Legal Mil Group of Companies provides comprehensive support for such transactions both in relation to Russian business and within the framework of international projects. Our implementation of these turnkey transactions includes, in addition to supporting M&A transactions, the creation of Russian and international joint ventures in various jurisdictions, building an optimal business ownership structure, conducting comprehensive legal checks of acquired assets (Due Diligence), etc.

- Reorganization in the form of spin-off

- Reorganization in the form of merger

- Reorganization in the form of combination

- Mixed enterprise reorganization

- Merger of two LLCs

- Send documents

- Request site information

- Get reporting

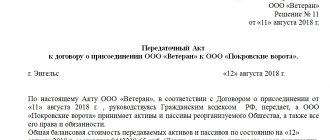

- Transfer deed sample

- Close organization

- Request articles of the law on reorganization

- Negotiation strategy

- Management and legal experience

- Assistance in registering a business

Show all

The purchase and sale of a business when merging the assets of companies requires serious expertise and a close-knit professional team of lawyers, therefore more than 10 years of experience of Legal Mil Law Firm partners and experts is a serious guarantee of impeccable support for the most complex M&A transactions.

With Legal Mill, you can be sure:

- in the reliability of the transaction

- in successfully achieving the most ambitious goals

- good synergistic effect in the future

The cost of individual projects implemented with the participation of Legal Mil experts amounted to up to half a billion US dollars.

A little theory

Reorganization of legal entities is possible in 5 forms: accession, division, separation, transformation and merger.

A merger is the absorption of the assets and liabilities of one company by another while retaining one of the legal entities. A merger is the combination of assets of several enterprises with the creation of a new legal entity and the liquidation of old ones.

It is generally accepted that merger is the most convenient and transparent form of business consolidation for beneficiaries. Such transactions are implemented quite technologically and reliably, and the transfer of rights and obligations to the legal successor usually does not cause concern either among creditors or tax authorities. In addition to other important corporate and business tasks, this allows you to optimize the management and taxation of your business, and maximize the effect of the complementary benefits of the consolidated businesses.

The new legal entity created as part of such transactions takes over the property and debts of the liquidated companies in accordance with the transfer deed, since it becomes a universal legal successor.

Let's consider the key aspects of such a reorganization:

- Reorganization goals

- Legal points and legal grounds

- Procedure for reorganization

- Package of documents

- Deadlines

- Individual features of the procedure

Initial stage of merger

A merger is a form of reorganization in which several companies cease to exist as separate legal entities and merge into one, larger organization.

The sequence of steps that must be taken in the first stage of a merger is the same as in other forms of reorganization. We have listed all the necessary steps in the table.

Actions to be taken at the initial stage of the merger

| No. | Action | Who commits | Deadlines |

| 1 | Decide on merger | Owners | By decision of the owners |

| 2 | Send the decision on the merger to the “registering” Federal Tax Service and attach a written message about the reorganization | The company that last decided to merge | Within three business days after the date of the merger decision. Next, the Federal Tax Service will make an entry in the state register about the start of the reorganization |

| 3 | Inform the Pension Fund and the Social Insurance Fund in writing about the upcoming reorganization | Each company involved in the merger | Within three working days after the date of the merger decision |

| 4 | Notify all known creditors | Each company involved in the merger | Within five working days from the date of filing the application with the Federal Tax Service |

| 5 | Publish a notice of reorganization in special publications on behalf of all participants | The company that last decided to merge | Twice at intervals of once a month |

| 6 | Prepare the constituent documents of the organization created by merger | Persons responsible for the reorganization | No deadlines set |

| 7 | Conduct an inventory of property and liabilities | Each company involved in the merger | Immediately before drawing up the transfer deed |

Which form should I choose?

Two similar forms of reorganization are affiliation and merger, however, despite many common features, they also have significant differences.

Therefore, the choice between them largely depends on the characteristics and characteristics of specific enterprises.

Merger is the only form of reorganization, as a result of which information about the new enterprise is not entered into the Unified State Register of Legal Entities.

On the contrary, one or more legal entities are deregistered.

In this case, all property and debts as a result of the closure of the LLC through a merger of enterprises are transferred to the legal successor, whose organizational and legal form does not change.

Another feature of the merger is the fact that to carry it out you do not need to obtain a certificate of absence of debts from the Pension Fund.

Often, it is the absence of this document that is the basis for refusal of reorganization.

As for the merger of two companies into one, as a result of this procedure all participants are liquidated, and on their basis a new enterprise arises, with completely different registration data.

It brings together all the assets of predecessors and allows you to start a new activity more efficiently, with more opportunities.

In general, the merger procedure is easier than merging an LLC. However, the first form may violate the rights of participants, while the second provides the most equal opportunities for all reorganized enterprises.

Transfer deed

The next step is preparing the transfer deed. Each company participating in the merger must draw up this document. The date of the transfer deed can be any. But it is better that it coincides with the end of the quarter or year - as stated in paragraph 6 of the Instructions for the formation of accounting records during reorganization *.

The transfer deed must contain provisions on legal succession (Article 59 of the Civil Code of the Russian Federation). This is information about the amounts of receivables and payables, as well as about the property transferred to the newly created company. The value of the property under the transfer deed can be market, residual, initial, or corresponding to the actual cost of inventories (clause 7 of the Instructions for the formation of accounting records during reorganization).

There are no restrictions on the form of the transfer deed. Most often, it is drawn up in the form of an ordinary balance sheet and transcripts are attached for each of the lines. Inventory sheets can be used as transcripts. There is another option: abandon the balance sheet form, and simply list all types of assets and liabilities (fixed assets, intangible assets, “debtor”, “creditor”, etc.) and indicate their value. And in separate appendices, provide lists of objects, debtors, etc. (example examples of the transfer deed can be downloaded here or here).

Required documents

The list of documents required for reorganization by merging can be divided into two groups:

- Documents that enterprises prepare before reorganization. These include: Application form P12001, which must be certified by a notary. This document indicates the form of reorganization, the number of participants in the procedure, as well as the number of enterprises that will be formed after completion of the procedure (in this case, one).

- The charter of the new enterprise, which must be developed and approved at the stage of the meeting of owners. are submitted to the registration authority , one of which is then returned. There are general requirements for the registration of the charter: it must be stitched and numbered.

- The transfer act is a mandatory document during a merger, and all enterprises participating in the reorganization must draw it up. The act must contain information about the amounts of accounts payable and receivable, as well as the amount of property that is transferred from each company to the new company. There is no established form for this document; it can be drawn up in the form of a regular balance sheet or by simply listing all assets.

- Permission from the Antimonopoly Committee. This document is required only if the total assets of the enterprises or proceeds from sales exceed the legally established limit.

- Documents confirming notification of creditors. These may be receipts for payment of letters sent to them, as well as copies of the pages of the Bulletin.

- The merger agreement signed by the participants at the general meeting. This document defines the conditions and rules for the reorganization, as well as the procedure for exchanging shares of old enterprises for new ones.

- Minutes of the joint meeting of enterprise owners.

- A certificate from the Pension Fund of Russia confirming the absence of debts, which must be received by each participating enterprise.

- Receipt of payment of the state duty (its amount is 4,000 rubles).

- Documents that must be obtained as a result of the reorganization. These papers are issued by the tax office: charter of LLC merger;

- documents on deregistration of enterprises;

- state registration certificate;

- documents on tax registration of a new company;

- extract from the Unified State Register of Legal Entities.

These papers must be issued within five days after submitting the first package of documents.

After this, the new enterprise can begin its work in accordance with the chosen type of activity and available capabilities. Read more about changing the types of LLC activities here.

Period until completion of merger

Then you need to prepare documents for the reorganization. This is a deed of transfer, an application for registration of a company created by merger, a decision on reorganization, a document on payment of state duty, etc. The full list is given in paragraph 1 of Article 14 of Federal Law No. 129-FZ dated 08.08.01.

The package of documents should be brought to the “registering” Federal Tax Service and wait until the inspectors make an entry in the Unified State Register of Legal Entities. With the advent of this entry, the predecessor companies will cease to exist, and a new successor organization will appear in their place. But until the waiting period is completed, the predecessors continue to work: they calculate wages, depreciation, register the “primary”, etc.

Transfer of property, rights and obligations

Notifying the state is not enough. We still need to make sure that everything goes according to plan. Property must be transferred, workers must be re-registered, old debts must be paid:

- Transfer deed . It regulates all property owned by the merging companies. It should be dated by the last date of the reporting period and include in it everything that can be useful: real estate, cars, technical equipment, even intellectual property. It is important to remember that the information specified in the act must be up-to-date - it is impossible for the newborn organization to transfer already obsolete or broken property, as well as inventory that has long been written off. It is also impossible for something that no longer exists to pass to her, for example, something stolen. You can indicate everything briefly, just as a list, or you can create an appendix to the act with a detailed description of each position, which can take up to a hundred pages.

- Transfer of claims and obligations . The debts of the company participating in the merger are transferred to the newborn company automatically; no documents need to be completed for this. You should simply continue to fulfill the once-concluded agreement. If the obligations were of an exclusively informal nature and were not documented, they are still inherited and must be fulfilled, otherwise the deceived party may sue.

- Transfer of real estate . Despite full continuity and the instructions in the transfer deed, the resulting organization must apply to the State Register and, after paying the fee and providing all documents, officially transfer everything to itself.

- Transfer of accounts, transactions, branches . Banks should be provided with complete information about the procedure and all accounts should be reissued to the newborn company. All concluded transactions should also be reissued. Branches should be transferred in advance to the ownership of the new organization.

- Transfer of intellectual property and licenses . If the merged companies traded intellectual property or needed permission to operate, the resulting company needs to re-register all licenses and patents to itself by paying a state fee.

- Personnel transition . There are two ways to re-register workers: dismiss them all from the merging companies and hire them in the new one as usual, or do not transfer them anywhere, but simply make an entry in their work books that the company has been reorganized. An employee may refuse the transition and resign - in this case, his dismissal takes place as usual and does not require special attention. The rest continue to work, and an entry like this is entered into their employment records: “The limited liability company “Horns and Hooves” was reorganized by merging on January 20, 2021 with the limited liability company “Tails and Horseshoes.” Signature, number."

Since all transitions require time and money, there are two ways in which they can be accomplished:

- On one's own. In this case, representatives of the merging companies independently run through the authorities, sit in queues and sort through documents. It's not so much energy-consuming as it is tedious, and requires professionalism and attention to detail.

- With the help of a hired lawyer. In this case, the hired employee goes through the authorities. He sits in lines and fiddles with documents.

With due attention and a careful approach to the matter, any company can carry out this procedure independently.

Final financial statements of predecessor companies

Each company participating in the merger must prepare final financial statements as of the date preceding the date of entry into the Unified State Register of Legal Entities about the reorganization. The statements consist of a balance sheet, profit and loss account, statements of changes in equity and cash flows, an explanation and an auditor's report (if the company is subject to statutory audit).

The final accounting statements must reflect transactions performed during the period from the signing of the transfer deed to the closure of the predecessor organization. Because of these transactions, the indicators in the final balance sheet will not coincide with the indicators in the transfer act.

In addition, each predecessor company must close account 99 “Profit and Loss”. Profits can be distributed according to the decision of the founders.

After the final reporting, predecessors do not have to submit balance sheets and other documents, since the last reporting period for them is the time from the beginning of the year to the date of merger.

Advantages and disadvantages of the accession procedure

Advantages:

- in the process there is no need to obtain a certificate of full settlement with the Pension Fund of the Russian Federation and the Social Insurance Fund, which would mean checking the correctness of the calculations by these bodies and repaying the debt, which takes up to 2 months;

- savings on state fees: upon merger you need to pay 4,000 rubles (as for registering a new legal entity), merger costs about 1,500 rubles.

The disadvantage is succession, the essence of which is that after the transaction is completed, the absorbing company bears all the risks of paying the debts of the acquired LLC, even if they were identified after registration. The limitation period is three years. Therefore, merger is practiced as an alternative to the voluntary and official liquidation of a company without debt.

Step-by-step instructions for joining an LLC to an LLC involve going through several stages.

Inaugural reporting of a newly created organization

An organization created as a result of a merger must draw up introductory financial statements as of the date on which an entry about the reorganization is made in the Unified State Register of Legal Entities. The lines of the opening balance will contain the sum of the corresponding indicators of the closing balances of predecessors. The exception is mutual settlements between predecessors - for example, when one of them was a borrower and the other a lender. Such indicators are not summed up, since if the debtor and creditor coincide, the obligation terminates. Also, in the introductory statements of the assignee, there is no need to summarize the data from the profit and loss statements of the reorganized companies.

Particular attention should be paid to the authorized capital of the successor organization. If it is less than the amount of capital of predecessors, then the difference is reflected in the balance sheet in the line “Retained earnings (uncovered loss).” If the legal successor’s capital is greater than the amount of capital before the reorganization, such a difference does not need to be shown in the balance sheet. In both cases, the accountant does not make any entries.

The introductory report must be submitted to the Federal Tax Service either immediately after registration or at the end of the current quarter - depending on what is more convenient for your inspector.

Merger Agreement

When indicated in the law, the parties draw up an agreement, which should establish, for example, the following:

- According to Art. 52 Federal Law “On Limited Liability Companies” dated 02/08/1998 No. 14-FZ:

- procedure, conditions of merger;

- the procedure for distributing shares of companies in the authorized capital of a new entity.

2. According to Art. 16 Federal Law “On Joint Stock Companies” dated December 26, 1995 No. 208-FZ (hereinafter referred to as Law No. 208-FZ):

- name, details of the participants in the reorganization, as well as the company being created;

- procedure and conditions of merger;

- the procedure for converting shares and their ratio;

- number of members of the board of directors (if this is reflected in the charter);

- information about the auditor or the list of members of the audit commission;

- list of members of the collegial executive body (if its formation relates to the powers of the meeting of shareholders and it is provided for by the charter);

- information about the executive body;

- name, details of the registrar.

The agreement may also contain other information (clause 3.1 of Article 16 of Law No. 208-FZ).

You will find a sample merger agreement using an LLC as an example in ConsultantPlus. If you do not yet have access to the ConsultantPlus system, you can obtain it free of charge for 2 days.

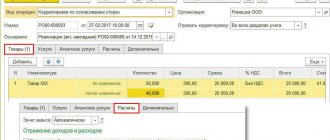

"Primary" in the transition period

After the merger, the newly created contractual relations of the reorganized legal entities. But the agreements themselves are still concluded on behalf of their predecessors. The question arises: is it necessary to sign additional agreements to replace the parties to the transaction? Or can you simply send information letters to counterparties that indicate the name and details of the successor company?

We believe that additional agreements are not necessary, because all the rights and obligations of each of the predecessor companies are transferred to the newly created organization under the transfer deed (clause 1 of Article 58 of the Civil Code of the Russian Federation). This also applies to contractual relations. This means that to continue cooperation with suppliers and clients, an extract from the Unified State Register of Legal Entities and a transfer deed are sufficient.

As for invoices, certificates of work performed and invoices, before the date of merger they are issued on behalf of predecessors, on the date of merger and further - on behalf of the successor.

Merger of two or more legal entities

A set of actions related to the completion of activities by existing organizations and the transfer of all their rights and obligations to the newly created company is called a merger.

The decision to merge organizations can be made by their participants or by a body vested with appropriate powers.

In some cases, despite the decision made, such a change is possible only with the permission of the authorized bodies.

For example, if the total value of assets of commercial organizations as of the last reporting date exceeded 7 billion or 10 billion rubles. their total sales revenue from the previous year, then their merger is possible with the consent of the antimonopoly authority (Article 27 of the Federal Law “On Protection of Competition” dated July 26, 2006 No. 135-FZ).

Important! In accordance with paragraph. 2 p. 3 art. 64 Federal Law “On Bankruptcy” dated October 26, 2002 No. 127-FZ, after the introduction of the monitoring procedure, the management bodies of the organization are prohibited from making decisions on reorganization.

Two organizations, even those created in different forms, can take part in the reorganization (Clause 1, Article 57 of the Civil Code of the Russian Federation). More information about changes in the legal status of organizations is described in the article “Reorganization of a legal entity is...”.

In order, for example, to merge with an organization of another form, you first need to transform into the form of this organization. For example, a joint-stock company can become a production cooperative (Article 104 of the Civil Code of the Russian Federation). But laws may contain restrictions on such conversions.

We recommend studying the ready-made solution ConsultantPlus about the procedure for merging an LLC. To learn how a JSC merger occurs, read the ConsultantPlus guide to corporate procedures. If you do not yet have access to the ConsultantPlus system, you can obtain it free of charge for 2 days.

Who submits declarations for reorganized companies

If possible, predecessor organizations must report all taxes before the merger, that is, before making an entry in the unified state register. But in practice, as a rule, they do not have time to do this. Then, the very next day after the reorganization, inspectors at the place of registration of the predecessor refuse to accept declarations. In this case, all tax reporting will have to be submitted to the newly created organization to its inspectorate. If, after the reorganization, mistakes of the predecessor are discovered, the successor submits a “clarification” for him.

Please note: the deadline for submitting declarations will not be shifted due to the reorganization. For example, for income tax for the year, the successor is required to report no later than March 28 of the following year - both for himself and for each predecessor.

Emerging nuances ↑

The procedure for merging companies is a legally complex process that may involve emergency situations.

These can be considered:

| Merger of large corporations | Which requires not only obtaining permission from the antimonopoly authority, but also resolving a lot of issues related to the transfer to a new business entity of securities liquidated by the JSC |

| The merger of financial organizations is carried out under the control of the Central Bank of the Russian Federation | Since we are talking about the subjects licensed by him |

The slightly modified merger process that is observed at the level of budgetary organizations, and, in particular, educational institutions, deserves special attention.

For budget organizations

If we are talking about the merger of budgetary organizations, then in this case the process is similar to the merger of commercial organizations, with the exception of some significant aspects:

| Merger decision | Budgetary organizations are accepted by the Government of the Russian Federation on the recommendation of federal and regional authorities, in agreement with line ministries and departments (Article 16 of Federal Law-7) |

| The Government of the Russian Federation is forming a special commission | From among the executives of the merging organizations, who oversees the merger process |

When reorganizing budgetary institutions, an important rule must be observed - organizations financed from the budget can only merge with similar non-profit structures.

If during a merger the debtor merged with the creditor

It happens that one participant in the merger is a debtor, and the other participant is a creditor. Then, after the reorganization, the creditor and debtor become one, and the debt is automatically repaid. This means that because of the merger, the debtor will not have to repay the debt, and the creditor will not be able to get his money back.

Is the debtor obliged to show income on the date of reorganization, and the creditor expenses? The Tax Code does not regulate this issue. But officials believe that taxable income does not arise for the debtor. This point of view was expressed by the Russian Ministry of Finance in letters dated July 30, 2010 No. 03-03-06/1/502 and dated November 29, 2010 No. 03-03-06/1/744. True, they talk about reorganization in the form of annexation. But, in our opinion, the conclusions are also applicable in the case of a merger.

In addition, similar conclusions can be drawn regarding the lender's costs. In other words, as of the merger date, the creditor may not include the extinguished debt as an expense.

A special case is the situation when a merger involves a supplier and a buyer who, before the reorganization, transferred an advance to the supplier. In such circumstances, the seller has the right, before reorganization, to deduct the VAT previously accrued on the prepayment. The buyer, on the contrary, is obliged to restore the tax previously accepted for deduction when transferring the advance payment. The same position is given in the letter of the Ministry of Finance of Russia dated September 25, 2009 No. 03-07-11/242. Although the letter refers to affiliation, it can also be used as a guide in the event of a merger.

Features of the merger procedure

Reorganization in the form of a merger is provided for by civil law for all organizations. However, they have their own characteristics:

- Limited liability companies. The decision on transformation, approval of the merger agreement, the charter of the company being created, as well as the transfer act are carried out for each company by its participants.

- Joint stock companies. In every company, the board of directors before the meeting of shareholders raises the issue of such a transformation and election of members of the board of directors of the newly created entity. Shareholders make such decisions, approve the merger agreement, transfer deed, and charter. If the charter of the company being created assigns the functions of the board of directors to the meeting of shareholders, such a board is not elected.

- Unitary enterprises. The functions of making decisions on changing enterprises are assigned to the owners of their property. They also approve constituent and other documents related to the reorganization. At the same time, a merger of organizations is permissible if the property of such merging enterprises is at the disposal of one owner (Article 29–30 of the Federal Law “On State and Municipal Unitary Enterprises” dated November 14, 2002 No. 161-FZ).

- Non-profit organizations. In relation to budgetary and government institutions, decisions on such transformation and its procedure are made by the authorities under which the institution is subordinate. The nuances of the merger procedure can be associated not only with the form of the organization, but also with its activities (Article 33 of the Federal Law “On Non-State Pension Funds” dated 05/07/1998 No. 75-FZ, regulation “On the reorganization of credit organizations in the form of merger and accession”, approved Bank of Russia dated August 29, 2012 No. 386-P).

Tax base for VAT

The newly created company can deduct value added tax that one of its predecessors paid to sellers or at customs, but did not have time to deduct before the merger.

The successor must confirm the right to deduction with an invoice and primary documents for the transaction. It is also necessary that the goods (results of work, services) purchased by the predecessor be registered for use in transactions subject to VAT. There is one more mandatory condition: the predecessor must transfer documents confirming payment (clause 5 of Article 162.1 of the Tax Code of the Russian Federation).

An organization formed as a result of a merger can deduct VAT, which predecessors accrued when receiving an advance. The assignee can do this after the sale of the prepaid goods, or after termination of the transaction and return of the advance payment. There is one limitation here - the deduction must be accepted no later than one year from the date of return (clause 4 of Article 162.1 of the Tax Code of the Russian Federation).

In practice, many problems arise due to the date of invoices issued in the name of predecessors. If the documents are dated after the reorganization, then the inspectors do not allow the deduction to be accepted. In such a situation, the accountant can only contact the suppliers and ask for corrections.

Succession during reorganization

Important! The newly created entity in the merger process assumes all the obligations of the reorganized organizations.

The document confirming such succession is the transfer deed (Article 59 of the Civil Code of the Russian Federation). It reflects the transfer of all rights and responsibilities to the new organization.

That is, succession is carried out in relation to all creditors and debtors, both for existing obligations (including disputed ones), and for those that may arise, change or terminate after the transfer deed is drawn up.

The following is attached to the transfer deed:

- financial statements;

- inventory acts;

- primary papers on material assets;

- an inventory of other transferred property;

- decryption of accounts payable and receivable.

The transfer act is approved by the persons who made such a decision and is submitted during registration.

By way of succession, the obligations to pay taxes, fees of reorganized entities, as well as all due penalties and fines are transferred to the created entity (Article 50 of the Tax Code of the Russian Federation).

Important! The merger procedure does not affect the deadlines for fulfilling obligations to pay taxes and fees.

Excess amounts paid by a person before the reorganization will either be proportionately distributed among his other debts, or offset against the fulfillment by the legal successor of obligations to repay arrears, and in the absence of debts - returned to the legal successor.

Personal income tax reporting

Reorganization in the form of a merger does not interrupt the personal income tax period. This is explained by the fact that the company is not a taxpayer, but a tax agent, and labor relations with personnel continue (Article 75 of the Labor Code of the Russian Federation). This means that there is no need to submit any interim reporting on personal income tax during reorganization.

There is one important nuance here: if, after the merger, an employee brought a notice for property deduction, where the predecessor organization is indicated as the employer, the accounting department of the successor company must refuse him. The employee will have to go to the tax office again and get another notice confirming the deduction related to the legal successor. Such clarifications were given by the Russian Ministry of Finance in letter dated August 25, 2011 No. 03-04-05/7-599. In practice, inspectors everywhere follow these clarifications and cancel the deduction provided under an “outdated” notification.

Personnel component

With any form of reorganization, the changes that have occurred in the company will affect such an element of the enterprise as personnel. A merger is no exception; some personnel changes will occur in this case as well.

What will happen to employees when organizations merge by joining?

It is worth highlighting several rules for reorganization that directly affect employees:

- None of the forms of enterprise reorganization provide for the dismissal of employees. Therefore, such an event cannot be a basis for termination of the employment contract with them (by the employer).

- Before the reorganization or after completion of the procedure, employees have the right to resign, indicating as a reason such a reason as a change in the owner of the enterprise or its legal form.

- Before the merger, employers are not required to notify staff of upcoming changes, however, after the procedure is completed, it is better to do this (in writing).

- In an organization that is formed as a result of the reorganization of a legal entity by merger, a new staffing table must be adopted. Duplication of responsibilities is also inevitable, so some employees may be transferred to new positions or dismissed due to staff reductions.

- In case of changes in working conditions, additional annexes to the employment contract must be accepted and signed and appropriate entries must be made in the employees’ work books.

Obviously, in most cases, layoffs are inevitable anyway. According to the labor code, it is impossible to dismiss employees due to the reorganization of structural divisions through a merger, however, after completion of the procedure, the management of the new enterprise will be able to legally reduce staff.

General steps for processing and registering changes in passport data

We suggest you read about how to formalize and register a change in the passport data of a director or founder, about the procedure for changing the founder of an enterprise or the name of an LLC, as well as about making changes to the OKVED IP, to the constituent documents. The site also contains materials about the reorganization of a closed joint stock company into an LLC and the division of an LLC into two LLCs.

Insurance premiums and reporting to funds

One of the most controversial issues arising in connection with a merger is this: should the newly created organization calculate the taxable base for insurance premiums from scratch? Or does it have the right to continue the countdown begun by its predecessors before the reorganization?

The amount of contributions directly depends on the answer. If the assignee resets the base, he will automatically lose the right to exempt accruals from contributions that exceed the maximum amount (in 2011 it is equal to 463,000 rubles). If he “inherits” the base, then along with it he will receive the right not to charge contributions for the excess amount.

In our opinion, when reorganizing in the form of a merger, the successor company must begin anew to determine the base for contributions. This is explained by the fact that for an organization created after January 1, the first billing period is the time from the date of creation to December 31 (Part 3 of Article 10 of the Federal Law of July 24, 2009 No. 212-FZ). At the same time, there are no provisions in this law that would talk about the transfer of the base “by inheritance” in this law.

If the predecessors did not pay fees or report to the funds before the merger, the successor will have to do this. This obligation is enshrined in Part 16 of Article 15 of Federal Law No. 212-FZ.

* Guidelines for the preparation of financial statements during the reorganization of organizations were approved by order of the Ministry of Finance of Russia dated May 20, 2003 No. 44n.

Owner goals

1. Business consolidation of small and medium-sized enterprises

Reorganization in the form of a merger allows small or medium-sized companies to merge into a larger one - including to increase competitiveness, tax optimization and concentration of assets and liabilities in one company. On the other hand, it allows you to reduce the number of players in the market, including those who are losing competition, illiquid ones, and create new conditions for conducting effective business.

2. Diversification

It is necessary to increase the scale and range of products produced, which makes it possible to increase supply and/or satisfy market demand more fully and on a larger scale.

3. Consolidation of personnel competencies, intellectual rights and know-how

Sometimes this process is the simplest way to obtain a multiplier effect from the addition of the advantages, strengths, intellectual rights and developments of several competitors in technically and technologically intensive industries and market niches.

4. Strengthening your reputation

Business owners pool capital with other companies in an effort to improve their reputation in the market. This is an alternative way to liquidate an unprofitable enterprise.

Laws

A merger of companies involves the formation of a new legal entity, which becomes the legal successor of the participants. The new business assumes all property and non-property rights, as well as all debts and obligations to third parties.

Essentially the process includes two key activities:

- Liquidation of the involved legal entities. persons

- Registration of a new legal entity

Based on the results of the transaction, several amendments are made to the Unified State Register of Legal Entities - a number of objects are deleted, and a new one is registered.

In this regard, the last stage of the merger process is for the reorganization participants to notify their territorial tax authorities and submit an application to register the new business.

The procedure can only be carried out at the level of commercial or non-profit organizations operating as legal entities. If the companies planning to carry out such a procedure have significant capital (the total assets of all participants in the reorganization must be more than 6,000,000 rubles), then they will definitely need to obtain permission from the antimonopoly service.

The government body regulating competition in the market must be sure that there are no precedents for market monopolization.

The legal basis for the merger is compliance with civil law, including:

- Art. 57 of the Civil Code of the Russian Federation establishes that reorganization can be carried out at the level of legal entities, and exclusively in the form of merger, accession, division, separation or transformation.

- Art. 52 FZ-14 describes the features of reorganization through merger into an LLC.

- Article 16 of Federal Law 208 reveals the process of combining assets and obligations during the merger of a joint stock company.

- Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation No. 19 of November 18, 2003 “On some issues of application of the Federal Law “On Joint-Stock Companies” determined the possibility of merging a joint-stock company with other forms of doing business - LLCs and partnerships. At the same time, it seems unacceptable to merge a joint stock company with non-profit organizations.

- The Federal Law “On Non-Profit Organizations” dated January 12, 1996 No. 7-FZ (Article 16) also regulates issues related to the merger of non-profit organizations.

When companies are reorganized, the business does not disappear forever - it continues to operate, having modified its form (Article 57 of the Civil Code of the Russian Federation).

The documentary basis for the reorganization is the decisions made by the founders or judicial authorities.

Procedure for reorganization of a legal entity

The procedure for reorganizing a legal entity has some aspects:

- The procedure provides for both the completion of the work of legal entities (if procedures such as accession, transformation or merger are carried out) and the formation of new ones (if processes such as separation or division occur).

- Unlike the liquidation process, the rights and existing obligations of the legal entity that is being reorganized are transferred to the newly established firms or enterprises.

- Succession has universal (general) specificity.

- The reorganization procedure involves drawing up and signing a transfer act (if a merger, accession or transformation is carried out) or a separation balance sheet (if a division or separation is carried out).

- The rights of creditors must be respected, which is achieved through written notification to each of them and publication of a note in the State Registration Bulletin.

Protection of creditors' rights

Protection of the rights of creditors during the reorganization of a legal entity is carried out in the regime established by Art. 60 Code. In accordance with the provisions of the law, the protection of creditors' rights is ensured through:

- Mandatory notification of creditors through periodic media, in particular, “Bulletin of State Registration”.

- Notifications to creditors by direct sending by registered mail to the address of the location of the relevant organization to which the reorganized company has performance obligations.

- Creditors have the right to demand early fulfillment of obligations from the debtor through legal proceedings if the creditor acquired the right to claim before the publication of the note in the State Registration Bulletin.

- Bearing joint liability together with the reorganized legal entity by those persons who are responsible for determining the significant actions of such a legal entity (collegial bodies, founders, shareholders, heads of the Board of Directors, etc.), if the creditor who requested early execution was not given sufficient security and/or execution.

- The possibility of issuing an irrevocable bank guarantee to the creditor, ensuring coverage of obligations and losses associated with their improper fulfillment.

Useful information on business disputes

- Company reorganization

- Reorganization of the JSC

- LLC reorganization

- Reorganization of Federal State Unitary Enterprise

- Reorganization of a legal entity

- JSC reorganization

- Reorganization of JSC

- Reorganization of NPOs

- Reorganization by merger

- How does reorganization differ from liquidation of a legal entity?

- Reorganization of an individual entrepreneur

- Ready-made companies with a license

- Reorganization by merger

- Reorganization of a budgetary institution in the form of annexation

- Reorganization by spin-off

- Reorganization in the form of division

- Mixed reorganization

- Reorganization by transformation

Reorganization in the form of transformation

Reorganization in the form of transformation of a legal entity is regulated by the Code:

- Art. 68 – in relation to business partnerships.

- Art. 92 – LLC.

- Art. 104 – JSC.

- Art. 106.6. – cooperatives.

For example, Part 1 of Art. 68 of the Code regulates that business partnerships can be transformed:

- In other types of partnerships.

- To production cooperatives.

LLC, according to Art. 92 of the Code, are converted only into:

- JSC.

- Household partnership.

- Production cooperatives.

JSC, according to the law, can be transformed into:

- OOO.

- Zoz. partnership.

- Prod. cooperative

- And also into a non-profit partnership (Article 20 of the Law on JSC).

Finally, Art. 106.6. The Code establishes the possibility of transforming a production cooperative into:

- Household partnership.

- Household society.