Any individual is required to submit a return to the tax service at the end of the year. This is necessary to pay taxes and also receive a deduction for them. A taxpayer’s personal account is a platform through which citizens can submit an individual entrepreneur’s declaration and send other documents online. In order to submit a declaration, you must be registered on the State Services portal or in your personal taxpayer account. A personal account can be created on the official website of the Federal Tax Service (www.nalog.ru). To access it for the first time, you need to visit either the tax office or the multifunctional center. Login and registration information is provided there.

Account registration

Each individual can create their own profile on the website of the Federal Tax Service (www.nalog.ru). This is not necessary, but a personal account will make many tasks easier. For example, any operations related to interaction with the tax office can be performed remotely and without queues.

First you need to get a login and password. Tax officials must issue it to the inspectorate. You can also contact the MFC.

Important! To obtain data, you only need to have your passport with you. If a citizen plans to open a business, he must also take his OGRNIP and TIN with him.

Before issuing a password and login, the user will be asked to fill out an application. There are situations when a person cannot visit the tax office due to some circumstances. In this case, you can register online. For this you will need a digital signature and email.

In order to register using an electronic signature, an individual must have an account on the tax service website and an electronic signature key certificate.

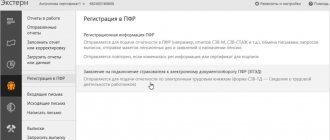

So, if a person has a CEP key and a personal account on the tax service website, you can register your personal taxpayer profile online:

- Fill out the registration application

- Prepare the necessary package of documents.

- Send all documents for review through your personal account of the Federal Tax Service (the website has a section with instructions on how to correctly attach and send documents).

Then login information is sent to your email address, with which you can later easily open your personal profile and gain access to functionality.

Why may the declaration not be accepted?

- The declaration submitted via the Internet does not contain the electronic signature of the taxpayer.

- The declaration was submitted to the tax office, which does not deal with you (in the wrong place).

- The declaration is filled out with errors (the programs correct what you enter in the wrong fields, but if you fill out the number of something and confuse the numbers, then no one will be able to correct it for you, and the fact will be revealed only when checked).

- The documentation does not include the taxpayer's full name

- The electronic signature with which the declaration is signed belongs to another person who is not a taxpayer for this particular declaration (in other words, you will not be able to sign a document with someone else’s digital signature).

In other cases, the FSN will not refuse you.

Algorithm for filing an individual entrepreneur’s declaration through the taxpayer’s personal account

Individual entrepreneurs must annually send a declaration (3-NDFL) to the tax service. This can be done remotely from the inspection through a personal account.

In order to send a document, you must:

- Prepare a declaration. It is important to remember that the format is strictly xml. The system does not accept other formats.

- Log in to your personal profile by following the link https://lkfl2.nalog.ru/lkfl/login.

- Open the “Life Situations” section.

- Click the “Submit 3-NDFL declaration” button.

- Click “Download”; you do not need to click the “Declaration” button, otherwise the system will redirect you to the link to download the document.

- Next, the site will require the use of an electronic signature. It's easy to get. The first option in the list is already selected by default, so you just need to create a password and send it by clicking the “Send request” button. Results can be obtained within 15-24 hours. You need to be prepared for the fact that this procedure may take a day, and take care of the time allocation.

- After receiving the electronic signature, you can start downloading the file. To do this, you need to mark the year in which the signature was issued and click the “Download” button (not “Declaration”).

Important! It should also be noted that the document must be strictly in xml format. The file name should not contain extra characters (dots, quotes, parentheses, etc.). There is also no need to rename the file after downloading.

After you have uploaded the declaration to your personal account, the system may require scans or photographs of documents that are usually needed when visiting the inspection office in person to submit a declaration. You will need a document indicating the expenses of an individual entrepreneur. This confirms the right to deduction.

Next, you will need to fill out an application for a tax refund. There is no need to specify the amount, it is selected automatically.

These were the last steps when submitting a return to the tax service through the taxpayer’s personal account without visiting a branch.

When to submit a declaration. Deadlines.

In the case when you fill out a report using the 3-NDFL form, then you have a maximum period of time - until the thirtieth of April of the following reporting year. But of course, it is advisable to do this earlier. If April 30 is a holiday, the deadline is moved forward one business day.

The same declaration reports that are submitted to the Federal Tax Service only to receive tax deductions do not have a deadline. They can be served at any time throughout the year.

When you break the serving rules and are late with this important task, you can prepare for a fine. Article 119 of the Tax Code of the Russian Federation threatens a five percent fine for this violation. This five percent is calculated from the amount that you did not pay as tax, and for each month of overdue time.

Benefits of filing your return online

Thus, the online format for submitting form 3-NDFL is very simple and convenient. It has a number of advantages:

- the ability to perform operations remotely at any time of the day;

- the entire package of documents is required in electronic form (this means that printed versions are not needed);

- History is saved in your personal account, so in any case you can see the history of your actions.

Thanks to the presence of a personal account, in addition to filing a declaration, an individual can also track taxes on property, transport and land. You can pay taxes without commission payments, accept all overpayments to your personal bank card and receive any information in the field of tax activities quickly and conveniently.

One-time reporting via the Internet: submission methods

Electronic reporting via the World Wide Web has long become an integral part of an accountant’s activities. The Tax Code of the Russian Federation stipulates the obligation to send tax returns to the Federal Tax Service, including in electronic form, according to established deadlines.

There are several ways to submit electronic reports. Read more about this in the article “Electronic reporting via the Internet - which is better?”

You can send tax reports via the Internet only if you have an electronic signature. It is purchased on a paid basis from certification centers or upon concluding an agreement with an EDF operator.

One-time reporting can be submitted to the tax authorities in two ways: through the Federal Tax Service website and through electronic document management (EDF) operators. In turn, submission through the tax website is more often used for one-time filing of reports and can be done either with the payer’s own electronic signature or by proxy.

When does an individual entrepreneur need electronic reporting?

Individual entrepreneurs must send reports electronically:

1. To the Federal Tax Service, if the individual entrepreneur:

- is a VAT payer;

- has a staff of employees exceeding 25 people for the previous year;

- submits a declaration for the first time and at the time of filing it has formed a staff of more than 100 people.

2. In the FSS, if:

- The individual entrepreneur has a staff of employees exceeding 25 people for the previous year;

- The individual entrepreneur submits reports to the funds for the first time and at the time of its submission formed a staff of more than 25 people.

How to prepare a declaration?

What can be used to prepare a document? The most “inconvenient” option is to fill out a printed form by hand. But this is impossible for a VAT return, and in other cases there is a high probability of error, and some parameters will have to be calculated “manually”.

It’s easier to use electronic programs: create a reporting file and save it in a “printable” format (if you plan to submit the document on paper) or in a “for sending” format (if you send it via the Internet).

Free programs

The first option: install the free “Taxpayer” program from the Federal Tax Service website. Doing this yourself is very difficult if you are not a professional programmer. In addition, you will have to monitor and install updates yourself. The advantage of the program is that it is free.

The second option: use professional online services that provide free promotional access to their services from time to time. Here is a brief overview of the most popular:

- "Circuit. Extern." The program allows you to fill out two main types of individual entrepreneur declarations: UTII and simplified tax system. A nice feature of the program is that you can connect to it for 3 months for free.

- Online accounting "My Business". In it, an entrepreneur will be able to fill out declarations under the UNDV, USN, OSNO taxation systems.

Registration of digital signature for reporting: nuances

When solving the IP problem under consideration, it is useful to pay attention to:

1. The possibility of obtaining an electronic signature through a representative. To do this, he needs to draw up a notarized power of attorney for the representative.

2. The ability to use not only installed software for working with digital signatures, but also cloud services for checking digital signatures and sending reporting documents to government agencies. Their advantage is:

- the ability to send reports from any computer and device (smartphone, tablet) with a browser;

- the ability to send reports from anywhere connected to the network;

- efficiency (no need to waste time installing and configuring software and modules required to verify digital signatures).

3. The need to establish internal corporate access control to the digital signature carrier - a flash drive, eToken or their analogues. Any signature made using them will be considered genuine, so only authorized personnel should use these devices.

Sending by mail

To do this, you will need to print out the declaration on paper, sign it and put a stamp (if you have one), fill out two copies of the list of investments and write on the envelope (address of the Federal Tax Service and the address of the sender). Take the unsealed envelope with the declaration and two copies of the inventory to the post office. The branch employee will stamp and sign the second copy of the inventory and issue a payment receipt, which will indicate the shipment ID. Keep these documents in case the tax authorities claim that they did not receive your documents.

How to get an electronic signature

A certification center accredited by the Ministry of Telecom and Mass Media of the Russian Federation can issue an electronic signature. According to the terms of the order of the Federal Tax Service of the Russian Federation dated April 8, 2013 No. ММВ-7-4/142, for correct authorization in the system, a special key certificate is used, which verifies the electronic signature.

According to Art. 80 of the Tax Code of the Russian Federation, reporting on TKS is sent with a qualified electronic signature. According to the law of April 6, 2011 No. 63-FZ, the concept of a simple and qualified, or enhanced, electronic signature was introduced. Tax reporting submitted to the Federal Tax Service is signed only by a qualified digital signature.

Similar to paper documentation certified by a signature and seal, an electronic document acquires legal force and status after an electronic signature is affixed to it.

How an individual entrepreneur can submit a tax return: types, deadlines, methods of submission

Every individual entrepreneur is, to one degree or another, concerned about the issue of timely submission of tax reports. In order for interaction with tax authorities to proceed smoothly, without errors, delays and claims from the Federal Tax Service, an entrepreneur needs to thoroughly understand these issues. The most important thing is to organize the process correctly: you can do some things yourself, but it makes more sense to outsource some functions to save time and money.

In this article we will tell entrepreneurs how to prepare and submit this type of tax reporting as a declaration.

Through PC “Taxpayer Legal Entity”

The “Legal Taxpayer” program is designed for filling out personal income tax forms, other financial statements, and calculating various contributions. The software takes up little space on your computer and is easy to use. On the main page, the payer will see what reports can be compiled using the software and select the required one.

The program has a built-in “Input Wizard” function, which instructs the person filling out the reports step by step. This simplifies the process and the payer does not need to study the algorithm first.

The software contains many useful functions:

- saves entered information automatically and archives completed declarations;

- saves information about the payer and the tax office to which the documentation is submitted;

- automatically generates a form;

- automatically calculates the necessary indicators.

GNIVC (Main Scientific Innovation Implementation Center) regularly updates the program. Updates are published on the official GNIVC resource.

Why is it convenient to submit reports through the New Astral Report?

- There is no need to waste time going to the tax office.

- There is no need to duplicate paper documents.

- The likelihood of making mistakes is reduced. The service has interactive tips and auto-filling of forms.

- Tax and accounting reporting forms are promptly updated, which means they are always relevant.

- Documents are reliably protected from viewing and correction by third parties.

- Convenient work with tax requirements. The service will automatically send confirmation of receipt of the request.

Each entrepreneur himself chooses which method of filing a tax return is optimal for him. We wish you success!

Astral

October 31, 2021 16502

Was the article helpful?

54% of readers find the article useful

Thanks for your feedback!

Comments for the site

Cackl e

Products by direction

Astral Report 5.0

—> Online service for submitting reports to regulatory authorities

Submitting reports without involving EDF operators

Submitting reports on TCS without using the services of EDF operators is carried out in two main ways:

- Registration of personal digital signature. This method is most convenient for individual entrepreneurs, since it does not require the execution of a notarized, expensive power of attorney. Using this method involves sending reports on behalf of the individual entrepreneur through the Federal Tax Service website. The digital signature is issued within 1–3 days, after which the individual entrepreneur can begin sending reports.

- Execution of a power of attorney for a representative organization or an individual with an electronic signature. For such a shipment, in addition to signing an agreement for the provision of relevant services, it is necessary to issue a notarized power of attorney. An electronic copy of the power of attorney is attached to the submitted report, and then submitted to the Federal Tax Service in paper form.

Free through the Federal Tax Service website

To do this you need to take the following steps:

- get an electronic digital signature key. This can be done in accredited centers listed on the website of the Ministry of Telecom and Mass Communications;

- obtain the subscriber ID using the appropriate section;

- install special software: “Taxpayer Legal Entity” and certificates;

- install crypto protection.

The programs offered by the Federal Tax Service sometimes work incorrectly and produce errors; moreover, not everyone knows how to install them correctly. You will also have to independently monitor software updates and download them from the tax service portal. This option can be called free quite conditionally: you will need to purchase an EDS key.