Who needs to submit a VAT return in 2017

The VAT return in 2021 must be prepared by organizations and individual entrepreneurs, including intermediaries, which (clause 5 of Article 174 and subclause 1 of clause 5 of Article 173 of the Tax Code of the Russian Federation):

- are recognized as VAT payers;

- are tax agents for VAT.

At the same time, the following may not submit a VAT return in 2021:

- organizations and individual entrepreneurs using the simplified tax system, unified agricultural tax, UTII or patent taxation system;

- organizations exempt from VAT (whose revenue excluding VAT over the last 3 months did not exceed 2 million rubles);

- taxpayers submitting a simplified tax return (who have no VAT transactions or no movements in current accounts).

Deadline for submitting VAT returns and deadlines for paying VAT for the 3rd quarter of 2021.

25.02.2020.

Deadline for submitting 6-NDFL calculations for the 4th quarter of 2021.

All employers (organizations and individual entrepreneurs-employers, being tax agents for personal income tax, are required to submit reports for 4 ...

16.02.2020.

Payment of insurance contributions for January 2021.

Employers-insurers must transfer insurance premiums no later than the 15th day of the month following the month of accrual of contributions (clause 3 of Article 431 of the Tax Code ...

5.02.2020.

Cancellation of UTII in 2021 - new data

Many entrepreneurs use UTII as a convenient and reliable way to save a significant part of their income. However, the deadline is inevitably approaching...

4.02.2020.

SZVM report due date for January 2021

From January 01, 2021 the SZV-M form is submitted to the Pension Fund branch at the employer’s place of registration no later than the 15th day of the next month. ...

4.02.2020.

Storage periods for primary documents – changes in 2020

From February 18, 2021, Order No. 558 of the Ministry of Culture of Russia dated August 25, 2010 on the list of standard management archival documents, ...

3.02.2020.

Since 2021, the balance sheet has not been submitted to Rosstat

The process of filing financial statements has been significantly simplified and accelerated at the same time due to the transition to electronic data transmission. ...

31.01.2020.

Unified property tax return - why you can’t file it

A company may have several real estate properties and be registered with the Federal Tax Service at their registered addresses. In this case, the Tax Code allows you to report on...

30.01.2020.

Desk audit is a cause for concern

If you receive a notification about a desk audit after the declaration has been submitted, this may mean that the tax inspector...

simplified tax system income in the form of real estate. Do you need accounting?

If an individual entrepreneur or an organization with a simplified tax system received income in kind, for example in the form of real estate, then it is necessary to record this...

Format for exchanging documents when registering cash registers - changes

The Federal Tax Service has changed the format for exchanging documents when registering cash registers. The corresponding order No. ED-7-20/ [email protected] dated 02/04/2020 changes the recommended format...

Is the sale of land subject to tax when applying the External Tax Code?

There are often cases when entrepreneurs on the Unified State Tax System sell land they own on a one-time basis to improve their financial affairs. The question arises about accounting...

The complaint to the higher body of the Federal Tax Service is now in a new form

Based on Art. 138 of the Tax Code of the Russian Federation, individual entrepreneurs and organizations have the right to file a complaint with a higher body of the Federal Tax Service against the actions or inactions of the Federal Tax Service on decisions based on the results of...

Collection of Pension Fund fines through the court is an important change in the law

Each employer is obliged to submit information about employees to the Pension Fund in a timely and complete manner. Failure to comply with the requirements of Article 17 of the Law of...

Deadlines for submitting the declaration in 2021: table

Submit your VAT return for 2021 no later than the 25th day of the month following the reporting quarter. We list the deadlines in the table.

| Reporting period | The deadline for submitting the declaration is 2021 |

| 4th quarter 2021 | no later than 01/25/2017 |

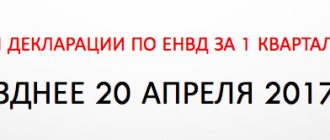

| 1st quarter 2021 | no later than 04/25/2017 |

| 2nd quarter 2021 | no later than July 25, 2017 |

| 3rd quarter 2021 | no later than October 25, 2017 |

VAT for the 3rd quarter 2021

What are the changes in the VAT form for the 3rd quarter of 2021?

The VAT return form has not changed. You must report to the Federal Tax Service for the 3rd quarter of 2021 using the declaration form, valid from March 12, 2017 and approved by Federal Tax Service order No. ММВ-7-3/ [email protected] dated October 29, 2014, as amended by Federal Tax Service order No. ММВ- dated December 20, 2016 7-3/ [email protected] The same form was submitted by taxpayers for the 1st and 2nd quarters of 2021.

Who submits VAT for the 3rd quarter of 2021?

VAT returns are submitted by legal entities and individual entrepreneurs, as well as intermediaries recognized as VAT payers. In some cases, the declaration is submitted by those who do not pay VAT (for example, companies using the simplified tax system), if during the reporting period they issued invoices with allocated VAT.

VAT payment deadline for the 3rd quarter of 2021

The VAT payment deadline has not changed. Companies and individual entrepreneurs must pay tax in equal installments in the amount of 1/3 of the total VAT amount for the reporting period. The deadline for making a transfer to the budget is the 25th of each month.

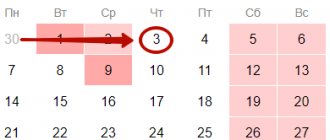

When paying tax, we are guided by the rule (according to clause 7 of Article 6.1 of the Tax Code of the Russian Federation) - if the deadline for paying the tax falls on a weekend or holiday, then it is postponed to the first working day following the weekend.

If you are still late in paying the tax, the fine will be 20% of the amount of the arrears. If intentional non-payment of VAT is proven, the fine will increase and will vary from 20 to 40 percent of the amount of tax payable. Tax officials also have the right to suspend transactions on bank accounts.

You can transfer VAT ahead of schedule: for example, pay the full tax on the due date of the first payment or 1/3 of the tax as part of the first transfer, and the remaining 2/3 of the VAT amount on the due date of the second payment. This scheme will not entail penalties from tax authorities.

We do not recommend postponing the transfer of the entire VAT amount, for example, until the third payment - then the accrual of penalties will definitely not be avoided.

VAT payment deadline for the 3rd quarter of 2021

| Payment number | Deadline for transferring VAT to the budget |

| First | October 25, 2021 |

| Second | November 27, 2021 |

| Third | December 25, 2021 |

Special deadlines for VAT payment for the 3rd quarter of 2021

Import from EAEU countries. Separate deadlines for paying VAT are established for taxpayers importing imports from EAEU countries. The transfer of tax to the budget is carried out until the 20th day of the month, which follows the month in which imported products were taken into account. For example, in October 2021, imported goods were registered, and tax will need to be paid no later than November 20.

Purchase from a foreign counterparty. An exception for payment deadlines for VAT tax agents applies in the case of purchasing products from a foreign company that is not registered for tax purposes in Russia. There are special rules for transferring VAT to the budget. The tax must be transferred to the budget on the same day when payment to the foreign counterparty for the transaction occurs.

Incorrectly issued invoice. Special rules apply to individual entrepreneurs and companies that use UTII and the simplified tax system and are thus exempt from tax by law. As a general rule, they should not remit VAT at all. However, in a number of cases, VAT is included as a separate line item in the invoices they issue to customers. Then simplifiers and imputators take on the responsibility of transferring the tax and are obliged to pay VAT in the month following the quarter in which VAT invoices were issued. The deadline is no later than the 25th day of the month following this quarter. The tax is paid in full, without breaking it down into parts. If invoices with allocated VAT were erroneously issued in the 3rd quarter of 2021, the full amount of VAT must be transferred no later than October 25, 2017.

Deadline for submitting the VAT return for the 3rd quarter of 2021

The VAT return is submitted only electronically using Electronic Reporting systems. Submitting a return on paper will be considered equivalent to failure to submit a report.

The declaration is submitted no later than the 25th day of the month following the reporting period. ND for VAT for the 3rd quarter of 2021 must be submitted no later than October 25, 2021. The VAT return is sent to the Federal Tax Service at the place of registration of the parent company or individual entrepreneur.

Late filing of the return will subject the company to a fine of 5% of the tax amount for each full and partial month, starting from the deadline for filing the report. The fine cannot exceed 30% of the tax amount, but cannot be less than 1000 rubles.

There is a practice of imposing a fine for late submission of a zero VAT return. Also, the Federal Tax Service can block a company’s current account for failure to submit VAT tax returns 10 working days after the deadline for submitting the report.

Deadline for submitting the journal of received and issued invoices in 2021

In 2021, intermediaries acting in the interests of third parties on their own behalf are required to submit logs of invoices received and issued. They are:

- commission agents;

- agents;

- forwarders (involving third parties without their own participation);

- developers (involving third parties without their own participation).

The deadline for submitting the log of received and issued invoices is no later than the 20th day of the month following the expired quarter. Below in the table we present the deadlines for submitting the journal of received and issued invoices in 2021.

| Reporting period | Deadline for journals is 2021 |

| 4th quarter 2021 | no later than 01/20/2017 |

| 1st quarter 2021 | no later than 04/20/2017 |

| 2nd quarter 2021 | no later than July 20, 2017 |

| 3rd quarter 2021 | no later than October 20, 2017 |

How to avoid difficulties when sending a declaration

Firstly, it is important to determine how data will be downloaded from the accounting system and converted into the required xml format. If there is a large volume of transactions, it will be quite difficult for an accountant to fill out the declaration personally. For these purposes, it is optimal to use a special software product that converts information (from Excel tables into xml format). For example, the VAT+ (Reconciliation) service converts xls, xlsx and csv files into the format established by the tax authority.

Secondly, in order not to encounter errors when uploading files or submitting a declaration, it is important that all data is entered correctly. To do this, it is necessary to enter information into the purchase and sales books, as well as fill out invoices in accordance with all established requirements (Resolution of the Government of the Russian Federation dated December 26, 2011 No. 1137).

Thirdly, when sending an electronic declaration, it is important not to allow “overweight”. Declarations with attachments can weigh up to several gigabytes, which means that preparing and sending such a volume will take a lot of time. You should first check whether your computer and Internet connection can cope with such tasks.

Delivery method in 2021

VAT returns must be submitted to the Federal Tax Service exclusively in electronic form through authorized telecom operators. And this has nothing to do with the number of employees of the organization and applies to everyone who must prepare VAT returns. Paper declarations are not considered submitted in 2021 (letter of the Federal Tax Service of Russia dated January 31, 2015 No. OA-4-17/1350).

An exception is made for tax agents who are not VAT payers and do not conduct intermediary activities with the issuance of invoices on their own behalf. They can submit VAT returns on paper (clause 5 of article 174 and clause 3 of article 80 of the Tax Code of the Russian Federation).

Also see “Explanations for VAT returns from 2021: sample”.

Read also

03.07.2017

What does the declaration include?

The declaration includes a title page and 12 sections.

The title page and section 1 of the declaration are submitted by all taxpayers (tax agents).

Sections 2 - 12, as well as appendices to sections 3, 8 and 9 of the declaration are included in the declaration when taxpayers carry out relevant transactions.

To send a declaration to the Federal Tax Service via telecommunication channels, you need to upload data in xml format, which is established by the tax service. After that, they are combined into an archive and sent in one package to the Federal Tax Service.

Who can be a VAT payer?

VAT payers can be both legal entities and individual entrepreneurs who have chosen the general taxation system. And also VAT payers are those taxpayers who import goods from abroad, regardless of what taxation system they are on.

Also, VAT payers can be divided into two groups:

- Domestic – implies payment of VAT tax within the country;

- External – tax is paid when goods are imported into the Russian Federation from abroad.

Current declaration form (2020)

The new VAT return was approved by Order of the Federal Tax Service of Russia dated October 29, 2014 N MMV-7-3/ with amendments made by Order of the Federal Tax Service of Russia dated December 28, 2018 N SA-7-3/ The new form of the VAT return is already applied from the submission of a tax return on VAT for the 1st quarter of 2021.

At the same time, no changes were made to the declaration part from January 1, 2021. Therefore, in 2021, conditionally, the old form of VAT reporting continues to be used.

Also see:

Consequences of late filing of VAT reports

Violation of reporting deadlines for the specified tax is a tax offense that provides for sanctions. Namely, the taxpayer is obliged to pay a tax penalty. It is important that the amount of the fine is not fixed, but flexible, since it depends on the unpaid amount of tax and is 5% of such amount. Please note that despite this, such a fine should not exceed 30% of the amount of unpaid tax, but not less than 1000 rubles.

We hope that our article was useful and interesting. And now you will not have any difficulties in determining the correct deadline for filing your tax return. Do not violate tax laws and submit your returns on time.

How the Federal Tax Service verifies data on invoices

It is important for tax authorities to find a copy of the second counterparty for each invoice and compare them with each other. If during the inspection it is discovered that the invoices differ in some way, the Federal Tax Service requests the relevant explanations from the legal entity or individual entrepreneur.

After this, the company has five days to respond with a clarification declaration or documents containing confirmation of the information specified in the invoices. Otherwise, the organization will be punished with an appropriate fine (clause 1 of Article 126 of the Tax Code of the Russian Federation).

How to fill out

By the way, filling out a zero VAT return follows the same rules as reporting with performance indicators. For example, in the lines that you fill out, information is entered from the first cell. And then they put dashes: as many as necessary.

After filling out the title page in the first section, enter the required details: TIN, KPP, OKTMO. Of course, both sheets must be signed and dated.

Below we have provided a sample of a zero VAT return:

When is VAT charged?

VAT is charged on transactions recognized as subject to taxation. Such operations include:

- sale of goods, works or services;

- free transfer of ownership of goods, results of work, provision of services;

- transfer of goods, works or services on the territory of Russia for one’s own needs, if expenses for them are not accepted when calculating income tax;

- construction and installation work for own needs;

- import of goods.

Deadline for payment of VAT to organizations importing products from the EAEU and other countries

| Period | Payment deadline |

| December 2019 | 20.01.2020 |

| January 2020 | 20.02.2020 |

| February 2020 | 20.03.2020 |

| March 2020 | 20.04.2020 |

| April 2020 | 20.05.2020 |

| May 2020 | 20.06.2020 |

| June 2020 | 20.07.2020 |

| July 2020 | 20.08.2020 |

| August 2020 | 20.09.2020 |

| September 2020 | 20.10.2020 |

| October 2020 | 20.11.2020 |

| November 2020 | 20.12.2020 |

| December 2020 | 20.01.2021 |