Cases of failure to submit reports to the Federal Tax Service are not that rare. They may be due to various reasons. Perhaps they simply forgot, or did not keep track of changes in legislation, or perhaps they began to engage in a new type of activity.

For example, newly created organizations often forget to submit Information on the average number of employees. For newly created organizations, the deadline for submitting such information is no later than the 20th day of the month following the month of registration (creation) of the organization. In the future, such an organization is obliged to submit information on the average headcount once a year (no later than January 20), like all long-standing organizations.

Regardless of the reasons, sanctions from regulatory authorities will still follow. Let's figure out what they can be (

Types of reports, sanctions and fines

All mandatory reports that businessmen submit can be divided into the following groups:

- Financial statements.

- Tax reporting.

- Reporting to extra-budgetary funds.

- Statistical reporting.

Each category has its own measures of influence on violators. Sanctions can be of the following types:

- Fixed fines.

- Fines depending on reporting indicators.

- Blocking of accounts.

Responsibility for the violation lies with both the organization and the guilty official. Usually this is the manager, but the chief accountant can also be punished.

Where can I get the details to fill out a payment form?

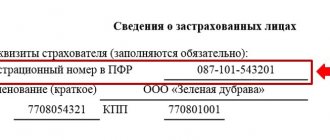

Let's look at an example of how to find the details of the Moscow Pension Fund for paying a fine in 2021 under SZV-M.

Step 1. Go to the main page of the official website of the Pension Fund of the Russian Federation, indicate the region in which the organization operates (in our case, it is Moscow). Then go to the “Information for Region Residents” section.

Step 2. Find in the list of links the section with bank details for paying penalties.

Step 3. Go to the desired section and you will find complete details for paying a fine to the Moscow Pension Fund for SZV-M in 2021 and filling out the corresponding payment order.

Financial statements

Legal entities must submit financial statements for 2021 to the Federal Tax Service and statistics authorities.

Therefore, if a businessman does not meet the deadline, he will be punished twice. In addition, the guilty officials will be fined separately.

- If the report is not submitted to the Federal Tax Service, the fine will be 200 rubles for each reporting form (clause 1 of Article 126 of the Tax Code of the Russian Federation). In this case, small enterprises will have an “advantage”, because for them the mandatory “set” of financial statements is limited to the balance sheet and form No. 2.

- For failure to submit financial statements to statistics, a larger fine is provided - from 3,000 to 5,000 rubles, regardless of the number of forms (Article 19.7 of the Code of Administrative Offenses of the Russian Federation).

- In both cases, the guilty officials will be fined from 300 to 500 rubles. (Articles 15.6 and 19.7 of the Code of Administrative Offenses of the Russian Federation).

The procedure described above is valid for the last time when submitting reports for 2021.

Next, the changes introduced by the law of November 28, 2018 No. 444-FZ will come into effect.

- Accounting statements will need to be submitted only to the Federal Tax Service.

- The “electronic” delivery format will become mandatory. An exception is made only for small enterprises, which can still report for the last time “on paper” for 2021.

The question arises: since there will be no need to submit financial statements to statistics in the future, then for violation of deadlines there will only be a “symbolic” fine in the amount of 200 rubles. for a document?

But everything is not so simple... The bill provides for a sharp tightening of sanctions for late submission of financial statements. Fines imposed on organizations and officials will amount to tens and even hundreds of thousands of rubles.

Sanctions will depend on the length of the delay and whether the unsubmitted reports are subject to mandatory audit.

The maximum fine provided for by the bill will be up to 700,000 rubles. for organizations and up to 50,000 rubles. - for officials.

It is assumed that the new law will come into force on January 1, 2021, i.e. will apply to violations committed upon submission of reports for 2021 and later.

Information presentation formats

Tax reporting documentation can be submitted electronically or on paper. This depends both on the tax or fee for which the document is generated, and on the company itself. When choosing a format for presenting data, it is necessary to focus on what exactly is specified in the legislation for a particular situation. However, you need to understand that submitting reports on paper is associated with an impressive amount of labor and time, while filing electronically allows you to reduce them.

As for the reporting method, it could be:

- personal visit to the Federal Tax Service Inspectorate office by the head or other person authorized to transmit reports (based on a power of attorney);

- sending a registered letter by Russian Post with a list of the attachments;

- personal account on the Federal Tax Service website;

- sending via telecommunication channels (TCC).

Important! It is imperative to make sure that one or another transmission method can be used for a particular type of report. If you violate the reporting rules, it will not be accepted by the tax authorities.

Tax reporting

Sanctions for late tax reports depend on their category:

- Tax returns and calculation of mandatory insurance contributions (DAM).

In this case, the amount of the fine is “tied” to the amount of tax (contribution) indicated in the report. For each full or partial month of delay, the violator will pay 5% of the amount due to the budget or payment fund (Clause 1 of Article 119 of the Tax Code of the Russian Federation).

If the declaration reflects an insignificant amount, or the report is generally “zero”, then a fixed minimum fine is applied - 1000 rubles.

The upper limit is 30% of the amount indicated in the report, i.e. In case of long delays (more than six months), the fine will no longer increase.

However, if the delay exceeded 10 days, then penalties will not be the biggest problem for a businessman. Indeed, in this case, tax authorities have the right to block his accounts (clause 1, clause 3 and clause 3.2, article 76 of the Tax Code of the Russian Federation)

- Other tax calculations.

These are mandatory tax reports and are not declarations. It must be borne in mind that the declaration is submitted at the end of the tax period, and all “interim” reports, even if they have a similar form, do not apply to declarations.

This applies, for example, to quarterly reports on income or property taxes, because For both of these payments, a one-year tax period is established. But quarterly forms for VAT and UTII are already declarations, because The tax period for them is a quarter.

The calculations also include Form 2-NDFL and information about the average number of employees.

The fine for failure to submit payments is 200 rubles. for each document (clause 1 of article 126 of the Tax Code of the Russian Federation). Account blocking does not apply in this case.

- Form 6-NDFL.

Separately, sanctions have been established for failure by tax agents to submit income tax calculations in Form 6-NDFL.

The fine in this case will be 1000 rubles. for each month of delay (clause 1.2 of Article 126 of the Tax Code of the Russian Federation). If the delay exceeds 10 days, then the tax authorities can block the accounts, as in the case of violations of declarations (clause 3.2 of Article 76 of the Tax Code of the Russian Federation).

As for responsible officials, for them fines for violation of deadlines for all types of tax reports will be the same - from 300 to 500 rubles. (Article 15.5, 15.6 of the Code of Administrative Offenses of the Russian Federation).

Results

The size of fines for failure to submit tax reports does not differ in variety.

It’s easy to remember them: if you’re late with your declaration, get ready to shell out at least 1,000 rubles from your “pocket.” Minimum 300 rubles. It will cost the manager a fine (if you're lucky, you can get off with a warning). It is highly undesirable to be late in submitting your declaration by more than 10 days, since such a delay will give the tax authorities grounds for suspending transactions on bank accounts. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Reporting to extra-budgetary funds

All employers must report quarterly to the Federal Social Insurance Fund of the Russian Federation on contributions “for injuries”. The sanctions here are similar to those applied for violations when filing tax returns: 5% of the amount payable is taken for each overdue month. The minimum is also 1000 rubles, and the maximum is 30%.

The only difference is that the basis for calculating the fine will not be the entire amount indicated in the calculation, but only that accrued over the last three months (Article 26.30 of the Law of July 24, 1998 No. 125-FZ “On Compulsory Social Insurance...”) .

In addition, employers - legal entities must annually send confirmation of their main type of activity to the Federal Social Insurance Fund of the Russian Federation in order for the fund to establish a contribution rate for them “for injuries”.

There is no penalty for late payment in this case. However, the fund then has the right to set a tariff for the violator at the maximum rate, based on all types of activities that are indicated for this organization in the state register (clause 13 of the Russian Government Resolution No. 713 dated December 1, 2005).

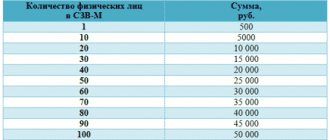

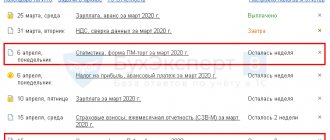

All employers must submit personal information about insured persons to the Pension Fund using the SZV-M and SZV-experience forms.

Fines for violation of deadlines are the same and amount to 500 rubles. for each employee included in the report (Article 17 of the Law of April 1, 1996 No. 27-FZ “On individual (personalized) accounting...").

Officials for delaying any reports sent to extra-budgetary funds will be punished with a fine of 300 to 500 rubles. This is provided for in Art. 15.33 and 15.33.2 of the Code of Administrative Offenses of the Russian Federation.

Examples of fine calculations

Consul LLC submitted a VAT return for the 3rd quarter of 2021, for which the filing deadline is October 25, 2020, and 3 days later - October 28, 2021.

The amount of payment under the ND amounted to 900,000 rubles, of which 300,000 rubles were transferred in arrears.

Since the delay was 3 days, the penalty for violation is calculated as follows:

300,000 × 5% × 1 (month of missed deadline) = 15,000 rubles.

The Federal Tax Service would limit itself to a fine for late submission of a VAT return in the amount of 1,000 rubles if the company paid the tax on time.

Statistical reporting

In addition to financial statements, businessmen must submit various specialized forms to the statistical authorities. Their list will be determined by Rosstat and depends on the type of activity and scale of the business.

The fines in this case are much higher than for failure to submit financial reports. In case of a primary violation, the organization will be fined in the amount of 20,000 to 70,000 rubles, and the official - in the amount of 10,000 to 20,000 rubles.

If the delay is repeated, then the organization may be charged an amount from 100,000 to 150,000 rubles, and from the official - from 30,000 to 50,000 rubles. (Article 13.19 of the Code of Administrative Offenses of the Russian Federation).

In addition, if the delay led to a distortion of the results of Rosstat’s consolidated reporting, then the violator may be required to compensate for the damage incurred by the department (Article 3 of Law No. 2761-1 of May 13, 1992 “On Liability ...”).

It should be noted that in accordance with Art. 2.4 of the Administrative Code of the Russian Federation, individual entrepreneurs “by default” (unless otherwise specified in a specific article of the Administrative Code) bear administrative responsibility as officials.

How to pay the fine?

The taxpayer may pay the fine upon notification sent by the tax office. He can also calculate and pay the fine himself. To do this you need:

- generate and submit reports;

- pay tax;

- determine the amount of the fine;

- pay a fine according to the details of the Federal Tax Service for a specific KBK for fines for this tax;

- carry out a reconciliation with the Federal Tax Service.

Important! The Federal Tax Service can hold a taxpayer accountable only within 3 years from the date of violation of reporting rules. This period does not depend on the tax system, specific tax or type of declaration.

The Federal Tax Service may reduce the fine if there are any mitigating circumstances. The taxpayer should submit an application indicating that tax reporting was not submitted on time for valid reasons. Supporting documents must be attached to the application.

Arguments as mitigating circumstances may include the following:

- the tax is transferred on time without delay;

- a reporting violation was committed for the first time;

- the taxpayer has no debts on other taxes;

If the tax office refuses to reduce the fine, the company may go to court to challenge this decision. When considering the case, it is necessary to submit supporting documents that will confirm the plaintiff’s stated claim.

Conclusion

For violation of reporting deadlines, the law provides mainly for various penalties. They are imposed both on the organization and on the responsible officials.

Fines can be either fixed or calculated based on the amounts reflected in the declarations or the number of individuals included in the report

In addition, accounts may be blocked for delays in a number of tax reports.

Today, maximum fixed fines (up to 150,000 rubles) are established for violations of deadlines for submitting statistical reports.

But if the bill developed by the Ministry of Finance is adopted, then fines for delays in accounting statements in some cases will amount to up to 700,000 rubles.

Checking the 1C database for errors with a 50% discount

Remotely in 1 hour 2000 ₽ 4000 ₽ We will provide a written report on errors. We analyze more than 30 parameters

- Incorrect indication of VAT in documents;

- Errors in mutual settlements (“red” and expanded balances according to settlement documents or agreements on accounts 60, 62, 76.);

- Lack of invoices, checking duplicates;

- Incorrect accounting of inventory items (re-grading, incorrect sequence of receipts and expenses);

- Duplication of elements (items, currencies, counterparties, contracts and accounts, etc.);

- Control of filling out details in documents (counterparties, contracts);

- Control (presence, absence) of movements in documents and others;

- Checking the correctness of contracts in transactions.

More details Order

What if I'm late with the deadline?

You still need to submit it, and as quickly as possible. There is still a chance to “slip through”, that is, to avoid penalties.

The Federal Tax Service explains this point as follows: if the violator was late, but managed to report taxes before he was brought to justice, there is every chance that he will not be held accountable - because there is no corpus delicti.

More information about the verification deadlines and the fine for not filing a declaration on time can be found here.