the rate of 5% of insurance premiums that were recorded as accruals for the period of the last 3 months;

- the minimum amount of punishment is 1000 rubles;

- The maximum penalty percentage is 30%.

If the deadline for reporting to the Social Insurance Fund, submitted in electronic format, is missed, the organization is issued a fine in the amount of 200 rubles. The head of the company may be found guilty of committing an administrative offense. In this case, the fine is assessed in the range of 300-500 rubles (Part 2 of Article 15.33 of the Administrative Code).

In what ways can I submit Form 4-FSS?

Employers who employ hired workers are required to submit Form 4-FSS and the accompanying injury report, containing information on contributions paid for accident insurance, once a quarter. The regulatory basis for calculating and paying premiums for injury insurance is the Law “On Insurance against Industrial Accidents and Occupational Diseases” dated July 24, 1998 No. 125-FZ.

If the organization is small and employs no more than 25 people, the form can be submitted on paper, electronically or through the MFC. Organizations with an average number of employees of more than 25 people must submit information only electronically, before the 25th day of the month following the quarter for which the information is submitted. Violation of the method of submitting a report is punishable by a fine of 200 rubles.

The FSS authorities confirm receipt of the report with a receipt (if the report was submitted in paper form) or an inspection protocol (if the report was submitted electronically).

Features of filing a 4-FSS report

The specifics of submitting a report are established by Federal Law No. 125 “On Insurance” dated July 24, 1998. The regulations state that reports must be sent electronically if it is an individual entrepreneur or legal entity with more than 25 employees. If the staff size is less than 25 employees, you can send a report in paper form. The following reporting deadlines have been approved:

- For commercial firms supplying paper reports - on the 20th day of the month following the reporting quarter.

- For institutions submitting an electronic report – until the 25th.

When creating a report, the accountant must carefully check the document for any defects. If the FSS identifies errors, the document will be sent back. The accountant also receives a notification with a list of shortcomings. All errors must be corrected in a timely manner. Otherwise, fines will be imposed on the company.

Step-by-step instructions for fixing error 508

So, if there is an error 508, the calculation is returned for revision. The procedure for further actions is the same for all obligated persons. (click to expand)

| Step-by-step actions of the obligated person to correct error 508 | Explanations |

| Read the FSS instructions regarding the existing error (508) and, according to them, make adjustments to the calculation | To make adjustments, you should update the program that generates the reports, check the completeness of the previously downloaded data, and perform other actions if necessary; all instructions sent by the fund along with the returned payment are binding |

| Check the adjusted calculation yourself on the official website of the Social Insurance Fund automatically | Sequence of actions for automatic checking: 1. Prepare calculations in an accounting program. 2. On the FSS website, find “Form 4-FSS”. 3. Upload the completed adjusted calculation form. 4. Check the downloaded calculation (click “check”). In this way, you can check any version of the 4-FSS before submitting it to the FSS |

| Submit an adjusted FSS calculation | When resubmitting the document, you must comply with the established deadlines for submitting reports. The payment must successfully pass all stages of verification: receipt, file decryption, digital signature verification, format and logical control, receipt generation. Only after this will it be considered accepted Date of submission of 4-FSS - the day the form was accepted after the verification was carried out |

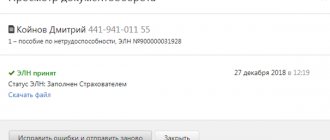

If the errors were corrected, the calculation successfully passed control and was accepted, the Social Insurance Fund authorities notify the obligated person about this. A confirmation of acceptance of 4-FSS is sent to him.

Printing a list of documents

In some cases, there is a need to print a list of documents with statuses, for example, to check downloaded information.

To print you should:

- Choose "Print" and onwards “List of documents with FSS statuses”:

- Specify for what period the list is printed:

- Select print format: PDF and XLS. The XLS format makes it possible to filter and sort a list of printed documents.

- Select "Print" . The document will be uploaded in the specified format. You need to open it and print.

Common protocol errors and how to resolve them

A complete list of error codes and their interpretation can be found on the FSS website.

- The most common error code in the FSS Form 4 verification protocol is error 508, which means that the file format is incorrect and the calculation has not passed format-logical control.

Its main reasons:

- When filling out a report in the 1C program, only part of the data is uploaded;

- The program for generating the report has not been updated.

In this case, the report can be filled out on the official FSS website portal.fss.ru (tab “Form 4-FSS”), and then download the correct file and send it through your telecom operator.

Sending is also available from the portal of the fund itself, but before this you need to register on the site and request a digital signature key. You need to take these steps in advance so as not to miss the deadline for submitting the calculation.

- Error code 503 in the FSS report means that the file name specified is incorrect and does not match the XSD schema.

According to Appendix 1 to the FSS order “On the implementation of secure exchange of documents in electronic form...” dated 02/12/2010 No. 19, the file name should look like this:

<policyholder number>_<accounting year>_<reporting quarter>. xml.

For example, 1234567891_2020_12.xml.

In this case, the policyholder number is a 10-digit digital designation of the payer’s registration number. It must correspond to the registration documents. The accounting year is written in YYYY format, for example 2021. The reporting quarter must contain 2 digits: for the 1st quarter it is designated 03, for 6 months. — 06, 9 months. - 09, years - 12.

To fix error 503, you need to rename the file or generate the file in the program and upload it again.

- Error 598 in the FSS report means that the provided file contains a TIN that does not match the registration number of the policyholder.

The reason may be the erroneous entry of information into the database by the special communications operator through whom the calculation is signed and sent, as well as an error by the accountant.

To resolve discrepancies, you must check the Taxpayer Identification Number and Registration Number on the cover page of the form. If no errors are identified, you should contact a representative of the operator’s company and check the data in their database.

Keep in mind that the courts do not consider an error in the policyholder's registration number to be a sufficient reason for not accepting a settlement. Read more about this in the material “An error in the registration number is not a reason for a fine for failure to submit 4-FSS.”

What to do if I receive a negative inspection report?

If, based on the results of the inspection, the FSS body sent a negative report, the payment is considered not submitted. It is necessary to correct all errors indicated in the document and send the report again. The date of submission of the calculation is the date when the file passed all stages of verification and was accepted by the fund.

If the file is accepted after the 25th, the FSS will charge a fine, which will be calculated as 5% of the amount of assessed contributions for injuries for the reporting period, but not less than 1,000 rubles. and no more than 30% of the specified amount (Clause 1, Article 26.30 of Law No. 125-FZ).

Important! Hint from ConsultantPlus In a situation where you submit an updated calculation after the deadline for paying contributions and the deadline for submitting the initial calculation have passed, you can avoid a fine if the following conditions are simultaneously met... Read more about the conditions in K+ . This can be done for free with trial access.

Let's look at the most common error codes in the protocol and how to correct them.

What do other error codes mean?

| No. | Error code | Meaning | Possible reasons | Elimination procedure |

| 1 | 10 | Unable to decrypt file | Invalid or expired certificate | Check the validity period of the digital signature certificate and its validity |

| 2 | 11 | It is impossible to verify the digital signature | 1. Certificate error. 2. The file is signed twice. 3. The file encryption algorithm is broken | 1. Contact a special operator and fix the certificate error. 2. Re-sign the file and send. 3. Sign the file first and then encrypt it |

| 3 | 13 | Absence of the policyholder's registration number in the certificate | An error made by a special operator when issuing a certificate | Contact the special operator representative and reissue the certificate |

| 4 | 14 | Lack of FSS department code in the certificate | See paragraph 3 | See paragraph 3 |

| 5 | 15 | Encryption error | System crash while transferring file | Resend the file |

| 6 | 16 | Incorrect format of policyholder registration number in the certificate | The number of characters of the registration number is less than or more than 10 | Reissue certificate |

| 7 | 17 | Incorrect format of the FSS unit code in the certificate | Number of code characters more or less 4 | Reissue certificate |

| 8 | 18 | The file is encrypted with an incorrect digital signature key | 1. An incorrect FSS authorized person certificate was selected. 2. Expired certificate selected | 1. Sign and encrypt the file using a valid certificate from an authorized person of the FSS. 2. Download a new certificate from the FSS website and install it in the certificate store |

| 9 | 19 | The file is not signed or encrypted | Re-sign, encrypt and send the file | |

| 10 | 20 | Unknown file format | File name does not match XD schema | Regenerate the xml file (see procedure for error 503) |

| 11 | 41 | The certificate issuer is not trusted | 1. The special operator’s certificate does not comply with the Law “On Electronic Signatures” dated April 6, 2011 No. 63-FZ. 2. The special operator’s certificate has been revoked or expired | Contact the special operator company, having first checked the validity of the root certificate in the cross-certification table |

| 12 | 42 | Error verifying certificate | Resend calculation | |

| 13 | 43 | The policyholder's certificate has been revoked | The digital signature of the certificate is invalid | Reissue certificate |

| 14 | 44 | The certificate revocation list (hereinafter referred to as CRL) of the certificate issuer is expired or not found | Certification center SOS error | Contact a representative of the telecom operator company |

| 15 | 45 | The certificate is damaged | Resend payment | |

| 16 | 46 | The insurance certificate is expired | Reissue certificate | |

| 17 | 50 | The organization's TIN is not included in the certificate | Error creating certificate | Reissue certificate |

| 18 | 504 | The certificate contains the wrong FSS division | See paragraph 17 | See paragraph 17 |

| 19 | 505 | Incorrect file name | File format does not match XD schema | Regenerate the file in xml format |

| 20 | 506 | Identical tax codes in section 2 of the report | Error filling out the form | Correct an error in the report, upload and send |

| 21 | 507 | xml file missing | Calculation file not loaded into the system | Upload file, sign, encrypt and send |

| 22 | 509 | The file contains a period that differs from the period in its name | Error when filling out the calculation | Regenerate the file and send it to the FSS |

| 23 | 511 | Error reading file | The file is empty or not in xml format | Regenerate the file and send |

| 24 | 512 | The reporting year in the file differs from the year in its name | Error when filling out the calculation | Correct the error, generate and send the file |

| 25 | 513 | The file contains a registration number that is different from the number in the file name | See paragraph 24 | See paragraph 24 |

| 26 | 514 | The policyholder's registration number on file is different from the number on the certificate | 1. Error when filling out the calculation. 2. Error when issuing a certificate | 1. Correct the error, generate the file and resend it. 2. Contact the certification authority and reissue the certificate |

| 27 | 515 | The registration number in the file name is different from the number in the report | See paragraph 24 | See paragraph 24 |

| 28 | 516 | The separate department code in the file name differs from the code in the file | See paragraph 24 | See paragraph 24 |

| 29 | 517 | File size is too large | The file must be no larger than 655 kilobytes | Generate a new calculation file |

| 30 | 518 | The file is zero size | The file is zero size | Generate a new file |

| 31 | 519 | The TIN in the certificate differs from the TIN in the calculation file | See paragraph 26 | See paragraph 26 |

| 32 | 520 | OGRN in the file differs from OGRN in the certificate | See paragraph 26 | See paragraph 26 |

| 33 | 550 | The certificate is not qualified | The certificate is not qualified | Contact the special operator company and reissue the certificate |

| 34 | 599 | The policyholder's data has not yet been entered into the FSS database | The report will be processed upon entry into the FSS database | |

Editing a document

To change the entered information, click on the line with the desired document - a window for entering data will become available. For sent documents, a page with a list is displayed:

To edit the entered data you need:

- For a document that did not pass the control and received an error protocol, select “Correct errors and resend” ;

- For an accepted document, select “Create recalculation” . After correcting the data, you need to indicate the reason for the recalculation.

To view the sent data without correcting it, you must select “View document” .

Error code 508 when sending sick leave

If an employee received sick leave on the day of dismissal, then pay him benefits for the entire period of illness.

If the organization received this protocol, the report is considered not submitted.

The benefit is paid for the entire period of illness of an employee who works in the organization under an employment contract.

And the day of dismissal is considered the last day of work. The deadlines remain the same. The corrected report file must be submitted within standard time limits. Error code “508” means that the 4-FSS calculation did not pass the logical control, because the presented file format is not correct and contains errors.

The reasons for the occurrence of such shortcomings are mostly of a technical nature.

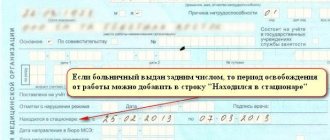

Error 508 can be caused by an outdated program for generating a report or incompleteness or partial loss of data when uploading while filling out 4-FSS using the 1C accounting program. Contents: On the back of the document the following entry is made: “Believe the corrected one.”

Next must be the signature of the responsible person and the company seal. The report may not pass verification due to errors.

In this case, the FSS sends a negative protocol to the company. If the organization received this protocol, the report is considered not submitted. The accountant needs to remove all the shortcomings and then send the document again.

The date the paper was sent is the date it was accepted by the fund. The Fund accepts a document only after it has passed all stages of verification. Yes, I've already tried this and that.

Error code 508 when sending sick leave

In this way, you can check any version of the 4-FSS before submitting it to the FSS Submit the adjusted FSS calculation When re-sending the document, you must meet the established deadlines for submitting reports The calculation must successfully pass all stages of verification: receipt, file decryption, digital signature verification, format and logical control, generating a receipt. It seems that everything is simple, but in practice, incorrect entries can be made both by the medical institution that issues this certificate of incapacity for work, and by the employer when filling it out. Contents: Upon receipt of the calculation, the FSS authorities must send the policyholder a receipt confirming receipt of the report or a negative inspection report describing the errors.

Thus, the period of an employee’s work in prison after November 1, 2001 must be included in the insurance period for calculating sick leave benefits. If the employee had such a period of work before November 1, 2001, then do not include this period in the insurance period.

If an accountant mistakenly overstates the amount of benefits, the Russian Social Insurance Fund will not reimburse the amount overpaid to the employee. Just enter the OGRN number written on the sick leave in the appropriate field. Literally in a matter of seconds you will receive information about the company: its exact name, tax identification number, checkpoint, registration date and address.

Error code 508 when sending sick leave

Make sure you have fresh certificates installed so that you don't accidentally sign a report with a certificate that is already expired. If a medical institution made a mistake when issuing a sick leave certificate, then, in accordance with paragraph 56 of the Issuance Procedure, such a certificate is considered damaged and a duplicate is issued in its place.

Contents: If, based on the results of the inspection, the FSS body sent a negative protocol, the payment is considered not submitted. It is necessary to correct all errors indicated in the document and send the report again.

The date of submission of the calculation is the date when the file passed all stages of verification and was accepted by the fund.

The chief accountant advises: if you are ready to argue with the inspectors, then you can not charge insurance premiums on the amounts of benefits that were not accepted by the Federal Social Insurance Fund of Russia for offset, even if the employee did not return the money. The following arguments will help you.

If an accountant mistakenly overstates the amount of benefits, the Russian Social Insurance Fund will not reimburse the amount overpaid to the employee. Just enter the OGRN number written on the sick leave in the appropriate field.

Literally in a matter of seconds you will receive information about the company: its exact name, tax identification number, checkpoint, registration date and address.

What errors can there be on a sick leave certificate when sent to the Social Insurance Fund? Table of accepted codes

In accordance with the Labor Code of the Russian Federation, an employee can count on financial assistance from the state in case of illness.

To take advantage of this type of support, the interested subject of labor relations must provide the appropriate sick leave certificate to the government agency. The correctness of filling out the form and the authenticity of the certificate of incapacity for work is checked by the Social Insurance Fund of the Russian Federation (FSS RF). And as practice shows, cases often arise when errors are discovered when sending documentation. The code, name and description of errors can be found on the official website of the Federal Social Insurance Fund of the Russian Federation. () Below is a table that describes in detail what an error code is when sending a sick leave certificate to FSS, for example, code 508 is a logical control error, and code 503 means that the calculation file did not pass the format control. The reasons for the appearance of these errors and methods for solving them are also given. Error code Name Reason for occurrence Method of solution 10 It is impossible to decrypt the file. The file is damaged, expired or invalid. It is necessary to check the status of the file (expiration, legal authenticity). 11 The digital signature could not be verified. The encryption sequence is broken; The digital signature was entered incorrectly. Check the coding algorithm; contact the certification center (hereinafter CA) and re-sign the certificate. 12 The digital signature is not correct. The digital signature is incorrect or missing. If there is no signature, contact the CA to affix it; If the digital signature is incorrect, the certificate must be reissued.

What does error code "508" mean?

An accountant may make errors in reporting. The shortcomings can be very different. They are classified and subdivided based on characteristics. Each type of error is assigned its own code.

One of the most common defect codes is “508”. It means that the document was compiled incorrectly. It contains errors. As a rule, these are technical errors. Error code “508” means that the report did not pass format and logical control. Such a defect usually occurs for the following reasons:

- The data has not been downloaded from the accounting system used by the company. Only part of the information has been loaded.

- The software in which the forms are located is outdated. The program generates papers that are no longer relevant.

What to do if reporting does not pass logical control? The defect needs to be removed. However, it is not always possible to do this. This impossibility is due to the specific cause of the “508” error (problems with the software). If the company cannot correct the error itself, you can use the resources of the FSS website. The report is filled out on it. You can submit reports through the same website. The resource has a document verification function. To use the service, you need to register in it and also obtain an electronic signature.

How to send a register of sick leave to the Social Insurance Fund in Kontur.Extern | Contour.VAT+

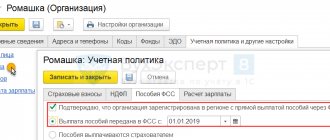

The Social Insurance Fund’s project “Direct Payments” involves changing the mechanism for calculating and paying benefits for compulsory social insurance. The direct payment system consists of the following steps:

- The employee receives documents confirming the right to benefits (a certificate of temporary disability, pregnancy and childbirth, a certificate of birth of a child or registration in the early stages of pregnancy).

- The employee provides the organization’s accounting department with a sick leave certificate (or a document confirming the right to another benefit) and an application indicating the details for transferring funds.

- The policyholder compiles an electronic register of documents using the “FSS Benefits” and sends it to the Fund.

- The FSS transfers funds to the insured person's bank account or sends them by postal order.

Next, we’ll look at how to work with registers of information (for example, certificates of incapacity for work) in Kontur.Extern.

List of benefits

To open the document flow, go to the main page of Kontur.Extern and select the “FSS” . After selecting the “FSS benefits” , a list of benefits for the current month will become available. Documents for previous months can be opened by clicking on the “All documents” :

Search documents

You can use the search bar to find the document you need. It must indicate the surname or insurance number of the employee (SNILS).

To search for documents from previous years, you need to use the “Continue search for...” :

Status values

Depending on the stage of creation and sending, documents are assigned certain statuses:

- “Created” – the document has been added, but not transferred;

- “Register in queue for sending” – the file is waiting to be sent;

- “Sending error...” – an error occurred while transferring the file. You need to open the document flow, select the desired line and click “Send again” ;

- “Register sent” – the file has been sent, but has not yet passed control;

- “The register is not accepted” - violations were discovered during the control. You need to find the document in the list and correct the violations by selecting the “Correct errors and resend” . Violations are specified in the protocol - it is available via the link “View error log” ;

- “Register accepted” – the file has successfully passed control and is considered submitted. The admission receipt is available for printing.

If an error is detected in the information register, the FSS department will send the user a notice (paper, by regular mail). To correct it, you need to enter the document and recalculate.

Printing a list of documents

In some cases, there is a need to print a list of documents with statuses, for example, to check downloaded information.

To print you should:

- Select “Print” and then “List of documents with FSS statuses” :

- Specify for what period the list is printed:

- Select print format: PDF and XLS. The XLS format makes it possible to filter and sort a list of printed documents.

- Select "Print" . The document will be uploaded in the specified format. You need to open it and print.

Creating a new document

To add a document you need:

- Go to the main page of the service, select the “FSS” and then “FSS Benefits” .

- On the page that opens, select “Create document” :

- In the “Create a new document” , you need to select the type of benefit:

- Specify the type of sick leave certificate “Paper” . To create an electronic sick leave certificate, we recommend that you refer to the separate instructions.

- Select employee:

- The employee is on the list. You should select it and click “Create document” . You can use the search bar. The search is carried out by last name or SNILS of the employee. After entering the data in the line, click “Find” .

- The employee is not on the list. You need to use the “Add a new employee” . After entering your last name, first name and SNILS, you need to click “Add employee” . The newly created employee will appear in the list. You should select it and click “Create document” . When you create a new employee, he will be displayed in the “Contour. PF report” (the services have the same list of employees). It will be available for reporting to the Pension Fund.

- Enter data into the table. The information consists of several sections, the number of which depends on the type of benefit.

Editing a document

To change the entered information, click on the line with the desired document - a window for entering data will become available. For sent documents, a page with a list is displayed: To edit the entered data you need to:

- For a document that did not pass the control and received an error protocol, select “Correct errors and resend” ;

- For an accepted document, select “Create recalculation” . After correcting the data, you need to indicate the reason for the recalculation.

To view the sent data without correcting it, you must select “View document” .

Uploading documents

To upload documents created in other programs:

- Go to the main page of the service and click the “FSS” , then click “FSS benefits” . A list of all documents will be displayed.

- Select "Download registry" :

- In the window that appears, select “Browse” and then the desired file. One file can contain several documents.

- When uploading a file, it may turn out that a certificate of incapacity with a similar number is already in the system. The service will offer you to choose whether to leave the existing document or replace it from a file:

- Select "Upload documents" . The list displays the downloaded documents.

- Check the uploaded documents and submit.

Printing the application

An application in form No. 578 is generated on the basis of the entered document. It can be printed and given to the employee for signature. Printing is available from two places:

- From the list of documents:

- By selecting “Print Application” on the document viewing page.

Printing a list of registries

Form No. 579 “Register of information for payment of benefits” is formed on the basis of a list of documents. Using the printed register, you can verify the downloaded data. To print you should:

- In the list of documents, select “Print” and then “Register of information for payment of benefits” :

- It is necessary to indicate for what period and in what format the printing is performed: PDF or XLS. The latter makes it possible to filter and sort a list of documents in printed form.

- After clicking “Print”, a printed form will be generated in the previously specified format. After this, you can open and print it.

Deleting documents

“Delete” in the line with the required document : Documents sent to the regional office of the Social Insurance Fund cannot be deleted.

Sending documents

To send and control documents you should:

- Go to the document viewing page and click the “Check and Send” .

- The system will check the document and show the results:

- If errors are identified, they must be eliminated. Fields with errors are marked in red. To correct the information, you need to close the page with the results of the check, then eliminate the shortcomings and send the document.

- When no violations are detected, you need to select an electronic certificate for signing and click “Send the document to the FSS” .

The file will be put on hold for transmission with the status “Queued for sending” .

Bulk sending of documents

Sending documents to the Social Insurance Fund can be done en masse.

To send several documents at once, you need to go to the page with a list of documents, then select the “Details and Settings” and then “Enable bulk sending mode.” This sending procedure is enabled for all users of the organization at the same time.

To disable bulk sending of documents, in the same window you must select the “Disable bulk sending mode” .

To send documents in bulk, select a date (the last 4 days are displayed by default) and click “No errors” . Next, click “Send N documents to the FSS” , then select an electronic signature certificate.

View sent documents

To view the sending status, select the line with the desired document and click on it. After this, a window with data on the last shipment will become available.

- Document status – read the meaning of statuses in the section “List of documents and statuses” .

- Report number in the FSS - the number is used to search for the transferred document on the FSS portal in the section “Information about transferred documents” .

- Error log – displays a list of errors detected by the Social Insurance Fund during control of the transmitted document.

- View receipt – the ability to open a receipt confirming receipt of the document by the Foundation.

- View document – allows you to display the information contained in the sent document.

- Download file – downloads the transferred document.

If you want to see the entire history of sendings, you should click “Show history” .

Instructions for eliminating the defect under code “508”

If a document contains a “508” error, it is sent for revision. If such a situation occurs, you need to act in accordance with this algorithm:

- Study of FSS regulations regarding the identified deficiency. Based on these instructions, appropriate changes must be made. As a rule, to correct the defect, it is necessary to update the accounting program used. You must also ensure that the information uploaded is complete. The instructions of the FSS must be followed without fail.

- You must ensure that there are no errors in the modified calculation. You can do this yourself. If the FSS service is used to fill out, the check can be performed automatically. To automatically check, you need to create a calculation in an accounting program. After this, in the service you need to go to the “Form 4-FSS” section. The modified document is loaded into it. After this, the check starts. To do this, click on the “Check” button.

- The modified file is submitted. After the accountant presses the “Submit” button, the file is checked again. Verification stages to be completed: receipt of the document, analysis of its contents, verification of the electronic signature, logical control, creation of a receipt. Only if the file has passed all stages of verification is it accepted.

The date of acceptance of the file is the date on which the document has passed all stages of verification. That is, you cannot submit a file on the final day allotted for submitting reports to the Social Insurance Fund. This must be done in advance so that the document has time to go through all stages of verification.

FOR YOUR INFORMATION! If the report passes the review, the company will be notified.

Examples

The accountant creates reports and submits them in electronic format. An error “508” was detected in the document, as a result of which the file was sent back. The accountant quickly corrects all shortcomings and submits the corrected document. It is successfully verified by the 20th and goes to the FSS. In this case, making a mistake does not entail any penalties.

Let's look at another example. Previously sent reports were returned due to error “508”. The accountant corrects all the shortcomings and submits the file on the 19th. However, the document passes all stages of verification only on the 21st. A file is considered submitted only when it goes through the full review cycle. Consequently, deadlines are missed. The company is held accountable. A fine of 200 rubles is imposed.

FOR YOUR INFORMATION! To prevent missed deadlines, you need to send the first version of the report in advance. You need to allow time for the fact that you may have to correct shortcomings.

Results

The law obliges employers to report every quarter on the amounts transferred for insurance in Form 4-FSS. Information must be provided in electronic version within the prescribed time limit. There is a fine for missing deadlines. If the report form is filled out incorrectly, the report will be rejected by the government agency and a negative report will be sent to the organization upon inspection. The corrected version must also be submitted before the deadline for submission. Therefore, the organization should take care of submitting reports in advance, without delaying until the last day.

Sources

- https://batutstyle.ru/kod-oshibki-508-v-otchete-fss/

- https://zen.yandex.ru/media/nalognalog/oshibka-v-forme-4fss-kak-ispravit—5b3b4374f03ecf00a86cde4c

- https://online-buhuchet.ru/kod-oshibki-508-v-otchete-fss/

- https://nalog-nalog.ru/strahovye_vznosy/fss/oshibka_508_v_otchete_fss_chto_eto_i_kak_ispravit/

- https://emelyanov-dokin.ru/kod-oshibki-508-pri-otpravke-bolnichnogo-lista-oshibka-logicheskogo-kontrolja-88050/

- https://assistentus.ru/buhuchet/oshibka-508-v-otchyote-fss/

Uploading documents

To upload documents created in other programs:

- Go to the main page of the service and click the “FSS” , then click “FSS benefits” . A list of all documents will be displayed.

- Select "Download registry" :

- In the window that appears, select “Browse” and then the desired file. One file can contain several documents.

- When uploading a file, it may turn out that a certificate of incapacity with a similar number is already in the system. The service will offer you to choose whether to leave the existing document or replace it from a file:

- Select "Upload documents" . The list displays the downloaded documents.

- Check the uploaded documents and submit.

Section "Calculation of benefits"

In this section, fill in the data necessary to assign benefits to an employee by the regional branch of the Social Insurance Fund. All required fields will be highlighted in red.

1. “Information attribute” - you should select the “Primary information” item if the benefit is sent to the Social Insurance Fund for the first time. The “Recalculation” item is selected if the benefit has been sent and adjustments need to be made.

2. “Date of submission of documents to the policyholder” - the date when the benefit recipient submitted the application and additional documents to the employer should be indicated.

3. Indicate the regional coefficient, rate, insurance period, year and amount of earnings.

If you need to specify information about replacing billing years, you should check the “Fill in information about replacing years” checkbox. Additional fields will appear to indicate the years to be replaced.

4. “Benefit payment period” - you should select whether the benefit is paid entirely at the expense of the employer or whether there is a period for which the benefit is paid at the expense of the Social Insurance Fund. In the second case, in the field “Benefit at the expense of the Social Insurance Fund for the period”, be sure to indicate the beginning and end of the period for which the benefit is accrued at the expense of the Social Insurance Fund.

5. The “Benefit Calculation” section is completed; click the “Check and Submit” button.

The three most common problems when working with electronic signatures

- The procurement participant certificate is not displayed on the electronic platform

- Electronic signature does not sign documents

- The system gives an error when logging into the electronic platform

In fact, there may be many more errors, but we will analyze the main ones and their causes, and also outline possible ways to eliminate problems.

The most important thing is to remember that for the electronic signature to work correctly, you must use the Internet Explorer browser no lower than version 8 and, preferably, no higher than 11 (with version 11 there is no guarantee of stable operation of the signature).

This is the same problem that I had to face. Surprisingly, with such an error, some sites work with the certificate without problems, while others simply do not notice it. Probably, in cases where such a certificate is valid, the path to the main certification authority is not checked.

Open the certificate store using the certmgr.msc console

Go to Personal/Certificates. Open the certificate that does not work and go to the Certification Path tab.

As can be seen in the figure, as the root authenticator, and the intermediate authenticator.

Let's return to the "General" tab to check who issued the personal certificate. The certificate was issued to the same company that is indicated in the certification path as an intermediate center. Everything is correct here.

Go to Intermediate Certification Authorities and check the intermediate certificate. Here you can see the message “This certificate could not be verified by tracing it to the certification authority.” This is where the path ends.

An error occurred while trying to load data from the database.

Printing a list of registries

Form No. 579 “Register of information for payment of benefits” is formed on the basis of a list of documents. Using the printed register, you can verify the downloaded data. To print you should:

- Select from the list of documents "Print" and onwards “Register of information for payment of benefits”:

- It is necessary to indicate for what period and in what format the printing is performed: PDF or XLS. The latter makes it possible to filter and sort a list of documents in printed form.

- After clicking “Print”, a printed form will be generated in the previously specified format. After this, you can open and print it.

Workstation for preparing calculations for the Social Insurance Fund, error “The set of keys is not defined”

This error occurs when incorrect records are stored in any application database table (for example, an empty or incorrect value of the electronic number, empty required fields, rows with the same value of the electronic number, including duplicate records). If there are such records in the database of the automated workplace of a healthcare facility, then the following errors are possible:

- Sending and receiving e-mail may not occur correctly, the status bar window may freeze;

- It is not possible to request an ELN number from the ELN form.

To fix it, you need to delete the incorrect row from the application database (such records can only be deleted manually).

The GOST of the FSS certificate does not correspond to the crypto provider selected in the settings, or the crypto provider cannot obtain the private key from the private key container for the selected certificate.

What to do:

- In the Signing and Encryption workstation settings, check that the specified crypto provider matches the one actually installed by the user;

- In the Signing and Encryption workstation settings, check that the GOST standards for the signing certificate and the FSS certificate are the same and correspond to the selected crypto provider;

- If you are using an electronic signature certificate in accordance with GOST 2012, open the certificate, the “Composition” tab, the “Electronic signature tool” parameter. It is necessary to check that the electronic signature corresponds to the crypto provider installed on the user;

- If you are using an electronic signature certificate in accordance with GOST 2012 and the cryptoprovider CryptoPro, check the settings on the “Algorithms” tab. In the “Select CSP type” drop-down list, select GOST R 34.10-2012 (256). The following parameters must be set:

- “Encryption algorithm parameters” - GOST 28147-89, parameters of the TK26 Z encryption algorithm

- “Signature algorithm parameters” - GOST 34.10-2001, default parameters

- “Parameters of the Diffie-Hellman algorithm” - GOST 34.10-2001, default exchange parameters

- The certificate is missing a private key. Using the certmgr.msc system utility, open the certificate, on the “General” tab it should say “There is a private key for this certificate”;

- The crypto provider does not see the private key container for this certificate. In the cryptoprovider CryptoPro CSP, go to the “Service” tab and click “Delete remembered passwords” - for the user;

- The container may be damaged by third-party software. Reinstall the certificate again, with the obligatory indication of the container;

- Reinstall your crypto provider.