During the economic crisis, most companies experience financial instability.

In times like these, credit institutions suspend issuing loans, and help from the founder of an enterprise becomes in demand and relevant. The contribution can be made to property or as financial assistance to the company. Any founders (individuals and legal entities) have the right to support their own company.

When depositing additional funds, in order not to increase the income tax base, you must adhere to the indicated standards when receiving gratuitous property:

- the founder (individual or legal entity) has more than half of the authorized capital;

- an enterprise receiving funds free of charge must have a share of the authorized capital exceeding 50% of the contributing company's funds.

The list of conditions is prescribed in Article 251 of the Tax Code of the Russian Federation (clause 11, clause 1). The remaining contribution, expressed in monetary units, must be included in the tax calculation.

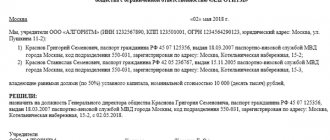

Sample decision of the founder on the provision of free financial assistance

This, in turn, means that the decision to transfer deposits leads to an increase in the size of the firm's net assets. The procedure for determining them is not established by law.

In this regard, LLCs may apply the rules in force for joint stock companies.

The value of net assets should be taken as the value obtained by subtracting liabilities from working capital taken into account. Essentially, the amount shows the amount of equity capital of the company. At the same time, according to sub. WATCH THE VIDEO ON THE TOPIC: Saving on taxes: a contract instead of a labor contract Financial assistance from the founder of the transaction Financial assistance from the founder is a way to support a company experiencing a lack of working capital. A company can receive financial assistance from the founder under different conditions.

In what cases does a company need financial assistance? The transfer of financial assistance from the founder is a common business transaction during which the founders transfer various things to their company, usually free of charge. According to the provisions of the Civil Code of the Kyrgyz Republic, after a company receives money into ownership, it has the opportunity to dispose of it at its own discretion. When choosing one method or another, it is necessary to assess the financial risks and know the tax consequences of each transaction.

Free assistance: accounting The easiest way to financially support an enterprise is the free assistance of the founder.

Contracts are...

Database of agreements "Contract-online".

You will find on our portal: employment contracts, articles of association, samples and forms of invoices, samples of accounting and financial documentation, various forms of claims, standard documents for liquidation of enterprises. In addition to the database of sample contracts, you will also find a wonderful forum. The link to the legal forum is in the top menu of the website. You can get any financial and legal advice from us. We will be glad if our legal portal is useful to you. [/td]

| © 2010 – 2019 |

Transfer of financial assistance to LLC from the founder

December 20, 2021 / / / Financial assistance from the founder is a way to support a company experiencing a lack of working capital. A company can receive financial assistance from the founder under different conditions.

We will discuss the options for providing it and the tax consequences in this article.

Photo: Agreement on financial assistance from a participant to the company Sample protocol on gratuitous assistance The transfer of financial assistance from the founder is a common business transaction during which the founders transfer various things to their company, usually free of charge. These include:

- works or services;

- securities;

- intellectual property;

- property rights.

- cash;

- real estate;

- movable property;

The law does not limit the purposes for which a company can spend financial assistance from the founder, so the money can be spent for any purpose that does not contradict the law, for example:

- salary payment;

- coverage of losses.

- acquisition of assets;

- replenishment of reserve funds;

- increase in working capital;

- fulfilling obligations to creditors and preventing bankruptcy;

- repayment of debts on payments to the budget;

According to

Free legal consultation: For any questions

Example: I took out loans from a microfinance organization to renovate an apartment and treat an illness.

I realized late that these were unaffordable loans for me. They call and threaten with various methods of influence. What should I do? Moscow St. Petersburg By clicking the SEND button, you accept the terms and conditions Send Send

Moscow Government

Ministry of Justice of the Russian Federation

Rospotrebnadzor Latest questions Full comprehensive service From the moment you contact us until the issue is completely resolved, we are ready to accompany our clients, providing them with the necessary services and advice.

Free detailed analysis of the situation Our specialists will study your situation in detail, review all available documents, and draw up a clear picture of the problem.

Working for results We are interested in the success of your business! Your victories are our victories. We are exclusively results-oriented.

Drawing up documents If necessary, the lawyers of our company will take upon themselves the preparation of all the necessary documents for a positive resolution of the case. Free study of options Only after a detailed analysis of the available documents and immersion in the current situation will we be able to work out solutions and the feasibility of their use.

Submitting documents We take care of everything. Compilation. Collection of the necessary package of documents.

Free financial assistance from the founder

- /

- /

March 14, 2021 0 Rating Share is one of the ways to replenish an organization’s working capital. Our article will tell you how to carry out this operation legally correctly. Transferring a participant's own funds (both a citizen and a legal entity) to the company's current account is a standard procedure carried out for a variety of reasons:

- expansion of activities, etc.

- to repay the organization's debt on its obligations;

- acquisition of necessary property;

At the same time, replenishing the organization’s account usually does not cause technical difficulties for the founder.

Since 2021, the procedure for providing free assistance to the organization by its participants has not changed.

However, due to the requirements of Article 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ, the organization whose account is replenished must correctly reflect the fact of receipt of funds so that they are not regarded by regulatory authorities as revenue with subsequent payment of tax payments in full .

The purposes of transferring the founder’s money to the company’s accounts may include:

- contribution to the authorized capital of the LLC in accordance with the requirements of Article 19 of the Federal Law “On Companies...” dated 02/08/1998 No. 14-FZ;

- transferring money to an account as a gift (gratuitous assistance) without changing the amount

Sample decision of the founder for financial assistance materials

In accounting, reflect all this with the following entries: Debit 50 (51) Credit 91-1 - reflects the gratuitous receipt of money from the participant (founder, shareholder); Debit 91-1 Credit 99 – profit for the year is reflected; Debit 99 Credit 84 – reflects net profit at the end of the year; Debit 84 Credit 82 – deductions were made to the reserve fund (capital) according to the standards approved by the charter.

This conclusion follows from the Instructions for the chart of accounts (accounts 84, 82). If, after increasing the reserve capital (fund), its value exceeds the restrictions established in the organization’s charter, amend the charter.

All this follows from paragraph 7 of PBU 9/99, paragraph 1 of Article 35 and Article 12 of the Law of December 26, 1995.

No. 208-FZ, paragraph 1 of Article 30, paragraph 4 of Article 12 of the Law of February 8, 1998 No. 14-FZ, Instructions for the chart of accounts (accounts 84, 99) and confirmed in the letter of the Ministry of Finance of Russia dated August 23, 2002.

No. 04-02-06/3/60. Property received free of charge The founders can also help the company in non-monetary form. One of the ways is the gratuitous transfer of property from the founder.

This method of assistance also has certain disadvantages: Property received free of charge from the founder cannot be sold or rented out for a year. Otherwise, its market value will have to be included in income (sub.

11 clause 1 art. 251 of the Tax Code of the Russian Federation). Such property can be depreciated only if it is included in income (clause 2 of Article 254 of the Tax Code of the Russian Federation). You cannot use bonus depreciation on capital investments (clause

9 tbsp. 258 Tax Code of the Russian Federation)

Sample decision on financial assistance of the sole founder

What you need to do: check whether the Charter of your company stipulates the possibility of founders to make contributions to the company’s property. If not, be sure to make changes. Additionally, you can stipulate that the founders can make contributions disproportionate to their shares.

After this, you need to hold a meeting of the founders and, based on its results, formalize a decision on making a contribution to the property.

The sole founder can himself approve such a decision and pay money on its basis. The contribution to the company's property does not affect the size of the authorized capital and the share of the founders in it. Increasing the authorized capital is a completely different procedure. Increasing the authorized capital This method of replenishing the company's budget will be the most difficult to formalize.

Because such changes will need to be registered with the Federal Tax Service.

The fact is that the size of the authorized capital is specified in the company's Charter. In order to avoid the procedure for reducing the authorized capital, one of the owners (who owns 40% of the authorized capital) decided to provide the company with free financial assistance in the amount of 3,000,000 rubles. by transferring it to a bank account.

The receipt of funds from the owner in the accounting registers will be reflected by the entry: Debit 51 Credit 83 - 3,000,000 rubles.

For profit tax purposes, this amount is not recognized as income. It is necessary to keep in mind: if the funds were received free of charge with some vague wording like “to replenish working capital,” then everything will depend on what share of the authorized capital belongs to the owner who transferred them.

1 tbsp.

SPECIAL CONDITIONS

4.1. In everything that is not provided for in this Agreement, the Parties are guided by the current legislation of the Russian Federation.

4.2. By agreement of the Parties, changes or additions may be made to this Agreement. Any changes or additions to this Agreement are valid if they are made in writing and signed by the Parties.

4.3. All notices and communications must also be sent in writing by delivery to the Party (its representative) against signature or by mail, if delivery is not possible.

4.4. The Agreement is drawn up in two copies, one of which is kept by the Participant, and the second – by the Company.

Founder's financial assistance

Contents Transfer of financial assistance from the founder is a common business transaction during which the founders transfer various things to their company, usually free of charge. These include:

- property rights.

- intellectual property;

- real estate;

- movable property;

- works or services;

- cash;

- securities;

The law does not limit the purposes for which a company can spend financial assistance from the founder, so the money can be spent for any purpose that does not contradict the law, for example:

- increase in working capital;

- fulfilling obligations to creditors and preventing bankruptcy;

- coverage of losses.

- replenishment of reserve funds;

- repayment of debts on payments to the budget;

- salary payment;

- acquisition of assets;

According to the provisions of paragraph 2 of Art. 209 of the Civil Code of the Russian Federation, after a company receives money into ownership, it has the opportunity to dispose of it at its own discretion. There are a number of ways you can help your organization:

- temporary financial assistance from the founder (loan);

- transfer of property or money into the ownership of a company.

When choosing one method or another, it is necessary to assess the financial risks and know the tax consequences of each transaction.

Unlike accounting, in tax accounting such an operation is not always reflected - the rule of controlling interest applies here (subclause 11, clause 1, article 251 of the Tax Code of the Russian Federation)

Concept

- rights to movable and immovable property;

- intellectual property;

- cash;

- works and services;

- securities.

As goals of financial assistance (there are no restrictions at the legislative level), an enterprise can designate:

- increase in current assets;

- coverage of incurred losses;

- payment of wages to employees;

- repayment of obligatory payments to the budget;

- replenishment of the reserve;

- acquisition of assets.

Article 209 of the Civil Code of the Russian Federation (clause 2) allows the company, after receiving money into ownership, to independently dispose of it.

Sample decision on free assistance from the founder

» 2 tbsp.

209 of the Civil Code of the Russian Federation, after a company receives money into ownership, it has the opportunity to dispose of it at its own discretion. There are a number of ways you can help your organization:

- transfer of property or money into the ownership of a company. temporary financial assistance from the founder (loan);

When choosing one method or another, it is necessary to assess the financial risks and know the tax consequences of each transaction.

The easiest way to financially support an enterprise is to provide free assistance from the founder. Such an operation must be reflected in accounting (para.

10 clause 7 PBU 9/99). It is necessary to register the receipt of funds, for which the posting is made: Dt 51 Kt 91, subaccount “Other income”. After this, the company can direct the funds to their destination. All agreements and agreed upon decisions are recorded in the minutes of the meeting.

The next stage of registration of assistance, including in the form of transfer of property, is the conclusion of one of the following agreements: A loan agreement is included in the preferential category of financial assistance in terms of taxation. No interest is charged on the money received.

The funds themselves are transferred on a repayable basis. With this form of financial support, it is important to take into account the following factors: the transferred funds do not in any way affect the size of the authorized capital; these finances do not increase or decrease the share of any participant in the legal entity;

Assignment of material support

First of all, you need to decide on the purpose of the payment. The employer must understand that financial assistance is not part of the wage fund. It cannot be classified as a bonus for the employee’s merits, and therefore it should not be specified in the regulations on remuneration. Material assistance falls into the category of social support for workers.

Financial assistance is a voluntary desire of the employer to support an employee who finds himself in difficult life circumstances. Its purpose may be different, but always individual. Typically, social guarantees in an organization provide for the participation of management in the event of:

- death of an employee;

- death of a close family member of the employee;

- marriage for organizing a wedding;

- birth of a child;

- emergency (theft, natural disasters);

- treatment and recovery.

Financial assistance is intended for the following purposes:

Payments related to family circumstances (death, wedding, birth) are targeted. In turn, payments arising as a result of an emergency situation are classified as non-targeted.

Sample decision of the founder for financial assistance materials

When choosing one method or another, it is necessary to assess the financial risks and know the tax consequences of each transaction.

Therefore, profit tax is not calculated on this money.

Free assistance: accounting The easiest way to financially support an enterprise is the free assistance of the founder. Such an operation must be reflected in accounting (para.

10 clause 7 PBU 9/99). It is necessary to register the receipt of funds, for which the posting is made: Dt 51 Kt 91, subaccount “Other income”. After this, the company can direct the funds to their destination. Free assistance: taxation Unlike accounting, such an operation is not always reflected in tax accounting - the rule of controlling interest applies here (subclause

11 clause 1 art. 251 of the Tax Code of the Russian Federation). Its essence is as follows. The prerequisites for such a transaction are:

- state registration.

- obtaining the consent of interested parties;

- consent of the parties;

- notarization;

According to the provisions of paragraph.

2 tbsp. 21 of the LLC Law, donation of a share can be made without obtaining the consent of the other founders.

However, the company's charter takes precedence in this matter. If the charter provides for the need to approve a donation, then its provisions apply. If this issue is not addressed in the charter, the founders can freely dispose of the share.

A gratuitous transfer of a share in an LLC to another participant can be made only if the share is paid in full.

Thus, the most profitable and easiest way to financially help your company for a founder who owns more than 50% of the share in the authorized capital is a gratuitous transfer of funds.

06/14/2021 The article discusses the main issues of provision. The features of its reflection in the tax and tax authorities are shown.

Agreements on the provision of financial assistance are provided. For profit tax purposes, when a company receives financial assistance from its shareholder, the size of his share in the authorized capital of the company is of fundamental importance. If he owns more than 50 percent of the shares, then those transferred free of charge are not taken into account as part of the tax base for income tax.

This rule is spelled out in subparagraph 11 of paragraph 1 of Article 251. Actually, this rule presupposes: when determining the base for this fiscal payment, income in the form of property received free of charge from an enterprise in which more than 50 percent consists of deposits of the receiving company is not taken into account.

Either from a company or an individual, if the authorized capital of the receiving party consists of more than half of the contribution of the transferring party. At the same time, another important restriction also applies: the received property must not be transferred to third parties within one year. As indicated, in particular, in the letter of the Ministry of Finance dated April 2, 2008 No. 03-03-06/1/252, cash also refers to property, as evidenced by Article 128 of the Civil Code and Article 38 of the Tax Code.

Therefore, the above rule applies to them. However, it is not at all necessary to keep the funds received in your current account untouched throughout the year. The company may well use the financial assistance provided by the founder without restrictions.

Temporary financial assistance from the founder: agreement (sample)

Copyright: Lori's photo bank Free assistance from the founder is the deposit of funds into the company account or the transfer of other property for specific purposes: increasing working capital, paying off financial obligations, expansion or modernization, etc.

To ensure that the tax authorities do not consider the deposited amount as profit and withhold tax from it, certain conditions must be met. Any of its founders, that is, both individuals and legal entities, can provide financial assistance to the organization. But at the same time, the Tax Code of the Russian Federation clearly establishes a list of cases when property received free of charge may not be included in:

- A legal entity that receives funds free of charge has a share exceeding 50% in the authorized capital of the organization that contributes the funds.

- The individual who contributes the funds has a share in the authorized capital of more than half.

- The legal entity that contributes the funds has a share in the authorized capital of more than half.

This list can be found in paragraphs.

11 clause 1 art. 251 Tax Code of the Russian Federation. In all other cases, assistance that is expressed in monetary units must be included in the tax calculation. The Federal Law “On Accounting” dated December 6, 2011 No. 402-FZ requires that all receipts to the current account and the organization’s cash desk, including those, be documented.

The most common method of gratuitous assistance is the conclusion of a gift agreement or gratuitous financial assistance between the one who contributes money and the one who receives it.

Is it necessary to draw up an agreement?

Law No. 402-FZ of December 6, 2011 regulates the documentation of any receipt of funds to the company’s current account or cash desk; gratuitous assistance is no exception.

The most common method of registering a deposit is signing a gift agreement or gratuitous financial assistance.

If the funds are used to increase the authorized capital, the assistance is not considered gratuitous.

To contribute funds or property, the founder must coordinate his actions at a general meeting of company participants, if he is not the sole owner.

About providing free support

The agreement is drawn up in one copy for each party.

In addition to the required details when drawing up this kind of document (name of the organization, full name of the founder, place and date of drawing up), designating the agreement as a contract of gift or gratuitous assistance, it is necessary to write down the following information in the text of the form:

- the most precise subject of the contract is recorded;

- the transferred amount is written down in words and numbers;

- the fact of gratuitousness, the provision of assistance only unilaterally, and the absence of obligations on the part of the receiving party are stated.

But there are some subtleties when drawing up such a document.

The Civil Code (Article 575, paragraph 1) does not accept the execution of a gift agreement if another commercial company acts as the founder; such transactions between commercial firms are prohibited (gifts up to 3000 are permitted).

It is also necessary to take into account the share of the individual founder in the capital of the company to ease the tax burden. This rule in relation to things applies similarly to the transfer of property that was in the ownership of the founder for 1 year.

Benefits apply to companies with a simplified tax system that do not remit income tax (Article 346.15 of the Tax Code of the Russian Federation).

agreement on the provision of free, non-repayable financial assistance to the organization from the founder – word.

Registration for return temporary assistance

Drawing up an agreement with the condition of returning financial assistance from the founder is carried out in free form and on the general rules for drawing up a loan agreement.

Its main provisions:

- It must be in writing and sealed by the company and signed by the parties. If the head of the company and the founder are the same person, his signature is affixed twice.

- Fixing interest in the terms of the loan agreement. Their size is clearly stated in the contract. When receiving interest on the loan, the founder pays personal income tax on it.

- Determining the validity period of the agreement, the absence of deadlines for the return of funds allows the founder to return the money 1 month after sending a notification to the borrowing organization.

- Designation of the procedure for transferring the loan (by wire transfer or in cash). In accounting, the received amount is recorded as accounts payable, which increases when funds are received and decreases when the loan is repaid.