In what cases and when is it used?

The unified form of the OS-1b act is used by the recipient organization for:

- inclusion of property in the form of a group of homogeneous objects in the fixed assets (their accounting and commissioning), acquired under sales contracts or for cash;

- when registering a financial lease (when the property is on the balance sheet of the lessee);

- when unaccounted for property is discovered during the inventory or manufactured in-house or with the help of contractors;

- exclusion from the OS of a group of objects during exchange, sale, donation, or transfer to another enterprise.

Important! The donating organization issues the OS-1b form only when exchanging, selling, or gratuitously transferring fixed assets.

For objects that do not require installation, the start of operation occurs at the time of purchase. If installation is necessary, then inclusion in the OS is carried out after the equipment assembly process. Initially, the property is accepted according to the OS-14 act, after which they are transferred for installation on the basis of the OS-15 form.

Who needs a form and why?

When equipment and intangible assets are received, the accountant credits them to account 08, which is intended to account for the costs of acquiring assets.

While the objects are listed on this account, they are not used in business activities. To commission equipment, a commission consisting of several employees is appointed. Most often, this is the head of the enterprise, the chief accountant and those responsible for the further use of the facility. The document confirming its inclusion on the balance sheet as a fixed asset is an act of form OS-1.

ConsultantPlus experts discussed how to correctly account for the sale of fixed assets. Use these instructions for free.

Which form should I use?

There are several types of unified forms for acceptance of fixed assets:

- OS-1 - for single OS;

- OS-1a - for one building and structure;

- OS-1b - for several objects (homogeneous), with the exception of buildings and structures.

Do not confuse these forms when putting the OS into operation.

You can also use a self-developed form in your work. The main point in this situation is the approval of the form by order of the head of the enterprise and the presence of all required details.

In practice, there are times when none of the listed forms are suitable. For example, the receipt of a fixed asset by the lessee company under a leasing contract. This application cannot be processed using standardized forms; the only solution is to develop your own form. All necessary data is entered into the document in accordance with the Federal Law of December 6, 2011 No. 402-FZ (Article 9).

Who fills it out and on what basis?

Form OS-1 is filled out by an accountant or other responsible person on the basis of technical documentation and approved by the heads of two organizations - the supplier and the buyer. The form was approved by Decree of the State Statistics Committee of Russia dated January 21, 2003 No. 7.

When selling a fixed asset, the delivering organization fills out the left side of the act, and the recipient organization fills out the right side. Pay attention to the sample act OS-1 for the sale of a fixed asset (title page) and the required details.

Filling out a unified form for the acceptance and transfer of groups of objects

The OS-1b act form consists of 4 pages.

Information contained in the introductory part of the unified form:

- data on organizations concluding a transaction for the acceptance and transfer of groups of objects: full name, OKPO code, bank account details, legal address, contact telephone number;

- information about the basis for drawing up the document (agreement for the acquisition of a group, an order from the manager on commissioning);

- day of reflection in the accounting documentation;

- title of the form, its number and date of preparation;

- purposes of transfer (sale, donation, inclusion in fixed assets);

- name of the organization producing the objects;

- background information about the participants in shared ownership (if any).

In the OS-1b form, information about a property owned by 2 or more enterprises is recorded in proportion to the company’s share in the common property right.

And on the page of the act, in the “For reference” section, information about the participants in shared ownership is entered.

The following pages of the OS-1b act form (from 2 to 4) are presented in the form of tables.

Second page

Information contained on the second page of form OS-1b:

- names of transferred fixed assets;

- factory, OS inventory number, depreciation group;

- year of manufacture, year of start of operation and major overhaul (if any).

The table is signed by members of the commission who receive the group of funds.

Below in the OS-1b act, the date of the activities carried out by the commission to inspect the main objects and the final conclusion are stated.

Finally, the applicable useful life of the specific property is indicated.

Technical documentation for each OS object is attached to the act; its presence is recorded at the bottom of the page.

Third sheet

The third page of the OS-1b form contains the information:

- actual service life of the property, depreciation and residual value (for used equipment);

- the cost of purchased objects for 1 unit and for the entire set of fixed assets;

- useful life of the asset, depreciation method.

This page of the unified form OS-1b is signed by the responsible employee of the submitting organization, the date and transcript of the employee’s signature are recorded.

Important! The chief accountant puts a mark on the inventory card about the disposal of fixed assets from the balance sheet of the enterprise.

Fourth page

The following information is entered on the fourth page of the OS-1b form:

- brief description, characteristics of the group of transferred property;

- content of precious metals in fixed assets in the object, their name, weight, quantity, item number, unit of measurement.

The sheet is signed by the receiving party.

The responsible specialist of the recipient organization affixes his autograph as confirmation of acceptance of the objects, including for safekeeping.

If an employee acts on behalf of the company under a power of attorney, then the details of the trust document are recorded in specially designated fields.

At the end of the OS-1b form, the chief accountant of the company signs for the opening of an inventory card for the OS object.

Sample

Below we offer a unified form OS-1b and a completed sample document in Excel format for free.

If you still have questions about filling out the transfer and acceptance certificate, you can ask them through the comments at the bottom of the article.

act of acceptance and transfer of a group of fixed assets OS-1b - excel.

filling out form OS-1b - excel.

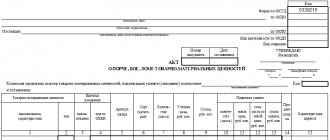

Completed example of act OS-1b:

When selling

Documentation for the sale of objects is filled out on the date of transfer of property rights to the buyer (the day of signing the purchase and sale agreement for fixed assets).

The acceptance certificate is drawn up in 2 copies - for the seller and the buyer. The basis for the act is also a signed contract between organizations.

The characteristics that unite property into groups include the purpose of the transfer and the manufacturing company. The goal is to sell, but the manufacturers may be different. When selling, for example, printers and copiers, from different manufacturers, separate acts are drawn up for each group of office equipment.

When the donating organization writes off a group of fixed assets, the accounting department stops accruing depreciation and property tax (if the former property was taxed).

The recipient company, on the contrary, begins to charge depreciation from the date of acceptance of the fixed asset into operation, as well as property tax.

What is the OS-1b form

This form is an act containing information on the acceptance and transfer of groups of fixed assets.

IMPORTANT! This act does not apply to buildings and structures. For them, the OS-1a form is used. The movement of individual fixed assets is reflected in the OS-1 act.

The unified form OS-1b, as well as 2 other varieties of this form, was approved by Decree of the State Statistics Committee of the Russian Federation dated January 21, 2003 No. 7. However, it is not mandatory for use and can be replaced by another document of similar content, developed independently.

Having such an act in hand, you can perform the following operations:

- on the transfer of fixed assets between counterparties;

- entering objects into fixed assets;

- disposal of fixed assets.

If you have access to ConsultantPlus, go to the Typical Situation and find out how to take into account the receipt of OS when purchasing. If you don't have access, get a free trial of online legal access.

To learn about the specifics of fixed assets accepted for accounting under the simplified tax system, read the article “Procedure for purchasing fixed assets under the simplified tax system (nuances)” .

Form OS-1b can be downloaded on our website.

conclusions

If it is necessary to formalize the transfer and acceptance of a group of objects that have homogeneous characteristics, then it is more convenient to fill out not separate acts for each fixed asset, but to fill out a single form in which data for the entire group will be combined.

You can draw up a transfer deed in free form, or use the unified OS-1b form. The form is presented on 4 pages and reflects a complete set of information about the parties to the process and the transferred equipment or other property.

Form OS-1b cannot be used to formalize the transfer of real estate.

Sample of filling out form OS-1b

In the introductory part of the document on the first sheet of the form, the following is indicated:

- general information about the contracting parties: their names, addresses, bank details;

- information about the operation: the contract on the basis of which the acceptance and transfer of objects is carried out, the date and account of reflection in accounting;

- information about the purpose of using the objects;

- information about the manufacturer.

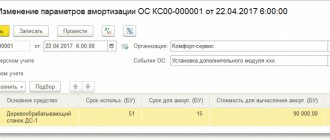

The tabular part of the act, occupying pages 2–4 of the form, provides detailed information about the fixed asset:

- its name;

- inventory number;

- date of commissioning;

- depreciation group;

- Production year;

- initial cost;

- amount of depreciation (at disposal);

- residual value (at disposal);

- useful life period;

- selected depreciation method;

- share in the right of ownership (indicated as a percentage for shared-share relations);

- actual service life (at disposal);

- brief information about the object (its technical characteristics);

- information about the precious metals it contains (if any).

IMPORTANT! The act should indicate the composition of the commission that accepts the fixed asset, as well as the final conclusion made by this commission. In the conclusion, it is necessary to indicate what useful life will be applied to a particular fixed asset.

A sample of filling out this form is presented on our website. You can download it and adjust it to suit your situation.