The Ministry of Finance has clarified the nuances of difficulties with payment documents this year. Whether all fields on the form are filled out correctly determines whether the banking institution will accept it. Having carefully studied the example of filling out a payment order in 2021, you can fill out payment orders quickly and without errors.

Reason for making a payment

When they talk about a payment order by decision of the tax authority, they mean the following situation:

- The payer (company/individual entrepreneur) is required by law to independently calculate the tax to be transferred to the treasury and draw up the appropriate payment document.

- The deadline established by law for voluntary repayment of the current tax debt has passed.

- The tax inspectorate received a request to make a tax payment within the deadline specified in it.

It should be noted that to fill out a payment order, by decision of the tax authority, use the same form as for voluntary repayment of current mandatory payments. It is enshrined in the regulation of the Central Bank of Russia dated June 19, 2012 No. 383-P. This form has index 0401060.

What to do if there is an error in the payment

One of the common mistakes when processing payment orders is the incorrect order of payment. What should I do if the payment has already been sent, and this detail is indicated incorrectly?

The Ministry of Finance in its letter dated October 4, 2017 indicates that Regulation 383-P does not stipulate that an error in this field should lead to a refusal to transfer funds. Yes, banks have the right to develop their own internal rules for the execution of documents, but they should not conflict with the federal ones.

It follows from this that formally the bank does not have the right to refuse to execute a payment to a client if the order is placed in the wrong order. However, most often banks ask to redo the disputed document, or to write a letter clarifying the details. You can, of course, insist on your own, but disputes with a credit institution can drag on for a long time.

Nuances

The procedure for filling out a payment order at the request of the Federal Tax Service in 2021 has its own characteristics. This applies to fields that must be traditionally filled out. The main nuances are discussed below in the table.

| Filling out a payment based on the request from the Federal Tax Service | |

| Field | What to indicate |

| 106 “Basis of payment” | The value should be “TR”. That is, the debt is repaid on the basis of a request received from the tax authority. |

| 107 “Tax period indicator” | The payment deadline established in the request for payment of taxes, fees, and contributions received from the Federal Tax Service is given. The format for filling out this field should be strictly as follows: “DD.MM.YYYY” For example, if we are talking about a late advance tax payment for the 2nd quarter of 2017, then field 107 should be like this: KV.02.2017 |

| 108 “Document number” | Number of the request for payment of tax, insurance premium, fee (without intermediate signs). In other cases, this field is not filled in at all. |

| 109 “Document date” | The date of the tax authority's request for payment of tax, insurance premium, or fee is transferred to this field. It is located next to the request number. In other cases, when voluntarily deducting current payments, indicate the date of signing the tax reporting (declaration). |

In field 106 “Base of payment”, enter exactly “ZD” if you voluntarily pay off debts for expired tax periods, but there have been no demands from the Federal Tax Service for payment of tax (fee, insurance contribution).

Changes in income tax – 2018

The innovations affected the relationship between payments to the federal and local budgets and the BCC.

Until 2021, the distribution of 20% of profits was made as follows:

- Federal budget – 2%;

- Local – 18%.

Starting from 2017, the proportions have changed:

- Federal contributions – 3%;

- Regional – 17%.

When repaying debts for previous periods, the old proportion is used; starting from 2017, the new proportion is used.

Payment Identifier (UPI)

Also, special attention should be paid to field 22 - “Unique payment identifier” (UPI). This consists of 20 or 25 characters. As a general rule, the UIP should be reflected in the payment only if it is set by the recipient of the funds. In addition, the latter must communicate its value to the payer (clause 1.1 of the instruction of the Central Bank of the Russian Federation dated July 15, 2013 No. 3025-U).

When transferring amounts of current taxes, fees, and insurance premiums calculated by the payer independently, additional identification of such payments is not required. In this case, the identifiers are KBK, INN, KPP and other details of payment orders. In field 22 “Code” it is enough to indicate “0”. In this case, the bank:

- cannot refuse to execute such an order;

- does not have the right to require filling out the “Code” field if the payer’s TIN is indicated (letter of the Federal Tax Service dated 04/08/2016 No. ZN-4-1/6133).

At the same time, filling out a payment order at the request of the Federal Tax Service for 2021 obliges to transfer to the payment the UIP value, which must be indicated in the submitted request.

Otherwise, filling out the fields of a payment order at the request of the Federal Tax Service does not have any fundamental features.

KBK

Depending on the activity carried out by an entrepreneur or company, the KBK designation has a different form.

- Tax on the sale of goods and services on the territory of the Russian Federation – 182 1 0300 110

- Import of goods from Kazakhstan, Belarus, Kyrgyzstan – 182 1 0400 110

- Import of goods from other countries – 153 1 0400 110

Fine

When you need to issue a payment order for a fine according to the decision of the Federal Tax Service in 2018, you should remember that in the KBK the numbers from 14 to 17 will be 3000. In addition:

- field 105 – OKTMO of the municipality, where funds from paying fines are accumulated;

- field 106 – “TR”;

- field 107 (“Tax period”) – “0”;

- field 108 – requirement number (the “No” sign does not need to be inserted);

- field 109 – date of the document from field 108 in the format “DD.MM.YYYY”;

- after 110 – do not fill in;

- field 22 (“Code”) – UIN (if it is not in the request, then “0”);

- field 101 – “01” for legal entities and “09” for “individual entrepreneurs”;

- “Payment order” – 5.

Basically, these are all the features of paying a fine to the Federal Tax Service by payment order in 2021.

Read also

16.05.2017

Other filling options

Instruction to pay personal income tax for employees on income in the form of dividends :

Payment for payment of personal income tax by an entrepreneur on his income :

payment for individuals working for individual entrepreneurs :

Advantages of plastic cards

In fact, the procedure for non-cash payment of money through a bank has several undeniable advantages.

If the cards are credited through the same institution where the company’s current accounts are opened, this will make it possible to simplify the payment of all taxes. The accountant simply needs to send two payment orders. One is related to receiving a salary, the other is related to personal income tax.

The employee has his own motivation:

- Withdrawing cash has now become much easier, the number of ATMs is increasing every year.

- Many banks are ready to provide a credit card with a good limit or use a salary card that can perform two functions at once.

- It becomes easier to get a loan, since funds are accrued monthly.

- Internet banking or SMS notifications will help you find out about the availability of money, track its movement and write-off. It becomes easier to make purchases, there is an opportunity to participate in promotions and receive bonuses.

- If you need to save money, you can determine the amount that will remain untouched until a certain date.

- It is convenient to pay utility bills or mobile communication services through the bank.

The procedure for processing and transferring payments to the card will not take much time. Now it has become more convenient than cash. Many employers and employees were able to verify this.

znaydelo.ru

What to write in the payment purpose of a payment order when transferring salary to a card?

Question: Tell me what should be written in the “payment purpose” field (field 24) of the payment order when transferring part of the earnings to a plastic card? Answer: The Regulations on the rules for transferring funds, approved by the Central Bank of the Russian Federation on June 19, 2012 No. 383-P, states the following about the purpose of payment:

- Field 20 (Name of pl.) - Payment purpose code. The value of the details is not indicated unless otherwise established by the Bank of Russia.

- Field 24 (Purpose of payment) - The payment order indicates the purpose of payment, the name of goods, works, services, numbers and dates of contracts, commodity documents, and may also indicate other necessary information, including in accordance with the law, including value added tax . In a payment order for the total amount with the register, a reference is made to the register and the total number of orders included in the register, while the symbol “//” is indicated before and after the word “register”. In a payment order for the total amount, drawn up on the basis of orders of payers - individuals, a reference is made to the register (application) and the total number of orders included in the register (application), with before and after the words “register”, “application” the symbol “//” is indicated

If you are transferring funds from your current account to your bank card, you can write: “Replenishment of card account, excluding VAT.” If the transfer is made by the employer, then the purpose of payment indicates: Salary for... month... year, number and date of the document on the basis of which the transfer is made (number, date of the employment agreement/contract concluded with the employee). Here a record is made that: payroll taxes were withheld and paid in such and such an amount. In connection with the introduction of the new “Regulations on the rules for transferring funds”, it is also worth agreeing with the servicing bank on everything that you should write in the “purpose of payment” section of the payment order. Full information on how to fill out the details field 24 can be found in the material: “How to fill out the “payment purpose” in a payment order”

Details for paying income tax in 2018

There have been no changes in filling out payment details compared to the previous period. When preparing a payment for income tax, the following BCCs are used:

- federal tax - 182 1 0100 110;

- regional share - 182 1 0100 110.

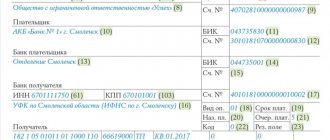

To pay income tax, full details of the payer and payee are required.

- In the first case, the name, INN and KPP, the name of the bank and the account in it, bank information: BIC, correspondent account, etc. must be indicated.

- The recipient is identified by accurately indicating the UFK, affiliation with a specific branch of the Federal Tax Service, its payment details, INN and KPP, OKTMO.

It is recommended that you check the recipient's details with your inspectorate before making the payment. They can also be verified on the Federal Tax Service website, using the function of filling out a payment document.

How is this regulated by law?

Now there are several standards that allow you to resolve all issues related to concluding a contract and calculating wages:

- First of all, we are talking about an employment or collective agreement, because it is in it that the conditions for payment through the bank are spelled out. If this happens later, changes must be made to it.

- Article 136 of the Labor Code is involved, concerning the place and procedure for payment of wages, as well as Art. 372 - form of payment sheet.

- The features of plastic cards and their handling are defined in the Regulation on Issue, which was approved by the Central Bank in 2004.

- In addition, certain provisions are spelled out in the Tax and Civil Codes, in particular in chapters 45 and 46. The fact is that almost simultaneously payments of various contributions and taxes are made, which are withheld from the amount accrued for work.

Therefore, the employer is simply obliged to transfer money to the card in full and on time, so as not to be subject to penalties. It is only necessary to have the written consent of the employee himself.

You can get detailed information about this procedure from the following video:

What are the features of advance payment?

Salary according to the employment contract, according to Art. 136 of the Labor Code of the Russian Federation, must be paid at least once every half month. More often it is not forbidden to pay remuneration for work, but still employers usually divide the salary into 2 parts:

- the amount paid based on the results of work for the 1st half of the billing month (it is “unofficially” called an advance, although such a term is not mentioned in the Labor Code of the Russian Federation);

- the main part paid based on the results of work for the 2nd half of the billing month.

You can learn more about the legal requirements for setting the deadline for paying wages in the article “How wages are paid - procedure and verification.”

If the salary is paid through a bank account, the payment slip in both of the above cases is filled out almost identically. The only difference is in filling out the details “Purpose of payment”: when transferring the advance, you need to provide wording reflecting the fact that the salary is transferred specifically for the 1st half of the month.

Let's consider exactly how this wording will sound and how other important payment details are filled out.

zarplata_na_kartu.jpg

Related publications

Labor legislation establishes the employer’s obligation to pay employees wages at least once every six months. The usual gradation for advance payment and payment. The payment deadlines are (Article 136 of the Labor Code of the Russian Federation):

- 30th day of the current month – for advance payment for the 1st half of the month;

- The 15th day of the next month is for monthly calculations.

Full compliance with these deadlines also applies to salaries transferred to the card, if the company practices issuing salaries not through a traditional cash register, but by bank transfer to staff cards.

Is this necessary?

If the employee has no fundamental objections, then the account number is indicated in the written statement. At the same time, there is always the opportunity to choose the bank that suits you best or where an account has already been opened. The employer must be notified about this five days before receiving the salary .

If the transfer of funds was not specified in the contract, or written consent was not obtained, then the illegal transfer may result in criminal prosecution. Money should not go to the bank without the appropriate documents. It is necessary to draw up an additional agreement or annex, especially if the already signed agreement provides for the procedure for payment through the cash register.

In this case, the entrepreneur must find a way for the employee to be able to receive payments in cash.

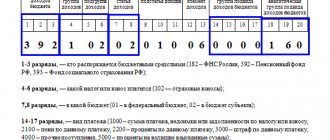

Data provided by the payer

The table shows that some fields are intended for bank marks. The payer must indicate:

Let's look at some fields in detail.

In fields 6 and 7 indicate the amounts that the payer sends to pay taxes or pay for goods, in words and then in numbers. The words “ruble” and “kopecks” in the required form should not be abbreviated.

Examples of correct entries for fields 6 and 7:

in words: Fifty thousand rubles 00 kopecks, in numbers: 50,000= in words: Three hundred eighty rubles 35 kopecks, in numbers: 380-35

In the details of codes 11 and 14, it is necessary to use the “BIC of Russia Directory”. Its current version is available on a separate page of the Central Bank of the Russian Federation. Errors in the BIC will lead to stuck payments, since cash settlement centers will not be able to identify the recipient. In some cases, users may see a return code of 40 on the payment order.

Field 21 is intended for the payer to specify the order of debiting funds from his bank account from 1 to 5. It must always be filled out, even if there is enough money in the account to carry out all operations. Based on Article 855 of the Civil Code of the Russian Federation, the payer indicates the corresponding value:

Field 22 in the 2021 payment order is used to indicate the unique payment identifier (UPI). This is a code of 20–25 digits, which is generated by the recipient of funds taking into account the rules provided for in Appendix 12 to Bank of Russia Regulation No. 383-P. The UIP is transferred to the payer upon signing the contract. If you do not indicate it or indicate it incorrectly, the bank may reject the payment.

Note that the UIP is formed only in two cases: when it is provided for by law and when requirements for the payment of income to the budget are formed. If it is not there, a UIN is written down instead - a unique accrual identifier. This is stated in paragraph 12 of Appendix No. 2 of Order of the Ministry of Finance No. 107n. If there is no such number, you must enter “0”.

Details 24 “Purpose of payment” must contain information that makes it easy to identify what the money is being sent to. The same field specifies whether VAT is included in the payment amount.

To pay for services under contract No. 110 dated January 22, 2018. Without VAT.

Advance payment for office equipment under contract No. 120 dated January 23, 2018. NDS is not appearing.

Additional payment under supply agreement No. 100 dated February 17, 2018. Including VAT (18%) 7654-32.

If VAT is indicated at mixed rates, you may not specify the tax rate.

To generate a payment order to the tax office, you must indicate the payer status in field 101. The data presented in table form (Appendix No. 5 to Order of the Ministry of Finance dated October 12, 2013 No. 107n) can be downloaded below. Persons performing duties to pay taxes and fees for other payers must indicate in the details the 101 code provided for their category.

In the details of fields 102 and 103, indicate the checkpoint of the payer (individual entrepreneurs put “0”) and the recipient (the Federal Tax Service code where the payment is sent). Current information is available on the department’s website in the section “Address and payment details of your inspection.” If errors are made in the 9-digit codes, the payment will be sent to the list of unknowns, and the bank will refuse to accept it. This is stated in the Order of the Ministry of Finance of Russia dated December 18, 2013 No. 125n.

Field 104 is intended for BCC (budget classification code) of a tax or contribution. They can change frequently, so you need to monitor information from the Ministry of Finance. Current codes are available in Order of the Ministry of Finance of Russia dated July 1, 2013 No. 65n. The document is quite cumbersome, and to make it easier, we suggest using the PPT.ru help, which presents the KBK taking into account the latest changes.

Detail 105 requires the indication of OKTMO at the payer's address. You can clarify the code using the online service “Find out OKTMO”, developed by the Federal Tax Service.

Field 106 (payment basis). The following values correspond to it:

Field 107 specifies the period for which the payment is made, in the format XX.YY.YYYY. The first two characters are always letters:

The next two characters are always numbers that indicate the reporting period: month (01 to 12), half-year (01/02) or year (00). The combination “YYYY” is always replaced by the year.

Examples of correct entries:

When payment is made at the request of regulatory authorities, the date specified in the request document is indicated. If the payer makes a payment according to an inspection report or writ of execution, he puts “0”.

Detail 108 is filled in if there is a payment basis document, for example, a writ of execution. Then simply indicate the corresponding number. If a business entity pays the current amount of tax, fee or contribution, it indicates “0”.

Field 109 also indicates the date from the payment basis document: inspection report, requirement, executive documents.

Notification to employees

Not every employment contract provides for non-cash payment. The employer has the right to subsequently change some conditions that may relate to remuneration. To do this, a corresponding decree is issued, which will indicate a specific date when the changes will occur.

- It is necessary to change the provisions related to the procedure for calculating salaries and receiving them.

- Persons are appointed who will take responsibility for the transition to non-cash payments and the registration procedure. In addition, the accounting department must receive a corresponding order, where all accounting entries will be listed.

- The HR department or those involved in hiring and firing will have to prepare some data for the bank employees if the need arises.

Each employee will be familiarized with the order and will sign the accompanying document. Such changes are notified two months before they come into force.