How to check VAT (VAT reconciliation)

To check the correctness of tax calculation, you should determine the organization’s total turnover for transactions subject to VAT. If you compare them with accounting data, it will become clear whether all goods have been taken into account.

To determine the turnover associated with the sale of products, the following types of information sources are used:

- bank statements for the company's current account;

- incoming and outgoing cash orders;

- statements of settlements with counterparties;

- invoices issued to customers and buyers.

When examining the sales statement, it becomes obvious which amounts were received in the form of an advance and which in the form of actual payment.

Errors made during tax calculations are made obvious. Check all the lines of the document and check each calculation so as not to miss anything.

Subsequently, representatives of the Federal Tax Service will use the same algorithm.

Having identified any shortcomings, the accountant can submit clarifications to the tax office. This must be done no later than the due date, otherwise fines will be imposed on the organization. If inaccuracies are identified during a desk audit, the underpaid tax amounts will be subject to penalties.

VAT check: algorithm of actions

To check the correctness of the indirect tax calculation, you can use information from the general ledger. Study every line of it.

Check whether the numbers and amounts of the primary documents are indicated correctly, and whether VAT is calculated correctly. If there were errors in the entries, correct them.

It is advisable to do this before submitting the declaration to the Federal Tax Service.

Create balance sheets for 60 and 62 accounts (settlements with suppliers and customers, respectively). Check that the wiring is correct.

To do this, it is enough to track one point: 60.2 and 62.1 can only be used for debit, 62.2 and 60.1 for credit.

If the rule is violated, you need to check the accounting data and identify when the incorrect posting was made.

Pay attention to the “turnover” balance. It must match the figures indicated in the Sales and Purchase Books. If this is not the case, review the transactions and look for where the incorrect amount is indicated.

Form “turnover” for account 41 “Goods”. Pay attention to where the remaining stock is located. They must be positive and go through debit. If this is not the case, pull up the primary documents and find out at what point the misgrading occurred.

Check the statement of account 19. At the end of the period there should be no balance in debit or credit. If present, incorrect entries were made during the quarter.

Examine the account of advances received from buyers and customers. The final balance reflected in the “turnover” of the loan should be equal to the product of the balance in account 62.2 and the tax rate.

Create a sub-account report in your accounting program for all counterparties. Check whether all amounts are posted to accounts according to the primary documentation.

You should not have “stuck” amounts.

If a supplier or buyer has several contracts, it makes sense to consider the report in the context of each of them.

How is VAT reconciliation carried out by tax authorities?

When checking the tax accounting data of enterprises, the Federal Tax Service specialists first of all pay attention to the correctness of the formation of the tax base (TB). They look at several significant points:

- When NB goods and services are sold, their value, free of taxes, is recognized. If we are talking about excisable goods, then excise taxes are added to the price.

- If an organization sells fixed assets reflected in the balance sheet including VAT, then the NB will be considered the difference between the sales price and the residual value of the property.

- If an organization operates under an agency agreement, then the tax is calculated not on the entire amount of funds received from the counterparty, but on the amount of the agency fee.

- If a product is transferred free of charge, the tax base is calculated as its value based on the average price level on the market.

- When it comes to assignment of financial claims, a standard calculation algorithm is used.

Checking accrued VAT is an important element of an accountant’s work.

Analysis of accounting program data and their reconciliation with primary documents allows us to promptly identify errors and inaccuracies.

If they are “revealed” after submitting a declaration or during a desk audit, the company may face lengthy proceedings with the tax authorities.

please select a piece of text and press Ctrl+Enter.

Source:

Initial data

So, for example, let’s take an organization that is engaged in wholesale trade. The organization purchases goods both on the domestic market and through import. Goods can be sold at rates of 18% and 0%. At the same time, the organization maintains separate VAT accounting.

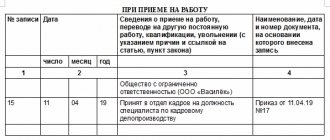

In the first quarter of 2021, the following transactions were recorded:

- Advances were issued to suppliers, invoices for advances were generated;

- Received advances from customers, generated invoices for advances;

- Goods were purchased for activities subject to 18% VAT;

- Goods were purchased for activities subject to 0% VAT;

- Imported goods were purchased, customs VAT was registered;

- Input VAT has been registered for the services of third-party organizations, which should be distributed to operations at 18% and 0%;

- A fixed asset was purchased at a VAT rate of 18%, the tax amount must be distributed among operations at different VAT rates;

- Goods were sold at a VAT rate of 18%;

- Goods were sold for activities subject to 0% VAT;

- Some of the goods on which VAT at a rate of 18% was previously accepted for deduction were sold at a rate of 0% - the restoration of VAT accepted for deduction is reflected;

- The shipment without transfer of ownership and then the sale of the shipped goods are reflected;

- Confirmed 0% rate for sales;

- Regular VAT operations were completed - sales and purchase book entries were generated, VAT was distributed for transactions at 18% and 0%, purchase book entries were prepared for the 0% rate.

How to check VAT accrual

The biggest headache for an accountant is VAT calculation. The slightest error in calculations and filling out a tax return can sometimes become fatal for an enterprise, which is subject to large penalties and possible legal costs.

To avoid these troubles, it is necessary to check the correctness of VAT calculation. Start checking with the general ledger. Check the numbers and dates of the primary documentation that is used when filling out accounting records.

Check the compliance of payment amounts and VAT charged on them. If any of the information was recorded incorrectly, make corrections before filing a tax return, otherwise these VAT amounts will be identified during a tax desk audit and penalties will be imposed.

Analyze the balance sheet. Separately make calculations for account 60 “Settlements with contractors and suppliers” and account 62 “Settlements with buyers and customers”. Break these indicators into subaccounts. Remember that subaccounts are 60.2 and 62.

1 should only be in debit, and subaccounts 60.1 and 62.1 should only be in credit. Otherwise, it is necessary to identify when an incorrect entry occurred. Reconcile the balance of these accounts at the end of the tax period with the balances in the sales and purchases book. They must match.

Create a balance sheet for account 41 “Goods”. Check that all balances are in debit and are not highlighted in red. If you have identified an error in this case, then you need to review the invoices for the fact that misgrading has occurred.

Check the debit balance in the balance sheet of account 19 “VAT on purchased assets.” This value should be zero. Open the statement of subaccount 76 “Advances”, if there were any in the reporting period.

Take the credit value of this account and compare it with the value obtained by multiplying the credit of subaccount 62.2 by the VAT rate. These amounts must be equal. Use the 1C program, in which you create subaccounts for counterparties.

Check the consistency of invoices, accompanying documents and amounts paid and received. If there are several agreements with one enterprise, it is advisable to create accounting for each agreement separately. This will avoid errors when calculating VAT.

Offer from our partner Sometimes, when applying for a job as a chief accountant, you need to double-check all tax accruals One of the most important taxes is VAT

.

As a rule, there are various pitfalls when calculating it. Start checking the correctness of the value added tax calculation from the general ledger. Reconcile all amounts payable, including VAT

.

Be sure to check all the numbers and dates of the accompanying documents with the accounting data, since if the information is filled out incorrectly, the tax inspector will “throw out” the VAT

and will charge a penalty on her.

After this, create a balance sheet for accounts 60 “Settlements with suppliers and contractors” and 62 “Settlements with buyers and customers”, broken down by subaccounts.

Please note that accounts 60 subaccount 2 and 62 subaccount 1 must be in debit, and 61 subaccount 1 and 62 subaccount 2 must be in credit only. Be sure to reconcile the balance at the end of the tax period on the above accounts with the final amounts indicated in the sales ledger and purchases ledger.

After this, in 1C, create a subaccount broken down by all counterparties; the amounts should not “hang” on the accounts, that is, everything should be on the accounts according to the accompanying documents.

If you have several contracts with the same supplier (buyer), it is advisable to break it down into contracts in accounting, so you will not get confused in payments, and in advances too.

Then create a balance sheet for account 41 “Goods”, all product balances should be reflected in debit, in no case should anything be highlighted in red.

If you nevertheless see this in your accounting, carefully review all the invoices issued and received; perhaps you have a mismatch.

After this, create a balance sheet for account 19 “Value added tax on purchased assets”, the debit balance should be equal to zero. If there were advances in the reporting period, then create a balance sheet for account 62 subaccount 2.

Divide the amount that is on credit by 118 and multiply by 18. Then open the statement for account 76 subaccount “Advances”, compare the amount you received and what is on credit to this account at the end of the period - they should match.

VAT payers must keep records of all invoices received and issued. These tax documents are recorded in special journals called the purchase and sales

.

If you make a mistake in registering a document, tax inspectors will cross out the specified VAT amount in the incorrect invoice, in addition, they will charge additional tax and penalties. That is why it is necessary to check all the data several times.

First, check the correctness of the sales

. Each invoice must have a serial number, date, product name, VAT amount and total cost. Under no circumstances is sequential numbering allowed. Please ensure that all required signatures and seals are present.

If there are corrections, they must be approved by the head or chief accountant of the enterprise. Be sure to carry out a reconciliation report with customers before stitching the sales

.

In the invoice journal, you must verify the following data: invoice number and date, VAT amount, total cost, name of the buyer, TIN number. Be sure to check the final amounts. To do this, use the balance sheet.

If the products were donated, the invoice does not need to be recorded in this journal. If partial payment is made, the invoice issued for the advance amount will not be recorded.

After checking, number the sales

, sew, seal the information with the blue imprint of the organization’s seal and the signature of the manager.

On the last page on the reverse side, write how many pages there are in the book. Proceed to check the purchase .

To do this, carry out reconciliation reports with suppliers. Check not only the amounts, but also the numbers and dates of invoices. Be sure to check that the details of the organizations are correct. After that, check the amounts with the data indicated in the balance sheet.

Remember that tax documents are registered in the period when the right to deduct VAT arises. If you notice an error in the invoice for the previous tax period, cancel it. Fill out an additional sheet, draw up an updated VAT return and submit it to the Federal Tax Service.

If an invoice is missed, you must do the same. Trade organizations must keep track of goods. Control over such transactions is necessary for reporting, as well as for analyzing the financial activities of the company.

- – tax and other documents;

- - automated program.

Accounting for goods includes several stages: receipt or production, movement and sale. Document each stage. To simplify accounting, it is advisable to use automated programs, for example, “1C: Trade and Warehouse”. Be sure to appoint responsible persons for the products. It could be one person, or it could be several. For example, you have your own production. The workshop must have a supervisor who controls the work of the staff and productivity, including quality. He must report to you regularly and submit reporting documents. It is also necessary to appoint a financially responsible person for storing goods in the warehouse. This person must receive documents for the movement of products and register goods for sale. If you purchase products from third parties, enter into sales agreements with counterparties and draw up supporting documents. For example, an employee must receive products from a supplier's warehouse. Write out a power of attorney to receive material assets in the employee’s name (form No. 2). He must accept the goods, check the availability and quality of the products. If everything is normal, the parties sign the invoice and delivery note. If there are deviations, you must draw up an act. After receiving all the documents for the goods, register the transaction in accounting. To do this, check that the forms are filled out correctly and verify the amounts. Enter the invoice in the purchase ledger. Capitalize the receipt of goods using the following entries: - D41 K60 - reflects the receipt of goods; - D19 K60 - reflects the amount of incoming VAT;

– D41 K42 – reflects the markup on goods.

When selling a product, you must issue the following documents: an invoice, a bill of lading (waybill) and an invoice. Draw up the tax document in duplicate and register it in the sales book.

Complete the delivery note in four copies.

In accounting, reflect these transactions as follows: - D50 K90 - revenue for goods sold is reflected; - D90 K68 - VAT accrual is reflected; - D90 K41 - write-off of the cost of goods sold is reflected;

– D90 K42 – reflects the write-off of the trade margin.

As you know, advances received are subject to value added tax, and after the sale, the amount of VAT paid on the advance payment is deductible. However, in certain cases, VAT payments on advance payments may not be paid on completely legal grounds.

Arrange for receipt of an advance payment and shipment of goods in the same tax period. Accept the accrued VAT amount from the prepayment for deduction.

Include the amount of the advance received in the VAT tax base, and then charge and pay value added tax to the budget on the total sales amount for this transaction (Article 54, paragraph 1 of Article 162 of the Tax Code of the Russian Federation).

Indicate in the declaration the amount of VAT that was calculated from the advance payment and accepted for deduction in the same period.

If an organization has an overpayment of value added tax, draw up and send to the inspectorate a letter of application requesting that the tax from the advance received be counted against the overpayment (Article 78 of the Tax Code of the Russian Federation).

Check the status of settlements with the VAT budget for previous periods, namely, compare the amounts of tax deductible and accrual. If the amount to be deducted exceeds the amount of accruals, VAT on advances is taken to account for this difference. (Article 176 of the Tax Code of the Russian Federation).

Agree with the buyer company on advance payments through drawing up a bill of exchange. Fill out a promissory note for the amount of advance payment for the goods. Transfer it to the buyer on the basis of the act of acceptance and transfer of securities.

When drawing up this document, indicate in it the maturity date of the bill, which must be later than the date of shipment of the goods. Receive money from the buyer in payment for this security.

In this case, the amount received is not considered an advance payment for the goods, so VAT is not paid. Ship the goods. The purchasing company must then present the bill for redemption.

Draw up an agreement on the offset of mutual claims, in which the seller organization pays off its accounts payable on the bill to the buyer organization, and the buyer organization pays off its debt to the seller organization for the goods received in the amount of the difference between the cost of this goods and its payment in cash ( i.e. the amount of the bill). The scheme of settlement by bills has the lowest tax risk (clause 37.1 of the Methodological recommendations for the application of Chapter 21 “Value Added Tax”, approved by order of the Ministry of Taxes of Russia dated No. BG-3-03/447).

Value added tax can be paid once a quarter if the monthly revenue (excluding VAT) of the organization does not exceed one million rubles.

- Tax Code of the Russian Federation (Part 2)

- advance payments for VAT

An accountant of a commercial enterprise has the right to write off accounts payable only due to the expiration of the statute of limitations. In all other cases, it can be disposed of by agreement with the partners or after the liquidation of the creditor organization. Conduct an inventory of property and financial obligations, during which their presence, condition and estimated value should be checked. Contact the head of the organization so that he issues an order to approve the composition of the inventory commission. Establish by checking the identity of settlements: - with credit organizations; - with government agencies; - with financial and tax authorities; - with extra-budgetary funds; - with structural divisions of your organization. Determine the correctness and validity of the amount of thefts and shortages on the balance sheet of your enterprise. Determine measures to collect this debt . To do this, you can go to court or resolve the matter with the employees of your organization in another way. Establish, based on the acts provided by the chief accountant, the timing of the occurrence of accounts payable . List in the settlement inventory report (form No. INV-17) the names of the verified accounts. Indicate the amounts of identified agreed and uncoordinated accounts , including those for which the statute of limitations has expired. Attach to the act a certificate listing the names and addresses of creditors, the amount of debt , the time and conditions of its occurrence, confirmed by documents. The certificate is drawn up only for synthetic accounting accounts. At the end of the inventory, calculate the total amounts by lines, pages and for the act as a whole. It must be drawn up in two copies and certified by the signatures of the chairman and members of the commission. Submit one of the copies to the accounting department to check the inventory results. The second remains at the disposal of the commission. Write off the obligations on the accounts in accordance with the order of the head of your organization, assigning the amounts of accounts (including the amount of input VAT) to non-operating income for the reporting period. You can do this only if the statute of limitations on them has expired, or the creditor organization has been liquidated, and you have a corresponding extract from the Unified State Register of Legal Entities. Reflect the following entries: - Debit 60, 66, 67, 71, 76 - Credit 91-1 (non-operating income); - Debit 91-1 - Credit 91-9 (profit at the end of the reporting period); - Debit 91-9 - Credit 99 (reflection of the financial result); - Debit 99 – Credit 68 (charge of income tax). If your organization uses a simplified taxation system, you will not be able to reduce the amount of accounts payable by the amount of input VAT. Under the simplified tax system, the accountant has the right to take into account only paid expenses as expenses. How to check the accrual of VAT

Source:

Who can they come to?

At the beginning of the article, it was mentioned about the increased efficiency of desk audits from the point of view of additional VAT assessment. However, in reality, it is very difficult to prove such serious violations of the law, such as the use of various schemes for the purpose of obtaining unjustified tax benefits, within the framework of the chamber. Therefore, materials from desk audits, as a rule, become a reason to go to negligent taxpayers for an on-site audit. Who will the tax inspectors knock on first?

Today there is a lot of talk about the risk-based approach, which forms the basis of tax control. In terms of VAT, this is expressed in the so-called tax traffic light , which inspectors see in their programs. Taxpayers are marked in different colors depending on their level of risk of violating tax laws.

As you might guess, red is a bad color. It is assigned to those companies whose activities raise serious suspicions. They do not pay taxes, do not report, have no employees, no office, and so on. In general, they show the classic signs of fly-by-night companies. Green organizations are conscientious taxpayers who do not arouse any suspicion from the tax authorities. They do everything on time, including resolving emerging issues, for example, submitting clarifications on VAT. Organizations to which the tax authorities may have questions regarding individual transactions are marked in yellow. For example, among the counterparties of such a company is one of the other “yellow” or “red”.

It would seem that companies that are colored red have the greatest risk of on-site inspection. Of course, they are also checked, but the tax authorities pay the main attention to their counterparties and affiliated organizations. They are usually classified as yellow, but can also be green. After all, the one-day items themselves are not of particular interest, since usually there is nothing to take from them. But they are intermediaries in illegal tax schemes, and by unwinding their relationships, you can reach the final beneficiary. But he will already get his in full!

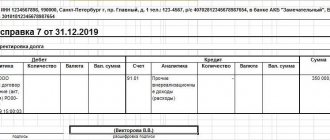

Checking turnover information

Although the courts have repeatedly confirmed that accounting registers are not taxable and that tax authorities should not rely on them during their desk audits and demand them from taxpayers, for an accountant the simplest and proven method for checking a VAT return for years is reconciliation of information with the SALT for the corresponding period .

Data from accounting registers, with correct accounting and tax accounting, give the values indicated in the report.

How to check the VAT return on turnover? Check the SALT figures for the accounts:

- 90 and 91 - sales volume at specific tax rates;

- 60, 62 and 76 - amounts of advances and VAT on them;

- 19 - amounts of deductions;

- 68.2 - all amounts that take part in the calculation and give the final result.

So, you have filled out your VAT return - how to check? If simple VAT is 18% (from - 20%), check the data on the report lines using the following formulas:

Table 1

Arguments for disputes in the Federal Tax Service

When the fact of a tax gap is recorded, additional VAT is charged. Often, a company (entrepreneur) that disagrees with this turn of affairs has to prove its case in court. And often they succeed. In this case, the taxpayer has the following arguments:

- collusion between counterparties, interaction with dependent organizations - the tax inspectorate must prove these facts; suspicions alone are not enough to remove the deduction;

- the real nature of the transaction is confirmed by primary documents, including invoices;

- a gap found in the transactions of counterparties of the second and subsequent links cannot be grounds for refusal to deduct, since the company did not participate in these transactions;

- The buyer is not responsible for the actions of the seller and cannot be deprived of a deduction because he failed to fulfill his tax obligations.

However, do not forget about the importance of exercising due diligence and checking your counterparties. An organization may be deprived of a deduction because its partner works with an unreliable supplier, and it was within her power to find out. For example, in judicial practice there were cases when arbitrators denied a taxpayer a deduction due to the fact that at the time of the transaction the counterparty supplier was not in the register of legal entities (Resolution 18 AAS dated 01.02.2017 No. 18AP-16650/2016).

How to check the VAT return using the balance sheet?

It is very important for an accountant, before submitting a VAT return, to double-check its completion, and in particular, the correct calculation of VAT payable to the state budget. This will help the company avoid penalties for possible errors and legal costs.

Procedure 1: Checking VAT accrual

Step-by-step algorithm:

- First of all, check the data from the general ledger. It is necessary to check the correspondence of the numbers and dates of the primary accompanying documentation that you use when filling out accounting records, check the amounts of payments and taxes on them. Correct all discrepancies and contradictions before the declaration falls into the hands of the tax inspector, otherwise you risk paying a penalty after a desk audit.

- Analyze the balance sheet. Now it is important to divide the data from accounts 60 and 62 into subaccounts, where 60.2 and 62.1 are always exclusively in debit, and 60.1 and 62.2 are in credit, respectively. If there is a contradiction, reconcile the balance at the end of the tax period using accounts and amounts from the books of purchases and sales.

- Next, you need to create a statement for account 41 “Goods”. The remaining goods must be in debit and not highlighted in red in accounting. Otherwise, if an error was made, check all issued and received invoices for mis-grading.

- In this order, you need to create a statement of account 19 “VAT on acquired values”, where the debit balance should be zero.

- If there were advances during the reporting period of the declaration, the balance sheet of subaccount 76 “Advances” should be opened. Multiply the credit of subaccount 62.2 by the VAT rate - the value should coincide with the credit at the end of the period.

- In the 1C program, you need to create a subaccount for counterparties, check all invoices, accompanying documents, amounts paid and received - they should not freeze. If you have signed multiple agreements with the same supplier or customer, break them down separately in your accounting. This will help you avoid getting lost in payments and advances, as well as VAT calculations.

- Be sure to check the data on the purchase and sales books for issued and received invoices: their numbers, dates, product names, amounts and costs - do not allow continuous numbering. The manager or chief accountant of the enterprise must approve the signatures and seals in the documentation if corrections have been made to them.

- Check the invoice journal: data on numbers and dates, VAT amounts, total cost, name of the buyer, TIN number and final amounts using the balance sheet. If the transfer of products was free of charge, invoices are not recorded in the journal. The invoice for the advance payment, if there was one, is also not registered.

- Next, it would be advisable to number the sales book, sew it together, certify the information with the seal and signature of the head of the organization, and indicate the number of pages on the last page on the reverse side.

- After checking the details of the purchase book, check the data with the specified statements. Tax documents must be registered in the period when the right to VAT deduction arose.

- If you missed an invoice for the last tax period, or made a mistake in it, cancel it. In this case, you need to fill out an additional sheet, draw up and submit an updated VAT return.

Procedure 2: Checking the balance sheet and accounting

To do this, use accounts 46, 47, 48, reconcile the data from the order journal 11, 13, statements 16 and 16a.

List of documentation to check the total turnover of product sales for tax purposes:

- statements of current bank accounts of the enterprise.

- bank and cash documents.

- statements of product sales and settlements.

- paid customer invoice, etc.

From the statement, determine:

- when the amount from the advance payment will be in the buyer's settlement account, and not in the sales account;

- Are there any errors in tax calculations?

All tax return data must match the data on the accounting forms.

Within the specified period, the taxpayer can correct errors in the prepared annual report. Failure to do so on time may result in a fine.

All of the above measures are necessary to prevent improper and unacceptable reduction in turnover and understatement of tax.

Dear readers, the information in the article may be out of date, please take advantage of a free consultation by calling: Moscow +7 , St. Petersburg +7 or using the feedback form below.

Source:

Tax traffic light

And now some information about what colors taxpayers appear in in the tax program. Tax officials are not particularly imaginative in this regard - they use the colors of traffic lights. The color of a particular company is not assigned forever; the color can change every quarter (usually after the camera room).

What does their tax traffic light mean for inspectors?

1. Red – companies with signs of being ephemeral. This is a classic - companies that, as a rule, do not have an office, staff, landline telephone, do not pay taxes or the amounts of payments are insignificant.

2. Green – organizations with real activities, turnover, assets, personnel. Such companies pay taxes, submit reports, and respond to requests and demands from tax authorities. The accounting department of such organizations actively responds to claims from tax authorities, communicates with them, and eliminates violations.

3. Yellow – all other companies that have errors in their invoice details and tax returns. Such companies can claim a deduction for the counterparty, which is marked in red or yellow by the tax authorities. As a rule, declarations of large companies that defend the right to a tax deduction are painted in this color even when the tax authorities have claims against their counterparties.

How can an accountant check himself?

There is a joke that an accountant, like a sapper, makes one mistake. In part, this is true. As soon as an accountant fails to check himself once, a technical inaccuracy or error entails unreliable reporting, clarification of tax return data and additional payment of taxes.

Therefore, it is important for an accountant to check himself in a timely manner.

Let us outline the main stages of an accountant’s self-test

It is better to check the correctness of filling out primary accounting documents immediately upon receipt.

Having received the primary document, it is necessary to check the completion of the required details, the presence of signatures and seals, as well as the arithmetic of the document.

If you have any comments, you can make a copy of the documents, mark the incorrect details with a red pen and return this copy to the counterparty for correction.

The original document issued by the counterparty with errors should be marked with a signal mark and replaced upon receipt of a correctly completed primary document.

Before preparing monthly reports, you must make sure that all documents related to the current month are reflected in the accounting. Documents must be processed in accounting as they are received. There is no need to accumulate a large number of documents that have not been processed in accounting.

Processed documents must be filed in folders by date, from least to highest. If necessary, you can always find the original electronic document by the date of its creation.

If you have loans and credits, you need to check the accrual of interest on loans and credits. Please note that for banks, the settlement period may not coincide with the calendar month.

Therefore, it is advisable to keep a table of interest rates for each loan agreement. And control the amount of accrued interest.

Some banks have a settlement period from the 15th to the 15th, while other banks charge interest from the 30th to the 30th.

Discrepancies in the amounts of accrued interest between banks and the enterprise must be assessed and verified.

Before preparing reports, it is necessary to reconcile the balances of balance sheet accounts 50 “Cash” and 51 “Cash account”, generated in the accounting program, with the balances of the cash book and bank statements as of the last day of the month. In practice, the following situations occur:

- We uploaded the data into the program, and some of the documents (bank statements) were cleared (the check mark for posting the document was removed).

- The bank has changed the statement originally issued.

In any case, you need to make sure that bank and cash balances are reflected correctly.

After this, you can carry out the routine operation “Closing the month”. We propose to carry out this routine operation at least 2 times.

- The first time we “close the month”,

- look at the balance sheet for the month,

- find and correct errors,

- We are holding the “closing of the month” again,

- We close the period in the program.

We begin to analyze the data generated in the balance sheet. What you need to pay attention to:

- there should be no account balances 20,44,90,91,

- there should be no red balances on accounts 62.1, 62.2, 60.1, 60.2,

- to check the residual value of fixed assets, we create a depreciation sheet and carefully look to see if there is a negative balance at the end of the period for each fixed asset; such errors are possible if some operations with fixed assets were carried out manually; to correct the error, it is necessary to re-perform the operations on the corresponding fixed asset ,

- it is necessary to generate analytical data for each of the subaccounts 62, 60, 76 and analyze the balances for each counterparty,

- if the same counterparty has the same balances for each of the subaccounts, we create a counterparty card, analyze it again and sequentially transfer all documents to the counterparty,

- we create a statement for the 10th account “Materials” and analyze the balances, paying attention to numbers that are too large or too small,

- we create account 19, check the correspondence of the amount on account Dt 19 and account Dt 60, if there are no balances on account 60 for this counterparty, we ask ourselves the question: for what reason is the VAT deduction not accepted?

- Similarly, we check the correspondence of account balances 76AB and 62.2.

In practice, we always did this: we deciphered each of the balance sheet balances. Sometimes primary documents were raised, for example, to make sure that the contract actually provided for prepayment of work.

After conducting such an analysis, the accountant can be sure that all balances reflected in the accounting accounts are supported by documents and correspond to reality.

We close the month again and close the period in the accounting program. Forming a balance, is Asset equal to Liability?

What else should you pay attention to?

It is necessary to request from the tax office a reconciliation of settlements with the budget and compare them with accounting data and, if necessary, make adjustments.

We prepare tax returns

The transport tax declaration is automatically generated from the 1C-Accounting 8 program; to do this, you need to enter data on the registration and deregistration of the vehicle into the directory. Moreover, these data must correspond to the PTS data; the sale of the vehicle may be later than deregistration. But the declaration must indicate exactly the date of deregistration.

The VAT return in the 1C-Accounting 8 program is generated correctly if you have correctly recorded business transactions in your accounting.

After you fill out the VAT return, create a Purchase Book and a Sales Book. Your task is to reconcile the amounts according to the declaration and according to the books.

Then you need to generate an accounting document “Analysis of account 68.2” and check it with the VAT return and the books.

The income tax return is generated in the 1C-Accounting program quite correctly, but verification is still necessary. Fill out the declaration, and then decipher each line of each sheet, create balance sheets for accounts 90 and 91 according to tax accounting data and check the declaration data.

Filling out a declaration under UTII or simplified tax system is not difficult. It is only important to check the amount of accrued and transferred tax payments.

And more tips from practice.

- Avoid “manual operations” and “manual adjustments” in accounting. This will allow you to obtain correctly completed accounting and tax registers.

- Do not rush to “break” the standard configuration of the accounting program. Explore all the capabilities of the program, try to use existing standard documents and processing. Otherwise, every time you update the program platform, you will need to take into account changes in non-standard documents, which will require additional financial investments for the business.

- If an enterprise applies a special tax regime, ensure compliance with the conditions under which the application of this regime is possible.

Source:

Point system: how information on the beneficiary is collected

The system has a huge section for filling out information. A system of points has been introduced, which are assigned to a company based on an analysis of about 30 indicators. These indicators include information about property, staff, etc.

Points are assigned for each essential criterion. The more points, the more “essential” the company and the greater the risk that it is a beneficiary.

Reducing risks at every stage of working with VAT: correct preparation of the declaration, elimination of errors and discrepancies in invoices, quick response to the requirements of the Federal Tax Service.

Try for free

There is such a criterion in the regulations as the solvency of the beneficiary. Solvency is determined through an analysis of the ratio of the amount of taxes paid to the amount of “scheme” deductions that the tax authority discovered. When there is a large gap, but at the same time a meager amount of taxes paid is shown, suspicions arise.

How to avoid problems during tax audits

First, you need to forget about the services of optimizers. All the promises they make have no basis and do not work in modern conditions. Rather, optimizers become a serious source of problems.

Do not ignore the requirements of the tax authorities. They must be answered in any case. If you believe that it is illegal, then provide a reasoned refusal or documents that provide you with protection.

Be proactive. Receiving a demand is a signal that they are already interested in you as a participant in some chain, so they are trying to get information and evidence from you to file a claim under Art. 54.1 Tax Code of the Russian Federation. Therefore, do not wait for on-site inspections, but begin to act as soon as you receive the requirements.